false

PLAINS GP HOLDINGS LP

0001581990

DE

0001581990

2024-08-19

2024-08-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) – August 19, 2024

Plains GP Holdings,

L.P.

(Exact name of registrant as specified in its charter)

| DELAWARE |

1-36132 |

90-1005472 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

333 Clay Street,

Suite 1600, Houston, Texas 77002

(Address of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code 713-646-4100

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of

each exchange on which registered |

| Class A Shares |

|

PAGP |

|

Nasdaq |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01. | Entry into a Material Definitive Agreement. |

Amendment to Senior Unsecured Revolving Credit

Agreement

On

August 19, 2024, Plains All American Pipeline, L.P. (the “Partnership”) and Plains Midstream Canada ULC (“PMC”),

each a wholly-owned subsidiary of Plains GP Holdings, L.P. (“PAGP” or the “Registrant”),

entered into that certain Second Amendment to Credit Agreement (the “Revolving Credit Facility Amendment”) amending certain

of the terms of their Credit Agreement dated as of August 20, 2021 among the Partnership and PMC, as borrowers, Bank of America,

N.A., as administrative agent, and the other lenders party thereto (as amended, the “Revolving Credit Agreement”). Pursuant

to the Revolving Credit Facility Amendment, among other things, the Canadian dollar offered rate (CDOR) was replaced with rates based

on the Canadian Overnight Repo Rate Average (CORRA), and the requirement that lenders accept Canadian bankers’ acceptances issued

by PMC or other designated borrowers was eliminated. In connection with the Revolving Credit Facility Amendment, the Maturity Date of

the Revolving Credit Agreement was also extended from August 18, 2028 to August 17, 2029. Terms used in this paragraph but not

defined herein have the meanings assigned to them in the Revolving Credit Agreement.

Amendment to Hedged Inventory Credit Agreement

On August 19, 2024, Plains

Marketing, L.P. (“PMLP”), a wholly-owned subsidiary of the Partnership, and PMC entered into that certain Second Amendment

to Fourth Amended and Restated Credit Agreement (the “Hedged Inventory Facility Amendment” and together with the Revolving

Credit Facility Amendment, the “Amendments”) amending certain of the terms of their Fourth Amended and Restated Credit Agreement

dated as of August 20, 2021 among PMLP and PMC, as borrowers, the Partnership, as guarantor, Bank of America, N.A., as administrative

agent, and the other lenders party thereto (as amended, the “Hedged Inventory Facility”). Pursuant to the Hedged Inventory

Facility Amendment, among other things, the Canadian dollar offered rate (CDOR) was replaced with rates based on the Canadian Overnight

Repo Rate Average (CORRA), and the requirement that lenders accept Canadian bankers’ acceptances issued by PMC or other designated

borrowers was eliminated. In connection with the Hedged Inventory Facility Amendment, the Maturity Date of the Hedged Inventory Facility

was also extended from August 18, 2026 to August 18, 2027. Terms used in this paragraph but not defined herein have the meanings

assigned to them in the Hedged Inventory Facility.

The above descriptions of

the Amendments are qualified in their entirety by the terms of the Revolving Credit Facility Amendment and the Hedged Inventory Facility

Amendment, as applicable, which are attached hereto as Exhibits 10.1 and 10.2, respectively, and are incorporated herein by reference.

| Item 2.03. | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The disclosure set forth above in Item 1.01

is incorporated by reference herein.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| |

|

|

| |

Exhibit 10.1 – |

Second Amendment to Credit Agreement dated as of August 19, 2024, among Plains All American Pipeline, L.P. and Plains Midstream Canada ULC, as Borrowers; certain subsidiaries of Plains All American Pipeline, L.P. from time to time party thereto, as Designated Borrowers; Bank of America, N.A., as Administrative Agent and Swing Line Lender; Bank of America, N.A., Citibank, N.A., JPMorgan Chase Bank, N.A. and Wells Fargo Bank, National Association, as L/C Issuers; and the other Lenders party thereto. |

| |

|

|

| |

Exhibit 10.2 – |

Second Amendment to Fourth Amended and Restated Credit Agreement dated as of August 19, 2024, among Plains Marketing, L.P. and Plains Midstream Canada ULC, as Borrowers; Plains All American Pipeline, L.P., as guarantor; Bank of America, N.A., as Administrative Agent and Swing Line Lender; Bank of America, N.A., Citibank, N.A., JPMorgan Chase Bank, N.A. and Wells Fargo Bank, National Association, as L/C Issuers; and the other Lenders party thereto. |

| |

|

|

| |

Exhibit 104 – |

Cover Page Interactive Data File (embedded within the inline XBRL document). |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

PLAINS GP HOLDINGS, L.P. |

| |

|

| Date: August 22, 2024 |

By: |

PAA GP Holdings LLC, its general partner |

| |

|

|

| |

|

|

| |

By: |

/s/ Al Swanson |

| |

|

Name: |

Al Swanson |

| |

|

Title: |

Executive Vice President |

Exhibit 10.1

Execution Copy

SECOND AMENDMENT TO CREDIT AGREEMENT

THIS SECOND AMENDMENT TO CREDIT

AGREEMENT (this “Amendment”) dated as of the 19th day of August, 2024, is by and among PLAINS ALL AMERICAN PIPELINE,

L.P. (the “Company”), PLAINS MIDSTREAM CANADA ULC, a British Columbia unlimited liability company (“PMCULC”,

and, together with the Company, the “Borrowers” and each individually, a “Borrower”), BANK OF AMERICA,

N.A., as Administrative Agent, and the Lenders party hereto.

W I T N E S S E T H:

WHEREAS, the Borrowers, Administrative

Agent and the L/C Issuers and Lenders party thereto entered into that certain Credit Agreement dated as of August 20, 2021 (as amended

by the First Amendment to Credit Agreement dated as of August 22, 2022, the “Original Agreement”) for the purposes

and consideration therein expressed; and

WHEREAS, the Borrowers, Administrative

Agent, and the Lenders party hereto desire to amend the Original Agreement to, among other things (i) extend the Existing Maturity

Date and (ii) adopt CORRA as the benchmark rate for Canadian Dollar Credit Extensions and remove the bankers’ acceptance facility

under the Original Agreement;

NOW, THEREFORE, in consideration

of the premises and the mutual covenants and agreements contained herein and in the Original Agreement, and for other good and valuable

consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto do hereby agree as follows:

ARTICLE I. — Definitions and References

§

1.1. Terms Defined in the Original Agreement. Unless the

context otherwise requires or unless otherwise expressly defined herein, the terms defined in the Credit Agreement shall have the same

meanings whenever used in this Amendment.

