Additional Proxy Soliciting Materials (definitive) (defa14a)

June 07 2022 - 8:31AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ |

Soliciting Material under §240.14a-12 |

Splunk Inc.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

| © 2022 SPLUNK INC.

Stockholder

Engagement

Spring 2022 |

| © 2022 SPLUNK INC.

This presentation contains forward-looking statements

regarding future events, plans or the expected financial

performance of our company including statements about

our expectations regarding our products, technology,

customers, markets, ESG initiatives, and Splunk’s other

plans, objectives, goals and strategies. These statements

reflect management’s current expectations, estimates and

assumptions based on the information currently available to

us. These forward-looking statements are not guarantees of

future performance and involve significant risks,

uncertainties and other factors that may cause our actual

results, performance or achievements to be materially

different from results, performance or achievements

expressed or implied by the forward-looking statements

contained in this presentation.

Forward-Looking

Statements

Splunk, Splunk>, and Turn Data Into Doing are trademarks and registered trademarks of Splunk Inc. in the United States and other countries. All other

brand names, product names, or trademarks belong to their respective owners. © 2022 Splunk Inc. All rights reserved.

A discussion of factors that may affect future results is

contained in our most recent SEC Form 10-Q filing

available at www.sec.gov, including descriptions of the risk

factors that may impact us and the forward-looking

statements made in this presentation. The forward-looking

statements made in this presentation are made as of June

7, 2022. If this presentation is reviewed after June 7, 2022,

even if made available by us, on our website or otherwise,

it may not contain current or accurate information. We

disclaim any obligation to update or revise any forward-

looking statement based on new information, future events

or otherwise, except as required by applicable law.

2 |

| © 2022 SPLUNK INC.

Splunk Provides Unified Security and

Observability Across Hybrid

Environments

Splunk by the Numbers1

690

Customers

>$1M Total Annual

Recurring Revenue

>90

Fortune 100

Customers

7,000+

Worldwide

Employees

$3.21B

Total Annual

Recurring Revenue

3 1 All numbers in graphic are as of Q1 FY23.

Logs | Metrics | Traces

On-Prem

Data Centers Public Clouds Edge

Third-Party

Tools

Apps /

Services

Splunk-Built

Observability Security

Splunkbase

2,400+ apps

Custom Apps

Build for your

unique needs |

| © 2022 SPLUNK INC.

Our Growth Strategy

Splunk continues to evolve and grow in line with our business strategy, which is

designed to create long-term, sustainable value

Cloud-First Platform and Solutions

• Cloud services represents the majority of our total software bookings

• Investment in cloud services offerings to deliver a cloud-optimized go-to-market and support model

• Investing in license offerings to enable both standalone consumption and hybrid Splunk deployments

Expand the Splunk Value Proposition

• Product strategy and go-to-market approaches focused on Security and Observability users, and expansion of offerings that serve these users

• Delivering new and enhanced capabilities and services that provide faster time-to-value and easier adoption and expansion

• New features tailored to meet user needs, including more comprehensive data reach, more powerful analytics, and AI/ML and automation

capabilities

Global Expansion

• Continued investment in go-to-market, operations and infrastructure to deliver our services to customers in targeted countries across public and

private sectors

4 |

| © 2022 SPLUNK INC.

Strong Leaders to Fuel the Next Chapter

of Our Growth

Our new President and CEO Gary Steele and our Chair Graham Smith are highly

experienced leaders who both have proven track records of successfully scaling

businesses in our industry

Our new CEO and our Chair’s proven track records of growing multi-billion-dollar global enterprises position

Splunk for continued growth and long-term success

5

Gary Steele

President and CEO

• Committed to scaling the business and

extending our value, driving innovation

and customer success

• Over 30 years of experience, with a

proven track record of successfully

scaling SaaS operations and growing

multi-billion dollar global enterprises

• Held CEO roles at Proofpoint and

Portera, as well as senior leadership

roles at Sybase, Sun Microsystems and

Hewlett-Packard Graham V. Smith

Chair

• Industry track record of successfully

scaling several cloud businesses

• Deep knowledge of Splunk's business

gained through service as a director

since 2011, Chair since 2019, and interim

CEO from November 2021 to April 2022

• Strong financial expertise and software

executive experience gained via CFO

roles at Salesforce and Advent Software

• Broad governance and industry expertise

via current and former director roles,

including at Slack and Citrix |

| © 2022 SPLUNK INC.

