Noodles & Company (Nasdaq: NDLS) today announced financial

results for the fourth quarter and fiscal year ended

December 31, 2024, and provided a 2025 business outlook.

Key highlights for the

fourth quarter of

2024 compared to the fourth

quarter of 2023 include:

- Total revenue decreased 2.0% to

$121.8 million from $124.3 million.

- Comparable restaurant sales

increased 0.8% system-wide, including a 0.5% increase for

company-owned restaurants and a 1.9% increase for franchise

restaurants.

- Net loss was $9.7 million, or $0.21

loss per diluted share, compared to net loss of $6.1 million, or

$0.14 loss per diluted share.

- Operating margin was (6.0)%

compared to an operating margin of (3.7)%.

- Restaurant contribution margin(1)

was 11.2% compared to a restaurant contribution margin of

14.7%.

- Six company-owned restaurants

closed in the fourth quarter of 2024. One franchise restaurant

opened and three franchise restaurants closed in the fourth quarter

of 2024.

Key highlights for fiscal year 2024

compared to fiscal year 2023 include:

- Total revenue decreased 2.0% to

$493.3 million from $503.4 million.

- Comparable restaurant sales

decreased 1.5% system-wide, including a 1.8% decrease for

company-owned restaurants and a 0.2% decrease for franchise

restaurants.

- Net loss was $36.2 million, or

$0.80 loss per diluted share, compared to net loss of $9.9 million,

or $0.21 loss per diluted share.

- Operating margin was (5.6)%

compared to an operating margin of (1.0)%.

- Restaurant contribution margin(1)

was 13.2% compared to a restaurant contribution margin of

14.9%.

- Ten new company-owned restaurants

opened and thirteen closed in 2024. Three franchise restaurants

opened and seven closed in 2024. The Company sold six restaurants

to a franchisee in 2024. The Company had 463 restaurants at the end

of 2024, comprised of 371 company-owned and 92 franchise

restaurants.

_____________________(1) Restaurant

contribution margin is a non-GAAP measure. A reconciliation of

operating income (loss) to restaurant contribution is included in

the accompanying financial data. See “Non-GAAP Financial

Measures.”

Drew Madsen, Chief Executive Officer of Noodles

& Company, remarked, “Fourth quarter earnings reflected an

improvement over our third quarter trends driven by a combination

of factors, including the rollout of our three new menu items, the

promotional offers that we ran during the first two months of the

quarter, and the renewed momentum in our third-party delivery

channel. We are especially pleased to share that the previously

reported improving sales and traffic trends during the fourth

quarter of 2024 have accelerated in the first quarter of 2025.

Through the first eight weeks of the first quarter of 2025, we have

delivered positive traffic and comparable restaurant sales growth

over 3%, which is in-line with our expectations for the full

quarter. This gives us great confidence that our five strategic

priorities to reignite profitable growth are working. Next week we

will launch the most substantial phase of our comprehensive menu

transformation with the addition of nine new dishes supported by

increased marketing investment and a new brand strategy. It is an

exciting time for Noodles as the sales improvements we have seen

starting in the fourth quarter of 2024 combined with our menu

re-launch have set the stage for a transformational 2025.”

Liquidity Update

As of December 31, 2024, the Company had

available cash and cash equivalents of $1.1 million and outstanding

debt of $103.0 million. As of December 31, 2024, the Company

had $19.0 million available for future borrowings under its

revolving credit facility.

Business Outlook

The Company is providing the following

expectations for the full fiscal year 2025:

- Total revenue of $503 million to

$512 million, including mid-single digit comparable restaurant

sales growth;

- Restaurant level contribution

margins of 12.5% to 14.0%;

- General and administrative expenses

of $49 million to $52 million, inclusive of stock-based

compensation expense of approximately $3.7 million;

- Depreciation and amortization of

$27 million to $29 million;

- Net interest expense of $8 million

to $10 million;

- New restaurant openings: two

company-owned;

- Restaurant closures: 12 to 15

company-owned restaurants and four franchised restaurants; and

- Capital expenditures of $11 million

to $13 million.

