false

2023-11-24

0001041514

Lesaka Technologies, Inc.

0001041514

2023-11-24

2023-11-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 24, 2023

LESAKA TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

Florida

|

000-31203

|

98-0171860

|

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

President Place, 4th Floor, Cnr.

Jan Smuts Avenue and Bolton Road

Rosebank, Johannesburg, South Africa

(Address of principal executive offices) (ZIP Code)

Registrant’s telephone number, including area code: 011-27-11-343-2000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

|

Common Shares

|

|

LSAK

|

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b -2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry Into a Material Definitive Agreement.

Amended and Restated Facility G and Facility H Agreements

On November 24, 2023, Lesaka Technologies, Inc. (“Lesaka”), through Lesaka Technologies Proprietary Limited (“Lesaka SA”), entered into an Amendment and Restatement Agreement (the “Amendment”), which includes an Amended and Restated Senior Facility G Agreement (“Facility G Agreement”) and an Amended and Restated Senior Facility H Agreement (“Facility H Agreement”) (collectively, the “Loan Documents”) with FirstRand Bank Limited (acting through its Rand Merchant Bank division) (“RMB” or the “Lenders”).

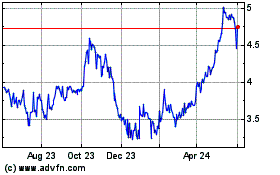

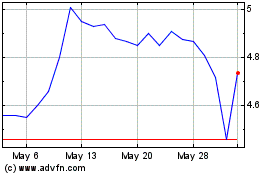

On November 24, 2023, the USD/ZAR exchange rate was $1: ZAR 18.84.

The Loan Documents have been amended to include a Look Through Leverage ("LTL") ratio, as defined in the Loan Documents, and expressed as times ("x"), to calculate the margin used in the determination of the interest rate. The LTL ratio is calculated as the Total Attributable Net Debt, as defined in the Loan Documents, to the Total Attributable EBITDA, as defined in the Loan Documents, for the measurement period ending on a specified date.

Interest on Facility G and Facility H is based on the 3-month Johannesburg Interbank Agreed Rate (“JIBAR”) in effect from time to time plus a margin, which as a result of the Amendment, from October 1, 2023, will be calculated as: (i) 5.50% if the LTL ratio is greater than 3.50x; (ii) 4.75% if the LTL ratio is less than 3.50x but greater than 2.75x; (iii) 3.75% if the LTL ratio is less than 2.75x but greater than 1.75x; or (iv) 2.50% if the LTL ratio is less than 1.75x.

The foregoing descriptions of the Loan Documents does not purport to be complete and are qualified in their entirety by reference to the full text thereof, a copy of which is attached hereto as Exhibits 10.1 and is incorporated herein by reference.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information provided in Item 1.01 of this Form 8-K is incorporated by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

LESAKA TECHNOLOGIES, INC. |

| |

|

|

| Date: December 1, 2023 |

By: |

/s/ Naeem E. Kola |

| |

Name: |

Naeem E. Kola |

| |

Title: |

Group Chief Financial Officer |

AMENDMENT AND RESTATEMENT AGREEMENT

DATED 24 NOVEMBER, 2023

between

LESAKA TECHNOLOGIES PROPRIETARY LIMITED

(as borrower)

and

FIRSTRAND BANK LIMITED

(ACTING THROUGH ITS RAND MERCHANT BANK DIVISION)

(as lender)

and

FIRSTRAND BANK LIMITED

(ACTING THROUGH ITS RAND MERCHANT BANK DIVISION)

(as facility agent)

relating to the Senior Facility G Agreement and Senior Facility H Agreement, originally dated

24 January, 2022

CONTENTS

THIS AGREEMENT is made between:

(1) LESAKA TECHNOLOGIES PROPRIETARY LIMITED, registration number 2002/031446/07, as borrower (the Borrower);

(2) EACH GUARANTOR LISTED IN SCHEDULE 1 (THE OBLIGORS) as guarantors (the Guarantors);

(3) FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION) as original lender under the Senior Facility G Agreement (in this capacity, the Original Senior Facility G Lender);

(4) FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION) as original lender under the Senior Facility H Agreement (in this capacity, the Original Senior Facility H Lender); and

(5) FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION) as agent of the Finance Parties (the Facility Agent).