§

1.2. Other Defined Terms. Unless the context otherwise requires,

the following terms when used in this Amendment shall have the meanings assigned to them in this § 1.2.

“Amendment”

means this Second Amendment to Credit Agreement.

“Amendment

Effective Date” has the meaning specified in § 3.1 of this Amendment.

“Credit

Agreement” means the Original Agreement as amended hereby.

ARTICLE II. — Amendments

§

2.1. Credit Agreement. The Original Agreement (other than

the signature pages, Annexes, Exhibits, Schedules thereto and the heading on the cover page thereto) is hereby amended (a) to

delete the red or green stricken text (indicated textually in the same manner as the following examples: stricken

text and stricken text) and (b) to add the blue or green double-underlined

text (indicated textually in the same manner as the following examples: double-underlined

text and double-underlined text), in each case, as set forth

in the marked pages of the Credit Agreement attached as Annex A hereto.

§

2.2. Committed Loan Notice. Exhibit A to the

Original Agreement is hereby amended in its entirety to read as set forth on Exhibit A attached hereto, which shall be deemed

to be attached as Exhibit A to the Credit Agreement.

§

2.3. Swing Line Loan Notice. Exhibit B to the

Original Agreement is hereby amended in its entirety to read as set forth on Exhibit B attached hereto, which shall be deemed

to be attached as Exhibit B to the Credit Agreement.

§

2.4. Extension of Maturity Date. With respect to the Company’s

request pursuant to Section 2.14 of the Credit Agreement to extend the Maturity Date applicable to each Lender for one additional

year from the Existing Maturity Date (the “Extension”), Administrative Agent has notified the Company of the Extending

Lenders and Non-Extending Lenders with respect thereto as set forth on Schedule A attached hereto. Subject to the satisfaction

of the conditions precedent set forth in Article III:

(a) Effective

as of the Amendment Effective Date (i) the Maturity Date with respect to each such Extending Lender is August 17, 2029, (ii) the

Existing Maturity Date of August 20, 2027 shall remain in effect with respect to each such Non-Extending Lender and (iii) Schedule

2.01 to the Original Agreement is hereby amended in its entirety to read as set forth on Schedule 2.01 attached hereto, which

shall be deemed to be attached as Schedule 2.01 to the Credit Agreement; and

(b) the

parties hereto agree that with respect to the Extension, the certification by the Company required by Section 2.14(f) of

the Credit Agreement is hereby satisfied by the Company’s execution and delivery of this Amendment.

ARTICLE III. — Conditions of Effectiveness

§

3.1. Amendment Effective Date. This Amendment shall become

effective as of the date first written above (the “Amendment Effective Date”), upon the satisfaction of the following

conditions precedent:

(a) The

Administrative Agent’s receipt of the following, each of which shall be originals, telecopies or other electronic copies (followed

promptly by originals) unless otherwise specified, each properly executed by a Responsible Officer of the signing Loan Party, if applicable,

each dated the Amendment Effective Date (or, in the case of certificates of governmental officials, a recent date before the Amendment

Effective Date and in the case of financial statements, the date or period of such financial statements) and each in form and substance

reasonably satisfactory to the Administrative Agent:

(i) executed

counterparts of this Amendment from each Borrower, Administrative Agent and Lenders, sufficient in number for distribution to the Administrative

Agent, each Lender and each Borrower; and

(ii) such

other assurances, certificates, documents, consents or opinions as the Administrative Agent may reasonably require.

(b) Any

fees due Administrative Agent or any Lender, including any arrangement fees, agency fees and upfront fees, and any expenses incurred by

Administrative Agent, in each case, as agreed in writing by the Company, required to be paid on or before the Amendment Effective Date

shall have been paid.

(c) The

Company shall have paid all reasonable fees, charges and disbursements of counsel to the Administrative Agent to the extent invoiced prior

to the Amendment Effective Date.

For

purposes of determining compliance with the conditions specified in this § 3.1,

each Lender that has signed this Amendment shall be deemed to have consented to, approved or accepted or to be satisfied with, each document

or other matter required thereunder to be consented to or approved by or acceptable or satisfactory to a Lender unless the Administrative

Agent shall have received notice from such Lender prior to the proposed Amendment Effective Date specifying its objection thereto and

the Administrative Agent hereby agrees to promptly provide the Company with a copy of any such notice received by the Administrative Agent.

ARTICLE IV. — Representations and

Warranties

§

4.1. Representations and Warranties of the Company. In order

to induce Administrative Agent, L/C Issuers and Lenders to enter into this Amendment, the Company represents and warrants to Administrative

Agent, L/C Issuers and each Lender that:

(a) The

representations and warranties of (i) the Company contained in Article V of the Credit Agreement and (ii) each Loan

Party in any other Loan Document are true and correct in all material respects on and as of the Amendment Effective Date, except to the

extent that such representations and warranties specifically refer to an earlier date, in which case they shall be true and correct in

all material respects as of such earlier date, and except that the representations and warranties contained in subsections (a) and

(b) of Section 5.05 of the Credit Agreement shall be deemed to refer to the most recent statements furnished pursuant

to clauses (a) and (b), respectively, of Section 6.01 of the Credit Agreement.

(b) No

Default has occurred and is continuing as of the Amendment Effective Date or would immediately result from the effectiveness hereof.

ARTICLE V. — Miscellaneous

§

5.1. Ratification of Agreements. The Original Agreement,

as hereby amended, is hereby ratified and confirmed in all respects. The Loan Documents, as they may be amended or affected by this Amendment,

are hereby ratified and confirmed in all respects by each Borrower. Any reference to the Original Agreement in any Loan Document shall

be deemed to refer to the Credit Agreement. Upon and after the effectiveness hereof, each reference in the Credit Agreement to “this

Agreement”, “hereunder”, “hereof” or words of like import referring to the Credit Agreement, and each reference

in the other Loan Documents to “the Credit Agreement”, “thereunder”, “thereof” or words of like import

referring to the Credit Agreement, shall mean and be a reference to the Credit Agreement as amended hereby. The execution, delivery and

effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right, power or remedy of Administrative

Agent, any L/C Issuer or any Lender under the Credit Agreement or any other Loan Document nor constitute a waiver of any provision of

the Credit Agreement or any other Loan Document.