The Company believes that a quantitative

reconciliation of the Company’s non-GAAP financial measures

guidance to the most comparable financial measures calculated and

presented in accordance with GAAP cannot be made available without

unreasonable efforts. A reconciliation of these non-GAAP

financial measures would require the Company to provide guidance

for various reconciling items that are outside of the Company’s

control and cannot be reasonably predicted due to the fact that

these items could vary significantly from period to period. A

reconciliation of certain non-GAAP financial measures would also

require the Company to predict the timing and likelihood of

outcomes that determine future impairments and the tax benefit

thereof. None of these measures, nor their probable

significance, can be reliably quantified. These non-GAAP financial

measures have limitations as analytical financial measures, as

discussed below in the section entitled “Non-GAAP Financial

Measures.” In addition, the guidance with respect to non-GAAP

financial measures is a forward-looking statement, which by its

nature involves risks and uncertainties that could cause actual

results to differ materially from the Company’s forward-looking

statement, as discussed below in the section entitled

“Forward-Looking Statements.”

Key Definitions

Average Unit Volumes —

represent the average annualized sales of all company-owned

restaurants for a given time period. AUVs are calculated by

dividing restaurant revenue by the number of operating days within

each time period and multiplying by the number of operating days we

have in a typical year. Based on this calculation, temporarily

closed restaurants are excluded from the definition of AUV, however

restaurants with temporarily reduced operating hours are included.

This measurement allows management to assess changes in consumer

traffic and per person spending patterns at our restaurants. In

addition to the factors that impact comparable restaurant sales,

AUVs can be further impacted by effective real estate site

selection and maturity and trends within new markets.

Comparable Restaurant Sales —

represents year-over-year sales comparisons for the comparable

restaurant base open for at least 18 full periods. This measure

highlights performance of existing restaurants, as the impact of

new restaurant openings is excluded. Changes in comparable

restaurant sales are generated by changes in traffic, which we

calculate as the number of entrées sold and changes in per-person

spend, calculated as sales divided by traffic.

Restaurant Contribution and Restaurant

Contribution Margin — restaurant contribution represents

restaurant revenue less restaurant operating costs, which are costs

of sales, labor, occupancy and other restaurant operating items.

Restaurant contribution margin represents restaurant contribution

as a percentage of restaurant revenue. Restaurant contribution and

restaurant contribution margin are presented because they are

widely-used metrics within the restaurant industry to evaluate

restaurant-level productivity, efficiency and performance.

Management also uses restaurant contribution and restaurant

contribution margin as metrics to evaluate the profitability of

incremental sales at our restaurants, restaurant performance across

periods, and restaurant financial performance compared with

competitors. See “Non-GAAP Financial Measures” below.

EBITDA and Adjusted EBITDA —

EBITDA represents net income (loss) before interest expense,

provision (benefit) for income taxes and depreciation and

amortization. Adjusted EBITDA represents net income (loss) before

interest expense, provision (benefit) for income taxes,

depreciation and amortization, restaurant impairments, loss on

disposal of assets, net lease exit costs (benefits), gain (loss) on

sale of restaurants, severance and executive transition costs and

stock-based compensation. EBITDA and Adjusted EBITDA are presented

because: (i) management believes they are useful measures for

investors to assess the operating performance of our business

without the effect of non-cash charges such as depreciation and

amortization expenses and restaurant impairments, asset disposals

and closure costs, and (ii) management uses them internally as a

benchmark for certain of our cash incentive plans and to evaluate

our operating performance or compare performance to that of

competitors. See “Non-GAAP Financial Measures” below.

