000104574209-302024Q2falsehttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentAndFinanceLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationxbrli:sharesiso4217:USDiso4217:USDxbrli:shareslive:segmentlive:Locationlive:installmentxbrli:purelive:propertylive:optionlive:loanlive:paymentutr:sqftlive:daylive:leaselive:executivelive:defendant00010457422023-10-012024-03-3100010457422024-05-1000010457422024-03-3100010457422023-09-300001045742us-gaap:NonrelatedPartyMember2024-03-310001045742us-gaap:NonrelatedPartyMember2023-09-300001045742us-gaap:RelatedPartyMember2024-03-310001045742us-gaap:RelatedPartyMember2023-09-300001045742live:SellerNotesMemberus-gaap:RelatedPartyMember2024-03-310001045742live:SellerNotesMemberus-gaap:RelatedPartyMember2023-09-300001045742live:SeriesEConvertiblePreferredStockMember2024-03-310001045742live:SeriesEConvertiblePreferredStockMember2023-09-3000010457422024-01-012024-03-3100010457422023-01-012023-03-3100010457422022-10-012023-03-3100010457422022-09-3000010457422023-03-310001045742live:PMWAcquisitionMember2023-10-012024-03-310001045742live:PMWAcquisitionMember2022-10-012023-03-310001045742live:CROAcquisitionMember2023-10-012024-03-310001045742live:CROAcquisitionMember2022-10-012023-03-310001045742live:JohnsonAcquisitionMember2023-10-012024-03-310001045742live:JohnsonAcquisitionMember2022-10-012023-03-310001045742us-gaap:PreferredStockMemberlive:SeriesEConvertiblePreferredStockMember2023-09-300001045742us-gaap:CommonStockMember2023-09-300001045742us-gaap:AdditionalPaidInCapitalMember2023-09-300001045742us-gaap:TreasuryStockPreferredMember2023-09-300001045742us-gaap:TreasuryStockCommonMember2023-09-300001045742us-gaap:RetainedEarningsMember2023-09-300001045742us-gaap:NoncontrollingInterestMember2023-09-300001045742us-gaap:AdditionalPaidInCapitalMember2023-10-012023-12-3100010457422023-10-012023-12-310001045742us-gaap:CommonStockMember2023-10-012023-12-310001045742us-gaap:TreasuryStockCommonMember2023-10-012023-12-310001045742us-gaap:RetainedEarningsMember2023-10-012023-12-310001045742us-gaap:PreferredStockMemberlive:SeriesEConvertiblePreferredStockMember2023-12-310001045742us-gaap:CommonStockMember2023-12-310001045742us-gaap:AdditionalPaidInCapitalMember2023-12-310001045742us-gaap:TreasuryStockPreferredMember2023-12-310001045742us-gaap:TreasuryStockCommonMember2023-12-310001045742us-gaap:RetainedEarningsMember2023-12-310001045742us-gaap:NoncontrollingInterestMember2023-12-3100010457422023-12-310001045742us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001045742us-gaap:CommonStockMember2024-01-012024-03-310001045742us-gaap:TreasuryStockCommonMember2024-01-012024-03-310001045742us-gaap:RetainedEarningsMember2024-01-012024-03-310001045742us-gaap:PreferredStockMemberlive:SeriesEConvertiblePreferredStockMember2024-03-310001045742us-gaap:CommonStockMember2024-03-310001045742us-gaap:AdditionalPaidInCapitalMember2024-03-310001045742us-gaap:TreasuryStockPreferredMember2024-03-310001045742us-gaap:TreasuryStockCommonMember2024-03-310001045742us-gaap:RetainedEarningsMember2024-03-310001045742us-gaap:NoncontrollingInterestMember2024-03-310001045742us-gaap:PreferredStockMemberlive:SeriesEConvertiblePreferredStockMember2022-09-300001045742us-gaap:CommonStockMember2022-09-300001045742us-gaap:AdditionalPaidInCapitalMember2022-09-300001045742us-gaap:TreasuryStockPreferredMember2022-09-300001045742us-gaap:TreasuryStockCommonMember2022-09-300001045742us-gaap:RetainedEarningsMember2022-09-300001045742us-gaap:NoncontrollingInterestMember2022-09-300001045742us-gaap:CommonStockMember2022-10-012022-12-310001045742us-gaap:TreasuryStockCommonMember2022-10-012022-12-3100010457422022-10-012022-12-310001045742us-gaap:RetainedEarningsMember2022-10-012022-12-310001045742us-gaap:PreferredStockMemberlive:SeriesEConvertiblePreferredStockMember2022-12-310001045742us-gaap:CommonStockMember2022-12-310001045742us-gaap:AdditionalPaidInCapitalMember2022-12-310001045742us-gaap:TreasuryStockPreferredMember2022-12-310001045742us-gaap:TreasuryStockCommonMember2022-12-310001045742us-gaap:RetainedEarningsMember2022-12-310001045742us-gaap:NoncontrollingInterestMember2022-12-3100010457422022-12-310001045742us-gaap:CommonStockMember2023-01-012023-03-310001045742us-gaap:TreasuryStockCommonMember2023-01-012023-03-310001045742us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001045742us-gaap:RetainedEarningsMember2023-01-012023-03-310001045742us-gaap:PreferredStockMemberlive:SeriesEConvertiblePreferredStockMember2023-03-310001045742us-gaap:CommonStockMember2023-03-310001045742us-gaap:AdditionalPaidInCapitalMember2023-03-310001045742us-gaap:TreasuryStockPreferredMember2023-03-310001045742us-gaap:TreasuryStockCommonMember2023-03-310001045742us-gaap:RetainedEarningsMember2023-03-310001045742us-gaap:NoncontrollingInterestMember2023-03-310001045742live:CarpetRemnantOutletIncMember2023-10-130001045742live:CarpetRemnantOutletIncMember2023-10-132023-10-130001045742live:TulsaOKMemberlive:JohnsonFloorHomeMember2023-11-300001045742live:JoplinMOMemberlive:JohnsonFloorHomeMember2023-11-300001045742live:JohnsonFloorHomeMember2023-11-300001045742live:JohnsonFloorHomeMember2023-11-302023-11-300001045742us-gaap:CustomerRelationshipsMemberlive:JohnsonFloorHomeMember2023-11-300001045742live:JohnsonFloorHomeMemberus-gaap:NoncompeteAgreementsMember2023-11-300001045742live:HarrisFlooringGroupBrandsMember2023-09-202023-09-200001045742live:HarrisFlooringGroupBrandsMember2023-09-200001045742live:PrecisionMetalWorksIncPMWMember2023-07-202023-07-200001045742live:PrecisionMetalWorksIncPMWMember2023-07-200001045742live:SaleLeaseBackTransactionMemberlive:PrecisionMetalWorksIncPMWMember2023-07-202023-07-200001045742live:SaleLeaseBackTransactionMemberlive:PrecisionMetalWorksIncPMWMember2023-07-200001045742live:SaleLeaseBackTransactionMemberlive:PrecisionMetalWorksIncPMWMemberlive:FrankfortLeaseAgreementMember2023-07-202023-07-200001045742live:LouisvilleLeaseAgreementMemberlive:SaleLeaseBackTransactionMemberlive:PrecisionMetalWorksIncPMWMember2023-07-202023-07-200001045742live:PrecisionMetalWorksIncPMWMember2023-07-202023-07-200001045742live:PrecisionMetalWorksIncPMWMember2024-01-012024-03-310001045742live:CalCoastCarpetsIncCalCoastMember2023-06-022023-06-020001045742us-gaap:CustomerRelationshipsMemberlive:CalCoastCarpetsIncCalCoastMember2023-06-022023-06-020001045742live:CalCoastCarpetsIncCalCoastMemberus-gaap:TradeNamesMember2023-06-022023-06-020001045742live:CalCoastCarpetsIncCalCoastMemberus-gaap:NoncompeteAgreementsMember2023-06-022023-06-020001045742live:PrecisionIndustriesAffiliatedHoldingsMemberlive:FlooringLiquidatorsMember2023-01-180001045742live:FlooringLiquidatorsMember2023-01-182023-01-180001045742live:FlooringLiquidatorsMemberus-gaap:CashMember2023-01-182023-01-180001045742live:FlooringLiquidatorsMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-182023-01-180001045742live:FlooringLiquidatorsMember2023-01-180001045742live:FlooringLiquidatorsMember2023-10-012024-03-310001045742live:FlooringLiquidatorsMemberus-gaap:TradeNamesMember2023-01-180001045742us-gaap:CustomerRelationshipsMemberlive:FlooringLiquidatorsMember2023-01-180001045742live:FlooringLiquidatorsMemberus-gaap:NoncompeteAgreementsMember2023-01-180001045742us-gaap:OtherIntangibleAssetsMemberlive:FlooringLiquidatorsMember2023-01-180001045742live:FlooringLiquidatorsMember2023-01-012023-03-310001045742srt:ProFormaMember2023-01-012023-03-310001045742us-gaap:ScenarioAdjustmentMember2023-01-012023-03-310001045742live:FlooringLiquidatorsMember2022-10-012023-03-310001045742srt:ProFormaMember2022-10-012023-03-310001045742us-gaap:ScenarioAdjustmentMember2022-10-012023-03-310001045742us-gaap:LandMember2024-03-310001045742us-gaap:LandMember2023-09-300001045742us-gaap:BuildingAndBuildingImprovementsMember2024-03-310001045742us-gaap:BuildingAndBuildingImprovementsMember2023-09-300001045742us-gaap:TransportationEquipmentMember2024-03-310001045742us-gaap:TransportationEquipmentMember2023-09-300001045742us-gaap:MachineryAndEquipmentMember2024-03-310001045742us-gaap:MachineryAndEquipmentMember2023-09-300001045742us-gaap:FurnitureAndFixturesMember2024-03-310001045742us-gaap:FurnitureAndFixturesMember2023-09-300001045742live:OfficeComputerEquipmentAndOtherMember2024-03-310001045742live:OfficeComputerEquipmentAndOtherMember2023-09-300001045742us-gaap:TradeNamesMember2024-03-310001045742us-gaap:TradeNamesMember2023-09-300001045742us-gaap:CustomerRelationshipsMember2024-03-310001045742us-gaap:CustomerRelationshipsMember2023-09-300001045742live:IntangibleAssetsOtherMember2024-03-310001045742live:IntangibleAssetsOtherMember2023-09-300001045742live:RetailEntertainmentSegmentMember2023-09-300001045742live:RetailFlooringSegmentMember2023-09-300001045742live:FlooringManufacturingSegmentMember2023-09-300001045742live:SteelManufacturingSegmentMember2023-09-300001045742live:CROAcquisitionMemberlive:RetailEntertainmentSegmentMember2023-10-012024-03-310001045742live:RetailFlooringSegmentMemberlive:CROAcquisitionMember2023-10-012024-03-310001045742live:FlooringManufacturingSegmentMemberlive:CROAcquisitionMember2023-10-012024-03-310001045742live:CROAcquisitionMemberlive:SteelManufacturingSegmentMember2023-10-012024-03-310001045742live:RetailEntertainmentSegmentMemberlive:PrecisionMetalWorksIncPMWMember2023-10-012024-03-310001045742live:RetailFlooringSegmentMemberlive:PrecisionMetalWorksIncPMWMember2023-10-012024-03-310001045742live:FlooringManufacturingSegmentMemberlive:PrecisionMetalWorksIncPMWMember2023-10-012024-03-310001045742live:PrecisionMetalWorksIncPMWMemberlive:SteelManufacturingSegmentMember2023-10-012024-03-310001045742live:PrecisionMetalWorksIncPMWMember2023-10-012024-03-310001045742live:FlooringLiquidatorsMemberlive:RetailEntertainmentSegmentMember2023-10-012024-03-310001045742live:RetailFlooringSegmentMemberlive:FlooringLiquidatorsMember2023-10-012024-03-310001045742live:FlooringManufacturingSegmentMemberlive:FlooringLiquidatorsMember2023-10-012024-03-310001045742live:FlooringLiquidatorsMemberlive:SteelManufacturingSegmentMember2023-10-012024-03-310001045742live:RetailEntertainmentSegmentMember2024-03-310001045742live:RetailFlooringSegmentMember2024-03-310001045742live:FlooringManufacturingSegmentMember2024-03-310001045742live:SteelManufacturingSegmentMember2024-03-310001045742us-gaap:NonrelatedPartyMemberlive:BankOfAmericaRevolverLoanMember2024-03-310001045742us-gaap:NonrelatedPartyMemberlive:BankOfAmericaRevolverLoanMember2023-09-300001045742us-gaap:NonrelatedPartyMemberlive:EquipmentLoansMember2024-03-310001045742us-gaap:NonrelatedPartyMemberlive:EquipmentLoansMember2023-09-300001045742live:TermLoanTwoMemberus-gaap:NonrelatedPartyMember2024-03-310001045742live:TermLoanTwoMemberus-gaap:NonrelatedPartyMember2023-09-300001045742live:OtherNotesPayableMemberus-gaap:NonrelatedPartyMember2024-03-310001045742live:OtherNotesPayableMemberus-gaap:NonrelatedPartyMember2023-09-300001045742live:NotesPayableMember2024-03-310001045742live:BankOfAmericaRevolverLoanMemberlive:MarquisIndustriesIncMemberus-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2020-01-310001045742live:BankOfAmericaRevolverLoanMemberlive:MarquisIndustriesIncMemberus-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2024-03-310001045742live:BankOfAmericaRevolverLoanMemberlive:MarquisIndustriesIncMemberus-gaap:SecuredDebtMemberus-gaap:RevolvingCreditFacilityMember2023-09-300001045742live:EncinaLoansMemberlive:FifthThirdBankMember2022-01-200001045742live:EncinaLoansMemberlive:FifthThirdBankMemberus-gaap:RevolvingCreditFacilityMember2022-01-200001045742us-gaap:MachineryAndEquipmentMemberlive:EncinaLoansMemberlive:FifthThirdBankMember2022-01-200001045742live:EncinaLoansMemberlive:FifthThirdBankMemberlive:CapitalExpenditureMember2022-01-200001045742live:SecuredOvernightFinancingRateMemberlive:FifthThirdBankMemberus-gaap:RevolvingCreditFacilityMember2022-01-202022-01-200001045742live:SecuredOvernightFinancingRateMemberlive:FifthThirdBankMember2022-01-202022-01-200001045742live:FifthThirdBankMember2023-10-012024-03-310001045742live:TermLoanOneAndTermLoanTwoMemberlive:KineticIndustriesMemberlive:FifthThirdBankMember2022-01-200001045742live:KineticIndustriesMember2022-01-200001045742live:KineticIndustriesMemberlive:TermLoanOneMember2022-01-200001045742live:TermLoanTwoMemberlive:KineticIndustriesMember2022-01-200001045742live:KineticIndustriesMemberlive:TermLoanOneMember2024-03-310001045742live:KineticIndustriesMemberlive:TermLoanOneMember2023-10-012024-03-310001045742live:TermLoanTwoMemberlive:KineticIndustriesMember2024-03-310001045742live:TermLoanTwoMemberlive:KineticIndustriesMember2023-10-012024-03-310001045742live:TermLoanTwoMemberlive:SecuredOvernightFinancingRateMemberlive:KineticIndustriesMember2022-01-202022-01-200001045742live:EncinaLoansMemberlive:FifthThirdBankMemberus-gaap:RevolvingCreditFacilityMember2024-03-310001045742live:EncinaLoansMemberlive:FifthThirdBankMemberus-gaap:RevolvingCreditFacilityMember2023-09-300001045742live:EncinaLoansMemberlive:FifthThirdBankMember2024-03-310001045742live:EncinaLoansMemberlive:FifthThirdBankMember2023-09-300001045742live:KineticIndustriesMemberlive:TermLoanOneMemberlive:FifthThirdBankMember2024-03-310001045742live:KineticIndustriesMemberlive:TermLoanOneMemberlive:FifthThirdBankMember2023-09-300001045742live:FifthThirdBankMemberus-gaap:RevolvingCreditFacilityMemberlive:CapitalExpenditureLoanMember2023-04-122023-04-120001045742live:FifthThirdBankMemberus-gaap:RevolvingCreditFacilityMemberlive:CapitalExpenditureLoanMember2024-03-310001045742live:FifthThirdBankMemberus-gaap:RevolvingCreditFacilityMemberlive:CapitalExpenditureLoanMember2023-09-300001045742live:EclipseBusinessCapitalLLCRevolverMemberus-gaap:RevolvingCreditFacilityMember2023-01-180001045742us-gaap:NotesPayableOtherPayablesMemberlive:MELendingLoanMember2023-01-180001045742live:EclipseBusinessCapitalLLCRevolverMemberus-gaap:RevolvingCreditFacilityMember2023-01-182023-01-180001045742live:SecuredOvernightFinancingRateSOFRMemberlive:EclipseBusinessCapitalLLCRevolverMemberus-gaap:RevolvingCreditFacilityMember2023-01-182023-01-180001045742live:SecuredOvernightFinancingRateSOFRMemberlive:EclipseBusinessCapitalLLCRevolverMemberus-gaap:RevolvingCreditFacilityMember2023-04-012023-04-010001045742us-gaap:NotesPayableOtherPayablesMemberlive:SecuredOvernightFinancingRateSOFRMemberlive:MELendingLoanMember2023-01-182023-01-180001045742us-gaap:NotesPayableOtherPayablesMemberlive:SecuredOvernightFinancingRateSOFRMemberlive:MELendingLoanMember2023-04-012023-04-010001045742live:EclipseBusinessCapitalLLCRevolverMemberus-gaap:RevolvingCreditFacilityMember2024-03-310001045742live:EclipseBusinessCapitalLLCRevolverMemberus-gaap:RevolvingCreditFacilityMember2023-09-300001045742us-gaap:NotesPayableOtherPayablesMemberlive:MELendingLoanMember2024-03-310001045742us-gaap:NotesPayableOtherPayablesMemberlive:MELendingLoanMember2023-09-300001045742live:FifthThirdBankMemberus-gaap:RevolvingCreditFacilityMember2023-07-200001045742live:MELendingLoanMemberlive:FifthThirdBankMember2023-07-200001045742live:FifthThirdBankMemberus-gaap:RevolvingCreditFacilityMember2023-07-202023-07-200001045742live:ReferenceRateMemberlive:FifthThirdBankMemberus-gaap:RevolvingCreditFacilityMember2023-07-202023-07-200001045742live:ReferenceRateMemberlive:MELendingLoanMemberlive:FifthThirdBankMember2023-07-202023-07-200001045742live:FifthThirdBankMemberus-gaap:RevolvingCreditFacilityMember2024-03-310001045742live:FifthThirdBankMemberus-gaap:RevolvingCreditFacilityMember2023-09-300001045742live:MELendingLoanMemberlive:FifthThirdBankMember2024-03-310001045742live:MELendingLoanMemberlive:FifthThirdBankMember2023-09-300001045742us-gaap:LineOfCreditMemberlive:BankMidwestMember2023-10-170001045742live:SecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMemberlive:BankMidwestMember2023-10-172023-10-170001045742us-gaap:LineOfCreditMemberlive:BankMidwestMember2024-03-310001045742live:TexasCapitalBankRevolverLoanMemberus-gaap:LineOfCreditMember2023-09-300001045742live:BancNotePayableBankThreeMemberlive:MarquisIndustriesIncMemberlive:EquipmentLoansMember2024-03-310001045742live:BancNotePayableBankThreeMemberlive:MarquisIndustriesIncMemberlive:EquipmentLoansMember2023-09-300001045742live:BancNotePayableBankFourMemberlive:MarquisIndustriesIncMemberlive:EquipmentLoansMember2024-03-310001045742live:BancNotePayableBankFourMemberlive:MarquisIndustriesIncMemberlive:EquipmentLoansMember2023-09-300001045742live:BancNotePayableBankFiveMemberlive:MarquisIndustriesIncMemberlive:EquipmentLoansMember2024-03-310001045742live:BancNotePayableBankFiveMemberlive:MarquisIndustriesIncMemberlive:EquipmentLoansMember2023-10-012024-03-310001045742live:BancNotePayableBankFiveMemberlive:MarquisIndustriesIncMemberlive:EquipmentLoansMember2023-09-300001045742live:BancNotePayableBankSixMemberlive:MarquisIndustriesIncMember2024-03-310001045742live:BancNotePayableBankSixMemberlive:MarquisIndustriesIncMember2023-10-012024-03-310001045742live:BancNotePayableBankSixMemberlive:MarquisIndustriesIncMember2023-09-300001045742live:MarquisIndustriesIncMemberlive:BancNotePayableBankSevenMember2024-03-310001045742live:MarquisIndustriesIncMemberlive:BancNotePayableBankSevenMember2023-10-012024-03-310001045742live:MarquisIndustriesIncMemberlive:BancNotePayableBankSevenMember2023-09-300001045742live:MarquisIndustriesIncMemberlive:BancNotePayableBankEightMember2024-03-310001045742live:MarquisIndustriesIncMemberlive:BancNotePayableBankEightMember2023-10-012024-03-310001045742live:MarquisIndustriesIncMemberlive:BancNotePayableBankEightMember2023-09-300001045742live:MarquisIndustriesIncMemberlive:BancNotePayableBankNineMember2021-12-310001045742live:MarquisIndustriesIncMemberlive:BancNotePayableBankNineMember2021-12-012021-12-310001045742live:MarquisIndustriesIncMemberlive:BancNotePayableBankNineMember2024-03-310001045742live:MarquisIndustriesIncMemberlive:BancNotePayableBankNineMember2023-09-300001045742live:MarquisIndustriesIncMemberlive:BancNotePayableBankTenMember2022-12-310001045742live:MarquisIndustriesIncMemberlive:BancNotePayableBankTenMember2022-12-012022-12-310001045742live:MarquisIndustriesIncMemberlive:BancNotePayableBankTenMemberlive:EquipmentLoansMember2024-03-310001045742live:MarquisIndustriesIncMemberlive:BancNotePayableBankTenMemberlive:EquipmentLoansMember2023-09-300001045742us-gaap:RelatedPartyMemberlive:IsaacCapitalFundMember2023-10-012024-03-310001045742us-gaap:RelatedPartyMemberlive:IsaacCapitalFundMember2024-03-310001045742us-gaap:RelatedPartyMemberlive:IsaacCapitalFundMember2023-09-300001045742us-gaap:RelatedPartyMemberlive:SpriggsInvestmentsLLCMember2023-10-012024-03-310001045742us-gaap:RelatedPartyMemberlive:SpriggsInvestmentsLLCMember2024-03-310001045742us-gaap:RelatedPartyMemberlive:SpriggsInvestmentsLLCMember2023-09-300001045742us-gaap:BuildingAndBuildingImprovementsMemberus-gaap:RelatedPartyMemberlive:SpriggsInvestmentsLLCMember2023-10-012024-03-310001045742us-gaap:BuildingAndBuildingImprovementsMemberus-gaap:RelatedPartyMemberlive:SpriggsInvestmentsLLCMember2024-03-310001045742us-gaap:BuildingAndBuildingImprovementsMemberus-gaap:RelatedPartyMemberlive:SpriggsInvestmentsLLCMember2023-09-300001045742us-gaap:RelatedPartyMemberlive:BankOfAmericaRevolverLoanMemberlive:IsaacCapitalFundMember2023-10-012024-03-310001045742us-gaap:RelatedPartyMemberlive:BankOfAmericaRevolverLoanMemberlive:IsaacCapitalFundMember2024-03-310001045742us-gaap:RelatedPartyMemberlive:BankOfAmericaRevolverLoanMemberlive:IsaacCapitalFundMember2023-09-300001045742us-gaap:BuildingAndBuildingImprovementsMemberus-gaap:RelatedPartyMemberlive:IsaacCapitalFundMember2023-10-012024-03-310001045742us-gaap:BuildingAndBuildingImprovementsMemberus-gaap:RelatedPartyMemberlive:IsaacCapitalFundMember2024-03-310001045742us-gaap:BuildingAndBuildingImprovementsMemberus-gaap:RelatedPartyMemberlive:IsaacCapitalFundMember2023-09-300001045742live:NotesPayableRelatedPartiesMemberus-gaap:RelatedPartyMember2024-03-310001045742us-gaap:NotesPayableOtherPayablesMemberlive:NotePayableToTheSellersOfFlooringLiquidatorsMemberus-gaap:RelatedPartyMember2024-03-310001045742us-gaap:NotesPayableOtherPayablesMemberlive:NotePayableToTheSellersOfFlooringLiquidatorsMemberus-gaap:RelatedPartyMember2023-09-300001045742us-gaap:NotesPayableOtherPayablesMemberus-gaap:RelatedPartyMemberlive:NotePayableToTheSellersOfPMWMember2024-03-310001045742us-gaap:NotesPayableOtherPayablesMemberus-gaap:RelatedPartyMemberlive:NotePayableToTheSellersOfPMWMember2023-09-300001045742us-gaap:NotesPayableOtherPayablesMemberlive:NotePayableToTheSellersOfKineticMemberus-gaap:RelatedPartyMember2024-03-310001045742us-gaap:NotesPayableOtherPayablesMemberlive:NotePayableToTheSellersOfKineticMemberus-gaap:RelatedPartyMember2023-09-300001045742live:SellerNotesMemberus-gaap:NotesPayableOtherPayablesMemberus-gaap:RelatedPartyMember2024-03-310001045742live:SellerNotesMemberus-gaap:NotesPayableOtherPayablesMemberus-gaap:RelatedPartyMember2023-09-300001045742us-gaap:NotesPayableOtherPayablesMemberlive:SellerNotesMember2024-03-310001045742live:SeriesEConvertiblePreferredStockMember2023-03-310001045742live:TwoThousandAndFourteenOmnibusEquityIncentivePlanMember2024-03-3100010457422021-10-012022-09-3000010457422022-10-012023-09-300001045742live:EmployeeStockOptionsAndRestrictedStockUnitsMember2024-01-012024-03-310001045742live:EmployeeStockOptionsAndRestrictedStockUnitsMember2023-01-012023-03-310001045742live:EmployeeStockOptionsAndRestrictedStockUnitsMember2023-10-012024-03-310001045742live:EmployeeStockOptionsAndRestrictedStockUnitsMember2022-10-012023-03-310001045742us-gaap:EmployeeStockOptionMember2024-03-310001045742us-gaap:SeriesEPreferredStockMember2024-01-012024-03-310001045742us-gaap:SeriesEPreferredStockMember2023-01-012023-03-310001045742us-gaap:SeriesEPreferredStockMember2023-10-012024-03-310001045742us-gaap:SeriesEPreferredStockMember2022-10-012023-03-310001045742srt:ProFormaMember2024-01-012024-03-310001045742srt:ProFormaMember2023-10-012024-03-310001045742us-gaap:EmployeeStockOptionMember2022-10-012023-03-310001045742us-gaap:EmployeeStockOptionMember2023-01-012023-03-310001045742us-gaap:RelatedPartyMember2023-10-012024-03-310001045742live:PresidentAndChiefExecutiveOfficerMemberus-gaap:CommonStockMemberus-gaap:RelatedPartyMember2023-10-012024-03-310001045742live:ICFLoanMemberus-gaap:RelatedPartyMember2015-12-310001045742live:ICFLoanMemberus-gaap:RelatedPartyMemberlive:IsaacCapitalGroupLLCMember2020-07-100001045742live:ICFLoanMemberus-gaap:RelatedPartyMemberlive:IsaacCapitalGroupLLCMember2024-03-310001045742live:ICFLoanMemberus-gaap:RelatedPartyMemberlive:IsaacCapitalGroupLLCMember2023-09-300001045742us-gaap:RelatedPartyMemberlive:IsaacCapitalGroupLLCMemberus-gaap:RevolvingCreditFacilityMember2020-04-090001045742us-gaap:RelatedPartyMemberlive:IsaacCapitalGroupLLCMemberus-gaap:RevolvingCreditFacilityMember2022-06-230001045742us-gaap:RelatedPartyMemberlive:IsaacCapitalGroupLLCMemberus-gaap:RevolvingCreditFacilityMember2023-03-310001045742us-gaap:RelatedPartyMemberlive:IsaacCapitalGroupLLCMemberus-gaap:RevolvingCreditFacilityMember2023-04-010001045742us-gaap:RelatedPartyMemberlive:IsaacCapitalGroupLLCMemberus-gaap:RevolvingCreditFacilityMember2024-01-110001045742us-gaap:RelatedPartyMemberlive:IsaacCapitalGroupLLCMemberus-gaap:RevolvingCreditFacilityMember2024-03-310001045742us-gaap:RelatedPartyMemberlive:IsaacCapitalGroupLLCMemberus-gaap:RevolvingCreditFacilityMember2023-09-300001045742us-gaap:RelatedPartyMemberlive:IcgFlooringLiquidatorsNoteMember2023-01-180001045742us-gaap:RelatedPartyMemberlive:IcgFlooringLiquidatorsNoteMember2024-03-310001045742us-gaap:RelatedPartyMemberlive:JanOneIncMember2024-03-310001045742live:RentIncomeMemberus-gaap:RelatedPartyMemberlive:JanOneIncMember2024-01-012024-03-310001045742live:RentIncomeMemberus-gaap:RelatedPartyMemberlive:JanOneIncMember2023-01-012023-03-310001045742live:RentIncomeMemberus-gaap:RelatedPartyMemberlive:JanOneIncMember2023-10-012024-03-310001045742live:RentIncomeMemberus-gaap:RelatedPartyMemberlive:JanOneIncMember2022-10-012023-03-310001045742live:ArcaRecyclingIncMemberus-gaap:RelatedPartyMemberlive:ARCANoteMember2022-04-050001045742live:ArcaRecyclingIncMemberus-gaap:RelatedPartyMember2024-03-310001045742live:NoteSaleAgreementMemberlive:ArcaRecyclingIncMemberus-gaap:RelatedPartyMember2024-03-060001045742live:NoteSaleAgreementMemberlive:ArcaRecyclingIncMemberus-gaap:RelatedPartyMember2024-03-112024-03-110001045742live:NoteSaleAgreementMemberlive:ArcaRecyclingIncMemberus-gaap:RelatedPartyMember2023-10-012024-03-310001045742live:SpriggsPromissoryNoteMemberus-gaap:RelatedPartyMemberlive:SpriggsInvestmentsLLCMember2020-07-100001045742live:SpriggsPromissoryNoteMemberus-gaap:RelatedPartyMember2020-07-100001045742live:SpriggsPromissoryNoteMemberus-gaap:RelatedPartyMember2023-01-190001045742live:SpriggsPromissoryNoteMemberus-gaap:RelatedPartyMemberlive:SpriggsInvestmentsLLCMember2024-02-292024-02-290001045742live:SpriggsPromissoryNoteMemberus-gaap:RelatedPartyMemberlive:SpriggsInvestmentsLLCMember2024-03-310001045742live:SpriggsPromissoryNoteMemberus-gaap:RelatedPartyMemberlive:SpriggsInvestmentsLLCMember2023-09-300001045742live:SpriggsPromissoryNoteTwoMemberus-gaap:RelatedPartyMemberlive:SpriggsInvestmentsLLCMember2023-01-190001045742live:SpriggsPromissoryNoteTwoMemberus-gaap:RelatedPartyMemberlive:SpriggsInvestmentsLLCMember2024-02-292024-02-290001045742live:SpriggsPromissoryNoteTwoMemberus-gaap:RelatedPartyMemberlive:SpriggsInvestmentsLLCMember2024-03-310001045742live:SpriggsPromissoryNoteTwoMemberus-gaap:RelatedPartyMemberlive:SpriggsInvestmentsLLCMember2023-09-300001045742us-gaap:BuildingMemberlive:SpyglassEstatePlanningLLCMemberus-gaap:RelatedPartyMember2022-07-010001045742live:SpyglassEstatePlanningLLCMemberus-gaap:RelatedPartyMember2022-07-010001045742srt:MinimumMemberlive:SpyglassEstatePlanningLLCMemberus-gaap:RelatedPartyMember2022-07-010001045742live:BetterBackerMemberlive:SpyglassEstatePlanningLLCMemberus-gaap:RelatedPartyMembersrt:MaximumMember2022-07-010001045742live:FlooringLiquidatorsMemberlive:K2LPropertyManagementMemberus-gaap:RelatedPartyMember2024-03-310001045742live:FlooringLiquidatorsMemberlive:RailroadInvestmentsMemberus-gaap:RelatedPartyMember2024-03-310001045742live:FlooringLiquidatorsMemberus-gaap:RelatedPartyMemberlive:MrStephenKellogAndMsKimberlyHendrickMember2024-03-310001045742live:NotePayableToTheSellersOfKineticMemberus-gaap:RelatedPartyMember2022-06-280001045742live:NotePayableToTheSellersOfKineticMemberus-gaap:RelatedPartyMember2024-03-310001045742live:NotePayableToTheSellersOfFlooringLiquidatorsMemberus-gaap:RelatedPartyMember2023-01-180001045742live:NotePayableToTheSellersOfFlooringLiquidatorsMemberus-gaap:RelatedPartyMember2024-03-310001045742live:NotePayableToTheSellersOfFlooringLiquidatorsMemberus-gaap:RelatedPartyMember2023-09-300001045742live:NotePayableToTheSellersOfPMWMemberus-gaap:RelatedPartyMember2023-07-200001045742live:NotePayableToTheSellersOfPMWMemberus-gaap:RelatedPartyMember2024-03-310001045742live:NotePayableToTheSellersOfPMWMemberus-gaap:RelatedPartyMember2023-09-300001045742live:SECInvestigationsMember2020-08-120001045742live:SECInvestigationsMember2021-08-020001045742live:SECInvestigationsMember2022-09-072022-09-070001045742live:IndemnityHoldbackMatterMember2022-10-100001045742live:IndemnityHoldbackMatterMember2022-10-102022-10-100001045742live:RetailEntertainmentSegmentMember2024-01-012024-03-310001045742live:RetailEntertainmentSegmentMember2023-01-012023-03-310001045742live:RetailEntertainmentSegmentMember2023-10-012024-03-310001045742live:RetailEntertainmentSegmentMember2022-10-012023-03-310001045742live:RetailFlooringSegmentMember2024-01-012024-03-310001045742live:RetailFlooringSegmentMember2023-01-012023-03-310001045742live:RetailFlooringSegmentMember2023-10-012024-03-310001045742live:RetailFlooringSegmentMember2022-10-012023-03-310001045742live:FlooringManufacturingSegmentMember2024-01-012024-03-310001045742live:FlooringManufacturingSegmentMember2023-01-012023-03-310001045742live:FlooringManufacturingSegmentMember2023-10-012024-03-310001045742live:FlooringManufacturingSegmentMember2022-10-012023-03-310001045742live:SteelManufacturingSegmentMember2024-01-012024-03-310001045742live:SteelManufacturingSegmentMember2023-01-012023-03-310001045742live:SteelManufacturingSegmentMember2023-10-012024-03-310001045742live:SteelManufacturingSegmentMember2022-10-012023-03-310001045742us-gaap:CorporateAndOtherMember2024-01-012024-03-310001045742us-gaap:CorporateAndOtherMember2023-01-012023-03-310001045742us-gaap:CorporateAndOtherMember2023-10-012024-03-310001045742us-gaap:CorporateAndOtherMember2022-10-012023-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

