UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under Rule 14a-12 |

REPUBLIC FIRST BANCORP, INC.

|

(Name of Registrant as Specified in Its Charter)

|

| |

DRIVER MANAGEMENT COMPANY LLC

DRIVER OPPORTUNITY PARTNERS I LP

J. ABBOTT R. COOPER

PETER B. BARTHOLOW

PAMELA D. BUNDY

RICHARD H. SINKFIELD III

|

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check

box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of

its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Driver Management Company

LLC, together with the other participants named herein (collectively, “Driver”), has filed a preliminary proxy statement and

accompanying WHITE proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of its slate of

highly-qualified director nominees at the 2022 annual meeting of shareholders of Republic

First Bancorp, Inc., a Pennsylvania corporation (the “Company”).

On April 6, 2022, J. Abbott

R. Cooper, Managing Member of Driver Management Company LLC, was quoted in the following article in Activist Insight:

Republic First tempts another lawsuit as it delays annual meeting

American Banker

By John Reosti

April 6, 2022

An increasingly bitter contest pitting management at Republic First Bancorp

and its chairman, Vernon Hill, against two separate shareholder activist groups has already spawned two lawsuits. Now, it looks as if

a third is likely, in response to an indefinite delay to the 2022 annual meeting the company announced Friday.

The $5.6 billion-asset Republic First, holding company for Republic Bank,

said it implemented the delay to permit its board's audit committee to engage legal counsel and investigate activist shareholders' claims

of improper related party transactions.

Any delay of the Philadelphia company's annual meeting will result in a

delay to a shareholder vote that could lead to Hill’s removal, an outcome both activist groups have loudly advocated.

Hill also serves as Republic First’s CEO, a position he assumed in

February 2021.

Republic First declined to say how long its investigation would take, though

it noted in a regulatory filing that the related party claims — instances where the company does business with insiders or their

family members — have already been disclosed, are the subject of current litigation, and are unlikely to have a material adverse

effect on its financial condition.

Abbott Cooper, founder and managing member at Driver Management Company

and the leader of one of the activist groups, characterized the annual meeting delay as a "tactic" by Hill to buy time to rally

support.

“You would think if someone had the votes they needed to win, they

would want to get to the election as soon as possible and end the proxy contest,” Driver said Tuesday in an interview.

As such, Republic First’s decision to delay the annual meeting, along

with the filing of its 2021 annual report, probably won’t go unchallenged.

“I don’t think this is the end of the issue,” Driver

said. “My guess is that there will be action taken” to seek a more timely meeting date.

A Republic First spokesman declined to comment, but on Wednesday the company

disclosed it had received a notice from the NASDAQ stock market, which lists Republic First’s shares, that its choice to delay filing

an annual report is a violation of a requirement for maintaining its listing. Republic First said it has 60 days to either file the report

or present a plan demonstrating how it intends to return to compliance.

The company added that it plans to submit its annual report “as soon

as practicable.”

A second activist investor group led by George Norcross, a prominent New

Jersey insurance executive, and Gregory Braca, a former vice chairman of TD Bank’s U.S. subsidiary, has filed two lawsuits against

Republic First. The most recent, filed March 29, seeks to compel the company to open its books — and in the process, disclose information

on related party transactions — for inspection.

In a court filing, Norcross raised concerns about Hill’s dealings

with John Silvestri, a longtime friend and business partner, as well as InterArch, a design firm owned by Hill’s wife Shirley.

The first Norcross-Braca suit, filed March 8, seeks to block Republic First

from modifying the employment contracts of the company’s senior management team to provide for outsized severance payouts if Hill

is voted off the board or removed as CEO.

Both cases, filed in the Philadelphia Court of Common Pleas, remain active.

A spokesman for the Norcross-Braca group did not immediately respond to a request for comment.

On March 4, prior to the filing of the first Norcross-Braca lawsuit, a

four-member group of Republic First directors led by the bank’s founder and former chairman and CEO, Harry Madonna, released a statement

accusing Hill and three other board members of seeking to implement changes to management employment contracts. The Madonna-led group,

calling themselves “concerned directors,” also claimed Republic First was seeking to hire a firm connected to Hill’s

wife to provide architectural and design services.

Republic First, which grew its assets by 11% in 2021 and touts itself as

one of the Philadelphia region’s fastest-growing banks, has continued this expansion in 2022. This week, Republic Bank opened a

branch, its 34th, in Wayne, Pennsylvania, about 12 miles west of Philadelphia. Last month, Republic First hired two veteran lenders to

join its team in New York.

“As we strategically open new locations…expanding our presence

in the Philadelphia suburbs remains a continued focus,” Hill said Tuesday in a press release.

In an April 4 letter to Republic First’s board included in a regulatory

filing with the Securities and Exchange Commission, Cooper criticized what he described as “a strategy of undisciplined growth.”

Cooper said that it could lead to safety-and-soundness concerns if the company fails to add capital, but noted the conflict among Republic

First’s directors makes agreement on a capital plan unlikely.

Republic First’s board, composed of eight directors, appears evenly

split between Madonna and his allies and a four-director faction led by Hill. “It seems safe to assume that the board deadlock precludes

any further capital raises,” Cooper wrote.

Cooper told American Banker the impasse is "Exhibit A for never having

a board with an equal number of directors."

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Driver Management Company LLC, together with

the other participants named herein (collectively, “Driver”), has filed a preliminary proxy statement and accompanying WHITE

proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of its slate of highly-qualified director

nominees at the 2022 annual meeting of shareholders of Republic First Bancorp, Inc., a Pennsylvania Company (the “Company”).

DRIVER STRONGLY ADVISES ALL SHAREHOLDERS OF

THE COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV.

IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON

REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

The participants in the proxy solicitation

are anticipated to be Driver Management Company LLC (“Driver Management”), Driver Opportunity Partners I LP (“Driver

Opportunity”), J. Abbott R. Cooper, Peter B. Bartholow, Pamela D. Bundy and Richard H. Sinkfield III.

As of the date hereof, the participants in

the proxy solicitation beneficially own in the aggregate 697,353 shares of Common Stock, par value $0.01 per share, of the Company (the

“Common Stock”). As of the date hereof, Driver Opportunity beneficially owns directly 340,496 shares of Common Stock, including

1,000 shares held in record name. As the investment advisor of certain managed accounts (the “Managed Accounts”), Driver Management

may be deemed to beneficially own 334,925 shares of Common Stock (consisting of shares of Common Stock held in the Managed Accounts).

Driver Management, as the general partner of Driver Opportunity, may be deemed to beneficially own the shares of Common Stock directly

beneficially owned by Driver Opportunity and held in the Managed Accounts. Mr. Cooper, as the Managing Member of Driver Management, may

be deemed to beneficially own the shares of Common Stock directly beneficially owned by Driver Opportunity and held in the Managed Accounts.

As of the date hereof, Mr. Bartholow directly beneficially owns 6,000 shares of Common Stock. As of the date hereof, Ms. Bundy directly

beneficially owns 10,000 shares of Common Stock. As of the date hereof, Mr. Sinkfield directly beneficially owns 5,932 shares of Common

Stock.

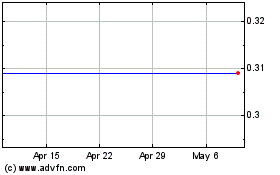

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jun 2024 to Jul 2024

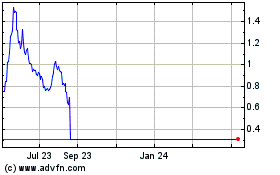

Republic First Bancorp (NASDAQ:FRBK)

Historical Stock Chart

From Jul 2023 to Jul 2024