§

5.2. Loan Documents. This Amendment is a Loan Document, and

all provisions in the Credit Agreement pertaining to Loan Documents apply hereto.

§

5.3. GOVERNING LAW. THIS

AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW

YORK.

§

5.4. Counterparts. This Amendment may be executed in counterparts

(and by different parties hereto in different counterparts), each of which shall constitute an original, but all of which when taken together

shall constitute a single contract. Delivery of an executed counterpart of a signature page of this Amendment by telecopy or other

electronic imaging means shall be effective as delivery of a manually executed counterpart of this Amendment.

§

5.5. ENTIRE AGREEMENT. THIS AMENDMENT AND THE OTHER LOAN

DOCUMENTS REPRESENT THE FINAL AGREEMENT AMONG THE PARTIES AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT

ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS AMONG THE PARTIES.

[Remainder of Page Intentionally Left Blank]

IN WITNESS WHEREOF, this Amendment

is executed as of the date first above written.

| |

PLAINS ALL AMERICAN PIPELINE,

L.P. as a Borrower |

| |

|

| |

By: |

PAA GP LLC, its general partner |

| |

|

|

| |

By: |

PLAINS AAP, L.P., its sole member |

| |

|

|

| |

By: |

PLAINS ALL AMERICAN GP LLC, |

| |

|

its general partner |

| |

|

| |

By: |

/s/ Sharon S. Spurlin |

| |

|

Sharon S. Spurlin |

| |

|

Senior Vice President and Treasurer |

| |

|

| |

PLAINS MIDSTREAM CANADA

ULC, as a Borrower |

| |

|

| |

By: |

/s/ Sharon S. Spurlin |

| |

|

Sharon S. Spurlin |

| |

|

Senior Vice President and Treasurer |

| |

bank of america, n.a.,

as Administrative Agent |

| |

|

|

| |

By: |

/s/ Melanie Brichant |

| |

Name: |

Melanie Brichant |

| |

Title: |

AVP |

| |

bank

of america, N.A., as a Lender, an L/C Issuer and Swing Line Lender |

| |

|

|

| |

By: |

/s/ Megan Baqui |

| |

Name: |

Megan Baqui |

| |

Title: |

Director |

| |

CITIBANK, n.A., as a Lender and an L/C Issuer |

| |

|

|

| |

By: |

/s/ Maureen Maroney |

| |

Name: |

Maureen Maroney |

| |

Title: |

Vice President |

| |

JPMORGAN CHASE BANK,

N.A., as a Lender and an L/C Issuer |

| |

|

|

| |

By: |

/s/ Kyle Gruen |

| |

Name: |

Kyle Gruen |

| |

Title: |

Authorized Officer |

| |

wells fargo bank, national association, as a Lender and an L/C Issuer |

| |

|

|

| |

By: |

/s/ Nathan Starr |

| |

Name: |

Nathan Starr |

| |

Title: |

Managing Director |

| |

BANCO BILBAO VIZCAYA ARGENTARIA, S.A. NEW YORK BRANCH,

as a Lender |

| |

|

|

| |

By: |

/s/ Cara Younger |

| |

Name: |

Cara Younger |

| |

Title: |

Managing Director |

| |

|

|

| |

By: |

/s/ Armen Semizian |

| |

Name: |

Armen Semizian |

| |

Title: |

Managing Director |

| |

BANK OF MONTREAL, as a Lender |

| |

|

|

| |

By: |

/s/ Jason Lang |

| |

Name: |

Jason Lang |

| |

Title: |

Managing Director |

| |

BANK OF NOVA SCOTIA, HOUSTON BRANCH, as a Lender |

| |

|

|

| |

By: |

/s/ Joe Lattanzi |

| |

Name: |

Joe Lattanzi |

| |

Title: |

Managing Director |

| |

BARCLAYS BANK PLC, as a Lender |

| |

|

|

| |

By: |

/s/ Sydney G. Dennis |

| |

Name: |

Sydney G. Dennis |

| |

Title: |

Director |

| |

CANADIAN IMPERIAL BANK OF COMMERCE, NEW YORK BRANCH, as a Lender |

| |

|

|

| |

By: |

/s/ Scott W. Danvers |

| |

Name: |

Scott W. Danvers |

| |

Title: |

Authorized Signatory |

| |

|

|

| |

By: |

/s/ Donovan C. Broussard |

| |

Name: |

Donovan C. Broussard |

| |

Title: |

Authorized Signatory |

| |

COBANK ACB, as a Lender |

| |

|

|

| |

By: |

/s/ Connor Schrotel |

| |

Name: |

Connor Schrotel |

| |

Title: |

Executive Director |

| |

ING CAPITAL LLC, as a Lender |

| |

|

|

| |

By: |

/s/ Paul Mandeville |

| |

Name: |

Paul Mandeville |

| |

Title: |

Director |

| |

|

|

| |

By: |

/s/ Anthony Rivera |

| |

Name: |

Anthony Rivera |

| |

Title: |

Director |

| |

MIZUHO BANK, LTD., as a Lender |

| |

|

|

| |

By: |

/s/ Edward Sacks |

| |

Name: |

Edward Sacks |

| |

Title: |

Managing Director |

| |

MUFG BANK, LTD., as a Lender |

| |

|

|

| |

By: |

/s/ Christopher Facenda |

| |

Name: |

Christopher Facenda |

| |

Title: |

Authorized Signatory |

| |

PNC BANK, NATIONAL ASSOCIATION, as a Lender |

| |

|

|

| |

By: |

/s/ Danielle Bernicky |

| |

Name: |

Danielle Bernicky |

| |

Title: |

Officer |

| |

REGIONS BANK, as a Lender |

| |

|

|

| |

By: |

/s/ David Valentine |

| |

Name: |

David Valentine |

| |

Title: |

Managing Director |

| |

ROYAL BANK OF CANADA, as a Lender |

| |

|

|

| |

By: |

/s/ Sue Carol Sedillo |

| |

Name: |

Sue Carol Sedillo |

| |

Title: |

Authorized Signatory |

| |

SUMITOMO MITSUI BANKING CORPORATION, as a Lender |

| |

|

|

| |

By: |

/s/ Alkesh Nanavaty |

| |

Name: |

Alkesh Nanavaty |

| |

Title: |

Executive Director |

| |

The TORONTO-DOMINION BANK, NEW YORK BRANCH, as a Lender |

| |

|

|

| |

By: |

/s/ Jonathan Schwartz |

| |

Name: |

Jonathan Schwartz |

| |

Title: |

Authorized Signatory |

| |

TRUIST BANK, as a Lender |

| |

|

|

| |

By: |

/s/ Lincoln LaCour |

| |

Name: |

Lincoln LaCour |

| |

Title: |

Director |

| |

U.s. BANK NATIONAL ASSOCIATION, as a Lender |

| |

|

|

| |

By: |

/s/ Beth Johnson |

| |

Name: |

Beth Johnson |

| |

Title: |

Senior Vice President |

| |

ZIONS BANCORPORATION, N.A. DBA AMEGY BANK, as a Lender |

| |

|

|

| |

By: |

/s/ Cameron Burns |

| |

Name: |

Cameron Burns |

| |

Title: |

Vice President |

| |

MORGAN STANLEY BANK, N.A., as a Lender |

| |

|

|

| |

By: |

/s/ Michael King |

| |

Name: |

Michael King |

| |

Title: |

Authorized Signatory |

EXHIBIT A

FORM

OF COMMITTED LOAN NOTICE

Date: ___________, _____

| To: | Bank of America, N.A., as Administrative Agent |

Ladies and Gentlemen:

Reference is made to that

certain Credit Agreement, dated as of August 20, 2021 (as amended, restated, extended, supplemented or otherwise modified in writing from

