false

0001737953

0001737953

2024-11-25

2024-11-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): November 25, 2024

REPLIMUNE GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-38596 |

|

82-2082553 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

500

Unicorn Park Drive

Suite 303

Woburn, MA 01801

(Address of principal executive offices, including Zip Code)

Registrant’s telephone number, including

area code: (781) 222-9600

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425) |

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12) |

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b)) |

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

REPL |

|

The Nasdaq Stock Market LLC

(Nasdaq Global Select Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this

chapter). Emerging growth company ¨

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Explanatory Note

This Current Report on Form

8-K/A (the “Amendment”) amends the Current Report on Form 8-K (the “Original Report”) of Replimune Group, Inc.

(the “Company”) filed on November 27, 2024. The sole purpose of this Amendment is to correct the previously disclosed maximum

beneficial ownership threshold in the Pre-Funded Warrants (as defined below) from 9.99% to 19.99% and to file an amended Form of Pre-Funded

Warrant to reflect such change as Exhibit 4.1 hereto. No other revisions have been made to the Original Report, and other than mentioned

in the foregoing sentence, this Amendment does not amend, update, or change any other items or disclosures contained in the Original Report.

Item 8.01 Other Events.

On November 25, 2024, the Company entered into an underwriting agreement (the “Underwriting Agreement”) with Leerink

Partners LLC (the “Underwriter”), relating to the issuance and sale of an aggregate of 6,923,000 shares of the Company’s

common stock (the “Firm Shares”) and pre-funded warrants to purchase 3,846,184 shares of the Company’s common stock

(the “Pre-Funded Warrants”) to the Underwriter (the “Offering”). Pursuant to the Underwriting Agreement, the Company

also granted the Underwriter a 30-day option to purchase up to 1,615,377 additional shares of the Company’s common stock (the “Option

Shares” and together with the Firm Shares, the “Shares”), which option was exercised in full by the Underwriters on November 26, 2024. The Shares will be sold at the public offering price of $13.00

per share and the Pre-Funded Warrants will be sold at a public offering price of $12.9999 per Pre-Funded Warrant, which equals the per

share public offering price for the Shares less the $0.0001 exercise price for each such Pre-Funded Warrant. The Underwriting Agreement

contains customary representations and warranties, conditions to closing, market standoff provisions, termination provisions and indemnification

obligations, including for liabilities under the Securities Act of 1933, as amended. The representations, warranties and covenants contained

in the Underwriting Agreement were made only for purposes of such agreement and as of specific dates, and were solely for the benefit

of the parties to the Underwriting Agreement.

The Pre-Funded Warrants are

exercisable at any time after the date of issuance. A holder of Pre-Funded Warrants may not exercise the warrant if the holder, together

with its affiliates, would beneficially own more than 4.99% of the number of shares of the Company’s common stock outstanding immediately

after giving effect to such exercise. A holder of Pre-Funded Warrants may increase or decrease this percentage not in excess of 19.99%

by providing at least 61 days’ prior notice to the Company.

The Company estimates that

net proceeds from the Offering will be approximately $155.8 million, after deducting underwriting discounts and commissions and estimated

Offering expenses payable by the Company, and giving effect to the exercise of the Underwriter’s 30 day option to purchase additional

shares of the Company’s common stock. Delivery of the Firm Shares is expected to be made on or about November 27, 2024, and delivery of the Pre-Funded Warrants is expected

to be made on or about December 4, 2024, subject to customary closing

conditions. The Offering is being made pursuant to the automatically effective shelf registration statement on Form S-3 ASR (File No.

333-273633) previously filed by the Company with the Securities and Exchange Commission (the “SEC”) on August 3, 2023, as

amended by the Post-Effective Amendment No. 1 filed with the SEC on May 16, 2024 and as further amended by the Post-Effective Amendment

No. 2 filed with the SEC on May 16, 2024, and declared effective by the SEC on July 22, 2024, and a related prospectus supplement.

The Underwriting Agreement

and the form of Pre-Funded Warrant are filed as Exhibits 1.1 and 4.1 to this Current Report on Form 8-K, respectively and the foregoing

description of the terms of the Underwriting Agreement and the Pre-Funded Warrants are qualified in their entirety by reference to such

exhibit. A copy of the opinion of Morgan, Lewis & Bockius LLP relating to the legality of the issuance and sale of the Shares and

Pre-Funded Warrants in the Offering is filed with this Current Report on Form 8-K as Exhibit 5.1.

On November 25, 2024, the

Company issued two press releases, the first announcing the commencement of the Offering and the second announcing the pricing of the Offering.

Copies of these press releases are attached as Exhibits 99.1 and 99.2 hereto, respectively.

Neither the disclosures on

this Current Report on Form 8-K nor the exhibits hereto shall constitute an offer to sell or the solicitation of an offer to buy the securities

described herein and therein, nor shall there be any sale of such securities in any state or jurisdiction in which such an offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Item 9.01 Financial Statements and Exhibits.

* Previously filed.

