false

0000944075

0000944075

2024-03-05

2024-03-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

March 5, 2024

Date of Report

(Date of earliest event reported)

________________________________________

SOCKET MOBILE, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-13810 |

|

94-3155066 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification

No.) |

40675 Encyclopedia Circle

Fremont, CA 94538

(Address of principal executive offices, including zip code)

(510) 933-3000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

[ ] Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

stock, $0.001 Par Value per Share |

SCKT |

NASDAQ |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act

of 1934 (17 CFR §240.12b-2).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if

the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item 2.02 Results of Operations and Financial Condition

On March 5, 2024, Socket Mobile, Inc. issued a press release

reporting its results for the three and twelve months ended December 31, 2023. The full text of the press release is furnished as Exhibit

99.1.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| Exhibit No. |

|

Description |

| |

|

|

| 99.1 |

|

Text of press release, dated March 5, 2024, titled

"Socket Mobile Reports Fourth Quarter 2023 and Full Year Results". |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

SOCKET

MOBILE, INC. |

| |

|

|

| |

By: |

/s/

Lynn Zhao |

|

| |

|

Name:

Lynn Zhao

Vice

President, Finance and Administration

and

Chief Financial Officer |

Date: March 5, 2024

Exhibit 99.1

Socket Mobile Reports Fourth

Quarter 2023 and Full Year Results

FREMONT, Calif., – March 5, 2024 – Socket

Mobile, Inc. (NASDAQ: SCKT), a leading provider of data capture and delivery solutions for enhanced workplace productivity, today reported

financial results that are determined in accordance with generally accepted accounting principles in the United States (“GAAP”)

for the three and twelve months ended December 31, 2023.

Fourth Quarter 2023 Financial Highlights:

| • | Revenue of $4.4 million,

a 15% decrease compared to $5.2 million in the comparable prior year quarter and a 37% increase sequentially compared to $3.7 million

in Q3 2023. |

| • | Gross margin of 52.8% compared

with 49.3% in the prior year quarter and 44.2% in the preceding quarter. |

| • | Operating loss was $475,000

compared to an operating loss of $152,000 a year ago and an operating loss of $1,399,000 in the preceding quarter. |

| • | Diluted earnings per share

of $0.08 compared to diluted earnings per share of $0.06 a year ago and a net loss per share of ($0.16) in the prior quarter. |

Full Year 2023 Financial Highlights:

| • | Revenue for the full year

of 2023 was $17.0 million versus $21.2 million in 2022, a decrease of 20% year-over-year. |

| • | Gross margin for 2023 was

49.7% compared to 48.8% in 2022. |

| • | Operating loss was $3.1

million in 2023 compared to operating loss of $446,000 in 2022. |

| • | Diluted loss per share

of $0.27, compared to diluted earnings per share of $0.01 in the prior year. |

"Our financial performance in 2023 was below our expectations.

However, we believe that the $17M in reported revenue does not accurately reflect the underlying demand for our products and services.

In 2023, our sales through distribution partners to resellers and end customers totaled $19.1 million, making a 2.8% decrease from the

$19.7M in sales through distributor partners to resellers and end customers in 2022. While the demand softened in 2023, the timing of

shipments to distributors in late 2022 had a positive impact on 2022 and a negative impact on 2023, contributing to the more dramatic

decline. Additionally, reductions in distributor inventory and adjustments to distribution reserves also impacted the reported revenue

for 2023," said Kevin Mills, President, and Chief Executive Officer.

"In Q4 2023, we saw a 37% increase in reported revenue compared

to Q3. Additionally, our gross margin improved by 8.5% compared to Q3. Moving forward, we aim to align our reported sales more closely

with the underlying demand for our products and services," continued Mills.

“In 2023, we achieved significant milestones aimed

at driving sustained growth in the data capture market. Our latest offerings include SocketCam, XtremeScan, DuraScan Wear, and NFC products.”

“The SocketCam C860, our cutting-edge camera scanning

solution, offers an upgrade path for users on both iOS and Android platforms with advanced capabilities such as swift and accurate reading

of damaged barcodes, even in low-light conditions, using the phone’s camera.”