time to time, the “Agreement”; the terms defined therein being used herein as therein defined), among Plains All American

Pipeline, L.P., a Delaware limited partnership (the “Company”), Plains Midstream Canada ULC, a British Columbia unlimited

liability company (“PMCULC”), each Subsidiary of the Company from time to time and during the time it is a party thereto

(each such Subsidiary and, together with the Company and PMCULC, the “Borrowers”, and each, a “Borrower”),

Bank of America, N.A., as Administrative Agent and Swing Line Lender, Bank of America, N.A., Citibank, N.A., JPMorgan Chase Bank, N.A.,

and Wells Fargo Bank, National Association, as L/C Issuers, and the Lenders from time to time party thereto.

The undersigned hereby requests

(select one):

¨

A Borrowing of Committed Loans

¨

A conversion or continuation of Committed Loans

| 2. | In the principal amount of [$/C$]___________]. |

| 3. | Comprised of [Base Rate Loans] [Term SOFR/Canadian Term Rate

Loans]. |

| 4. | For Term SOFR Loans: with an Interest Period of [one] [three]

[six] [_____] month[s]. |

For Canadian Term Rate

Loans: with an Interest Period of [one] [three] month[s].

[5. If a conversion or

continuation of Committed Loans, the existing Borrowing(s) of Committed Loans to be converted or continued:

Principal amount of [$/C$]

____________ of [Term SOFR/Canadian Term Rate] Loans with an Interest Period ending _________.

Principal amount of [$/C$]

____________ of Base Rate Loans.]

The Committed Borrowing, if

any, requested herein complies with the proviso to the first sentence of Section 2.01 of the Agreement.

[BORROWER]

EXHIBIT B

FORM

OF swing line loan NOTICE

Date: ___________, _____

| To: | Bank of America, N.A., as Swing Line Lender

Bank of America, N.A., as Administrative Agent |

Ladies and Gentlemen:

Reference

is made to that certain Credit Agreement, dated as of August 20, 2021 (as amended, restated, extended, supplemented or otherwise modified

in writing from time to time, the “Agreement”; the terms defined therein being used herein as therein defined), among

Plains All American Pipeline, L.P., a Delaware limited partnership (the “Company”), Plains Midstream Canada ULC, a

British Columbia unlimited liability company (“PMCULC”), each Subsidiary of the Company from time to time and during

the time it is a party thereto (each such Subsidiary and, together with the Company, the “Borrowers”, and each, a “Borrower”),

Bank of America, N.A., as Administrative Agent and Swing Line Lender, Bank of America, N.A., Citibank, N.A., JPMorgan Chase Bank, N.A.,

and Wells Fargo Bank, National Association, as L/C Issuers, and the Lenders from time to time party thereto.

The undersigned hereby requests a Swing Line Loan:

1. On (a Business Day).

2. In the principal amount of [$/C$] .

3. Comprised

of [Base Rate/Term SOFR] [Canadian Prime Rate/Canadian Swing Line Rate] Loans.

The Swing Line Borrowing requested

herein complies with the requirements of the provisos to the first sentence of Section 2.04(a) of the Agreement.

| |

[BORROWER] |

| |

|

| |

|

By: |

|

| |

|

Name: |

|

| |

|

Title: |

|

SCHEDULE

2.01

COMMITMENTS

AND APPLICABLE PERCENTAGES

| Lender | |

Commitment | | |

Applicable Percentage | | |

Maturity Date |

| Bank of America, N.A. | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| Citibank, N.A. | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| JPMorgan Chase Bank, N.A. | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| Wells Fargo Bank, National Association | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| Banco Bilbao Vizcaya Argentaria, S.A. New York Branch | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 20, 2027 |

| Bank of Montreal | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| Bank of Nova Scotia, Houston Branch | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| Barclays Bank PLC | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| Canadian Imperial Bank of Commerce, New York Branch | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| CoBank, ACB** | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| ING Capital LLC | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| Mizuho Bank, Ltd. | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| MUFG Bank, Ltd. | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| PNC Bank, National Association | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| Regions Bank | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| Royal Bank of Canada | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| Sumitomo Mitsui Banking Corporation | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| The Toronto-Dominion Bank, New York Branch | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| Truist Bank | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| U.S. Bank National Association | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 17, 2029 |

| Zions Bancorporation, N.A. DBA Amegy Bank | |

$ | 35,000,000.00 | | |

| 2.5925925926 | % | |

August 17, 2029 |

| Morgan Stanley Bank, N.A. | |

$ | 35,000,000.00 | | |

| 2.5925925926 | % | |

August 17, 2029 |

| TOTAL | |

$ | 1,350,000,000.00 | | |

| 100.0000000000 | % | |

|

*Rounded to ten decimal places

**Unlicensed Term CORRA Lender

SCHEDULE A

PAA EXTENDING AND NON-EXTENDING LENDERS

EXTENDING LENDERS:

| Bank of America, N.A. |

| Citibank, N.A. |

| JPMorgan Chase Bank, N.A. |

| Wells Fargo Bank, National Association |

| Bank of Montreal |

| Bank of Nova Scotia, Houston Branch |

| Barclays Bank PLC |

| Canadian Imperial Bank of Commerce, New York Branch |

| CoBank ACB |

| ING Capital LLC |

| Mizuho Bank, Ltd. |

| MUFG Bank, Ltd. |

| PNC Bank, National Association |

| Regions Bank |

| Royal Bank of Canada |

| Sumitomo Mitsui Banking Corporation |

| The Toronto-Dominion Bank, New York Branch |

| Truist Bank |

| U.S. Bank National Association |

| Zions Bancorporation, N.A. DBA Amegy Bank |

| Morgan Stanley Bank, N.A. |

NON-EXTENDING LENDERS:

Banco Bilbao Vizcaya Argentaria, S.A. New York Branch

Exhibit 10.2

Execution Copy

SECOND AMENDMENT TO FOURTH AMENDED AND RESTATED

CREDIT AGREEMENT

THIS SECOND AMENDMENT TO

FOURTH AMENDED AND RESTATED CREDIT AGREEMENT (this “Amendment”) dated as of the 19th day of August, 2024, is by and

among PLAINS MARKETING, L.P., a Texas limited partnership (the “Company”), PLAINS MIDSTREAM CANADA ULC, a British

Columbia unlimited liability company (“PMCULC”, and, together with the Company, the “Borrowers”

and each individually, a “Borrower”), PLAINS ALL AMERICAN PIPELINE, L.P., a Delaware limited partnership (“PAA”),

as guarantor, BANK OF AMERICA, N.A., as Administrative Agent, and the Lenders party hereto.

W I T N E S S E T H:

WHEREAS, the Borrowers, PAA,

Administrative Agent and the L/C Issuers and Lenders party thereto entered into that certain Fourth Amended and Restated Credit Agreement

dated as of August 20, 2021 (as amended by the First Amendment to Fourth Amended and Restated Credit Agreement dated as of August 22,

2022, the “Original Agreement”) for the purposes and consideration therein expressed; and

WHEREAS, the Borrowers, PAA,

Administrative Agent, and the Lenders party hereto desire to amend the Original Agreement to, among other things (i) extend the

Existing Maturity Date and (ii) adopt CORRA as the benchmark rate for Canadian Dollar Credit Extensions and remove the bankers’

acceptance facility under the Original Agreement;

NOW, THEREFORE, in consideration

of the premises and the mutual covenants and agreements contained herein and in the Original Agreement, and for other good and valuable

consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto do hereby agree as follows:

ARTICLE I. — Definitions and References

§

1.1. Terms Defined in the Original Agreement. Unless the context otherwise requires or

unless otherwise expressly defined herein, the terms defined in the Credit Agreement shall have the same meanings whenever used in this

Amendment.

§

1.2. Other Defined Terms. Unless the context otherwise

requires, the following terms when used in this Amendment shall have the meanings assigned to them in this § 1.2.

“Amendment”

means this Second Amendment to Fourth Amended and Restated Credit Agreement.

“Amendment

Effective Date” has the meaning specified in § 3.1 of this Amendment.

“Credit

Agreement” means the Original Agreement as amended hereby.

ARTICLE II. — Amendments

§

2.1. Credit Agreement. The Original Agreement (other

than the signature pages, Annexes, Exhibits, Schedules thereto and the heading on the cover page thereto) is hereby amended (a) to

delete the red or green stricken text (indicated textually in the same manner as the following examples: stricken

text and stricken text) and (b) to add the blue or green double-underlined

text (indicated textually in the same manner as the following examples: double-underlined

text and double-underlined text), in each case, as set

forth in the marked pages of the Credit Agreement attached as Annex A hereto.

§

2.2. Committed Loan Notice. Exhibit A

to the Original Agreement is hereby amended in its entirety to read as set forth on Exhibit A attached hereto, which shall

be deemed to be attached as Exhibit A to the Credit Agreement.

§

2.3. Swing Line Loan Notice. Exhibit B

to the Original Agreement is hereby amended in its entirety to read as set forth on Exhibit B attached hereto, which shall

be deemed to be attached as Exhibit B to the Credit Agreement.

§

2.4. Extension of Maturity Date. With respect to

the Company’s request pursuant to Section 2.14 of the Credit Agreement to extend the Maturity Date applicable to each

Lender for one additional year from the Existing Maturity Date (the “Extension”), Administrative Agent has notified

the Company of the Extending Lenders and Non-Extending Lenders with respect thereto as set forth on Schedule A attached hereto.

Subject to the satisfaction of the conditions precedent set forth in Article III:

(a) Effective

as of the Amendment Effective Date (i) the Maturity Date with respect to each such Extending Lender is August 18, 2027, (ii) the

Existing Maturity Date of August 18, 2026 shall remain in effect with respect to each such Non-Extending Lender and (iii) Schedule

2.01 to the Original Agreement is hereby amended in its entirety to read as set forth on Schedule 2.01 attached hereto, which

shall be deemed to be attached as Schedule 2.01 to the Credit Agreement; and

(b) the

parties hereto agree that with respect to the Extension, the certification by the Company required by Section 2.14(f) of

the Credit Agreement is hereby satisfied by the Company’s execution and delivery of this Amendment.

ARTICLE III. — Conditions of Effectiveness

§

3.1. Amendment Effective Date. This Amendment shall

become effective as of the date first written above (the “Amendment Effective Date”), upon the satisfaction of the

following conditions precedent:

(a) The

Administrative Agent’s receipt of the following, each of which shall be originals, telecopies or other electronic copies (followed

promptly by originals) unless otherwise specified, each properly executed by a Responsible Officer of the signing Loan Party, if applicable,

each dated the Amendment Effective Date (or, in the case of certificates of governmental officials, a recent date before the Amendment

Effective Date and in the case of financial statements, the date or period of such financial statements) and each in form and substance

reasonably satisfactory to the Administrative Agent:

(i) executed

counterparts of this Amendment from each Borrower, PAA, Administrative Agent and Lenders, sufficient in number for distribution to the

Administrative Agent, each Lender, each Borrower and PAA; and

(ii) such

other assurances, certificates, documents, consents or opinions as the Administrative Agent may reasonably require.

