Pineapple Energy Encourages Shareholders to Vote FOR the Reverse Stock Split and Increase in Authorized Shares

April 08 2024 - 7:00AM

Pineapple Energy Inc. (NASDAQ: PEGY) (“Pineapple” or the

“Company”), a leading provider of sustainable solar energy and

back-up power to households and small businesses encourages its

shareholders to participate actively in the upcoming meeting of

shareholders scheduled on April 12, 2024.

The Board of Directors emphasizes the importance of this

shareholders’ vote, specifically urging for a positive vote FOR the

reverse stock split and FOR the increase in authorized shares. If

you have previously cast your vote against these proposals, we

strongly recommend reconsidering your position and voting in favor

of these proposals.

Pineapple’s management team is committed to growing leading

local and regional solar, storage, and energy services companies

nationwide. The Board believes that the reverse stock split and

increase in authorized shares is instrumental for several reasons,

including:

- Maintenance with Nasdaq Listing Status: If the

Reverse Stock Split Proposal is not approved by the Company’s

shareholders, the Company’s common stock may be delisted from

Nasdaq. Maintaining a Nasdaq listing is crucial for investor

confidence, potential investment inflows, and to maintain liquidity

in the Company’s common stock; and

- Increased Shares to Satisfy Conversion Obligations and

for Potential Fundraising: The Company is obligated to

maintain a required minimum reserve of at least 200% of the number

of shares issuable upon conversion of the Series A convertible

preferred stock and common stock warrants from the authorized

shares of its common stock. Shareholders must approve the increase

in authorized shares in order for the Company to have enough

authorized shares to meet these obligations. In addition to

satisfying its conversion obligations, additional authorized shares

are needed to facilitate the Company’s ability to conduct a

successful fundraising effort.

Failure to secure approval for the reverse stock split may

hinder management’s ability to execute its strategy, to the

potential detriment of shareholders. Additionally, it may impede

business development initiatives dependent on the issuance of

common stock. A Nasdaq delisting could complicate shareholders’

ability to trade the Company’s common stock, impact its price and

affect the shareholders’ ability buy or sell when desired. It is

essential to understand that a reverse stock split consolidates

existing shares, preserving the Company’s overall value and each

shareholder’s respective ownership percentage.

Failure to increase the company’s authorized shares will result

in the Company being unable to meet its conversion obligations and

will limit the Company’s ability to conduct successful fundraising.

The inability to conduct successful fundraising raises substantial

doubt about the Company’s ability to continue as a going

concern.

How to vote or how to change your

vote:Shareholders of record as of February 13, 2024, can

vote or change their vote using the instructions in the proxy

materials received via email or mail around March 6, 2024. For

emailed materials, check for an email from id@proxyvote.com.

If you have not received or located your proxy materials, contact

your brokerage firm or similar organization for your proxy control

number.

Most shareholders can vote via proxyvote.com or by

calling 1-800-690-6903. Some shareholders may vote by contacting

Pineapple Energy’s proxy solicitor, Morrow Sodali, at

1-877-787-9239. Interactive Brokers or Robinhood users should

follow instructions from their respective brokers.

Voting will remain open until 11:59 p.m. ET on

April 11, 2024.

We urge you to vote TODAY.

About Pineapple EnergyPineapple is focused on

growing leading local and regional solar, storage, and energy

services companies nationwide. Our vision is to power the energy

transition through grass-roots growth of solar electricity paired

with battery storage. Our portfolio of brands (SUNation, Hawaii

Energy Connection, E-Gear, Sungevity, and Horizon Solar Power)

provide homeowners and small businesses with an end-to-end product

offering spanning solar, battery storage, and grid services.

Forward Looking StatementsThis press release

includes certain forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995, including,

among others, statements regarding the Company’s ability to pass

the proposals at the upcoming annual meeting of shareholders and

the consequences if such proposals should fail to pass. These

statements are based on the Company’s current expectations or

beliefs and are subject to uncertainty and changes in

circumstances. Actual results may vary materially from those

expressed or implied by the statements here due to changes in

economic, business, competitive or regulatory factors, and other

risks and uncertainties, including those set forth in the Company’s

filings with the Securities and Exchange Commission. The

forward-looking statements in this press release speak only as of

the date of this press release. The Company does not undertake any

obligation to update or revise these forward-looking statements for

any reason, except as required by law.

Contacts:

Pineapple Energy

Kyle UdsethChief Executive Officer+1 (952)

996-1674Kyle.Udseth@pineappleenergy.com

Eric IngvaldsonChief Financial Officer+1 (952)

996-1674Eric.Ingvaldson@pineappleenergy.com

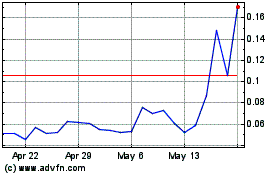

Pineapple Energy (NASDAQ:PEGY)

Historical Stock Chart

From Nov 2024 to Dec 2024

Pineapple Energy (NASDAQ:PEGY)

Historical Stock Chart

From Dec 2023 to Dec 2024