Filed pursuant to Rule 424(b)(3)

Registration No. 333-274955

PROSPECTUS

36,468,392

Shares

Sadot

Group Inc.

Common

Stock

This

prospectus relates to the offer and sale, from time to time, by the selling stockholders identified below, or their permitted transferees,

of up to 36,468,392 shares of our common stock, par value $0.0001 per share (“common stock”), including (i) up to 34,087,810

shares of our common stock that we may issue and sell to YA II PN, LTD., a Cayman Islands exempt limited partnership (“Yorkville”)

fund managed by Yorkville Advisors Global, LP from time to time after the date of this prospectus, pursuant to the Standby Equity Purchase

Agreement (“SEPA”) dated September 22, 2023, entered into with Yorkville, (ii) 227,273 shares of common stock (the “Yorkville

Commitment Shares”) issued to Yorkville as consideration for its irrevocable commitment under the SEPA, and (iii) 2,153,309 shares

of common stock issuable upon exercise of a Common Stock Purchase Warrant held by Altium Growth Fund Ltd. (“Altium” and collectively

with Yorkville, the “Selling Stockholders”).

Yorkville

The

shares of our common stock being offered by Yorkville have been and may be issued pursuant to the Standby Equity Purchase Agreement,

dated September 22, 2023, that we entered into with Yorkville. Under the SEPA, the Company agreed to issue and sell to Yorkville, from

time to time, and Yorkville agreed to purchase from the Company, up to $25 million of the Company’s common stock. The Company shall

not affect any sales under the SEPA and Yorkville shall not have any obligation to purchase shares of common stock under the SEPA to

the extent that after giving effect to such purchase and sale (i) Yorkville would beneficially own more than 4.99% of the Company’s

outstanding common stock at the time of such issuance (the “Ownership Limitation”), or (ii) the aggregate number of shares

of common stock issued under the SEPA together with any shares of common stock issued in connection with any other related transactions

that may be considered part of the same series of transactions, would exceed 19.9% of the outstanding voting common stock as of September

22, 2023 (the “Exchange Cap”). Thus, the Company may not have access to the right to sell the full $25 million of shares

of common stock to Yorkville.

In

connection with the SEPA, and subject to the condition set forth therein, Yorkville has agreed to advance us an aggregate principal amount

of $4.0 million (the “Pre-Paid Advance”) which shall be evidenced by convertible promissory notes (the “Convertible

Notes”) to be issued to Yorkville at a purchase price equal to 94.0% of the principal amount of each Pre-Paid Advance. On September

22, 2203, Yorkville advanced the first Pre-Paid Advance to us in the principal amount of $3.0 million and we issued a Convertible Note

to Yorkville in the principal amount of $3.0 million. The balance of $1.0 million of the Pre-Paid Advance will be advanced by Yorkville

to us upon the registration statement registering the resale of the shares of common stock issuable under the SEPA being declared effective.

The purchase price for each Convertible Note representing a Pre-Paid Advance is 94.0% of the principal amount of the Pre-Paid Advance.

Interest shall accrue on the outstanding balance of any Convertible Note at an annual rate equal to 6.0%, subject to an increase to 18%

upon an event of default as described in the Convertible Notes. The maturity date of each Convertible Note will be September 22, 2024,

12-months after the closing of the initial Pre-Paid Advance. Yorkville may convert the Convertible Notes into shares of our common stock

at a conversion price equal to the lower of (A) (i) with respect to the initial Convertible Note issued on September 22, 2023, $1.1495,

and (ii) with respect to the Convertible Note to be issued at the closing of the subsequent Pre-Paid Advance, a price per share equal

to 110% of the daily volume weighted average price (“VWAP”) of the common stock on Nasdaq on the last trading day prior to

the issuance of such Convertible Note, or (B) 95% of the lowest daily VWAP during the seven consecutive trading days immediately preceding

the conversion (the “Conversion Price”), which in no event may the Conversion Price be lower than $0.33 (the “Floor

Price”). Yorkville, in its sole discretion and providing that there is a balance remaining outstanding under the Convertible Notes,

may deliver a notice under the SEPA requiring the issuance and sale of shares of common stock to Yorkville at a price per share equivalent

to the Conversion Price as determined in accordance with the Convertible Notes in consideration of an offset to the Convertible Notes

(“Yorkville Advance”). Yorkville, in its sole discretion, may select the amount of any Yorkville Advance, provided that the

number of shares issued does not cause Yorkville to exceed the Ownership Limitation, does not exceed the Exchange Cap or the amount of

shares of common stock that are registered. As a result of a Yorkville Advance, the amounts payable under the Convertible Notes will

be offset by such amount subject to each Yorkville Advance.

In

connection with the SEPA, we are registering herein 34,315,083 shares of common stock, comprised of (i) 227,273 Yorkville Commitment

Shares and (ii) 34,087,810 shares of common stock issuable pursuant to the SEPA. The shares may be issued and sold to Yorkville, either

(i) at the election of the Company, at 97% of the Market Price (as defined below) for the three consecutive trading days (the “Pricing

Period”) commencing on the date that we direct Yorkville to purchase amounts of our common stock that we specify in a written notice

(an “Advance Notice”), or (ii) pursuant to a Yorkville Advance, at a price per share equivalent to the Conversion Price as

determined in accordance with the Convertible Notes. “Market Price” is defined as, for any Pricing Period, the daily VWAP

of the common stock on Nasdaq during the Pricing Period.

We

are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of our common stock by Yorkville.

Yorkville

is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities

Act”), and any profits on the sales of shares of our common stock by Yorkville and any discounts, commissions, or concessions received

by Yorkville are deemed to be underwriting discounts and commissions under the Securities Act. Yorkville may offer and sell the securities

covered by this prospectus from time to time. Yorkville may offer and sell the securities covered by this prospectus in a number of different

ways and at varying prices. If any underwriters, dealers or agents are involved in the sale of any of the securities, their names and

any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will be calculable

from the information set forth, in any applicable prospectus supplement. See the sections of this prospectus titled “About this

Prospectus” and “Plan of Distribution” for more information. No securities may be sold without delivery of this prospectus

and any applicable prospectus supplement describing the method and terms of the offering of such securities. You should carefully read

this prospectus and any applicable prospectus supplement before you invest in our securities.

Altium

On

July 27, 2023, we entered into the Exercise Agreement with Altium, the holder of outstanding warrants to purchase 2,153,309 shares of

our common stock issued in November 2021 (collectively, the “Original Warrants”), whereby Altium and our company agreed that

Altium would exercise the Original Warrants in consideration of 2,153,309 shares of common stock. In order to induce Altium to exercise

the Original Warrants, we agreed to reduce the exercise price on the Original Warrants from $1.385 to $1.00 per share.

In

connection with the exercise of the Original Warrants, we issued an additional warrant to Altium that is exercisable to acquire 2,153,309

shares of common stock (the “Additional Warrant”) exercisable at a per share price of $2.40.

We

will bear all costs, expenses and fees in connection with the registration of the common stock. The Selling Stockholders will pay all

brokerage fees and commissions and similar expenses in connection with the offer and sale of the shares by the Selling Stockholders pursuant

to this prospectus. We will pay the expenses (except brokerage fees and commissions and similar expenses) incurred in registering under

the Securities Act the offer and sale of the shares included in this prospectus by Selling Stockholders. See “Plan of Distribution.”