Forward-Looking Statements

This Current Report on Form

8-K contains forward looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of

the Securities Exchange Act of 1934, as amended, and that involve risks and uncertainties, including statements regarding the expected

net proceeds and the closing date of the Offering and other statements identified by words such as “could,” “expects,”

“intends,” “may,” “plans,” “potential,” “should,” “will,” “would,”

or similar expressions and the negatives of those terms. Forward-looking statements are not promises or guarantees of future performance,

and are subject to a variety of risks and uncertainties, many of which are beyond our control, and which could cause actual results to

differ materially from those contemplated in such forward-looking statements, including, but not limited to, the risks as may be detailed

from time to time in our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q and other reports we file with the SEC, and in

the preliminary prospectus supplement, the final prospectus supplement, and the accompanying prospectus related to the Offering. Our actual

results could differ materially from the results described in or implied by such forward-looking statements. Forward-looking statements

speak only as of the date hereof, and, except as required by law, we undertake no obligation to update or revise these forward-looking

statements.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

REPLIMUNE GROUP, INC. |

| |

|

|

| Date: December 4, 2024 |

By: |

/s/ Sushil Patel |

| |

|

Sushil Patel |

| |

|

Chief Executive Officer |

Exhibit 4.1

REPLIMUNE GROUP, INC.

FORM OF WARRANT TO PURCHASE COMMON STOCK

Number of Shares: [●]

(subject to adjustment)

| Warrant No. [●] |

Original Issue Date: [●], 2024 |

Replimune Group, Inc., a Delaware corporation (the “Company”),

hereby certifies that, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, [●] or

its registered assigns (the “Holder”), is entitled, subject to the terms set forth below, to purchase from the Company

up to a total of [●] shares of common stock, $0.001 par value per share (the “Common Stock”), of the Company

(each such share, a “Warrant Share” and all such shares, the “Warrant Shares”) at an exercise price

per share equal to $0.0001 per share (as adjusted from time to time as provided in Section 9 herein, the “Exercise

Price”) upon surrender of this Warrant to Purchase Common Stock (including any Warrants to Purchase Common Stock issued in exchange,

transfer or replacement hereof, the “Warrant”) at any time and from time to time on or after the date hereof (the “Original

Issue Date”), subject to the following terms and conditions:

1. Definitions. For purposes of this Warrant, the following

terms shall have the following meanings:

(a) “Affiliate” means

any Person directly or indirectly controlled by, controlling or under common control with, a Holder, as such terms are used in and construed

under Rule 405 under the Securities Act, but only for so long as such control shall continue.

(b) “Commission” means

the United States Securities and Exchange Commission.

(c) “Closing Sale Price”

means, for any security as of any date, the last trade price for such security on the Principal Trading Market for such security, as reported

by Bloomberg L.P., or, if such Principal Trading Market begins to operate on an extended hours basis and does not designate the last trade

price, then the last trade price of such security prior to 4:00 P.M., New York City time, as reported by Bloomberg L.P., or if the security

is not listed for trading on a national securities exchange or other trading market on the relevant date, the last quoted bid price for

the security in the over-the-counter market on the relevant date as reported by OTC Markets Group Inc. (or a similar organization or agency

succeeding to its functions of reporting prices). If the Closing Sale Price cannot be calculated for a security on a particular date on

any of the foregoing bases, the Closing Sale Price of such security on such date shall be the fair market value as mutually determined

by the Company and the Holder. If the Company and the Holder are unable to agree upon the fair market value of such security, then the

Board of Directors of the Company shall use its good faith judgment to determine the fair market value. The Board of Directors’

determination shall be binding upon all parties absent demonstrable error. All such determinations shall be appropriately adjusted for

any stock dividend, stock split, stock combination or other similar transaction during the applicable calculation period.

(d) “Principal Trading Market”

means the national securities exchange or other trading market on which the Common Stock is primarily listed on and quoted for trading,

which, as of the Original Issue Date, shall be the Nasdaq Global Select Market.

(e) “Registration Statement”

means the automatically effective registration statement (File No. 333-273633), including a prospectus, as amended by Post-Effective

Amendment No. 1 filed on May 16, 2024 and Post-Effective Amendment No. 2 filed on May 16, 2024 (collectively, the

“Post-Effective Amendments”).

(f) “Securities Act” means

the Securities Act of 1933, as amended.

(g) “Trading Day” means

any weekday on which the Principal Trading Market is open for trading. If the Common Stock is not listed or admitted for trading, “Trading

Day” means any day except any Saturday, any Sunday, any day which is a federal legal holiday in the United States or any day on

which banking institutions in New York City are authorized or required by law or other governmental action to close.

(h) “Transfer Agent” means

Computershare Trust Company, N.A., the Company’s transfer agent and registrar for the Common Stock, and any successor appointed

in such capacity.

2. Issuance of Securities; Registration of Warrants. The Warrant,

as initially issued by the Company, is offered and sold pursuant to the Registration Statement. As of the Original Issue Date, the Warrant

Shares are issuable under the Registration Statement. Accordingly, the Warrant and, assuming issuance pursuant to the Registration Statement

or an exchange meeting the requirements of Section 3(a)(9) of the Securities Act as in effect on the Original Issue Date, the

Warrant Shares, are not “restricted securities” under Rule 144 promulgated under the Securities Act as of the Original

Issue Date. The Company shall register ownership of this Warrant, upon records to be maintained by the Company for that purpose (the “Warrant

Register”), in the name of the record Holder (which shall include the initial Holder or, as the case may be, any assignee to

which this Warrant is assigned hereunder) from time to time. The Company may deem and treat the registered Holder of this Warrant as the

absolute owner hereof for the purpose of any exercise hereof or any distribution to the Holder, and for all other purposes, absent actual

notice to the contrary.