Adjusted Net Income (Loss) —

represents net income (loss) before restaurant impairments, net

lease exit costs (benefits), gain( (loss) on sale of restaurants,

severance and executive transition costs and loss on debt

modifications and the tax effects of such adjustments. Adjusted net

income (loss) is presented because management believes it helps

convey supplemental information to investors regarding the

Company’s performance, excluding the impact of special items that

affect the comparability of results in past quarters and expected

results in future quarters. See “Non-GAAP Financial Measures”

below.

Conference Call

Noodles & Company will host a conference

call to discuss its fourth quarter and fiscal year 2024 financial

results on Thursday, March 6, 2025 at 4:30 p.m. EST. The

conference call can be accessed live over the phone by dialing

201-389-0920. A replay will be available after the call and can be

accessed by dialing 412-317-6671; the passcode is 13750888. The

replay will be available until Thursday, March 20, 2025. The

conference call will also be webcast live from the Company’s

corporate website at investor.noodles.com, under the “Events &

Presentations” page. An archive of the webcast will be available at

the same location on the corporate website shortly after the call

has concluded.

Non-GAAP Financial Measures

To supplement its condensed consolidated

financial statements, which are prepared and presented in

accordance with accounting principles generally accepted in the

United States of America (“GAAP”), the Company uses the following

non-GAAP financial measures: EBITDA, adjusted EBITDA, adjusted net

income (loss), adjusted earnings (loss) per share, restaurant

contribution and restaurant contribution margin (collectively, the

“non-GAAP financial measures”). The presentation of this financial

information is not intended to be considered in isolation or as a

substitute for, or to be superior to, the financial information

prepared and presented in accordance with GAAP. The Company uses

these non-GAAP financial measures for financial and operational

decision making and as a means to evaluate period-to-period

comparisons. The Company believes that they provide useful

information about operating results, enhance the overall

understanding of past financial performance and future prospects

and allow for greater transparency with respect to key metrics used

by management in its financial and operational decision making.

However, the Company recognizes that non-GAAP financial measures

have limitations as analytical financial measures. The Company

compensates for these limitations by relying primarily on its GAAP

results and using non-GAAP metrics only supplementally. There are

numerous of these limitations, including that: adjusted EBITDA does

not reflect the Company’s capital expenditures or future

requirements for capital expenditures; adjusted EBITDA does not

reflect interest expense or the cash requirements necessary to

service interest or principal payments, associated with our

indebtedness; adjusted EBITDA does not reflect depreciation and

amortization, which are non-cash charges, although the assets being

depreciated and amortized will likely have to be replaced in the

future, and do not reflect cash requirements for such replacements;

adjusted EBITDA does not reflect the cost of stock-based

compensation; adjusted EBITDA does not reflect changes in, or cash

requirements for, our working capital needs; adjusted net income

(loss) does not reflect cash expenditures, or future requirements,

for lease termination payments and certain other expenses

associated with reduced new restaurant development; and restaurant

contribution and restaurant contribution margin are not reflective

of the underlying performance of our business because

corporate-level expenses are excluded from these measures. When

analyzing the Company’s operating performance, investors should not

consider non-GAAP financial metrics in isolation or as substitutes

for net income (loss) or cash flow from operations, or other

statement of operations or cash flow statement data prepared in

accordance with GAAP. The non-GAAP financial measures used by the

Company in this press release may be different from the measures

used by other companies.

For more information on the non-GAAP financial

measures, please see the “Reconciliation of Non-GAAP Measurements

to GAAP Results” tables in this press release. These accompanying

tables have more details on the GAAP financial measures that are

most directly comparable to non-GAAP financial measures and the

related reconciliations between these financial measures.

About Noodles & Company

Since 1995, Noodles & Company has been

serving guests Uncommon Goodness, offering globally inspired

flavors and classic comfort dishes. From indulgent Wisconsin Mac

& Cheese to craveable Japanese Pan Noodles, Noodles &

Company delivers a world of flavor in every bowl. With over 460

restaurants and 7,000 passionate team members, the brand is

committed to nourishing and inspiring every guest who walks through

its doors. To learn more or find the location nearest you, visit

www.noodles.com.

