Pure Cycle Corporation Announces First Fiscal Quarter 2014 Financial Results

January 10 2014 - 4:35PM

Marketwired

Pure Cycle Corporation Announces First Fiscal Quarter 2014

Financial Results

DENVER, CO--(Marketwired - Jan 10, 2014) - Pure Cycle

Corporation (NASDAQ: PCYO) today reported financial results for the

three months ended November 30, 2013. Basic and diluted loss per

share decreased 36% from a loss of $.06 per share last year to $.04

per share this year.

"In our first quarter we continued delivering record revenue and

are continuing momentum for our Company," commented Mark Harding,

President of Pure Cycle Corporation. "This was an exciting quarter

for Pure Cycle, both operationally and financially, and we are well

positioned to continue our strong performance and drive long-term

shareholder value."

The following table summarizes results of operations for the

three months ended November 30, 2013 and 2012:

| |

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended November 30, |

|

|

|

|

|

|

|

| |

|

2013 |

|

|

2012 |

|

|

$ Change |

|

|

% Change |

|

| |

Industrial water used for fracking |

|

$ |

290,300 |

|

|

$ |

3,700 |

|

|

$ |

286,600 |

|

|

7746 |

% |

| |

Water

& wastewater |

|

|

41,100 |

|

|

|

53,700 |

|

|

|

(12,600 |

) |

|

-23 |

% |

| |

Farm

operations |

|

|

220,300 |

|

|

|

362,700 |

|

|

|

(142,400 |

) |

|

-39 |

% |

| |

Other |

|

|

26,800 |

|

|

|

18,300 |

|

|

|

8,500 |

|

|

46 |

% |

| Total Revenues |

|

|

578,500 |

|

|

|

438,400 |

|

|

|

140,100 |

|

|

32 |

% |

| Cost of revenues |

|

|

(180,400 |

) |

|

|

(71,500 |

) |

|

|

(108,900 |

) |

|

152 |

% |

| Gross margin |

|

|

398,100 |

|

|

|

366,900 |

|

|

|

31,200 |

|

|

9 |

% |

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

General and administrative |

|

|

(619,900 |

) |

|

|

(838,100 |

) |

|

|

218,200 |

|

|

-26 |

% |

| |

Other |

|

|

(15,500 |

) |

|

|

(55,500 |

) |

|

|

40,000 |

|

|

-72 |

% |

| Loss from operations |

|

|

(237,300 |

) |

|

|

(526,700 |

) |

|

|

289,400 |

|

|

-55 |

% |

| Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Interest on TPF and Convertible Debt |

|

|

(657,200 |

) |

|

|

(894,600 |

) |

|

|

237,400 |

|

|

-27 |

% |

| |

Other

income |

|

|

112,100 |

|

|

|

114,600 |

|

|

|

(2,500 |

) |

|

-2 |

% |

| |

Other

expenses |

|

|

(64,100 |

) |

|

|

(26,900 |

) |

|

|

64,100 |

|

|

-100 |

% |

| Net loss |

|

$ |

(846,500 |

) |

|

$ |

(1,333,600 |

) |

|

$ |

588,400 |

|

|

-44 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per share |

|

$ |

(0.04 |

) |

|

$ |

(0.06 |

) |

|

$ |

0.02 |

|

|

33 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues increased approximately 32% during the our three months

ended November 30, 2013 compared to our three months ended November

30, 2012 primarily as a result of increased water sales used for

fracking.

Our summarized approximate financial position as of November 30,

2013 and August 31, 2013 is as follows:

