SoFi Invest members will now be able to invest

in mutual funds and money market funds as well as select

alternative investments

SoFi (NASDAQ: SOFI), the all-in-one digital personal finance

company, announced today that SoFi Invest members will now be able

to invest in select alternative investment funds, mutual funds, and

money market funds. With the launch of alternative investments,

SoFi is granting everyday investors access to the power to build

and protect their wealth through investment opportunities

traditionally reserved for the ultra wealthy.

Initially, SoFi will offer over 6,000 different mutual funds to

members on the SoFi Invest platform, as well as access to invest in

the ARK Venture Fund, Carlyle Tactical Credit Fund (CTAC), KKR

Credit Opportunities Portfolio (KCOP), as well as Franklin

Templeton’s Clarion Partners Real Estate Income Fund (CPREX) and

Franklin BSP Private Credit Fund (FBSPX). These funds feature a

unique lineup of assets, including private credit, real estate and

pre-IPO companies offering a diverse mix of investing

opportunities. SoFi will roll out access to alternative

investments, mutual funds and money market funds to all SoFi Invest

members over the coming days.

“Our goal at SoFi is to empower our members to get their money

right so they can achieve financial independence. We know investing

is critical to building wealth, but many investment vehicles are

still not accessible to everyday investors,” said Anthony Noto, CEO

of SoFi. “Introducing access to alternative investments continues

our focus of offering access to investments that are usually

reserved for the ultra wealthy, and allows us to provide our

members with even more choice and flexibility when it comes to

investing their hard-earned money.”

Alternative Investments & Increasing

Accessibility

SoFi will continue to be a leader in affordable investing by

offering no SoFi transaction fees for mutual funds and no

transaction fees for the new alternatives funds for the first 60

days. After this promotional period, SoFi will offer a competitive

0.50% purchase fee for the alternatives funds with low minimum

investment.

Traditionally, alternative investments have the potential to

provide uncorrelated returns compared to traditional investments

and offer opportunities to invest in private companies and assets

with significant growth potential.1 Until recently, many investors

haven’t been able to invest in certain of these funds, which

limited their ability to diversify investments with alternatives.

SoFi Invest offers a wide range of investing tools from traditional

stocks to ETFs to robo-investing, access to IPOs, and now will

include mutual funds, money market funds, and alternatives funds

across a broad range of categories including commodities, currency

alternatives, and venture capital. SoFi is the only digital finance

app that allows its members to borrow, save, spend, invest, and

protect their money all in one place.

Educating Investors on Alts

Alongside access to alternative investments, SoFi is also

launching an educational hub to help investors better understand

these investment vehicles. The educational hub will cover topics

such as the basics of what alternative investments are, how they

work and fit into a portfolio, and be available to any investor,

not just SoFi members.

Additionally, SoFi offers all members complimentary access to

Certified Financial Planners (CFPs™) to discuss their full

financial plans and goals to ensure they are making the right moves

for their goals and needs.

About SoFi

SoFi (NASDAQ: SOFI) is a member-centric, one-stop shop for

digital financial services on a mission to help people achieve

financial independence to realize their ambitions. The company’s

full suite of financial products and services helps its more than

7.5 million SoFi members borrow, save, spend, invest, and protect

their money better by giving them fast access to the tools they

need to get their money right, all in one app. SoFi also equips

members with the resources they need to get ahead – like career

advisors, Certified Financial Planner™ (CFP®) professionals,

exclusive experiences and events, and a thriving community – on

their path to financial independence.

SoFi innovates across three business segments: Lending,

Financial Services – which includes SoFi Checking and Savings, SoFi

Invest, SoFi Credit Card, SoFi Protect, and SoFi Insights – and

Technology Platform, which offers the only end-to-end vertically

integrated financial technology stack. SoFi Bank, N.A., an

affiliate of SoFi, is a nationally chartered bank, regulated by the

OCC and FDIC and SoFi is a bank holding company regulated by the

Federal Reserve. The company is also the naming rights partner of

SoFi Stadium, home of the Los Angeles Chargers and the Los Angeles

Rams. For more information, visit SoFi.com or download our iOS and

Android apps.

Disclosures

SoFi Invest refers to the two investment and trading platforms

operated by Social Finance, Inc. and its affiliates (described

below). Individual customer accounts may be subject to the terms

applicable to one or more of the platforms below.

1) Automated Investing and advisory services are provided by

SoFi Wealth LLC, an SEC-registered investment adviser (“SoFi

Wealth“). Brokerage services are provided to SoFi Wealth LLC by

SoFi Securities LLC.

2) Active Investing and brokerage services are provided by SoFi

Securities LLC, Member FINRA (www.finra.org)/SIPC (www.sipc.org).

Clearing and custody of all securities are provided by APEX

Clearing Corporation.

For additional disclosures related to the SoFi Invest platforms

described above, including state licensure of SoFi Digital Assets,

LLC, please visit SoFi.com/legal.

Neither the Investment Advisor Representatives of SoFi Wealth,

nor the Registered Representatives of SoFi Securities are

compensated for the sale of any product or service sold through any

SoFi Invest platform. Information related to lending products

contained herein should not be construed as an offer or

pre-qualification for any loan product offered by SoFi Bank,

N.A.

INVESTMENTS ARE NOT FDIC INSURED • ARE NOT BANK GUARANTEED • MAY

LOSE VALUE

________________________________

1Investing in alternative investments and/or strategies may not

be suitable for all investors and involves unique risks, including

the risk of loss. These risks include those associated with

commodities, real estate, leverage, selling securities short, the

use of derivatives, potential adverse market forces, regulatory

changes, and potential illiquidity. An investor should consider

their individual circumstances and any investment information, such

as a prospectus, prior to investing. This information should not be

construed as a recommendation to buy, sell, or hold any security,

nor is a recommendation or endorsement of any investment

strategy.

SOFI-F

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240129143159/en/

Media Contact For SoFi Meghan Brown PR@sofi.com

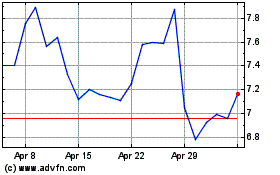

SoFi Technologies (NASDAQ:SOFI)

Historical Stock Chart

From Oct 2024 to Nov 2024

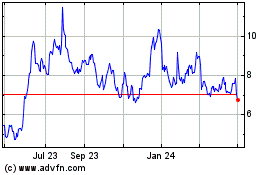

SoFi Technologies (NASDAQ:SOFI)

Historical Stock Chart

From Nov 2023 to Nov 2024