UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of December 2024

Commission

File No. 001-41010

MAINZ

BIOMED N.V.

(Translation

of registrant’s name into English)

Robert

Koch Strasse 50

55129 Mainz

Germany

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form

20-F ☒ Form 40-F ☐

Entry

into a Material Agreement

On

December 12, 2024, Mainz Biomed N.V. (the “Company”) and an institutional investor (the “Purchaser”) entered

into a securities purchase agreement (the “SPA”), pursuant to which the Company sold to the Purchaser (i) 220,165 ordinary

units, with each ordinary unit consisting of one ordinary share, one class A warrant to purchase one ordinary share (the “Class

A Warrant”), and one class B warrant to purchase one ordinary share (the “Class B Warrant”), and (ii) 1,147,356 pre-funded

units with each pre-funded unit consisting of one pre-funded warrant to purchase one ordinary share, one Class A Warrant, and one Class

B Warrant “Offering”). Each ordinary unit was sold at an offering price of $5.85 per unit, and each pre-funded unit sold

at an offering price of $5.85 per unit less the nominal remaining exercise price of $0.0001. The Offering resulted in gross proceeds

to the Company of approximately $8,000,000 before deducting placement agent fees and other estimated offering expenses (the “Offering”).

The Offering closed on December 16, 2024.

Each

pre-funded warrant is immediately exercisable upon issuance and can be exercised until all such pre-funded warrants are exercised at

the remaining exercise price per share equal to $0.001. Each Class A Warrant is immediately exercisable upon issuance at an exercise

price of $5.85 per share and will expire five years from the date of issuance. Each Class B Warrant is immediately exercisable upon issuance

at an exercise price of $5.85 per share and will expire on the earlier of (a) 30 days following receipt of results from the Company’s

eAArly Detect 2 study, or (b) one year from the date of issuance. Each Class A Warrant and Class B Warrant is subject to anti-dilution

provisions to reflect stock dividends and splits or other similar transactions, as well as any subsequent financings at an effective

price per share less than the exercise price of the Class A Warrant or Class B Warrant then in effect.

The

Company also entered into a placement agency agreement dated December 12, 2024 (the “Placement Agency Agreement”) with Maxim

Group, LLC, as exclusive placement agent (the “Placement Agent”), pursuant to which the Placement Agent agreed to act as

the placement agent in connection with the Offering. Pursuant to the Placement Agency Agreement, the Company paid the Placement Agent

an aggregate fee equal to 7% of the gross proceeds raised in the Offering plus $100,000 in fixed fees.

The

form of the Class A Warrant, the Class B Warrant, the Pre-Funded Warrant, the SPA, and the Placement Agency Agreement were described

in the Registration Statement on Form F-1 (no. 333-282993) for the Offering and were attached as exhibits thereto.

Other

Events

On

December 16, 2024, the Company issued a press release announcing the Offering entitled “Mainz Biomed Announces Closing of $8.0 Million

Follow-On Offering”. A copy of the press release is attached hereto as Exhibit 99.1

The

information contained in this Report on Form 6-K (excluding Exhibit 99.1) is hereby incorporated by reference into our Registration Statement

on Form F-3 (File No. 333-269091).

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date:

December 16, 2024 |

By: |

/s/

William J. Caragol |

| |

Name: |

William

J. Caragol |

| |

Title: |

Chief

Financial Officer |

2

Exhibit

99.1

Mainz

Biomed Announces Closing of $8.0 Million Follow-On Offering

BERKELEY,

US and MAINZ, Germany – December 16, 2024 - Mainz Biomed N.V. (NASDAQ:MYNZ) (“Mainz Biomed” or the “Company”),

a molecular genetics diagnostic company specializing in the early detection of cancer, today announced the closing of its previously

announced follow-on offering of 1,367,521 units, with each unit consisting of one ordinary share (or prefunded warrant in lieu thereof)

one Class A warrant to purchase one ordinary share, and one Class B warrant to purchase one ordinary share for gross proceeds of approximately

$8.0 million. Each unit was sold at an effective offering price of $5.85 per unit, priced at-the-market under Nasdaq rules. Each Class

A warrant is immediately exercisable at an exercise price of $5.85 per share and will expire five years from the date of issuance. Each

Class B warrant is immediately exercisable at an exercise price of $5.85 per share and will expire on the earlier of 30 days following

receipt of results from the Company’s eAArly Detect 2 study, and one year from the date of issuance.

