Filed pursuant to Rule 424(b)(3)

Registration No. 333-275229

PROSPECTUS

Portage Biotech Inc.

9,631,580 Ordinary Shares underlying Warrants

The selling shareholders (the “Selling Shareholders”)

named in this prospectus may use this prospectus to offer and resell from time to time up to 9,631,580 of our ordinary shares, no par

value per share, consisting of (i) up to 3,157,895 ordinary shares (the “Series A Warrant Shares”), issuable upon the

exercise of warrants (the “Series A Warrants”), (ii) up to 3,157,895 ordinary shares (the “Series B Warrant

Shares”) issuable upon the exercise of warrants (the “Series B Warrants”), (iii) up to 3,157,895 ordinary

shares (the “Series C Warrant Shares,” together with the Series A Warrant Shares and the Series B Warrant Shares, the

“Private Warrant Shares”) issuable upon the exercise of warrants (the “Series C Warrants,” together

with the Series A Warrants and the Series B Warrants, the “Private Warrants”) issued in a private placement that closed

on October 3, 2023 (the “Private Placement”), pursuant to that certain Securities Purchase Agreement by and between

us and certain of the Selling Shareholders, dated as of September 29, 2023 (the “Securities Purchase Agreement”), and

(iv) up to 157,895 ordinary shares (the “Placement Agent Warrant Shares,” together with the Private Warrant Shares,

the “Shares”) issuable upon the exercise of warrants (the “Placement Agent Warrants,” together with

the Private Warrants, the “Warrants”) issued to the designees of the placement agent as compensation in connection

with the Registered Direct Offering (defined below) and the Private Placement.

The Warrants were offered and sold without registration under the Securities

Act of 1933, as amended (the “Securities Act”), in reliance on the exemption provided by Section 4(a)(2) of the Securities

Act and Rule 506 of Regulation D promulgated thereunder. We are registering the offer and resale of the Shares to satisfy the provisions

of the Securities Purchase Agreement pursuant to which we agreed to register the resale of the Shares.

We are not selling any of our ordinary shares under this prospectus and

will not receive any of the proceeds from the sale of the Shares by the Selling Shareholders. We will, however, receive the net proceeds

of any Warrants exercised for cash.

The Selling Shareholders may sell or otherwise dispose of the Shares covered

by this prospectus in a number of different ways and at varying prices. We provide more information about how the Selling Shareholders

may sell or otherwise dispose of the Shares covered by this prospectus in the section entitled “Plan of Distribution” on page

29. Discounts, concessions, commissions and similar selling expenses attributable to the sale of the Shares covered by this

prospectus will be borne by the Selling Shareholders. We will pay all expenses (other than discounts, concessions, commissions and similar

selling expenses) relating to the registration of the Shares with the Securities and Exchange Commission (the “SEC”).

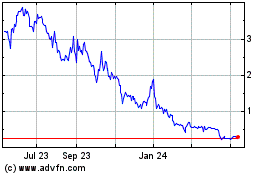

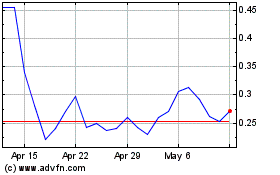

Our ordinary shares are traded on The Nasdaq Capital Market under the

symbol “PRTG.” On November 6, 2023, the last reported sale price of our ordinary shares on The Nasdaq Capital Market was

$1.88 per share.

Investing in the securities offered in this prospectus involve a

high degree of risk. Before making any investment in these securities, you should consider carefully the risks and uncertainties in

the section entitled “Risk Factors” beginning on page 9 of this prospectus, and in the other documents that are

incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state or non-U.S.

regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation

to the contrary is a criminal offense.

The date of this prospectus is November 7, 2023

TABLE OF CONTENTS

| Prospectus |

|

Page

Number |

| |

|

|

| ABOUT THIS PROSPECTUS |

|

2 |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS |

|

3 |

| PROSPECTUS SUMMARY |

|

4 |

| THE OFFERING |

|

8 |

| RISK FACTORS |

|

9 |

| USE OF PROCEEDS |

|

13 |

| DIVIDEND POLICY |

|

13 |

| SELLING SHAREHOLDERS |

|

14 |

| CAPITALIZATION |

|

16 |

| DESCRIPTION OF SECURITIES BEING REGISTERED |

|

17 |

| TAXATION |

|

24 |

| PLAN OF DISTRIBUTION |

|

29 |

| EXPENSES |

|

31 |

| ENFORCEABILITY OF CIVIL LIABILITIES |

|

32 |

| LEGAL MATTERS |

|

34 |

| EXPERTS |

|

34 |

| WHERE YOU CAN FIND MORE INFORMATION |

|

34 |

| INCORPORATION OF CERTAIN INFORMATION BY REFERENCE |

|

35 |

ABOUT THIS PROSPECTUS

This prospectus relates to the resale by the Selling Shareholders identified

in this prospectus under the caption “Selling Shareholders,” from time to time, of up to an aggregate of 9,631,580 of our

ordinary shares. We are not selling any of our ordinary shares under this prospectus and will not receive any of the proceeds from the

sale of the Shares by the Selling Shareholders. We will, however, receive the net proceeds of any Warrants exercised for cash.

You should rely only on the information contained in this prospectus. We

have not, and the Selling Shareholders have not, authorized anyone to provide you with information other than the information that has

been provided or incorporated by reference in this prospectus and your reliance on any unauthorized information or representation is at

your own risk. The information appearing in this prospectus, the documents incorporated by reference in this prospectus and any free writing

prospectus authorized for use in connection with this offering is accurate only as of its respective date, regardless of the time of delivery

of the respective document or of any sale of securities covered by this prospectus. Our business, financial condition, results of operations

and prospects may have changed since those dates.

To the extent there is a conflict between the information contained in

this prospectus, on the one hand, and the information contained in any document incorporated by reference that was filed with the SEC

before the date of this prospectus, on the other hand, you should rely on the information in this prospectus. If any statement in a document

incorporated by reference is inconsistent with a statement in another document incorporated by reference having a later date, the statement

in the document having the later date modifies or supersedes the earlier statement. These documents contain important information you

should consider when making your investment decision.

This prospectus does not constitute an offer to sell or the solicitation

of an offer to buy any of our securities other than the securities covered hereby, nor does this prospectus constitute an offer to sell

or the solicitation of an offer to buy any securities of the Company in any jurisdiction to any person to whom it is unlawful to make

such offer or solicitation in such jurisdiction. You should read this prospectus, including any information incorporated by reference,

and any free writing prospectus authorized for use in connection with this offering, in its entirety before making an investment decision.

You should also read and consider the information in the documents to which we have referred you in the sections entitled “Where

You Can Find More Information” and “Incorporation of Certain Information by Reference.”

In this prospectus, unless the context indicates otherwise the terms “Portage

Biotech Inc.,” “the Company,” “our Company,” “Portage,” “we,” “us” or

“our” are used interchangeably and mean Portage Biotech Inc. and its subsidiaries.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as “believe,”

“expect,” “anticipate,” “intend,” “estimate,” “will,” “should,”

“could,” “would,” “may,” “target,” “project,” “predict,” “plan,”

“potential,” “continue,” “indicate,” “suggests,” “may,” “designed to,”

“ongoing,” “forecast,” and similar references, although not all forward-looking statements contain these words.