3. Registration of Transfers. Subject to compliance with all

applicable securities laws and the rules of the Principal Trading Market, the Company shall, or will cause its Transfer Agent to,

register the transfer of all or any portion of this Warrant in the Warrant Register, upon surrender of this Warrant, and payment for all

applicable transfer taxes (if any). Upon any such registration or transfer, a new warrant to purchase Common Stock in substantially the

form of this Warrant (any such new warrant, a “New Warrant”) evidencing the portion of this Warrant so transferred

shall be issued to the transferee, and a New Warrant evidencing the remaining portion of this Warrant not so transferred, if any, shall

be issued to the transferring Holder. The acceptance of the New Warrant by the transferee thereof shall be deemed the acceptance by such

transferee of all of the rights and obligations in respect of the New Warrant that the Holder has in respect of this Warrant. The Company

shall, or will cause its Transfer Agent to, prepare, issue and deliver at the Company’s own expense any New Warrant under this Section 3.

Until due presentment for registration of transfer, the Company may treat the registered Holder hereof as the owner and holder for all

purposes, and the Company shall not be affected by any notice to the contrary.

4. Exercise and Duration of Warrants.

(a) All or any part of this Warrant shall

be exercisable by the registered Holder in any manner permitted by this Warrant at any time and from time to time on or after the Original

Issue Date.

(b) The Holder may exercise this Warrant

by delivering to the Company (i) an exercise notice, in the form attached as Schedule 1 hereto (the “Exercise Notice”),

completed and duly signed, and (ii) payment of the Exercise Price for the number of Warrant Shares as to which this Warrant is being

exercised (which may take the form of a “cashless exercise” if so indicated in the Exercise Notice pursuant to Section 10

below). The date on which such exercise notice is delivered to the Company (as determined in accordance with the notice provisions hereof)

is an “Exercise Date.” The Holder shall not be required to deliver the original Warrant in order to effect an exercise

hereunder. Execution and delivery of the Exercise Notice shall have the same effect as cancellation of the original Warrant and issuance

of a New Warrant evidencing the right to purchase the remaining number of Warrant Shares, if any. The Holder and any assignee, by acceptance

of this Warrant, acknowledge and agree that, by reason of the provisions of this paragraph, following the purchase of a portion of the

Warrant Shares hereunder, the number of Warrant Shares available for purchase hereunder at any given time may be less than the amount

stated on the face hereof.

5. Delivery of Warrant Shares.

(a) Upon exercise of this Warrant, the Company

shall promptly (but in no event later than one (1) Trading Day after the Exercise Date), upon the request of the Holder, cause the

Transfer Agent to credit such aggregate number of shares of Common Stock to which the Holder is entitled pursuant to such exercise to

the Holder’s or its designee’s balance account with The Depository Trust Company (“DTC”) through its Deposit

Withdrawal Agent Commission system or if the Transfer Agent is not participating in the Fast Automated Securities Transfer Program (the

“FAST Program”) or if the certificates are required to bear a legend regarding restriction on transferability, issue

and dispatch by overnight courier to the address as specified in the Exercise Notice, a certificate, registered in the Company’s

share register in the name of the Holder or its designee, for the number of shares of Common Stock to which the Holder is entitled pursuant

to such exercise. The Holder, or any natural person or legal entity (each, a “Person”) so designated by the Holder

to receive Warrant Shares, shall be deemed to have become the holder of record of such Warrant Shares as of the Exercise Date, irrespective

of the date such Warrant Shares are credited to the Holder’s DTC account or the date of delivery of the certificates evidencing

such Warrant Shares, as the case may be.

(b) If by the close of the first (1st) Trading

Day after the Exercise Date, the Company fails to deliver to the Holder a certificate representing the required number of Warrant Shares

in the manner required pursuant to Section 5(a) or fails to cause the Transfer Agent to credit the Holder’s DTC

account for such number of Warrant Shares to which the Holder is entitled, and if after such first (1st) Trading Day and prior to the

receipt of such Warrant Shares, the Holder purchases (in an open market transaction or otherwise) shares of Common Stock to deliver in

satisfaction of a sale by the Holder of the Warrant Shares which the Holder anticipated receiving upon such exercise (a “Buy-In”),

then the Company shall, within three (3) Trading Days after the Holder’s written request and in the Holder’s sole discretion,

either (i) pay in cash to the Holder an amount equal to the Holder’s total purchase price (including brokerage commissions,

if any) for the shares of Common Stock so purchased, at which point the Company’s obligation to deliver such certificate (and to

issue such Warrant Shares) or to cause the Holder’s DTC account to be credited for such Warrant Shares shall terminate or (ii) promptly

deliver to the Holder a certificate or certificates representing such Warrant Shares and pay cash to the Holder in an amount equal to

the excess (if any) of Holder’s total purchase price (including brokerage commissions, if any) for the shares of Common Stock so

purchased in the Buy-In over the product of (A) the number of shares of Common Stock purchased in the Buy-In, times (B) the

Closing Sale Price of a share of Common Stock on the Exercise Date.

(c) To the extent permitted by law and subject

to Section 5(b), the Company’s obligations to cause the Transfer Agent to issue and deliver Warrant Shares in accordance

with and subject to the terms hereof (including the limitations set forth in Section 11 below) are absolute and unconditional,

irrespective of any action or inaction by the Holder to enforce the same, any waiver or consent with respect to any provision hereof,

the recovery of any judgment against any Person or any action to enforce the same, or any setoff, counterclaim, recoupment, limitation

or termination, or any breach or alleged breach by the Holder or any other Person of any obligation to the Company or any violation or

alleged violation of law by the Holder or any other Person, and irrespective of any other circumstance that might otherwise limit such

obligation of the Company to the Holder in connection with the issuance of Warrant Shares. Subject to Section 5(b), nothing

herein shall limit the Holder’s right to pursue any other remedies available to it hereunder, at law or in equity including, without

limitation, a decree of specific performance and/or injunctive relief with respect to the Company’s failure to timely deliver certificates

representing shares of Common Stock upon exercise of the Warrant as required pursuant to the terms hereof.