BACKGROUND:

(A) This Agreement (defined below) is supplemental to, amends and restates (but does not novate) the Original Senior Facility G Agreement (defined below) and the Original Senior Facility H Agreement (defined below).

(B) The Parties have consented to the amendments to the Original Senior Facility G Agreement and the Original Senior Facility H Agreement contemplated by this Agreement.

IT IS AGREED as follows:

1. INTERPRETATION

1.1 Definitions

In this Agreement:

1.1.1 Agreement means this amendment and restatement agreement.

1.1.2 Amended and Restated Senior Facility G Agreement means the Original Senior Facility G Agreement as amended and restated by this Agreement.

1.1.3 Amended and Restated Senior Facility H Agreement mean the Original Senior Facility H Agreement as amended and restated by this Agreement.

1.1.4 Amendment Document means;

(a) this Agreement; and

(b) the Amended and Restated Senior Facility G Agreement; and

(c) the Amended and Restated Senior Facility H Agreement.

1.1.5 Effective Date means the date on which the Facility Agent issues the notice referred to in Clause 2.1 (Effective Date).

1.1.6 Original Senior Facility G Agreement means the written agreement entitled "Senior Facility G Agreement", dated on or about 24 January, 2022, between the Borrower (as borrower), the Original Senior Facility G Lender and the Facility Agent, as amended from time to time.

1.1.7 Original Senior Facility H Agreement means the written agreement entitled "Senior Facility H Agreement" dated on or about 24 January, 2022, between the Borrower (as borrower), the Original Senior Facility H Lender and the Facility Agent, as amended from time to time.

1.1.8 Party means a party to this Agreement.

1.1.9 Signature Date means the date on which, once this Agreement has been signed by all the Parties, it is signed by the last Party to do so.

Unless expressly otherwise defined in this Agreement, terms and expressions defined in the Amended and Restated Original Senior Facility G Agreement and the Amended and Restated Original Senior Facility H Agreement have the same meaning in this Agreement.

1.2 Construction

The provisions of clause 1 (Definitions and Interpretation) of the Amended and Restated Original Senior Facility G Agreement and the Amended and Restated Original Senior Facility H Agreement apply to this Agreement as though they were set out in full in this Agreement, except that references to the Senior Facility G Agreement and the Senior Facility H Agreement are to be construed as references to the Amended and Restated Senior Facility G Agreement and the Amended and Restated Senior Facility H Agreement as amended by this Agreement.

2. EFFECTIVE DATE

2.1 The Original Senior Facility G Agreement and the Original Senior Facility H Agreement will not be amended by this Agreement unless the Facility Agent notifies the Borrower that the Borrower has delivered to the Facility Agent all the documents set out in Schedule 2 (Conditions Precedent) in form and substance satisfactory to the Finance Parties. The Facility Agent must give this notification as soon as reasonably practicable. The requirements set out in this Clause 2.1 are for the benefit solely of the Finance Parties. The Facility Agent, acting on the instructions of the Finance Parties, may waive or defer delivery of any or all of the documents set out in Schedule 2 (Conditions Precedent), subject to such other conditions (if any) as it may determine.

2.2 If the Facility Agent does not give the notice contemplated in Clause 2.1 to the Borrower on or before 23h59 on 31 December, 2023, the Original Senior Facility G Agreement and the Original Senior Facility H Agreement shall not be amended as provided in this Agreement.

3. AMENDMENTS

3.1 Amendment and Restatement of the Original Senior Facility G Agreement

Subject to the terms of this Agreement, on and with effect from 30 September, 2023, the Original Senior Facility G Agreement will be amended so that it reads as if it were restated in the form set out in Schedule 3 (Amended and Restated Senior Facility G Agreement).

3.2 Amendment and Restatement of the Original Senior Facility H Agreement

Subject to the terms of this Agreement, on and with effect from 30 September, 2023, the Original Senior Facility H Agreement will be amended so that it reads as if it were restated in the form set out in Schedule 4 (Amended and Restated Senior Facility H Agreement).

3.3 Finance Documents

On and with effect from the Effective Date, any reference in a Finance Document to the "Senior Facility G Agreement" and the "Senior Facility H Agreement" shall be a reference to that agreement as amended pursuant to this Agreement.

4. REPRESENTATIONS AND WARRANTIES

Each Obligor makes the representations and warranties set out in this Clause to each Finance Party on the Signature Date and on the Effective Date. References in this Clause to it or its include, unless the context otherwise requires, each Obligor.