Forward-looking statements are neither historical facts nor assurances of future performance. These statements are based only on our current

beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events

and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent

uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Risks and

uncertainties that could cause actual results to vary from expected results expressed in our forward-looking statements include, but are

not limited to:

| · | our need for financing and our estimates regarding our capital requirements and future revenues and profitability; |

| · | our plans and ability to develop and commercialize product candidates and the timing of these development programs; |

| · | clinical development of our product candidates, including the timing for availability and release of results of current and future

clinical trials; |

| · | our expectations regarding regulatory communications, submissions or approvals; |

| · | the potential functionality, capabilities, benefits and risks of our product candidates as compared to others; |

| · | our maintenance and establishment of intellectual property rights in our product candidates; |

| · | our estimates of the size of the potential markets for our product candidates; and |

| · | our selection and licensing of product candidates. |

The risks and uncertainties set forth above are not exhaustive and additional

factors, including those identified in this prospectus under the heading “Risk Factors,” and factors described elsewhere in

this prospectus and in other filings we periodically make with the SEC, including the other risks and uncertainties identified in

Item 3.D. Risk Factors in our Annual Report on Form 20-F for the year ended March 31, 2023, could adversely affect our business and financial

performance. Therefore, you should not rely unduly on any of these forward-looking statements. Forward-looking statements contained in

this prospectus speak as of the date hereof and we do not undertake any obligation to update or revise any of these forward-looking statements,

whether as a result of new information, future events and developments or otherwise, except as required by law.

PROSPECTUS SUMMARY

The following summary highlights certain information contained

elsewhere or incorporated by reference in this prospectus. This summary provides an overview of selected information and does not

contain all of the information you should consider in making your investment decision. Therefore, you should read the entire

prospectus, and the documents incorporated by reference herein carefully before investing in our securities. Investors should

carefully consider the information set forth under “Risk Factors” beginning on page 9 of this prospectus and the

financial statements and other information incorporated by reference in this prospectus.

Overview

We are a clinical stage immune-oncology company advancing treatments we

believe will be first-in-class therapies that target known checkpoint resistance pathways to improve long-term treatment response and

quality of life in patients with invasive cancers. Our access to next-generation technologies coupled with a deep understanding of biological

mechanisms enables the identification of clinical therapies and product development strategies that accelerate these medicines through

the translational pipeline. We currently are working on 9 immuno-oncology assets, of which five are pre-clinical and four of which are

clinical stage. This excludes backup compounds. We source, nurture and develop the creation of early- to mid-stage treatments that we

believe will be first-in-class therapies for a variety of cancers, by funding, implementing viable, cost-effective product development

strategies, clinical counsel/trial design, shared services, financial and project management to enable efficient, turnkey execution of

commercially informed development plans. Our drug development pipeline portfolio encompasses product candidates or technologies based

on biology addressing known resistance pathways/mechanisms of current checkpoint inhibitors with established scientific rationales, including

intratumoral delivery, nanoparticles, liposomes, aptamers and virus-like particles.

The Portage Approach

Our mission is to advance and grow a portfolio of innovative, early-stage

oncology assets based on the latest scientific breakthroughs focused on overcoming immune resistance and expanding the addressable patient

population. Given these foundations, we manage capital allocation and risk as much as we oversee drug development. By focusing our efforts

on translational medicine and pipeline diversification, we seek to mitigate overall exposure to many of the inherent risks of drug development.

Our approach is guided by the following core elements:

| · | Portfolio diversification to mitigate risk and maximize optionality; |

| · | Capital allocation based on risk-adjusted potential, including staged funding to pre-specified scientific

and clinical results; |

| · | Virtual infrastructure and key external relationships to maintain a lean operating base; |

| · | Internal development capabilities complemented by external business development; |

| · | Rigorous asset selection for broad targets with disciplined ongoing evaluation; |

| · | Focus on translational medicine and therapeutic candidates with single agent activity; |

| · | Conduct randomized trials early and test non-overlapping mechanisms of action; and |

| · | Improve potential outcomes for patients with invasive cancers. |

Our execution is achieved, in part, through our internal core team and

our large network of experts, contract labs and academic partners.

Our Science Strategy

Our goal is to develop immuno-oncology therapeutics that will dramatically

improve the standard-of-care for patients with cancer. The key elements of our scientific strategy are to:

| · | Build a pipeline of differentiated oncology therapeutic candidates that are diversified by mechanism,

broad targets, therapeutic approach, modality, stage of development, leading to a variety of deal types that can be executed with partners; |

| · | Expand our pipeline through research collaborations, business development and internally designed programs; |

| · | Continue to advance and evolve our pipeline with a goal of advancing one therapeutic candidate into the

clinic and one program into Investigational New Drug-enabling studies each year; and |

| · | Evaluate strategic opportunities to accelerate development timelines and maximize the value of our portfolio. |

Our Pipeline

We have built a pipeline of immuno-oncology therapeutic

product candidates and programs that are diversified by mechanism, therapeutic approach, modality and stage of development. On an ongoing

basis, we rigorously assess each of our programs using internally defined success criteria to justify continued investment and determine

proper capital allocation. When certain programs do not meet our de-risking criteria for advancement, we look to monetize or terminate

those programs and preserve our capital and resources to invest in programs with greater potential. As a result, our pipeline will continue

to be dynamic.

The charts below set forth, as of October 25, 2023, the current state

of our immuno-oncology therapeutic product candidates and programs. The chart contains forward-looking information and projections

based on management’s current estimates. The chart information is based on and subject to many assumptions, as determined by management

and not verified by any independent third party, which may change or may not occur as modeled. We undertake no obligation to update or

revise any forward-looking statements, whether as a result of new information, future events or otherwise. Before you make an investment

decision regarding us, you should make your own analysis of forward-looking statements and our projections about candidate and program

development and results. PORT-3 has been paused as we await more data. Additionally, PORT-7 is in Phase 1a from an IND perspective, though

we have not commenced dosing patients, which we expect to commence in the first half of calendar year 2024, based upon available liquidity.

Recent Developments

On October 3, 2023, we issued and sold, pursuant to the Securities Purchase

Agreement, in a registered direct offering (the “Registered Direct Offering”) by us directly to a certain Selling Shareholder,

(i) 1,970,000 of our ordinary shares at a purchase price of $1.90 per share and (ii) pre-funded warrants (the “Pre-Funded Warrants”)

to purchase up to 1,187,895 ordinary shares, at a purchase price of $1.899 per Pre-Funded Warrant (the “Pre-Funded Warrant Shares”),

for aggregate net proceeds of approximately $5.3 million after deducting the placement agent’s fees and related offering expenses.

These securities were offered by us pursuant to an effective shelf registration statement on Form F-3 (File No. 333-253468) previously

filed with the SEC on February 24, 2021 and declared effective by the SEC on March 8, 2021.

Also pursuant to the Securities Purchase Agreement, for each ordinary share

and Pre-Funded Warrant issued and sold in the Registered Direct Offering, an accompanying Series A Warrant, Series B Warrant and Series

C Warrant was issued and sold to such Selling Shareholder in the concurrent Private Placement. Each Series A Warrant is exercisable for

one Series A Warrant Share at an exercise price of $1.90 per share, is immediately exercisable and will expire 18 months from the date

of issuance. Each Series B Warrant is exercisable for one Series B Warrant Share at an exercise price of $2.26 per share, is immediately

exercisable and will expire three years from the date of issuance. Each Series C Warrant is exercisable for one Series C Warrant Share

at an exercise price of $2.26 per share, is immediately exercisable and will expire five years from the date of issuance.

