Current Report Filing (8-k)

June 08 2023 - 6:01AM

Edgar (US Regulatory)

0001844419

false

0001844419

2023-06-07

2023-06-07

0001844419

MAQC:UnitsEachConsistingOfOneShareOfClassCommonStockAndOnehalfOfOneRedeemableWarrantMember

2023-06-07

2023-06-07

0001844419

MAQC:ClassCommonStockParValue0.0001PerShareMember

2023-06-07

2023-06-07

0001844419

MAQC:RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfClassCommonStockFor11.50PerShareMember

2023-06-07

2023-06-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

June 7, 2023

Maquia Capital Acquisition Corporation

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40380 |

|

85-4283150 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

50 Biscayne Boulevard, Suite 2406

Miami, FL 33132

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (305) 608-1395

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one share of Class A Common Stock and one-half of one Redeemable Warrant |

|

MAQCU |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Class A Common Stock, par value $0.0001 per share |

|

MAQC |

|

The Nasdaq Stock Market LLC |

| |

|

|

|

|

| Redeemable warrants, each whole warrant exercisable for one share of Class A Common Stock for $11.50 per share |

|

MAQCW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 8.01. Other Events.

Overpayment in the

Redemption of the First Extension Redeeming Stockholders and Correction for the Overpayment Amount

On

November 4, 2022, Maquia Capital Acquisition Corporation, a Delaware corporation (the “Company”),

held a special meeting in lieu of the 2022 annual meeting of stockholders (the “First Extension Meeting”).

At the First Extension Meeting, the Company’s stockholders approved an amendment to the Company’s Amended and Restated Certificate

of Incorporation to extend the date by which the Company must consummate its initial business combination from November 7, 2022 to May

7, 2023. In connection with the First Extension Meeting, as set forth in the Company’s Current Report on Form 8-K filed with the

Securities and Exchange Commission (the “SEC”) on November 9, 2022, stockholders holding 13,769,910 shares of Class

A common stock (the “Public Shares”) exercised their right to redeem (the “First Extension Redeeming Stockholders”)

such shares for a pro rata portion of the funds in the Company’s trust account (“Trust Account”).

On

December 16, 2022, an initial redemption payment was made by Continental Stock Transfer & Trust Company (“CST”),

as trustee of the Trust Account, to the First Extension Redeeming Stockholders at a rate of $10.41858638 per Public Share to the First

Extension Redeeming Stockholders (the “First Redemption Payment”). It was later determined that the Company did not

withdraw all of the interest from the Trust Account that it was allowed to withdraw to cover income and franchise taxes and, therefore,

the First Redemption Payment should have been $10.40345615 per Public Share. This meant that the First Extension Redeeming Stockholders

were overpaid in the amount of $0.01513023 per Public Share (the “Overpayment Amount”).

The

First Extension Redeeming Stockholders are in the process of being notified of this situation and are being instructed to return

the Overpayment Amount to CST. Anyone with questions about the contents of this report, can reach out to CST at spacredemptions@continentalstock.com.

Second Extension Stockholder

Meeting and Per Share Redemption to be Paid to Second Extension Redeeming Stockholders

On

May 5, 2023, the Company held another special meeting of stockholders (the “Second Extension Meeting”). At the Second

Extension Meeting, the Company’s stockholders approved a second amendment to the Company’s Amended and Restated Certificate

of Incorporation to extend the date by which the Company must consummate its initial business combination from May 7, 2023 to February

7, 2024 (or such earlier date as determined by the Company’s board of directors). In connection with the

Second Extension Meeting, stockholders holding 2,449,091 Public Shares properly exercised their right to redeem (the “Second

Extension Redeeming Stockholders”) such shares for a pro rata portion of the funds in

the Company’s Trust Account.

After

taking into account an adjustment to the balance in the Trust Account for the Overpayment Amount as described above and an additional

tax withdrawal from the Trust Account for taxes payable since the First Extension Meeting, the per share redemption payment to be paid

to the Second Extension Redeeming Stockholders will be $10.83587186 per Public Share properly submitted for redemption (the “Second

Redemption Payment”). This Second Redemption Payment is approximately $0.07412814 less than the previously disclosed estimated

$10.91 redemption payment that was estimated to be made in connection with the Second Extension Meeting as set forth in the Company’s

Current Report on Form 8-K filed with the SEC on April 26, 2023. This difference between the amount of $10.91 estimated as of April 26,

2023 and the final Second Redemption Payment of $10.83587186 is, as noted above, due to both adjusting for the previously mentioned Overpayment

Amount and withdrawing an additional amount from the Trust Account to cover income and franchise taxes incurred by the Company

between the First Extension Meeting and the Second Extension Meeting. CST is in the process of making

the Second Redemption Payment to the Second Extension Redeeming Stockholders.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| Dated: June 7, 2023 |

Maquia Capital Acquisition Corporation |

| |

|

|

| |

By: |

/s/ Jeronimo Peralta |

| |

|

Name: |

Jeronimo Peralta |

| |

|

Title: |

Chief Financial Officer |

2

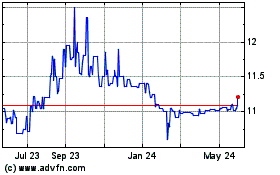

Maquia Capital Acquisition (NASDAQ:MAQC)

Historical Stock Chart

From Oct 2024 to Nov 2024

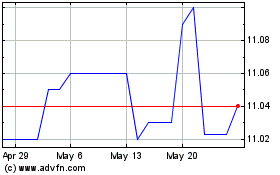

Maquia Capital Acquisition (NASDAQ:MAQC)

Historical Stock Chart

From Nov 2023 to Nov 2024