4.1 Status

4.1.1 It is a limited liability corporation, duly incorporated and validly existing under the laws of its jurisdiction of incorporation.

4.1.2 It and each of its Subsidiaries has the power to own its assets and carry on its business as it is being conducted.

4.2 Capacity, power and authority

4.2.1 It has the legal capacity and power to enter into and perform, and has taken all necessary action to authorise the entry into and performance of, this Agreement and the other Finance Documents to which it is or will be a party and the transactions contemplated by this Agreement and those other Finance Documents.

4.2.2 No limit on its powers will be exceeded as a result of the borrowing, grant of security or giving of guarantees or indemnities contemplated by this Agreement and the other Finance Documents to which it is a party.

4.3 Binding obligations

4.3.1 The obligations expressed to be assumed by it in this Agreement and each Finance Document to which it is a party are legal, valid, binding and enforceable obligations.

4.3.2 This Agreement and each other Finance Document to which it is a party is in the proper form for its enforcement in the jurisdiction of its incorporation.

4.3.3 Each original Security Document to which it is a party creates the security interests which that original Security Agreement purports to create and those security interests are valid and effective.

4.4 Non-conflict with other obligations

The entry into and performance by it of, and the transactions contemplated by, this Agreement and the other Finance Documents to which it is a party and the establishment of Transaction Security pursuant to the Security Documents to which it is a party, do not and will not conflict with:

4.4.1 any law or regulation applicable to it;

4.4.2 its or any of its Subsidiaries' constitutional documents; or

4.4.3 any material agreement or instrument binding upon it or any of its Subsidiaries or any of its or any of its Subsidiaries' assets or constitute a default or termination event (however described) under any such agreement or instrument.

4.5 Authorisations

Except as expressly set out in Schedule 10 (Disclosure Schedule) of the Common Terms Agreement, all authorisations required:

4.5.1 to enable it lawfully to enter into, exercise its rights and comply with its obligations under this Agreement and the other Finance Documents to which it is a party;

4.5.2 to make this Agreement and the other Finance Documents to which it is a party admissible in evidence in its jurisdiction of incorporation; and

4.5.3 for it and those of its Subsidiaries which are members of the Group to carry on their respective businesses in the ordinary course and in all material respects as they are being conducted,

have been obtained or effected and are in full force and effect.

4.6 Default

No Default is continuing or would result from the entry into and performance by it of, and the transactions contemplated by, this Agreement and the other Finance Documents.

4.7 Repeating Representations

The Repeating Representations:

4.7.1 are true; and

4.7.2 would also be true if references to the Original Senior Facility G Agreement and the Original Senior Facility H Agreement were construed as references to the Amended and Restated Senior Facility G Agreement and the Amended and Restated Senior Facility H Agreement respectively.

In each case, each Repeating Representation is made by reference to the circumstances existing at the Signature Date and the Effective Date, as applicable, as if references to the Original Senior Facility G Agreement and the Original Senior Facility H Agreement are references to the Amendment Document with reference to the facts and circumstances existing as at the date of this Agreement or the Effective Date, as applicable.

5. GUARANTEES

On the Effective Date, each Obligor:

5.1 confirms its acceptance of the Amendment Documents;

5.2 agrees that it is bound as an Obligor by the terms of the Amendment Documents; and

5.3 confirms that its guarantee under clause [18] (Guarantee and Indemnity) of the Common Terms Agreement:

5.3.1 continues in full force and effect on the terms of the Amended Documents; and

5.3.2 extends to the obligations of the Obligors under the Finance Documents (including the Amendment Documents).

6. SECURITY

On the Effective Date, each Obligor hereby agrees and confirms that notwithstanding any amendments which may be made to any Finance Document and the imposition of any amended, new or more onerous obligations under the original Security Agreements pursuant to this Agreement and/or the amendments arising pursuant to this Agreement:

6.1 any Security created by it under the Security Documents extends to the obligations of the Obligors under the Finance Documents (including the Amended and Restated Senior Facility G Agreement and the Amended and Restated Senior Facility H Agreement); and

6.2 the Security created under each Security Document to which it is a party continues in full force and effect on the terms of the respective Security Documents.