6. Charges, Taxes and Expenses. Issuance and delivery of certificates

for shares of Common Stock, if any, upon exercise of this Warrant shall be made without charge to the Holder for any issue or transfer

tax, transfer agent fee or other incidental tax or expense (excluding any applicable stamp duties) in respect of the issuance of such

certificates, all of which taxes and expenses shall be paid by the Company; provided, however, that the Company shall not

be required to pay any tax that may be payable in respect of any transfer involved in the registration of any certificates for Warrant

Shares or the Warrants in a name other than that of the Holder or an Affiliate thereof. The Holder shall be responsible for all other

tax liability that may arise as a result of holding or transferring this Warrant or receiving Warrant Shares upon exercise hereof.

7. Replacement of Warrant. If this Warrant is mutilated, lost,

stolen or destroyed, the Company shall issue or cause to be issued in exchange and substitution for and upon cancellation hereof, or in

lieu of and substitution for this Warrant, a New Warrant, but only upon receipt of evidence reasonably satisfactory to the Company of

such loss, theft or destruction (in such case) and, in each case, a customary and reasonable indemnity and surety bond, if requested by

the Company. Applicants for a New Warrant under such circumstances shall also comply with such other reasonable regulations and procedures

and pay such other reasonable third-party costs as the Company may prescribe. If a New Warrant is requested as a result of a mutilation

of this Warrant, then the Holder shall deliver such mutilated Warrant to the Company as a condition precedent to the Company’s obligation

to issue the New Warrant.

8. Reservation of Warrant Shares. The Company covenants that

it will, at all times while this Warrant is outstanding, reserve and keep available out of the aggregate of its authorized but unissued

and otherwise unreserved Common Stock, solely for the purpose of enabling it to issue Warrant Shares upon exercise of this Warrant as

herein provided, the number of Warrant Shares that are initially issuable and deliverable upon the exercise of this entire Warrant, free

from preemptive rights or any other contingent purchase rights of persons other than the Holder (taking into account the adjustments and

restrictions of Section 9). The Company covenants that all Warrant Shares so issuable and deliverable shall, upon issuance

and the payment of the applicable Exercise Price in accordance with the terms hereof, be duly and validly authorized, issued and fully

paid and non-assessable. The Company will take all such action as may be reasonably necessary to assure that such shares of Common Stock

may be issued as provided herein without violation of any applicable law or regulation, or of any requirements of any securities exchange

or automated quotation system upon which the Common Stock may be listed. The Company further covenants that it will not, without the prior

written consent of the Holder, take any actions to increase the par value of the Common Stock at any time while this Warrant is outstanding.

9. Certain Adjustments. The Exercise Price and number of Warrant

Shares issuable upon exercise of this Warrant are subject to adjustment from time to time as set forth in this Section 9.

(a) Stock Dividends and Splits. If

the Company, at any time while this Warrant is outstanding, (i) pays a stock dividend on its Common Stock or otherwise makes a distribution

on any class of capital stock issued and outstanding on the Original Issue Date and in accordance with the terms of such stock on the

Original Issue Date that is payable in shares of Common Stock, (ii) subdivides its outstanding shares of Common Stock into a larger

number of shares of Common Stock, (iii) combines its outstanding shares of Common Stock into a smaller number of shares of Common

Stock or (iv) issues by reclassification of shares of capital stock any additional shares of Common Stock of the Company, then in

each such case the Exercise Price shall be multiplied by a fraction, the numerator of which shall be the number of shares of Common Stock

outstanding immediately before such event and the denominator of which shall be the number of shares of Common Stock outstanding immediately

after such event. Any adjustment made pursuant to clause (i) of this paragraph shall become effective immediately after the record

date for the determination of stockholders entitled to receive such dividend or distribution, provided, however, that if

such record date shall have been fixed and such dividend is not fully paid on the date fixed therefor, the Exercise Price shall be recomputed

accordingly as of the close of business on such record date and thereafter the Exercise Price shall be adjusted pursuant to this paragraph

as of the time of actual payment of such dividends. Any adjustment pursuant to clause (ii) or (iii) of this paragraph shall

become effective immediately after the effective date of such subdivision or combination.

(b) Pro Rata Distributions. If the

Company, at any time while this Warrant is outstanding, distributes to all holders of Common Stock for no consideration (i) evidences

of its indebtedness, (ii) any security (other than a distribution of Common Stock covered by the preceding paragraph) (iii) rights

or warrants to subscribe for or purchase any security, or (iv) cash or any other asset (in each case, a “Distribution”),

other than a reclassification as to which Section 9(c) applies, then in each such case, the Holder shall be entitled

to participate in such Distribution to the same extent that the Holder would have participated therein if the Holder had held the number

of shares of Common Stock acquirable upon complete exercise of this Warrant (without regard to any limitations on exercise hereof, including

without limitation, the ownership limitation set forth in Section 11(a) hereof) immediately before the date of which

a record is taken for such Distribution, or, if no such record is taken, the date as of which the record holders of Common Stock are to

be determined for the participation in such Distribution provided, however, to the extent that the Holder’s right

to participate in any such Distribution would result in the Holder exceeding the ownership limitation set forth in Section 11(a) hereof,

then the Holder shall not be entitled to participate in such Distribution to such extent (or in the beneficial ownership of any Common

Stock as a result of such Distribution to such extent) and the portion of such Distribution shall be held in abeyance for the benefit

of the Holder until the earlier of (i) such time, if ever, as the delivery to such Holder of such portion would not result in the

Holder exceeding the ownership limitation set forth in Section 11(a) hereof and (ii) such time as the Holder has

exercised this Warrant.

