Robinhood Markets, Inc. (“Robinhood”) (NASDAQ: HOOD) today

announced financial results for the fourth quarter and full year of

2024, which ended December 31, 2024.

“We hit the gas on product development in 2024

with a new platform for active traders, Gold Card launch, an

expanded UK and EU product suite, and much more,” said Vlad

Tenev, CEO and Co-Founder of Robinhood. “We see a huge

opportunity ahead of us as we work toward enabling anyone,

anywhere, to buy, sell, or hold any financial asset and conduct any

financial transaction through Robinhood.”

“Q4 was a record-breaking quarter that caps off

a record-setting year in 2024,” said Jason Warnick, Chief

Financial Officer of Robinhood. “For both the quarter and

full year, we reached new highs for Assets Under Custody, Net

Deposits, Gold Subscribers, Revenues, Net Income, Adjusted EBITDA,

and EPS. We’re entering 2025 with strong momentum as we remain

focused on delivering another year of profitable growth."

Fourth Quarter Results:

- Total

net revenues increased 115% year-over-year to

$1.01 billion.

-

Transaction-based revenues increased over 200%

year-over-year to $672 million, primarily driven by

cryptocurrencies revenue of $358 million, up over 700%, options

revenue of $222 million, up 83%, and equities revenue of $61

million, up 144%.

- Net

interest revenues increased 25% year-over-year to $296

million, primarily driven by growth in interest-earning assets,

partially offset by a lower federal funds rate.

- Other revenues

increased 31% year-over-year to $46 million, primarily due to

increased Gold subscription revenues.

- Net income

increased over 10X year-over-year to $916 million, or diluted

earnings per share (EPS) of $1.01, compared to $30 million, or

diluted EPS of $0.03, in Q4 2023. Q4 2024 net income included:

- a $369 million deferred tax benefit

($0.41 of diluted EPS), primarily from the release of the Company's

valuation allowance on most of its net deferred tax assets.

- a $55 million benefit ($0.06 of

diluted EPS) due to a reversal of an accrual as part of a

regulatory settlement.

- Total

operating expenses increased 3% year-over-year to $458

million, including a $55 million benefit due to a reversal of an

accrual as part of a regulatory settlement.

- Adjusted Operating Expenses and

Share-Based Compensation (SBC) (non-GAAP) increased 14%

year-over-year to $508 million, which includes Adjusted Operating

Expenses (non-GAAP) of $431 million and SBC of $77

million.

- Adjusted EBITDA

(non-GAAP) increased over 300% year-over-year to

$613 million.

- Funded

Customers increased 8% year-over-year to

25.2 million.

-

Investment Accounts increased by 10%

year-over-year to 26.2 million.

- Assets

Under Custody (AUC) increased 88% year-over-year to

$193 billion, driven by continued Net Deposits and higher

equity and cryptocurrency valuations.

- Net

Deposits were $16.1 billion, an annualized growth rate of

42% relative to AUC at the end of Q3 2024. Over the past twelve

months, Net Deposits were $50.5 billion, a growth rate of 49%

relative to AUC at the end of Q4 2023.

- Average

Revenue Per User (ARPU) increased by 102% year-over-year

to $164.

- Gold

Subscribers increased by 1.2 million, or 86%,

year-over-year to 2.6 million.

-

Cash and cash equivalents totaled

$4.3 billion compared with $4.8 billion at the end of Q4

2023.

- Share

repurchases were $160 million, representing

5.3 million shares of our Class A common stock at an average

price per share of $29.79.

Full Year Results:

- Total

net revenues increased 58% year-over-year to $2.95

billion.

- Net

income increased $1.95 billion year-over-year to $1.41

billion, or diluted EPS of $1.56, compared to a net loss of $0.54

billion, or diluted EPS of -$0.61, in 2023.

- 2024 included a

deferred tax benefit of $369 million, primarily from the release of

the Company's valuation allowance on most of its net deferred tax

assets.

- 2023 included an

expense of $485 million from the 2021 Founders Award

Cancellation.

- Total

operating expenses decreased 21% year-over-year to $1.90

billion.

- Adjusted

Operating Expenses and SBC decreased 16% year-over-year to $1.94

billion, which includes Adjusted Operating Expenses of $1.63

billion and SBC of $304 million.

- Adjusted Operating Expenses and SBC

excluding the 2021 Founders Award Cancellation (non-GAAP) increased

7% year-over-year.

- Adjusted

EBITDA increased 167% year-over-year to $1.43 billion,

compared to $536 million in 2023.

- Share

repurchases were $257 million, representing

10.4 million shares of our Class A common stock at an average

price per share of $24.78 as we make progress on our

$1 billion share repurchase program.

Highlights

Strong product momentum drove record

growth in 2024 as Robinhood delivers on roadmap

- Expanding Access to Crypto

Across the U.S. and EU - Crypto notional volumes increased

over 400 percent year-over-year, reaching $71 billion in Q4 2024.

Since the start of Q4, Robinhood has also added seven crypto assets

in the U.S. and launched Ethereum (ETH) staking in the EU. In June

2024, Robinhood entered into an agreement to acquire Bitstamp, the

world's longest running cryptocurrency exchange serving

institutional and retail customers internationally. The acquisition

is subject to customary closing conditions, including regulatory

approvals, and is expected to close in the first half of 2025.

- Establishing Ourselves as

the #1 Platform for Active Traders - Last month, Robinhood

made index options available to all customers and started to roll

out futures trading directly in-app, allowing customers to trade

stock indexes, energy, currency, metals and crypto. Additionally,

since launching in October 2024, Robinhood Legend - the desktop

trading platform built for active traders - has added nearly 30

additional indicators and rolled out crypto trading.

- Robinhood Expands Global

Ambitions - Robinhood announced plans to expand into the

Asia-Pacific region in 2025, with Singapore serving as its local

headquarters. Earlier this week, Robinhood also started to offer

options trading to its UK customers.

- Robinhood Gold Membership

Continues to Climb - Robinhood Gold subscribers hit 2.6

million, with an adoption rate of over 10 percent in Q4. In

addition, the Robinhood Gold Credit Card reached over 100 thousand

cardholders and we have plans to continue expanding the cardholder

base in 2025.

- Stepping Into the

Investment Advisory Space - In November 2024, Robinhood

entered into an agreement to acquire TradePMR, a custodial and

portfolio management platform for Registered Investment Advisors

with over 25 years in the industry and over $40 billion in

assets under administration at the time of signing. The acquisition

is subject to customary closing conditions, including regulatory

approvals, and is expected to close in the first half of 2025.

Additional Q4 2024 Operating

Data

- Retirement AUC

increased over 600% year-over-year to $13.1 billion.

