- Net sales of $418 million compared to $419 million in Q3

2023

- Gross margin of 17.3% improved 60 basis points

year-over-year

- GAAP EPS from continuing operations improved to $1.02 per

diluted share compared to $0.99 in Q3 2023

- Adjusted EPS from continuing operations was $1.07 per diluted

share, up 8% vs. $0.99 in Q3 2023

- EBITDA, as defined was $39 million, 9.2% of net sales

- Significantly increased liquidity resulting from debt

repayments of $23 million

Park-Ohio Holdings Corp. (NASDAQ: PKOH) today announced its

results for the third quarter of 2024.

“We are pleased with the performance of our Company during the

third quarter. While demand was stable overall, we continue to see

challenges in some of our varied end markets. Regardless, we

delivered improved profitability and additional progress towards

our margin and debt reduction goals. We anticipate modest growth to

return in the fourth quarter and into 2025, as well as continued

progress on our debt reduction initiatives," said Matthew V.

Crawford, Chairman and Chief Executive Officer.

THIRD QUARTER CONSOLIDATED RESULTS FROM

CONTINUING OPERATIONS

In the third quarter of 2024, net sales from continuing

operations were $417.6 million compared to $418.8 million in the

2023 period. Gross margin was 17.3%, an increase of 60 basis points

compared to 16.7% in the 2023 third quarter. Income from continuing

operations attributable to ParkOhio common shareholders in the

third quarter of 2024 was $13.7 million, or $1.02 per diluted

share, compared to $12.5 million, or $0.99 per diluted share in the

third quarter of 2023. Excluding special non-recurring items,

adjusted EPS from continuing operations was $1.07 per diluted share

in the third quarter of 2024 compared to $0.99 per diluted share in

the 2023 period, an increase of 8%. The year-over-year profit

improvement was driven by strong sales and record operating margins

in our Supply Technologies segment; higher sales and operating

income in the capital equipment business included in our Engineered

Products segment; and ongoing profit-improvement initiatives

throughout the company. In addition, our net income in the third

quarter of 2024 benefited from changes in estimates related to

federal research and development credits which positively impacted

our EPS by $0.18 per diluted share. EBITDA, as defined totaled

$38.5 million, or 9.2% of net sales, in the 2024 third quarter.

Please refer to the table that follows for a reconciliation of

income from continuing operations to adjusted income from

continuing operations and EBITDA, as defined.

THIRD QUARTER SEGMENT RESULTS FROM CONTINUING

OPERATIONS

In our Supply Technologies segment, net sales in the third

quarter of 2024 were $194.5 million compared to $192.8 million in

the third quarter a year ago. In our supply chain business,

continued strength in certain of our end markets, including

aerospace and defense, consumer electronics, electrical

distribution and medical equipment, offset lower year-over-year

sales in our heavy-duty truck and power sports end markets. Strong

customer demand continued in our fastener manufacturing business,

with sales up 9% compared to the 2023 third quarter. Segment

operating income increased $4.9 million, or 31%, to a record $20.5

million in the third quarter of 2024 compared to $15.6 million in

the third quarter of 2023. Operating income margin was a record

10.5% in the 2024 quarter, up 240 basis points from 8.1% in the

2023 third quarter, due primarily to an increase in sales of

higher-margin products, strong operational execution, and continued

strong demand in our fastener manufacturing business.

In our Assembly Components segment, net sales were $98.7 million

compared to $108.4 million in the 2023 third quarter. Sales were

lower year-over-year due primarily to lower product pricing on

certain legacy programs and lower unit volumes primarily on

end-of-life programs, partially offset by higher product pricing on

certain other programs. Segment operating income in the 2024 third

quarter was $6.1 million compared to $11.2 million in the 2023

third quarter and $6.9 million last quarter. On an adjusted basis,

which excludes restructuring and other special charges, segment

operating income was $6.6 million in the third quarter of 2024

compared to $11.2 million in the third quarter of 2023 and $6.9

million last quarter. The decrease in operating income and margin

in the third quarter of 2024 compared to the 2023 third quarter was

due to the lower product pricing and unit volumes, which were

partially offset by profit enhancement initiatives in the 2024

period. On a sequential basis, adjusted operating income margin was

6.7% in both the second and third quarters of 2024, as higher

pricing on certain programs in the third quarter 2024 offset lower

volumes on certain programs compared to the second quarter of

2023.