| |

|

|

|

|

|

|

|

| |

|

November 30, 2013 |

|

August 31, 2013 |

|

$ Change |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

| |

Cash, cash equivalents and marketable securities |

|

$ |

1,481,000 |

|

$ |

2,448,400 |

|

$ |

(967,400 |

) |

| |

Other current assets |

|

|

7,735,500 |

|

|

7,451,600 |

|

|

283,900 |

|

| |

|

Total current assets |

|

|

9,216,500 |

|

|

9,900,000 |

|

|

(683,500 |

) |

| |

Investments in water and water systems, net |

|

|

88,944,300 |

|

|

88,512,200 |

|

|

432,100 |

|

| |

Land - Sky Ranch |

|

|

3,765,400 |

|

|

3,768,000 |

|

|

3,765,400 |

|

| |

Other long-term assets |

|

|

6,362,700 |

|

|

6,438,100 |

|

|

(75,400 |

) |

| |

|

Total assets |

|

$ |

108,288,900 |

|

$ |

108,618,300 |

|

$ |

(329,400 |

) |

| |

|

|

|

|

|

|

|

|

|

|

| Liabilities and Shareholders' Equity |

|

|

|

|

|

|

|

|

|

|

| |

Current liabilities |

|

$ |

937,600 |

|

$ |

733,400 |

|

$ |

204,200 |

|

| |

Current portion of mortgages payable |

|

|

4,654,500 |

|

|

4,668,900 |

|

|

(14,400 |

) |

| |

Tap participation fee payable to HP A&M |

|

|

48,432,700 |

|

|

59,807,300 |

|

|

(11,374,600 |

) |

| |

Other long-term liabilities |

|

|

5,251,500 |

|

|

5,636,200 |

|

|

(384,700 |

) |

| |

|

Total liabilities |

|

|

59,276,300 |

|

|

70,845,800 |

|

|

(11,569,500 |

) |

| |

Total shareholders' equity |

|

|

49,012,600 |

|

|

37,772,500 |

|

|

11,240,100 |

|

| |

|

Total liabilities and shareholders' equity |

|

$ |

108,288,900 |

|

$ |

108,618,300 |

|

$ |

(329,400 |

) |

| |

|

|

|

|

|

|

|

|

|

|

Consistent with prior years, management hosts earnings calls

reviewing mid-year and year end results. Our next earnings

call will be hosted after the release of our second quarter results

-- anticipated to be in April 2014. We have posted a detailed

slide presentation which overviews the Company and presents summary

financial results on our website which can be accessed at

www.purecyclewater.com.

The Company will be holding its annual shareholders' meeting on

Wednesday, January 15, 2014 at 2PM Mountain. The meeting will

be held at the offices of Davis, Graham & Stubbs LLP, at 1550

17th Street, Suite 500, Denver, CO 80202. Additional details

can be found on our website.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the U.S. Private Securities Litigation Reform Act of

1995 and other applicable securities laws. Forward-looking

statements are all statements, other than statements of historical

facts, including in this press release that address activities,

events or developments that we expect or anticipate will or may

occur in the future. Investors are cautioned that forward-looking

statements are inherently uncertain and involve risks and

uncertainties that could cause actual results to differ

materially. Factors that could cause actual results to differ

from projected results include the risk factors discussed in Part

I, Item 1A of our most recent Annual Report on Form 10-K and those

factors discussed from time to time in our press releases, public

statements and documents filed or furnished with the U.S.

Securities and Exchange Commission. Although we have attempted

to identify important factors that could cause actual results to

differ materially from those described in forward-looking

statements, there may be other factors that cause results not to be

as anticipated or intended. Except as required by law, we

disclaim any obligation to publicly update any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Company Information

Pure Cycle owns water assets in several river basins in the

State of Colorado as well as certain aquifers in the Denver,

Colorado metropolitan area. Pure Cycle provides water and

wastewater services to customers located in the Denver metropolitan

area including the design, construction, operation and maintenance

of water and wastewater systems. Pure Cycle also owns approximately

16,700 acres in Southeastern Colorado that are leased to area

farmers.

Additional information including our recent press releases and

Annual Reports are available at www.purecyclewater.com, or you may

contact our President, Mark W. Harding, at 303-292-3456 or at

info@purecyclewater.com.

Mark W. Harding President 303-292-3456

info@purecyclewater.com

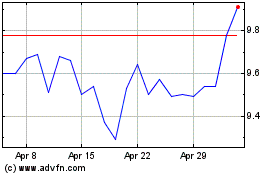

Pure Cycle (NASDAQ:PCYO)

Historical Stock Chart

From Oct 2024 to Nov 2024

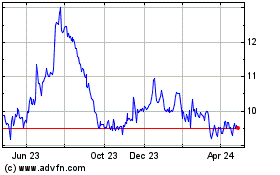

Pure Cycle (NASDAQ:PCYO)

Historical Stock Chart

From Nov 2023 to Nov 2024