Revance Therapeutics, Inc. (RVNC) announced that the

company is hosting its Investor Day today, September 19, 2023, from

9:30 am ET to 12:00 pm ET.

The Investor Day will include management presentations on

Revance’s vision and strategy, Revance Aesthetics overview and

launch progress, DAXXIFY® KOL panel, Revance Therapeutics

commercial launch plans, future growth opportunities, and financial

review and outlook. The presentations will be followed by a Q&A

session.

Key Corporate Updates

- Real-world feedback reinforces DAXXIFY’s differentiated

performance profile and continued opportunity for long-term,

broad-based adoption.

- New pricing program for DAXXIFY®, which became effective

September 1, 2023, positions the product to be priced competitively

to Botox® Cosmetic for the provider, to further accelerate market

share expansion.

- Expects long-term supply chain strategy to support U.S.

DAXXIFY® adjusted gross margin of over 80%.

- Continued confidence in blockbuster potential in U.S.

aesthetics product portfolio.

- Provides update on DAXXIFY® cervical dystonia PrevU program and

commercial launch plans, early feedback from payers and market

access dynamics.

- Exiting OPUL® payments business by the end of Q1 2024 to

prioritize capital allocation and streamline operations. Expects to

free up approximately $20 million a year for reinvestment in

DAXXIFY® aesthetics and therapeutic commercial launches.

- The company provides additional updates to its 2023 financial

guidance:

- With current cash, cash equivalents, and short-term investments

of $319.7 million as of June 30, 2023, and the additional $50

million in notes funded through Athyrium Capital in August 2023,

the company is funded to breakeven and expects to be Adjusted

EBITDA positive in 2025.

- Expects to provide product revenue guidance in first half

2024.

- Q3 2023 product revenue has the potential to be around Q2 2023

levels based on the recent roll out of the new pricing program and

traditional seasonality in facial injectables.

- Revised 2023 GAAP and Non-GAAP operating expense guidance to

reflect the company’s exit of the OPUL® payments business:

- GAAP operating expenses updated from $460 million – $480

million to $545 million – $585 million.

- Non-GAAP operating expenses updated from $320 million – $340

million to $315 million – $335 million.

- Non-GAAP research and development expenses updated from $80

million – $90 million to $75 million – $85 million.

Interested parties can access the live webcast for this event

from the Events and Presentations section of the company’s

Investor Relations webpage.

A webcast replay will be available beginning September 19, 2023,

at 12:00 p.m. PT / 3:00 p.m. ET. To access the replay, please

register via the webcast link on the events page.

About Revance

Revance is a biotechnology company setting the new standard in

healthcare with innovative aesthetic and therapeutic offerings that

enhance patient outcomes and physician experiences. Revance’s

portfolio includes DAXXIFY® (DaxibotulinumtoxinA-lanm) for

injection and the RHA® Collection of dermal fillers in the U.S.

Revance has also partnered with Viatris Inc. to develop a

biosimilar to onabotulinumtoxinA for injection and Shanghai Fosun

Pharmaceutical to commercialize DAXXIFY® in China.

Revance is headquartered in Nashville, Tenn., with additional

office locations in Newark and Irvine, Calif. Learn more at

www.Revance.com, www.RevanceAesthetics.com, www.DAXXIFY.com,

www.hcp.DAXXIFYTherapy.com, or connect with us on LinkedIn.

“Revance” and the Revance logo, and DAXXIFY® are registered

trademarks of Revance Therapeutics, Inc. Resilient Hyaluronic Acid®

and RHA® are trademarks of TEOXANE SA. BOTOX® is a registered

trademark of Allergan, Inc.

Forward-Looking Statements

Any statements in this press release that are not statements of

historical fact, including statements related to our adjusted gross

margins; 2023 product revenue, operating expenses and research and

development expense guidance and our guidance plans; our funding to

cash flow breakeven; our capital requirements; the timing for

reaching positive adjusted EBITDA; projected loss from the services

segment; the plans for the OPUL® business and the anticipated cash

to be freed up from the exit of the OPUL® payments business; our

ability to successfully commercialize DAXXIFY®, drive adoption,

take market share and grow; our blockbuster potential; the

competitive pricing of DAXXIFY®; the potential benefits and

performance of our products; the efficacy, duration and safety of

DAXXIFY®; our ability to set a new standard of care; potential

benefits of our products to physicians and patients; development of

a biosimilar to onabotulinumtoxinA for injection with Viatris; and

our business and marketing strategy, timeline and other goals, and

plans and prospects, including our commercialization plans;

constitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. You should not rely

upon forward-looking statements as predictions of future events.

Although we believe that the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee that

the future results, levels of activity, performance, events,

circumstances or achievements reflected in the forward-looking

statements will ever be achieved or occur.