In our Engineered Products segment, net sales were $124.4

million in the 2024 third quarter, an increase of 6% compared to

$117.6 million in last year's third quarter. This increase was

primarily driven by higher sales in Europe, which were up 32%

year-over-year, and higher sales of aftermarket parts and services

in North America, which were up 19% compared to the third quarter

of 2023. New equipment backlog totaled $161 million at September

30, 2024 compared to $162 million at December 31, 2023. In our

forged and machined products business, third quarter 2024 sales

were down 23% compared to the same quarter a year ago. Segment

operating income in the 2024 third quarter was $4.8 million

compared to $7.1 million in the 2023 third quarter. On an adjusted

basis, which excludes restructuring and other special charges,

segment operating income was $5.2 million in the third quarter of

2024 compared to $7.1 million in the 2023 period. The lower

profitability in the 2024 third quarter was driven by lower sales

levels and operating margins in our forged and machined products

business, which more than offset higher sales and profitability in

our capital equipment business.

Please refer to the tables that follow for a reconciliation of

segment operating income to adjusted segment operating income.

YEAR-TO-DATE CONSOLIDATED RESULTS FROM

CONTINUING OPERATIONS

In the nine months ended September 30, 2024, net sales from

continuing operations were $1,267.8 million compared to $1,270.4

million in the 2023 period. Gross margin was 17.1%, an increase of

80 basis points compared to 16.3% in the 2023 period. Income from

continuing operations attributable to ParkOhio common shareholders

in the nine months ended September 30, 2024 increased 35% to $36.6

million, or $2.81 per diluted share, compared to $27.1 million, or

$2.19 per diluted share in the same period in 2023. Excluding

special non-recurring items, adjusted EPS from continuing

operations was $2.94 per diluted share in the 2024 period compared

to $2.55 per diluted share in the 2023 period, an increase of 15%.

EBITDA, as defined increased 10% and totaled $115.2 million during

the nine-month period ended September 30, 2024, and EBITDA margins

were up 90 basis points year-over-year to 9.1% of net sales. Please

refer to the table that follows for a reconciliation of income from

continuing operations to adjusted income from continuing operations

and EBITDA, as defined.

LIQUIDITY AND CASH FLOWS

At September 30, 2024, our total liquidity was $194.4 million,

which included cash and cash equivalents of $59.5 million and

$134.9 million of unused borrowing capacity under our credit

agreements and was an increase of 21% from June 30, 2024. During

the third quarter of 2024, we made debt repayments of $23.3 million

utilizing the majority of cash proceeds from the sale of our common

stock, which totaled $24.7 million.

2024 OUTLOOK - CONTINUING OPERATIONS

For 2024, we now expect revenues to be 1%-2% above our record

2023 revenues, reflecting stable demand in most end markets and

revenue growth in the fourth quarter of this year compared to a

year ago. In addition, we now expect adjusted EPS to increase more

than 10% year-over-year, and EBITDA, as defined to approximate $150

million, an increase of 12% compared to 2023.

CONFERENCE CALL

A conference call reviewing ParkOhio’s third quarter 2024

results will be broadcast live over the Internet on Thursday,

November 7, commencing at 10:00 am Eastern Time. Simply log on to

http://www.pkoh.com. An investor presentation is available on

the Company's website.

ParkOhio is a diversified international company providing

world-class customers with a supply chain management outsourcing

service, capital equipment used on their production lines, and

manufactured components used to assemble their products.

Headquartered in Cleveland, Ohio, ParkOhio operates approximately

130 manufacturing sites and supply chain logistics facilities

worldwide, through three reportable segments: Supply Technologies,

Assembly Components and Engineered Products.