- Cash Sweep increased

59% year-over-year to $26.1 billion.

- Margin Book increased

126% year-over-year to $7.9 billion.

- Equity Notional Trading

Volumes increased 154% year-over-year to

$423 billion.

- Options Contracts

Traded increased 61% year-over-year to

477 million.

- Crypto Notional Trading

Volumes increased over 400% year-over-year to

$71.0 billion.

Conference Call and Livestream

Information

Robinhood will host a video call to discuss its

results at 2 p.m. PT / 5 p.m. ET today, February 12, 2025. The

video call can be accessed at investors.robinhood.com, along with

the earnings press release and accompanying slide presentation. The

event will also be live streamed to YouTube and X.com via

Robinhood's official channels, @RobinhoodApp.

Following the call, a replay and transcript will

also be available at investors.robinhood.com.

Financial Outlook

The paragraph below provides information on our

2025 expense plan and outlook. We are not providing a 2025 outlook

for total operating expenses and have not reconciled our 2025

outlook for Adjusted Operating Expenses and SBC to the most

directly comparable GAAP financial measure, total operating

expenses, because we are unable to predict with reasonable

certainty the impact of certain items without unreasonable effort.

These items include, but are not limited to, provisions for credit

losses and significant regulatory expenses which may be material

and could have a significant impact on total operating expenses for

2025.

Our 2025 expense plan includes growth

investments in new products, features, and international expansion

while also getting more efficient in our existing businesses. Our

outlook for combined Adjusted Operating Expenses and SBC for

full-year 2025 is $2.0 billion to $2.1 billion. This

expense outlook does not include provisions for credit losses,

costs related to TradePMR or Bitstamp, potential significant

regulatory matters, or other significant expenses (such as

impairments, restructuring charges, and other business acquisition-

or disposition-related expenses) that may arise or accruals we may

determine in the future are required, as we are unable to

accurately predict the size or timing of such matters, expenses or

accruals at this time.

Actual results might differ materially from our

outlook due to several factors, including the rate of growth in

Funded Customers and our effectiveness to cross-sell products which

affects variable marketing costs, the degree to which we are

successful in managing credit losses and preventing fraud, and our

ability to manage web-hosting expenses efficiently, among other

factors. See “Non-GAAP Financial Measures” for more information on

Adjusted Operating Expenses and SBC, including significant items

that we believe are not indicative of our ongoing expenses that

would be adjusted out of total operating expenses (GAAP) to get to

Adjusted Operating Expenses and SBC (non-GAAP) should they

occur.

About Robinhood

Robinhood Markets, Inc. (NASDAQ: HOOD)

transformed financial services by introducing commission-free stock

trading and democratizing access to the markets for millions of

investors. Today, Robinhood lets you trade stocks, options, futures

(which includes options on futures, swaps, and event contracts),

and crypto, invest for retirement, and earn with Robinhood Gold.

Headquartered in Menlo Park, California, Robinhood puts customers

in the driver's seat, delivering unprecedented value and products

intentionally designed for a new generation of investors.

Additional information about Robinhood can be found at

www.robinhood.com.

Robinhood uses the “Overview” tab of its

Investor Relations website (accessible at

investors.robinhood.com/overview) and its Newsroom (accessible at

newsroom.aboutrobinhood.com), as means of disclosing information to

the public in a broad, non-exclusionary manner for purposes of the

U.S. Securities and Exchange Commission's (“SEC”) Regulation Fair

Disclosure (Reg. FD). Investors should routinely monitor those web

pages, in addition to Robinhood’s press releases, SEC filings, and

public conference calls and webcasts, as information posted on them

could be deemed to be material information.

“Robinhood” and the Robinhood feather logo are

registered trademarks of Robinhood Markets, Inc. All other names

are trademarks and/or registered trademarks of their respective

owners.

Contacts

Investors:ir@robinhood.com

Press:press@robinhood.com

|

|

|

ROBINHOOD MARKETS, INC.CONDENSED

CONSOLIDATED BALANCE SHEETS(Unaudited) |

|

|

|

|

December 31, |

|

(in millions, except share and per share data) |

|

2023 |

|

|

|

2024 |

|

|

Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

4,835 |

|

|

$ |

4,332 |

|

|

Cash, cash equivalents, and securities segregated under federal and

other regulations |

|

4,448 |

|

|

|

4,724 |

|

|

Receivables from brokers, dealers, and clearing organizations |

|

89 |

|

|

|

471 |

|

|

Receivables from users, net |

|

3,495 |

|

|

|

8,239 |

|

|

Securities borrowed |

|

1,602 |

|

|

|

3,236 |

|

|

Deposits with clearing organizations |

|

338 |

|

|

|

489 |

|

|

User-held fractional shares |

|

1,592 |

|

|

|

2,530 |

|

|

Held-to-maturity investments |

|

413 |

|

|

|

398 |

|

|

Prepaid expenses |

|

63 |

|

|

|

75 |

|

|

Deferred customer match incentives |

|

11 |

|

|

|

100 |

|

|

Other current assets |

|

196 |

|

|

|

509 |

|

|

Total current assets |

|

17,082 |

|

|

|

25,103 |

|

|

Property, software, and equipment, net |

|

120 |

|

|

|

139 |

|

|

Goodwill |

|

175 |

|

|

|

179 |

|

|

Intangible assets, net |

|

48 |

|

|

|

38 |

|

|

Non-current held-to-maturity investments |

|

73 |

|

|

|

— |

|

|

Non-current deferred customer match incentives |

|

19 |

|

|

|

195 |

|

|

Other non-current assets, including non-current prepaid expenses of

$4 as of December 31, 2023 and $17 as of December 31, 2024 |

|

107 |

|

|

|

533 |

|

|

Total assets |

$ |

17,624 |

|

|

$ |

26,187 |

|

|

Liabilities and stockholders’ equity |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable and accrued expenses |

