At its annual Focus conference, LPL Financial LLC shared its

priorities for helping financial advisors and financial

institutions advance their businesses by providing personalized

support that enables custom client experiences, building flexible

operating environments by leveraging innovative technology, and

supporting advisors’ growth and legacy planning.

“Being the best firm in our industry at helping clients define

and maximize their success throughout their business lifecycle. For

all of us at LPL, that’s our very clear vision for the company’s

success,” said Rich Steinmeier, chief growth officer, LPL

Financial, speaking here today at Focus 2024, one of the industry’s

largest in-person gatherings of financial advisors.

In detailing the company’s investments that serve to help LPL

clients run thriving businesses, LPL announced today an expanded

suite of business solutions, designed to help financial advisors

and institutions more effectively manage and grow their wealth

management practices. The suite, which has grown from three to 14

services over the past six years, is expected to reach 20 by

year-end, and includes services co-designed with advisors to

address common challenges.

The Build Your Extraordinary Business study by LPL revealed

that top-performing advisors often share the same strategies for

exceptional business outcomes. The research highlighted that the

most successful 10% of LPL advisors, who typically partner with LPL

for support with at least two core functions like marketing or

administration, work similar hours to their peers but earn three

times more revenue.1

“We have an incredible opportunity in wealth management not only

to deliver sound advice but also to do so in ways that deliver

long-lasting positive effects that contribute to local economies,

support communities, inspire the next generation and enable

thriving businesses that fortify Main Streets far from Wall

Street,” said Aneri Jambusaria, managing director of LPL Business

and Wealth Solutions, to nearly 9,000 Focus 2024 attendees.

The company outlined the following differentiated ways that LPL

is uniquely serving clients to help them excel at their multiple

roles.

LPL’s New Payroll and HR Solutions Streamline Talent

ManagementHuman resource and talent issues are often top

of mind with business owners, which led LPL to create new services

to meet the growing need for foundational HR support and

expertise.

LPL’s new Payroll Solutions will cover

everything from set-up to full-service processing and includes

ongoing access to a dedicated payroll expert. In addition, a new

set of HR Solutions helps firms create HR

policies, resources and handbooks, and can provide ongoing guidance

for talent-related needs.

Tech Consulting Service Aims to Optimize Technology

UtilizationA recent study by InvestmentNews revealed that

less than half (48%) of advisors feel fully satisfied with their

current technology setups, highlighting a significant gap in the

effective use of technology within the industry.2 Many advisors

face a common struggle in integrating and optimizing technology to

enhance client interactions and operational efficiency.

Recognizing these challenges, LPL has introduced a comprehensive

Tech Consulting service designed to evaluate and improve an

advisor’s technology stack. Whether an advisor is looking to evolve

technology or optimize existing systems, LPL’s service aims to

streamline operations and enhance digital client interactions.

Chief Investment Officer Service Elevates

ExpertiseLPL’s Chief Investment Officer (CIO) service

allows advisors to benefit from a dedicated CIO who partners with

them to strengthen their investment strategies, develop custom

model portfolios, and even participate in investment committees and

client consultations. The OCIO service is supported by the robust

LPL Research team, ensuring advisors have access to top-tier market

insights and investment expertise. The service has already made an

impact on early users, who found the demands of research and

portfolio management were limiting client interaction time.

Personalized Growth Coaching Drives Scale and Business

Development WinsThe newly launched LPL Growth Program

helps advisors fast-track their goals through personalized programs

led by industry and LPL professionals. Advisors have access to

one-on-one and group sessions tailored to their specific growth

objectives and learn practical tactics used by some of their most

successful peers. These tools are crafted to assist advisors in

defining and executing their business visions, fostering growth and

enhancing client engagement.

Expanded Marketing Solutions Amplify Advisors’

Connections with Prospective and Current Clients LPL’s new

Digital Marketing Platform is designed to enhance client engagement

through personalized communication across social media, email and

digital channels. This tool makes it easy to share LPL Research

insights as well as relevant premium content from leading

publications, helping advisors keep their clients well informed

amid a 24/7 news cycle.

Access to Capital to Support Advisors Through Lifecycle

Stages“Independence doesn’t mean you’re alone; it does

mean you get to lead the way,” said Steinmeier today while

detailing the company’s commitment to providing capital for growth,

liquidity and succession throughout the lifecycle of an advisor’s

business. Through LPL Capital Partners, the company is

strengthening its commitment to and investments in partnering with

advisors to support growth through acquisitions, monetization

opportunities and clear succession paths that preserve client

relationships while protecting their respected legacy.