Patricia Morrison,

Former EVP and CIO,

Cardinal Health

Committees: Audit,

Cybersecurity & Data Responsibility

Mark Carges

Former CTO, Ebay

Committee: Cybersecurity & Data

Responsibility

Sara Baack

Former Chief Product Officer,

Equinix

Committee: Governance &

Sustainability (Chair)

Sean Boyle

COO and CFO, Wildlife Studios

Committee: Audit (Chair)

Kenneth Hao

Chairman and Managing Partner,

Silver Lake

Committees: None

Stephen Newberry

Former Chairman,

Lam Research

Committee: Talent & Compensation

(Chair)

Graham Smith

Independent Chair, Splunk

Committee: Talent & Compensation

Elisa Steele

Independent Board Member

Committees: Governance &

Sustainability, Talent &

Compensation

General Dennis Via

EVP, Booz Allen Hamilton

and Retired Four-Star

U.S. Army General

Committee: Cybersecurity & Data

Responsibility (Chair)

Luis Visoso

CFO, Unity Software

Committees: Audit,

Governance & Sustainability

Gary Steele

President and Chief Executive

Officer, Splunk

Committees: None

Joined in

2021

Skilled and Experienced Board

Joined in

2022

Joined in

2022

Proposal 1: Election of Class I Directors

= Class I Directors 6 |

| © 2022 SPLUNK INC.

1 For the purposes of this information, a member of an underrepresented community is defined as an individual who self-identifies as Black, African American, Hispanic, Latino, Asian, Pacific

Islander, Native American, Native Hawaiian, or Alaska Native, or who self-identifies as gay, lesbian, bisexual or transgender.

Capability Number of Directors with the Capability

Technology and security

infrastructure 4 4 4

Scaling a SaaS business 4 4 4 4

Investment 4 4 4 4 4

CEO experience 4 4 4 4 4

Modern cloud technologist 4 4 4 4 4 4

Sales 4 4

Marketing 4 4

Key customer segment insight 4 4 4 4

Finance 4 4 4

People and compensation 4 4 4 4

Governance, risk and

compliance 4 4 4 4 4 4 4 4

Directors Have Diverse Backgrounds and

Expertise

Underrepresented

Community1

Diverse Board with Strong Independence and Thoughtful Refreshment

Tenure

5 years

Average Tenure

1

10-13 Yrs

3

6-9 Yrs

5

0-2 Yrs

2

3-5 Yrs

Gender Diversity

Independence

91%

Independent

10

Independent

1

Non-Independent

27%

Women

3

Women

8

Men

36%

Underrepresented

Community

Members 7

Other

4

Under-

represented

Community

Proposal 1: Election of Class I Directors

7

4 Strong capability Moderate capability |

| © 2022 SPLUNK INC.

Robust Board Oversight of ESG

Our Board works closely with management to oversee ESG as we leverage our

technology, expertise and talent to advance lasting solutions to important issues

Climate Resilience and Innovation

• Governance and strategy

• Risks and opportunities

• TCFD disclosures

and metrics

• Scenario planning

and targets

ESG Business Integration

• Governance and standards

• Risk, audit and compliance

• Reporting and metrics

Global Impact Strategy

• Social impact

• Ethical and inclusive growth

• Data responsibility

• Environmental sustainability

For more information, please refer to our 2021 Global Impact Report, pages 10-11.