“Our XtremeScan marks our initial entry into an expansive

industrial barcode market. It enables the use of iPhones and iOS applications in rugged work environments, combining robustness with

top-tier protection. Additionally, our DuraScan Wear products feature a glove-like, wearable design, enhancing speed and flexibility

for scanning tasks in warehouse, manufacturing, and distribution settings," continued Mills.

"Our SocketScan S550 NFC Mobile Wallet Reader is Apple-certified

to comply with Apple's VAS Protocol, enabling seamless integration with Apple Wallet. Additionally, it meets Sony's FeliCa standards

and CIPURSE international security standards. Similarly, our SocketScan S370 Universal NFC & QR Code Mobile Wallet Reader received

certification from NFC Forum. These certifications empower our NFC products to cater to a wide range of needs, including VAS Passes,

Mobile Driver's Licenses (mDL) and non-traditional payments such as cryptocurrency," continued Mills.

"We remain committed to returning profitable operating results

as we continue to innovate and strive to deliver world-class data capture solutions to our application partners," concluded Mills.

Conference Call

The management of Socket Mobile will hold a conference call

today at 2 P.M. Pacific (5 P.M. Eastern) to discuss the quarterly and year-end results and outlook for the future. The dial-in number

to access the live conference call is (800) 237-1091 toll-free from within the U.S. or (848) 488-9280 (toll).

About Socket Mobile, Inc.

Socket Mobile is a leading provider of data capture and

delivery solutions for enhanced productivity in workforce mobilization. Socket Mobile’s revenue is primarily driven by the deployment

of third-party barcode enabled mobile applications that integrate Socket Mobile’s cordless barcode scanners and contactless reader/writers.

Mobile Applications servicing the specialty retailer, field service, digital ID, transportation, and manufacturing markets are the primary

revenue drivers. Socket Mobile has a network of thousands of developers who use its software developer tools to add sophisticated data

capture to their mobile applications. Socket Mobile is headquartered in Fremont, Calif. and can be reached at +1-510-933-3000 or www.socketmobile.com.

Follow Socket Mobile on LinkedIn, Twitter, and keep up with our latest News and Updates.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

Such forward-looking statements include, but are not limited to, statements regarding new mobile computer and data collection products,

including details on the timing, distribution, and market acceptance of the products, and statements predicting trends, sales, market

conditions, and opportunities in the markets in which we sell our products. Such statements involve risks and uncertainties, and actual

results could differ materially from the results anticipated in such forward-looking statements as a result of a number of factors, including,

but not limited to, the risk that our new products may be delayed or not rollout as predicted, if ever, due to technological, market,

or financial factors, including the availability of necessary working capital, the risk that market acceptance and sales opportunities

may not happen as anticipated, the risk that our application partners and current distribution channels may choose not to distribute

the new products or may not be successful in doing so, the risk that acceptance of our new products in vertical application markets may

not happen as anticipated, and other risks described in our most recent Form 10-K and 10-Q reports filed with the Securities and Exchange

Commission.

| Socket

Mobile Investor Contact: |

| Lynn

Zhao |

| Chief

Financial Officer |

| 510-933-3016 |

| lynn@socketmobile.com |

Socket is a registered trademark of Socket Mobile.

All other trademarks and trade names contained herein may be those of their respective owners.

© 2024, Socket Mobile, Inc. All rights reserved.

– Financial tables to follow –

Socket

Mobile, Inc.

Condensed

Summary Statements of Operations (Unaudited)

(Amounts

in thousands except per share amounts)

| | |

Year ended Dec 31, | |

Three months ended Dec 31, |

| | |

(Unaudited)

2023 | |

2022 | |

(Unaudited)

