false

0000890394

0000890394

2024-06-11

2024-06-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event Reported):

June 11, 2024

PERASO INC.

(Exact Name of Registrant as Specified in Charter)

000-32929

(Commission File Number)

| Delaware |

|

77-0291941 |

(State or Other Jurisdiction

of Incorporation) |

|

(I.R.S. Employer

Identification Number) |

2309 Bering Dr.

San Jose, California 95131

(Address of principal executive offices, with zip

code)

(408) 418-7500

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

PRSO |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR§230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material

Definitive Agreement.

On

June 11, 2024, Peraso Inc. (the “Company”) entered into a Stock Purchase Agreement (the “Purchase Agreement”)

with Ian McWalter, a member of the Company’s board of directors, pursuant to which the Company sold and Mr. McWalter purchased 100,000

shares (the “Shares”) of the Company’s common stock, par value $0.001 per share, at a price per share of $1.27, for

aggregate gross proceeds of $127,000 (the “Private Sale”).

The

Shares sold pursuant to the Purchase Agreement were issued as restricted securities as defined in Rule 144 of the Securities Act of 1933,

as amended (the “Securities Act”), and do not contain any registration rights. The Company intends to use the net proceeds

from the Private Sale for general corporate purposes, including research and development and working capital.

The

foregoing description of the terms of the Purchase Agreement does not purport to be complete and is qualified in its entirety by the full

text of the Purchase Agreement attached as Exhibit 10.1 to this Current Report on Form 8-K, which is incorporated by reference

herein.

Item 3.02 Unregistered Sales of

Equity Securities.

To

the extent required, the disclosure under Item 1.01 above is hereby incorporated in this Item 3.02 by reference.

The

Shares were issued pursuant to an exemption from registration provided by Section 4(a)(2) and/or Rule 506 of Regulation

D of the Securities Act because such issuance did not involve a public offering, Mr. McWalter took the Shares for investment

and not resale, the Company took appropriate measures to restrict transfer, and Mr. McWalter is a sophisticated investor. The Shares are

subject to transfer restrictions, and the book-entry records evidencing the securities contain an appropriate legend stating that such

securities have not been registered under the Securities Act and may not be offered or sold absent registration or pursuant

to an exemption therefrom. The Shares were not registered under the Securities Act and such securities may not be offered or

sold in the United States absent registration or an exemption from registration under the Securities Act and any applicable

state securities laws.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

PERASO INC. |

| |

|

| Date: June 13, 2024 |

By: |

/s/ James

Sullivan |

| |

|

James Sullivan

Chief Financial Officer |

Exhibit 10.1

STOCK PURCHASE AGREEMENT

This STOCK

PURCHASE AGREEMENT (this “Agreement”) is entered into as of the 11th day of June,

2024, by and between Peraso Inc., a Delaware corporation (the “Company”) and Ian McWalter, an individual (the “Purchaser”).

WHEREAS, the

Purchaser desires to purchase, and the Company desires to sell, an aggregate of 100,000 shares (the “Shares”) of the Company’s

common stock, par value US$0.001 per share (the “Common Stock”), upon the terms and conditions hereof; and

NOW, THEREFORE, in consideration

of the premises and the mutual agreements herein contained, the Purchaser and the Company hereby agree as follows:

SECTION 1: SALE OF THE SHARES

1.1 Sale of

the Shares. Subject to the terms and conditions hereof, at the Closing, the Company will sell to the Purchaser and the Purchaser will

purchase from the Company, the Shares for an aggregate purchase price equal to US$127,000 (the “Purchase Price”).

SECTION 2: CLOSING DATE; DELIVERY

2.1

Closing Date. The closing of the purchase and sale of the Shares (the “Closing”) shall occur June 13th, 2024.

At the Closing, the Company shall deliver to the Purchaser, using customary book-entry procedures, the Shares, and the Purchaser shall

deliver, or cause to be delivered, to the Company by wire transfer funds in the full amount of the Purchase Price for the Shares being

purchased.

2.2

Restrictive Legend. The Shares have not been registered under the Securities Act of 1933, as amended (the “Securities

Act”), and will bear a restrictive legend.

SECTION 3: REPRESENTATIONS AND

WARRANTIES OF THE PURCHASER

The undersigned Purchaser hereby represents and warrants to

the Company as follows:

3.1

Restricted Securities. None of the Shares are registered under the Securities Act, or any state securities laws. The Purchaser

acknowledges that the Shares have not been recommended by any U.S. Federal or State securities commission or regulatory authority and

have not confirmed the accuracy or determined the adequacy of this Agreement. The Purchaser understands that the offering and sale of

the Shares is intended to be exempt from registration under the Securities Act, by virtue of Section 4(a)(2) thereof and, if deemed advisable

by the Company, the provisions of Regulation D promulgated thereunder, based, in part, upon the representations, warranties and agreements

of the Purchaser contained in this Agreement. The Purchaser understands that the Shares may not be sold, transferred or otherwise disposed

of without registration under the Securities Act or an exemption therefrom.

3.2 Experience.

The Purchaser has such knowledge and experience in financial and business matters that the Purchaser is capable of evaluating the

merits and risks of investment in the Company and of making an informed investment decision. The Purchaser has adequate means of

providing for the Purchaser’s current needs and possible future contingencies and the Purchaser has no need, and anticipates

no need in the foreseeable future, to sell the Shares for which the Purchaser subscribes. The Purchaser is able to bear the economic

risks of this investment and, consequently, without limiting the generality of the foregoing, the Purchaser is able to hold the

Shares for an indefinite period of time and has sufficient net worth to sustain a loss of the Purchaser’s entire investment in

the Company in the event such loss should occur. Except as otherwise indicated herein, the Purchaser is the sole party in interest

as to its investment in the Company, and it is acquiring the Shares solely for investment for the Purchaser’s own account and

has no present agreement, understanding or arrangement to subdivide, sell, assign, transfer or otherwise dispose of all or any part

of the Shares subscribed for to any other person.