ESG High-Level Objectives

Proposal 1: Election of Class I Directors

Governance & Sustainability

Committee

• General oversight of ESG activities,

programs and public disclosure

• Factors in any feedback received

from stockholders

Audit

Committee

• Oversight of enterprise risk

management framework

• Oversight of disclosure of ESG

metrics and key performance

indicators

Talent & Compensation

Committee

• Oversight of human capital

management

• Includes talent acquisition, talent

management and development,

employee engagement, and DEI

Cybersecurity & Data Responsibility

Committee

• Oversight of cybersecurity and data

responsibility objectives, strategies,

capabilities, initiatives, risks and

mitigation protocols

Board Oversight

8 |

| © 2022 SPLUNK INC.

Performance-Based Pay Aligned with

Strategy

In line with our pay-for-performance philosophy, the majority of our NEOs’ FY22

compensation, other than our interim CEO’s1, was performance-based and in the form of

long-term equity

Proposal 3: Advisory Vote to Approve Executive Compensation

9

Element Objective FY22 Design Features

Base

Salary

Recognize ongoing performance

of job responsibilities

• Reviewed on an annual basis

• Salaries determined after considering several factors, including compensation data from our peer group

Annual Cash

Bonus

Align compensation with rigorous

performance goals

• Earned solely based on achievement against corporate financial performance

• Based on ARR growth achievement aligned with increasing stockholder value and our growth strategy

Long-Term

Equity

Compensation3

Emphasize long-term performance

objectives

Align NEO and stockholder

interests

Motivate and retain key executives

through performance and time-

based vesting periods

Performance-based RSUs (“PSUs”) (60%)

• Based on ARR (60%) and operating cash flow (40%) achievement

• One-year performance period, given the Company’s rapid growth and ongoing business model transition (see slide 13

for information on go-forward change to three-year performance period and elimination of overlapping metrics with

annual cash bonus plan)

• Additional portion of the PSUs eligible to vest quarterly beginning June 2023 if stock price hurdles are achieved

• Earned portions time vest over three years (1/3 vesting after approximately one year; 2/3 quarterly over remaining two

years)

Time-based RSUs (40%)

• Based on continued service through vesting date

• Time vests over three years (1/3 vesting after approximately one year; 2/3 quarterly over remaining two years)

1 Per the offer letter between the Company and Graham Smith, the interim CEO compensation did not include annual cash bonus or long-term compensation components, and his salary of $12,000,000

was on an annualized basis.

2 Excludes sign-on bonuses awarded to new hire NEOs and interim CEO compensation.

3 Ms. Carlson received 69% of her long-term equity compensation in RSUs, a portion of which had a 4-year vesting schedule.

FY22 Normal Course NEO Compensation Program2 |

| © 2022 SPLUNK INC.

Thoughtfully Designed Interim CEO

Compensation

Interim CEO compensation was structured to be simple and less than the median CEO

total direct compensation for CEOs in our compensation peer group

Proposal 3: Advisory Vote to Approve Executive Compensation

1 Per the offer letter between the Company and Graham Smith, the interim CEO compensation was awarded on an annualized basis (i.e., salary of $1,000,000 per month of service).

2 Mr. Smith’s annual total compensation, as reported in the Summary Compensation Table, was $3,010,388, which includes director fees paid to Mr. Smith in FY22 and the aggregate grant date fair

value of RSUs granted to Mr. Smith in FY22, in both cases for his service as a member of our Board.