_________________________

(Mark One)

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2024

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _______________

Commission File Number 001-33937

Live Ventures Incorporated

(Exact name of registrant as specified in its charter)

| | | | | |

| Nevada | 85-0206668 |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

| |

325 E. Warm Springs Road, Suite 102 Las Vegas, Nevada | 89119 |

| (Address of principal executive offices) | (Zip Code) |

(702) 997-5968

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

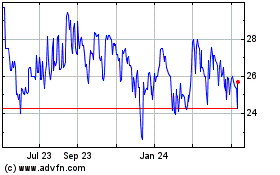

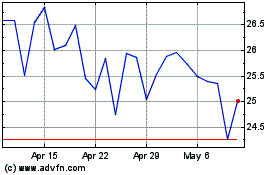

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | LIVE | | The Nasdaq Stock Market LLC (The Nasdaq Capital Market) |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | x | Smaller reporting company | x |

| Emerging growth company | o | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The number of shares of the issuer’s common stock, par value $0.001 per share, outstanding as of May 10, 2024 was 3,144,028.

INDEX TO FORM 10-Q FILING

FOR THE THREE AND SIX MONTHS ENDED MARCH 31, 2024

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

Item 1. Financial Statements

LIVE VENTURES INCORPORATED

CONDENSED CONSOLIDATED BALANCE SHEETS

(dollars in thousands, except per-share amounts)

| | | | | | | | | | | |

| March 31, 2024 | | September 30, 2023 |

| (Unaudited) | | |

| Assets | | | |

| Cash | $ | 4,489 | | | $ | 4,309 | |

Trade receivables, net of allowance for doubtful accounts of $1.1 million at March 31, 2024 and $1.6 million at September 30, 2023 | 45,510 | | | 41,194 | |

| Inventories, net | 130,980 | | | 131,314 | |

| Income taxes receivable | — | | | 1,116 | |

| Prepaid expenses and other current assets | 4,430 | | | 4,919 | |

| Total current assets | 185,409 | | | 182,852 | |

| Property and equipment, net | 78,432 | | | 80,703 | |

| Right of use asset - operating leases | 64,867 | | | 54,544 | |

| | | |

| Deposits and other assets | 1,579 | | | 1,282 | |

| | | |

| Intangible assets, net | 26,942 | | | 26,568 | |

| Goodwill | 76,639 | | | 75,866 | |

| Total assets | $ | 433,868 | | | $ | 421,815 | |

| Liabilities and Stockholders' Equity | | | |

| Liabilities: | | | |

| Accounts payable | $ | 26,466 | | | $ | 27,190 | |

| Accrued liabilities | 33,180 | | | 31,826 | |

| Income taxes payable | 322 | | | — | |

| Current portion of lease obligations - operating leases | 13,459 | | | 11,369 | |

| Current portion of lease obligations - finance leases | 361 | | | 359 | |

| Current portion of long-term debt | 31,396 | | | 23,077 | |

| Current portion of notes payable related parties | 1,200 | | | 4,000 | |

| Total current liabilities | 106,384 | | | 97,821 | |

| Long-term debt, net of current portion | 75,322 | | | 78,710 | |

| Lease obligation long term - operating leases | 56,678 | | | 48,156 | |

| Lease obligation long term - finance leases | 33,023 | | | 32,942 | |

| Notes payable related parties, net of current portion | 10,124 | | | 6,914 | |

| Seller notes - related parties | 40,354 | | | 38,998 | |

| Deferred taxes | 10,320 | | | 14,035 | |

| Other non-current obligations | 5,795 | | | 4,104 | |

| Total liabilities | 338,000 | | | 321,680 | |

| Commitments and contingencies | | | |

| Stockholders' equity: | | | |

Series E convertible preferred stock, $0.001 par value, 200,000 shares authorized, 47,840 shares issued and outstanding at March 31, 2024 and September 30, 2023, respectively, with a liquidation preference of $0.30 per share outstanding | — | | | — | |

Common stock, $0.001 par value, 10,000,000 shares authorized, 3,148,135 and 3,164,330 shares issued and outstanding at March 31, 2024 and September 30, 2023, respectively | 2 | | | 2 | |

| Paid in capital | 69,487 | | | 69,387 | |

Treasury stock common 676,258 and 660,063 shares as of March 31, 2024 and September 30, 2023, respectively | (8,610) | | | (8,206) | |