(c) Fundamental Transactions. If,

at any time while this Warrant is outstanding (i) the Company effects any merger or consolidation of the Company with or into another

Person, in which the Company is not the surviving entity and in which the stockholders of the Company immediately prior to such merger

or consolidation do not own, directly or indirectly, at least 50% of the voting power of the surviving entity immediately after such merger

or consolidation, (ii) the Company effects any sale to another Person of all or substantially all of its assets in one transaction

or a series of related transactions, (iii) pursuant to any tender offer or exchange offer (whether by the Company or another Person),

holders of capital stock tender shares representing more than 50% of the voting power of the capital stock of the Company and the Company

or such other Person, as applicable, accepts such tender for payment, (iv) the Company consummates a stock purchase agreement or

other business combination (including, without limitation, a reorganization, recapitalization, spin-off or scheme of arrangement) with

another Person whereby such other Person acquires more than the 50% of the voting power of the capital stock of the Company (except for

any such transaction in which the stockholders of the Company immediately prior to such transaction maintain, in substantially the same

proportions, the voting power of such Person immediately after the transaction) or (v) the Company effects any reclassification of

the Common Stock or any compulsory share exchange pursuant to which the Common Stock is effectively converted into or exchanged for other

securities, cash or property (other than as a result of a subdivision or combination of shares of Common Stock covered by Section 9(a) above)

(in any such case, a “Fundamental Transaction”), then following such Fundamental Transaction the Holder shall have

the right to receive, upon exercise of this Warrant, the same amount and kind of securities, cash or property as it would have been entitled

to receive upon the occurrence of such Fundamental Transaction if it had been, immediately prior to such Fundamental Transaction, the

holder of the number of Warrant Shares then issuable upon exercise in full of this Warrant without regard to any limitations on exercise

contained herein (the “Alternate Consideration”). The Company shall not effect any Fundamental Transaction in which

the Company is not the surviving entity or the Alternate Consideration includes securities of another Person unless (i) the Alternate

Consideration is solely cash and the Company provides for the simultaneous “cashless exercise” of this Warrant pursuant to

Section 10 below or (ii) prior to or simultaneously with the consummation thereof, any successor to the Company, surviving

entity or other Person (including any purchaser of assets of the Company) shall assume the obligation to deliver to the Holder such Alternate

Consideration as, in accordance with the foregoing provisions, the Holder may be entitled to receive, and the other obligations under

this Warrant. The provisions of this paragraph (c) shall similarly apply to subsequent transactions analogous of a Fundamental Transaction

type.

(d) Number of Warrant Shares. Simultaneously

with any adjustment to the Exercise Price pursuant to Section 9 (including any adjustment to the Exercise Price that would

have been effected but for the final sentence in this paragraph (d)), the number of Warrant Shares that may be purchased upon exercise

of this Warrant shall be increased or decreased proportionately, so that after such adjustment the aggregate Exercise Price payable hereunder

for the increased or decreased number of Warrant Shares shall be the same as the aggregate Exercise Price in effect immediately prior

to such adjustment. Notwithstanding the foregoing, in no event may the Exercise Price be adjusted below the par value of the Common Stock

then in effect.

(e) Calculations. All calculations

under this Section 9 shall be made to the nearest one-hundredth of one cent or the nearest share, as applicable.

(f) Notice of Adjustments. Upon the

occurrence of each adjustment pursuant to this Section 9, the Company at its expense will, at the written request of the Holder,

promptly compute such adjustment, in good faith, in accordance with the terms of this Warrant and prepare a certificate setting forth

such adjustment, including a statement of the adjusted Exercise Price and adjusted number or type of Warrant Shares or other securities

issuable upon exercise of this Warrant (as applicable), describing the transactions giving rise to such adjustments and showing in detail

the facts upon which such adjustment is based. Upon written request, the Company will promptly deliver a copy of each such certificate

to the Holder and to the Transfer Agent.

(g) Notice of Corporate Events. If,

while this Warrant is outstanding, the Company (i) declares a dividend or any other distribution of cash, securities or other property

in respect of its Common Stock, including, without limitation, any granting of rights or warrants to subscribe for or purchase any capital

stock of the Company or any subsidiary, (ii) authorizes or approves, enters into any agreement contemplating or solicits stockholder

approval for any Fundamental Transaction or (iii) authorizes the voluntary dissolution, liquidation or winding up of the affairs

of the Company, then, except if such notice and the contents thereof shall be deemed to constitute material non-public information, the

Company shall deliver to the Holder a notice of such transaction at least ten (10) days prior to the applicable record or effective

date on which a Person would need to hold Common Stock in order to participate in or vote with respect to such transaction; provided,

however, that the failure to deliver such notice or any defect therein shall not affect the validity of the corporate action required

to be described in such notice. In addition, if while this Warrant is outstanding, the Company authorizes or approves, enters into any

agreement contemplating or solicits stockholder approval for any Fundamental Transaction contemplated by Section 9(c), other

than a Fundamental Transaction under clause (iii) of Section 9(c), then, except if such notice and the contents thereof

shall be deemed to constitute material non-public information, the Company shall deliver to the Holder a notice of such Fundamental Transaction

at least ten (10) days prior to the date such Fundamental Transaction is consummated.