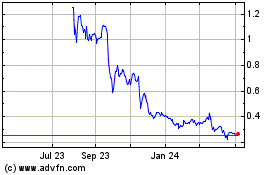

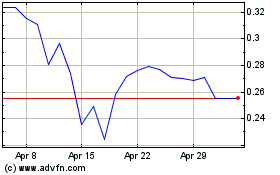

Our

common stock is traded on The Nasdaq Capital Market (“Nasdaq”) under the symbol “SDOT”. On October 10, 2023,

the last reported sale price on Nasdaq of our common stock was $0.7943 per share.

Our

principal executive office is located at 1751 River Run, Suite 200, Fort Worth, Texas 76107, and our telephone number is (832) 604-9568.

Investing

in our securities involves a high degree of risk. You should review carefully the risks and uncertainties referenced under the heading

“Risk Factors” beginning on page 6 of this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is October 26, 2023

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission (the “SEC”)

using the “shelf” registration process. Under this shelf registration process, the Selling Stockholders may, from time to

time, sell the securities offered by it described in this prospectus. We will not receive any proceeds from the sale by such Selling

Stockholder of the securities offered by it described in this prospectus.

Neither

we nor the Selling Stockholders have authorized anyone to provide you with any information or to make any representations other than

those contained in this prospectus or any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf

of us or to which we have referred you. Neither we nor the Selling Stockholders take responsibility for, and can provide no assurance

as to the reliability of, any other information that others may give you. Neither we nor the Selling Stockholders will make an offer

to sell these securities in any jurisdiction where the offer or sale is not permitted.

We

may also provide a prospectus supplement or post-effective amendment to the registration statement to add information to, or update or

change information contained in, this prospectus. You should read both this prospectus and any applicable prospectus supplement or post-effective

amendment to the registration statement together with the additional information to which we refer you in the section of this prospectus

entitled “Where You Can Find More Information.”

Unless

the context indicates otherwise, references in this prospectus to the “Company,” “Sadot Group,” “Sadot,”

“we,” “us,” “our,” and similar terms refer to Sadot Group Inc., a Nevada corporation. Effective July

27, 2023, the Company changed its name from “Muscle Maker Inc.” to “Sadot Group Inc.”. Any reference herein to

“Muscle Maker Inc.” refers to the Company.

This

prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the

actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some

of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described below under “Where You

Can Find More Information.”

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain

statements contained in this prospectus may constitute “forward-looking statements” for purposes of federal securities laws.

Such statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements

appear in a number of places in this prospectus including, without limitation, in the section titled “Business.” In

addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including

any underlying assumptions, are forward-looking statements. Forward-looking statements are typically identified by words such as “plan,”

“believe,” “expect,” “anticipate,” “contemplate,” “intend,” “outlook,”

“estimate,” “forecast,” “project,” “continue,” “could,” “may,”

“might,” “possible,” “potential,” “predict,” “should,” “will,”

“would” and other similar words and expressions (including the negative of any of the foregoing), but the absence of these

words does not mean that a statement is not forward-looking.

These

forward-looking statements are based on information available as of the date of this prospectus and our managements’ current expectations,

forecasts and assumptions, and involve a number of judgments, known and unknown risks and uncertainties and other factors, many of which

are outside the control of the Company and our directors, officers and affiliates. There can be no assurance that future developments

will be those that have been anticipated. Accordingly, forward-looking statements should not be relied upon as representing our views

as of any subsequent date.

These

forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance

to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include,

but are not limited to, those factors described in “Risk Factors,” our periodic filings with the SEC and the following:

| ● |

Our

goals and strategies. |

| ● |

Our

future business development, financial condition and results of operations. |

| |

|

| ● |

Expected

changes in our revenue, costs or expenditures. |

| ● |

Our

ability to obtain financing in amounts sufficient to fund our operations and continue as a going concern. |

| ● |

Growth

of and competition trends in our industry. |

| ● |

Our

expectations regarding demand for, and market acceptance of, our products and services. |

| ● |

Our

expectations regarding our relationships with investors, institutional funding partners and other parties we collaborate with. |

| ● |

Fluctuations

in general economic and business conditions in the markets in which we operate. |

| ● |

Our

ability to raise capital when needed. |

| ● |

Relevant

government policies and regulations relating to our industry. |

Our

forward-looking statements speak only as of the dates on which they are made. We do not undertake any obligation to publicly update or

revise our forward-looking statements even if experience or future changes makes it clear that any projected results expressed or implied

in such statements will not be realized, except as may be required by law.

These

statements relate to future events or our future operational or financial performance, and involve known and unknown risks, uncertainties

and other factors that may cause our actual results, performance or achievements to be materially different from any future results,

performance or achievements expressed or implied by these forward-looking statements. Factors that may cause actual results to differ

materially from current expectations include, among other things, those listed under the section titled “Risk Factors” and

elsewhere in this prospectus, in any related prospectus supplement and in any related free writing prospectus.

Any

forward-looking statement in this prospectus, in any related prospectus supplement and in any related free writing prospectus reflects

our current view with respect to future events and is subject to these and other risks, uncertainties and assumptions relating to our

business, results of operations, industry and future growth. Given these uncertainties, you should not place undue reliance on these

forward-looking statements. No forward-looking statement is a guarantee of future performance. You should read this prospectus, any related

prospectus supplement and any related free writing prospectus and the documents that we reference herein and therein and have filed as

exhibits hereto and thereto completely and with the understanding that our actual future results may be materially different from any

future results expressed or implied by these forward-looking statements. Except as required by law, we assume no obligation to update

or revise these forward-looking statements for any reason, even if new information becomes available in the future.

This

prospectus, any related prospectus supplement and any related free writing prospectus also contain or may contain estimates, projections

and other information concerning our industry, our business and the markets for our products, including data regarding the estimated

size of those markets and their projected growth rates. We obtained the industry and market data in this prospectus from our own research

as well as from industry and general publications, surveys and studies conducted by third parties. This data involves a number of assumptions

and limitations and contains projections and estimates of the future performance of the industries in which we operate that are subject

to a high degree of uncertainty, including those discussed in “Risk Factors.” We caution you not to give undue weight to

such projections, assumptions and estimates. Further, industry and general publications, studies and surveys generally state that they

have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information.

While we believe that these publications, studies and surveys are reliable, we have not independently verified the data contained in

them. In addition, while we believe that the results and estimates from our internal research are reliable, such results and estimates

have not been verified by any independent source.

PROSPECTUS

SUMMARY

The

following summary highlights information contained elsewhere in this prospectus. This summary may not contain all of the information

that may be important to you. You should read this entire prospectus carefully, including the sections entitled “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our historical financial

statements and related notes included elsewhere in this prospectus.

Overview

Sadot

Group Inc. has rapidly established itself as an emerging player in the global food supply chain sector. The Company provides innovative

and sustainable supply chain solutions that address the world’s growing food security challenges. The Sadot Group currently operates

within three key verticals of the global food supply chain including 1) global agri-commodity origination and trading operations for

food/feed products such as soybean meal, wheat and corn, 2) farm operations producing grains and tree crops in Southern Africa, and 3)

food service operations with more than 45 restaurants across the U.S. and Kuwait. The Sadot Group is headquartered in Ft. Worth, Texas

with subsidiary operations in Miami, Dubai, Singapore, Kyiv and Zambia.