$ |

384 |

|

|

$ |

397 |

|

|

Payables to users |

|

5,097 |

|

|

|

7,448 |

|

|

Securities loaned |

|

3,547 |

|

|

|

7,463 |

|

|

Fractional shares repurchase obligation |

|

1,592 |

|

|

|

2,530 |

|

|

Other current liabilities |

|

217 |

|

|

|

266 |

|

|

Total current liabilities |

|

10,837 |

|

|

|

18,104 |

|

|

Other non-current liabilities |

|

91 |

|

|

|

111 |

|

|

Total liabilities |

|

10,928 |

|

|

|

18,215 |

|

|

Commitments and contingencies |

|

|

|

|

Stockholders’ equity: |

|

|

|

|

Preferred stock, $0.0001 par value. 210,000,000 shares authorized,

no shares issued and outstanding as of December 31, 2023 and

December 31, 2024. |

|

— |

|

|

|

— |

|

|

Class A common stock, $0.0001 par value. 21,000,000,000 shares

authorized, 745,401,862 shares issued and outstanding as of

December 31, 2023; 21,000,000,000 shares authorized, 764,903,997

shares issued and outstanding as of December 31, 2024. |

|

— |

|

|

|

— |

|

|

Class B common stock, $0.0001 par value. 700,000,000 shares

authorized, 126,760,802 shares issued and outstanding as of

December 31, 2023; 700,000,000 shares authorized, 119,588,986

shares issued and outstanding as of December 31, 2024. |

|

— |

|

|

|

— |

|

|

Class C common stock, $0.0001 par value. 7,000,000,000 shares

authorized, no shares issued and outstanding as of December 31,

2023 and December 31, 2024. |

|

— |

|

|

|

— |

|

|

Additional paid-in capital |

|

12,145 |

|

|

|

12,008 |

|

|

Accumulated other comprehensive loss |

|

(3 |

) |

|

|

(1 |

) |

|

Accumulated deficit |

|

(5,446 |

) |

|

|

(4,035 |

) |

|

Total stockholders’ equity |

|

6,696 |

|

|

|

7,972 |

|

|

Total liabilities and stockholders’ equity |

$ |

17,624 |

|

|

$ |

26,187 |

|

|

|

|

ROBINHOOD MARKETS, INC.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS(Unaudited) |

|

|

|

(in millions, except share, per share, and percentage

data) |

Three Months EndedDecember

31, |

|

YOY% Change |

|

Three Months EndedSeptember

30, |

|

QOQ% Change |

|

|

2023 |

|

|

|

2024 |

|

|

|

|

2024 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

Transaction-based revenues |

$ |

200 |

|

|

$ |

672 |

|

|

236 |

% |

|

$ |

319 |

|

111 |

% |

|

Net interest revenues |

|

236 |

|

|

|

296 |

|

|

25 |

% |

|

|

274 |

|

8 |

% |

|

Other revenues |

|

35 |

|

|

|

46 |

|

|

31 |

% |

|

|

44 |

|

5 |

% |

|

Total net revenues |

|

471 |

|

|

|

1,014 |

|

|

115 |

% |

|

|

637 |

|

59 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Operating expenses(1)(2): |

|

|

|

|

|

|

|

|

|

|

Brokerage and transaction |

|

32 |

|

|

|

50 |

|

|

56 |

% |

|

|

39 |

|

28 |

% |

|

Technology and development |

|

197 |

|

|

|

208 |

|

|

6 |

% |

|

|

205 |

|

1 |

% |

|

Operations |

|

26 |

|

|

|

29 |

|

|

12 |

% |

|

|

27 |

|

7 |

% |

|

Provision for credit losses |

|

14 |

|

|

|

19 |

|

|

36 |

% |

|

|

23 |

|

(17)% |

|

Marketing |

|

43 |

|

|

|

82 |

|

|

91 |

% |

|

|

59 |

|

39 |

% |

|

General and administrative |

|

133 |

|

|

|

70 |

|

|

(47)% |

|

|

133 |

|

(47)% |

|

Total operating expenses |

|

445 |

|

|

|

458 |

|

|

3 |

% |

|

|

486 |

|

(6)% |

| |

|

|

|

|

|

|

|

|

|

|

Other income, net |

|

3 |

|

|

|

2 |

|

|

(33)% |

|

|

2 |

|

— |

% |

|

Income before income taxes |

|

29 |

|

|

|

558 |

|

|

NM |

|

|

153 |

|

265 |

% |

|

Provision for (benefit from) income taxes |

|

(1 |

) |

|

|

(358 |

) |

|

NM |

|

|

3 |

|

NM |

|

Net income |

$ |

30 |

|

|

$ |

916 |

|

|

NM |

|

$ |

150 |

|

511 |

% |

|

Net income attributable to common stockholders: |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