10. Payment of Cashless Exercise Price. Notwithstanding anything

contained herein to the contrary, the Holder may, in its sole discretion, satisfy its obligation to pay the Exercise Price through a “cashless

exercise,” in which event the Company shall issue to the Holder the number of Warrant Shares in an exchange of securities effected

pursuant to Section 3(a)(9) of the Securities Act as determined as follows:

X = Y [(A-B)/A]

where:

“X” equals the number of Warrant Shares

to be issued to the Holder;

“Y” equals the total number of Warrant

Shares with respect to which this Warrant is then being exercised;

“A” equals the Closing Sale Price

per share of Common Stock as of the Trading Day on the date immediately preceding the Exercise Date; and

“B” equals the Exercise Price per

Warrant Share then in effect on the Exercise Date.

For purposes of Rule 144 promulgated under the Securities Act,

it is intended, understood and acknowledged that the Warrant Shares issued in such a “cashless exercise” transaction shall

be deemed to have been acquired by the Holder, and the holding period for the Warrant Shares shall be deemed to have commenced, on the

Original Issue Date (provided that the Commission continues to take the position that such treatment is proper at the time of such exercise).

In the event that the Registration Statement or another registration statement registering the issuance of Warrant Shares is, for any

reason, not effective at the time of exercise of this Warrant, then this Warrant may only be exercised through a cashless exercise, as

set forth in this Section 10.

In no event will the exercise of this Warrant be settled in cash.

11. Limitations on Exercise.

(a) Notwithstanding anything to the contrary

contained herein, the Company shall not effect any exercise of this Warrant, and the Holder shall not be entitled to exercise this Warrant

for a number of Warrant Shares in excess of that number of Warrant Shares which, upon giving effect or immediately prior to such exercise,

would cause (i) the aggregate number of shares of Common Stock beneficially owned by the Holder, its Affiliates and any other Persons

whose beneficial ownership of Common Stock would be aggregated with the Holder’s for purposes of Section 13(d) of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), to exceed 4.99% (the “Maximum Percentage”)

of the total number of issued and outstanding shares of Common Stock of the Company following such exercise, or (ii) the combined

voting power of the securities of the Company beneficially owned by the Holder and its Affiliates and any other Persons whose beneficial

ownership of Common Stock would be aggregated with the Holder’s for purposes of Section 13(d) of the Exchange Act to exceed

4.99% of the combined voting power of all of the securities of the Company then outstanding following such exercise. For purposes of this

Warrant, in determining the number of outstanding shares of Common Stock, the Holder may rely on the number of outstanding shares of Common

Stock as reflected in (x) the Company’s most recent Form 10-Q or Form 10-K, as the case may be, filed with the Commission

prior to the Exercise Date, (y) a more recent public announcement by the Company or (z) any other notice by the Company or the

Transfer Agent setting forth the number of shares of Common Stock outstanding. Upon the written request of the Holder, the Company shall

within three (3) Trading Days confirm in writing or by electronic mail to the Holder the number of shares of Common Stock then outstanding.

In any case, the number of outstanding shares of Common Stock shall be determined after giving effect to the conversion or exercise of

securities of the Company, including this Warrant, by the Holder since the date as of which such number of outstanding shares of Common

Stock was reported. By written notice to the Company, the Holder may from time to time increase or decrease the Maximum Percentage to

any other percentage not in excess of 19.99% specified in such notice; provided that any such increase or decrease will not be effective

until the sixty-first (61st) day after such notice is delivered to the Company. For purposes of this Section 11(a), the aggregate

number of shares of Common Stock or voting securities beneficially owned by the Holder and its Affiliates and any other Persons whose

beneficial ownership of Common Stock would be aggregated with the Holder’s for purposes of Section 13(d) of the Exchange

Act shall include the shares of Common Stock issuable upon the exercise of this Warrant with respect to which such determination is being

made, but shall exclude the number of shares of Common Stock which would be issuable upon (x) exercise of the remaining unexercised

and non-cancelled portion of this Warrant by the Holder and (y) exercise or conversion of the unexercised, non-converted or non-cancelled

portion of any other securities of the Company that do not have voting power (including without limitation any securities of the Company

which would entitle the holder thereof to acquire at any time Common Stock, including without limitation any debt, preferred stock, right,

option, warrant or other instrument that is at any time convertible into or exercisable or exchangeable for, or otherwise entitles the

holder thereof to receive, Common Stock), is subject to a limitation on conversion or exercise analogous to the limitation contained herein

and is beneficially owned by the Holder or any of its Affiliates and other Persons whose beneficial ownership of Common Stock would be

aggregated with the Holder’s for purposes of Section 13(d) of the Exchange Act.

(b) This Section 11 shall not

restrict the number of shares of Common Stock which a Holder may receive or beneficially own in order to determine the amount of securities

or other consideration that such Holder may receive in the event of a Fundamental Transaction as contemplated in Section 9(c) of

this Warrant.

12. No Fractional Shares. No fractional Warrant Shares will

be issued in connection with any exercise of this Warrant. In lieu of any fractional shares that would otherwise be issuable, the number

of Warrant Shares to be issued shall be rounded down to the next whole number and the Company shall pay the Holder in cash the fair market

value (based on the Closing Sale Price) for any such fractional shares.