For more information about these programs, visit LPL

Business Solutions and LPL Liquidity and Capital, and download

LPL Business Solutions’ latest report, Build Your

Extraordinary Business.

About LPL FinancialLPL Financial Holdings Inc.

(Nasdaq: LPLA) was founded on the principle that the firm should

work for advisors and institutions, and not the other way

around. Today, LPL is a leader in the markets we serve,

serving more than 23,000 financial advisors, including advisors at

approximately 1,000 institutions and at approximately 580

registered investment advisor firms nationwide. We are steadfast in

our commitment to the advisor-mediated model and the belief that

Americans deserve access to personalized guidance from a financial

professional. At LPL, independence means that advisors and

institution leaders have the freedom they deserve to choose the

business model, services and technology resources that allow them

to run a thriving business. They have the flexibility to do

business their way. And they have the freedom to manage

their client relationships, because they know their clients best.

Simply put, we take care of our advisors and institutions, so they

can take care of their clients.

Securities and Advisory services offered through LPL

Financial LLC (“LPL Financial”), a registered investment

advisor. Member FINRA/SIPC. LPL Financial and its

affiliated companies provide financial services only from the

United States.

Throughout this communication, the terms “financial advisors”

and “advisors” are used to refer to registered representatives

and/or investment advisor representatives affiliated with LPL

Financial.

We routinely disclose information that may be important to

shareholders in the “Investor Relations” or “Press Releases”

section of our website.

1 The top 10% of LPL advisors was determined by Gross

Dealer Concessions (GDC) taken from commission data in 2022.

Individual results may vary. Past performance does not guarantee

future results.

2 Investment News 2022 Adviser Technology Study

Warning Regarding Forward-Looking

StatementsStatements in this press release regarding LPL’s

future service offerings, growth and plans, including statements

about the planned expansion of LPL’s suite of business support

solutions, or any other statements that are not related to present

facts or current conditions or that are not purely historical,

constitute forward-looking statements. These forward-looking

statements are based on the historical performance of LPL and LPL’s

plans, estimates and expectations as of August 13, 2024.

Forward-looking statements are not guarantees that the future

plans, intentions or expectations expressed or implied by LPL will

be achieved.

Matters subject to forward-looking statements involve known and

unknown risks and uncertainties, including economic, legislative,

regulatory, competitive and other factors, which may cause actual

results to be materially different than those expressed or implied

by forward-looking statements. In particular, LPL can provide no

assurance that the expansion of LPL’s suite of business solutions

will occur in the expected timeframe, or at all. Important factors

that could cause or contribute to such differences include: changes

in general economic and financial market conditions, including

retail investor sentiment; effects of competition in the financial

services industry and the success of the Company in attracting and

retaining financial advisors and institutions, and their ability to

market financial products and services effectively; the effect of

current, pending and future legislation, regulation and regulatory

actions, including disciplinary actions imposed by federal and

state regulators and self-regulatory organizations; the execution

of the Company’s plans and its success in realizing the synergies,

expense savings, service improvements or efficiencies expected to

result from its investments, initiatives and acquisitions, expense

plans and technology initiatives; and the other factors set forth

in Part I, “Item 1A. Risk Factors” in LPL’s 2023 Annual Report on

Form 10-K and any subsequent SEC filing. Except as required by law,

LPL specifically disclaims any obligation to update any

forward-looking statements as a result of developments occurring

after the date of this press release, even if its estimates change,

and you should not rely on those statements as representing the

Company’s views as of any date subsequent to the date of this press

release.

Connect with Us!

https://twitter.com/lpl

https://www.linkedin.com/company/lpl-financial

https://www.facebook.com/LPLFinancialLLC

https://www.youtube.com/user/lplfinancialllc

Media

Contact:Media.relations@LPLFinancial.com(402) 740-2047

Tracking # 614735

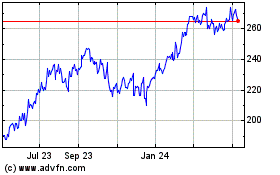

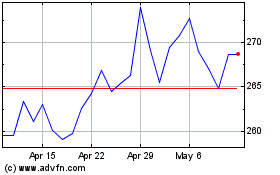

LPL Financial (NASDAQ:LPLA)

Historical Stock Chart

From Nov 2024 to Dec 2024

LPL Financial (NASDAQ:LPLA)

Historical Stock Chart

From Dec 2023 to Dec 2024