Pursuant to an engagement letter, dated as of August 26, 2023, between

us and H.C. Wainwright & Co., LLC (the “Placement Agent”), we issued to designees of the Placement Agent warrants

to purchase up to 157,895 Placement Agent Warrant Shares, which represented 5.0% of the aggregate number of ordinary shares and Pre-Funded

Warrants sold in the Registered Direct Offering. The Placement Agent Warrants have an exercise price equal to $2.375, or 125% of the offering

price per share sold in the Registered Direct Offering, and will expire five years from the commencement of the sales pursuant to the

Registered Direct Offering and Private Placement.

The Warrants were offered and sold without registration under the Securities

Act in reliance on the exemption provided by Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D promulgated thereunder.

Corporate Information

We were originally incorporated in Ontario, Canada in 1973. We were inactive

until 1985. Then, between 1986 and 2012, we were engaged in variety of businesses. Between 1986 to 2012, we went through several name

changes ending with “Bontan Corporation Inc.” In December 2012, we decided to change the focus of our business activities

and, in 2013, we began our business focus within the biotechnology sector. On June 4, 2013, we acquired Portage Pharma Ltd., a biotech

private limited company formed under the laws of the British Virgin Islands, by an exchange of shares. On July 5, 2013, we changed our

name to “Portage Biotech Inc.” and moved our jurisdiction from Ontario, Canada, to the British Virgin Islands (the “BVI”)

under a certificate of continuance issued by the Registrar of Corporate Affairs of the BVI.

We are a BVI business company incorporated under the BVI Business Companies

Act (Revised Edition 2020, as amended) (the “BVI Act”) with our registered office located at Clarence Thomas Building,

P.O. Box 4649, Road Town, Tortola, British Virgin Islands, VG1110. Our U.S. agent, Portage Development Services, Inc., is located at 61

Wilton Road, Westport, CT 06880. Our telephone number is (203) 221-7378. Our website address is https://www.portagebiotech.com. The inclusion

of our website address is intended to be an inactive textual reference only and not an active hyperlink to our website. The information

contained in, or that can be accessed through, our website address is not incorporated by reference in this prospectus and is not part

of this prospectus. The SEC also maintains an internet website located at www.sec.gov that contains the information we file or furnish

electronically with the SEC.

THE OFFERING

| Ordinary shares offered by the Selling Shareholders: |

Up to 9,631,580 Shares following issuance upon exercise of the Warrants. |

| |

|

| Ordinary shares outstanding prior this offering: |

20,944,1851 ordinary shares assuming full exercise of the Pre-Funded Warrants issued in the Registered Direct Offering, no exercise of the Series A Warrants, Series B Warrants or Series C Warrants issued in the Private Placement and no exercise of the Placement Agent Warrants issued to the Placement Agent. |

| |

|

| Ordinary shares outstanding after this offering: |

30,575,7651 ordinary shares assuming full exercise of the Pre-Funded Warrants issued in the Registered Direct Offering, full exercise of all the Series A Warrants, Series B Warrants and Series C Warrants issued in the Private Placement and full exercise of all the Placement Agent Warrants issued to the Placement Agent. |

| |

|

| Use of proceeds: |

We will not receive any proceeds from the sale of the Shares offered hereby by the Selling Shareholders, although we will receive the net proceeds of any Warrants exercised for cash. See the section entitled “Use of Proceeds” for more information. |

| |

|

| Risk factors: |

You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in these securities. |

| |

|

| Nasdaq Capital Market symbol: |

“PRTG” |

1 The number of ordinary shares to be outstanding after this

offering is based on 17,786,290 ordinary shares outstanding as of June 30, 2023, plus 1,970,000 of our ordinary shares and Pre-Funded

Warrants to purchase up to 1,187,895 ordinary shares issued in the Registered Direct Offering and excludes:

| · | Restricted stock units with respect to 378,740 ordinary shares outstanding as of June 30, 2023, which

vested immediately on the date of grant and are subject to certain restrictions; |

| · | 6,833 ordinary shares earned for services rendered in July and August 2023, accrued at August 31, 2023

but not yet issued; |

| · | 1,963,420 ordinary shares issuable upon the exercise of options outstanding as of June 30, 2023 at a weighted-average

exercise price of $10.53 per share; and |

| · | 538,832 ordinary shares available for future issuance under our Amended and Restated 2021 Equity Incentive

Plan as of June 30, 2023. |

Unless otherwise indicated, all information in this prospectus assumes

full exercise of the Pre-Funded Warrants issued in the Registered Direct Offering, full exercise of all the Series A Warrants, Series

B Warrants and Series C Warrants issued the Private Placement and full exercise of all the Placement Agent Warrants issued to the designees

of the Placement Agent as compensation in connection with the Registered Direct Offering and the Private Placement.

RISK FACTORS

Investing in our securities involve a high degree of risk. Before investing

in our securities, you should carefully consider the risks, uncertainties and assumptions described below, in the section under the heading

“Risk Factors” included in our Annual Report on Form 20-F for our most recent fiscal year, our Reports of Foreign Private

Issuer on Form 6-K, any amendments or updates thereto reflected in subsequent filings with the SEC,

and in other reports we file with the SEC that are incorporated by reference herein, before making an investment decision. Our

business, financial condition, results of operations and future growth prospects could be materially and adversely affected by any of

these risks. In these circumstances, the market price of our ordinary shares could decline, and you may lose all or part of your investment.

Risks Related to this Offering

We will have future capital needs, and there are uncertainties as

to our ability to raise additional funding.

Our current cash resources will not cover all of our operational costs

and the needs of our subsidiaries to progress towards and through clinical trials. Additional capital will be needed to continue to test

product candidates in human trials, obtain regulatory approvals and ultimately to commercialize such product candidates if approved.

In addition, our future cash requirements may vary materially from those

now expected. For example, our future capital requirements may increase if:

| · | we experience scientific progress sooner than expected in our future discovery, research and development

projects, if we expand the magnitude and scope of these activities, or if we modify our focus as a result of our discoveries; |

| · | we experience setbacks in our progress with pre-clinical studies and clinical trials are delayed; |

| · | we experience delays or unexpected increased costs in connection with obtaining regulatory approvals,

particularly in light of the current inflationary environment; |

| · | we are required to perform additional pre-clinical studies and/or clinical trials; |

| · | we experience unexpected or increased costs relating to preparing, filing, prosecuting, maintaining, defending

and enforcing patent claims; or |

| · | we elect to develop, acquire or license new technologies and products. |

We have incurred, and we expect to continue to incur substantial costs

related to the development of our product candidates, including costs related to the clinical trials for our iNKT platform and adenosine

platform. If sufficient capital is not available, we may be required to delay, reduce the scope of, eliminate or divest of one or more

of our research or development projects, any of which could have a material adverse effect on our business, financial condition, prospects

or results of operations.

Furthermore, under General Instruction I.B.5 to Form F-3 (the “Baby

Shelf Rule”), the amount of funds we can raise through primary public offerings of securities in any 12-month period using our

registration statement on Form F-3 is limited to one-third of the aggregate market value of the ordinary shares held by our non-affiliates,

which limitation may change over time based on our stock price, number of ordinary shares outstanding and the percentage of ordinary shares

held by non-affiliates. We therefore are limited by the Baby Shelf Rule as of the filing of this prospectus, until such time as our non-affiliate

public float exceeds $75 million.