This news release contains forward-looking statements, including

statements regarding future performance of the Company, that are

subject to known and unknown risks, uncertainties and other factors

that may cause our actual results, performance and achievements, or

industry results, to be materially different from any future

results, performance or achievements expressed or implied by such

forward-looking statements. These factors that could cause actual

results to differ materially from expectations include, but are not

limited to, the following: our ability to realize any contingent

consideration from the sale of the Aluminum Products business; the

impact supply chain and logistic issues have on our business,

results of operations, financial position and liquidity; our

substantial indebtedness; the uncertainty of the global economic

environment; general business conditions and competitive factors,

including pricing pressures and product innovation; demand for our

products and services; the impact of labor disturbances affecting

our customers; raw material availability and pricing; fluctuations

in energy costs; component part availability and pricing; changes

in our relationships with customers and suppliers; the financial

condition of our customers, including the impact of any

bankruptcies; our ability to successfully integrate recent and

future acquisitions into existing operations; the amounts and

timing, if any, of purchases of our common stock; changes in

general economic conditions such as inflation rates, interest

rates, tax rates, unemployment rates, higher labor and healthcare

costs, recessions and changing government policies, laws and

regulations, including those related to the current global

uncertainties and crises, such as tariffs and surcharges; adverse

impacts to us, our suppliers and customers from acts of terrorism

or hostilities, including the conflicts between Russia and Ukraine

and in the Middle East, or political unrest, including the rising

tension between China and the United States; public health issues,

including the outbreak of infectious diseases and any impact on our

facilities and operations and our customers and suppliers; our

ability to meet various covenants, including financial covenants,

contained in the agreements governing our indebtedness;

disruptions, uncertainties or volatility in the credit markets that

may limit our access to capital; potential disruption due to a

partial or complete reconfiguration of the European Union;

increasingly stringent domestic and foreign governmental

regulations, including those affecting the environment or import

and export controls and other trade barriers; inherent

uncertainties involved in assessing our potential liability for

environmental remediation-related activities; the outcome of

pending and future litigation and other claims and disputes with

customers; our dependence on the automotive and heavy-duty truck

industries, which are highly cyclical; the dependence of the

automotive industry on consumer spending; our ability to negotiate

contracts with labor unions; our dependence on key management; our

dependence on information systems; our ability to continue to pay

cash dividends, and the timing and amount of any such dividends;

and the other factors we describe under "Item 1A. Risk Factors"

included in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2023. Any forward-looking statement speaks only

as of the date on which such statement is made, and we undertake no

obligation to update any forward-looking statement, whether as a

result of new information, future events or otherwise, except as

required by law. In light of these and other uncertainties, the

inclusion of a forward-looking statement herein should not be

regarded as a representation by us that our plans and objectives

will be achieved. The Company assumes no obligation to update the

information in this release.

Park-Ohio Holdings Corp. and

Subsidiaries

Condensed Consolidated

Statements of Income (Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(In millions, except per share

data)

Net sales

$

417.6

$

418.8

$

1,267.8

$

1,270.4

Cost of sales

345.3

348.8

1,050.9

1,063.1

Selling, general and administrative

expenses

47.8

43.0

142.3

135.1

Restructuring, acquisition-related and

other special charges

0.9

—

2.4

6.6

Gains on sales of assets

—

—

—

(0.8

)

Operating income

23.6

27.0

72.2

66.4

Other components of pension and other

postretirement benefits income, net

1.1

0.6

3.8

1.9

Interest expense, net

(12.1

)

(11.6

)

(36.0

)

(33.4

)

Income from continuing operations before

income taxes

12.6

16.0

40.0

34.9

Income tax benefit (expense)

0.6

(3.8

)

(5.3

)

(8.5

)

Income from continuing operations

13.2

12.2

34.7

26.4

Loss attributable to noncontrolling

interests

0.5

0.3

1.9

0.7

Income from continuing operations

attributable to Park-Ohio Holdings Corp. common shareholders

13.7

12.5

36.6

27.1

Loss from discontinued operations, net of

tax

(3.9

)

(1.4

)

(5.3

)

(4.8

)

Net income attributable to Park-Ohio

Holdings Corp. common shareholders

$

9.8

$

11.1

$

31.3

$

22.3

Income (loss) per common share

attributable to Park-Ohio Holdings Corp. common shareholders:

Basic:

Continuing operations

$

1.05

$

1.01

$

2.88

$

2.22

Discontinued operations

(0.30

)

(0.11

)

(0.42

)

(0.39

)

Total

$

0.75

$

0.90

$

2.46

$

1.83

Diluted:

Continuing operations

$

1.02

$

0.99

$

2.81

$

2.19

Discontinued operations

(0.29

)

(0.11

)

(0.41

)

(0.39

)

Total

$

0.73

$

0.88

$

2.40

$

1.80

Weighted-average shares used to compute

income (loss) per share:

Basic

13.1

12.4

12.7

12.2

Diluted

13.4

12.6

13.0

12.4

Dividends per common share

$

0.125

$

0.125

$

0.375

$

0.375

Other financial data:

EBITDA, as defined

$

38.5

$

38.5

$

115.2

$

104.8

Park-Ohio Holdings Corp. and

Subsidiaries Supplemental Non-GAAP Financial Measures

(Unaudited)

