- The spin-off aims to maximize shareholder value by unlocking

the fully distributed value of Sunrise over time, supported by

Sunrise’s fully integrated FMC challenger position, attractive

growth outlook, excellent expected cash generation and experienced

management team

- Liberty Global will invest up to CHF1.5B ($1.7B1) for debt

reduction, underpinning a strong initial leverage range of

3.5-4.5x. This will be funded through Sunrise FCF generation and

Liberty Global corporate liquidity, including non-core asset

disposal proceeds

- Sunrise’s strong cash generation profile expected to support

attractive shareholder returns including dividends, deleveraging

and continued investment to support future growth

- Sunrise will be listed on the SIX Swiss Exchange with two

classes of shares

- Liberty Global has appointed J.P. Morgan and UBS as financial

advisors

- The proposed spin-off is expected to be tax free for US

shareholders of Liberty Global with evaluation of tax treatment in

other jurisdictions ongoing and is subject to market conditions,

board approval of the final terms of the transaction, shareholder

approval and other customary closing conditions

- Sunrise will host a Capital Markets Day in due course to

provide more information on Sunrise and the proposed

transaction

Liberty Global Ltd. (Liberty Global) (NASDAQ: LBTYA, LBTYB and

LBTYK) today announces its intention to spin-off 100% of Sunrise to

Liberty Global shareholders. The transaction aims to maximize

shareholder value by crystallizing the value of Sunrise, allowing

shareholders to fully participate in the future growth and upside

of both Sunrise and Liberty Global. The spin-off will also provide

scope to broaden and deepen the investor base given the distinct

and compelling investment profiles of both Sunrise and Liberty

Global.

The spin-off will leverage the full potential of Sunrise as a

locally listed FMC challenger, building on the successful

integration of Sunrise and UPC since their combination in 2020. The

operational business will not be affected by the spin-off.

Customers, employees, suppliers, or other stakeholders can rely on

continuity.

Liberty Global CEO Mike Fries commented: ‘The proposed

spin-off of Sunrise to Liberty Global shareholders is aligned with

our strategy of unlocking value by allowing our shareholders to

directly participate in the future performance of Sunrise. Liberty

is fully committed to listing Sunrise with a strong capital

structure which, alongside its future cash generation potential,

will underpin Sunrise’s attractive equity story and scope for

dividends.’

Sunrise CEO André Krause said: ‘We are excited at the

prospect of being listed in Switzerland once again and providing

local and international investors with access to our scaled FMC

challenger position in the market. Following the successful

integration and synergy delivery of the UPC combination, Sunrise

has a very strong FCF profile and plans to offer an attractive

shareholder remuneration framework. We will present more detail at

a Capital Markets Day later this year.’

Key Sunrise investment highlights include:

- Attractive macro and telecom market: 100% exposure to

the attractive Swiss telecom market, characterized by favorable

macro fundamentals including low inflation, appealing tax

environment and low cost of capital, a stable three-player

structure and supportive regulatory framework

- Strong fully-converged national challenger: Clear number

two operator with scaled positions across all fixed, mobile and

converged products in the market

- Best 5G coverage and next-generation fixed network:

Delivering nationwide 5G and 1 GIG coverage to support a

multi-brand strategy and converged offerings

- Multiple growth levers: Strategy focused on growing

share in B2B and B2C segments, combined with further cost

efficiencies and low capital intensity, benefiting from high

quality, well-invested infrastructure and attractive wholesale

economics

- High cash generating asset: Sunrise benefits from strong

cash generation and expects to have a more de-levered balance sheet

with a long-term fixed rate debt profile (with 5 years average

maturity, ~3% average cost of debt) enabling an attractive dividend

distribution policy going forward

- Experienced management team: Sunrise leadership have

strong telecoms track record and experience in managing a listed

company with CEO André Krause and CFO Jany Fruytier

The listing of Sunrise on the SIX Swiss Exchange is planned for

2H24. Sunrise will be listed with a long dated, low-cost capital

structure supported by up to CHF1.5B ($1.7B2) of debt reduction.

The debt reduction is expected to be accomplished through Sunrise’s

expected FCF generation, debt optimization and Liberty Global

corporate liquidity including non-core asset disposals at Liberty

Global.

Following a strong Q423 performance at Sunrise with a return to

both revenue and adjusted EBITDA growth, we are communicating the

following Sunrise financial guidance for 20243: stable revenue,

stable to low-single digit adjusted EBITDA growth on a rebased

basis4, P&E additions as a percentage of sales of 16-18%

including costs to capture, and adjusted FCF5 range of CHF360-400m,

prior to any de-leveraging benefit.