Forward-Looking Statements

In addition to historical information, this

press release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995

that involve risks and uncertainties such as the number of

restaurants we intend to open, projected capital expenditures and

estimates of our effective tax rates. In some cases, you can

identify forward-looking statements by terms such as “may,”

“might,” “will,” “objective,” “intend,” “should,” “could,” “can,”

“would,” “expect,” “believe,” “design,” “estimate,” “predict,”

“potential,” “plan” or the negative of these terms and similar

expressions intended to identify forward-looking statements. These

statements reflect our current views with respect to future events

and are based on currently available operating, financial and

competitive information. Examples of forward-looking statements

include all matters that are not historical facts, such as

statements regarding expectations with respect to our business

strategy and priorities, unit growth and planned restaurant

openings, projected capital expenditures, potential volatility

through 2024 due to the current high inflationary environment,

including the effects on consumer sentiment and behavior, and all

of the statements within “Business Outlook.” Our actual results may

differ materially from those anticipated in these forward-looking

statements due to reasons including, but not limited to, our

ability to execute on our strategic priorities; our ability to

sustain our overall growth, including, our digital sales growth;

our ability to open new restaurants on schedule and cause those

newly opened restaurants to be successful; our ability to achieve

and maintain increases in comparable restaurant sales and to

successfully execute our business strategy, including new

restaurant initiatives and operational strategies to improve the

performance of our restaurant portfolio; the success of our

marketing efforts, including our ability to introduce new products

and pricing strategies; economic conditions including any impact

from inflation, an economic recession or a high interest rate

environment; price and availability of commodities and other supply

chain challenges; our ability to adequately staff our restaurants;

changes in labor costs; our ability to qualify for continued

listing on the Nasdaq Global Select Market; other conditions beyond

our control such as weather, natural disasters, disease outbreaks,

epidemics or pandemics impacting our customers or food supplies;

and consumer reaction to industry related public health issues and

health pandemics, including perceptions of food safety. For

additional information on these and other factors that could affect

the Company’s forward-looking statements, see the Company’s risk

factors, as they may be amended from time to time, set forth in its

filings with the SEC, included in our Annual Report on Form 10-K

and Quarterly Reports on Form 10-Q. The Company disclaims and does

not undertake any obligation to update or revise any

forward-looking statement in this press release, except as may be

required by applicable law or regulation.