Forward-looking statements are subject to risks and

uncertainties that could cause actual results and the timing of

events to differ materially from our expectations. These risks and

uncertainties relate to, but are not limited to: our ability to

obtain funding for our operations; the timing of capital

expenditures; the accuracy of our estimates regarding expenses,

revenues, capital requirements, our financial performance and the

economics of DAXXIFY® and the RHA® Collection of dermal fillers;

the extent of future impairment charges; our ability to comply with

our debt obligations; the impact of macroeconomic factors on our

manufacturing operations, supply chain, end user demand for our

products, commercialization efforts, business operations,

regulatory meetings, inspections and approvals, clinical trials and

other aspects of our business and on the market; our ability to

maintain approval of our products; our ability and the ability of

our partners to manufacture supplies for DAXXIFY® and our drug

product candidates; our ability to acquire supplies of the RHA®

Collection of dermal fillers; the uncertain clinical development

process; our ability to obtain, and the timing relating to,

regulatory submissions and approvals with respect to our drug

product candidates and third-party manufacturers; the risk that

clinical trials may not have an effective design or generate

positive results or that positive results would assure regulatory

approval or commercial success; the applicability of clinical study

results to actual outcomes; the rate and degree of economic

benefit, safety, efficacy, commercial acceptance, market,

competition and/or size and growth potential of DAXXIFY®, the RHA®

Collection of dermal fillers, and our drug product candidates, if

approved; our ability to successfully commercialize DAXXIFY® and to

continue to successfully commercialize the RHA® Collection of

dermal fillers; the timing and cost of commercialization

activities; securing or maintaining adequate coverage or

reimbursement by third-party payors for DAXXIFY®;the proper

training and administration of our products by physicians and

medical staff; our ability to gain acceptance from physicians in

the use of DAXXIFY® for therapeutic indications; our ability to

expand sales and marketing capabilities; the status of commercial

collaborations; changes in and failures to comply with laws and

regulations; our ability to continue obtaining and maintaining

intellectual property protection for our products; the cost and our

ability to defend ourselves in product liability, intellectual

property, class action or other lawsuits; our ability to limit or

mitigate cybersecurity incidents; the volatility of our stock

price; and other risks. Detailed information regarding factors that

may cause actual results to differ materially from the expectations

expressed or implied by statements in this press release may be

found in our periodic filings with the Securities and Exchange

Commission (“SEC”), including factors described in the section

entitled "Risk Factors" in our Form 10-K filed with the SEC on

February 28, 2023, and including, without limitation, our Form

10-Qs for the quarters ended March 31, 2023 and June 30, 2023,

filed with the SEC on May 9, 2023 and August 8, 2023, respectively.

The forward-looking statements in this press release speak only as

of the date hereof. We disclaim any obligation to update these

forward-looking statements.

Use of Non-GAAP Financial Measures

The Company has presented certain preliminary and unaudited

non-GAAP financial measures in this press release, including

non-GAAP R&D expense, non-GAAP operating expense, adjusted

gross margin and adjusted EBITDA. Non-GAAP R&D expense excludes

depreciation, amortization, non-cash stock-based compensation and

restructuring charges. Non-GAAP operating expense excludes costs of

revenue, depreciation, amortization, stock-based compensation, and

restructuring and impairment charges. Adjusted gross margin is

defined as gross margin, excluding stock-based compensation,

depreciation and amortization. Adjusted EBITDA is defined as

earnings before interest, taxes, depreciation and amortization,

stock-based compensation and extraordinary items such as

restructuring and impairment charges. Actual non-GAAP R&D

expense, non-GAAP operating expense and adjusted EBITDA may exclude

extraordinary items not indicative of our ongoing operating

performance such as restructuring and impairment charges. The

Company excludes costs of revenue, depreciation, amortization,

stock-based compensation and extraordinary items like restructuring

and impairment charges because management believes the exclusion of

these items is helpful to investors to evaluate the Company’s

recurring operational performance. Company management uses these

non-GAAP financial measures to monitor and evaluate its operating

results and trends on an ongoing basis, and internally for

operating, budgeting and financial planning purposes. The non-GAAP

financial measures should be considered in addition to results

prepared in accordance with GAAP but should not be considered a

substitute for or superior to GAAP results.

Certain non-GAAP measures included in this press release were

not reconciled to the comparable GAAP financial measures because

the GAAP measures are not accessible on a forward-looking basis.

The Company is unable to reconcile these forward-looking non-GAAP

financial measures to the most directly comparable GAAP measures

without unreasonable effort because the Company is currently unable

to predict with a reasonable degree of certainty the type and

extent of certain items that would be expected to impact GAAP

measures for these periods but would not impact the non-GAAP

measures. Such items include costs of revenue, depreciation,

amortization, stock-based compensation as well as extraordinary

items like restructuring and impairment charges. The unavailable

information could have a significant impact on the Company’s GAAP

financial results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230919664980/en/

Investors Revance Therapeutics, Inc.: Jessica Serra,

510-279-6886 jessica.serra@revance.com or Gilmartin Group, LLC.:

Laurence Watts, 619-916-7620 laurence@gilmartinir.com

Media Revance Therapeutics, Inc.: Sara Fahy, 949-887-4476

sfahy@revance.com

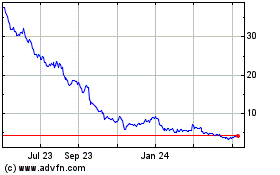

Revance Therapeutics (NASDAQ:RVNC)

Historical Stock Chart

From Oct 2024 to Nov 2024

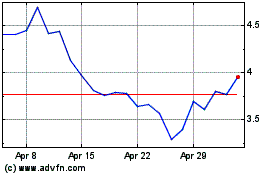

Revance Therapeutics (NASDAQ:RVNC)

Historical Stock Chart

From Nov 2023 to Nov 2024