2023 | |

2022 |

| Revenue | |

$ | 17,034 | | |

$ | 21,238 | | |

$ | 4,398 | | |

$ | 5,171 | |

| Cost of revenue | |

| 8,571 | | |

| 10,872 | | |

| 2,078 | | |

| 2,623 | |

| Gross profit | |

| 8,463 | | |

| 10,366 | | |

| 2,320 | | |

| 2,548 | |

| Gross profit percent | |

| 49.7 | % | |

| 48.8 | % | |

| 52.8 | % | |

| 49.3 | % |

Research & development

| |

| 4,832 | | |

| 4,362 | | |

| 1,188 | | |

| 1,091 | |

| Sales & marketing | |

| 4,016 | | |

| 3,638 | | |

| 1,003 | | |

| 909 | |

| General & administrative | |

| 2,736 | | |

| 2,812 | | |

| 605 | | |

| 700 | |

| Total operating expenses | |

| 11,584 | | |

| 10,812 | | |

| 2,796 | | |

| 2,700 | |

| Operating income (loss) | |

| (3,121 | ) | |

| (446 | ) | |

| (476 | ) | |

| (152 | ) |

| Interest expense | |

| (242 | ) | |

| (175 | ) | |

| (72 | ) | |

| (41 | ) |

| Income (loss) before income taxes | |

| (3,363 | ) | |

| (621 | ) | |

| (548 | ) | |

| (193 | ) |

| Deferred income tax benefit (expense) | |

| 1,444 | | |

| 708 | | |

| 1,460 | | |

| 708 | |

| Net income (loss) | |

$ | (1,919 | ) | |

$ | 87 | | |

$ | 912 | | |

$ | 515 | |

| Net income (loss)per share: | |

| | | |

| | | |

| | | |

| | |

| Basic | |

$ | (0.27 | ) | |

$ | 0.01 | | |

$ | 0.11 | | |

$ | 0.06 | |

| Fully diluted | |

$ | (0.27 | ) | |

$ | 0.01 | | |

$ | 0.08 | | |

$ | 0.06 | |

Weighted average shares outstanding:

Basic

Fully diluted | |

| 7,230 7,230 | | |

| 7,185 7,533 | | |

| 7,327 9,486 | | |

| 7,135 8,246 | |

*Derived from audited financial

statements.

Socket

Mobile, Inc.

Condensed

Summary Balance Sheets

(Amounts

in Thousands)

| | |

(Unaudited)

December 31, 2023 | |

December 31, 2022* |

| Cash | |

$ | 2,827 | | |

$ | 3,624 | |

| Accounts receivable | |

| 1,700 | | |

| 2,660 | |

| Inventories | |

| 5,409 | | |

| 5,602 | |

Deferred costs on shipments to distributors

| |

| 323 | | |

| 266 | |

| Other current assets | |

| 441 | | |

| 617 | |

| Property and equipment, net | |

| 3,033 | | |

| 1,657 | |

| Deferred tax assets | |

| 10,112 | | |

| 8,668 | |

| Intangible assets, net | |

| 1,559 | | |

| 1,694 | |

| Operating leases right-of-use assets | |

| 3,088 | | |

| 3,560 | |

| Other long-term assets | |

| 250 | | |

| 250 | |

| Total assets | |

$ | 28,742 | | |

$ | 28,598 | |

| Accounts payable and accrued liabilities | |

$ | 2,185 | | |

$ | 2,407 | |

| Bank non-formula loan | |

| — | | |

| 125 | |

| Subordinated convertible notes payable, net of discount | |

| 150 | | |

| 147 | |

| Subordinated convertible notes payable, net of discount-related party | |

| 2,836 | | |

| 1,231 | |

| Deferred revenue on shipments to distributors | |

| 826 | | |

| 595 | |

Deferred service revenue

| |

| 33 | | |

| 34 | |

| Operating lease liabilities | |

| 3,292 | | |

| 3,737 | |

| Total liabilities | |

| 9,322 | | |

| 8,276 | |

| Common stock | |

| 68,391 | | |

| 67,165 | |

| Accumulated deficit | |

| (47,933 | ) | |

| (46,013 | ) |

| Treasury stock | |

| (1,038 | ) | |

| (830) | |

| Total equity | |

| 19,420 | | |

| 20,322 | |

| Total liabilities and equity | |

$ | 28,742 | | |

$ | 28,598 | |

*Derived from audited financial statements.

# # #

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

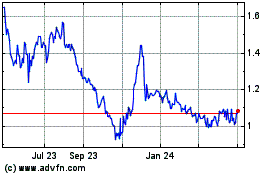

Socket Mobile (NASDAQ:SCKT)

Historical Stock Chart

From Mar 2024 to Apr 2024

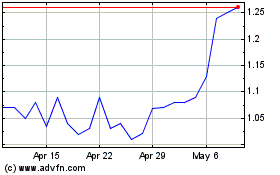

Socket Mobile (NASDAQ:SCKT)

Historical Stock Chart

From Apr 2023 to Apr 2024