• Structured as cash given the temporary and transitional nature

of Mr. Smith’s role as interim CEO, and his existing meaningful

equity stake in Splunk

• As interim CEO, Mr. Smith was not eligible for an annual cash

bonus opportunity or equity awards, considering that more than

three-quarters of the one-year performance periods within our

FY22 annual and long-term performance-based incentive

programs had elapsed at time of appointment

• Equity awards previously granted to Mr. Smith in connection with

his services as a member of our Board continued to vest, and he

did not receive any other compensation for his services as a

member of our Board during his term as interim CEO

10

Interim CEO Compensation1 Program

Base Salary $12,000,000 annually

Cash Bonus Not eligible

Long-Term Equity

Compensation Not eligible

Graham Smith’s prorated salary for serving as our interim CEO in FY22 was ~$2.6 million(2) |

| © 2022 SPLUNK INC.

FY22 Incentive Pay Outcomes Aligned

with Long Term Value Creation

Our FY22 Annual Cash Bonus and PSU Plan payouts reflect strong performance in

our business, which will drive stockholder value over time

Incentive Plan Results Payout

Cash

Bonus

• ARR: Achieved $3.12B vs. $3.027B

target

– $3.12B in ARR represented a

~32% increase from FY21 ARR

– Target ARR represented 28%

YoY growth, demonstrating rigor

• 167.72% of each eligible

NEO’s target bonus

opportunity

Performance

Share Units

(PSUs)

(60% of total

LTI)

• ARR (60%): Achieved $3.12B vs.

$3.027B target

• Operating Cash Flow (40%):

Achieved $128.0M vs. $80M target

– Compared to FY21 OCF of

$(191M)

• 167.97% of each eligible

NEO’s target PSU award

1/3 of earned Corporate PSUs

vested in March 2022. The

remaining Corporate PSUs vest

over remaining 2 years; up to

50% of earned corporate PSUs

eligible to be earned based on

aggressive stock price growth

goals

As discussed further on slide 13, beginning with FY23, we eliminated overlapping

performance metrics in our annual bonus plan and PSU program

Continued Strong ARR Growth

Will Drive Stockholder Value

Broad-Based Strong Performance Provides

Building Blocks for Growth(1)

Total Revenues Cash Flow Customers with

ARR > $1 million

$2.67 billion

Up 20%

year-over-year

Operating Cash Flow

of

$128 million

Free Cash Flow of

$117 million(2)

675

Customers

Up 32%

year-over-year

($ in millions) – FYE January 31

50%

54%

41%

32%

Proposal 3: Advisory Vote to Approve Executive Compensation

11 1 As of FY22.

2 To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we provide investors with certain non-GAAP financial measures, including non-

GAAP free cash flow. For a full reconciliation between GAAP and net cash used in operating activities and free cash flow, please see Appendix A. |

| © 2022 SPLUNK INC.

We engaged extensively with stockholders to solicit feedback on our executive

compensation practices, approach to equity compensation and other topics of importance

to investors

2022 Stockholder Engagement

We reached out to

institutional stockholders

representing

62%

of shares outstanding

Scope of Outreach Responsive Actions to Address Stockholders’ Feedback

• Did not lower or otherwise adjust FY22 performance metrics

• Committed that, in the future, would only lower performance metrics for in-flight

incentives in extraordinary circumstances that could not have been foreseen

• In the event of such a circumstance, committed to capping any related

payout at its original target level

• Provided extensive disclosure of context and rationale for 2022 Equity Incentive

Plan

• Continued to thoughtfully consider the cost of equity compensation to investors

• Enhanced FY23 compensation program to better align with strategy and respond

to stockholder feedback and 2021 Say-on-Pay vote (see next slide for details)

Proposal 3: Advisory Vote to Approve Executive Compensation

Lead Independent Director

participated in calls with

institutional stockholders

representing

27%

of shares outstanding

We engaged with

institutional stockholders

that voted against 2021

Say-on-Pay representing

29%

of shares outstanding

We engaged with

institutional stockholders

representing

43%

of shares outstanding

12 |

| © 2022 SPLUNK INC.