Adjusted earnings from continuing operations is a non-GAAP

financial measure that the Company is providing in this press

release. Adjusted earnings from continuing operations is income

from continuing operations calculated in accordance with generally

accepted accounting principles ("GAAP"), adjusted for special

items. The Company presents this non-GAAP financial measure because

management uses adjusted earnings from continuing operations to

compare its operating performance on a consistent basis over

multiple periods because they remove the impact of certain

significant noncash credits or charges and certain infrequent items

impacting net income. Adjusted earnings is not a measure of

performance under GAAP and should not be considered in isolation

from, or as a substitute for, income from continuing operations

calculated in accordance with GAAP. Adjusted income from continuing

operations herein may not be comparable to similarly titled

measures of other companies. The following table reconciles income

from continuing operations to adjusted earnings from continuing

operations:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Earnings

Diluted EPS

Earnings

Diluted EPS

Earnings

Diluted EPS

Earnings

Diluted EPS

(In millions, except for

earnings per share (EPS))

Income from continuing operations

attributable to Park-Ohio Holdings Corp. common shareholders

$

13.7

$

1.02

$

12.5

$

0.99

$

36.6

$

2.81

$

27.1

$

2.19

Adjustments:

Restructuring and other special

charges

0.9

0.07

—

—

2.1

0.16

6.5

0.52

Acquisition-related expenses

—

—

—

—

0.3

0.02

0.1

0.01

Gains on sales of assets

—

—

—

—

—

—

(0.8

)

(0.06

)

Tax effect of above adjustments

(0.3

)

(0.02

)

—

—

(0.7

)

(0.05

)

(1.3

)

(0.11

)

Non-controlling interest impact

—

—

—

—

(0.1

)

—

—

—

Adjusted earnings

$

14.3

$

1.07

$

12.5

$

0.99

$

38.2

$

2.94

$

31.6

$

2.55

The following table shows the impact of

these adjustments on our segment results (continuing

operations):

Cost of Sales

SG&A

Total

Cost of Sales

SG&A

Total

(In millions)

Three Months Ended September

30, 2024

Three Months Ended September

30, 2023

Supply Technologies

$

—

$

—

$

—

$

—

$

—

$

—

Assembly Components

—

0.5

0.5

—

—

—

Engineered Products

—

0.4

0.4

—

—

—

Corporate

—

—

—

—

—

—

Total continuing operations

$

—

$

0.9

$

0.9

$

—

$

—

$

—

Nine Months Ended September

30, 2024

Nine Months Ended September

30, 2023

Supply Technologies

$

—

$

0.2

$

0.2

$

—

$

0.2

$

0.2

Assembly Components

—

0.5

0.5

1.5

—

1.5

Engineered Products

—

1.7

1.7

0.2

4.7

4.9

Corporate

—

—

—

—

—

—

Total continuing operations

$

—

$

2.4

$

2.4

$

1.7

$

4.9

$

6.6

Park-Ohio Holdings Corp. and

Subsidiaries Supplemental Non-GAAP Financial Measures

(Unaudited)

EBITDA, as defined is a non-GAAP financial measure that the

Company is providing in this press release. EBITDA, as defined

reflects net income attributable to Park-Ohio Holdings Corp. common

shareholders before interest expense, income taxes, depreciation

and amortization, and also excludes certain charges and

corporate-level expenses as defined in the Company's current

revolving credit facility. The Company presents this non-GAAP

financial measure because management uses EBITDA, as defined to

assess the Company's performance and to calculate its debt service

coverage ratio under its current revolving credit facility. EBITDA,

as defined is not a measure of performance under GAAP and should

not be considered in isolation from, or as a substitute for, net

income or cash flow information calculated in accordance with GAAP.

EBITDA, as defined herein may not be comparable to similarly titled

measures of other companies. The following table reconciles net

income to EBITDA, as defined:

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(In millions)

Income from continuing operations

attributable to Park-Ohio Holdings Corp. common shareholders

$

13.7

$

12.5

$

36.6

$

27.1

Add back:

Interest expense, net

12.1

12.6

36.0

35.9

Income tax expense

—

3.0

5.3

6.3

Depreciation and amortization

8.5

7.9

25.2

23.4

Stock-based compensation expense

1.4

1.6

4.1

4.9

Restructuring, business optimization and

other costs

0.9

—

1.1

6.5

Acquisition-related expenses

—

—

0.3

0.1

EBITDA loss attributable to Designated

Subsidiary

1.9

1.2

6.5

2.0

Other

—

(0.3

)

0.1

(1.4

)

EBITDA, as defined

$

38.5

$

38.5

$

115.2

$

104.8

Note: Nine months ended may not equal the

sum of quarterly amounts due to defined calculation within

Park-Ohio Industries, Inc. Seventh Amended and Restated Credit

Agreement.