|

Noodles & CompanyConsolidated

Statements of Operations(in thousands, except

share and per share data, unaudited) |

| |

| |

Fiscal Quarter Ended |

|

Fiscal Year Ended |

| |

December 31,2024 |

|

January 2,2024 |

|

December 31,2024 |

|

January 2,2024 |

| Revenue: |

|

|

|

|

|

|

|

|

Restaurant revenue |

$ |

119,200 |

|

|

$ |

121,819 |

|

|

$ |

483,097 |

|

|

$ |

492,648 |

|

|

Franchise royalties and fees, and other |

|

2,574 |

|

|

|

2,501 |

|

|

|

10,174 |

|

|

|

10,757 |

|

|

Total revenue |

|

121,774 |

|

|

|

124,320 |

|

|

|

493,271 |

|

|

|

503,405 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

Restaurant operating costs (exclusive of depreciation and

amortization shown separately below): |

|

|

|

|

|

|

|

|

Cost of sales |

|

32,469 |

|

|

|

30,920 |

|

|

|

123,692 |

|

|

|

124,102 |

|

|

Labor |

|

38,467 |

|

|

|

38,982 |

|

|

|

154,258 |

|

|

|

157,608 |

|

|

Occupancy |

|

11,381 |

|

|

|

11,574 |

|

|

|

46,366 |

|

|

|

45,925 |

|

|

Other restaurant operating costs |

|

23,518 |

|

|

|

22,396 |

|

|

|

95,032 |

|

|

|

91,559 |

|

|

General and administrative |

|

11,321 |

|

|

|

13,865 |

|

|

|

50,824 |

|

|

|

51,833 |

|

|

Depreciation and amortization |

|

7,081 |

|

|

|

7,479 |

|

|

|

29,066 |

|

|

|

26,792 |

|

|

Pre-opening |

|

121 |

|

|

|

573 |

|

|

|

1,543 |

|

|

|

2,215 |

|

|

Restaurant impairments, closure costs and asset disposals |

|

4,780 |

|

|

|

3,087 |

|

|

|

20,268 |

|

|

|

8,400 |

|

|

Total costs and expenses |

|

129,138 |

|

|

|

128,876 |

|

|

|

521,049 |

|

|

|

508,434 |

|

| Loss from operations |

|

(7,364 |

) |

|

|

(4,556 |

) |

|

|

(27,778 |

) |

|

|

(5,029 |

) |

| Interest expense, net |

|

2,323 |

|

|

|

1,602 |

|

|

|

8,381 |

|

|

|

4,803 |

|

| Loss before income taxes |

|

(9,687 |

) |

|

|

(6,158 |

) |

|

|

(36,159 |

) |

|

|

(9,832 |

) |

| Provision for (benefit from)

income taxes |

|

6 |

|

|

|

(21 |

) |

|

|

54 |

|

|

|

24 |

|

| Net loss |

$ |

(9,693 |

) |

|

$ |

(6,137 |

) |

|

$ |

(36,213 |

) |

|

$ |

(9,856 |

) |

| Loss per share, combined |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.21 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.80 |

) |

|

$ |

(0.21 |

) |

|

Diluted |

$ |

(0.21 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.80 |

) |

|

$ |

(0.21 |

) |

| Weighted average common shares

outstanding |

|

|

|

|

|

|

|

|

Basic |

|

45,692,943 |

|

|

|

44,955,913 |

|

|

|

45,465,727 |

|

|

|

45,863,719 |

|

|

Diluted |

|

45,692,943 |

|

|

|

44,955,913 |

|

|

|

45,465,727 |

|

|

|

45,863,719 |

|

|

Noodles & CompanyConsolidated

Selected Balance Sheet Data and Selected Operating

Data(in thousands, except restaurant activity,

unaudited) |

| |

| |

As of |

| |

December 31,2024 |

|

January 2,2024 |

| Balance Sheet

Data |

|

|

Total current assets |

$ |

20,192 |

|

|

$ |

22,624 |

| Total assets |

|

324,648 |

|

|

|

368,095 |

| Total current liabilities |

|

65,717 |

|

|

|

67,514 |

| Total long-term debt |

|

100,742 |

|

|

|

80,218 |

| Total liabilities |

|

330,227 |

|

|

|

340,935 |

| Total stockholders’ (deficit)