Treasury stock Series E preferred 80,000 shares as of March 31, 2024 and September 30, 2023, respectively | (7) | | | (7) | |

| Retained earnings | 34,996 | | | 38,959 | |

| Total stockholders' equity | 95,868 | | | 100,135 | |

| | | |

| | | |

| Total liabilities and stockholders' equity | $ | 433,868 | | | $ | 421,815 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

LIVE VENTURES INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF (LOSS) INCOME

(UNAUDITED)

(dollars in thousands, except per-share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended March 31, | | For the Six Months Ended March 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 118,626 | | | $ | 91,122 | | | $ | 236,219 | | | $ | 160,108 | |

| Cost of revenue | 83,159 | | | 59,514 | | | 164,425 | | | 106,556 | |

| Gross profit | 35,467 | | | 31,608 | | | 71,794 | | | 53,552 | |

| | | | | | | |

| Operating expenses: | | | | | | | |

| General and administrative expenses | 29,824 | | | 22,617 | | | 57,503 | | | 37,217 | |

| Sales and marketing expenses | 6,481 | | | 4,039 | | | 11,588 | | | 6,816 | |

| Total operating expenses | 36,305 | | | 26,656 | | | 69,091 | | | 44,033 | |

| Operating income (loss) | (838) | | | 4,952 | | | 2,703 | | | 9,519 | |

| Other expense: | | | | | | | |

| Interest expense, net | (4,167) | | | (3,235) | | | (8,330) | | | (5,282) | |

| | | | | | | |

| Other Income | 507 | | | 391 | | | 223 | | | 330 | |

| Total other expense, net | (3,660) | | | (2,844) | | | (8,107) | | | (4,952) | |

| (Loss) income before provision for income taxes | (4,498) | | | 2,108 | | | (5,404) | | | 4,567 | |

| (Benefit) provision for income taxes | (1,217) | | | 550 | | | (1,441) | | | 1,165 | |

| Net (loss) income | $ | (3,281) | | | $ | 1,558 | | | $ | (3,963) | | | $ | 3,402 | |

| | | | | | | |

| (Loss) income per share: | | | | | | | |

| Basic | $ | (1.04) | | | $ | 0.50 | | | $ | (1.25) | | | $ | 1.10 | |

| Diluted | $ | (1.04) | | | $ | 0.49 | | | $ | (1.25) | | | $ | 1.08 | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 3,154,771 | | 3,143,911 | | 3,159,180 | | 3,101,007 |

| Diluted | 3,154,771 | | 3,184,982 | | 3,159,180 | | 3,137,625 |

The accompanying notes are an integral part of these condensed consolidated financial statements.

LIVE VENTURES INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(dollars in thousands)

| | | | | | | | | | | |

| For the Six Months Ended March 31, |

| 2024 | | 2023 |

| Operating Activities: | | | |

| Net (loss) income | $ | (3,963) | | | $ | 3,402 | |

| Adjustments to reconcile net (loss) income to net cash provided by operating activities, net of acquisition: | | | |

| Depreciation and amortization | 8,483 | | | 6,297 | |

| Gain on disposal of fixed assets | — | | | (7) | |

| Amortization of seller note discount | 1,355 | | | — | |

| Amortization of debt issuance cost | 43 | | | 105 | |

| Stock based compensation expense | 100 | | | 109 | |

| Amortization of right-of-use assets | 2,008 | | | 1,397 | |

| Change in reserve for uncollectible accounts | (449) | | | 350 | |

| Change in reserve for obsolete inventory | 1,557 | | | 169 | |

| Changes in assets and liabilities, net of acquisitions: | | | |

| Trade receivables | (2,357) | | | 436 | |

| Inventories | 469 | | | 2,384 | |

| Income taxes payable/receivable | 1,438 | | | 166 | |

| Prepaid expenses and other current assets | 791 | | | 3,453 | |

| Deposits and other assets | (295) | | | (1,095) | |

| Accounts payable | (2,511) | | | (3,668) | |

| Accrued liabilities | (1,709) | | | (3,547) | |

| Change in deferred income taxes | (2,829) | | | 4,168 | |

| Other Liabilities | — | | | 59 | |

| Net cash provided by operating activities | 2,131 | | | 14,178 | |

| | | |

| Investing Activities: | | | |

| Acquisition of CRO | (1,034) | | | — | |

| Acquisition of Johnson | (500) | | | — | |

| Acquisition of Flooring Liquidators, net of cash received | — | | | (33,929) | |

| Purchase of property and equipment | (3,373) | | | (2,900) | |

| Net cash used in investing activities | (4,907) | | | (36,829) | |

| | | |

| Financing Activities: | | | |

| Net borrowings under revolver loans | 7,731 | | | 12,312 | |

| Proceeds from issuance of notes payable | 227 | | | 8,449 | |

| Payments on notes payable | (3,359) | | | (3,679) | |

| Proceeds from issuance of related party notes payable | 1,000 | | | 7,000 | |

| Payments on related party notes payable | (600) | | | — | |

| Payments for debt acquisition costs | — | | | (96) | |

| Purchase of common treasury stock | (405) | | | (639) | |

| Payments on financing leases | (1,638) | | | (1,077) | |

| Payments on seller finance arrangements | — | | | (51) | |

| Net cash provided by financing activities | 2,956 | | | 22,219 | |

| | | |

| Change in cash | 180 | | | (432) | |

| Cash, beginning of period | 4,309 | | | 4,600 | |

| Cash, end of period | $ | 4,489 | | | $ | 4,168 | |

| | | |

| Supplemental cash flow disclosures: | | | |

| Interest paid | $ | 6,665 | | | $ | 4,602 | |

| Income taxes received, net | $ | 106 | | | $ | — | |

| Income taxes paid, net | $ | — | | | $ | 43 | |

| Noncash financing and investing activities: | | | |

| Noncash items related to Flooring Liquidators acquisition | $ | — | | | $ | 36,900 | |

| PMW goodwill adjustment | $ | 233 | | | $ | — | |

| Noncash items related to CRO acquisition | $ | 725 | | | $ | — | |

| Noncash items related to Johnson acquisition | $ | 1,501 | | | $ | — | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

LIVE VENTURES INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS' EQUITY

(UNAUDITED)

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Series E

Preferred Stock | | Common Stock | | | | Series E

Preferred

Stock | | Common

Stock | | | | | | |

| | Shares | | Amount | | Shares | | Amount | | Paid-In

Capital | | Treasury

Stock | | Treasury

Stock | | Retained

Earnings | | Non-controlling

Interest | | Total

Equity |

| Balance, September 30, 2023 | | 47,840 | | $ | — | | | 3,164,330 | | $ | 2 | | | $ | 69,387 | | | $ | (7) | | | $ | (8,206) | | | $ | 38,959 | | | $ | — | | | $ | 100,135 | |

| Stock based compensation | | — | | | — | | | — | | | — | | | 50 | | | — | | | — | | | — | | | — | | | 50 | |

| Purchase of common treasury stock | | — | | | — | | | (4,346) | | — | | | — | | | — | | | (106) | | | — | | | — | | | (106) | |

| Net loss | | — | | | — | | | — | | — | | | — | | | — | | | — | | | (682) | | | — | | | (682) | |

| Balance, December 31, 2023 | | 47,840 | | $ | — | | | 3,159,984 | | $ | 2 | | | $ | 69,437 | | | $ | (7) | | | $ | (8,312) | | | $ | 38,277 | | | $ | — | | | $ | 99,397 | |

| Stock based compensation | | — | | | — | | | | | — | | | 50 | | | — | | | — | | | — | | | — | | | 50 | |

| Purchase of common treasury stock | | — | | | — | | | (11,849) | | — | | | — | | | — | | | (298) | | | — | | | — | | | (298) | |

| Net loss | | — | | | — | | | — | | — | | | — | | | — | | | — | | | (3,281) | | | — | | | (3,281) | |

| Balance, March 31, 2024 | | 47,840 | | $ | — | | | 3,148,135 | | $ | 2 | | | $ | 69,487 | | | $ | (7) | | | $ | (8,610) | | | $ | 34,996 | | | $ | — | | | $ | 95,868 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Series E

Preferred Stock | | Common Stock | | | | Series E

Preferred

Stock | | Common

Stock | | | | | | |

| | Shares | | Amount | | Shares | | Amount | | Paid-In

Capital | | Treasury

Stock | | Treasury

Stock | | Retained

Earnings | | Non-controlling

Interest | | Total

Equity |

| Balance, September 30, 2022 | | 47,840 | | $ | — | | | 3,074,833 | | $ | 2 | | | $ | 65,321 | | | $ | (7) | | | $ | (7,215) | | | $ | 39,509 | | | $ | (448) | | | $ | 97,162 | |

| Purchase of common treasury stock | | — | | — | | | (24,710) | | — | | | — | | | — | | | (621) | | | — | | | | | (621) | |

| Net income | | — | | — | | | — | | — | | | — | | | — | | | — | | | 1,844 | | | — | | | 1,844 | |

| Balance, December 31, 2022 | | 47,840 | | $ | — | | | 3,050,123 | | $ | 2 | | | $ | 65,321 | | | $ | (7) | | | $ | (7,836) | | | $ | 41,353 | | | $ | (448) | | | $ | 98,385 | |

| Purchase of common treasury stock | | — | | — | | (674) | | — | | — | | | — | | (17) | | | — | | | — | | | (17) | |

| Stock based compensation | | — | | — | | — | | — | | 109 | | | — | | — | | | — | | | — | | | 109 | |

| Issuance of common stock | | — | | — | | 116,441 | | — | | 3,200 | | | — | | — | | | — | | | — | | | 3,200 | |

| Net income | | — | | — | | — | | — | | — | | | — | | — | | | 1,558 | | | — | | | 1,558 | |

| Balance, March 31, 2023 | | 47,840 | | $ | — | | | 3,165,890 | | $ | 2 | | | $ | 68,630 | | | $ | (7) | | | $ | (7,853) | | | $ | 42,911 | | | $ | (448) | | | $ | 103,235 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

LIVE VENTURES INCORPORATED

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

FOR THE THREE AND SIX MONTHS ENDED MARCH 31, 2024 AND 2023

(dollars in thousands, except per-share amounts)