Maxim

Group LLC acted as the sole placement agent for the offering.

The

securities described above were offered pursuant to a registration statement on Form F-1, as amended (File No. 333-282993) (the “Registration

Statement”), which was declared effective by the U.S. Securities and Exchange Commission (the “SEC”) on December 12,

2024. The offering was made only by means of a prospectus which is a part of the Registration Statement. A final prospectus relating

to the offering has been filed with the SEC. Copies of the final prospectus relating to this offering may be obtained from Maxim Group

LLC, 300 Park Avenue, 16th Floor, New York, NY 10022, at (212) 895-3745. This press release shall not constitute an offer to sell or

a solicitation of an offer to buy any of the securities described herein, nor shall there be any sale of these securities in any state

or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the

securities laws of any such state or other jurisdiction.

Please

visit Mainz Biomed’s official website for investors at mainzbiomed.com/investors/for more information

About

Mainz Biomed NV

Mainz

Biomed develops market-ready molecular genetic diagnostic solutions for life-threatening conditions. The Company’s flagship product

is ColoAlert®, an accurate, non-invasive and easy-to-use, early-detection diagnostic test for colorectal cancer. ColoAlert®

is marketed across Europe. The Company is currently running a pivotal FDA clinical study for US regulatory approval. Mainz Biomed’s

product candidate portfolio also includes PancAlert, an early-stage pancreatic cancer screening test based on real-time Polymerase Chain

Reaction-based (PCR) multiplex detection of molecular-genetic biomarkers in stool samples. To learn more, visit mainzbiomed.com.

For

media inquiries

MC

Services AG

Anne Hennecke/Caroline Bergmann

+49 211 529252 20

mainzbiomed@mc-services.eu

For

investor inquiries, please contact info@mainzbiomed.com

Forward-Looking

Statements

Certain

statements made in this press release are “forward-looking statements” within the meaning of the “safe harbor”

provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words

such as “anticipate”, “believe”, “expect”, “estimate”, “plan”, “outlook”,

and “project” and other similar expressions or the negative of such expressions that predict or indicate future events or

trends or that are not statements of historical matters. These forward-looking statements reflect the current analysis of existing information

and are subject to various risks and uncertainties. As a result, caution must be exercised in relying on forward-looking statements.

Due to known and unknown risks, actual results may differ materially from the Company’s expectations or projections. The following

factors, among others, could cause actual results to differ materially from those described in these forward-looking statements: (i)

the failure to meet projected development and related targets; (ii) changes in applicable laws or regulations; (iii) the effect of the

COVID-19 pandemic on the Company and its current or intended markets; and (iv) other risks and uncertainties described herein, as well

as those risks and uncertainties discussed from time to time in other reports and other public filings with the Securities and Exchange

Commission (the “SEC”) by the Company. Additional information concerning these and other factors that may impact the Company’s

expectations and projections can be found in its initial filings with the SEC, including its annual report on Form 20-F filed on April

9, 2024. The Company’s SEC filings are available publicly on the SEC’s website at www.sec.gov. Any forward-looking statement

made by us in this press release is based only on information currently available to Mainz Biomed and speaks only as of the date on which

it is made. Mainz Biomed undertakes no obligation to publicly update any forward-looking statement, whether written or oral, that may

be made from time to time, whether as a result of new information, future developments or otherwise, except as required by law.

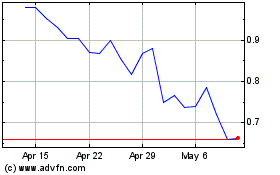

Mainz BioMed NV (NASDAQ:MYNZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Mainz BioMed NV (NASDAQ:MYNZ)

Historical Stock Chart

From Dec 2023 to Dec 2024