(b) Any

fees due Administrative Agent or any Lender, including any arrangement fees, agency fees and upfront fees, and any expenses incurred

by Administrative Agent, in each case, as agreed in writing by the Company, required to be paid on or before the Amendment Effective

Date shall have been paid.

(c) The

Company shall have paid all reasonable fees, charges and disbursements of counsel to the Administrative Agent to the extent invoiced

prior to the Amendment Effective Date.

For

purposes of determining compliance with the conditions specified in this § 3.1,

each Lender that has signed this Amendment shall be deemed to have consented to, approved or accepted or to be satisfied with, each document

or other matter required thereunder to be consented to or approved by or acceptable or satisfactory to a Lender unless the Administrative

Agent shall have received notice from such Lender prior to the proposed Amendment Effective Date specifying its objection thereto and

the Administrative Agent hereby agrees to promptly provide the Company with a copy of any such notice received by the Administrative

Agent.

ARTICLE IV. — Representations and

Warranties

§

4.1. Representations and Warranties of the Company.

In order to induce Administrative Agent, L/C Issuers and Lenders to enter into this Amendment, the Company (and PMCULC, solely as to

itself) represents and warrants to Administrative Agent, L/C Issuers and each Lender that:

(a) The

representations and warranties of (i) the Company (and PMCULC, solely as to itself) contained in Article V of the Credit

Agreement and (ii) each Loan Party in any other Loan Document are true and correct in all material respects on and as of the Amendment

Effective Date, except to the extent that such representations and warranties specifically refer to an earlier date, in which case they

shall be true and correct in all material respects as of such earlier date, and except that the representations and warranties contained

in subsections (a) and (b) of Section 5.05 of the Credit Agreement shall be deemed to refer to the most

recent statements furnished pursuant to clauses (a) and (b), respectively, of Section 6.01 of the Credit Agreement.

(b) No

Default has occurred and is continuing as of the Amendment Effective Date or would immediately result from the effectiveness hereof.

ARTICLE V. — Miscellaneous

§

5.1. Ratification of Agreements. The Original Agreement,

as hereby amended, is hereby ratified and confirmed in all respects. The Loan Documents, as they may be amended or affected by this Amendment,

are hereby ratified and confirmed in all respects by each Borrower and PAA. Any reference to the Original Agreement in any Loan Document

shall be deemed to refer to the Credit Agreement. Upon and after the effectiveness hereof, each reference in the Credit Agreement to

“this Agreement”, “hereunder”, “hereof” or words of like import referring to the Credit Agreement,

and each reference in the other Loan Documents to “the Credit Agreement”, “thereunder”, “thereof”

or words of like import referring to the Credit Agreement, shall mean and be a reference to the Credit Agreement as amended hereby. The

execution, delivery and effectiveness of this Amendment shall not, except as expressly provided herein, operate as a waiver of any right,

power or remedy of Administrative Agent, any L/C Issuer or any Lender under the Credit Agreement or any other Loan Document nor constitute

a waiver of any provision of the Credit Agreement or any other Loan Document.

§

5.2. Ratification of PAA Guaranty and Collateral Documents.

PAA, by its signature hereto, represents and warrants that PAA has no defense to the enforcement of the PAA Guaranty, and that according

to its terms the PAA Guaranty will continue in full force and effect to guaranty each Borrower’s Obligations and the other amounts

described in the PAA Guaranty following execution of this Amendment. Each Borrower, Administrative Agent, L/C Issuers and Lenders each

acknowledges and agrees that any and all Obligations of such Borrower are secured indebtedness under, and are secured by, each and every

Collateral Document with respect to the Collateral pledged thereunder by such Borrower. The Company hereby re-pledges, re-grants and

re-assigns a security interest in and lien on every asset of such Borrower described as Collateral in any Collateral Document.

§

5.3. Loan Documents. This Amendment is a Loan Document,

and all provisions in the Credit Agreement pertaining to Loan Documents apply hereto.

§

5.4. GOVERNING LAW. THIS

AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW

YORK.

§

5.5. Counterparts. This Amendment may be executed

in counterparts (and by different parties hereto in different counterparts), each of which shall constitute an original, but all of which

when taken together shall constitute a single contract. Delivery of an executed counterpart of a signature page of this Amendment

by telecopy or other electronic imaging means shall be effective as delivery of a manually executed counterpart of this Amendment.

§

5.6. ENTIRE AGREEMENT. THIS AMENDMENT AND THE OTHER

LOAN DOCUMENTS REPRESENT THE FINAL AGREEMENT AMONG THE PARTIES AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS,

OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS AMONG THE PARTIES.

[Remainder of Page Intentionally Left

Blank]

IN WITNESS WHEREOF, this

Amendment is executed as of the date first above written.

| |

|

| |

PLAINS MARKETING, L.P., as

a Borrower |

| |

|

| |

|

| |

By: PLAINS

GP LLC, |

| |

|

its general partner |

| |

|

| |

By: |

/s/ Sharon S.

Spurlin |

| |

|

Sharon S. Spurlin |

| |

|

Senior Vice President and Treasurer |

| |

|

| |

PLAINS MIDSTREAM CANADA ULC, as

a Borrower |

| |

|

| |

|

| |

By: |

/s/ Sharon S.

Spurlin |

| |

|

Sharon S. Spurlin |

| |

|

Senior Vice President and Treasurer |

| |

|

| |

PLAINS ALL AMERICAN PIPELINE, L.P.

as Guarantor |

| |

|

| |

|

| |

By: |

PAA GP LLC, its general partner |

| |

By: |

PLAINS AAP, L.P., its sole member |

| |

By: |

PLAINS ALL AMERICAN GP LLC, |

| |

|

its general partner |

| |

|

| |

By: |

/s/ Sharon S.