13. Notices. Any and all notices or other communications or

deliveries hereunder (including, without limitation, any Exercise Notice) shall be in writing and shall be deemed given and effective

on the earliest of (i) the date of transmission, if such notice or communication is delivered via facsimile or confirmed e-mail prior

to 5:30 P.M., New York City time, on a Trading Day, (ii) the next Trading Day after the date of transmission, if such notice or communication

is delivered via facsimile or confirmed e-mail on a day that is not a Trading Day or later than 5:30 P.M., New York City time, on any

Trading Day, (iii) the Trading Day following the date of mailing, if sent by nationally recognized overnight courier service specifying

next business day delivery, or (iv) upon actual receipt by the Person to whom such notice is required to be given, if by hand delivery.

The addresses, facsimile numbers and e-mail addresses for such communications shall be:

If to the Company:

Replimune Group, Inc.

Attention: Shawn Glidden

500 Unicorn Park, Suite 103

Woburn, MA 01801

Telephone: (781) 222-9600

Fax: (781) 926-0870

Email: shawn.glidden@replimune.com

If to the Holder, to its address, facsimile number or e-mail

address set forth herein or on the books and records of the Company.

Or, in each of the above instances, to such other address, facsimile

number or e-mail address as the recipient party has specified by written notice given to each other party at least five (5) days

prior to the effectiveness of such change.

14. Warrant Agent. The Company shall initially serve as warrant

agent under this Warrant. Upon ten (10) days’ notice to the Holder, the Company may appoint a new warrant agent. Any corporation

into which the Company or any new warrant agent may be merged or any corporation resulting from any consolidation to which the Company

or any new warrant agent shall be a party or any corporation to which the Company or any new warrant agent transfers substantially all

of its corporate trust or shareholders services business shall be a successor warrant agent under this Warrant without any further act.

Any such successor warrant agent shall promptly cause notice of its succession as warrant agent to be mailed (by first class mail, postage

prepaid) to the Holder at the Holder’s last address as shown on the Warrant Register.

15. Miscellaneous.

(a) No Rights as a Stockholder. The

Holder, solely in such Person’s capacity as a holder of this Warrant, shall not be entitled to vote or receive dividends or be deemed

the holder of share capital of the Company for any purpose, nor shall anything contained in this Warrant be construed to confer upon the

Holder, solely in such Person’s capacity as the Holder of this Warrant, any of the rights of a stockholder of the Company or any

right to vote, give or withhold consent to any corporate action (whether any reorganization, issue of stock, reclassification of stock,

consolidation, merger, amalgamation, conveyance or otherwise), receive notice of meetings, receive dividends or subscription rights, or

otherwise, prior to the issuance to the Holder of the Warrant Shares which such Person is then entitled to receive upon the due exercise

of this Warrant. In addition, nothing contained in this Warrant shall be construed as imposing any liabilities on the Holder to purchase

any securities (upon exercise of this Warrant or otherwise) or as a stockholder of the Company, whether such liabilities are asserted

by the Company or by creditors of the Company.

(b) Authorized Shares. Except and

to the extent as waived or consented to by the Holder, the Company shall not by any action, including, without limitation, amending its

certificate or articles of incorporation or through any reorganization, transfer of assets, consolidation, merger, dissolution, issue

or sale of securities or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms of this

Warrant, but will at all times in good faith assist in the carrying out of all such terms and in the taking of all such actions as may

be necessary or appropriate to protect the rights of Holder as set forth in this Warrant against impairment. Without limiting the generality

of the foregoing, the Company will (a) not increase the par value of any Warrant Shares above the amount payable therefor upon such

exercise immediately prior to such increase in par value, (b) take all such action as may be necessary or appropriate in order that

the Company may validly and legally issue fully paid and non-assessable Warrant Shares upon the exercise of this Warrant, and (c) use

commercially reasonable efforts to obtain all such authorizations, exemptions or consents from any public regulatory body having jurisdiction

thereof as may be necessary to enable the Company to perform its obligations under this Warrant.

(c) Successors and Assigns. Subject

to compliance with applicable securities laws, this Warrant may be assigned by the Holder. This Warrant may not be assigned by the Company

without the written consent of the Holder, except to a successor in the event of a Fundamental Transaction. This Warrant shall be binding

on and inure to the benefit of the Company and the Holder and their respective successors and assigns. Subject to the preceding sentence,

nothing in this Warrant shall be construed to give to any Person other than the Company and the Holder any legal or equitable right, remedy

or cause of action under this Warrant. This Warrant may be amended only in writing signed by the Company and the Holder, or their successors

and assigns.

(d) Amendment and Waiver. Except as

otherwise provided herein, the provisions of the Warrants may be amended and the Company may take any action herein prohibited, or omit

to perform any act herein required to be performed by it, only if the Company has obtained the written consent of the Holder.

(e) Acceptance. Receipt of this Warrant

by the Holder shall constitute acceptance of and agreement to all of the terms and conditions contained herein.