Our need for future financing may result in the issuance of additional

securities which may cause our shareholders to experience dilution.

Our cash requirements may vary from those now planned depending upon numerous

factors, including the results of future research and development activities. We expect our expenses to increase if and when we initiate

and conduct additional clinical trials, and seek marketing approval for our product candidates. Accordingly, we will need to obtain substantial

additional funding in connection with our continuing operations. Our securities may be offered to investors at a price lower than the

price per share paid by existing shareholders, or upon terms which may be deemed more favorable than those of existing shareholders. In

addition, the issuance of securities in any future financing may dilute the equity ownership of existing shareholders and may have the

effect of depressing the market price for our securities, including the ordinary shares. Moreover, we may issue derivative securities,

including options and/or warrants, from time to time, which may further dilute the equity ownership of our shareholders. No assurance

can be given as to our ability to procure additional financing, if required, and on terms deemed favorable to us. To the extent additional

capital is required and cannot be raised successfully, we may then have to limit our then current operations and/or may have to curtail

certain, if not all, of our business objectives and plans.

We have a history of operating losses and may never achieve profitability

in the future.

Historically, we have generated only a limited amount of business income,

notwithstanding a highly valued asset distribution to our shareholders of share ownership of Biohaven Pharmaceuticals Holding Company

Ltd. (“Biohaven”).

Our objective is to enable research and development so as to create early-

to mid-stage, first- and best-in-class therapies for a variety of cancers, by providing funding, strategic business and clinical counsel,

and shared services, with the goal of creating viable products that may be monetized through licensing, manufacturing and distribution

or outright sale. Our principal activities are engaging in research and development to identify and validate new drug targets that could

become marketed drugs in the future. For this, we will require significant financial resources without any income, and we expect to continue

incurring operating losses for the foreseeable future.

Our ability to generate revenue in the future or achieve profitable operations

is largely dependent upon our ability to attract and maintain experienced management and know-how to develop new drug candidates and to

partner with major pharmaceutical companies to successfully commercialize any successful drug candidates. It takes many years and significant

financial resources to successfully develop pre-clinical or early clinical drug candidates into marketable drugs, and we cannot assure

you that we will be able to achieve these objectives. Although, we were successful in achieving significant value growth in an investment

made in Biohaven, which resulted in the distribution of Biohaven shares as an asset dividend to our shareholders with a then market value

of approximately $153 million in fiscal 2018, we cannot guarantee that we will be able to achieve any similar success in our future business

activities.

Our share price has fluctuated in the past, has recently been volatile

and may be volatile in the future, and as a result, investors in our ordinary shares could incur substantial losses.

Our share price has fluctuated in the past, has recently been volatile,

and may be volatile in the future. The stock market in general and the market for biotechnology companies in particular has experienced

volatility that has often been unrelated to the operating performance of particular companies. As a result of this volatility, investors

may experience losses on their investment in our ordinary shares. The market price for our ordinary shares may be influenced by many factors,

including, but not limited to, the following:

| · | investor reaction to our business strategy; |

| · | our ability or inability to raise additional capital and the terms on which we raise it; |

| · | the success of competitive products or technologies; |

| · | results of clinical trials or future product candidates or those of our competitors; |

| · | regulatory or legal developments, especially changes in laws or regulations applicable to our product

candidates; |

| · | introductions and announcements of new product candidates by us, results of clinical trials, our commercialization

partners, or our competitors, and the timing of these introductions or announcements; |

| · | actions taken by regulatory agencies with respect to our clinical studies, manufacturing process or sales

and marketing terms; |

| · | variations in our financial results or those of companies that are perceived to be similar to us; |

| · | the success of our efforts to acquire or in-license additional products or product candidates; |

| · | developments concerning our collaborations; |

| · | announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures

or capital commitments; |

| · | developments or disputes concerning patents or other proprietary rights, including patents, litigation

matters and our ability to obtain patent protection for our products; |

| · | the recruitment or departure of key personnel; |

| · | market conditions in the pharmaceutical and biotechnology sectors; |

| · | declines in the market prices of publicly traded stocks generally; |

| · | actual or anticipated changes in earnings estimates or changes in stock market analyst recommendations

regarding our ordinary shares, other comparable companies, or our industry generally; |

| · | trading volume of our ordinary shares; |

| · | sales of our ordinary shares by us or our shareholders; |

| · | general economic, industry and market conditions; |

| · | other events or factors, including those resulting from such events, or the prospect of such events, including

war, terrorism and other international conflicts, public health issues including health epidemics or pandemics such as COVID-19, and natural

disasters such as fire, hurricanes, earthquakes, tornados or other adverse weather and climate conditions, whether occurring in the United

States or elsewhere, could disrupt our operations, disrupt the operations of our suppliers or result in political or economic instability;

and |

| · | the other risks described in this “Risk Factors” section and the “Risk Factors”

sections included in the documents incorporated by reference in this prospectus. |

We have additional ordinary shares available for issuance, which,

if issued, could adversely affect the rights of the holders of our ordinary shares.

Our Memorandum and Articles of Association (as amended from time to time,

“Memorandum and Articles”) authorize the issuance of an unlimited number of ordinary shares, upon resolution of our

board of directors, without shareholder approval. Any future issuances of ordinary shares would further dilute the percentage ownership

of us held by holders of our ordinary shares. In addition, the issuance of additional ordinary shares may be used as an “anti-takeover”

device without further action on the part of our shareholders, and may adversely affect the holders of our ordinary shares.

As of April 1, 2024, we may no longer qualify as a foreign private

issuer, which will result in significant additional costs and expenses and subject us to increased regulatory requirements.

As a foreign private issuer, we are not required to comply with certain

provisions of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that are applicable to U.S. domestic

public companies, including (1) the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in

respect of a security registered under the Exchange Act, (2) the sections of the Exchange Act requiring insiders to file public reports

of their share ownership and trading activities and liability for insiders who profit from trades made in a short period of time and (3)

all of the periodic disclosure and current reporting requirements of the Exchange Act applicable to domestic issuers.

In accordance with Nasdaq Listing Rule 5615(a)(3), we have also elected

to follow home country corporate governance practices rather than those of Nasdaq. For example, British Virgin Islands law does not require

that a majority of our board of directors consist of independent directors or that our board committees consist of entirely independent

directors. In addition, we are not subject to Nasdaq Listing Rule 5605(b)(2), which requires that independent directors must regularly

have scheduled meetings at which only independent directors are present. We also are exempt from the Nasdaq listing rules so as to follow

the quorum rules for shareholder meetings under British Virgin Islands law. We also are exempt from the Nasdaq listing rules so as to

not be required to obtain shareholder approval for certain issuance of securities, shareholder approval of share option plans and change

of control transactions under the Nasdaq Listing Rule 5635.

The determination of foreign private issuer status is made annually on

the last business day of an issuer’s most recently completed second fiscal quarter. We are assessing whether, as of September 30,

2023, we satisfied the requirements for retaining our foreign private issuer status as of such date. Assuming we did not satisfy the requirements

to remain a foreign private issuer as of September 30, 2023, we would cease to be a foreign private issuer and cease to be eligible for

the foregoing exemptions and privileges effective April 1, 2024.