Sadot

Agri-Foods Origination and Trading Operations (Sadot LLC, our wholly-owned subsidiary), is an international agri-commodities company

engaged in the trading and shipping of food and feed (e.g., soybean meal, wheat and corn) via dry bulk cargo ships to/from markets across

the globe. Sadot Agri-Foods originates food supply chain transactions from the point of origination (producers) to point of consumption

(customers), taking advantage of arbitrages between currencies, origins and products. Sadot Agri-Foods executes agri-commodity

trades between producing geographies such as the Americas, Africa, and the Black Sea to consumer markets in Southeast Asia, China, and

the Middle East/North Africa (MENA) region, coordinating with headquarters to ensure that each transaction is appropriately financed

and risk management is applied. Sadot Agri-Foods seeks to drive growth through new product lines, new geographies and new verticals within

the food supply chain. The organization is powered by a global team of deeply experienced agri-commodity consultants at Aggia LLC FZ,

a major shareholder of Sadot Group. Sadot Agri-Foods was formed as part of our diversification strategy to own and operate, through its

subsidiaries, business lines throughout the food value chain and is our largest operating unit.

Sadot

Food Service Operations, which is operated through various wholly-owned subsidiaries, has three unique concepts, including two fast casual

restaurant concepts, Pokémoto and Muscle Maker Grill, plus one subscription-based fresh prep meal concept, SuperFit Foods. Following

our strategic pivot to the global food supply chain sector, we are fully engaged in the restructuring of these legacy restaurant operations.

By refranchising company-owned units and closing underperforming locations while growing Pokémoto through franchising, the Company

is continuing its restructuring efforts with the goal of reducing annualized restaurant operating expenses and overhead while potentially

increasing franchise royalty revenue at Pokémoto. The Pokémoto concept has garnered significant interest among potential

franchisees owing to its low cost of entry and straightforward operational model. Currently, there are 34 Pokémoto units in operation

across 15 states, with a pipeline of over 45 franchise locations already sold but not yet opened.

Sadot

Farm Operations (Sadot Zambia LLC) includes ~5,000 acres of farmland in the Mkushi Region of Zambia which was acquired August of 2023.

Farm operations are expected to provide a reliable supply of grains and tree crops (mango and avocado), which are currently experiencing

constant demand and yielding higher margins. Sadot Zambia has had its first successful harvest in September 2023 of 987 metric tons of

premium-grade wheat and is gearing up for additional planting phases this year including more than 1,300 acres of maize and 775 acres

of soybean.

Yorkville

Transaction

On

September 22, 2023, we entered into the SEPA with Yorkville. Under the SEPA, we agreed to issue and sell to Yorkville, from time to time,

and Yorkville agreed to purchase from us, up to $25 million of our common stock. We shall not affect any sales under the SEPA and Yorkville

shall not have any obligation to purchase shares of common stock under the SEPA to the extent that after giving effect to such purchase

and sale Yorkville would exceed the Ownership Limitation or the Exchange Cap. Thus, we may not have access to the right to sell the full

$25 million of shares of common stock to Yorkville.

In

connection with the SEPA, and subject to the condition set forth therein, Yorkville has agreed to advance us the Pre-Paid Advance which

shall be evidenced by the Convertible Notes to be issued to Yorkville at a purchase price equal to 94.0% of the principal amount of each

Pre-Paid Advance. On September 22, 2203, Yorkville advanced the first Pre-Paid Advance to us in the principal amount of $3.0 million

and we issued a Convertible Note to Yorkville in the principal amount of $3.0 million. The balance of $1.0 million of the Pre-Paid Advance

will be advanced by Yorkville to us upon the registration statement registering the resale of the shares of common stock issuable under

the SEPA being declared effective. The purchase price for each Convertible Note representing a Pre-Paid Advance is 94.0% of the principal

amount of the Pre-Paid Advance. Interest shall accrue on the outstanding balance of any Convertible Note at an annual rate equal to 6.0%,

subject to an increase to 18% upon an event of default as described in the Convertible Notes. The maturity date of each Convertible Note

will be September 22, 2024, 12-months after the closing of the initial Pre-Paid Advance. Yorkville may convert the Convertible Notes

into shares of our common stock at the Conversion Price, which in no event may the Conversion Price be lower than the Floor Price. Yorkville,

in its sole discretion and providing that there is a balance remaining outstanding under the Convertible Notes, may deliver a notice

under the SEPA requiring a Yorkville Advance. Yorkville, in its sole discretion, may select the amount of any Yorkville Advance, provided

that the number of shares issued does not cause Yorkville to exceed the Ownership Limitation, does not exceed the Exchange Cap or the

amount of shares of common stock that are registered. As a result of a Yorkville Advance, the amounts payable under the Convertible Notes

will be offset by such amount subject to each Yorkville Advance.

Altium

Transaction

On

July 27, 2023, we entered into the Exercise Agreement with Altium, the holder of outstanding warrants to purchase the Original Warrants,

whereby Altium and our company agreed that Altium would exercise the Original Warrants in consideration of 2,153,309 shares of common

stock. In order to induce Altium to exercise the Original Warrants, we agreed to reduce the exercise price on the Original Warrants from

$1.385 to $1.00 per share. In connection with the exercise of the Original Warrants, we issued the Additional Warrant to Altium exercisable

at a per share price of $2.40.

Implications

of Being an Emerging Growth Company

We

qualify as an emerging growth company as defined in the Jumpstart our Business Startups Act of 2012 (“JOBS Act”). As an emerging

growth company, we take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions

include, but are not limited to:

| |

● |

being

permitted to present only two years of audited financial statements, in addition to any required unaudited interim financial statements,

with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

disclosure in this prospectus; |

| |

● |

not

being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (“Sarbanes-Oxley”); |

| |

● |

reduced

disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| |

● |

exemptions

from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute

payments not previously approved. |

We

expect to take advantage of these reporting exemptions until we are no longer an emerging growth company. We could be an emerging growth

company for up to five years, circumstances could cause us to lose that status earlier, including if the market value of our Common Stock

held by non-affiliates exceeds $700 million, if we issue $1 billion or more in non-convertible debt during a three-year period, or if

our annual gross revenues exceed $1 billion. We would cease to be an emerging growth company on the last day of the fiscal year following

the date of the fifth anniversary of our first sale of common equity securities under an effective registration statement or a fiscal

year in which we have $1 billion in gross revenues. Finally, at any time we may choose to opt-out of the emerging growth company reporting

requirements. If we choose to opt out, we will be unable to opt back in to being an emerging growth company.

The

JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised

accounting standards. To the extent that we continue to qualify as a “smaller reporting company,” as such term is defined

in Rule 12b-2 under the Securities Exchange Act of 1934, after we cease to qualify as an emerging growth company, certain of the exemptions

available to us as an emerging growth company may continue to be available to us as a smaller reporting company, including (i) not being

required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes Oxley Act, (ii) scaled executive compensation

disclosures, and (iii) the requirement to provide only two years of audited financial statements, instead of three years.