equity |

|

(5,579 |

) |

|

|

27,160 |

| |

Fiscal Quarter Ended |

| |

December 31,2024 |

|

October 1,2024 |

|

July 2,2024 |

|

April 2,2024 |

|

January 2,2024 |

| Selected Operating

Data |

|

| Restaurant Activity: |

|

|

|

|

|

|

|

|

|

|

|

|

Company-owned restaurants at end of period |

|

371 |

|

|

|

377 |

|

|

|

379 |

|

|

|

380 |

|

|

|

380 |

|

|

Franchise restaurants at end of period |

|

92 |

|

|

|

94 |

|

|

|

94 |

|

|

|

89 |

|

|

|

90 |

|

| Revenue Data: |

|

|

|

|

|

|

|

|

|

|

|

|

Company-owned average unit volumes |

$ |

1,310 |

|

|

$ |

1,272 |

|

|

$ |

1,322 |

|

|

$ |

1,253 |

|

|

$ |

1,314 |

|

|

Franchise average unit volumes |

$ |

1,292 |

|

|

$ |

1,243 |

|

|

$ |

1,300 |

|

|

$ |

1,223 |

|

|

$ |

1,232 |

|

|

Company-owned comparable restaurant sales |

|

0.5 |

% |

|

|

(3.4 |

)% |

|

|

1.3 |

% |

|

|

(5.7 |

)% |

|

|

(4.3 |

)% |

|

Franchise comparable restaurant sales |

|

1.9 |

% |

|

|

(2.9 |

)% |

|

|

4.7 |

% |

|

|

(4.5 |

)% |

|

|

(3.6 |

)% |

|

System-wide comparable restaurant sales |

|

0.8 |

% |

|

|

(3.3 |

)% |

|

|

2.0 |

% |

|

|

(5.4 |

)% |

|

|

(4.2 |

)% |

Reconciliations of Non-GAAP Measurements

to GAAP Results

|

Noodles & CompanyReconciliation

of Net Loss to EBITDA and Adjusted EBITDA(in

thousands, unaudited) |

| |

| |

Fiscal Quarter Ended |

|

Fiscal Year Ended |

| |

December 31,2024 |

|

January 2,2024 |

|

December 31,2024 |

|

January 2,2024 |

|

Net loss |

$ |

(9,693 |

) |

|

$ |

(6,137 |

) |

|

$ |

(36,213 |

) |

|

$ |

(9,856 |

) |

| Depreciation and

amortization |

|

7,081 |

|

|

|

7,479 |

|

|

|

29,066 |

|

|

|

26,792 |

|

| Interest expense, net |

|

2,323 |

|

|

|

1,602 |

|

|

|

8,381 |

|

|

|

4,803 |

|

| Provision for (benefit from)

income taxes |

|

6 |

|

|

|

(21 |

) |

|

|

54 |

|

|

|

24 |

|

| EBITDA |

$ |

(283 |

) |

|

$ |

2,923 |

|

|

$ |

1,288 |

|

|

$ |

21,763 |

|

| Restaurant impairments(1) |

|

2,178 |

|

|

|

1,747 |

|

|

|

13,441 |

|

|

|

2,987 |

|

| Loss on disposal of

assets |

|

1,031 |

|

|

|

597 |

|

|

|

3,079 |

|

|

|

1,979 |

|

| Lease exit costs, net |

|

546 |

|

|

|

66 |

|

|

|

924 |

|

|

|

396 |

|

| Gain on sale of

restaurants |

|

— |

|

|

|

— |

|

|

|

(490 |

) |

|

|

— |

|

| Severance and executive

transition costs |

|

201 |

|

|

|

1,368 |

|

|

|

1,677 |

|

|

|

1,559 |

|

| Stock-based compensation

expense |

|

339 |

|

|

|

765 |

|

|

|

3,680 |

|

|

|

4,346 |

|

| Adjusted EBITDA |

$ |

4,012 |

|

|

$ |

7,466 |

|

|

$ |

23,599 |

|

|

$ |

33,030 |

|

______________________________(1) Restaurant

impairments in all periods presented above include amounts related

to restaurants previously impaired.

EBITDA and adjusted EBITDA are supplemental

measures of operating performance that do not represent and should

not be considered as alternatives to net income (loss) or cash flow

from operations, as determined by GAAP, and our calculation thereof

may not be comparable to that reported by other companies. These

measures are presented because we believe that investors’

understanding of our performance is enhanced by including these

non-GAAP financial measures as a reasonable basis for evaluating

our ongoing results of operations.

EBITDA is calculated as net income (loss) before

interest expense, provision (benefit) for income taxes and

depreciation and amortization. Adjusted EBITDA further adjusts

EBITDA to reflect the eliminations shown in the table above.