30 |

|

|

$ |

916 |

|

|

|

|

$ |

150 |

|

|

|

Diluted |

$ |

30 |

|

|

$ |

916 |

|

|

|

|

$ |

150 |

|

|

| Net income per share

attributable to common stockholders: |

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.03 |

|

|

$ |

1.04 |

|

|

|

|

$ |

0.17 |

|

|

|

Diluted |

$ |

0.03 |

|

|

$ |

1.01 |

|

|

|

|

$ |

0.17 |

|

|

| Weighted-average shares used

to compute net income per share attributable to common

stockholders: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

867,298,537 |

|

|

|

883,884,676 |

|

|

|

|

|

884,108,545 |

|

|

|

Diluted |

|

883,227,967 |

|

|

|

907,767,796 |

|

|

|

|

|

905,544,750 |

|

|

|

|

|

|

|

Year EndedDecember 31, |

|

YOY% Change |

|

(in millions, except share, per share, and percentage data) |

|

|

2023 |

|

|

|

2024 |

|

|

|

Revenues: |

|

|

|

|

|

|

|

Transaction-based revenues |

|

$ |

785 |

|

|

$ |

1,647 |

|

|

110 |

% |

|

Net interest revenues |

|

|

929 |

|

|

|

1,109 |

|

|

19 |

% |

|

Other revenues |

|

|

151 |

|

|

|

195 |

|

|

29 |

% |

|

Total net revenues |

|

|

1,865 |

|

|

|

2,951 |

|

|

58 |

% |

| |

|

|

|

|

|

|

|

Operating expenses(1)(2): |

|

|

|

|

|

|

|

Brokerage and transaction |

|

|

146 |

|

|

|

164 |

|

|

12 |

% |

|

Technology and development |

|

|

805 |

|

|

|

818 |

|

|

2 |

% |

|

Operations |

|

|

116 |

|

|

|

112 |

|

|

(3)% |

|

Provision for credit losses |

|

|

43 |

|

|

|

76 |

|

|

77 |

% |

|

Marketing |

|

|

122 |

|

|

|

272 |

|

|

123 |

% |

|

General and administrative |

|

|

1,169 |

|

|

|

455 |

|

|

(61)% |

|

Total operating expenses |

|

|

2,401 |

|

|

|

1,897 |

|

|

(21)% |

| |

|

|

|

|

|

|

|

Other income, net |

|

|

3 |

|

|

|

10 |

|

|

233 |

% |

|

Income (loss) before income taxes |

|

|

(533 |

) |

|

|

1,064 |

|

|

NM |

|

Provision for (benefit from) income taxes |

|

|

8 |

|

|

|

(347 |

) |

|

NM |

|

Net income (loss) |

|

|

(541 |

) |

|

|

1,411 |

|

|

NM |

|

Net income (loss) attributable to common stockholders: |

|

|

|

|

|

|

|

Basic |

|

$ |

(541 |

) |

|

$ |

1,411 |

|

|

|

|

Diluted |

|

$ |

(541 |

) |

|

$ |

1,411 |

|

|

|

| Net income (loss) per share

attributable to common stockholders: |

|

|

|

|

|

|

|

Basic |

|

$ |

(0.61 |

) |

|

$ |

1.60 |

|

|

|

|

Diluted |

|

$ |

(0.61 |

) |

|

$ |

1.56 |

|

|

|

| Weighted-average shares used

to compute net income (loss) per share attributable to common

stockholders: |

|

|

|

|

|

|

|

Basic |

|

|

890,857,659 |

|

|

|

881,113,156 |

|

|

|

|

Diluted |

|

|

890,857,659 |

|

|

|

906,171,504 |

|

|

|

________________(1) The following table presents

operating expenses as a percent of total net revenues:

|

|

Three Months EndedDecember

31, |

|

Three Months EndedSeptember

30, |

|

Year EndedDecember 31, |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

| Brokerage and transaction |

7 |

% |

|

5 |

% |

|

6 |

% |

|

8 |

% |

|

5 |

% |

| Technology and

development |

42 |

% |

|

20 |

% |

|

32 |

% |

|

43 |

% |

|

28 |

% |

| Operations |

6 |

% |

|

3 |

% |

|

4 |

% |

|

6 |

% |

|

4 |

% |

| Provision for credit

losses |

2 |

% |

|

2 |

% |

|

4 |

% |

|

3 |

% |

|

3 |

% |

| Marketing |

9 |

% |

|

8 |

% |

|

9 |

% |

|

7 |

% |

|

9 |

% |

| General and

administrative |

28 |

% |

|

7 |

% |

|

21 |

% |

|

63 |

% |

|

15 |

% |

|

Total operating expenses |

94 |

% |

|

45 |

% |

|

76 |

% |

|

130 |

% |

|

64 |

% |

(2) The following table presents the SBC on

our unaudited condensed consolidated statements of operations for

the periods indicated:

| |

Three Months EndedDecember

31, |

|

Three Months EndedSeptember

30, |

|

Year EndedDecember 31, |

|

(in millions) |

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

| Brokerage and transaction |

$ |

1 |

|

$ |

2 |

|

$ |

2 |

|

$ |

7 |

|

|

9 |

| Technology and

development |

|

50 |

|

|

48 |

|

|

48 |

|

|

211 |

|

|

192 |

| Operations |

|

2 |

|

|

2 |

|

|

1 |

|

|

8 |

|

|

7 |

| Marketing |

|

2 |

|

|

2 |

|

|

3 |

|

|

5 |

|

|

8 |

| General and

administrative |

|

26 |

|

|

23 |

|

|

25 |

|

|

640 |

|

|

88 |

|

Total SBC |

$ |

81 |

|

$ |

77 |

$ |

— |

$ |

79 |

|

$ |

871 |

|

$ |

304 |

|

|

|

ROBINHOOD MARKETS, INC.CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS(Unaudited) |

|

|

|

|

Three Months EndedDecember

31, |

|

Year Ended December 31, |

|

(in millions) |

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

Operating activities: |

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

30 |

|

|

$ |

916 |

|

|

$ |

(541 |

) |

|

$ |

1,411 |

|

|

Adjustments to reconcile net income (loss) to net cash

provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

17 |

|

|

|

22 |

|

|

|

71 |

|

|

|

77 |

|

|

Impairment of long-lived assets |

|

4 |

|

|

|

— |

|

|

|

5 |

|

|

|

2 |

|

|

Provision for credit losses |

|

14 |

|

|

|

19 |

|

|

|

43 |

|

|

|

76 |

|

|

Deferred income taxes |

|

— |

|

|

|

(369 |

) |

|

|

— |

|

|

|

(369 |

) |

|

Share-based compensation |

|

81 |

|

|

|

77 |

|

|

|

871 |

|

|

|

304 |

|

|

Other |

|

1 |

|

|

|

— |

|

|

|

3 |

|

|

|

(2 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Securities segregated under federal and other regulations |

|

— |

|

|

|

(397 |

) |

|

|

— |

|

|

|

(397 |

) |

|

Receivables from brokers, dealers, and clearing organizations |

|

(26 |

) |

|

|

(332 |

) |

|

|

(13 |

) |

|

|

(382 |

) |

|

Receivables from users, net |

|

204 |

|

|

|

(2,621 |

) |

|

|

(298 |

) |

|

|

(4,592 |

) |

|

Securities borrowed |

|

(398 |

) |

|

|

468 |

|

|

|

(1,085 |

) |

|

|

(1,634 |

) |

|

Deposits with clearing organizations |

|

(63 |

) |

|

|

(25 |

) |

|

|

(152 |

) |

|

|

(151 |

) |

|

Current and non-current prepaid expenses |

|

11 |

|

|

|

16 |

|

|

|

37 |

|

|

|

(25 |

) |

|

Current and non-current deferred customer match incentives |

|

(20 |

) |

|

|

(63 |

) |

|

|

(30 |

) |

|

|

(265 |

) |

|

Other current and non-current assets |

|

(19 |

) |

|

|

(404 |

) |

|

|

(18 |

) |

|

|

(415 |

) |

|

Accounts payable and accrued expenses |

|

(11 |

) |

|

|

(63 |

) |

|

|

134 |

|

|

|

(35 |

) |

|

Payables to users |

|

772 |

|

|

|

1,184 |

|

|

|

396 |

|

|

|

2,351 |

|

|

Securities loaned |

|

302 |

|

|

|

157 |

|

|

|

1,713 |

|

|

|

3,916 |

|

|

Other current and non-current liabilities |

|

61 |

|

|

|

15 |

|

|

|

45 |

|

|

|

(27 |

) |

|

Net cash provided by (used in) operating activities |

|

960 |

|

|

|

(1,400 |

) |

|

|

1,181 |

|

|

|

(157 |

) |

|

Investing activities: |

|

|

|

|

|

|

|

|

Purchases of property, software, and equipment |

|

(1 |

) |

|

|

(4 |

) |

|

|

(2 |

) |

|

|

(13 |

) |

|

Capitalization of internally developed software |

|

(5 |

) |

|

|

(11 |

) |

|

|

(19 |

) |

|

|

(37 |

) |

|

Business acquisition, net of cash and cash equivalents

acquired |

|

(3 |

) |

|

|

— |

|

|

|

(93 |

) |

|

|

(6 |

) |

|

Asset acquisition, net of cash acquired |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3 |