Risk

Factors Summary

An

investment in our common shares involves a high degree of risk. You should carefully consider the risks summarized below. The risks are

more fully discussed in the “Risk Factors” section of this prospectus.

| |

● |

Risks

relating to our strategy, such as those associated with our ability to deploy capital effectively, execute our business strategy,

compete in highly competitive markets, develop our new products and services, and protect our intellectual property. |

| |

|

|

| |

● |

Risks

relating to our operations, such as those associated with our limited operating history, attracting and retaining experienced

personnel, changes in technology and customer requirements, the adaption of our solutions by our customers, ability to manage growth

and confront cybersecurity challenges. |

| |

|

|

| |

● |

Risks

relating to our liquidity, including those associated with our ability to generate sufficient cash flow from operations, obtain

additional funding on market terms to continue our current level of operations and growth, and forecast our cash needs. |

| |

|

|

| |

● |

Risks

relating to compliance and regulation, including those associated with our ability to develop and maintain an effective system

of internal controls, management’s ability to significantly influence matters submitted to our stockholders for approval, our

ability to comply with current and future regulations. |

| |

|

|

| |

● |

Risks

relating to this offering and investing in our Common Stock, including those associated with the limited public market for our

common stock, the dilutive effect of our outstanding warrants on our common stockholders, our ability to maintain listing of our

Common Stock on Nasdaq, government and FINRA rules to limit a stockholder’s ability to buy and sell our common stock, securities

or industry analysts not following or negatively reporting on us, restrictions on third party seeking to acquire us, our dividend

policy, restrictions on the exclusive forum for stockholders’ actions, the cost and our time devoted to being a public company,

and our status as an “emerging growth company”. |

Corporate

Information

Our

common stock is listed on Nasdaq under the symbol “SDOT”. Our principal executive office is located at 1751 River Run, Suite

200, Fort Worth, Texas 76107, and our telephone number is (832) 604-9568. Our website address is www.sadotgroupinc.com. This website

address is not intended to be an active link, and information on, or accessible through, our website is not incorporated by reference

into this prospectus and you should not consider any information on, or that can be accessed from, our website as part of this prospectus

or any accompanying prospectus supplement.

THE

OFFERING

Yorkville

On

September 22, 2023, we entered into the Standby Equity Purchase Agreement (“SEPA”) with YA II PN, LTD, a Cayman Islands exempt

limited partnership (“Yorkville”) pursuant to which we have the right to sell to Yorkville up to $25 million of our shares

of common stock, subject to certain limitations and conditions set forth in the SEPA, from time to time during the term of the SEPA.

Sales of the shares of common stock to Yorkville under the SEPA, and the timing of any such sales, are at our option, and we are under

no obligation to sell any shares of common stock to Yorkville under the SEPA except in connection with notices that may be submitted

by Yorkville, in certain circumstances as described below.

Upon

the satisfaction of the conditions to Yorkville’s purchase obligation set forth in the SEPA, including having a registration statement

registering the resale of the shares of common stock issuable under the SEPA declared effective by the SEC, we will have the right, but

not the obligation, from time to time at its discretion until the SEPA is terminated to direct Yorkville to purchase a specified number

of shares of common stock (“Advance”) by delivering written notice to Yorkville ( “Advance Notice”). While there

is no mandatory minimum amount for any Advance, it may not exceed an amount equal to 100% of the average of the daily traded amount during

the five consecutive trading days immediately preceding an Advance Notice.

The

shares of common stock purchased pursuant to an Advance that we deliver will be purchased at a price equal to 97.0% of the lowest daily

VWAP of the shares of common stock during the three consecutive trading days commencing on the date of the delivery of the Advance Notice,

other than the daily VWAP on a day in which the daily VWAP is less than a minimum acceptable price as stated by us in the Advance Notice

or there is no VWAP on the subject trading day. We may establish a minimum acceptable price in each Advance Notice below which we will

not be obligated to make any sales to Yorkville. “VWAP” is defined as the daily volume weighted average price of the shares

of common stock for such trading day on the Nasdaq Stock Market during regular trading hours as reported by Bloomberg L.P. Accordingly,

as may otherwise be limited by Yorkville’s 4.99% beneficial ownership limitation, assuming we submits an Advance requiring Yorkville

to provide $100,000 in funding and assuming an applicable VWAP of $0.79 and, in turn, a purchase price of $0.7663 (97.0% of the VWAP),

the Company would be required to issue 130,497 shares of common stock and Yorkville would receive a profit of approximately $0.0237 per

share, or approximately $3,092.78, if it sold all of such shares at $0.79 per share.

In

connection with the SEPA, and subject to the condition set forth therein, Yorkville has agreed to advance us an aggregate principal amount

of $4.0 million (the “Pre-Paid Advance”) which shall be evidenced by convertible promissory notes (the “Convertible

Notes”) to be issued to Yorkville at a purchase price equal to 94.0% of the principal amount of each Pre-Paid Advance. On September

22, 2203, Yorkville advanced the first Pre-Paid Advance to us in the principal amount of $3.0 million and we issued a Convertible Note

to Yorkville in the principal amount of $3.0 million. The balance of $1.0 million of the Pre-Paid Advance will be advanced by Yorkville

to us upon the registration statement registering the resale of the shares of common stock issuable under the SEPA being declared effective.

The purchase price for each Convertible Note representing a Pre-Paid Advance is 94.0% of the principal amount of the Pre-Paid Advance.

Interest shall accrue on the outstanding balance of any Convertible Note at an annual rate equal to 6.0%, subject to an increase to 18%

upon an event of default as described in the Convertible Notes. The maturity date of each Convertible Note will be September 22, 12-months

after the closing of the initial Pre-Paid Advance. Yorkville may convert the Convertible Notes into shares of our common stock at a conversion

price equal to the lower of (A) (i) with respect to the initial Convertible Note issued on September 22, 2023, $1.1495, and (ii) with

respect to the Convertible Note to be issued at the closing of the subsequent Pre-Paid Advance, a price per share equal to 110% of the

daily volume weighted average price (“VWAP”) of the common stock on Nasdaq on the last trading day prior to the issuance

of such Convertible Note, or (B) 95% of the lowest daily VWAP during the seven consecutive trading days immediately preceding the conversion

(the “Conversion Price”), which in no event may the Conversion Price be lower than $0.33 (the “Floor Price”)..

In addition, upon the occurrence and during the continuation of an event of default, the Convertible Notes shall become immediately due

and payable and we shall pay to Yorkville the principal and interest due thereunder. In no event shall Yorkville be allowed to effect

a conversion if such conversion, along with all other shares of common stock beneficially owned by Yorkville and its affiliates would

exceed 4.99% of the outstanding shares of our common stock. If any time on or after October 22, 2023 (i) the daily VWAP is less than

the Floor Price for seven trading days during a period of nine consecutive trading days (“Floor Price Trigger”), or (ii)

the Company has issued in excess of 99% of the shares of common stock available under the Exchange Cap (as defined below) (“Exchange

Cap Trigger” and collectively with the Floor Price Trigger, the “Trigger”)), then we shall make monthly payments to

Yorkville beginning on the seventh trading day after the Trigger and continuing monthly in the amount of $500,000 plus an 8.0% premium

and accrued and unpaid interest. The Exchange Cap Trigger will not apply in the event we have obtained the approval from its stockholders

in accordance with the rules of Nasdaq Stock Market for the issuance of shares of common stock pursuant to the transactions contemplated

in the Convertible Note and the SEPA in excess of 19.99% of the aggregate number of shares of common stock issued and outstanding as

of the effective date of the SEPA (the “Exchange Cap”).