Park-Ohio Holdings Corp. and

Subsidiaries

Condensed Consolidated Balance

Sheets

(Unaudited)

September 30,

2024

December 31,

2023

(In millions)

ASSETS

Current assets:

Cash and cash equivalents

$

59.5

$

54.8

Accounts receivable, net

276.5

263.3

Inventories, net

430.8

411.1

Other current assets

119.2

95.2

Total current assets

886.0

824.4

Property, plant and equipment, net

187.9

184.9

Operating lease right-of-use assets

43.4

44.7

Goodwill

115.7

110.2

Intangible assets, net

74.4

73.3

Other long-term assets

99.2

103.2

Total assets

$

1,406.6

$

1,340.7

LIABILITIES AND SHAREHOLDERS'

EQUITY

Current liabilities:

Trade accounts payable

$

202.1

$

204.0

Current portion of long-term debt and

short-term debt

10.2

9.4

Current portion of operating lease

liabilities

11.6

10.6

Accrued expenses and other

137.4

139.6

Total current liabilities

361.3

363.6

Long-term liabilities, less current

portion:

Long-term debt

651.1

633.4

Long-term operating lease liabilities

32.1

34.4

Other long-term liabilities

19.1

19.4

Total long-term liabilities

702.3

687.2

Park-Ohio Holdings Corp. and Subsidiaries

shareholders' equity

335.9

280.4

Noncontrolling interests

7.1

9.5

Total equity

343.0

289.9

Total liabilities and shareholders'

equity

$

1,406.6

$

1,340.7

Park-Ohio Holdings Corp. and

Subsidiaries

Condensed Consolidated

Statements of Cash Flows (Unaudited)

Nine Months Ended September

30,

2024

2023

(In millions)

OPERATING ACTIVITIES FROM CONTINUING

OPERATIONS

Income from continuing operations

$

34.7

$

26.4

Adjustments to reconcile income from

continuing operations to net cash provided by operating activities

from continuing operations:

Depreciation and amortization

25.2

23.4

Stock-based compensation expense

4.1

4.9

Gain on sale of assets

—

(0.8

)

Changes in operating assets and

liabilities:

Accounts receivable

(7.9

)

(20.2

)

Inventories

(13.9

)

2.5

Prepaid and other current assets

(19.1

)

(30.8

)

Accounts payable and accrued expenses

(9.6

)

14.2

Other

(4.9

)

4.7

Net cash provided by operating activities

from continuing operations

8.6

24.3

INVESTING ACTIVITIES FROM CONTINUING

OPERATIONS

Purchases of property, plant and

equipment

(22.3

)

(20.8

)

Proceeds from sales of assets

—

2.0

Business acquisitions, net of cash

acquired

(11.0

)

(1.2

)

Net cash used in investing activities from

continuing operations

(33.3

)

(20.0

)

FINANCING ACTIVITIES FROM CONTINUING

OPERATIONS

Proceeds from revolving credit facility,

net

18.7

1.4

Proceeds from other debt, net

1.4

3.7

(Payments on) proceeds from finance lease

facilities, net

(1.7

)

0.3

Net proceeds from common stock

issuances

24.7

—

Payments related to prior acquisitions

(2.2

)

(2.1

)

Dividends

(5.4

)

(4.9

)

Payments of withholding taxes on share

awards

(2.4

)

(1.9

)

Net cash provided by (used in) financing

activities from continuing operations

33.1

(3.5

)

DISCONTINUED OPERATIONS:

Total used by operating activities

(4.1

)

(3.4

)

Total used by investing activities

—

(2.0

)

Total used by financing activities

—

(1.9

)

Decrease in cash and cash equivalents from

discontinued operations

(4.1

)

(7.3

)

Effect of exchange rate changes on

cash

0.4

(0.5

)

Increase (decrease) in cash and cash

equivalents

4.7

(7.0

)