) |

|

Purchases of held-to-maturity investments |

|

(108 |

) |

|

|

(87 |

) |

|

|

(759 |

) |

|

|

(556 |

) |

|

Proceeds from maturities of held-to-maturity investments |

|

115 |

|

|

|

219 |

|

|

|

282 |

|

|

|

658 |

|

|

Purchases of credit card receivables by Credit Card Funding

Trust |

|

— |

|

|

|

(509 |

) |

|

|

— |

|

|

|

(748 |

) |

|

Collections of purchased credit card receivables |

|

— |

|

|

|

426 |

|

|

|

— |

|

|

|

556 |

|

|

Proceeds from sales and maturities of available-for-sale

investments |

|

— |

|

|

|

— |

|

|

|

10 |

|

|

|

— |

|

|

Other |

|

(1 |

) |

|

|

— |

|

|

|

(1 |

) |

|

|

1 |

|

|

Net cash provided by (used in) investing activities |

|

(3 |

) |

|

|

34 |

|

|

|

(582 |

) |

|

|

(148 |

) |

|

Financing activities: |

|

|

|

|

|

|

|

|

Proceeds from exercise of stock options, net of repurchases |

|

3 |

|

|

|

8 |

|

|

|

5 |

|

|

|

18 |

|

|

Proceeds from issuance of common stock under the Employee Share

Purchase Plan |

|

5 |

|

|

|

6 |

|

|

|

14 |

|

|

|

16 |

|

|

Taxes paid related to net share settlement of equity awards |

|

(3 |

) |

|

|

(89 |

) |

|

|

(12 |

) |

|

|

(244 |

) |

|

Repurchase of Class A common stock |

|

— |

|

|

|

(160 |

) |

|

|

(608 |

) |

|

|

(257 |

) |

|

Draws on credit facilities |

|

— |

|

|

|

10 |

|

|

|

20 |

|

|

|

22 |

|

|

Repayments on credit facilities |

|

— |

|

|

|

(10 |

) |

|

|

(20 |

) |

|

|

(22 |

) |

|

Borrowings by the Credit Card Funding Trust |

|

— |

|

|

|

37 |

|

|

|

— |

|

|

|

132 |

|

|

Repayments on borrowings by the Credit Card Funding Trust |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1 |