As a result of losing foreign private issuer status, we would be required

to file with the SEC periodic reports and registration statements on U.S. domestic issuer forms, which are more detailed and extensive

than the forms available to a foreign private issuer. We would be required to begin preparing our financial statements in accordance with

U.S. GAAP, which would result in financial statements that are different than our historical financial statements and may make it difficult

for investors to compare our financial performance over time. We would also have to mandatorily comply with U.S. federal proxy requirements,

and our officers, directors and principal shareholders would become subject to the reporting and short-swing profit disclosure and recovery

provisions of Section 16 of the Exchange Act. In addition, we would lose our ability to rely upon exemptions from certain corporate governance

requirements under the listing rules of Nasdaq. As a U.S. listed public company that is not a foreign private issuer, we would expect

to incur significant additional legal, accounting and other expenses that we have not incurred as a foreign private issuer. We would also

expect that complying with the rules and regulations applicable to U.S. domestic issuers will make it more difficult and expensive for

us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher

costs to obtain coverage. These rules and regulations could also make it more difficult for us to attract and retain qualified members

of our management team.

USE OF PROCEEDS

The net proceeds from any disposition of Shares covered by this prospectus

will be received by the Selling Shareholders. We will not receive any of the proceeds from any such ordinary shares offered by this prospectus.

We will, however, receive the net proceeds of any Warrants exercised for cash. We intend to use any such net proceeds to fund the development

of our product candidates, other research and development activities and for general working capital purposes.

DIVIDEND POLICY

We do not plan on declaring any cash dividends on our ordinary shares in

the foreseeable future. We expect to retain all available cash funds and future earnings, if any, to fund the development and growth of

our business. Any future determination to pay dividends, if any, on our ordinary shares will be at the discretion of our board of directors

and will depend on, among other factors, our results of operations, financial condition, capital requirements and contractual restrictions.

SELLING SHAREHOLDERS

The Shares being offered by the Selling Shareholders consists of Shares

issuable to the Selling Shareholders upon exercise of the Warrants. For additional information regarding the issuances of the Shares and

Warrants, see “Recent Developments” in the section entitled “Prospectus Summary”. We are registering the Shares

in order to permit the Selling Shareholders to offer the Shares for resale from time to time. Except for (a) the ownership of the Shares

and the Warrants and (b) with respect to the Warrants issued as compensation to the Placement Agent, who acted as our Placement Agent

in the Registered Direct Offering and the Private Placement, or its designees, the Selling Shareholders have not had any material relationship

with us within the past three years.

The table below lists the Selling Shareholders and other information regarding

the beneficial ownership of our ordinary shares by each of the Selling Shareholders. The second column lists the number of our ordinary

shares beneficially owned by each Selling Shareholder, based on its ownership of the Shares and Warrants, as of October 20, 2023, assuming

exercise of the Warrants held by the Selling Shareholders on that date, without regard to any limitations on exercises.

The fourth column lists the Shares being offered under this prospectus

by the Selling Shareholders.

The fifth column assumes the sale of all of the Shares offered by the Selling

Shareholders pursuant to this prospectus.

Under the terms of the Warrants, a Selling Shareholders may not exercise

the Warrants to the extent such exercise would cause such Selling Shareholder, together with its affiliates, to beneficially own a number

of ordinary shares that would exceed 4.99% of our then outstanding ordinary shares following such exercise, excluding for purposes of

such determination ordinary shares issuable upon exercise of such Warrants which have not been exercised. The number of ordinary shares

in the second and fifth columns do not reflect this limitation. The Selling Shareholders may sell all, some or none of their Shares in

this offering. See the section entitled “Plan of Distribution” below for further information.

| Selling Shareholder | |

Number of Ordinary Shares Beneficially

Owned Before this

Offering(1) | |

Percentage of Ordinary Shares Beneficially Owned Before this Offering(1) | |

Number of Shares to be Sold in

this Offering | |

Number of Shares Beneficially Owned

After this Offering | |

Percentage of Total Outstanding Ordinary Shares Owned After this Offering (1) |

| Armistice Capital, LLC (2) | |

| 12,631,580 | | |

| 41.5 | % | |

| 9,473,685 | | |

| 3,157,895 | | |

| 10.4 | % |

| Michael Mirsky(3) | |

| 15,000 | | |

| * | | |

| 15,000 | | |

| - | | |

| - | |

| Noam Rubinstein(3) | |

| 34,737 | | |

| * | | |

| 34,737 | | |

| - | | |

| - | |

| Craig Schwabe(3) | |

| 5,329 | | |

| * | | |

| 5,329 | | |

| - | | |

| - | |

| Michael Vasinkevich(3) | |

| 101,250 | | |

| * | | |

| 101,250 | | |

| - | | |

| - | |

| Charles Worthman(3) | |

| 1,579 | | |

| * | | |

| 1,579 | | |

| - | | |

| - | |

* Represents beneficial ownership of less than one percent.

(1) The ability to exercise the Warrants held by the Selling Shareholders

is subject to a beneficial ownership limitation that, at the time of initial issuance of the Warrants, was capped at 4.99% beneficial

ownership of our issued and outstanding ordinary shares (post-exercise). These beneficial ownership limitations may be adjusted up or

down, subject to providing advanced notice to us. Beneficial ownership as reflected in this table reflects the total number of ordinary

shares potentially issuable underlying the Warrants and does not give effect to these beneficial ownership limitations. Accordingly, actual

beneficial ownership, as calculated in accordance with Section 13(d) and Rule 13d-3 thereunder may be lower than as reflected in the table.

(2) Consists of (i) 1,970,000 ordinary shares, (ii) 1,187,895 ordinary

shares issuable upon exercise of the Pre-Funded Warrants (iii) 9,473,685 ordinary shares issuable upon the exercise of the Private Warrants.

The securities are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”),

and may be deemed to be beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment

manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. The Private Warrants are subject to a beneficial

ownership limitation of 4.99%, which such limitation restricts the Selling Shareholder from exercising that portion of the Private Warrants

that would result in the Selling Shareholder and its affiliates owning, after exercise, a number of shares of common stock in excess of

the beneficial ownership limitation. The number of ordinary shares set forth in the above table does not reflect the application of this

limitation. The address of Armistice Capital Master Fund Ltd. is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York,

NY 10022.

(3) Each of these Selling Shareholders is affiliated with H.C. Wainwright

& Co., LLC, the Placement Agent in connection with the Securities Purchase Agreement and a registered broker dealer, with a registered

address of H.C. Wainwright & Co., LLC, 430 Park Ave, 3rd Floor, New York, NY 10022, and has sole voting and dispositive power over

the securities held. The number of ordinary shares beneficially owned prior to this offering consists of ordinary shares issuable upon

exercise of the Placement Agent Warrants, which were received as compensation. Each of these Selling Shareholders acquired the Placement

Agent Warrants in the ordinary course of business and, at the time the Placement Agent Warrants were acquired, each of these Selling Shareholders

had no agreement or understanding, directly or indirectly, with any person to distribute such securities.