Yorkville,

in its sole discretion and providing that there is a balance remaining outstanding under the Convertible Notes, may deliver a notice

under the SEPA requiring the issuance and sale of shares of common stock to Yorkville at a price per share equivalent to the Conversion

Price as determined in accordance with the Convertible Notes in consideration of an offset of the Convertible Notes (“Yorkville

Advance”). Yorkville, in its sole discretion, may select the amount of any Yorkville Advance, provided that the number of shares

issued does not cause Yorkville to exceed the 4.99% ownership limitation, does not exceed the Exchange Cap or the amount of shares of

common stock that are registered. As a result of a Yorkville Advance, the amounts payable under the Convertible Notes will be offset

by such amount subject to each Yorkville Advance.

We

will control the timing and amount of any sales of shares of common stock to Yorkville, except with respect to Yorkville Advances. Actual

sales of shares of common stock to Yorkville as an Advance under the SEPA will depend on a variety of factors to be determined by us

from time to time, which may include, among other things, market conditions, the trading price of our common stock and determinations

by us as to the appropriate sources of funding for our business and operations.

The

SEPA will automatically terminate on the earliest to occur of (i) the first day of the month next following the 36-month anniversary

of the date of the SEPA or (ii) the date on which Yorkville shall have made payment of Advances pursuant to the SEPA for shares of common

stock equal to $25 million. We have the right to terminate the SEPA at no cost or penalty upon five (5) trading days’ prior written

notice to Yorkville, provided that there are no outstanding Advance Notices for which shares of common stock need to be issued and we

have paid all amounts owed to Yorkville pursuant to the Convertible Notes. Together with Yorkville, we may also agree to terminate the

SEPA by mutual written consent. Neither our company nor Yorkville may assign or transfer our respective rights and obligations under

the SEPA, and no provision of the SEPA may be modified or waived by us or Yorkville other than by an instrument in writing signed by

both parties.

As

consideration for Yorkville’s commitment to purchase the shares of common stock pursuant the SEPA, the Company paid Yorkville,

(i) a due diligence fee in the amount of $25,000 and (ii) a commitment fee equal to 227,273 shares of common stock.

The

SEPA contains customary representations, warranties, conditions and indemnification obligations of the parties. The representations,

warranties and covenants contained in such agreements were made only for purposes of such agreements and as of specific dates, were solely

for the benefit of the parties to such agreements and may be subject to limitations agreed upon by the contracting parties.

The

net proceeds we generate under the SEPA will depend on the frequency and prices at which we sell our shares of common stock to Yorkville.

We expect that any proceeds received from such sales to Yorkville will be used for working capital and general corporate purposes.

While

Yorkville may experience a positive rate of return based on the current trading price of our shares of common stock, our shareholders

may not experience a similar rate of return on the shares of common stock they purchased due to differences in the purchase prices and

the then-current trading price at the time of any sale. The purchase price for the shares of common stock under the SEPA and the number

of shares we might issue to Yorkville under the SEPA cannot be known. There are substantial risks to our stockholders as a result of

the sale and issuance of common stock to Yorkville under the SEPA. These risks include substantial dilution, significant declines in

our stock price and our inability to draw sufficient funds when needed. See the section entitled “Risk Factors” included

elsewhere in this prospectus. Issuances of our common stock under the SEPA will not affect the rights or privileges of our existing stockholders,

except that the economic and voting interests of each of our existing stockholders will be diluted as a result of any such issuance.

Although the number of shares of common stock that our existing stockholders own will not decrease, the shares owned by our existing

stockholders will represent a smaller percentage of our total outstanding shares after any such issuances pursuant to the SEPA.

Altium

On

July 27, 2023, we entered into the Exercise Agreement with Altium, the holder of the Original Warrants, whereby Altium and our company

agreed that Altium would exercise the Original Warrants in consideration of 2,153,309 shares of common stock (the “Shares”).

In order to induce Altium to exercise the Original Warrants, we agreed to reduce the exercise price on the Original Warrants from $1.385

to $1.00 per share. In connection with the exercise of the Original Warrants, we issued an additional warrant to Altium that is exercisable

to acquire 2,153,309 shares of common stock (the “Additional Warrant”). The Additional Warrant is exercisable at a per share

price of $2.40.

SECURITIES

OFFERED

Shares

of Common Stock Offered by

the

Selling Stockholders |

|

|

| |

|

Yorkville

|

| |

|

|

| |

|

227,273

shares of common stock issued to Yorkville as the Yorkville Commitment Shares We have not and will not receive any cash proceeds

from the issuance of these Commitment Shares. |

| |

|

|

| |

|

up

to 34,087,810 shares of our common stock issuable to Yorkville under the SEPA from time to time. |

| |

|

|

| |

|

We

have not and will not receive any cash proceeds from the issuance of these shares to Yorkville. |

| |

|

|

| |

|

Altium |

| |

|

|

| |

|

On

July 27, 2023, we entered into the Exercise Agreement with Altium, the holder of the Original Warrants, whereby Altium and our company

agreed that Altium would exercise the Original Warrants in consideration of the Shares. In order to induce Altium to exercise the

Original Warrants, we agreed to reduce the exercise price on the Original Warrants from $1.385 to $1.00 per share. In connection

with the exercise of the Original Warrants, we issued an additional warrant to Altium that is exercisable to acquire 2,153,309 shares

of common stock exercisable at a per share price of $2.40. |

| |

|

|

| Shares

of Common Stock Outstanding Prior to this Offering |

|

|

| |

|

46,148,386

shares of common stock (as of October 10, 2023). |

| |

|

|

| Shares

of Common Stock Outstanding After this Offering |

|

|

| |

|

36,468,392

shares of common stock, assuming (i) the sale of a total of 34,315,083 shares of common stock to Yorkville (including the 227,273

Commitment Shares issued to Yorkville) and (ii) the exercise of the Additional Warrant by Altium to acquire 2,153,309 shares of common

stock. The actual number of shares will vary depending upon the number of shares we sell under the SEPA. |

| |

|

|

| Use

of Proceeds |

|

|

| |

|

We

will not receive any proceeds from the sale of shares of common stock included in this prospectus by Yorkville. We may receive up

to $25.0 million aggregate gross proceeds under the SEPA from sales of common stock that we elect to make to Yorkville pursuant to

the SEPA, if any, from time to time in our sole discretion, although the actual amount of proceeds that we may receive cannot be

determined at this time and will depend on the number of shares we sell under the SEPA and market prices at the times of such sales.

Yorkville has agreed to advance us in the form of Convertible Notes the Pre-Paid Advance. The Pre-Paid Advance was disbursed on September

22, 2023 with respect to $3.0 million and the balance of $1.0 million will be disbursed upon the registration statement registering

the resale of the shares of common stock issuable under the SEPA being declared effective. The purchase price for the Pre-Paid Advance

is 94.0% of the principal amount of the Pre-Paid Advance. The proceeds from the Pre-Paid Advance will be used for working capital

and general corporate purposes. |

| |

|

|

| |

|

We

expect that any proceeds that we receive from sales of our common stock to Yorkville under the SEPA or from Altium as a result of

the exercise of their Additional Warrant will be used for working capital and general corporate purposes. See “Use of Proceeds.” |

| |

|

|

| Market

for Common Stock |

|

|

| |

|

Our

common stock is currently traded on the Nasdaq Capital Market under the symbol “SDOT.” |

| |

|

|

| Risk

Factors |

|

|

| |

|

See

“Risk Factors” and other information included in this prospectus for a discussion of factors you should consider before

investing in our securities. |

RISK

FACTORS

An

investment in our securities involves a high degree of risk. This prospectus contains the risks applicable to an investment in our securities.

