LOS ANGELES, April 24 /PRNewswire-FirstCall/ -- Preferred Bank

(NASDAQ:PFBC), an independent commercial bank focusing on the

Chinese-American and diversified Southern California mainstream

market, today reported net income for the quarter ended March 31,

2008. Net income totaled $3.4 million, a 48.0% decrease from net

income of $6.5 million for the same period in 2007 while diluted

earnings per share decreased 44.3% to $0.34 for the quarter

compared to $0.61 for the first quarter of 2007. Net income for the

quarter was negatively impacted by a provision for loan losses of

$5.1 million and a decrease in net interest income of $1.4 million

as compared to the first quarter of 2007. Being consistent with our

prior practice of a targeted dividend payout ratio, the Board of

Directors has decided to reduce the quarterly cash dividend from

$0.17 per share to $0.10 per share. The dividend is payable on May

20, 2008 to holders of record on May 6, 2008. Mr. Li Yu, Chairman

and President of Preferred Bank commented, "Our first quarter 2008

earnings decreased significantly from the previous year. Principal

reasons for the decrease are as follows: -- A large loan loss

provision due to the economy and the slumping housing market. --

Margin compression resulting from rapid Fed rate reductions. --

Further margin compression from lost interest related to non

performing loans." "For the first quarter of 2008, we made

unusually large provisions for loan losses in the amount of $5.1

million. Most of this amount is related to the same loans that were

classified as of December 31, 2007, due to some deterioration in

value and developments regarding the borrowers. For the first three

months of the year, the housing market, in my opinion, further

deteriorated due partly to buyer/investor non-confidence and partly

due to lack of mortgage availability. We see little

pay-down/closing activities from our already completed housing

construction portfolio. At present, we have not seen any sign of

improvement but we are prepared to meet the challenges." "During

the three month period from December to March, Fed Fund rates have

decreased 200 basis points. We have previously estimated that for

each rate drop of 50 basis points that Preferred Bank's earnings

per share will reduce by $0.04 and $0.02 in each of the two ensuing

quarters, respectively. Our estimate was based upon an interest

rate risk model that makes certain assumptions about market deposit

rates. In reality, due to severe competition, deposit rates did not

drop as much we had originally anticipated. As of March 31, 2008,

we have seen our average loan yields drop over 150 basis points but

the average rate paid on deposits have only dropped 71 basis

points. We are hopeful that the margin will stabilize soon as the

Fed may be near the end of its cycle of credit easing." "At March

31, 2008, Preferred Bank's common equity capital ratio is 9.7%. To

preserve and strengthen our capital and to be consistent with our

dividend policy, our Board of Directors has declared a quarterly

dividend of $0.10 per share which is a reduction from the $0.17 per

share declared in the previous quarter. The Board will continue to

evaluate the dividend payout on a quarterly basis." Net Interest

Income and Net Interest Margin. Net interest income before

provision for loan and lease losses decreased to $14.8 million,

compared to $16.2 million for the first quarter of 2007. The 8.6%

decrease was due primarily to the 300 basis point decrease in the

Fed Funds rate and the prime rate since September of 2007 partially

offset by an increase in loan outstandings. As Preferred Bank's

balance sheet is asset-sensitive, the drop in short-term rates has

had a significantly negative impact on the Bank's net interest

margin. The Company's net interest margin was 4.11% for the first

quarter of 2008, down from the 5.16% achieved in the first quarter

of 2007 and down from the 4.82% for the fourth quarter of 2007.

Noninterest Income. For the first quarter of 2008 noninterest

income was $782,000 compared with $763,000 for the same quarter

last year and $756,000 for the fourth quarter of 2007. The increase

in noninterest income this quarter compared to last year was due

mainly to an increase in service charges to $457,000 from $421,000

in the same period last year. Noninterest Expense. Total

noninterest expense was $5,005,000 for the first quarter of 2008,

compared to $5,376,000 for the same period in 2007 and $5,090,000

for the fourth quarter of 2007. Salaries and benefits decreased by

$962,000 from the first quarter due to a decrease in bonus expense

which is based on overall profitability. Professional services

increased due to the outsourcing of internal audit and financial

reporting. Office supplies & equipment expense increased due to

the installation of a new phone system and moving costs associated

with the moving of our headquarters office and our Irvine branch.