Spurlin |

| |

|

Sharon S. Spurlin |

| |

|

Senior Vice President and Treasurer |

| |

bank of america, n.a.,

as Administrative Agent |

| |

|

| |

|

| |

By: |

/s/ Melanie Brichant |

| |

Name: |

Melanie Brichant |

| |

Title: |

AVP |

| |

bank

of america, n.a., as a Lender, an L/C Issuer and Swing Line Lender |

| |

|

| |

|

| |

By: |

/s/ Megan Baqui |

| |

Name: |

Megan Baqui |

| |

Title: |

Director |

| |

CITIBANK, N.A., as a Lender and an L/C Issuer |

| |

|

| |

|

| |

By: |

/s/ Maureen Maroney |

| |

Name: |

Maureen Maroney |

| |

Title: |

Vice President |

| |

JPMORGAN CHASE BANK, N.A.,

as a Lender and an L/C Issuer |

| |

|

| |

|

| |

By: |

/s/ Kyle Gruen |

| |

Name: |

Kyle Gruen |

| |

Title: |

Authorized Officer |

| |

WELLS FARGO BANK, NATIONAL ASSOCIATION,

as a Lender and an L/C Issuer |

| |

|

| |

|

| |

By: |

/s/ Nathan Starr |

| |

Name: |

Nathan Starr |

| |

Title: |

Managing Director |

| |

BANCO BILBAO VIZCAYA ARGENTARIA,

S.A. NEW YORK BRANCH, as a

Lender |

| |

|

| |

|

| |

By: |

/s/ Cara Younger |

| |

Name: |

Cara Younger |

| |

Title: |

Managing Director |

| |

|

|

| |

By: |

/s/ Armen Semizian |

| |

Name: |

Armen Semizian |

| |

Title: |

Managing Director |

| |

BANK OF MONTREAL, as a Lender |

| |

|

| |

|

| |

By: |

/s/ Jason Lang |

| |

Name: |

Jason Lang |

| |

Title: |

Managing Director |

| |

|

|

|

| |

|

| |

BANK OF NOVA

SCOTIA, HOUSTON BRANCH, as a Lender |

| |

|

| |

|

| |

By: |

/s/

Joe Lattanzi |

| |

Name: |

Joe Lattanzi |

| |

Title: |

Managing Director |

| |

|

|

|

| |

|

| |

BARCLAYS BANK

PLC, as a Lender |

| |

|

| |

|

| |

By: |

/s/

Sydney G. Dennis |

| |

Name: |

Sydney G. Dennis |

| |

Title: |

Director |

| |

|

|

|

| |

|

| |

CANADIAN

IMPERIAL BANK OF COMMERCE, NEW YORK BRANCH,

as a Lender |

| |

|

| |

|

| |

By: |

/s/

Scott W. Danvers |

| |

Name: |

Scott W. Danvers |

| |

Title: |

Authorized Signatory |

| |

|

|

| |

By: |

/s/

Donovan C. Broussard |

| |

Name: |

Donovan C. Broussard |

| |

Title: |

Authorized Signatory |

| |

|

|

|

| |

|

| |

COBANK

ACB,as a Lender |

| |

|

| |

|

| |

By: |

/s/

Connor Schrotel |

| |

Name: |

Connor Schrotel |

| |

Title: |

Executive Director |

| |

|

|

|

| |

|

| |

ING

CAPITAL LLC, as a Lender |

| |

|

| |

|

| |

By: |

/s/

Paul Mandeville |

| |

Name: |

Paul Mandeville |

| |

Title: |

Director |

| |

|

|

| |

By: |

/s/

Anthony Rivera |

| |

Name: |

Anthony Rivera |

| |

Title: |

Director |

| |

|

|

|

| |

|

| |

MIZUHO

BANK, LTD.,as a Lender |

| |

|

| |

|

| |

By: |

/s/

Edward Sacks |

| |

Name: |

Edward Sacks |

| |

Title: |

Managing Director |

| |

|

|

|

| |

|

| |

MUFG

BANK, LTD.,as a Lender |

| |

|

| |

|

| |

By: |

/s/

Christopher Facenda |

| |

Name: |

Christopher Facenda |

| |

Title: |

Authorized Signatory |

| |

|

|

|

| |

|

| |

PNC

BANK, NATIONAL ASSOCIATION, as a Lender |

| |

|

| |

|

| |

By: |

/s/

Danielle Bernicky |

| |

Name: |

Danielle Bernicky |

| |

Title: |

Officer |

| |

REGIONS

BANK, as a

Lender |

| |

|

| |

|

| |

By: |

/s/

David Valentine |

| |

Name: |

David Valentine |

| |

Title: |

Managing Director |

| |

ROYAL

BANK OF CANADA, as a Lender |

| |

|

| |

|

| |

By: |

/s/

Sue Carol Sedillo |

| |

Name: |

Sue Carol Sedillo |

| |

Title: |

Authorized Signatory |

| |

|

|

|

| |

|

| |

SUMITOMO

MITSUI BANKING CORPORATION, as a Lender |

| |

|

| |

|

| |

By: |

/s/

Alkesh Nanavaty |

| |

Name: |

Alkesh Nanavaty |

| |

Title: |

Executive Director |

| |

|

|

|

| |

|

| |

The

TORONTO-DOMINION BANK, NEW YORK BRANCH,

as a Lender |

| |

|

| |

|

| |

By: |

/s/

Jonathan Schwartz |

| |

Name: |

Jonathan Schwartz |

| |

Title: |

Authorized Signatory |

|

| |

|

| |

TRUIST

BANK, as a Lender |

| |

|

| |

|

| |

By: |

/s/

Lincoln LaCour |

| |

Name: |

Lincoln LaCour |

| |

Title: |

Director |

| |

|

|

|

| |

|

| |

U.s.

BANK NATIONAL ASSOCIATION, as a Lender |

| |

|

| |

|

| |

By: |

/s/

Beth Johnson |

| |

Name: |

Beth Johnson |

| |

Title: |

Senior Vice President |

| |

|

|

|

| |

|

| |

ZIONS

BANCORPORATION, N.A. DBA AMEGY BANK, as a Lender |

| |

|

| |

|

| |

By: |

/s/

Cameron Burns |

| |

Name: |

Cameron Burns |

| |

Title: |

Vice President |

| |

|

|

|

| |

|

| |

MORGAN

STANLEY BANK, N.A., as a Lender |

| |

|

| |

|

| |

By: |

/s/

Michael King |

| |

Name: |

Michael King |

| |

Title: |

Authorized Signatory |

EXHIBIT A

FORM

OF COMMITTED LOAN NOTICE

Date: ___________, _____

| To: | Bank of America, N.A., as Administrative Agent |

Ladies and Gentlemen:

Reference

is made to that certain Fourth Amended and Restated Credit Agreement, dated as of August 20, 2021 (as amended, restated, extended, supplemented

or otherwise modified in writing from time to time, the “Agreement”; the terms defined therein being used herein as

therein defined), among Plains Marketing, L.P., a Texas limited partnership (the “Company”), Plains Midstream Canada

ULC, a British Columbia unlimited liability company (“PMCULC” and, together with the Company, the “Borrowers”,

and each, a “Borrower”), Plains All American Pipeline, L.P., a Delaware limited partnership, as guarantor, Bank

of America, N.A., as Administrative Agent and Swing Line Lender, Bank of America, N.A., Citibank, N.A., JPMorgan Chase Bank, N.A., and

Wells Fargo Bank, National Association, as L/C Issuers, and the Lenders from time to time party thereto.

