Replimune Announces Pricing of Upsized Public Offering

November 25 2024 - 11:55PM

Replimune Group, Inc. (Nasdaq: REPL), a clinical stage

biotechnology company pioneering the development of novel oncolytic

immunotherapies, today announced the pricing of its public offering

of 6,923,000 shares of its common stock at a public offering price

of $13.00 per share. In addition, in lieu of common stock to

certain investors, Replimune today announced the pricing of its

public offering of pre-funded warrants to purchase 3,846,184 shares

of its common stock at a purchase price of $12.9999 per pre-funded

warrant, which equals the public offering price per share of the

common stock less the $0.0001 per share exercise price of each

pre-funded warrant. The aggregate gross proceeds from the offering

are expected to be approximately $140 million, before deducting the

underwriting discounts and commissions and offering expenses

payable by Replimune. All securities in the offering are being

offered by Replimune. In addition, Replimune has granted the

underwriter a 30-day option to purchase up to an additional

1,615,377 shares of its common stock from Replimune at the public

offering price, less the underwriting discounts and commissions.

The offering is expected to close on November 27, 2024, subject to

the satisfaction of customary closing conditions.

Leerink Partners is acting as sole bookrunning

manager for the offering.

A preliminary prospectus supplement relating to

and describing the terms of the offering was filed with the

Securities and Exchange Commission (the “SEC”) on November 25,

2024. The final prospectus supplement relating to the offering will

be filed with the SEC. Copies of the final prospectus supplement

and the accompanying prospectus relating to the offering may be

obtained, when available, by visiting EDGAR on the SEC website at

www.sec.gov. Alternatively, copies of the preliminary prospectus

supplement and the accompanying prospectus, when available, may be

obtained from Leerink Partners LLC, Attention: Syndicate

Department, 53 State Street, 40th Floor, Boston, Massachusetts

02109, by telephone at + 1 (800) 808-7525, ext. 6105, or by email

at syndicate@leerink.com. The final terms of the offering will be

disclosed in a final prospectus supplement to be filed with the

SEC.

The securities described above are being offered

by Replimune pursuant to its shelf registration statement

on Form S-3, including a base prospectus, that was previously filed

by Replimune with the SEC on August 3,

2023, as amended by the Post-Effective Amendment No. 1 filed with

the SEC on May 16, 2024, and as further amended by the

Post-Effective Amendment No. 2 filed with the SEC on May 16,

2024, and declared effective by the SEC on July

22, 2024. This press release shall not constitute an offer to sell

or the solicitation of an offer to buy, nor shall there be any sale

of securities, in any state or jurisdiction in which such an offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Replimune

Replimune Group, Inc., headquartered

in Woburn, MA, was founded in 2015 with the mission to

transform cancer treatment by pioneering the development of novel

oncolytic immunotherapies. Replimune’s proprietary RPx platform is

based on a potent HSV-1 backbone intended to maximize immunogenic

cell death and the induction of a systemic anti-tumor immune

response. The RPx platform is designed to have unique dual local

and systemic activity consisting of direct selective virus-mediated

killing of the tumor resulting in the release of tumor derived

antigens and altering of the tumor microenvironment to ignite a

strong and durable systemic response. The RPx product candidates

are expected to be synergistic with most established and

experimental cancer treatment modalities, leading to the

versatility to be developed alone or combined with a variety of

other treatment options.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, including statements regarding the timing of

closing of our public offering, the gross proceeds we expect to

receive from our public offering and other statements identified by

words such as “could,” “expects,” “intends,” “may,” “plans,”

“potential,” “should,” “will,” “would,” or similar expressions and

the negatives of those terms. Forward-looking statements are not

promises or guarantees of future performance, and are subject to a

variety of risks and uncertainties, many of which are beyond our

control, and which could cause actual results to differ materially

from those contemplated in such forward-looking statements. These

factors include risks related to our limited operating history, our

ability to generate positive clinical trial results for our product

candidates, the costs and timing of operating our in-house

manufacturing facility, the timing and scope of regulatory

approvals, the availability of combination therapies needed to

conduct our clinical trials, changes in laws and regulations to

which we are subject, competitive pressures, our ability to

identify additional product candidates, political and global macro

factors including the impact of the coronavirus as a global

pandemic and related public health issues and the Russian-Ukrainian

and Israel-Hamas political and military conflicts, and other risks

as may be detailed from time to time in our Annual Reports on Form

10-K and Quarterly Reports on Form 10-Q and other reports we file

with the SEC, and in the preliminary prospectus supplement and

the accompanying prospectus, once filed with the SEC. Our actual

results could differ materially from the results described in or

implied by such forward-looking statements. Forward-looking

statements speak only as of the date hereof, and, except as

required by law, we undertake no obligation to update or revise

these forward-looking statements.

Investor InquiriesChris

BrinzeyICR Westwicke339.970.2843chris.brinzey@westwicke.com

Media InquiriesArleen

GoldenbergReplimune917.548.1582media@replimune.com

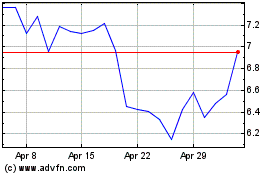

Replimune (NASDAQ:REPL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Replimune (NASDAQ:REPL)

Historical Stock Chart

From Jan 2024 to Jan 2025