Cash and cash equivalents at beginning of

period

54.8

58.2

Cash and cash equivalents at end of

period

$

59.5

$

51.2

Interest paid

$

29.9

$

29.6

Income taxes paid

$

8.5

$

7.1

Park-Ohio Holdings Corp. and

Subsidiaries

Business Segment Information

(Unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(In millions)

NET SALES OF CONTINUING OPERATIONS:

Supply Technologies

$

194.5

$

192.8

$

594.0

$

585.9

Assembly Components

98.7

108.4

309.0

330.8

Engineered Products

124.4

117.6

364.8

353.7

$

417.6

$

418.8

$

1,267.8

$

1,270.4

INCOME FROM CONTINUING OPERATIONS BEFORE

INCOME TAXES:

Supply Technologies

$

20.5

$

15.6

$

59.0

$

45.0

Assembly Components

6.1

11.2

21.6

26.9

Engineered Products

4.8

7.1

14.6

15.3

Total segment operating income

31.4

33.9

95.2

87.2

Corporate costs

(7.8

)

(6.9

)

(23.0

)

(21.6

)

Gains on sales of assets

—

—

—

0.8

Operating income

23.6

27.0

72.2

66.4

Other components of pension and other

postretirement benefits income, net

1.1

0.6

3.8

1.9

Interest expense, net

(12.1

)

(11.6

)

(36.0

)

(33.4

)

Income from continuing operations before

income taxes

$

12.6

$

16.0

$

40.0

$

34.9

Park-Ohio Holdings Corp. and

Subsidiaries Supplemental Non-GAAP Financial Measures

(Unaudited)

Adjusted segment operating income (loss) is a non-GAAP financial

measure that the Company is providing in this press release.

Adjusted segment operating income (loss) is calculated as segment

operating income (loss) plus adjustments for plant closure and

consolidation, severance and other. The Company presents this

non-GAAP financial measure because the business segments have

incurred significant restructuring and related expenses during the

year-to-date periods. Adjusted segment operating income (loss) is

not a measure of performance under GAAP and should not be

considered in isolation from, or as a substitute for, earnings in

accordance with GAAP. Adjusted segment operating income (loss)

herein may not be comparable to similarly titled measures of other

companies. The following table reconciles adjusted segment

operating income (loss) to segment operating income (loss):

Three Months Ended September

30,

2024

2023

(In millions)

As reported

Adjustments

As adjusted

As reported

Adjustments

As adjusted

Supply Technologies

$

20.5

$

—

$

20.5

$

15.6

$

—

$

15.6

Assembly Components

6.1

0.5

6.6

11.2

—

11.2

Engineered Products

4.8

0.4

5.2

7.1

—

7.1

Corporate

(7.8

)

—

(7.8

)

(6.9

)

—

(6.9

)

Operating income - continuing

operations

$

23.6

$

0.9

$

24.5

$

27.0

$

—

$

27.0

Nine Months Ended September

30,

2024

2023

(In millions)

As reported

Adjustments

As adjusted

As reported

Adjustments

As adjusted

Supply Technologies

$

59.0

$

0.2

$

59.2

$

45.0

$

0.2

$

45.2

Assembly Components

21.6

0.5

22.1

26.9

1.5

28.4

Engineered Products

14.6

1.7

16.3

15.3

4.9

20.2

Corporate

(23.0

)

—

(23.0

)

(21.6

)

—

(21.6

)

Gain on sale of assets

—

—

—

0.8

(0.8

)

—

Operating income - continuing

operations

$

72.2

$

2.4

$

74.6

$

66.4

$

5.8

$

72.2

Three Months Ended June

30,

2024

(In millions)

As reported

Adjustments

As adjusted

Assembly Components

$

6.9

$

—

$

6.9

Note: Amounts above include

non-controlling interest impact.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106228973/en/

MATTHEW V. CRAWFORD PARK-OHIO HOLDINGS CORP. (440) 947-2000

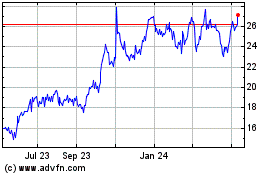

Park Ohio (NASDAQ:PKOH)

Historical Stock Chart

From Dec 2024 to Jan 2025

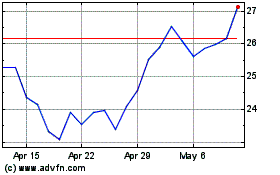

Park Ohio (NASDAQ:PKOH)

Historical Stock Chart

From Jan 2024 to Jan 2025