SiTime Reports Fourth Quarter and Fiscal Year 2020 Financial Results

February 03 2021 - 4:05PM

SiTime Corporation, (Nasdaq: SITM), a leader in MEMS timing,

today announced financial results for the fourth quarter and

fiscal year ended December 31, 2020.

Net revenue in the fourth quarter of 2020 was $40.3

million, a 43.4% increase from the $28.1 million in the fourth

quarter of 2019.

Net revenue for the year ended December 31, 2020

was $116.2 million, a 38.2% increase from the $84.1 million in the

year ended December 31, 2019.

Generally Accepted Accounting Principles

(GAAP) Results

In the fourth quarter of 2020, gross margins were

$21.1 million, or 52.3% of revenue, operating expenses were $19.0

million or 47.2% of revenue, GAAP income from operations was $2.1

million, or 5.1% of revenue and net income was $2.0 million, or

$0.10 per diluted share.

For the year ended 2020, gross margins were $57.9

million, or 49.9% of revenue, operating expenses were $66.5 million

or 57.3% of revenue, GAAP loss from operations was $8.6 million, or

7.4% of revenue and net loss was $9.4 million, or $0.58 per diluted

share.

Total cash and cash equivalents were $73.5

million on December 31, 2020.

Non-GAAP Results

This press release and its attachments include

certain non-GAAP supplemental performance measures. The

presentation of this financial information is not intended to be

considered in isolation or as a substitute for the financial

information prepared and presented in accordance with GAAP.

SiTime believes that the presentation of non-GAAP

financial measures provides important supplemental information to

management and investors regarding financial and business trends

relating to SiTime’s financial condition and results of operations.

SiTime believes that these non-GAAP financial measures provide

additional insight into SiTime’s ongoing performance and core

operational activities and has chosen to provide these measures for

more consistent and meaningful comparison between periods. These

measures should only be used to evaluate SiTime’s results of

operations in conjunction with the corresponding GAAP measures. The

non-GAAP results exclude the effect of stock-based compensation and

related payroll taxes.

The reconciliation between GAAP and non-GAAP

financial results is provided in the financial statements portion

of this release.

In the fourth quarter of 2020, non-GAAP gross

margins were $21.6 million, or 53.5% of revenue, non-GAAP operating

expenses were $13.2 million, or 32.7% of revenue, non-GAAP income

from operations was $8.4 million, or 20.8% of revenue and non-GAAP

net income was $8.3 million, or $0.43 per diluted share.

For the fiscal year 2020, non-GAAP gross margins

were $58.7 million, or 50.5% of revenue, non-GAAP operating

expenses were $49.6 million, or 42.7% of revenue, non-GAAP income

from operations was $9.1 million, or 7.9% of revenue and non-GAAP

net income was $8.4 million, or $0.46 per diluted share.

Conference Call

SiTime will broadcast its fourth quarter and fiscal

year 2020 financial results conference call today, February 3,

2021, at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time), which can

be accessed by calling +1-844-467-7657 and using conference ID

3193344. The conference call will also be available via a live

webcast on the investor relations section of the SiTime website

at https://investor.sitime.com. Please access the website at

least a few minutes prior to the start of the call to download and

install any necessary audio software. An archived webcast replay of

the call will be available on the website for a limited period of

time.

About SiTime

SiTime Corporation is a market leader in silicon

MEMS timing. Our programmable solutions offer a rich feature set

that enables customers to differentiate their products with higher

performance, smaller size, lower power, and better reliability.

With over 2 billion devices shipped, SiTime is changing the timing

industry. For more information,

visit https://www.sitime.com/.

|

SiTime Corporation |

|

|

Unaudited GAAP Condensed Consolidated Statement of

Operations |

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

|

Year Ended |

|

| |

|

|

|

|

|

| |

December 31, 2020 |

|

| |

(in thousands, except per share data) |

|

| Revenue |

$ |

40,274 |

|

|

$ |

116,156 |

|

| Cost of revenue |

|

19,203 |

|

|

|

58,224 |

|

| Gross profit |

|

21,071 |

|

|

|

57,932 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Research and development |