Prior to making a decision about investing in our securities, you should carefully consider the specific factors discussed under the

heading “Risk Factors” in this prospectus. The risks and uncertainties we have described are not the only ones we face. Additional

risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations. The occurrence

of any of these known or unknown risks might cause you to lose all or part of your investment in the offered securities.

Risks

Related to this Offering

Substantial

blocks of our common stock may be sold into the market as a result of the shares sold to Yorkville under the SEPA, which may cause the

price of our common stock to decline.

The

price of our common stock could decline if there are substantial sales of shares of our common stock, if there is a large number of shares

of our common stock available for sale, or if there is the perception that these sales could occur.

On

September 22, 2023, we entered into the SEPA with Yorkville. Under the SEPA, we agreed to issue and sell to Yorkville, from time to time,

and Yorkville agreed to purchase from us, up to $25 million of our common stock. We shall not affect any sales under the SEPA and Yorkville

shall not have any obligation to purchase shares of common stock under the SEPA to the extent that after giving effect to such purchase

and sale Yorkville would exceed the Ownership Limitation or the Exchange Cap. Thus, we may not have access to the right to sell the full

$25 million of shares of common stock to Yorkville. In connection with the SEPA, and subject to the condition set forth therein, Yorkville

has agreed to advance us the Pre-Paid Advance which shall be evidenced by the Convertible Notes to be issued to Yorkville at a purchase

price equal to 94.0% of the principal amount of each Pre-Paid Advance. On September 22, 2023, Yorkville advanced the first Pre-Paid Advance

to us in the principal amount of $3.0 million and we issued a Convertible Note to Yorkville in the principal amount of $3.0 million.

The balance of $1.0 million of the Pre-Paid Advance will be advanced by Yorkville to us upon the registration statement registering the

resale of the shares of common stock issuable under the SEPA being declared effective. The purchase price for each Convertible Note representing

a Pre-Paid Advance is 94.0% of the principal amount of the Pre-Paid Advance. Interest shall accrue on the outstanding balance of any

Convertible Note at an annual rate equal to 6.0%, subject to an increase to 18% upon an event of default as described in the Convertible

Notes. The maturity date of each Convertible Note will be September 22, 2024, 12-months after the closing of the initial Pre-Paid Advance.

Yorkville may convert the Convertible Notes into shares of our common stock at the Conversion Price, which in no event may the Conversion

Price be lower than the Floor Price. Yorkville, in its sole discretion and providing that there is a balance remaining outstanding under

the Convertible Notes, may deliver a notice under the SEPA requiring a Yorkville Advance. Yorkville, in its sole discretion, may select

the amount of any Yorkville Advance, provided that the number of shares issued does not cause Yorkville to exceed the Ownership Limitation,

does not exceed the Exchange Cap or the amount of shares of common stock that are registered. As a result of a Yorkville Advance, the

amounts payable under the Convertible Notes will be offset by such amount subject to each Yorkville Advance.

Any

issuance of shares of common stock pursuant to this facility will dilute the percentage ownership of stockholders and may dilute the

per share projected earnings (if any) or book value of our common stock. Sales of a substantial number of shares of our common stock

in the public market or other issuances of shares of our common stock, or the perception that these sales or issuances could occur, could

cause the market price of our common stock to decline and may make it more difficult for you to sell your shares at a time and price

that you deem appropriate.

It

is not possible to predict the actual number of shares we will sell under the SEPA to Yorkville at any one time or in total, or the actual

gross proceeds resulting from those sales.

We

generally have the right to control the timing and amount of any sales of our shares of common stock to Yorkville under the SEPA. Sales

of our common stock, if any, to Yorkville under the SEPA will depend upon market conditions and other factors. We may ultimately decide

to sell to Yorkville all, some or none of the shares of our common stock that may be available for us to sell to Yorkville pursuant to

the SEPA. In connection with the SEPA, and subject to the condition set forth therein, Yorkville has agreed to advance us the Pre-Paid

Advance which shall be evidenced by the Convertible Notes to be issued to Yorkville at a purchase price equal to 94.0% of the principal

amount of each Pre-Paid Advance. On September 22, 2023, Yorkville advanced the first Pre-Paid Advance to us in the principal amount of

$3.0 million and we issued a Convertible Note to Yorkville in the principal amount of $3.0 million. The balance of $1.0 million of the

Pre-Paid Advance will be advanced by Yorkville to us upon the registration statement registering the resale of the shares of common stock

issuable under the SEPA being declared effective. The purchase price for each Convertible Note representing a Pre-Paid Advance is 94.0%

of the principal amount of the Pre-Paid Advance. Interest shall accrue on the outstanding balance of any Convertible Note at an annual

rate equal to 6.0%, subject to an increase to 18% upon an event of default as described in the Convertible Notes. The maturity date of

each Convertible Note will be September 22, 2024, 12-months after the closing of the initial Pre-Paid Advance. Yorkville may convert

the Convertible Notes into shares of our common stock at the Conversion Price, which in no event may the Conversion Price be lower than

the Floor Price. Yorkville, in its sole discretion and providing that there is a balance remaining outstanding under the Convertible

Notes, may deliver a notice under the SEPA requiring a Yorkville Advance. Yorkville, in its sole discretion, may select the amount of

any Yorkville Advance, provided that the number of shares issued does not cause Yorkville to exceed the Ownership Limitation, does not

exceed the Exchange Cap or the amount of shares of common stock that are registered. As a result of a Yorkville Advance, the amounts

payable under the Convertible Notes will be offset by such amount subject to each Yorkville Advance.

Because

the purchase price per share to be paid by Yorkville for the shares of common stock that we may elect to sell to Yorkville under the

SEPA, if any, will fluctuate based on the market prices of our common stock during the applicable Pricing Period for each Advance made

pursuant to the SEPA, if any, it is not possible for us to predict, as of the date of this prospectus and prior to any such sales, the

number of shares of common stock that we will sell to Yorkville under the SEPA, the purchase price per share that Yorkville will pay

for shares purchased from us under the SEPA, or the aggregate gross proceeds that we will receive from those purchases by Yorkville under

the SEPA, if any.

In

addition, unless we obtain stockholder approval, we will not be able to issue shares of common stock in excess of the Exchange Cap under

the SEPA in accordance with applicable Nasdaq rules. Depending on the market prices of our common stock in the future, this could be

a significant limitation on the amount of funds we are able to raise pursuant to the SEPA. Other limitations in the SEPA, including the

Ownership Limitation, and our ability to meet the conditions necessary to deliver an Advance Notice, could also prevent us from being

able to raise funds up to the Commitment Amount.

Moreover,

although the SEPA provides that we may sell up to an aggregate of $25.0 million of our common stock to Yorkville, only 34,315,083 shares

of our common stock are being registered for resale by Yorkville under the registration statement that includes this prospectus, consisting

of (i) the 227,273 Commitment Shares that we issued to Yorkville upon execution of the SEPA as consideration for its commitment to purchase

our common stock under the SEPA and (ii) up to 34,087,810 shares of common stock that we may elect to sell to Yorkville, in our sole

discretion, from time to time from and after the date of, and pursuant to, the SEPA or that Yorkville may require that we sell pursuant

to a Yorkville Advance. Even if we elect to sell to Yorkville all of the shares of common stock being registered for resale under this

prospectus, depending on the market prices of our common stock at the time of such sales, the actual gross proceeds from the sale of

all such shares may be substantially less than the $25.0 million Commitment Amount under the SEPA, which could materially adversely affect

our liquidity.

