false

0001687187

0001687187

2023-12-06

2023-12-06

0001687187

us-gaap:CommonClassAMember

2023-12-06

2023-12-06

0001687187

METC:NinePercentageSeniorNotesDue2026Member

2023-12-06

2023-12-06

0001687187

us-gaap:CommonClassBMember

2023-12-06

2023-12-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): December 6, 2023

Ramaco Resources, Inc.

(Exact name of Registrant

as specified in its Charter)

| Delaware |

001-38003 |

38-4018838 |

(State

or other jurisdiction of

incorporation)

|

(Commission

File Number) |

(IRS

Employer Identification No.) |

250 West Main Street, Suite 1900

Lexington, Kentucky 40507

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (859)

244-7455

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Class

A common stock, $0.01 par value |

METC |

NASDAQ Global Select Market |

| 9.00% Senior Notes due 2026 |

METCL |

NASDAQ Global Select Market |

| Class B common stock, $0.01 par value |

METCB |

NASDAQ Global Select Market |

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. Regulation FD Disclosure

On December 6, 2023,

Ramaco Resources, Inc. (the “Company) issued a press release announcing an increase in its quarterly cash dividend on the Company’s

Class A common stock. The Company’s board of directors approved and declared a 10% increase in the Company’s quarterly

cash dividend to $0.1375 per share of Class A common. The dividend is payable on March 15, 2024 to shareholders of record as

of March 1, 2024. A copy of this press release is attached hereto as Exhibit 99.1 to this Current Report on Form 8-K and

is incorporated herein by reference.

None of the information

furnished in this Item 7.01 will be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934,

as amended, or otherwise subject to the liability of that section, nor will it be incorporated into any filing by the Company under the

Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

Signatures

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Ramaco Resources, Inc. |

| |

|

| |

By: |

/s/ Randall W. Atkins |

| |

|

Name: Randall W. Atkins |

| |

|

Title: Chairman and Chief Executive Officer |

Date: December 6, 2023

Exhibit 99.1

Ramaco Resources, Inc.

Announces Increase to its First-Quarter 2024 Class A Dividend, Initial 2024 Guidance, and Rare Earth Element Update

LEXINGTON, Ky., December 6, 2023

/PRNewswire/ – Ramaco Resources, Inc. (NASDAQ: METC, METCB, "Ramaco" or the "Company"), a leading operator

and developer of high-quality, low-cost metallurgical coal, today provided an update on several operational and financial matters.

RAMACO ANNOUNCES INCREASE TO ITS

CLASS A DIVIDEND

| ● | In-line

with the Company’s historic dividend policy, Ramaco's Board of Directors has approved

an increase in the Class A dividend by 10%. This is the third such increase since the

original dividend was declared in 2022. |

| ● | The

Board also approved and declared the quarterly Class A common stock cash dividend of $0.1375 per

share for the first quarter of 2024. The first quarter dividend is payable on March 15,

2024, to shareholders of record on March 1, 2024. |

| ● | The

Board will announce the amount and timing of the Class B common stock dividend after

completion of the Company’s year-end financials in February 2024. |

RAMACO ANNOUNCES INITIAL 2024 GUIDANCE

| ● | The

Company is issuing initial guidance for the 2024 calendar year. For production volumes, the

Company expects between 3.9 – 4.4 million tons, with and ability to vary the range

of the production levels largely dependent on market demand and outlook. |

| ● | As

of November 30, 2023, the Company has sales commitments of over 2 million tons for delivery

in 2024. This consists of had 1.3 million tons committed to North American customers at an

average realized price of $167 per ton. The Company additionally has 0.7 million tons committed

at index-linked pricing for delivery to export customers. |

| ● | The

Company anticipates that 2024 sales will ultimately exceed production by at least 0.2 million

tons, as it continues to monetize its current elevated inventory levels. Should additional

purchase coal opportunities emerge, 2024 sales may exceed production by additional greater

amounts. |

| ● | Ramaco

anticipates its 2024 cash cost of sales will be in the range of $105 - $111 per ton, as increased

production levels are partially offset by continued inflationary cost pressure. |

| ● | The

Company anticipates capital expenditures in 2024 of between $45 - $55 million, at the midpoint

of production guidance. Even at the high end of production guidance, the Company anticipates

2024 capital expenditures to remain well below 2023 figures, as the production range is driven

more by demand factors as opposed to capex spend. |

| ● | The

range for the Company’s 2024 selling, general and administrative costs is between $38

- $42 million, excluding non-cash stock compensation. The Company expects interest expense

of less than $5 million, and an effective tax rate of 20 – 25%. |

| ● | Lastly,

the Company anticipates depreciation, depletion, and amortization of $57 - $63 million. |

RAMACO ANNOUNCES RARE EARTH ELEMENT

UPDATE

| ● | The

Company anticipates that Weir International, the mining consultancy that authored the original

May 2023 Exploration Technical Summary Report, will provide an updated year-end report

which will be available early next year. |

| ● | The

Company continues with further drilling and independent chemical testing following development

mining which commenced in October. It will continue to release regular disclosure of ongoing

results. |

About Ramaco Resources, Inc.

Ramaco Resources, Inc. is an operator

and developer of high-quality, low-cost metallurgical coal in southern West Virginia, southwestern Virginia and southwestern Pennsylvania.

Its executive offices are in Lexington, Kentucky, with operational offices in Charleston, West Virginia and Sheridan, Wyoming. The Company

currently has three active metallurgical coal mining complexes in Central Appalachia and one development rare earth and coal mine near

Sheridan, Wyoming in the initial stages of production. In May 2023, the Company announced that a major rare earth deposit of primary

magnetic rare earths was discovered at its mine near Sheridan, Wyoming. Contiguous to the Wyoming mine, the Company operates a carbon

research and pilot facility related to the production of advanced carbon products and materials from coal. In connection with these activities,

it holds a body of roughly 50 intellectual property patents, pending applications, exclusive licensing agreements and various trademarks.