|

8,747 |

|

|

|

31,652 |

|

|

Sales, general and administrative |

|

10,250 |

|

|

|

34,893 |

|

|

Total operating expenses |

|

18,997 |

|

|

|

66,545 |

|

| Income (loss) from

operations |

|

2,074 |

|

|

|

(8,613 |

) |

|

Interest expense |

|

- |

|

|

|

(726 |

) |

|

Other expense, net |

|

(83 |

) |

|

|

(32 |

) |

| Income (loss) before income

taxes |

|

1,991 |

|

|

|

(9,371 |

) |

| Income tax expense |

|

- |

|

|

|

(1 |

) |

| Net income (loss) |

$ |

1,991 |

|

|

$ |

(9,372 |

) |

| Net income (loss) attributable

to common stockholder and comprehensive income |

$ |

1,991 |

|

|

$ |

(9,372 |

) |

| Net income (loss) per share

attributable to common stockholder, basic |

$ |

0.12 |

|

|

$ |

(0.58 |

) |

| Weighted-average shares used

to compute basic net income (loss) per share |

|

17,036 |

|

|

|

16,064 |

|

| Net income (loss) per share

attributable to common stockholder, diluted |

$ |

0.10 |

|

|

$ |

(0.58 |

) |

| Weighted-average shares used

to compute diluted net income (loss) per share |

|

19,263 |

|

|

|

16,064 |

|

|

SiTime Corporation |

|

|

Unaudited Reconciliation of Non-GAAP

Adjustments |

|

| |

Three Months Ended |

|

|

Year Ended |

|

| |

|

|

|

|

|

| |

December 31, 2020 |

|

| |

(in thousands, except per share data) |

|

|

Reconciliation of GAAP gross profit and margin to

non-GAAP |

|

|

|

|

|

|

|

| Revenue |

$ |

40,274 |

|

|

$ |

116,156 |

|

| GAAP gross profit |

|

21,071 |

|

|

|

57,932 |

|

| GAAP gross margin |

|

52.3 |

% |

|

|

49.9 |

% |

|

Stock-based compensation |

|

494 |

|

|

|

751 |

|

| Non-GAAP gross profit |

$ |

21,565 |

|

|

$ |

58,683 |

|

| Non-GAAP gross margin |

|

53.5 |

% |

|

|

50.5 |

% |

| |

|

|

|

|

|

|

|

| Reconciliation of GAAP

operating expenses to non-GAAP |

|

|

|

|

|

|

|

| GAAP research and development

expenses |

|

8,747 |

|

|

|

31,652 |

|

|

Stock-based compensation |

|

(2,047 |

) |

|

|

(5,707 |

) |

| Non-GAAP research and

development expenses |

$ |

6,700 |

|

|

$ |

25,945 |

|

| |

|

|

|

|

|

|

|

| GAAP sales, general and

administrative expenses |

|

10,250 |

|

|

|

34,893 |

|

|

Stock-based compensation |

|

(3,761 |

) |

|

|

(11,280 |

) |

| Non-GAAP sales, general and

administrative expenses |

$ |

6,489 |

|

|

$ |

23,613 |

|

| Total Non-GAAP operating

expenses |

$ |

13,189 |

|

|

$ |

49,558 |

|

| |

|

|

|

|

|

|

|

| Reconciliation of GAAP

income (loss) from operations to non-GAAP income from

operations |

|

|

|

|

|

|

|

| GAAP income (loss) from

operations |

$ |

2,074 |

|

|

$ |

(8,613 |

) |

|

Stock-based compensation |

|

6,302 |

|

|

|

17,738 |

|

| Non-GAAP income from

operations |

$ |

8,376 |

|

|

$ |

9,125 |

|

| Non-GAAP income from

operations as a percentage of revenue |

|

20.8 |

% |

|

|

7.9 |

% |

| |

|

|

|

|

|

|

|

| Reconciliation of GAAP

net income (loss) to non-GAAP net income (loss) |

|

|

|

|

|

|

|

| GAAP net income (loss) |

$ |

1,991 |

|

|

$ |

(9,372 |

) |

|

Stock-based compensation |

|

6,302 |

|

|

|

17,738 |

|

| Non-GAAP net income |

$ |

8,293 |

|

|

$ |

8,366 |

|

| Weighted-average shares used

to compute diluted net income (loss) per share |

|

19,263 |

|

|

|

18,159 |

|

| |

|

|

|

|

|

|

|

| GAAP net income (loss) per

share diluted |

$ |

0.10 |

|

|

$ |

(0.58 |

) |

| Non-GAAP adjustments detailed

above |

|

0.33 |

|

|

|

1.04 |

|

| Non-GAAP net income per share

diluted |

$ |

0.43 |

|

|

$ |

0.46 |

|

| |

|

|

|

|

|

|

|

|

SiTime Corporation |

|

|

Unaudited GAAP Condensed Consolidated Balance

Sheet |

|

| |

As of |

|

| |

December 31, 2020 |

|

| |

(in thousands, except share and per share data) |

|

|

Assets: |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

73,525 |

|

|

Accounts receivable, net |

|

23,920 |

|

|

Related party accounts receivable |

|

736 |

|

|

Inventories |

|

12,350 |

|

|

Prepaid expenses and other current assets |

|

2,649 |

|

|

Total current assets |

|

113,180 |

|

| Property and equipment,

net |

|

11,708 |

|

| Intangible assets, net |

|

2,069 |

|

| Right-of-use assets, net |

|

8,892 |

|

| Other assets |

|

162 |

|

|

Total assets |

$ |

136,011 |

|

| Liabilities and

Stockholders' Equity: |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

6,182 |

|

|

Accrued expenses and other current liabilities |

|

12,963 |

|

|

Total current liabilities |

|

19,145 |

|

| Lease liabilities |

|

6,986 |

|

|

Total liabilities |

|

26,131 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’ equity: |

|

|

|

|

Common stock |

|

2 |

|

| Additional paid-in

capital |

|

173,274 |

|

| Accumulated deficit |

|

(63,396 |

) |

|

Total stockholders’ equity |

|

109,880 |

|

|

Total liabilities and stockholders’ equity |

$ |

136,011 |

|

Investor Relations

Contacts:

Shelton GroupLeanne Sievers | Brett Perry949-224-3874 |

214-272-0070sheltonir@sheltongroup.com

SiTime CorporationArt ChadwickChief Financial

Officerinvestor.relations@sitime.com

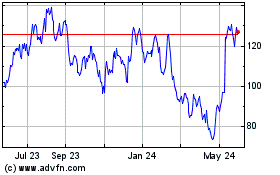

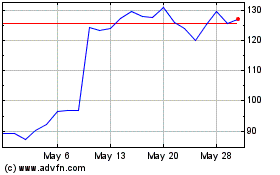

SiTime (NASDAQ:SITM)

Historical Stock Chart

From Oct 2024 to Nov 2024

SiTime (NASDAQ:SITM)

Historical Stock Chart

From Nov 2023 to Nov 2024