) |

|

Change in principal collected from customers due to Coastal

Bank |

|

4 |

|

|

|

21 |

|

|

|

1 |

|

|

|

6 |

|

|

Payments of debt issuance costs |

|

— |

|

|

|

(1 |

) |

|

|

(10 |

) |

|

|

(15 |

) |

|

Net cash provided by (used in) financing activities |

|

9 |

|

|

|

(178 |

) |

|

|

(610 |

) |

|

|

(345 |

) |

|

Effect of foreign exchange rate changes on cash and cash

equivalents |

|

— |

|

|

|

(2 |

) |

|

|

— |

|

|

|

(1 |

) |

|

Net increase (decrease) in cash, cash equivalents,

segregated cash, and restricted cash |

|

966 |

|

|

|

(1,546 |

) |

|

|

(11 |

) |

|

|

(651 |

) |

|

Cash, cash equivalents, segregated cash,

and restricted cash, beginning of the period |

|

8,380 |

|

|

|

10,241 |

|

|

|

9,357 |

|

|

|

9,346 |

|

|

Cash, cash equivalents, segregated cash,

and restricted cash, end of the period |

$ |

9,346 |

|

|

$ |

8,695 |

|

|

$ |

9,346 |

|

|

$ |

8,695 |

|

| |

|

|

|

|

|

|

|

|

Reconciliation of cash, cash equivalents,

segregated cash

and restricted cash, end of the period: |

|

Cash and cash equivalents, end of the period |

$ |

4,835 |

|

|

$ |

4,332 |

|

|

$ |

4,835 |

|

|

$ |

4,332 |

|

|

Segregated cash and cash equivalents, end of the period |

|

4,448 |

|

|

|

4,327 |

|

|

|

4,448 |

|

|

|

4,327 |

|

|

Restricted cash in other current assets, end of the period |

|

46 |

|

|

|

18 |

|

|

|

46 |

|

|

|

18 |

|

|

Restricted cash in other non-current assets, end of the period |

|

17 |

|

|

|

18 |

|

|

|

17 |

|

|

|

18 |

|

|

Cash, cash equivalents, segregated

cash and restricted cash, end of the period |

$ |

9,346 |

|

|

$ |

8,695 |

|

|

$ |

9,346 |

|

|

$ |

8,695 |

|

|

Supplemental disclosures: |

|

|

|

|

|

|

|

|

Cash paid for interest |

$ |

4 |

|

|

$ |

4 |

|

|

$ |

12 |

|

|

$ |

16 |

|

|

Cash paid for income taxes, net of refund received |

$ |

— |

|

|

$ |

4 |

|

|

$ |

9 |

|

|

$ |

18 |

|

|

|

|

Reconciliation of GAAP to Non-GAAP

Results(Unaudited) |

|

|

|

|

|

Three Months EndedDecember

31, |

|

Three Months EndedSeptember

30, |

|

Year EndedDecember 31, |

|

(in millions) |

|

|

2023 |

|

|

|

2024 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

Net income (loss) |

|

$ |

30 |

|

|

$ |

916 |

|

|

$ |

150 |

|

|

$ |

(541 |

) |

|

$ |

1,411 |

|

|

Net margin |

|

|

6 |

% |

|

|

90 |

% |

|

|

24 |

% |

|

(29)% |

|

|

48 |

% |

|

Add: |

|

|

|

|

|

|

|

|

|

|

| Interest expenses related to

credit facilities |

|

|

6 |

|

|

|

6 |

|

|

|

6 |

|

|

|

23 |

|

|

|

24 |

|

|

Provision for (benefit from) income taxes |

|

|

(1 |

) |

|

|

(358 |

) |

|

|

3 |

|

|

|

8 |

|

|

|

(347 |

) |

|

Depreciation and amortization |

|

|

17 |

|

|

|

22 |

|

|

|

20 |

|

|

|

71 |

|

|

|

77 |

|

|

EBITDA (non-GAAP) |

|

|

52 |

|

|

|

586 |

|

|

|

179 |

|

|

|

(439 |

) |

|

|

1,165 |

|

|

Add: SBC |

|

|

|

|

|

|

|

|

|

|

|

SBC Excluding 2021 Founders Award Cancellation |

|

|

81 |

|

|

|

77 |

|

|

|

79 |

|

|

|

386 |

|

|

|

304 |

|

|

2021 Founders Award Cancellation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

485 |

|

|

|

— |

|

| Significant legal and tax

settlements and reserves(1) |

|

|

— |

|

|

|

(50 |

) |

|

|

10 |

|

|

|

104 |

|

|

|

(40 |

) |

|

Adjusted EBITDA (non-GAAP) |

|

$ |

133 |

|

|

$ |

613 |

|

|

$ |

268 |

|

|

$ |

536 |

|

|

$ |

1,429 |

|

| Adjusted EBITDA margin

(non-GAAP) |

|

|

28 |

% |

|

|

60 |

% |

|

|

42 |

% |

|

|

29 |

% |

|

|

48 |

% |

|

|

Three Months EndedDecember

31, |

|

Three Months EndedSeptember

30, |

|

Year EndedDecember 31, |

|

(in millions) |

|

2023 |

|

|

2024 |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

Total operating expenses (GAAP) |

$ |

445 |

|

$ |

458 |

|

|

$ |

486 |

|

$ |

2,401 |

|

$ |

1,897 |

|

|

Less: SBC |

|

|

|

|

|

|

|

|

|

|

SBC Excluding 2021 Founders Award Cancellation |

|

81 |

|

|

77 |

|

|

|

79 |

|

|

386 |

|

|

304 |

|

|

2021 Founders Award Cancellation |

|

— |

|

|

— |

|

|

|

— |

|

|

485 |

|

|

— |

|

| Significant legal and tax

settlements and reserves(1) |

|

— |

|

|

(50 |

) |

|

|

10 |

|

|

104 |

|

|

(40 |

) |

|

Adjusted Operating Expenses (Non-GAAP) |

$ |

364 |

|

$ |

431 |

|

|

$ |

397 |

|

$ |

1,426 |

|

$ |

1,633 |

|

|

|

Three Months EndedDecember

31, |

|

Year EndedDecember 31, |

|

(in millions) |

|

2023 |

|

|

2024 |

|

|

|

2023 |

|

|

2024 |

|

|

Total operating expenses (GAAP) |

$ |

445 |

|

$ |

458 |

|

|

$ |

2,401 |

|

$ |

1,897 |

|

|

Less: SBC |

|

|

|

|

|

|

|

|

SBC Excluding 2021 Founders Award Cancellation |

|

81 |

|

|

77 |

|

|

|

386 |

|

|

304 |

|

|

2021 Founders Award Cancellation |

|

— |

|

|

— |

|

|

|

485 |

|

|

— |

|

| Significant legal and tax

settlements and reserves(1) |

|

— |

|

|

(50 |

) |

|

|

104 |

|

|

(40 |

) |

|

Adjusted Operating Expenses (Non-GAAP) |

|

364 |

|

|

431 |

|

|

|

1,426 |

|

|

1,633 |

|

| Add: SBC |

|

|

|

|

|

|

|

|

SBC Excluding 2021 Founders Award Cancellation |

|

81 |

|

|

77 |

|

|

|

386 |

|

|

304 |

|

|

2021 Founders Award Cancellation |

|

— |

|

|

— |

|

|

|

485 |

|

|

— |

|

|

Adjusted Operating Expenses and SBC (Non-GAAP) |

|

445 |

|

|

508 |

|

|

|

2,297 |

|

|

1,937 |

|

|

Less: 2021 Founders Award Cancellation |

|

— |

|

|

— |

|

|

|

485 |

|

|

— |

|

| Adjusted Operating Expense and

SBC excluding the 2021 Founders Award Cancellation (Non-GAAP) |

$ |

445 |

|

$ |

508 |

|

|

$ |

1,812 |

|

$ |

1,937 |

|

________________

(1) Amounts for the three months and year ended

December 31, 2024 included a $55 million benefit due to a reversal

of an accrual as part of a regulatory settlement.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking

statements regarding the expected financial performance of

Robinhood Markets, Inc. and its consolidated subsidiaries (“we,”

“Robinhood,” or the “Company”) and our strategic and operational

plans, including (among others) statements regarding that we see a

huge opportunity ahead of us as we work toward enabling anyone,

anywhere, to buy, sell, or hold any financial asset and conduct any

financial transaction through Robinhood; that we're entering 2025

with strong momentum as we remain focused on delivering another

year of profitable growth; that we plan to expand into the

Asia-Pacific region in 2025, with Singapore serving as our local

headquarters; that we plan to continue expanding the cardholder

base for the Robinhood Gold Credit Card in 2025; that the

acquisitions of Bitstamp and TradePMR are each expected to close in

the first half of 2025; and all statements and information under

the headings “Financial Outlook”. Forward-looking statements

generally relate to future events or our future financial or

operating performance. In some cases, you can identify

forward-looking statements because they contain words such as

“believe,” “may,” “will” “should,” “expect,” “plan,” “anticipate,”

“could,” “intend,” “target,” “project,” “contemplate,” “estimate,”

“predict,” “potential,” or “continue,” or the negative of these

words or other similar terms or expressions that concern our

expectations, strategy, plans, or intentions. Our forward-looking

statements are subject to a number of known and unknown risks,

uncertainties, assumptions, and other factors that may cause our

actual future results, performance, or achievements to differ

materially from any future results expressed or implied in this

press release. Reported results should not be considered an

indication of future performance. Factors that contribute to the

uncertain nature of our forward-looking statements include, among

others: our rapid and continuing expansion, including continuing to

introduce new products and services on our platforms as well as

geographic expansion; the difficulty of managing our business

effectively, including the size of our workforce, and the risk of

declining or negative growth; the fluctuations in our financial

results and key metrics from quarter to quarter; our reliance on

transaction-based revenue, including payment for order flow

(“PFOF”), the risk of new regulation or bans on PFOF and similar

practices, and the addition of our new fee-based model for

cryptocurrency; our exposure to fluctuations in interest rates and

rapidly changing interest rate environments; the difficulty of

raising additional capital (to provide liquidity needs and support

business growth and objectives) on reasonable terms, if at all; the

need to maintain capital levels required by regulators and

self-regulatory organizations; the risk that we might mishandle the

cash, securities, and cryptocurrencies we hold on behalf of

customers, and our exposure to liability for processing,

operational, or technical errors in clearing functions; the impact

of negative publicity on our brand and reputation; the risk that

changes in business, economic, or political conditions that impact

the global financial markets, or a systemic market event, might

harm our business; our dependence on key employees and a skilled

workforce; the difficulty of complying with an extensive, complex,

and changing regulatory environment and the need to adjust our

business model in response to new or modified laws and regulations;

