SiTime Corporation Announces Pricing of Follow-on Public Offering

February 17 2021 - 11:20PM

SiTime Corporation (Nasdaq: SITM), a leader in MEMS timing, today

announced the pricing of its follow-on public offering of 3,000,000

shares of its common stock at a price to the public

of $127.00 per share, including 1,500,000 shares of

common stock to be sold by MegaChips Corporation and 1,500,000

shares of common stock to be issued and sold by SiTime. SiTime will

not receive any proceeds from the sale of shares of common stock by

MegaChips Corporation. The gross proceeds of the offering to

SiTime, before deducting underwriting discounts and commissions and

other offering expenses, are expected to be $190.5 million,

excluding any exercise of the underwriters’ option. The offering is

expected to close on February 22, 2021, subject to customary

closing conditions.

SiTime has granted the underwriters a 30-day option to purchase

up to 450,000 additional shares of common stock from SiTime at the

public offering price, less underwriting discounts and

commissions.

Barclays, Credit Suisse and Stifel are joint lead book-running

managers for the offering. Needham & Company, Raymond James,

and Roth Capital Partners are co-managers for the offering.

A registration statement relating to these securities was filed

with the U.S. Securities and Exchange Commission on February 16,

2021, and became effective upon filing. SiTime has also filed a

preliminary prospectus supplement for the offering. The offering is

being made only by means of a prospectus supplement and

accompanying prospectus. A copy of the final prospectus supplement,

when available, may be obtained from: Barclays Capital Inc., c/o

Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, or by telephone at (888) 603-5847 or by email at

Barclaysprospectus@broadridge.com; Credit Suisse Securities (USA)

LLC, Attention: Prospectus Department, 6933 Louis Stephens Drive,

Morrisville, North Carolina 27560, or by telephone at

1-800-221-1037 or by email at usa.prospectus@credit-suisse.com; or

Stifel, Nicolaus & Company, Incorporated, Attention: Prospectus

Department, One Montgomery Street, Suite 3700, San Francisco,

California 94104, or by telephone at (415) 364-2720 or by email at

syndprospectus@stifel.com.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About SiTime

SiTime Corporation is a market leader in silicon MEMS timing.

Our programmable solutions offer a rich feature set that enables

customers to differentiate their products with higher performance,

smaller size, lower power, and better reliability. With over 2

billion devices shipped, SiTime is changing the timing

industry.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements relating to SiTime’s expectations

regarding the public offering. These statements are subject to

significant risks and uncertainties and actual results could differ

materially from those projected. SiTime cautions investors not to

place undue reliance on the forward-looking statements contained in

this release. These risks and uncertainties include, without

limitation, that the closing of the offering is subject to the

satisfaction of customary closing conditions. Risks and

uncertainties relating to SiTime and its business can be found in

the “Risk Factors” section of SiTime’s Form 10-K for the year ended

December 31, 2020, filed with the SEC on February 16, 2021, and in

the preliminary prospectus supplement related to the public

offering filed with the SEC on February 16, 2021. SiTime undertakes

no duty or obligation to update any forward-looking statements

contained in this release as a result of new information, future

events or changes in SiTime’s expectations, except as required by

law.

Investor Relations Contacts:

Shelton GroupLeanne Sievers | Brett Perry949-224-3874 |

214-272-0070sheltonir@sheltongroup.com

SiTime CorporationArt ChadwickChief Financial

Officerinvestor.relations@sitime.com

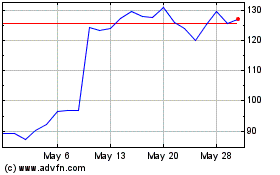

SiTime (NASDAQ:SITM)

Historical Stock Chart

From Oct 2024 to Nov 2024

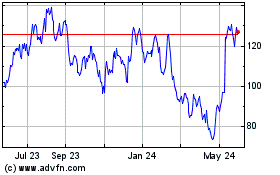

SiTime (NASDAQ:SITM)

Historical Stock Chart

From Nov 2023 to Nov 2024