National Beverage Corp.

Vote FOR: Proxy Ballot Item #2

“Disclose Environmental, Governance, & Social (ESG) Reporting”

Annual Meeting: October 4th, 2024

CONTACT: Christopher

Richardson, Mercy Investment Services | crichardson@Mercyinvestments.org

Written materials are submitted pursuant to Rule 14a-6(g)

(1) promulgated under the Securities Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule but is

made voluntarily in the interest of public disclosure and consideration of these important issues.

Mercy Investment Services (“the Proponents”

or “we”) seek your support for Item #2:

Disclose Environmental, Social, and Governance (ESG) Reporting on The National Beverage Corp. (“National Beverage) 2024 proxy

ballot. The resolved clause states:

RESOLVED: Shareholders request that National

Beverage Corp. commits to the annual preparation and disclosure of a comprehensive ESG report detailing the company’s ESG strategies,

practices, and performance metrics. This report should include, but not be limited to, governance structures, environmental impacts (including

water and emissions management), and social practices (such as labor standards and workplace safety).

For the following reasons, we believe National Beverage

should disclose ESG Reporting and urge National Beverage investors to vote FOR PROPOSAL 2:

| 1. | Enhancing competitive position and addressing market disadvantages |

| 2. | Mitigating regulatory and compliance risks |

| 3. | Improving operational efficiency and cost management |

RATIONALE FOR A “YES” VOTE

| 1. | Enhancing competitive position and addressing market disadvantages |

In today’s market, National Beverage faces intense competition

from larger companies that have adopted comprehensive ESG reporting, which is increasingly viewed as an indicator of a company’s

long-term viability and ethical operations. By committing to annual ESG disclosure, National Beverage can significantly enhance its brand

reputation, demonstrating a commitment to transparency that is highly valued by consumers and investors alike. This step would align us

with industry leaders and enable us to compete more effectively on both a national and global scale.

The trend among investors is clear: there is a growing allocation of

capital towards companies that demonstrate robust and transparent ESG practices. According to the Global Sustainable Investment Alliance,

sustainable investment assets reached $35.3 trillion in 2020, showcasing a growing trend among investors to allocate capital towards companies

with robust ESG frameworks.1 By implementing ESG reporting, National Beverage would not only provide current investors with

reassurance of the Company's dedication to sustainable and ethical business practices but also attract new capital from rapidly growing

ESG-focused funds. These funds often control significant investment capital and seek to invest in companies with strong ESG frameworks,

potentially leading to higher valuation premiums and increased stock liquidity.

Furthermore, the investor community increasingly equates sustainability

with lower financial risk and improved returns, as companies with strong ESG records tend to exhibit better operational performance and

less volatility. For example, a study by MSCI found that companies with strong ESG ratings outperformed their peers in financial returns

and had lower risk profiles.2 For National Beverage, adopting ESG reporting could open doors to new markets and customer segments,

particularly among the younger, more environmentally and socially conscious consumers. This shift could catalyze a broader market share

and fortify the Company’s competitive position in the fast-evolving beverage industry.

| 2. | Mitigating regulatory and compliance risks |

Regulatory environments across the

globe are rapidly evolving, with an increasing focus on sustainability reporting and corporate accountability. Proactive ESG disclosures

will prepare National Beverage to efficiently meet these changing requirements, reducing the risk of penalties and fines associated with

non-compliance. By leading in transparency, we can avoid the disruptive impacts of regulatory changes and position the Company as an industry

leader in corporate responsibility.

Detailed ESG reporting demonstrates

a company's commitment to upholding high standards in environmental stewardship, social responsibility, and governance. For National Beverage,

this could mean enhanced compliance with environmental regulations, labor laws, and safety standards. It would provide a clear framework

for addressing these issues systematically and proactively, which could prevent potential legal and financial repercussions. This approach

not only protects the company but also builds trust with regulators, potentially easing the burden of future regulatory challenges.

Moreover, by documenting and publicly

disclosing adherence to these standards, National Beverage can cultivate a corporate culture that prioritizes ethical practices and compliance.

This culture can lead to operational improvements and foster a more engaged and committed workforce. In turn, these internal enhancements

can reduce operational disruptions and foster a stable business environment, thereby protecting the Company from regulatory risks and

enhancing its reputation as a responsible business entity.