the possibility of adverse developments in pending litigation and

regulatory investigations; the effects of competition; our need to

innovate and acquire or invest in new products, services,

technologies, and geographies in order to attract and retain

customers and deepen their engagement with us in order to maintain

growth; our reliance on third parties to perform some key functions

and the risk that processing, operational or technological failures

could impair the availability or stability of our platforms; the

risk of cybersecurity incidents, theft, data breaches, and other

online attacks; the difficulty of processing customer data in

compliance with privacy laws; our need as a regulated financial

services company to develop and maintain effective compliance and

risk management infrastructures; the risks associated with

incorporating artificial intelligence technologies into some of our

products and processes; the volatility of cryptocurrency prices and

trading volumes; the risk that our platforms and services could be

exploited to facilitate illegal payments; and the risk that

substantial future sales of Class A common stock in the public

market, or the perception that they may occur, could cause the

price of our stock to fall. Because some of these risks and

uncertainties cannot be predicted or quantified and some are beyond

our control, you should not rely on our forward-looking statements

as predictions of future events. More information about potential

risks and uncertainties that could affect our business and

financial results can be found in Part II, Item 1A of our Quarterly

Report on Form 10-Q for the quarter ended September 30, 2024, as

well as in our other filings with the SEC, all of which are

available on the SEC’s web site at www.sec.gov. Moreover, we

operate in a very competitive and rapidly changing environment; new

risks and uncertainties may emerge from time to time, and it is not

possible for us to predict all risks nor identify all

uncertainties. The events and circumstances reflected in our

forward-looking statements might not be achieved and actual results

could differ materially from those projected in the forward-looking

statements. Except as otherwise noted, all forward-looking

statements in this press release are made as of the date of this

press release, February 12, 2025, and are based on information

and estimates available to us at this time. Although we believe

that the expectations reflected in our forward-looking statements

are reasonable, we cannot guarantee future results, performance, or

achievements. Except as required by law, Robinhood assumes no

obligation to update any of the statements in this press release

whether as a result of any new information, future events, changed

circumstances, or otherwise. You should read this press release

with the understanding that our actual future results, performance,

events, and circumstances might be materially different from what

we expect. All fourth quarter and full year 2024 financial

information in this press release is preliminary, based on our

estimates and subject to completion of our financial closing

procedures. Final results for the full year, which will be reported

in our Annual Report on Form 10-K for the year ended December 31,

2024, may vary from the information in this press release. In

particular, until our financial statements are issued in our Annual

Report on Form 10-K, we may be required to recognize certain

subsequent events (such as in connection with contingencies or the

realization of assets) which could affect our final results.

Non-GAAP Financial Measures

We collect and analyze operating and financial

data to evaluate the health of our business, allocate our resources

and assess our performance. In addition to total net revenues, net

income (loss), and other results under GAAP, we utilize non-GAAP

calculations of adjusted earnings before interest, taxes,

depreciation, and amortization (“Adjusted EBITDA”), Adjusted EBITDA

Margin, Adjusted Operating Expenses, Adjusted Operating Expenses

and SBC, Adjusted Operating Expenses and SBC excluding the 2021

Founders Award Cancellation, and SBC excluding the 2021 Founders

Award Cancellation. This non-GAAP financial information is

presented for supplemental informational purposes only, should not

be considered in isolation or as a substitute for, or superior to,

financial information presented in accordance with GAAP, and may be

different from similarly titled non-GAAP measures used by other

companies. Reconciliations of these non-GAAP measures to the most

directly comparable financial measures calculated and presented in

accordance with GAAP are provided in the financial tables included

in this press release.

Adjusted EBITDA

Adjusted EBITDA is defined as net income (loss),

excluding (i) interest expenses related to credit facilities, (ii)

provision for (benefit from) income taxes, (iii) depreciation and

amortization, (iv) SBC, (v) significant legal and tax settlements

and reserves, and (vi) other significant gains, losses, and

expenses (such as impairments, restructuring charges, and business

acquisition- or disposition-related expenses) that we believe are

not indicative of our ongoing results.

The above items are excluded from our Adjusted

EBITDA measure because these items are non-cash in nature, or

because the amount and timing of these items are unpredictable, are

not driven by core results of operations, and render comparisons

with prior periods and competitors less meaningful. We believe

Adjusted EBITDA provides useful information to investors and others

in understanding and evaluating our results of operations, as well

as providing a useful measure for period-to-period comparisons of

our business performance. Moreover, Adjusted EBITDA is a key

measurement used by our management internally to make operating

decisions, including those related to operating expenses, evaluate

performance, and perform strategic planning and annual

budgeting.

Adjusted EBITDA Margin

Adjusted EBITDA Margin is calculated as Adjusted

EBITDA divided by total net revenues. The most directly comparable

GAAP measure is net margin (calculated as net income (loss) divided

by total net revenues). We believe Adjusted EBITDA Margin provides

useful information to investors and others in understanding and

evaluating our results of operations, as well as providing a useful

measure for period-to-period comparisons of our business

performance. Adjusted EBITDA Margin is used by our management

internally to make operating decisions, including those related to

operating expenses, evaluate performance, and perform strategic

planning and annual budgeting.

Adjusted Operating Expenses

Adjusted Operating Expenses is defined as GAAP

total operating expenses minus (i) SBC, (ii) significant legal and

tax settlements and reserves, and (iii) other significant expenses

(such as impairments, restructuring charges, and business

acquisition- or disposition-related expenses) that we believe are

not indicative of our ongoing expenses. The amount and timing of

the excluded items are unpredictable, are not driven by core

results of operations, and render comparisons with prior periods

less meaningful. We believe Adjusted Operating Expenses provides

useful information to investors and others in understanding and

evaluating our results of operations, as well as providing a useful

measure for period-to-period comparisons of our cost structure.

Adjusted Operating Expenses is used by our management internally to

make operating decisions, including those related to operating

expenses, evaluate performance, and perform strategic planning and

annual budgeting. Starting in Q1 2025, Adjusted Operating Expenses

will no longer include provision for credit losses.

Adjusted Operating Expenses and SBC

Adjusted Operating Expenses and SBC is defined

as GAAP total operating expenses minus (i) significant legal and

tax settlements and reserves and (ii) other significant expenses

(such as impairments, restructuring charges, and business

acquisition- or disposition-related expenses), that we believe are

not indicative of our ongoing expenses. The amount and timing of

the excluded items are unpredictable, are not driven by core

results of operations, and render comparisons with prior periods

less meaningful. Unlike Adjusted Operating Expenses, Adjusted

Operating Expenses and SBC does not adjust for SBC. We believe

Adjusted Operating Expense and SBC provides useful information to

investors and others in understanding and evaluating our results of

operations, as well as providing a useful measure for

period-to-period comparisons of our cost structure. Adjusted

Operating Expenses and SBC is used by our management internally to

make operating decisions, including those related to operating

expenses, evaluate performance, and perform strategic planning and

annual budgeting.