Recent Responsive Compensation

Program Enhancements

Proposal 3: Advisory Vote to Approve Executive Compensation

Beginning with FY23, we are transitioning to longer performance periods for PSUs

and eliminating overlapping performance metrics between our annual and PSU

incentive programs

Elimination of overlapping metrics in our annual executive bonus plan and our PSU program

Transition to a three-year performance period for PSUs

13

• As a result of stockholder feedback and in line with best practices, we have eliminated overlapping metrics in our annual executive bonus plan and our PSU program

• FY23 annual executive bonus plan metrics: annual recurring revenue and operating cash flow – to motivate and incentivize executives to drive top-line growth and

operational discipline

• FY23 PSU program: relative total stockholder return metric, measured relative to companies in the SPDR S&P Software & Services ETF – to reward executives for

outperformance

• Our business has matured and our financial results have become more

predictable, enabling us to respond to stockholder feedback and transition to

a PSU program with a three-year performance period

• Relative total stockholder return (TSR) metric will be the sole metric to align

financial incentives with long-term stockholder value

• As we transition to this new structure, the FY23 PSUs include interim payout

opportunities after the end of the first and second year of the three-year

performance period to avoid a payout gap at the end of year one and year two

• Comparator Group: Companies in the SPDR S&P Software &

Services ETF, given its representation of our technology industry

peers and the fact that it is challenging relative to other potential

benchmark index companies

• Challenging Performance Hurdles: The minimum, target and

maximum relative TSR metrics for the FY23 program are the 25th,

55th and 75th percentile

• Negative TSR Cap: Payouts under the FY23 PSUs are capped at

the target level if the Company’s absolute total stockholder

return is negative

Key

Design

Features |

| © 2022 SPLUNK INC.

Competitive, Stockholder-Aligned

Compensation for New CEO

A competitive compensation package that is majority long-term equity with significant

performance conditions enabled us to attract and retain our new CEO

Proposal 3: Advisory Vote to Approve Executive Compensation

Go-Forward Compensation Structure

(Beginning with FY24)

CEO New Hire Compensation Package

Base

Salary

Annual Cash

Bonus Cash Signing Bonus RSUs PSUs

$900,000

Target of 125% of

annual base salary

(prorated for FY23)

$8,000,000

(subject to

reimbursement in certain

circumstances)

$12,000,000

Vests over four

years

$18,000,000 (target value)

Performance-based vesting

over three years

Mr. Steele’s forfeited long-term compensation opportunity at his

former employer was valued at more than 2x the target value of his

initial equity awards and cash signing bonus

Beginning in FY24, Mr. Steele’s compensation will have a

similar mix of performance-based and long-term

compensation that aligns with the Company’s pay-for-

performance compensation philosophy for its executives

New Hire RSUs and PSUs entirety of equity delivered

to Mr. Steele

• Notably, these are the only equity awards Mr. Steele

received in FY23 – he will not receive any additional

awards in FY23

14

The Talent & Compensation Committee determined Mr. Steele’s new hire compensation as follows:

• Analyzed CEO compensation within our compensation peer group, as well as recent new-hire CEO

compensation among 14 broader technology companies

• Set target total cash compensation (excluding signing bonus) to approximate median of both peer groups

• In determining target value of initial equity awards, considered values delivered to external CEO

appointments as a multiple of annual equity awards

• The cash + equity ultimately delivered was less than half of the long-term performance-based

compensation opportunity Mr. Steele forfeited when he separated from his prior employer |

| © 2022 SPLUNK INC.

• Historically, we have used equity awards strategically and on a broad basis to successfully compete and grow in an extremely competitive

talent market

• Cloud services represents the majority of our total software bookings, and we reached significant milestones in our ongoing business

transformation as we lapped revenue and cash troughs due to previous accounting and billing changes, respectively

• Our transformation requires us to recruit, incentivize and retain the best available employees in the hyper-competitive cloud, security

and observability technology talent markets

• Equity awards align employee interests with stockholders’ by helping employees maintain continued focus and dedication, thus

maximizing stockholder value

2022 Equity Incentive Plan is Critical to

Our Growth Strategy

Equity-based pay ensures retention of top talent in an extremely competitive

environment, while aligning Splunk employees’ interests with those of long-term

stockholders

Proposal 4: Approval of 2022 Equity Incentive Plan

Key Component of Competitive Hiring Consistent with Our Strategic Transformation

The 2022 plan is critical to our growth and will allow us to recruit, incentivize and retain the best talent

15 |

| © 2022 SPLUNK INC.