Note 1: Background and Basis of Presentation

The accompanying unaudited condensed consolidated financial statements include the accounts of Live Ventures Incorporated, a Nevada corporation, and its subsidiaries (collectively, “Live Ventures” or the “Company”). Live Ventures is a diversified holding company with a strategic focus on value-oriented acquisitions of domestic middle-market companies. The Company has five operating segments: Retail-Entertainment, Retail-Flooring, Flooring Manufacturing, Steel Manufacturing, and Corporate and Other. The Retail-Entertainment segment includes Vintage Stock, Inc. (“Vintage Stock”), which is engaged in the retail sale of new and used movies, music, collectibles, comics, books, games, game systems and components. The Retail-Flooring segment includes Flooring Liquidators, Inc. (“Flooring Liquidators”), which is engaged in the retail sale and installation of floors, carpets, and countertops. The Flooring Manufacturing segment includes Marquis Industries, Inc. (“Marquis”), which is engaged in the manufacture and sale of carpet and the sale of vinyl and wood floor coverings. The Steel Manufacturing Segment includes Precision Industries, Inc. (“Precision Marshall”), which is engaged in the manufacture and sale of alloy and steel plates, ground flat stock and drill rods, The Kinetic Co., Inc. (“Kinetic”), which is engaged in the production of industrial knives and hardened wear products for the tissue and metals industries, and Precision Metal Works, Inc. (“PMW”), which is engaged in metal forming, assembly, and finishing solutions across diverse industries, including appliance, automotive, hardware, electrical, electronic, medical products, and devices. PMW reports on a 13-week quarter, as opposed to the Company's calendar quarter reporting. However, the Company has determined that the difference in reporting periods has no material effect on its reported financial results.

The unaudited condensed consolidated financial statements have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”) for interim financial information. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for audited financial statements. In the opinion of the Company’s management, this interim information includes all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the results for the interim periods. The results of operations for the three and six months ended March 31, 2024 are not necessarily indicative of the results to be expected for the fiscal year ending September 30, 2024. The financial information included in these statements should be read in conjunction with the condensed consolidated financial statements and related notes thereto as of September 30, 2023 and for the fiscal year then ended included in the Company’s Annual Report on Form 10-K, filed with the U.S. Securities and Exchange Commission (the “SEC”) on December 22, 2023 (the “2023 Form 10-K”).

Note 2: Summary of Significant Accounting Policies

Principles of Consolidation

The unaudited condensed financial statements include the accounts of the Company and its majority owned subsidiaries over which the Company exercises control. All intercompany accounts and transactions have been eliminated in consolidation. These reclassifications have no material effect on the reported financial results.

Use of Estimates

The preparation of the unaudited condensed consolidated financial statements in conformity with U.S. GAAP requires the Company’s management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the condensed consolidated financial statements, as well as the reported amounts of revenue and expenses during the reporting period. Actual results could differ from those estimates.

Significant estimates made in connection with the accompanying consolidated financial statements include the estimated reserve for doubtful current and long-term trade and other receivables, the estimated reserve for excess and obsolete inventory, fair values in connection with the analysis of goodwill, other intangibles and long-lived assets for impairment, valuation allowance against deferred tax assets, lease terminations, and estimated useful lives for intangible assets and property and equipment.

Recently Issued Accounting Pronouncements

In November 2023, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards Update ("ASU") 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures ("ASU 2023-07"). ASU 2023-07 requires, among other updates, enhanced disclosures about significant segment expenses that are regularly

provided to the Chief Operating Decision Maker, as well as the aggregate amount of other segment items included in the reported measure of segment profit or loss. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, and requires retrospective adoption. Early adoption is permitted. The Company is evaluating the impact of this guidance on its consolidated financial statements and related disclosures.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures ("ASU 2023-09"). ASU 2023-09 requires enhanced annual disclosures regarding the rate reconciliation and income taxes paid information. ASU 2023-09 is effective for fiscal years beginning after December 15, 2024, and may be adopted on a prospective or retrospective basis. Early adoption is permitted. The Company is evaluating the impact of this guidance on its consolidated financial statements and related disclosures.

Note 3: Acquisitions

Acquisition of CRO

On October 13, 2023, Flooring Liquidators acquired certain assets and assumed certain liabilities of Carpet Remnant Outlet, Inc. (“CRO”), a floor covering retailer and installer serving residential and commercial customers throughout Northwest Arkansas. Total consideration for the acquisition was approximately $1.8 million and was comprised of cash at close of approximately $1.0 million, an indemnification holdback amount of $300,000, and additional consideration valued at $425,000.

The fair value of the purchase price components was $1.8 million, as detailed below (in $000's):

| | | | | | | | |

| Cash | | $ | 1,034 | |

| Additional consideration | | 425 | |

| Holdback | | 300 | |

| Purchase price | | $ | 1,759 | |

Under the preliminary purchase price allocation, the Company recognized goodwill of $425,000, which is calculated as the excess of both the consideration exchanged and liabilities assumed as compared to the fair value of the identifiable assets acquired. The values assigned to the assets acquired and liabilities assumed are based on their estimates of fair value available as of October 13, 2023, as calculated by an independent third-party firm. The value of the additional consideration was calculated by management. The Company anticipates the $425,000 of goodwill arising from the acquisition to be fully deductible for tax purposes. The table below outlines the purchase price allocation of the purchase for CRO to the acquired identifiable assets, liabilities assumed and goodwill as of March 31, 2024 (in $000’s):

| | | | | | | | | | | |

| Total purchase price | | | $ | 1,759 | |

| Accounts payable | | | 770 | |

| Accrued liabilities | | | 1,298 | |

| Total liabilities assumed | | | 2,068 | |

| Total consideration | | | 3,827 | |

| Accounts receivable | | | 259 | |

| Inventory | | | 1,406 | |

| Property, plant and equipment | | | 261 | |

| Intangible assets | | | 1,190 | |

| Other assets | | | 286 | |

| Total assets acquired | | | 3,402 | |

| Total goodwill | | | $ | 425 | |

Acquisition of Johnson

On November 30, 2023, CRO acquired certain assets and assumed certain liabilities of Johnson Floor & Home (“Johnson”), a floor covering retailer and installer serving residential and commercial customers through four locations in the Tulsa, Oklahoma area, and one in Joplin, Missouri. Total consideration for the acquisition was $2.0 million, comprised of cash at close of $500,000, deferred consideration in the form of a seller note of $1.2 million, with additional

consideration paid in the form of an earnout valued at approximately $300,000. The deferred consideration is payable in three $400,000 installments due annually on the first three anniversary dates following the closing date. Each installment will accrue interest at 6.0% per annum until paid.

The fair value of the purchase price components outlined above was approximately $2.0 million, as detailed below (in $000's):

| | | | | | | | |

| Cash | | $ | 500 | |

| Deferred consideration | | 1,200 | |

| Earnout | | 301 | |

| Purchase price | | $ | 2,001 | |

The values assigned to the assets acquired and liabilities assumed are based on their estimates of fair value available as of November 30, 2023, as calculated by management. The table below outlines the purchase price allocation of the purchase for Johnson to the acquired identifiable assets, liabilities assumed and goodwill as of March 31, 2024 (in $000’s):

| | | | | | | | | | | |

| Total purchase price | | | $ | 2,001 | |

| Accounts payable | | | 1,017 | |

| Accrued liabilities | | | 1,141 | |

| Total liabilities assumed | | | 2,158 | |

| Total consideration | | | 4,159 | |

| Accounts receivable | | | 1,252 | |

| Inventory | | | 1,127 | |

| Property, plant and equipment | | | 157 | |

| Intangible assets | | | |

| Customer relationships | | $ | 1,301 | | |

| Non-compete agreement | | 306 | | |

| Subtotal intangible assets | | | 1,607 | |

| Other assets | | | 16 | |

| Total assets acquired | | | 4,159 | |

| Total goodwill | | | $ | — | |

Acquisition of Harris Flooring Group® Brands

On September 20, 2023, Marquis acquired the Harris Flooring Group® brands from Q.E.P., a designer, manufacturer, and distributor of a broad range of best-in-class flooring and installation solutions for commercial and home improvement projects. Specifically, Marquis acquired the Harris Flooring Group brands, inventory, and book of business and intends to retain all sales representatives. The purchase price was $10.1 million, consisting of $3.0 million in cash at close, and the recording of a deferred payment of $5.1 million and holdback of $2.0 million. The acquisition was determined to be an asset acquisition for accounting purposes. The entirety of the purchase price was allocated to inventory.

Acquisition of PMW

On July 20, 2023 (“Effective Date”), the Company acquired PMW, a Kentucky-based metal stamping and value-added manufacturing company. PMW was acquired for total consideration of approximately $28 million, comprised of a $25 million purchase price, plus closing cash, and subject to working capital adjustments, with additional consideration of up to $3 million paid in the form of an earn-out. The purchase price was funded in part by a $2.5 million seller note, borrowings under a credit facility of $14.4 million, and proceeds under a sale and leaseback transaction of approximately $8.6 million. The acquisition involved no issuance of stock of the Company.

As of the Effective Date, the Company entered into a sales and leaseback transaction for two properties acquired, one located in Frankfort, Kentucky, and the other located in Louisville, Kentucky, with Legacy West Kentucky Portfolio, LLC (“Lessor”). The aggregate sales price of the real estate was approximately $14.5 million. The Louisville, Kentucky property was acquired on the Effective Date for $5.1 million in connection with an option of PMW to purchase that property.

The provisions of each of the two lease agreements include a 20-year lease term with two five-year renewal options. The base rent under the Frankfort lease agreement is $34,977 per month for the first year of the term and a 2% per annum escalator thereafter. The base rent under the Louisville lease agreement is $63,493 per month for the first year of the term and a 2% per annum escalator thereafter. Both lease agreements are “net leases,” such that the lessees are also obligated to pay all taxes, insurance, assessments, and other costs, expenses, and obligations of ownership of the real property incurred by the lessor. Due to the highly specialized nature of the leased assets, the Company currently believes it is more likely than not that each of the two five-year options will be exercised. The proceeds of $14.5 million, net of closing fees, from the sale-leaseback were used to assist in funding the acquisition of PMW.