CAPITALIZATION

The following table sets forth our capitalization:

| · | on an actual basis as of June 30, 2023; and |

| · | on an as adjusted basis, giving effect to the issuance of an aggregate of (i) 1,970,000 ordinary shares

issued in the Registered Direct Offering, (ii) 1,187,895 ordinary shares (assuming full exercise of the Pre-Funded Warrants issued in

the Registered Direct Offering), (iii) 9,473,685 ordinary shares following an assumed exercise for all cash of all Warrants issued in

the Private Placement and (iv) 157,895 ordinary shares following an assumed exercise for cash of all the Placement Agent Warrants. |

The as adjusted amounts shown below are unaudited and represent management’s

estimate. The information in this table should be read in conjunction with and is qualified by reference to the financial statements and

notes thereto and other financial information incorporated by reference into this prospectus.

| | |

June 30, 2023 |

| | |

Actual | |

As Adjusted |

| | |

(U.S. Dollars in thousands) |

| Cash and cash equivalents | |

$ | 7,698 | | |

$ | 13,026 | |

| Other assets: | |

| | | |

| | |

| Current assets | |

$ | 3,194 | | |

$ | 3,194 | |

| Non-current assets | |

$ | 87,477 | | |

$ | 87,477 | |

| Liabilities: | |

| | | |

| | |

| Current liabilities | |

$ | 2,638 | | |

$ | 2,638 | |

| Non-current liabilities | |

$ | 23,081 | | |

$ | 23,081 | |

| Equity: | |

| | | |

| | |

| Capital stock | |

$ | 219,425 | | |

$ | 224,753 | |

| Stock option reserve | |

$ | 21,973 | | |

$ | 21,973 | |

| Accumulated other comprehensive loss | |

$ | (2,556 | ) | |

$ | (2,556 | ) |

| Accumulated deficit | |

$ | (165,535 | ) | |

$ | (165,535 | ) |

| Non-controlling interest | |

$ | (657 | ) | |

$ | (657 | ) |

| Total equity | |

$ | 72,650 | | |

$ | 77,978 | |

| Total capitalization | |

$ | 62,163 | | |

$ | 73,200 | |

The number of ordinary shares to be outstanding after this offering is

based on 17,786,290 ordinary shares outstanding as of June 30, 2023, plus 1,970,000 of our ordinary shares and Pre-Funded Warrants to

purchase up to 1,187,895 ordinary shares issued in the Registered Direct Offering and excludes:

| · | Restricted stock units with respect to 378,740 ordinary shares outstanding as of June 30, 2023, which

vested immediately on the date of grant and are subject to certain restrictions; |

| · | 6,833 ordinary shares earned for services rendered in July and August 2023, accrued at August 31, 2023

but not yet issued; |

| · | 1,963,420 ordinary shares issuable upon the exercise of options outstanding as of June 30, 2023 at a weighted-average

exercise price of $10.53 per share; and |

| · | 538,832 ordinary shares available for future issuance under our Amended and Restated 2021 Equity Incentive

Plan as of June 30, 2023. |

DESCRIPTION OF SECURITIES BEING REGISTERED

Ordinary Shares

The following description of our ordinary shares is only a summary. This

description is subject to, and qualified in its entirety by reference to, our Memorandum and Articles, which have previously been filed

with the SEC and in the Territory of the British Virgin Islands, pursuant to the BVI Act.

Our authorized capital stock includes an unlimited number of ordinary shares,

with no par value per share. As of the date of this prospectus, there are 19,771,390 ordinary shares issued and outstanding. No ordinary

shares are held in treasury. We are not authorized to issue any preferred stock.

Rights of Holders of Ordinary Shares

General.

All of our outstanding ordinary shares are fully paid and non-assessable.

We have the right to issue ordinary shares for cash and other consideration. Additionally, ordinary shares may not be fully paid, but

are then susceptible to being forfeited by us until fully paid and non-assessable. Certificates representing our ordinary shares are issued

in registered form and book entry form. Our shareholders who are non-residents of the British Virgin Islands may freely hold and vote

their ordinary shares.

Dividends.

By a resolution of directors, we may declare and pay dividends in money,

ordinary shares, or other property at such time and of such an amount as the board thinks fit if they are satisfied on reasonable grounds

that the company will, immediately after the distribution, satisfy the solvency test set forth in the BVI Act.

Unissued Ordinary Shares.

Our unissued ordinary shares shall be at the disposal of the directors

who may without prejudice to any rights previously conferred on the holders of any existing ordinary shares or class or series of ordinary

shares offer, allot, grant options over or otherwise dispose of ordinary shares or other securities to such persons, at such times and

upon such terms and conditions as we may by resolution of the directors determine. Before issuing ordinary shares for a consideration

other than money, the directors shall pass a resolution stating the amount to be credited for the issue of the ordinary shares, and that,

in their opinion, the present cash value of the non-money consideration and money consideration for the issue is not less than the amount

to be credited for the issue of the ordinary shares.

Voting Rights.

Each ordinary share is entitled to one vote on all matters upon which our

ordinary shares are entitled to vote. Additionally, our directors may convene meetings of our shareholders at such times and in such-manner

and places within or outside the British Virgin Islands as the directors consider necessary or desirable. At least 10 days’ notice

of the meeting shall be given, counting from the date of service of the notice.

Upon the written request of shareholders holding 10% or more of the outstanding

voting rights attaching to our ordinary shares, the directors shall convene a meeting of shareholders not later than 45 days after deposit

of the demand. The directors shall give not less than 10 days’ notice of a meeting of shareholders to those persons whose names

at the close of business on a day to be determined by the directors appear as shareholders in our share register and are entitled to vote

at the meeting.

A meeting of shareholders is duly constituted if, at the commencement of

the meeting, there are present in person or by proxy not less than two persons. Shareholder resolutions may be decided by a show of hands

unless a poll is demanded by the chairman or one or more shareholders present in person or by proxy entitled to vote. On a show of hands,

each shareholder has one vote.

An action that may be taken by the shareholders at a meeting may also be

taken by a resolution of shareholders consented to in writing without the need for any notice; provided, however, that where such a resolution

is passed without the written consent of a majority of the shareholders (i.e., where for example one person holding 65% of the ordinary

shares passes the resolution) a copy of such resolution shall forthwith be sent to all shareholders not consenting to such resolution.

Any shareholder that is a corporation or other entity may by resolution

of its directors or other governing body authorize a natural person to act as its representative at any meeting of our company or of any

meeting of holders of a class or series, and the person so authorized shall be entitled to exercise the same powers on behalf of the corporation

or other entity which he represents as that corporation or entity could exercise if it were an individual shareholder.

Transfer of Ordinary Shares.

Certificated ordinary shares in our company may be transferred by a written

instrument of transfer (which complies with the rules of the SEC and federal and state securities laws of the United States) signed by

the transferor and containing the name and address of the transferee, but in the absence of such written evidence of transfer the directors

may accept such evidence of a transfer of shares as they consider appropriate. We may also issue ordinary shares in uncertificated form.

We shall not be required to treat a transferee of a registered ordinary share in our company as a member until the transferee's name has

been entered in the share register. The register of members may be closed at such times and for such periods as the board of directors

may from time to time determine.

Liquidation.

In the case of the distribution of assets by a voluntary liquidator on

a winding-up of our company, subject to payment of, or to discharge of, all claims, debts, liabilities and obligations of our company,

any surplus assets shall then be distributed amongst our shareholders according to their rights and interests in our company according

to our Memorandum and Articles.

Calls on Ordinary Shares and Forfeiture of Ordinary Shares.

Our board of directors may from time to time make calls upon shareholders

for any amounts unpaid on their ordinary shares in a notice served to such shareholders at least 14 days prior to the specified time and

place of payment. The ordinary shares that have been called upon and remain unpaid at the specified time are subject to forfeiture.

Redemption of Ordinary Shares.