The proposed spin-off is expected to be tax-free for Liberty

Global US shareholders with evaluation of tax treatment in other

jurisdictions ongoing and is subject to market conditions, board

approval of the final terms of the spin-off, Liberty Global

shareholder approval and other customary conditions.

Following the Sunrise spin-off, Liberty Global will retain its

consolidated interests in Telenet, Virgin Media Ireland, and its

joint venture stakes in Virgin Media-O2 and VodafoneZiggo in

addition to its Ventures portfolio and significant remaining cash

balance.

Liberty Global believes the spin-off will deliver significant

benefits for both Liberty Global and Sunrise shareholders,

including through:

- Optimized capital structures to pursue their distinct strategic

agendas for long-term value creation

- Distinct and compelling investment profiles appealing to

broader, deeper investor bases including local Swiss/European

investors as well as index/passive demand for Sunrise

ABOUT LIBERTY GLOBAL

Liberty Global (NASDAQ: LBTYA, LBTYB and LBTYK) is a world

leader in converged broadband, video and mobile communications

services. We deliver next-generation products through advanced

fiber and 5G networks, and currently provide over 85 million*

connections across Europe. Our businesses operate under some of the

best-known consumer brands, including Sunrise in Switzerland,

Telenet in Belgium, Virgin Media in Ireland, UPC in Slovakia,

Virgin Media-O2 in the U.K. and VodafoneZiggo in The Netherlands.

Through our substantial scale and commitment to innovation, we are

building Tomorrow’s Connections Today, investing in the

infrastructure and platforms that empower our customers to make the

most of the digital revolution, while deploying the advanced

technologies that nations and economies need to thrive.

Liberty Global's consolidated businesses generate annual revenue

of more than $7 billion, while the VMO2 JV and the VodafoneZiggo JV

generate combined annual revenue of more than $18 billion.**

Liberty Global Ventures, our global investment arm, has a

portfolio of more than 75 companies and funds across the content,

technology and infrastructure industries, including stakes in

companies like ITV, Televisa Univision, Plume, AtlasEdge and the

Formula E racing series.

* Represents aggregate consolidated and 50% owned

non-consolidated fixed and mobile subscribers. Includes wholesale

mobile connections of the VMO2 JV and B2B fixed subscribers of the

VodafoneZiggo JV.

** Revenue figures above are provided based on full year 2023

Liberty Global consolidated results and the combined as reported

full year 2023 results for the VodafoneZiggo JV and full year 2023

U.S. GAAP results for the VMO2 JV.

Sunrise, Telenet, the VMO2 JV and the VodafoneZiggo JV deliver

mobile services as mobile network operators. Virgin Media Ireland

delivers mobile services as a mobile virtual network operator

through third-party networks. UPC Slovakia delivers mobile services

as a reseller of SIM cards.

Liberty Global Ltd. is listed on the Nasdaq Global Select Market

under the symbols "LBTYA", "LBTYB" and "LBTYK".

For more information, please visit www.libertyglobal.com.

No offer to sell or solicit

This communication is not an offer to sell or a solicitation of

offers to purchase or subscribe for shares or a solicitation of any

vote or approval. This document is not a prospectus within the

meaning of the Swiss Financial Services Act and not a prospectus

under any other applicable laws. Copies of this document may not be

sent to, distributed in or sent from jurisdictions in which this is

barred or prohibited by law. The information contained herein shall

not constitute an offer to sell or the solicitation of an offer to

buy, in any jurisdiction in which such offer or solicitation would

be unlawful prior to registration, exemption from registration or

qualification under the securities laws of any jurisdiction and

there shall be no sale of securities in any such jurisdiction.

This announcement is only addressed to and directed at specific

addresses who: (A) if in member states of the European Economic

Area (the EEA) are people who are “qualified investors” within the

meaning of Article 2(e) of Regulation (EU) 2017/1129 (as amended)

(the Prospectus Regulation) (Qualified Investors); and (B) if in

the U.K., are “qualified investors” within the meaning of Article

2(e) of the UK version of the Prospectus Regulation as it forms

part of domestic law in the U.K. by virtue of the European Union

(Withdrawal) Act 2018 (the UK Prospectus Regulation) who

are: (i) persons having professional experience in matters relating

to investments who fall within the definition of “investment

professionals” in Article 19(5) of the Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005, as amended (the

Order); or (ii) high net worth entities falling within

Article 49(2)(a) to (d) of the Order; or (C) are other persons to

whom an invitation or inducement to engage in investment activity

(within the meaning of section 21 of the Financial Services and

Markets Act 2000 (as amended)) in connection with the sale of any

securities of the Company or any member of its group may otherwise

lawfully be communicated or caused to be communicated (all such

persons referred to in (B) and (C) being Relevant Persons).