EBITDA and adjusted EBITDA are presented

because: (i) we believe they are useful measures for investors

to assess the operating performance of our business without the

effect of non-cash charges such as depreciation and amortization

expenses and restaurant impairments, gain (loss) on disposal of

assets, net lease exit costs (benefits), loss on sale of

restaurants and (ii) we use adjusted EBITDA internally as a

benchmark for certain of our cash incentive plans and to evaluate

our operating performance or compare our performance to that of our

competitors. The use of adjusted EBITDA as a performance measure

permits a comparative assessment of our operating performance

relative to our performance based on our GAAP results, while

isolating the effects of some items that vary from period to period

without any correlation to core operating performance or that vary

widely among similar companies. Companies within our industry

exhibit significant variations with respect to capital structures

and cost of capital (which affect interest expense and income tax

rates) and differences in book depreciation of property, plant and

equipment (which affect relative depreciation expense), including

significant differences in the depreciable lives of similar assets

among various companies. Our management believes that adjusted

EBITDA facilitates company-to-company comparisons within our

industry by eliminating some of these foregoing variations.

Adjusted EBITDA as presented may not be comparable to other

similarly-titled measures of other companies, and our presentation

of adjusted EBITDA should not be construed as an inference that our

future results will be unaffected by excluded or unusual items.

|

Noodles & CompanyReconciliation

of Net Loss to Adjusted Net

Loss(in thousands, except share and per share

data, unaudited) |

| |

| |

Fiscal Quarter Ended |

|

Fiscal Year Ended |

| |

December 31,2024 |

|

January 2,2024 |

|

December 31,2024 |

|

January 2,2024 |

|

Net loss |

$ |

(9,693 |

) |

|

$ |

(6,137 |

) |

|

$ |

(36,213 |

) |

|

$ |

(9,856 |

) |

| Restaurant impairments(1) |

|

2,178 |

|

|

|

1,747 |

|

|

|

13,441 |

|

|

|

2,987 |

|

| Lease exit costs, net |

|

546 |

|

|

|

66 |

|

|

|

924 |

|

|

|

396 |

|

| Gain on sale of

restaurants |

|

— |

|

|

|

— |

|

|

|

(490 |

) |

|

|

— |

|

| Severance and executive

transition costs |

|

201 |

|

|

|

1,368 |

|

|

|

1,677 |

|

|

|

1,559 |

|

| Tax effect of

adjustments(2) |

|

46 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Adjusted net loss |

$ |

(6,722 |

) |

|

$ |

(2,956 |

) |

|

$ |

(20,661 |

) |

|

$ |

(4,914 |

) |

| |

|

|

|

|

|

|

|

| Loss per share |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.21 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.80 |

) |

|

$ |

(0.21 |

) |

|

Diluted |

$ |

(0.21 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.80 |

) |

|

$ |

(0.21 |

) |

| Adjusted loss per share |

|

|

|

|

|

|

|

|

Basic |

$ |

(0.15 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.45 |

) |

|

$ |

(0.11 |

) |

|

Diluted |

$ |

(0.15 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.45 |

) |

|

$ |

(0.11 |

) |

| Weighted average common shares

outstanding |

|

|

|

|

|

|

|

|

Basic |

|

45,692,943 |

|

|

|

44,955,913 |

|

|

|

45,465,727 |

|

|

|

45,863,719 |

|

|

Diluted |

|

45,692,943 |

|

|

|

44,955,913 |

|

|

|

45,465,727 |

|

|

|

45,863,719 |

|

_____________________________Adjusted net income

(loss) is a supplemental measure of financial performance that is

not required by or presented in accordance with GAAP. We define

adjusted net income (loss) as net income (loss) before restaurant

impairments, net lease exit costs (benefits), gain (loss) on sale

of restaurants, severance and executive transition costs and loss

on debt modification, and the tax effects of such adjustments.