The BVI Act provides that, subject to the memorandum and articles of a

company, shareholders holding 90% or more of all the voting ordinary shares in a company, may instruct the directors to redeem the ordinary

shares of the remaining shareholders. The directors shall be required to redeem the ordinary shares of the minority shareholders, whether

or not the shares are by their terms redeemable. The directors must notify the minority shareholders in writing of the redemption price

to be paid for the ordinary shares and the manner in which the redemption is to be effected. In the event that a minority shareholder

objects to the redemption price to be paid and the parties are unable to agree to the redemption amount payable, the BVI Act sets out

a mechanism whereby the shareholder and the company may each appoint an appraiser, who will together appoint a third appraiser and all

three appraisers will have the power to determine the fair value of the ordinary shares to be compulsorily redeemed. Pursuant to the BVI

Act, the determination of the three appraisers shall be binding on us and the minority shareholder for all purposes.

Variations of Rights of Ordinary Shares.

If at any time, there are different classes or series of ordinary shares

issued and outstanding, unless otherwise provided by the terms at the time of issuance of those ordinary shares of that class or series,

the rights and privileges attaching to any such class or series may, whether or not our company is being wound up, be varied with the

consent in writing of the holders of not less than three-fourths of the issued and outstanding ordinary shares of the class or series

and of the holders of not less than three-fourths of the issued and outstanding ordinary shares of any other class or series of shares

which may be adversely affected by such variation.

Differences in Corporate Law

The BVI Act differs from laws generally applicable to United States corporations

and their shareholders. Set forth below is a brief summary of the significant differences between the provisions of the BVI Act applicable

to us and the laws applicable to companies incorporated in the United States and their shareholders. The discussion of the variations

does not cover any requirements of a stock exchange, trading medium or any applicable securities laws.

Protection for Minority Shareholders.

Under the laws of most U.S. jurisdictions, majority and controlling shareholders

of a company generally have certain "fiduciary" responsibilities to the minority shareholders. Corporate actions taken by majority

and controlling shareholders which are unreasonable and materially detrimental to the interest of minority shareholders may be declared

null and void. The rights of minority shareholders of British Virgin Islands companies will typically be governed by British Virgin Islands

law. These include the statutory right not to suffer the company's affairs to be conducted in a manner which is oppressive, unfairly discriminatory

or unfairly prejudicial in their capacity as shareholders, as well as certain protections at common law. The common law of the British

Virgin Islands (including as to the obligations of fiduciaries) is based on English common law. The availability and interpretation of

minority shareholder rights under British Virgin Islands law may differ from the position in the United States, even in relation to laws

which may appear to be analogous. Similarly, the exercise and enforcement of such rights may involve seeking remedies under foreign law

before a court or tribunal outside the United States, where the procedure and outcome may differ from what might apply or eventuate in

a court in the United States.

The BVI Act also provides that shareholders of the company owning 90% of

the votes entitled to be voted may cause the company to redeem the shares held by the remaining shareholders.

Powers of Directors.

The directors of a British Virgin Islands company, subject in certain cases

to the approval of the court (which will generally require shareholder approval), may implement the sale, transfer, exchange or disposition

of any asset, property, part of the business, or securities of the company, if the board determines such transaction to be in the best

interests of the company with the exception that shareholder approval may be required for any sale, transfer, lease exchange or other

disposition of more than 50% in value of the assets of the company other than in the usual or regular course of business of the company.

The BVI Act, however, provides that the memorandum and articles of a company may exclude application of the above shareholder approval

requirement for the disposition of 50% or more of the assets as set forth in Section 175 of the BVI Act. Our Memorandum and Articles incorporate

the exclusion; therefore our directors may act to sell or otherwise dispose of any or all the assets of our company without restriction

and without complying with section 175 of the BVI Act.

Directors appoint the officers and establish the responsibilities of

the officer positions.

The directors of a British Virgin Islands company may by resolution appoint

a person (who may also be a director) to be an officer or agent of the company.

Unlike in United States corporate law, subject to the memorandum and articles

of association of a BVI company, a director may appoint another person, who need not be a director, to be his alternate, provided such

person has consented in writing to be an alternate director. An alternate director has the same rights as the appointing director in relation

to any director’s meeting and any written resolution circulated for written consent. Our Articles of Association prohibit the appointment

of alternate directors.

Any director that is a corporation or other entity may by resolution of

its directors or other governing body authorize a natural person to act as its representative at any meeting of the directors or of a

committee of directors, and the person so authorized shall be entitled to exercise the same powers on behalf of the corporation or other

entity which he represents as that corporation or entity could exercise if it were an individual director.

Conflict of Interests.

Similar to the laws of most United States jurisdictions, when a director

of a BVI company becomes aware of the fact that he has an interest in a transaction which the company is to enter into, he must disclose

it to the board of directors. With sufficient disclosure of the interest in relation to that transaction, the director who is interested

in a transaction entered into or to be entered into by us may (i) vote on a matter relating to the transaction; (ii) attend a meeting

of directors at which a matter relating to the transaction arises and be included in the quorum; and (iii) sign a document on behalf

of us, or do any other thing in his capacity as a director, that relates to the transaction. If there is required disclosure by a director,

which is not made, then the transaction is voidable by us, unless the transaction is one that is an ordinary course transaction of our

company and the transaction is between us and the director or unless the material facts of the transaction are known by the shareholders

and the transaction is approved or ratified by a resolution of the shareholders or us received fair value for the transaction.

Written Consent and Cumulative Voting.

Under the British Virgin Islands law, shareholders are permitted to approve

matters by way of written resolution in place of a formal meeting. Our Memorandum and Articles provide that actions of the shareholders

may be taken in writing, including by telex, telegram, cable, facsimile or other written electronic communication, without the need for

any notice; provided, however, that where a written resolution of shareholders is passed without the written consent of a majority of

the shareholders (i.e., where for example it is passed by one shareholder holding 65% of the ordinary shares) a copy of such resolution

shall forthwith be sent to all shareholders not consenting to such resolution.

The BVI Act does not make a specific reference to cumulative voting, and

our current Memorandum and Articles have no provisions authorizing cumulative voting.

Independent Directors.

There is no requirement for a majority, or for that matter any, of the

directors of the company to be independent under British Virgin Islands law.

Forfeiture of Ordinary Shares.

Although we intend to only sell our ordinary shares upon receipt of the

full purchase price, if ordinary shares are not fully paid, then under our Memorandum and Articles and the BVI Act any ordinary shares

that are not fully paid are subject to forfeiture. We have the right to demand full payment at any time, upon notice served on the shareholder

stating the time and amount due, and advising the shareholder that if the payment is not made then the ordinary shares will be forfeited

and cancelled. Any funds paid in respect of ordinary shares which are subsequently forfeited is non-refundable.

Redemption and Treasury Shares.

We may purchase, redeem or otherwise acquire and hold our own shares in

such manner and upon such other terms as the directors may agree with the relevant shareholder(s). Subject to the BVI Act, we may redeem

our ordinary shares only with the consent of the shareholders whose ordinary shares are to be redeemed, except that the consent from the

shareholders is not needed under the circumstances of the compulsory redemption, at the request of the shareholders holding 90% of the

votes of the outstanding ordinary shares entitled to vote, of the remaining issued ordinary shares.

Takeover Provisions.

The BVI Act does not provide anti-takeover measures, similar to some jurisdictions

in the United States. Generally speaking, our Memorandum and Articles do not introduce anti-takeover measures. For example, we have shareholder

action permitted by written consent, directors may be removed with or without cause, and we do not have staggered board appointments.