If

we desire to issue and sell to Yorkville under the SEPA more than the 34,087,810 shares being registered for resale under this prospectus,

and the Exchange Cap provisions and other limitations in the SEPA would allow us to do so, we would need to file with the SEC one or

more additional registration statements to register under the Securities Act the resale by Yorkville of any such additional shares of

our common stock and the SEC would have to declare such registration statement or statements effective before we could sell additional

shares.

Further,

the resale by Yorkville of a significant amount of shares registered for resale in this offering at any given time, or the perception

that these sales may occur, could cause the market price of our common stock to decline and to be highly volatile.

The

sale and issuance of our shares of Common Stock to Yorkville will cause dilution to our existing shareholders, and the sale of the shares

of Common Stock acquired by Yorkville, or the perception that such sales may occur, could cause the price of our Common Stock to fall.

The

purchase price for the shares that we may sell to Yorkville under the SEPA will fluctuate based on the price of our shares of Common

Stock. Depending on a number of factors, including market liquidity, sales of such shares may cause the trading price of our Common Stock

to fall. If and when we do sell shares to Yorkville or when Yorkville requires a Yorkville Advance, Yorkville may resell all, some, or

none of those shares at its discretion, subject to the terms of the SEPA. Therefore, sales to Yorkville by us could result in substantial

dilution to the interests of other holders of our shares of Common Stock. Additionally, the sale of a substantial number of shares of

Common Stock to Yorkville, or the anticipation of such sales, could make it more difficult for us to sell equity or equity-related securities

in the future at a desirable time and price. The resale of shares of Common Stock by Yorkville in the public market or otherwise, including

sales pursuant to this prospectus, or the perception that such sales could occur, could also harm the prevailing market price of our

shares of Common Stock.

Following

these issuances described above and as restrictions on resale end and registration statements are available for use, the market price

of our shares of Common Stock could decline if the holders of restricted shares sell them or are perceived by the market as intending

to sell them. As such, sales of a substantial number of shares of Common Stock in the public market could occur at any time. These sales,

or the perception in the market that the holders of a large number of shares intend to sell shares, could reduce the market price of

our shares of Common Stock.

Once

we receive a Pre-Paid Advance, we do not have the right to control the timing and amount of the issuance of our Ordinary Shares to the

Investor under the PPA and, accordingly, it is not possible to predict the actual number of shares we will issue pursuant to the Pre-Paid

Advance Agreement at any one time or in total.

Once

we receive any of the Pre-Paid Advances, including the initial Pre-Paid Advance, we do not have the right to control the timing and amount

of any issuances of our shares of Common Stock to Yorkville under the SEPA. Sales of our shares of Common Stock, if any, to Yorkville

under the SEPA will depend upon market conditions and other factors, and the discretion of Yorkville. We may ultimately decide to sell

to Yorkville all, some or none of the shares of Common Stock that may be available for us to sell to Yorkville pursuant to the SEPA.

Each Pre-Paid Advance matures within one year.

Because

the purchase price per share to be paid by Yorkville for the shares of Common Stock that we may elect to sell to Yorkville under the

SEPA, if any, will fluctuate based on the market prices of our shares of Common Stock, if any, it is not possible for us to predict,

as of the date of this prospectus supplement and prior to any such sales, the number of shares of Common Stock that we will sell to Yorkville

under the SEPA, the purchase price per share that Yorkville will pay for shares purchased from us under the SEPA, or the aggregate gross

proceeds that we will receive from those purchases by Yorkville under the SEPA, if any.

Further,

the resale by Yorkville of a significant amount of shares registered in this offering at any given time, or the perception that these

sales may occur, could cause the market price of our shares of Common Stock to decline and to be highly volatile.

Upon

a trigger event, we may be required to make payments that could cause us financial hardship.

In

connection with the SEPA, and subject to the condition set forth therein, Yorkville has agreed to advance us the Pre-Paid Advance which

shall be evidenced by the Convertible Notes to be issued to Yorkville at a purchase price equal to 94.0% of the principal amount of each

Pre-Paid Advance. On September 22, 2203, Yorkville advanced the first Pre-Paid Advance to us in the principal amount of $3.0 million

and we issued a Convertible Note to Yorkville in the principal amount of $3.0 million. The balance of $1.0 million of the Pre-Paid Advance

will be advanced by Yorkville to us upon the registration statement registering the resale of the shares of common stock issuable under

the SEPA being declared effective. The purchase price for each Convertible Note representing a Pre-Paid Advance is 94.0% of the principal

amount of the Pre-Paid Advance. Interest shall accrue on the outstanding balance of any Convertible Note at an annual rate equal to 6.0%,

subject to an increase to 18% upon an event of default as described in the Convertible Notes. The maturity date of each Convertible Note

will be September 22, 2024, 12-months after the closing of the initial Pre-Paid Advance. Yorkville may convert the Convertible Notes

into shares of our common stock at the Conversion Price, which in no event may the Conversion Price be lower than the Floor Price. Yorkville,

in its sole discretion and providing that there is a balance remaining outstanding under the Convertible Notes, may deliver a notice

under the SEPA requiring a Yorkville Advance. Yorkville, in its sole discretion, may select the amount of any Yorkville Advance, provided

that the number of shares issued does not cause Yorkville to exceed the Ownership Limitation, does not exceed the Exchange Cap or the

amount of shares of common stock that are registered. As a result of a Yorkville Advance, the amounts payable under the Convertible Notes

will be offset by such amount subject to each Yorkville Advance.

This

financial obligation may be an undue and unsustainable burden and may cause a material adverse effect on our operations and financial

condition.

Investors

who buy shares at different times will likely pay different prices.

Pursuant

to the SEPA, we will have discretion, subject to market demand, to vary the timing, prices, and numbers of shares sold to Yorkville.

If and when we do elect to sell shares of our common stock to Yorkville pursuant to the SEPA, Yorkville may resell all, some or none

of such shares at any time or from time to time in its discretion and at different prices. As a result, investors who purchase shares

from Yorkville in this offering at different times will likely pay different prices for those shares, and so may experience different

levels of dilution and in some cases substantial dilution and different outcomes in their investment results. Investors may experience

a decline in the value of the shares they purchase from Yorkville in this offering as a result of future sales made by us to Yorkville

at prices lower than the prices such investors paid for their shares in this offering.

Our

current business plans require a significant amount of capital. If we are unable to obtain sufficient funding or do not have access to

capital, we may not be able to execute our business plans and our prospects, financial condition and results of operations could be materially

adversely affected.

The

extent to which we rely on Yorkville as a source of funding will depend on a number of factors, including the prevailing market price

of our common stock, our ability to meet the conditions necessary to deliver Advance Notices under the SEPA, the impacts of the Exchange

Cap and the Ownership Limitation and the extent to which we are able to secure funding from other sources. In addition to the amount

of funds we ultimately raise under the SEPA, if any, we expect to continue to seek other sources of funding, including by offering additional

equity, and/or equity-linked securities, through one or more credit facilities and potentially by offering debt securities, to finance

a portion of our future expenditures.