3.3

Investment; Access to Data. The Purchaser has carefully reviewed and understands the risks of, and other considerations

relating to, a purchase of the Shares and an investment in the Company. The Purchaser has been furnished materials relating to the Company,

the private placement of the Common Stock or anything else that it has requested and has been afforded the opportunity to ask questions

and receive answers concerning the terms and conditions of the offering and obtain any additional information which the Company possesses

or can acquire without unreasonable effort or expense. Representatives of the Company have answered all inquiries that the Purchaser has

made of them concerning the Company, or any other matters relating to the formation and operation of the Company and the offering and

sale of the Common Stock. The Purchaser has not been furnished any offering literature other than the materials that the Company may have

provided at the request of the Purchaser; and the Purchaser has relied only on such information furnished or made available to the Purchaser

by the Company as described in this Section. The Purchaser is acquiring the Shares for investment for the Purchaser’s own account,

not as a nominee or agent and not with the view to, or for resale in connection with, any distribution thereof.

3.4

Authorization. (a) This Agreement, upon execution and delivery thereof, will be a valid and binding obligation of the Purchaser,

enforceable in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization and moratorium laws and other laws

of general application affecting enforcement of creditors’ rights generally.

(b) The execution,

delivery and performance by the Purchaser of this Agreement and compliance therewith and the purchase and sale of the Shares will not

result in a violation of and will not conflict with, or result in a breach of, any of the terms of, or constitute a default under, any

provision of state or Federal law to which the Purchaser is subject, or any mortgage, indenture, agreement, instrument, judgment, decree,

order, rule or regulation or other restriction to which the Purchaser is a party or by which the Purchaser is bound, or result in the

creation of any mortgage, pledge, lien, encumbrance or charge upon any of the properties or assets of the Purchaser pursuant to any such

term.

3.5

Accredited Investor. The Purchaser is an accredited investor as defined in Rule 501(a) of Regulation D under the Securities

Act of 1933, as amended either because: (i) the Purchaser is a natural person and (A) the Purchaser’s net worth, or joint net worth

with Purchaser’s spouse, exceeds $1,000,000,1 or (B) the Purchaser had an individual income in excess of $200,000 in

each of the two most recent years or joint income with Purchaser’s spouse in excess of $300,000 in each of the two most recent

years, and the Purchaser has a reasonable expectation of reaching the same level of income in the current year, or (ii) the Purchaser

is an executive officer, director, manager or general partner of the Company or the Company’s general partner (executive officers

include the president, any vice president in charge of a principal business unit, division or function (such as sales, administration

or finance), and any other officer who performs a policy making function for the Company), or (iii) the Purchaser is an entity that otherwise

meets the definition of “accredited investor” set forth in Rule 501(a).

SECTION 4: MISCELLANEOUS

4.1

Governing Law. This Agreement shall be governed in all respects by the laws of the State of Delaware, without regard to

conflicts of laws principles thereof.

4.2 Survival. The terms, conditions and agreements made herein shall survive the Closing.

4.3

Successors and Assigns. Except as otherwise expressly provided herein, the provisions hereof shall inure to the benefit

of, and be binding upon, the successors, assigns, heirs, executors and administrators of the parties hereto.

4.4

Entire Agreement; Amendment; Waiver. This Agreement constitutes the entire and full understanding and agreement between

the parties with regard to the subject matter hereof. Neither this Agreement nor any term hereof may be amended, waived, discharged or

terminated, except by a written instrument signed by all the parties hereto.

4.5

Counterparts; Electronic Signature. This Agreement may be executed in any number of counterparts, each of which shall be

an original, but all of which together, shall constitute one instrument. This Agreement may be executed by facsimile or pdf signature

by any party and such signature will be deemed binding for all purposes hereof without delivery of an original signature being thereafter

required.

[The remainder of this page has been intentionally

left blank.]

| 1 | For purposes of calculation of Purchaser’s net worth

in Clause (A), (i) such person’s primary residence shall not be included as an asset; (ii) indebtedness secured by Purchaser’s

primary residence, up to the estimated fair market value of such primary residence as of the date hereof, shall not be included as a

liability (except that if the amount of such indebtedness outstanding as of the date hereof exceeds the amount outstanding as of 60 days

before the date hereof, other than as a result of the acquisition of such primary residence, the amount of such excess shall be included

as a liability) and (iii) indebtedness that is secured by Purchaser’s primary residence in excess of the estimated fair market

value of such primary residence as of the date hereof, shall be included as a liability. |

IN WITNESS WHEREOF, the undersigned

have hereunto set their hands as of the day and year first above written.

| |

PERASO INC. |

| |

|

| |

By: |

/s/ James Sullivan |

| |

Name: |

James Sullivan |

| |

Title: |

Chief Financial Officer |

| |

|

| |

PURCHASER |

| |

|

| |

By: |

/s/ Ian McWalter |

| |

Name: |

Ian McWalter |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

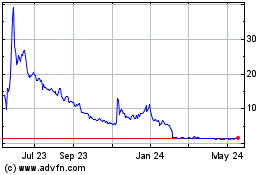

Peraso (NASDAQ:PRSO)

Historical Stock Chart

From Nov 2024 to Dec 2024

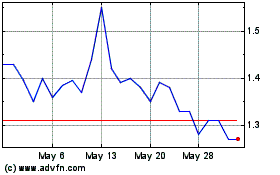

Peraso (NASDAQ:PRSO)

Historical Stock Chart

From Dec 2023 to Dec 2024