SuRo Capital Corp. Will Commence a Modified Dutch Auction Tender Offer to Repurchase up to 3 Million Shares of its Common Stock

March 20 2023 - 8:30AM

SuRo Capital Corp. (“SuRo Capital”, the

“Company”, “we”, “us”, and “our”) (Nasdaq:

SSSS) announced today that it will commence a

modified “Dutch Auction” tender offer (the “Tender Offer”) to

purchase up to 3 million shares of its common stock at a price per

share not less than $3.00 and not greater than $4.50 in $0.10

increments, using available cash.

“As we have consistently demonstrated, SuRo

Capital is committed to initiatives that enhance shareholder value,

and we believe the market is currently undervaluing our portfolio.

Accordingly, on March 17, 2023, our Board of Directors authorized a

modified Dutch Auction Tender Offer to purchase up to 3 million

shares of our common stock at a price per share between $3.00 and

$4.50. Given our stock is trading at a significant discount to net

asset value, coupled with the extreme market volatility, we believe

the modified Dutch Auction Tender offer to be an efficient and

accretive deployment of capital,” said Mark Klein, Chairman and

Chief Executive Officer of SuRo Capital.

Modified Dutch Auction Tender

Offer

On March 17, 2023, the Company’s Board of

Directors authorized a modified “Dutch Auction” tender offer (the

“Tender Offer”) to purchase up to 3,000,000 shares of its common

stock at a price per share not less than $3.00 and not greater than

$4.50 in $0.10 increments, using available cash. The Tender Offer

will commence on March 21, 2023 and will expire at 5:00 P.M.,

Eastern Time, on April 17, 2023, unless extended. If the Tender

Offer is fully subscribed, the Company will purchase 3,000,000

shares, or approximately 10.6%, of the Company’s outstanding shares

of its common stock. Any shares tendered may be withdrawn prior to

expiration of the Tender Offer. Stockholders that do not wish to

participate in the Tender Offer do not need to take any action.

Based on the number of shares tendered and the

prices specified by the tendering stockholders, the Company will

determine the lowest per-share price that will enable it to acquire

up to 3,000,000 shares of its common stock. All shares accepted in

the Tender Offer will be purchased at the same price even if

tendered at a lower price.

The Tender Offer is not contingent upon any

minimum number of shares being tendered. The Tender Offer is,

however, subject to other conditions, which will be disclosed in

the Tender Offer documents. In the future, the Board of Directors

may consider additional tender offer(s) or other measures to

enhance shareholder value based upon a variety of factors,

including the market price of the Company’s common stock and its

net asset value.

The Company’s Board of Directors is not making

any recommendation to stockholders as to whether to tender or

refrain from tendering their shares into the Tender Offer.

Stockholders must decide how many shares they will tender, if any,

and the price within the stated range at which they will offer

their shares for purchase.

The information agent for the Tender Offer is

D.F. King & Co. Inc., and the depositary is American Stock

Transfer & Trust Company, LLC. The offer to purchase (the

“Offer to Purchase”), a letter of transmittal and related documents

will be mailed to registered holders and certain of our beneficial

holders. Beneficial holders may alternatively receive the Offer to

Purchase and a communication to consult with their bank, broker or

custodian, if they wish to tender shares. For questions and

information, please contact the information agent. Banks and

brokers may call the information agent at (212) 269-5550, and all

others may call the information agent toll-free at (800)

848-3409.

Certain Information Regarding the Tender

Offer

The information in this press release describing

the Company’s Tender Offer is for informational purposes only and

does not constitute an offer to buy or the solicitation of an offer

to sell shares of the Company’s common stock in the Tender Offer.

The Tender Offer is being made only pursuant to the Offer to

Purchase and the related materials that the Company will file with

the Securities and Exchange Commission, and is distributing to its

stockholders, as they may be amended or supplemented. Stockholders

should read such Offer to Purchase and related materials carefully

and in their entirety because they contain important information,

including the various terms and conditions of the Tender Offer.

Stockholders of SuRo Capital Corp. may obtain a free copy of the

Tender Offer statement on Schedule TO, the Offer to Purchase and

other documents that the Company will be filing with the Securities

and Exchange Commission from the Securities and Exchange

Commission’s website at www.sec.gov. Stockholders may also obtain a

copy of these documents, without charge, from D.F. King & Co.

Inc., the information agent for the Tender Offer, by calling

toll-free at (800) 848-3409. Stockholders are urged to carefully

read all of these materials prior to making any decision with

respect to the Tender Offer. Stockholders and investors who have

questions or need assistance may call D.F. King & Co. Inc.

Forward-Looking Statements

Statements included herein, including statements

regarding SuRo Capital's beliefs, expectations, intentions, or

strategies for the future, may constitute "forward-looking

statements". SuRo Capital cautions you that forward-looking

statements are not guarantees of future performance and that actual

results or developments may differ materially from those projected

or implied in these statements. All forward-looking statements

involve a number of risks and uncertainties, including the impact

of the COVID-19 pandemic and any market volatility that may be

detrimental to our business, our portfolio companies, our industry,

and the global economy, that could cause actual results to differ

materially from the plans, intentions, and expectations reflected

in or suggested by the forward-looking statements. Risk factors,

cautionary statements, and other conditions which could cause SuRo

Capital's actual results to differ from management's current

expectations are contained in SuRo Capital's filings with the

Securities and Exchange Commission. SuRo Capital undertakes no

obligation to update any forward-looking statement to reflect

events or circumstances that may arise after the date of this press

release.

About SuRo Capital Corp.

SuRo Capital Corp. (Nasdaq: SSSS) is a publicly

traded investment fund that seeks to invest in high-growth,

venture-backed private companies. The fund seeks to create a

portfolio of high-growth emerging private companies via a

repeatable and disciplined investment approach, as well as to

provide investors with access to such companies through its

publicly traded common stock. SuRo Capital is headquartered in New

York, NY and has offices in San Francisco, CA. Connect with the

company on Twitter, LinkedIn, and at www.surocap.com.

ContactSuRo Capital Corp.(212)

931-6331IR@surocap.com

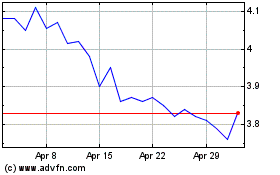

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Dec 2024 to Jan 2025

SuRo Capital (NASDAQ:SSSS)

Historical Stock Chart

From Jan 2024 to Jan 2025