Adjusted net income (loss) is presented because management believes

it helps convey supplemental information to investors regarding our

performance, excluding the impact of special items that affect the

comparability of results in past quarters to expected results in

future quarters. Adjusted net income (loss) as presented may not be

comparable to other similarly-titled measures of other companies,

and our presentation of adjusted net income (loss) should not be

construed as an inference that our future results will be

unaffected by excluded or unusual items. Our management uses this

non-GAAP financial measure to analyze changes in our underlying

business from quarter to quarter based on comparable financial

results.

(1) Restaurant impairments in all periods

presented above include amounts related to restaurants previously

impaired.

(2) The tax impact of the other

adjustments is immaterial while the Company has a full valuation

allowance and significant net operating losses.

|

Noodles & CompanyReconciliation

of Operating Loss to Restaurant Contribution (in

thousands, unaudited) |

| |

| |

Fiscal Quarter Ended |

|

Fiscal Year Ended |

| |

December 31,2024 |

|

January 2,2024 |

|

December 31,2024 |

|

January 2,2024 |

|

Loss from operations |

$ |

(7,364 |

) |

|

$ |

(4,556 |

) |

|

$ |

(27,778 |

) |

|

$ |

(5,029 |

) |

| Less: Franchising royalties

and fees |

|

2,574 |

|

|

|

2,501 |

|

|

|

10,174 |

|

|

|

10,757 |

|

| Plus: General and

administrative |

|

11,321 |

|

|

|

13,865 |

|

|

|

50,824 |

|

|

|

51,833 |

|

|

Depreciation and amortization |

|

7,081 |

|

|

|

7,479 |

|

|

|

29,066 |

|

|

|

26,792 |

|

|

Pre-opening |

|

121 |

|

|

|

573 |

|

|

|

1,543 |

|

|

|

2,215 |

|

|

Restaurant impairments, closure costs and asset disposals |

|

4,780 |

|

|

|

3,087 |

|

|

|

20,268 |

|

|

|

8,400 |

|

| Restaurant contribution |

$ |

13,365 |

|

|

$ |

17,947 |

|

|

$ |

63,749 |

|

|

$ |

73,454 |

|

| |

|

|

|

|

|

|

|

| Restaurant contribution

margin |

|

11.2 |

% |

|

|

14.7 |

% |

|

|

13.2 |

% |

|

|

14.9 |

% |

_____________________________Restaurant

contribution represents restaurant revenue less restaurant

operating costs, which are the cost of sales, labor, occupancy and

other operating items. Restaurant contribution margin represents

restaurant contribution as a percentage of restaurant revenue.

Restaurant contribution and restaurant contribution margin are

non-GAAP measures that are neither required by, nor presented in

accordance with GAAP, and the calculations thereof may not be

comparable to similar measures reported by other companies. These

measures are supplemental measures of the operating performance of

our restaurants and are not reflective of the underlying

performance of our business because corporate-level expenses are

excluded from these measures.

Restaurant contribution and restaurant

contribution margin have limitations as analytical tools and should

not be considered in isolation or as substitutes for analysis of

our results as reported under GAAP. Management does not consider

these measures in isolation or as an alternative to financial

measures determined in accordance with GAAP. However, management

believes that restaurant contribution and restaurant contribution

margin are important tools for investors and other interested

parties because they are widely-used metrics within the restaurant

industry to evaluate restaurant-level productivity, efficiency and

performance. Management also uses these measures as metrics to

evaluate the profitability of incremental sales at our restaurants,

restaurant performance across periods, and restaurant financial

performance compared with competitors.

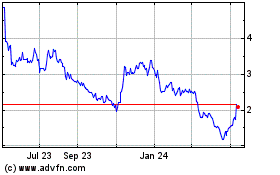

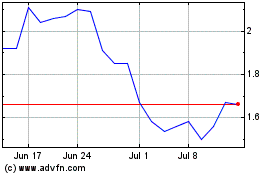

Noodles (NASDAQ:NDLS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Noodles (NASDAQ:NDLS)

Historical Stock Chart

From Mar 2024 to Mar 2025