The fair value of the purchase price components outlined above was $26.8 million due to fair value adjustments for the contingent consideration, cash acquired, and working capital adjustments, as detailed below (in $000’s):

| | | | | | | | |

| Purchase price | | $ | 25,000 | |

| Fair value of earnout | | 2,675 | |

| Cash from balance sheet | | 1,602 | |

| Working capital adjustment | | (2,500) | |

| Net purchase price | | $ | 26,777 | |

Under the preliminary purchase price allocation, the Company recognized goodwill of approximately $4.0 million, which is calculated as the excess of both the consideration exchanged and liabilities assumed as compared to the fair value of the identifiable assets acquired. The values assigned to the assets acquired and liabilities assumed are based on their estimates of fair value available as of July 20, 2023, as calculated by an independent third-party firm. Because the transaction was considered a stock purchase for tax purposes, none of the goodwill arising from the acquisition will be deductible for tax purposes. During the three months ended December 31, 2023, the Company recorded noncash fair value adjustments related to inventory and other liabilities assumed, as well as an adjustment to deferred tax liabilities in the aggregate amount of $652,000. The table below outlines the purchase price allocation of the purchase for PMW to the acquired identifiable assets, liabilities assumed and goodwill (in $000’s):

| | | | | | | | |

| Net purchase price | | $ | 26,777 | |

| Accounts payable | | 10,788 | |

| Accrued liabilities | | 4,995 | |

| Total liabilities assumed | | 15,783 | |

| Total consideration | | 42,560 | |

| Cash | | 1,602 | |

| Accounts receivable | | 12,613 | |

| Inventory | | 6,266 | |

| Property, plant and equipment | | 13,616 | |

| Intangible assets | | 3,600 | |

| Other assets | | 849 | |

| Total assets acquired | | 38,546 | |

| Total goodwill | | $ | 4,014 | |

Acquisition of Cal Coast Carpets

On June 2, 2023, Flooring Liquidators acquired certain fixed assets and other intangible assets of Cal Coast Carpets, Inc. (“Cal Coast”), and its shareholders. No liabilities were assumed as part of either transaction. The purchase price for the fixed assets acquired from Cal Coast was $35,000, and the intangible assets acquired from the shareholders was approximately $1.265 million, for a total combined purchase price of $1.3 million. The intangible assets acquired were comprised of customer relationships, trade name, and non-compete agreements. The acquisition was determined to be an asset acquisition for accounting purposes and, as such, no goodwill was recorded as part of the transaction. The values assigned to the assets acquired are based on their estimates of fair value available as of June 2, 2023, as calculated by management.

The table below outlines the purchase price allocation of the purchase for Cal Coast to the acquired identifiable assets (in $000’s):

| | | | | | | | |

| Property, plant and equipment | | $ | 35 | |

| Intangible assets | | |

| Customer relationships | | 785 | |

| Trade name | | 425 | |

| Non-compete agreement | | 55 | |

| Total intangible assets | | 1,265 | |

| Total assets acquired | | $ | 1,300 | |

Acquisition of Flooring Liquidators

On January 18, 2023, Live Ventures acquired 100% of the issued and outstanding equity interests (the “Equity Interests”) of Flooring Liquidators, Inc., Elite Builder Services, Inc. (“EBS”), 7 Day Stone, Inc., Floorable, LLC, K2L Leasing, LLC, and SJ & K Equipment, Inc. (collectively, the “Acquired Companies”). The Acquired Companies are leading retailers and installers of floors, carpets, and countertops to consumers, builders and contractors in California and Nevada.

The acquisition was effected pursuant to a Securities Purchase Agreement (the “Purchase Agreement”) with an effective date of January 18, 2023 by and among the Company, and Stephen J. Kellogg, as the seller representative of the equity holders of the Acquired Companies and individually in his capacity as an equity holder of the Acquired Companies, and the other equity holders of the Acquired Companies (collectively, the “Seller”). The purchase price for the Equity Interests was $83.8 million before any fair value considerations, and is comprised of the following:

•$41.8 million in cash to the Seller;

•$34.0 million (the “Note Amount”) to certain trusts for the benefit of Kellogg and members of his family (the “Kellogg Trusts”) pursuant to the issuance by the Company of a subordinated promissory note (the “Note”) in favor of the Kellogg Trusts;

•$4.0 million to the Kellogg 2022 Family Irrevocable Nevada Trust by issuance of 116,441 shares of Company Common Stock (as defined in the Purchase Agreement) (the “Share Amount”), calculated in the manner described in the Purchase Agreement;

•$2.0 million holdback; and

•$2.0 million of contingent consideration, comprised of $1.0 million in cash and $1.0 million in restricted stock units.

The fair value of the purchase price components outlined above was $78.7 million due to fair value adjustments for the Note, and restricted stock, as detailed below (in $000's).

| | | | | | | | |

| Purchase price | | $ | 83,800 | |

| Fair value adjustment, sellers note | | (3,300) | |

| Fair value adjustment, restricted stock | | (1,800) | |

| Net purchase price | | $ | 78,700 | |

Under the preliminary purchase price allocation, the Company recognized goodwill of approximately $31.4 million, which is calculated as the excess of both the consideration exchanged and liabilities assumed as compared to the fair value of the identifiable assets acquired. The values assigned to the assets acquired and liabilities assumed are based on their estimates of fair value available as of January 18, 2023, as calculated by an independent third-party firm. The Company anticipates approximately $13.4 million of the goodwill arising from the acquisition to be fully deductible for tax purposes. During the three months ended December 31, 2023, the Company recorded a fair value adjustment related to its contingent

consideration of $1 million. The table below outlines the purchase price allocation, as revised, of the purchase for Flooring Liquidators to the acquired identifiable assets, liabilities assumed and goodwill (in $000’s):

| | | | | | | | | | | |

| Purchase price | | | $ | 78,700 | |

| | | |

| | | |

| Accounts payable | | | 5,189 | |

| Accrued liabilities | | | 10,700 | |

| Debt | | | 60 | |

| Total liabilities assumed | | | 15,949 | |

| Total consideration | | | 94,649 | |

| Cash | | | 9,131 | |

| Accounts receivable | | | 4,824 | |

| Inventory | | | 19,402 | |

| Property, plant and equipment | | | 4,643 | |

| Intangible assets | | | |

| Trade names | $ | 13,275 | | | |

| Customer relationships | 7,700 | | | |

| Non-compete agreements | 1,625 | | | |

| Other | 49 | | | |

| Subtotal intangible assets | | | 22,649 | |

| Other | | | 2,581 | |

| Total assets acquired | | | 63,230 | |

| Total goodwill | | | $ | 31,419 | |

Pro Forma Information

The table below presents selected proforma information for the Company for the three and six-month periods ended March 31, 2023, assuming that the acquisition had occurred on October 1, 2022 (the beginning of the Company’s 2023 fiscal year), pursuant to ASC 805-10-50 (in $000's). This proforma information does not purport to represent what the actual results of operations of the Company would have been had the acquisition occurred on that date, nor does it purport to predict the results of operations for future periods.

| | | | | | | | | | | | | | | | | | | | | | | |

| As Reported | | Adjustments | | Proforma |

| Live Unaudited Three Months Ended March 31, 2023 | | Flooring Liquidators Unaudited Three Months Ended March 31, 2023 | | Adjustments(1) | | Live for the Three Months Ended March 31, 2023 |

| Net revenue | $ | 91,122 | | | $ | 4,222 | | | | | $ | 95,344 | |

| Net income | $ | 1,558 | | | $ | (2,188) | | | $ | (300) | | | $ | (930) | |

| Earnings per basic common share | $ | 0.50 | | | | | | | $ | (0.30) | |

| Earnings per basic diluted share | $ | 0.49 | | | | | | | $ | (0.29) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| As Reported | | Adjustments | | Proforma |

| Live Unaudited Six Months Ended March 31, 2023 | | Flooring Liquidators Unaudited Six Months Ended March 31, 2023 | | Adjustments(1) | | Live for the Six Months Ended March 31, 2023 |

| Net revenue | $ | 160,108 | | | $ | 37,702 | | | | | $ | 197,810 | |

| Net income | $ | 3,402 | | | $ | (1,033) | | | $ | (2,226) | | | $ | 143 | |

| Earnings per basic common share | $ | 1.10 | | | | | | | $ | 0.05 | |

| Earnings per basic diluted share | $ | 1.08 | | | | | | | $ | 0.05 | |

(1) Adjustments are related to adjustments made for the following:

•Amortization expense of definite-lived intangible assets has been adjusted based on the preliminary fair value at the acquisition date.

•Interest expense has been adjusted to include proforma interest expense that would have been incurred as a result of the acquisition financing obtained by the Company.

•Elimination of revenue and costs of revenue associated with sales between Flooring Liquidators and the Company prior to acquisition.

Note 4: Inventory

The following table details the Company's inventory as of March 31, 2024 and September 30, 2023 (in $000's):

| | | | | | | | | | | |

| Inventory, net | March 31, 2024 | | September 30, 2023 |

| Raw materials | $ | 28,695 | | | $ | 32,590 | |

| Work in progress | 9,320 | | | 9,028 | |

| Finished goods | 52,674 | | | 50,082 | |

| Merchandise | 46,388 | | | 43,438 | |

| 137,077 | | | 135,138 | |

| Less: Inventory reserves | (6,097) | | | (3,824) | |

| Total inventory, net | $ | 130,980 | | | $ | 131,314 | |

Note 5: Property and Equipment

The following table details the Company's property and equipment as of March 31, 2024 and September 30, 2023 (in $000's):

| | | | | | | | | | | |

| March 31, 2024 | | September 30, 2023 |

| Property and equipment, net: | | | |

| Land | $ | 2,029 | | | $ | 2,029 | |

| Building and improvements | 36,955 | | | 35,684 | |

| Transportation equipment | 2,086 | | | 2,062 | |

| Machinery and equipment | 69,322 | | | 67,575 | |

| Furnishings and fixtures | 6,285 | | | 6,028 | |

| Office, computer equipment and other | 5,003 | | | 4,569 | |

| 121,680 | | | 117,947 | |

| Less: Accumulated depreciation | (43,248) | | | (37,244) | |

| Total property and equipment, net | $ | 78,432 | | | $ | 80,703 | |

Depreciation expense was $3.0 million and $2.7 million for the three months ended March 31, 2024 and 2023, respectively, and $6.1 million and $5.1 million for the six months ended March 31, 2024 and 2023, respectively.