This announcement must not be acted on or relied on (i) in the

U.K., by persons who are not Relevant Persons and (ii) in any

member state of the EEA by persons who are not Qualified Investors.

Any investment activity to which this announcement relates (i) in

the U.K. is available only to, any may be engaged in only with,

Relevant Persons; and (ii) in any member state of the EEA is

available only to, and may be engaged only with, Qualified

Investors.

This communication is an advertisement for the purposes of the

Prospectus Regulation (EU) 2017/1129 as it forms part of domestic

law by virtue of the European Union (Withdrawal) Act 2018 (as

amended) and underlying legislation. It is not a prospectus. A copy

of any prospectus published by the Company will, if approved and

published, be made available for inspection on the issuer’s website

at www.libertyglobal.com subject to certain access

restrictions.

Additional Information and Where to Find It

In connection with the spin-off of Liberty Global’s businesses

attributed to Sunrise into a separate publicly traded company (the

“Transaction”), a registration statement on Form F-4 that will

include a preliminary proxy statement (the “Proxy

Statement/Prospectus”) will be filed and mailed to the Liberty

Global shareholders. LIBERTY GLOBAL SHAREHOLDERS ARE URGED TO READ

THE DEFINITIVE PROXY STATEMENT/PROSPECTUS AS WELL AS ANY AMENDMENTS

OR SUPPLEMENTS THERETO AND ANY DOCUMENTS INCORPORATED BY REFERENCE

THEREIN AND OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE

PROPOSED TRANSACTION THAT LIBERTY GLOBAL AND SUNRISE WILL FILE WITH

THE SECURITIES AND EXCHANGE COMMISSION WHEN THEY BECOME AVAILABLE

BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE

TRANSACTION. Liberty Global shareholders and investors may obtain

free copies of the Proxy Statement/Prospectus and other relevant

materials (when they become available) and other documents filed by

Liberty Global and Sunrise at the SEC’s website at www.sec.gov.

Copies of the Proxy Statement/Prospectus (and other relevant

materials when they become available) and the filings that will be

incorporated by reference therein may also be obtained, without

charge, by contacting Liberty Global’s Investor Relations at

ir@libertyglobal.com or +1 (303) 220-6600.

Participants in the Solicitation

Liberty Global and its directors, executive officers and certain

employees, may be deemed, under rules of the Securities and

Exchange Commission (the “SEC”), to be participants in the

solicitation of proxies in respect of the proposed Transaction.

Information regarding Liberty Global’s directors and executive

officers is set forth in Liberty Global’s filings with the SEC.

Other information regarding the participants in the proxy

solicitation and a description of their direct and indirect

interests, by security holdings or otherwise, will be contained in

the Proxy Statement/Prospectus and other relevant materials to be

filed with the SEC (when they become available). These documents

can be obtained free of charge from the sources indicated

above.

__________________________ 1 FX rate as of Feb 15 2024 2 FX rate

as of Feb 15 2024 3 Based on current reporting under US GAAP 4

Rebased growth percentages, which are non-GAAP measures, are

presented as a basis for assessing growth rates on a comparable

basis. We calculate Sunrise rebased growth percentages consistent

with the way we calculate Liberty Global rebased growth percentages

in our earnings releases 5 We define Adjusted FCF as net cash

provided by the operating activities of our continuing operations,

plus operating-related vendor financed expenses (which represents

an increase in the period to our actual cash available as a result

of extending vendor payment terms beyond normal payment terms,

which are typically 90 days or less, through non-cash financing

activities), less (i) cash payments in the period for capital

expenditures, (ii) principal payments on operating- and

capital-related amounts financed by vendors and intermediaries

(which represents a decrease in the period to our actual cash

available as a result of paying amounts to vendors and

intermediaries where we previously had extended vendor payments

beyond the normal payment terms), and (iii) principal payments on

finance leases (which represents a decrease in the period to our

actual cash available)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240215867829/en/

Investor Relations Michael Bishop +44 20 8483 6246

Corporate Communications Bill Myers +1 303 220 6686 Matt

Beake +44 20 8483 6428

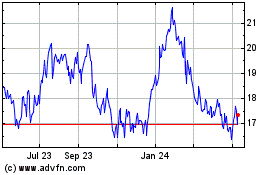

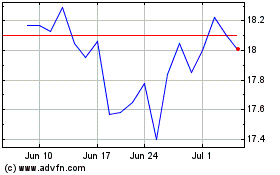

Liberty Global (NASDAQ:LBTYK)

Historical Stock Chart

From Oct 2024 to Nov 2024

Liberty Global (NASDAQ:LBTYK)

Historical Stock Chart

From Nov 2023 to Nov 2024