2022 Equity Incentive Plan is Governed by

Best Practices

The 2022 plan includes compensation and governance best practices, protecting

Splunk stockholders’ interests

Proposal 4: Approval of 2022 Equity Incentive Plan

• No annual “evergreen” provision

• Certain shares are no longer returned to the share reserve

• No repricing without stockholder approval

• No single-trigger vesting acceleration upon a change in control for

employees and consultants

• Reasonable annual limits on non-employee director compensation

• Minimum vesting requirements

• No transferability without Talent & Compensation Committee

approval

• No tax gross-ups

• Clawback policy

• No dividends on unvested awards

• Minimum exercise price of 100% of fair market value

To exhibit our commitment to a disciplined approach to granting equity, we are asking for approximately one year’s

worth of shares under the 2022 plan as we transition to a new equity compensation program

16

Best Practice Plan Features / Governance |

| © 2022 SPLUNK INC.

RATIFICATION OF APPOINTMENT OF PRICEWATERHOUSECOOPERS – RECOMMEND FOR

✔The Board and the Audit Committee believe that the retention of PricewaterhouseCoopers LLP for the fiscal year ending

January 31, 2023 is in the best interests of the Company and its stockholders

We Request Your Support at the 2022

Annual Meeting of Stockholders

The Board asks that you vote FOR all proposals

ELECTION OF CLASS I DIRECTORS – RECOMMEND FOR

✔Our Board’s extensive, diverse experience enables robust, independent oversight through our ongoing business transformation

✔Demonstrated commitment to refreshment ensures our Board is equipped to create long-term value

SAY ON PAY – RECOMMEND FOR

✔We link incentive compensation for executive officers with achieving or exceeding our strategic and financial performance goals

✔Our executive compensation program demonstrates the continuing evolution of our “pay for performance” philosophy, and

reflects feedback received from extensive stockholder engagement

APPROVAL OF 2022 EQUITY INCENTIVE PLAN – RECOMMEND FOR

✔We use equity-based compensation thoughtfully to attract and retain top talent in an extremely competitive industry, which is

particularly critical as we continue our strategic transformation

✔The 2022 Plan includes compensation and governance best practices

17 |

| © 2022 SPLUNK INC.

Appendix A: Reconciliation of GAAP and

Non-GAAP Information

18

(in thousands) 2022 2021 2022 2021

Net cash provided by (used in) operating activities $ 132,689 $ (23,766) $ 128,048 $ (190,862)

Less purchases of property and equipment (841) (8,800) (10,671) (37,107)

Free cash flow (non-GAAP) $ 131,848 $ (32,566) $ 117,377 $ (227,969)

Net cash provided by (used in) investing activities $ 11,052 $ 195,234 $ (333,752) $ 797,190

Net cash provided by (used in) financing activities $ (19,431) $ (55,417) $ (136,669) $ 382,882

Reconciliation of Cash Provided By (Used In) Operating Activities to Free Cash Flow

Three Months Ended

January 31,

Fiscal Year Ended

January 31, |

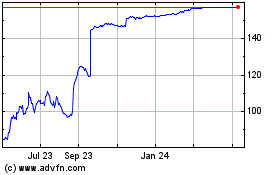

Splunk (NASDAQ:SPLK)

Historical Stock Chart

From Sep 2024 to Oct 2024

Splunk (NASDAQ:SPLK)

Historical Stock Chart

From Oct 2023 to Oct 2024