Note 6: Leases

The Company leases retail stores, warehouse facilities, and office space. These assets and properties are generally leased under noncancelable agreements that expire at various future dates with many agreements containing renewal options for additional periods. The agreements, which have been classified as either operating or finance leases, generally provide for minimum rent and, in some cases, percentage rent, and require the Company to pay all insurance, taxes, and other maintenance costs. As a result, the Company recognizes assets and liabilities for all leases with lease terms greater than 12 months. The amounts recognized reflect the present value of remaining lease payments for all leases. The discount rate

used is an estimate of the Company’s blended incremental borrowing rate based on information available associated with each subsidiary’s debt outstanding at lease commencement. In considering the lease asset value, the Company considers fixed and variable payment terms, prepayments and options to extend, terminate or purchase. Renewal, termination, or purchase options affect the lease term used for determining lease asset value only if the option is reasonably certain to be exercised.

The following table details the Company's right of use assets and lease liabilities as of March 31, 2024 and September 30, 2023 (in $000's):

| | | | | | | | | | | |

| March 31, 2024 | | September 30, 2023 |

| Right of use asset - operating leases | $ | 64,867 | | | $ | 54,544 | |

| | | |

| Lease liabilities: | | | |

| Current - operating | 13,459 | | | 11,369 | |

| Current - finance | 361 | | | 359 | |

| Long term - operating | 56,678 | | | 48,156 | |

| Long term - finance | 33,023 | | | 32,942 | |

As of March 31, 2024, the weighted average remaining lease term for operating leases is 10.0 years. The Company's weighted average discount rate for operating leases is 9.8%. Total cash payments for operating leases for the six months ended March 31, 2024 and 2023 were approximately $8.8 million and $3.9 million, respectively. Additionally, the Company recognized approximately $17.4 million in right of use assets and liabilities upon commencement of operating leases during the six months ended March 31, 2024.

As of March 31, 2024, the weighted average remaining lease term for finance leases is 27.3 years. The Company's weighted average discount rate for finance leases is 11.7%. Total cash payments for finance leases for the six months ended March 31, 2024 and 2023 were approximately $1.6 million and $1.1 million, respectively. No finance right-of-use assets or liabilities were recognized during the six months ended March 31, 2024.

The Company records finance lease right-of-use assets as property and equipment. The balance, as of March 31, 2024 and September 30, 2023 is as follows (in $000’s):

| | | | | | | | | | | |

| March 31, 2024 | | September 30, 2023 |

| Property and equipment, at cost | $ | 22,526 | | | $ | 22,526 | |

| Accumulated depreciation | $ | (1,048) | | | $ | (702) | |

| Property and equipment, net | $ | 21,478 | | | $ | 21,824 | |

Total present value of future lease payments of operating leases as of March 31, 2024 (in $000's):

| | | | | |

| Twelve months ended March 31, | |

| 2025 | $ | 18,466 | |

| 2026 | 16,286 | |

| 2027 | 13,774 | |

| 2028 | 11,132 | |

| 2029 | 7,049 | |

| Thereafter | 31,421 | |

| Total | 98,128 | |

| Less implied interest | (27,991) | |

| Present value of payments | $ | 70,137 | |

Total present value of future lease payments of finance leases as of March 31, 2024 (in $000's):

| | | | | |

| Twelve months ended March 31, | |

| 2025 | $ | 3,185 | |

| 2026 | 3,197 | |

| 2027 | 3,257 | |

| 2028 | 3,348 | |

| 2029 | 3,453 | |

| Thereafter | 103,196 | |

| Total | 119,636 | |

| Less implied interest | (86,252) | |

| Present value of payments | $ | 33,384 | |

During the six months ended March 31, 2024 and 2023, the Company recorded no impairment charges relating to any of its leases.

Note 7: Intangibles

The following table details the Company's intangibles as of March 31, 2024 and September 30, 2023 (in $000's):

| | | | | | | | | | | |

| March 31, 2024 | | September 30, 2023 |

| Intangible assets, net: | | | |

| Intangible assets - Tradenames | $ | 14,940 | | | $ | 14,940 | |

| Intangible assets - Customer relationships | 15,139 | | | 13,874 | |

| Intangible assets - Other | 3,810 | | | 2,316 | |

| 33,889 | | | 31,130 | |

| Less: Accumulated amortization | (6,947) | | | (4,562) | |

| Total intangibles, net | $ | 26,942 | | | $ | 26,568 | |

Amortization expense was $1.2 million and $992,000 for the three months ended March 31, 2024 and 2023, respectively, and $2.4 million and $1.2 million for the six months ended March 31, 2024 and 2023, respectively.

The following table summarizes estimated future amortization expense related to intangible assets that have net balances (in $000’s):

| | | | | |

| Twelve months ending March 31, | |

| 2025 | $ | 4,984 | |

| 2026 | 4,984 | |

| 2027 | 4,915 | |

| 2028 | 4,799 | |

| 2029 | 4,141 | |

| Thereafter | 3,119 | |

| $ | 26,942 | |

Note 8: Goodwill

The following table details the Company's goodwill as of September 30, 2023 and March 31, 2024 (in $000's):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Retail - Entertainment | | Retail - Flooring | | Flooring Manufacturing | | Steel Manufacturing | | Total |

| September 30, 2023 | 36,947 | | | 30,419 | | | 807 | | | 7,693 | | | 75,866 | |

| | | | | | | | | |

| CRO acquisition | — | | | 425 | | | — | | | — | | | 425 | |

| PMW adjustment | — | | | — | | | — | | | (652) | | | (652) | |

| Flooring Liquidators adjustment | — | | | 1,000 | | | — | | | — | | | 1,000 | |

| March 31, 2024 | $ | 36,947 | | | $ | 31,844 | | | $ | 807 | | | $ | 7,041 | | | $ | 76,639 | |

During the six months ended March 31, 2024, the Company made fair value adjustments, in the amount of approximately ($652,000) related to the acquisition of PMW, $425,000 related to the CRO acquisition, and $1.0 million related to the acquisition of Flooring Liquidators (see Note 3).

As of March 31, 2024, the Company did not identify any triggering events that would require impairment testing.

Note 9: Accrued Liabilities

The following table details the Company's accrued liabilities as of March 31, 2024 and September 30, 2023 (in $000's):

| | | | | | | | | | | |

| March 31, 2024 | | September 30, 2023 |

| Accrued liabilities: | | | |

| Accrued payroll and bonuses | $ | 6,524 | | | $ | 5,802 | |

| Accrued sales and use taxes | 1,884 | | | 1,529 | |

| Accrued customer deposits | 6,548 | | | 4,579 | |

| Accrued gift card and escheatment liability | 1,825 | | | 1,819 | |

| Accrued interest payable | 846 | | | 669 | |

| Accrued inventory | 2,230 | | | 5,700 | |

| Accrued professional fees | 2,476 | | | 3,146 | |

| Accrued expenses - other | 10,847 | | | 8,582 | |

| Total accrued liabilities | $ | 33,180 | | | $ | 31,826 | |

Note 10: Long-Term Debt

Long-term debt as of March 31, 2024 and September 30, 2023 consisted of the following (in $000's):

| | | | | | | | | | | |

| March 31, 2024 | | September 30, 2023 |

| Revolver loans | $ | 64,510 | | | $ | 56,779 | |

| Equipment loans | 13,543 | | | 15,486 | |

| Term loans | 13,192 | | | 14,290 | |

| Other notes payable | 15,997 | | | 15,789 | |

| Total notes payable | 107,242 | | | 102,344 | |

| Less: unamortized debt issuance costs | (524) | | | (557) | |

| Net amount | 106,718 | | | 101,787 | |

| Less: current portion | (31,396) | | | (23,077) | |

| Total long-term debt | $ | 75,322 | | | $ | 78,710 | |

Future maturities of long-term debt at March 31, 2024, are as follows which does not include related party debt separately stated (in $000's):

| | | | | |

| Twelve months ending March 31, | |

| 2024 | $ | 31,396 | |

| 2025 | 5,992 | |

| 2026 | 53,669 | |

| 2027 | 4,441 | |

| 2028 | 11,220 | |

| |

| Total future maturities of long-term debt | $ | 106,718 | |

Bank of America Revolver Loan

On January 31, 2020, Marquis entered into an amended $25.0 million revolving credit agreement (“BofA Revolver”) with Bank of America Corporation (“BofA”). The BofA Revolver is a five-year, asset-based facility that is secured by substantially all of Marquis’ assets. Availability under the BofA Revolver is subject to a monthly borrowing base calculation. Marquis’ ability to borrow under the BofA Revolver is subject to the satisfaction of certain conditions, including meeting all loan covenants under the credit agreement with BofA. The BofA Revolver has a variable interest rate and matures in January 2025. As of March 31, 2024 and September 30, 2023, the outstanding balance was approximately $16.4 million and $6.1 million, respectively.

Loan with Fifth Third Bank (Precision Marshall)

On January 20, 2022, Precision Marshall refinanced its Encina Business Credit loans with Fifth Third Bank, and the balance outstanding was repaid. The refinanced credit facility, totaling $29 million, is comprised of $23.0 million in revolving credit, $3.5 million in M&E lending, and $2.5 million for Capex lending. Advances under the new credit facility will bear interest at the 30-day SOFR plus 200 basis points for lending under the revolving facility, and 30-day SOFR plus 225 basis points for M&E and Capex lending. The refinancing of the Borrower’s existing credit facility reduces interest costs and improves the availability and liquidity of funds by approximately $3.0 million at the close. The facility terminates on January 20, 2027, unless terminated earlier in accordance with its terms.