(f) Governing Law; Jurisdiction. ALL

QUESTIONS CONCERNING THE CONSTRUCTION, VALIDITY, ENFORCEMENT AND INTERPRETATION OF THIS WARRANT SHALL BE GOVERNED BY AND CONSTRUED AND

ENFORCED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK WITHOUT REGARD TO THE PRINCIPLES OF CONFLICTS OF LAW THEREOF. EACH OF THE

COMPANY AND THE HOLDER HEREBY IRREVOCABLY SUBMITS TO THE EXCLUSIVE JURISDICTION OF THE STATE AND FEDERAL COURTS SITTING IN THE CITY OF

NEW YORK, BOROUGH OF MANHATTAN, FOR THE ADJUDICATION OF ANY DISPUTE HEREUNDER OR IN CONNECTION HEREWITH OR WITH ANY TRANSACTION CONTEMPLATED

HEREBY OR DISCUSSED HEREIN (INCLUDING WITH RESPECT TO THE ENFORCEMENT OF THE WARRANT OR ANY OF THE DOCUMENTS DELIVERED HEREUNDER), AND

HEREBY IRREVOCABLY WAIVES, AND AGREES NOT TO ASSERT IN ANY SUIT, ACTION OR PROCEEDING, ANY CLAIM THAT IT IS NOT PERSONALLY SUBJECT TO

THE JURISDICTION OF ANY SUCH COURT. EACH OF THE COMPANY AND THE HOLDER HEREBY IRREVOCABLY WAIVES PERSONAL SERVICE OF PROCESS AND CONSENTS

TO PROCESS BEING SERVED IN ANY SUCH SUIT, ACTION OR PROCEEDING BY MAILING A COPY THEREOF VIA REGISTERED OR CERTIFIED MAIL OR OVERNIGHT

DELIVERY (WITH EVIDENCE OF DELIVERY) TO SUCH PERSON AT THE ADDRESS IN EFFECT FOR NOTICES TO IT AND AGREES THAT SUCH SERVICE SHALL CONSTITUTE

GOOD AND SUFFICIENT SERVICE OF PROCESS AND NOTICE THEREOF. NOTHING CONTAINED HEREIN SHALL BE DEEMED TO LIMIT IN ANY WAY ANY RIGHT TO SERVE

PROCESS IN ANY MANNER PERMITTED BY LAW. EACH OF THE COMPANY AND THE HOLDER HEREBY WAIVES ALL RIGHTS TO A TRIAL BY JURY.

(g) Headings. The headings herein

are for convenience only, do not constitute a part of this Warrant and shall not be deemed to limit or affect any of the provisions hereof.

(h) Severability. In case any one

or more of the provisions of this Warrant shall be invalid or unenforceable in any respect, the validity and enforceability of the remaining

terms and provisions of this Warrant shall not in any way be affected or impaired thereby, and the Company and the Holder will attempt

in good faith to agree upon a valid and enforceable provision which shall be a commercially reasonable substitute therefor, and upon so

agreeing, shall incorporate such substitute provision in this Warrant.

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

IN WITNESS WHEREOF, the Company has caused this

Warrant to be duly executed by its authorized officer as of the date first indicated above.

| |

REPLIMUNE GROUP, INC. |

| |

|

| |

By: |

|

| |

|

Name: [●] |

| |

|

Title: [●] |

[Signature

Page to Warrant]

SCHEDULE 1

FORM OF EXERCISE NOTICE

[To be executed by the Holder to purchase Warrant

Shares under the Warrant]

Ladies and Gentlemen:

(1) The undersigned is the Holder of Warrant No.

(the “Warrant”) issued by Replimune Group, Inc., a Delaware corporation (the “Company”). Capitalized terms

used herein and not otherwise defined herein have the respective meanings set forth in the Warrant.

(2) The undersigned hereby exercises its right to purchase Warrant

Shares pursuant to the Warrant.

(3) The Holder intends that payment of the Exercise Price shall

be made as (check one):

| |

¨ |

“Cashless Exercise” under Section 10 of the Warrant |

(4) If the Holder has elected a Cash Exercise, the Holder shall

pay the sum of $ __________ in immediately available funds to the Company in accordance with the terms of the Warrant.

(5) Pursuant to this Exercise Notice, the Company shall deliver

to the Holder Warrant Shares determined in accordance with the terms of the Warrant. The Warrant Shares shall be delivered to the following

DWAC Account Number:

(6) By its delivery of this Exercise Notice, the undersigned represents

and warrants to the Company that in giving effect to the exercise evidenced hereby the Holder, its Affiliates and any other Person whose

beneficial ownership of Common Stock would be aggregated with the Holder’s for purposes of Section 13(d) of the Exchange

Act will not beneficially own in excess of the number of shares of Common Stock (as determined in accordance with Section 13(d) of

the Securities Exchange Act of 1934, as amended) permitted to be owned under Section 11(a) of the Warrant to which this notice

relates.

| Dated: |

|

|

| |

|

|

| Name of Holder: |

|

|

| |

|

|

| By: |

|

|

| |

|

|

| Name: |

|

|

| |

|

|

| Title: |

|

|

(Signature must conform in all respects to name

of Holder as specified on the face of the Warrant)

v3.24.3

Cover

|

Nov. 25, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 25, 2024

|

| Entity File Number |

001-38596

|

| Entity Registrant Name |

REPLIMUNE GROUP, INC.

|

| Entity Central Index Key |

0001737953

|

| Entity Tax Identification Number |

82-2082553

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

500

Unicorn Park Drive

|

| Entity Address, Address Line Two |

Suite 303

|

| Entity Address, City or Town |

Woburn

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

01801

|

| City Area Code |

781

|

| Local Phone Number |

222-9600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

REPL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

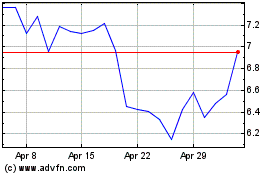

Replimune (NASDAQ:REPL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Replimune (NASDAQ:REPL)

Historical Stock Chart

From Jan 2024 to Jan 2025