While we do not have any other class of equity authorized, which could have anti-takeover effect, we do have unlimited ordinary shares

and could use them for an anti-takeover plan or action, such as a poison pill plan, which would have to be in place before a takeover

offer is in contemplation, as, if not, the directors might be seen as exercising their powers for an improper purpose in trying to introduce

such a measure.

Notwithstanding the foregoing, we could consider and adopt anti-takeover

measures. Some of these require an amendment to our Articles Association and/or Memorandum of Association, which would have to be approved

by way of director and/or shareholder resolutions.

Shareholder's Access to Corporate Records.

Similar to the corporate laws in the United States, a shareholder is entitled,

on giving written notice to the company, to inspect the company's (i) memorandum and articles of association; (ii) register of members;

(iii) register of directors; and (iv) minutes of meetings and resolutions of members and of those classes of members of which he

is a member. A shareholder is also entitled to copies of the records. Notwithstanding the foregoing, the directors may limit access to

company records if it is contrary to the company interests. However, where a shareholder is denied access to the company records, the

shareholder may apply to the courts for an order to permit access and copying. We have not restricted the provisions of the BVI Act in

regard to access to the records of the company.

Indemnification.

Similar to the corporate law in the United States, British Virgin Islands

law does not limit the extent to which a company’s memorandum and articles of association may provide for indemnification of officers

and directors, except to the extent any such provision may be held by the British Virgin Islands courts to be contrary to public policy,

such as to provide indemnification against civil fraud or the consequences of committing a crime.

Our Memorandum and Articles provide for the indemnification of our directors

against all losses or liabilities incurred or sustained by a director as a director of our company in defending any proceedings, whether

civil or criminal and this indemnity only applies if he or she acted honestly and in good faith with a view to our best interests and,

with respect to any criminal action, he or she must have had no reasonable cause to believe his or her conduct was unlawful.

We may purchase and maintain insurance in relation to any person who is

or was a director, or who at the request of our company is or was serving as a director of, or in any other capacity is or was acting

for another body corporate or a partnership, joint venture, trust or other enterprise, against any liability asserted against the person

and incurred by the person in that capacity, whether or not we have or would have had the power to indemnify the person against the liability.

Mergers and Similar Arrangements.

The BVI Act, in Part IX, provides for the merger and other combination

arrangements for companies. In order to merge or consolidate, the directors of each constituent company must approve a written plan of

merger or consolidation which must be authorized by a resolution of shareholders.

While a director may vote on a merger or consolidation even if he has a

financial interest in the plan of merger of consolidation, in order for the resolution to be valid and the transaction not voidable, the

interest must have been disclosed to the board of directors forthwith upon him becoming aware of such interest. The transaction will not

be voidable if the shareholders approve it.

Shareholders not otherwise entitled to vote on a merger or consolidation

may still acquire the right to vote if the plan of merger or consolidation contains any provision which, if proposed as an amendment to

the memorandum or articles of association, would entitle them to vote as a class or series on the proposed amendment. In any event, all

shareholders must be given a copy of the plan of merger or consolidation irrespective of whether they are entitled to vote at the meeting

or consent to the written resolution to approve the plan of merger or consolidation.

The shareholders of the constituent companies are not required to receive

shares of the surviving or consolidated company but may receive cash, debt obligations or other securities of the surviving or consolidated

company, or other assets, or a combination thereof. Further, some or all of the shares of a class or series may be converted into a kind

of asset while the other shares of the same class or series may receive a different kind of asset. As such, not all the shares of a class

or series must receive the same kind of consideration.

After the plan of merger or consolidation has been approved by the directors

and authorized by a resolution of the shareholders, articles of merger or consolidation are executed by each company and filed with the

Registrar of Corporate Affairs in the British Virgin Islands.

A shareholder may dissent from a mandatory redemption of his shares, an

arrangement (if permitted by the court), a merger (unless the shareholder was a shareholder of the surviving company prior to the merger

and continues to hold the same or similar shares after the merger) and a consolidation. A shareholder properly exercising his dissenter

rights is entitled to payment of the fair value of their shares.

A shareholder dissenting from a merger or consolidation must object in

writing to the merger or consolidation before the vote by the shareholders on the merger or consolidation, unless notice of the meeting

was not given to the shareholder. If the merger or consolidation is approved by the shareholders, the company must within 20 days give

notice of this fact to each shareholder who gave written objection, and to each shareholder who did not receive notice of the meeting.

Such shareholders then have 20 days to give to the company their written election in the form specified by the BVI Act to dissent from

the merger or consolidation, provided that in the case of a merger, the 20 days starts when the plan of merger is delivered to the shareholder.

Upon giving notice of his election to dissent, a shareholder ceases to

have any rights of a shareholder except the right to be paid the fair value of his shares. As such, the merger or consolidation may proceed

in the ordinary course notwithstanding the dissent.

Within seven days of the later of the delivery of the notice of election

to dissent and the effective date of the merger or consolidation, the company must make a written offer to each dissenting shareholder

to purchase his shares at a specified price that the company determines to represent fair value. The company and the shareholder then

have 30 days to agree upon the price. If the company and the shareholder fail to agree on the price within the 30 days, then the company

and the shareholder shall each designate an appraiser and these two appraisers shall designate a third appraiser. These three appraisers

shall fix the fair value of the shares as of the close of business on the day before the shareholders approved the transaction without

taking into account any change in value as a result of the transaction.

Shareholders’ Suits.

Similar to the corporate laws in the United States, the BVI Act permits

derivative actions against its directors. However, the circumstances under which such actions may be brought, and the procedures and defenses

available under British Virgin Islands law may result in the rights of shareholders of a British Virgin Islands company being more limited

than those of shareholders of a company incorporated and/or existing in the United States.

The British Virgin Islands does not have provision for "class actions."

It does however provide for "representative action", whereby a representative may be appointed to represent parties with the

same interest. In such cases those parties will typically be bound by any decision in the proceedings. Section 184C(1) of the BVI Act

specifically provides for the process by which a claim may be brought "derivatively" on behalf of a company by one of its shareholders.

Importantly, proceedings may not be brought by a shareholder without leave of the court. The courts of the British Virgin Islands may,

on the application of a shareholder of a company, grant leave to that shareholder to bring proceedings in the name and on behalf of that

company, or intervene in proceedings to which the company is a party for the purpose of continuing, defending or discontinuing the proceedings

on behalf of the company. In determining whether to grant leave, the High Court of the British Virgin Islands must take into account (i)

whether the shareholder is acting in good faith. (ii) whether the derivative action is in the interests of the company taking account

of the views of the company's directors on commercial matters. (iii) whether the proceedings are likely to succeed, (iv) the costs of

the proceedings in relation to the relief likely to be obtained. and (v) whether an alternative remedy to the derivative claim is available.

Leave to bring or intervene in proceedings may be granted only if the High

Court of the British Virgin Islands is satisfied that (i) the company does not intend to bring, diligently continue or defend, or discontinue

the proceedings, as the case may be or (ii) it is in the interests of the company that the conduct of the proceedings should not be left

to the directors or to the determination of the shareholders as a whole.

Anti-Takeover Effect of Authorized but Unissued Ordinary Shares

The BVI Act does not require shareholder approval for any issuance of our

ordinary shares. The ordinary shares that may be issued under our Memorandum and Articles may be used for a variety of corporate purposes,