We

have experienced operating losses, and we expect to continue to incur operating losses as we implement our business plans. We expect

our capital expenditures to continue to be significant in the foreseeable future as we expand our business. We expect to expend capital

with significant outlays directed towards servicing our Sadot agri-foods, Sadot restaurant group and Sadot farming operations. The fact

that we have a limited operating history with respect to the agri-foods and farming operations business means we have limited historical

data on the demand for our services. As a result, our capital requirements are uncertain and actual capital requirements may be different

from those we currently anticipate. In addition, new opportunities for growth in future product lines and markets may arise and may require

additional capital.

As

of June 30, 2023, our principal source of liquidity is our cash balance in the amount of approximately $5.1 million. We entered into

the SEPA whereby we will have the right, but not the obligation, to sell to Yorkville up to $25.0 million of our shares of common stock.

However, our right to sell shares under the SEPA is subject to certain conditions that may not be satisfied. Accordingly, we may not

be able to utilize this facility to raise additional capital when, or in the amounts, we may require. In addition, under the SEPA, we

have received $3.0 in Pre-Paid Advance and may receive an additional $1.0 million upon this registration statement being declared effective.

The Pre-Paid Advances were made in the form of Convertible Notes. In addition, upon the occurrence and during the continuation of an

event of default, the Convertible Notes shall become immediately due and payable and we shall pay to Yorkville the principal and interest

due thereunder. If any time on or after October 22, 2023 (i) the daily VWAP is less than the Floor Price for seven trading days during

a period of nine consecutive trading days (“Floor Price Trigger”), or (ii) the Company has issued in excess of 99% of the

shares of common stock available under the Exchange Cap (“Exchange Cap Trigger” and collectively with the Floor Price Trigger,

the “Trigger”)), then we shall make monthly payments to Yorkville beginning on the seventh trading day after the Trigger

and continuing monthly in the amount of $500,000 plus an 8.0% premium and accrued and unpaid interest. The Exchange Cap Trigger will

not apply in the event we have obtained the approval from our stockholders in accordance with the rules of Nasdaq Stock Market for the

issuance of shares of common stock pursuant to the transactions contemplated in the Convertible Note and the SEPA in excess of 19.99%

of the aggregate number of shares of common stock issued and outstanding as of the effective date of the SEPA (the “Exchange Cap”).

Any debt we incur from Yorkville or other parties could make us more vulnerable to a downturn in our operating results or a downturn

in economic conditions. If our cash flow from operations is insufficient to meet any debt service requirements including the repayment

of the Convertible Notes in the event of a Trigger, we could be required to refinance our obligations, or dispose of assets in order

to meet debt service requirements.

As

an early-stage growth company, our ability to access capital is critical. We expect that we will need to raise additional capital in

order to continue to execute our business plans in the future, and we plan to use the SEPA, if the conditions for its use are satisfied

and seek additional equity and/or debt financing, including by offering additional equity, and/or equity-linked securities, through one

or more credit facilities and potentially by offering debt securities, to finance a portion of our future expenditures.

The

sale of additional equity or equity-linked securities could dilute our stockholders. The incurrence of indebtedness would result in increased

debt service obligations and could result in operating and financing covenants that would restrict our operations or our ability to pay

dividends to our stockholders. Our ability to obtain the necessary additional financing to carry out our business plans or to refinance,

if necessary, any outstanding debt when due is subject to a number of factors, including general market conditions and investor acceptance

of our business model. These factors may make the timing, amount, terms and conditions of such financing unattractive or unavailable

to us. If we are unable to raise sufficient funds on favorable terms, we may have to significantly reduce our spending, delay or cancel

our planned activities or substantially change our corporate structure. We might not be able to obtain any such funding or we might not

have sufficient resources to conduct our business as projected, both of which could mean that we would be forced to curtail or discontinue

our operations and our prospects, financial consolidated results of operations could be materially adversely affected, in which case

our investors could lose some or all of their investment.

Management

will have broad discretion as to the use of the proceeds from the SEPA, and uses may not improve our financial condition or market value.

Because

we have not designated the amount of net proceeds from the SEPA to be used for any particular purpose, our management will have broad

discretion as to the application of such proceeds. Our management may use the proceeds for working capital and general corporate purposes

that may not improve our financial condition or advance our business objectives.

Risks

Related to Our Business and Industry

Inflationary

pressures across all services, equipment, commodities, labor, rent and other areas of the business may cause a negative impact on our

financial results if we are not able to pass these increased costs in the form of price increases to consumers or find alternative options

to reduce costs.

The

global supply chain is currently experiencing extensive inflationary pressures across most segments of the economy. While these increases

may be temporary, we may have to implement price increases in order to maintain acceptable margins. We have no ability to predict how

long these increased costs will last and if consumers will be able or willing to accept retail price increases, decreased portion sizes,

alternative ingredients or other measures to offset the overall rise in our cost structure. Without being able to pass along these increases

in costs to consumers, we may experience a negative impact on our margins.

We

may need additional capital to fund our operations, which, if obtained, could result in substantial dilution or significant debt service

obligations. We may not be able to obtain additional capital on commercially reasonable terms, which could adversely affect our liquidity

and financial position.

In

order to continue operating, we may need to obtain additional financing, either through borrowings, private placements, public offerings,

or some type of business combination, such as a merger, or buyout, and there can be no assurance that we will be successful in such pursuits.

We may be unable to acquire the additional funding necessary to continue operating. Accordingly, if we are unable to generate adequate

cash from operations, and if we are unable to find sources of funding, it may be necessary for us to sell one or more lines of business

or all or a portion of our assets, enter into a business combination, or reduce or eliminate operations. These possibilities, to the

extent available, may be on terms that result in significant dilution to our shareholders or that result in our shareholders losing all

of their investment in our Company.

We

require significant capital in relation to our operations, including continuing access to credit markets, to operate our current business

and fund our growth strategy. Moreover, the expansion of our business and pursuit of acquisitions or other business opportunities may

require significant amounts of capital. Access to credit markets and pricing of our capital is dependent upon maintaining sufficient

credit ratings from credit rating agencies. Sufficient credit ratings will allow us to access cost competitive commercial paper markets.

If we are unable to maintain sufficiently high credit ratings, access to these commercial paper and other debt markets and costs of borrowings

could be adversely affected. If we are unable to generate sufficient cash flow or maintain access to adequate external financing, including

as a result of significant disruptions in the global credit markets, it could restrict our current operations and our growth opportunities.

Assuming we are able to access traditional credit markets, we intend to manage this risk with constant monitoring of credit/liquidity

metrics, cash forecasting, and routine communications with credit rating agencies regarding risk management practices.

If

we need to raise additional capital, we do not know what the terms of any such capital raising would be. In addition, any future sale

of our equity securities could dilute the ownership and control of your shares and could be at prices substantially below prices at which

our shares currently trade. We may seek to increase our cash reserves through the sale of additional equity or debt securities. The sale

of convertible debt securities or additional equity securities could result in additional and potentially substantial dilution to our

shareholders. The incurrence of indebtedness would result in increased debt service obligations and could result in operating and financing

covenants that would restrict our operations and liquidity. In addition, our ability to obtain additional capital on acceptable terms

is subject to a variety of uncertainties. We cannot assure you that financing will be available in amounts or on terms acceptable to

us, if at all. Any failure to raise additional funds on favorable terms could have a material adverse effect on our liquidity and financial

condition.

Our