Other expense is up over the same quarter last year due to a change

in accrual estimates in the first quarter of 2007. Operating

Efficiency Ratio. For the quarter, the operating efficiency ratio

was 32.0% as compared to 31.6% for the same quarter in 2007 and

28.4% recorded in the fourth quarter of 2007. The year-over-year

deterioration is primarily attributable to the decline in net

interest income as compared to the first and fourth quarters of

2007. Balance Sheet Summary Total gross loans and leases at March

31, 2008 were $1.23 billion, a $173.5 million or 16.4% increase

over the $1.057 billion at March 31, 2007 and a $2.96 million or

0.2% decrease over the $1.233 billion total as of December 31,

2007. Commercial real estate loans were up from $424 million as of

March 31, 2007 to $543.8 million at March 31, 2008 while

construction loans increased $40.9 million from March 31, 2007 and

commercial & industrial loans increased $12.8 million from

March 31, 2007. Total deposits as of March 31, 2008 were $1.265

billion, an increase of $69.3 million or 5.8% over the $1.196

billion at March 31, 2007 and an $11.9 million or 0.9% increase

over the $1.253 billion total as of December 31, 2007.

Noninterest-bearing demand deposits decreased by $17.2 million or

7.5%, interest-bearing demand and savings deposits increased by

$12.1 million or 5.54% and time deposits increased by $74.4 million

or 9.96%. Total assets were $1.551 billion, an 11.7% increase over

the total of $1.389 billion as of March 31, 2007. Asset Quality As

of March 31, 2008 total nonaccrual loans were $36.2 million

compared to $230,000 as of March 31, 2007 and $20.9 million as of

December 31, 2007. During the first quarter 2008 the Bank placed

one commercial real estate loan and one construction loan totaling

$16.6 million on nonaccrual status. This is in addition to the

$20.9 million in loans that were on nonaccrual status as of

December 31, 2007. Total net charge-offs for the first quarter of

2008 were $0. Total non-performing loans to total loans were 2.95%

as of March 31, 2008 as compared to 1.69% as of December 31, 2007

and 0.02% as of March 31, 2007. Because of the increase in

non-performing loans and further deterioration of a few larger

classified credits during the first quarter of 2008, the Bank

recorded a provision for loan losses of $5.1 million as compared to

$2.9 million in the fourth quarter of 2007 and $600,000 for the

first quarter of 2007. The allowance for loan loss at March 31,

2008 was $20.0 million or 1.62% of total loans compared to $10.6

million and 1.0%, respectively at March 31, 2007. Capitalization

Preferred Bank continues to be "well capitalized" under all

regulatory requirements, with a Tier 1 leverage ratio of 9.84% and

a total risk based capital ratio of 11.93% at March 31, 2008.

Conference Call and Webcast A conference call with simultaneous

webcast to discuss Preferred Bank's first quarter 2008 financial

results will be held today, April 24, at 5:00 p.m. Eastern / 2:00

p.m. Pacific. Interested participants and investors may access the

conference call by dialing (800) 366-7640 (domestic) or (303)

262-2130 (international). There will also be a live webcast of the

call available at the Investor Relations section of Preferred

Bank's web site at http://www.preferredbank.com/. Web participants

are encouraged to go to the web site at least 15 minutes prior to

the start of the call to register, download and install any

necessary audio software. Preferred Bank's Chairman, President and

CEO Li Yu, Chief Credit Officer Robert Kosof and Chief Financial

Officer Edward Czajka will be present to discuss Preferred Bank's

financial results, business highlights and outlook. After the live

webcast, a replay will remain available in the Investor Relations

section of Preferred Bank's web site. A replay of the call will be

available at 800-405-2236 (domestic) or 303-590-3000

(international) through May 1, 2008; the pass code is 11112933.

About Preferred Bank Preferred Bank is one of the largest

independent commercial banks in California focusing on the

Chinese-American market. The bank is chartered by the State of

California, and its deposits are insured by the Federal Deposit

Insurance Corporation, or FDIC, to the maximum extent permitted by

law. The Company conducts its banking business from its main office

in Los Angeles, California, and through ten full-service branch

banking offices in Alhambra, Century City, Chino Hills, City of

Industry, Torrance, Arcadia, Irvine, Diamond Bar, Santa Monica and

Valencia, California. Preferred Bank offers a broad range of

deposit and loan products and services to both commercial and

consumer customers. The bank provides personalized deposit services

as well as real estate finance, commercial loans and trade finance

to small and mid-sized businesses, entrepreneurs, real estate

developers, professionals and high net worth individuals. Preferred

Bank continues to benefit from the significant migration to

Southern California of ethnic Chinese from China and other areas of

East Asia. While its business is not solely dependent on the

Chinese-American market, it represents an important element of the

bank's operating strategy, especially for its branch network and

deposit products and services. Preferred Bank believes it is well

positioned to compete effectively with the smaller Chinese-American

community banks, the larger commercial banks and other major banks

operating in Southern California by offering a high degree of

personal service and responsiveness, experienced multi-lingual

staff and substantial lending limits. Forward-Looking Statements

This press release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

Such statements include, but are not limited to, statements about

the Bank's future financial and operating results, the Bank's

plans, objectives, expectations and intentions and other statements

that are not historical facts. Such statements are based upon the

current beliefs and expectations of the Bank's management and are

subject to significant risks and uncertainties. Actual results may

differ from those set forth in the forward-looking statements. The

following factors, among others, could cause actual results to

differ from those set forth in the forward-looking statements:

changes in economic conditions; changes in the California real

estate market; the loss of senior management and other employees;

natural disasters or recurring energy shortage; changes in interest

rates; competition from other financial services companies;

ineffective underwriting practices; inadequate allowance for loan

and lease losses to cover actual losses; risks inherent in

construction lending; adverse economic conditions in Asia; downturn

in international trade; inability to attract deposits; inability to

raise additional capital when needed or on favorable terms;

inability to manage growth; inadequate communications, information,

operating and financial control systems, technology from fourth

party service providers; the U.S. government's monetary policies;

government regulation; environmental liability with respect to

properties to which the bank takes title; and the threat of

terrorism. Additional factors that could cause the Bank's results

to differ materially from those described in the forward-looking

statements can be found in the Bank's 2007 Annual Report on Form

10-K filed with the Federal Deposit Insurance Corporation. The

forward-looking statements in this press release speak only as of

the date of the press release, and the Bank assumes no obligation

to update the forward-looking statements or to update the reasons

why actual results could differ from those contained in the

forward-looking statements. For additional information about

Preferred Bank, please visit the Bank's website at

http://www.preferredbank.com/. Financial Tables to Follow PREFERRED

BANK Consolidated Statements of Income (Unaudited) (In thousands,

except for net income per share and shares) For the Three Months

Ended March 31, December 31, March 31, 2008 2007 2007 Interest

income: Loans and leases, including fees $21,972 $25,352 $22,993

Investment securities, available for sale 3,304 3,192 2,727 Federal

funds sold 12 35 794 Total interest income 25,288 28,579 28,579

Interest expense: Interest-bearing demand 438 590 667 Savings 554

800 742 Time certificates of $100,000 or more 6,784 7,304 7,577

Other time certificates 1,630 1,731 1,080 Federal funds purchased

793 731 31 FHLB borrowings 248 248 183 Total interest expense

10,447 11,404 10,280 Net interest income before provision for

credit losses 14,841 17,175 16,234 Provision for credit losses

5,080 2,900 600 Net interest income after provision for credit

losses 9,761 14,275 15,634 Noninterest income: Fees and service

charges on deposit accounts 457 455 421 Trade finance income 141

144 145 BOLI income 88 87 84 Other income 96 70 113 Total

noninterest income 782 756 763 Noninterest expense: Salaries and

employee benefits 2,638 2,140 3,600 Net occupancy expense 592 589

591 Business development and promotion expense 96 173 46

Professional services 632 750 519 Office supplies and equipment

expense 294 261 188 Other 753 1,177 432 Total noninterest expense

5,005 5,090 5,376 Income before provision for income taxes 5,538

9,941 11,021 Provision for income taxes 2,160 4,112 4,528 Net

income $3,378 $5,829 $6,493 Net income per share: Basic $0.34 $0.57

$0.63 Diluted $0.34 $0.57 $0.61 Weighted-average common shares

outstanding Basic 9,898,204 10,154,749 10,364,874 Diluted 9,937,828

10,301,706 10,682,401 PREFERRED BANK Consolidated Statements of

Financial Condition (Unaudited) (In thousands) March 31, December

31, March 31, 2008 2007 2007 Assets Cash and due from banks $20,272

$22,803 $23,992 Federal funds sold 2,200 - 85,800 Cash and cash

equivalents 22,472 22,803 109,792 Securities available-for-sale, at

fair value 267,234 245,268 201,919 Loans and leases 1,230,140

1,233,099 1,056,627 Less allowance for loan and lease losses

(19,976) (14,896) (10,636) Less unamortized deferred loan fees, net

(1,154) (682) (1,643) Net loans and leases 1,209,010 1,217,521

1,044,348 Other real estate owned 8,441 8,444 - Customers'

liability on acceptances 131 5,083 306 Bank furniture and fixtures,

net 6,793 4,721 1,647 Bank-owned life insurance 8,238 8,168 7,963

Accrued interest receivable 8,734 10,165 8,691 Federal Home Loan

Bank ("FHLB") stock 4,761 4,700 3,736 Deferred tax assets 14,596

12,278 9,577 Other assets 515 3,459 629 Total assets $1,550,925

$1,542,610 $1,388,608 Liabilities and Shareholders' Equity

Deposits: Demand $213,301 $230,083 $230,525 Interest-bearing demand

149,475 137,220 132,077 Savings 80,928 93,398 86,230 Time

certificates of $100,000 or more 685,681 639,455 655,681 Time

certificates less than $100,000 135,575 152,954 91,158 Total

deposits 1,264,960 1,253,110 1,195,671 Acceptances outstanding 131

5,083 306 Advances from the Federal Home Loan Bank 120,000 111,000

20,000 Accrued interest payable 5,062 5,493 5,027 Other liabilities

11,117 14,972 14,769 Total liabilities 1,401,270 1,389,658

1,235,773 Commitments and contingencies Shareholders' equity:

Preferred stock. Authorized 5,000,000 shares; no shares issued and

outstanding at March 31, 2008, December 31, 2007 and March 31,

2007. - - - Common stock, no par value. Authorized 100,000,000

shares; issued and outstanding 9,755,507, 10,154,749 and 10,364,874

shares at March 31, 2008, December 31, 2007 and March 31, 2007,

respectively. 72,008 71,863 71,110 Treasury stock (19,115) (14,976)

- Additional paid-in capital 3,357 2,948 1,902 Retained earnings

96,281 94,595 79,943 Accumulated other comprehensive loss:

Unrealized loss on securities available-for-sale, net of tax of

$2,087,000, $1,072,000 and $87,000 at March 31, 2008, December 31,

2007 and March 31, 2007, respectively. (2,876) (1,478) (120) Total

shareholders' equity 149,655 152,952 152,835 Total liabilities and

shareholders' equity $1,550,925 $1,542,610 $1,388,608 PREFERRED

BANK Selected Financial Information (Unaudited) (In thousands,

except for ratios) March 31, December 31, March 31, 2008 2007 2007

For the period: Return on average assets 0.89% 1.56% 1.99% Return

on average equity 8.77% 14.59% 17.55% Net interest margin (fully

taxable equivalent) 4.11% 4.82% 5.16% Noninterest expense to

average assets 1.31% 1.36% 1.65% Efficiency ratio 32.04% 28.39%

31.63% Net charge-offs to average loans (annualized) 0.00% 0.00%

0.08% Period end: Tier 1 leverage capital ratio 9.84% 10.31% 11.60%

Tier 1 risk-based capital ratio 10.53% 10.54% 11.40% Total

risk-based capital ratio 11.93% 11.57% 12.19% Nonperforming assets

to total assets 2.88% 1.90% 0.02% Nonaccrual loans to total loans

2.95% 1.69% 0.02% Allowance for loan and lease losses to total

loans 1.62% 1.21% 1.01% Allowance for loan and lease losses to

nonaccrual loans 55.12% 71.28% 4624.35% Average balances: Total

loans and leases $1,218,485 $1,195,870 $1,010,148 Earning assets

1,478,608 1,432,486 1,281,814 Total assets 1,531,723 1,481,506

1,320,501 Total deposits 1,251,993 1,205,911 1,127,321 Period end:

Loans and leases: Real estate - multifamily/commercial $543,767

$518,304 $423,997 Real estate - construction 350,426 366,706

309,479 Commercial 253,852 255,912 224,547 Trade finance 81,592

91,565 98,109 Other 503 612 495 Total gross loans and leases

1,230,140 1,233,099 1,056,627 Allowance for loan and lease losses

(19,976) (14,896) (10,636) Net deferred loan fees (1,154) (682)

(1,643) Net loans and leases $1,209,010 $1,217,521 $1,044,348

Deposits: Noninterest-bearing demand $213,301 $230,083 $230,525

Interest-bearing demand and savings 230,403 232,405 218,307 Total

core deposits 443,704 462,488 448,832 Time deposits 821,256 790,622

746,839 Total deposits $1,264,960 $1,253,110 $1,195,671 AT THE

COMPANY: AT FINANCIAL RELATIONS BOARD: Edward J. Czajka Lasse

Glassen Senior Vice President General Information Chief Financial

Officer (213) 486-6546 (213) 891-1188 DATASOURCE: Preferred Bank

CONTACT: Edward J. Czajka, Senior Vice President, Chief Financial

Officer of Preferred Bank, +1-213-891-1188; or General Information,

Lasse Glassen of Financial Relations Board, +1-213-486-6546, , for

Preferred Bank Web site: http://www.preferredbank.com/

Copyright

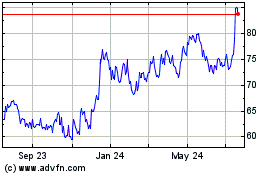

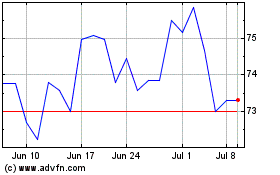

Preferred Bank (NASDAQ:PFBC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Preferred Bank (NASDAQ:PFBC)

Historical Stock Chart

From Nov 2023 to Nov 2024