1 https://www.gsi-alliance.org/wp-content/uploads/2021/08/GSIR-20201.pdf

2

https://www.msci.com/esg-101-what-is-esg/esg-and-performance

| 3. | Improving Operational Efficiency and Cost Management |

The implementation of an ESG reporting framework at National Beverage

can significantly improve our operational efficiency by enabling us to better identify and manage environmental impacts and resource usage.

By systematically documenting these areas, we can detect inefficiencies and opportunities for improvement that may not be visible without

the structured inquiry that comes with ESG reporting. According to McKinsey & Company, companies with strong ESG profiles report up

to a 20% decrease in operational costs due to efficient resource management and reduced waste.3 This can lead to direct cost

savings, for example, through reduced energy consumption or more efficient waste management practices, which directly contribute to our

bottom line.

In addressing our limited pricing power and the efficiencies in our

supply chain, ESG reporting can serve as a crucial tool. Transparently displaying our efforts to optimize resource use and enhance environmental

stewardship can strengthen our position in negotiations with large retail customers. These customers are increasingly valuing sustainability

in their suppliers and may offer better terms or prioritization to companies that demonstrate these commitments. Moreover, ESG initiatives

can lead to innovations in product development and packaging, potentially opening new markets and customer segments that value eco-friendly

products.

Furthermore, ESG reporting enhances our labor relations and workforce

management, creating a more positive work environment and improving company culture. By publicly committing to and reporting on fair labor

practices and workplace safety, National Beverage can boost employee morale and attract talent who are looking for employers with a strong

record on these fronts. Research has found that employee morale was 55% better with companies with strong sustainability programs, compared

to poor ones, and employee loyalty was 38% better.4 This can reduce turnover rates, lower hiring, and training costs, and increase

overall productivity, which are critical factors in maintaining competitiveness in the industry.

Lastly, ESG reporting aids in managing our dependency on raw materials

and energy, which are significant operational costs. By disclosing our strategies for sourcing and using these resources sustainably,

we can not only mitigate risks associated with price volatility and supply disruptions but also position ourselves as a responsible company

committed to reducing our environmental footprint. This approach not only addresses potential vulnerabilities but also aligns with global

movements towards sustainability, positioning National Beverage as a forward-thinking leader in the beverage industry.

These combined efforts through ESG reporting can significantly enhance

our operational efficiencies, reduce costs, and improve our overall competitive stance in the market, delivering greater value to our

shareholders and other stakeholders. According to a 2021 survey by PwC, 83% of consumers think companies should be actively shaping ESG

best practices, and 72% of employees prefer to work for a company that is environmentally and socially responsible, highlighting the broad

support for these initiatives from both the market and the workforce.5

CONCLUSION

We believe National Beverage should disclose ESG reporting

because not only does it align with regulatory trends and enhances competitive positioning, but it also leads to substantial operational

efficiencies and cost savings. We urge shareholders to vote YES on this resolution.

3

https://www.mckinsey.com/~/media/McKinsey/Business%20Functions/Strategy%20and%20Corporate%20Finance/

Our%20Insights/Five%20ways%20that%20ESG%20creates%20value/Five-ways-that-ESG-creates-value.ashx

4

https://hbr.org/2016/10/the-comprehensive-business-case-for-sustainability

5

https://www.pwc.com/us/en/services/consulting/library/consumer-intelligence-series/consumer-and-employee-esg-expectations.html

Vote FOR

Item #2

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO SHAREHOLDERS

VIA TELEPHONE, U.S. MAIL, E-MAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE OR

AS A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY. THE COST OF DISSEMINATING THE FOREGOING INFORMATION TO SHAREHOLDERS IS BEING BORNE

ENTIRELY BY ONE OR MORE OF THE CO-FILERS. PROXY CARDS WILL NOT BE ACCEPTED BY ANY CO- FILER. PLEASE DO NOT SEND YOUR PROXY TO ANY CO-FILER.

TO VOTE YOUR PROXY, PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

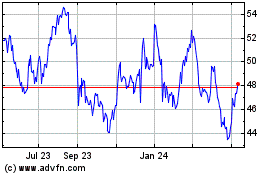

National Beverage (NASDAQ:FIZZ)

Historical Stock Chart

From Dec 2024 to Jan 2025

National Beverage (NASDAQ:FIZZ)

Historical Stock Chart

From Jan 2024 to Jan 2025