Adjusted Operating Expenses and SBC excluding

the 2021 Founders Award Cancellation

Adjusted Operating Expenses and SBC excluding

the 2021 Founders Award Cancellation is defined as GAAP total

operating expenses minus (i) significant legal and tax settlements

and reserves, (ii) other significant expenses (such as impairments,

restructuring charges, and business acquisition- or

disposition-related expenses), and (iii) the 2021 Founders Award

Cancellation, that we believe are not indicative of our ongoing

expenses. The amount and timing of the excluded items are

unpredictable, are not driven by core results of operations, and

render comparisons with prior periods less meaningful. We believe

Adjusted Operating Expense and SBC excluding the 2021 Founders

Award Cancellation provides useful information to investors and

others in understanding and evaluating our results of operations,

as well as providing a useful measure for period-to-period

comparisons of our cost structure. Adjusted Operating Expenses and

SBC excluding the 2021 Founders Award Cancellation is used by our

management internally to make operating decisions, including those

related to operating expenses, evaluate performance, and perform

strategic planning and annual budgeting.

SBC excluding the 2021 Founders Award

Cancellation

We define SBC excluding the 2021 Founders Award

Cancellation as GAAP SBC minus the impact of the 2021 Founders

Award Cancellation, which we do not believe is indicative of our

ongoing expenses. The amount and timing of the 2021 Founders Award

Cancellation are not driven by core results of operations and

renders comparisons with prior periods less meaningful. We believe

SBC excluding the 2021 Founders Award Cancellation provides useful

information to investors and others in understanding and evaluating

our results of operations, as well as providing a useful measure

for period-to-period comparisons of our cost structure. SBC

excluding the Founders Award Cancellation is used by our management

internally to make operating decisions, including those related to

operating expenses, evaluate performance, and perform strategic

planning and annual budgeting.

Key Performance Metrics

In addition to the measures presented in our

unaudited condensed consolidated financial statements, we use the

following key performance metrics to help us evaluate our business,

identify trends affecting our business, formulate business plans,

and make strategic decisions.

Funded Customers

We define a Funded Customer as a unique person

who has at least one account with a Robinhood entity and, within

the past 45 calendar days (a) had an account balance that was

greater than zero (excluding amounts that are deposited into a

Funded Customer account by the Company with no action taken by the

unique person) or (b) completed a transaction using any such

account. Individuals who share a funded joint investing account

(which launched in July 2024) are each considered to be a Funded

Customer.

Assets Under Custody (“AUC”)

We define AUC as the sum of the fair value of

all equities, options, cryptocurrency, futures (including options

on futures, swaps, and event contracts), and cash held by users in

their accounts, net of receivables from users, as of a stated date

or period end on a trade date basis. Net Deposits and net market

gains (losses) drive the change in AUC in any given period.

Net Deposits

We define Net Deposits as all cash deposits and

asset transfers from customers, as well as dividends, interest, and

cash or assets earned in connection with Company promotions (such

as account transfer and retirement match incentives and free stock

bonuses) received by customers, net of reversals, customer cash

withdrawals, margin interest, Gold subscription fees, and assets

transferred off of our platforms for a stated period. Prior to the

second quarter of 2024, Net Deposits did not include inflows from

cash or assets earned in connection with Company promotions and

prior to January 2024, Net Deposits did not include inflows from

dividends and interest or outflows from Robinhood Gold subscription

fees and margin interest, although we have not restated amounts in

prior periods as the impact to those figures was immaterial.

Average Revenue Per User (“ARPU”)

We define ARPU as total revenue for a given

period divided by the average number of Funded Customers on the

last day of that period and the last day of the immediately

preceding period. Figures in this press release represent ARPU

annualized for each three-month period presented.

Gold Subscribers

We define a Gold Subscriber as a unique person

who has at least one account with a Robinhood entity and who, as of

the end of the relevant period (a) is subscribed to Robinhood Gold

and (b) has made at least one Robinhood Gold subscription fee

payment.

Additional Operating

Metrics

Retirement AUC

We define Retirement AUC as the total AUC in

traditional IRAs and Roth IRAs.

Cash Sweep

We define Cash Sweep as the period-end total

amount of participating users’ uninvested brokerage cash that has

been automatically “swept” or moved from their brokerage accounts

into deposits for their benefit at a network of program banks. This

is an off-balance-sheet amount. Robinhood earns a net interest

spread on Cash Sweep balances based on the interest rate offered by

the banks less the interest rate given to users as stated in our

program terms.

Margin Book

We define Margin Book as our period-end

aggregate outstanding margin loan balances receivable (i.e., the

period-end total amount we are owed by customers on loans made for

the purchase of securities, supported by a pledge of assets in

their margin-enabled brokerage accounts).

Notional Trading Volume

We define Notional Trading Volume or Notional

Volume for any specified asset class as the aggregate dollar value

(purchase price or sale price as applicable) of trades executed in

that asset class over a specified period of time.

Options Contracts Traded

We define Options Contracts Traded as the total

number of options contracts bought or sold over a specified period

of time. Each contract generally entitles the holder to trade 100

shares of the underlying stock.

Glossary Terms

2021 Founders Award Cancellation

We define the 2021 Founders Award Cancellation

as the cancellation in February 2023 of the 2021 pre-IPO

market-based restricted stock units granted to our founders of 35.5

million unvested shares.

Investment Accounts

We define an Investment Account as a funded

individual brokerage account, a funded joint investing account, or

a funded individual retirement account ("IRA"). As of December 31,

2024, a Funded Customer can have up to four Investment Accounts -

individual brokerage account, joint investing account (which

launched in July 2024), traditional IRA, and Roth IRA.

Gold Adoption Rate

We define the Gold adoption rate as end of

period Gold Subscribers divided by end of period Funded

Customers.

Growth Rate and Annualized Growth Rate with

respect to Net Deposits

Growth rate is calculated as aggregate Net

Deposits over a specified 12 month period, divided by AUC for the

fiscal quarter that immediately precedes such 12 month period.

Annualized growth rate is calculated as Net Deposits for a

specified quarter multiplied by 4 and divided by AUC for the

immediately preceding quarter.

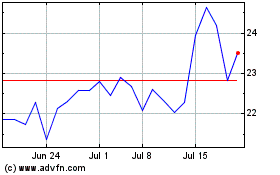

Robinhood Markets (NASDAQ:HOOD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Robinhood Markets (NASDAQ:HOOD)

Historical Stock Chart

From Feb 2024 to Feb 2025