News and additional information about Ramaco Resources, including filings with the Securities and Exchange Commission, are available

at http://www.ramacoresources.com. For more information, contact investor relations at (859) 244-7455.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

Certain statements contained in this

news release constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements represent Ramaco Resources’ expectations or beliefs concerning guidance, future events,

anticipated revenue, future demand and production levels, macroeconomic trends, the development of ongoing projects, costs and expectations

regarding operating results, and it is possible that the results described in this news release will not be achieved. These forward-looking

statements are subject to risks, uncertainties and other factors, many of which are outside of Ramaco Resources’ control, which

could cause actual results to differ materially from the results discussed in the forward-looking statements. These factors include,

without limitation, risks related to the impact of the COVID-19 global pandemic, unexpected delays in our current mine development activities,

the ability to successfully ramp up production at the Berwind and Knox Creek complexes, the timing of the Elk Creek preparation plant

to come online, failure of our sales commitment counterparties to perform, increased government regulation of coal in the United States

or internationally, the further decline of demand for coal in export markets and underperformance of the railroads, the expected benefits

of the Ramaco Coal and Maben acquisitions to the Company’s shareholders, the anticipated benefits and impacts of the Ramaco Coal

and Maben acquisitions, and the Company's ability to successfully develop the Brook Mine, including whether the increase in the Company's

exploration target and estimates for such mine are realized. Any forward-looking statement speaks only as of the date on which it is

made, and, except as required by law, Ramaco Resources does not undertake any obligation to update or revise any forward-looking statement,

whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for

Ramaco Resources to predict all such factors. When considering these forward-looking statements, you should keep in mind the risk factors

and other cautionary statements found in Ramaco Resources’ filings with the Securities and Exchange Commission (“SEC”),

including its Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. The risk factors and other factors noted in Ramaco

Resources’ SEC filings could cause its actual results to differ materially from those contained in any forward-looking statement.

Point

of Contact:

INVESTOR

RELATIONS: info@ramacometc.com or 859-244-7455

MEDIA: press@ramacometc.com

SOURCE Ramaco Resources, Inc.

Reconciliation of Non-GAAP Measures

Non-GAAP cash cost per ton sold is calculated

as cash cost of coal sales less transportation costs and idle mine costs, divided by tons sold. We believe cash cost per ton provides

useful information to investors as these enable investors to compare cash cost per ton for the Company against similar measures made

by other publicly-traded coal companies and more effectively monitor changes in costs from period to period excluding the impact of transportation

costs, which are beyond our control. The adjustments made to arrive at these measures are significant in understanding and assessing

the Company’s financial performance. Cash cost per ton are not measures of financial performance in accordance with GAAP and therefore

should not be considered as a substitute to cost of sales under GAAP. The table below show how we calculate non-GAAP cash cost per ton:

Non-GAAP cash cost per ton

| | |

Nine months ended September 30, 2023 | |

| | |

Company | | |

Purchased | | |

| |

| 5(In thousands, except per ton amounts) | |

Produced | | |

Coal | | |

Total | |

| Cost of sales | |

$ | 338,629 | | |

$ | 15,754 | | |

$ | 354,383 | |

| Less: Adjustments to reconcile to Non-GAAP cash cost of sales | |

| | | |

| | | |

| | |

| Transportation costs | |

| (72,894 | ) | |

| (1,573 | ) | |

| (74,467 | ) |

| Idle mine costs | |

| (2,937 | ) | |

| — | | |

| (2,937 | ) |

| Non-GAAP cash cost of sales | |

$ | 262,798 | | |

$ | 14,181 | | |

$ | 276,979 | |

| Tons sold | |

| 2,372 | | |

| 96 | | |

| 2,467 | |

| Cash cost per ton sold | |

$ | 111 | | |

$ | 148 | | |

$ | 112 | |

v3.23.3

Cover

|

Dec. 06, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 06, 2023

|

| Entity File Number |

001-38003

|

| Entity Registrant Name |

Ramaco Resources, Inc.

|

| Entity Central Index Key |

0001687187

|

| Entity Tax Identification Number |

38-4018838

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

250 West Main Street

|

| Entity Address, Address Line Two |

Suite 1900

|

| Entity Address, City or Town |

Lexington

|

| Entity Address, State or Province |

KY

|

| Entity Address, Postal Zip Code |

40507

|

| City Area Code |

859

|

| Local Phone Number |

244-7455

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Class A [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class

A common stock, $0.01 par value

|

| Trading Symbol |

METC

|

| Security Exchange Name |

NASDAQ

|

| 9.00% Senior Notes due 2026 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

9.00% Senior Notes due 2026

|

| Trading Symbol |

METCL

|

| Security Exchange Name |

NASDAQ

|

| Common Class B [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class B common stock, $0.01 par value

|

| Trading Symbol |

METCB

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=METC_NinePercentageSeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassBMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

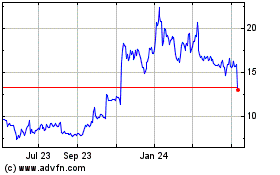

Ramaco Resources (NASDAQ:METC)

Historical Stock Chart

From Dec 2024 to Jan 2025

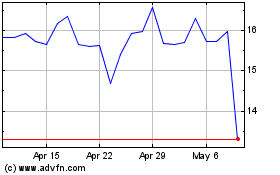

Ramaco Resources (NASDAQ:METC)

Historical Stock Chart

From Jan 2024 to Jan 2025