The undersigned hereby requests

(select one):

¨

A Borrowing of Committed Loans

¨

A conversion or continuation of Committed Loans

1. On (a Business Day).

2. In

the principal amount of [$/C$]___________.

3. Comprised

of [Base Rate Loans] [Term SOFR/Canadian Term Rate Loans].

4. For

Term SOFR Loans: with an Interest Period of [one] [three] [six] [_____] month[s].

For Canadian Term Rate

Loans: with an Interest Period of [one] [three] month[s].

[5. If a conversion or

continuation of Committed Loans, the existing Borrowing(s) of Committed Loans to be converted or continued:

Principal amount of [$/C$]

____________ of [Term SOFR/Canadian Term Rate] Loans with an Interest Period ending _________.

Principal amount of [$/C$]

____________ of Base Rate Loans.]

The Committed Borrowing, if

any, requested herein complies with the proviso to the first sentence of Section 2.01 of the Agreement.

| |

[BORROWER] |

| |

|

| |

|

By: |

|

| |

|

Name: |

|

| |

|

Title: |

|

EXHIBIT B

FORM

OF swing line loan NOTICE

Date: ___________, _____

| To: | Bank of America, N.A., as Swing Line Lender

Bank of America, N.A., as Administrative Agent |

Ladies and Gentlemen:

Reference

is made to that certain Fourth Amended and Restated Credit Agreement, dated as of August 20, 2021 (as amended, restated, extended, supplemented

or otherwise modified in writing from time to time, the “Agreement”; the terms defined therein being used herein as

therein defined), among Plains Marketing, L.P., a Texas limited partnership (the “Company”), Plains Midstream Canada

ULC, a British Columbia unlimited liability company (“PMCULC” and, together with the Company, the “Borrowers”,

and each, a “Borrower”), Plains All American Pipeline, L.P., a Delaware limited partnership, as guarantor, Bank

of America, N.A., as Administrative Agent and Swing Line Lender, Bank of America, N.A., Citibank, N.A., JPMorgan Chase Bank, N.A., and

Wells Fargo Bank, National Association, as L/C Issuers, and the Lenders from time to time party thereto.

The undersigned hereby requests a Swing Line Loan:

1. On (a Business Day).

2. In the principal amount of [$/C$] .

3. Comprised

of [Base Rate/Term SOFR] [Canadian Prime Rate/Canadian Swing Line Rate] Loans.

The Swing Line Borrowing requested

herein complies with the requirements of the provisos to the first sentence of Section 2.04(a) of the Agreement.

| |

[BORROWER] |

| |

|

| |

|

By: |

|

| |

|

Name: |

|

| |

|

Title: |

|

SCHEDULE

2.01

COMMITMENTS

AND APPLICABLE PERCENTAGES

| Lender | |

Commitment | | |

Applicable Percentage | | |

Maturity Date |

| Bank of America, N.A. | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| Citibank, N.A. | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| JPMorgan Chase Bank, N.A. | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| Wells Fargo Bank, National Association | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| Banco Bilbao Vizcaya Argentaria, S.A. New York Branch | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2026 |

| Bank of Montreal | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| Bank of Nova Scotia, Houston Branch | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| Barclays Bank PLC | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| Canadian Imperial Bank of Commerce, New York Branch | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| CoBank, ACB** | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| ING Capital LLC | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| Mizuho Bank, Ltd. | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| MUFG Bank, Ltd. | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| PNC Bank, National Association | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| Regions Bank | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| Royal Bank of Canada | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| Sumitomo Mitsui Banking Corporation | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| The Toronto-Dominion Bank, New York Branch | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| Truist Bank | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| U.S. Bank National Association | |

$ | 64,000,000.00 | | |

| 4.7407407407 | % | |

August 18, 2027 |

| Zions Bancorporation, N.A. DBA Amegy Bank | |

$ | 35,000,000.00 | | |

| 2.5925925926 | % | |

August 18, 2027 |

| Morgan Stanley Bank, N.A. | |

$ | 35,000,000.00 | | |

| 2.5925925926 | % | |

August 18, 2027 |

| TOTAL | |

$ | 1,350,000,000.00 | | |

| 100.0000000000 | % | |

|

*Rounded to ten decimal places

**Unlicensed Term CORRA Lender

SCHEDULE A

PAA EXTENDING AND NON-EXTENDING LENDERS

EXTENDING LENDERS:

| Bank of America, N.A. |

| Citibank, N.A. |

| JPMorgan Chase Bank, N.A. |

| Wells Fargo Bank, National Association |

| Bank of Montreal |

| Bank of Nova Scotia, Houston Branch |

| Barclays Bank PLC |

| Canadian Imperial Bank of Commerce, New York Branch |

| CoBank ACB |

| ING Capital LLC |

| Mizuho Bank, Ltd. |

| MUFG Bank, Ltd. |

| PNC Bank, National Association |

| Regions Bank |

| Royal Bank of Canada |

| Sumitomo Mitsui Banking Corporation |

| The Toronto-Dominion Bank, New York Branch |

| Truist Bank |

| U.S. Bank National Association |

| Zions Bancorporation, N.A. DBA Amegy Bank |

| Morgan Stanley Bank, N.A. |

NON-EXTENDING LENDERS:

Banco Bilbao Vizcaya Argentaria, S.A. New York Branch

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

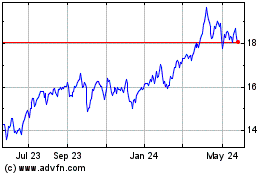

Plains GP (NASDAQ:PAGP)

Historical Stock Chart

From Jan 2025 to Feb 2025

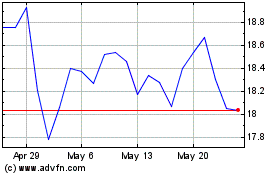

Plains GP (NASDAQ:PAGP)

Historical Stock Chart

From Feb 2024 to Feb 2025