7. MISCELLANEOUS

7.1 This Agreement is a Finance Document.

7.2 The Original Senior Facility G Agreement and this Agreement will, from the Effective Date, be read and construed as one document. The Original Senior Facility H Agreement and this Agreement will, from the Effective Date, be read and construed as one document.

7.3 Except as otherwise provided in this Agreement, the Finance Documents remain in full force and effect without any amendment whatsoever.

7.4 Except to the extent expressly waived in this Agreement, no waiver is given by this Agreement and the Finance Parties expressly reserve all their rights and remedies in respect of any breach of, or other Default under, the Finance Documents.

8. GOVERNING LAW

This Agreement is governed by the laws of South Africa.

9. COUNTERPARTS

This Agreement may be executed in any number of counterparts. This has the same effect as if the signatures on the counterparts were on a single copy of this Agreement.

SCHEDULE 1

THE OBLIGORS

|

|

Name of Borrower

|

Jurisdiction of

Incorporation

|

Registration number

(or equivalent, if any)

|

|

1.

|

Lesaka Technologies Proprietary Limited

|

South Africa

|

2002/031446/07

|

| |

|

|

|

|

|

Name of Guarantor

|

Jurisdiction of

Incorporation

|

Registration number

(or equivalent, if any)

|

|

1.

|

EasyPay Proprietary Limited

|

South Africa

|

1983/008597/07

|

|

2.

|

Lesaka Technologies Proprietary Limited

|

South Africa

|

2002/031446/07

|

|

3.

|

Lesaka Technologies, Inc

|

State of Florida, United States

|

N/A

|

|

4.

|

Moneyline Financial Services Proprietary Limited

|

South Africa

|

1998/020799/07

|

|

5.

|

Net1 Applied Technologies Netherlands B.V.

|

Netherlands

|

34307123

|

|

6.

|

Net1 Finance Holdings Proprietary Limited

|

South Africa

|

1998/020801/07

|

|

87.

|

Prism Holdings Proprietary Limited

|

South Africa

|

1998/018949/07

|

|

8.

|

Prism Payment Technologies Proprietary Limited

|

South Africa

|

1990/005062/07

|

|

9.

|

Pros Software Proprietary Limited

|

South Africa

|

2005/043662/07

|

|

10.

|

RMT Systems Proprietary Limited

|

South Africa

|

2001/028826/07

|

|

11.

|

Smartswitch Netherlands Holdings B.V.

|

Netherlands

|

76723178

|

SCHEDULE 2

CONDITIONS PRECEDENT

1. Original Obligors

1.1 A copy of the constitutional documents of each Original Obligor or confirmation that the constitutional documents of each Original Obligor have not changed since they were last provided.

1.2 A copy of a resolution of the board of directors of the Borrower:

1.2.1 approving the terms of, and the transactions contemplated by, this Agreement and resolving that it execute this Agreement;

1.2.2 authorising it, for all purposes required under sections 45 and/or 46 of the Companies Act (as applicable), to provide the "financial assistance" and to make any "distribution" that may arise as a result of its entry into of this Agreement;

1.2.3 authorising a specified person or persons to execute this Agreement on its behalf; and

1.2.4 authorising a specified person or persons, on its behalf, to sign and/or despatch all documents and notices to be signed and/or despatched by it under or in connection with this Agreement.

1.3 A copy of a special resolution duly passed by the holders of the issued shares of the Borrower authorising it, for all purposes required under section 45 of the Companies Act, to provide the "financial assistance" that may arise as a result of its entry into this Agreement.

1.4 A specimen of the signature of each person authorised by the resolution referred to in paragraph 1.2 above.

1.5 A certificate of the Borrower and each other Original Obligor (signed by a director or other authorised signatory):

1.5.1 confirming that borrowing or guaranteeing, as appropriate, the Total Commitments would not cause any borrowing, guaranteeing or similar limit binding on it to be exceeded.

1.5.2 certifying that each copy document relating to it specified in this Schedule 2 is correct, complete and in full force and effect as at a date no earlier than the Effective Date.

1.6 A certificate of the Borrower (signed by a director or other authorised signatory) confirming as at the Effective Date that:

1.6.1 no Default or Event of Default has occurred or is continuing or will result from the execution of this Agreement;

1.6.2 the representations and warranties set out in Clause 19 (Representations) of the Common Terms Agreement are true and correct in all respects;

1.6.3 that no event or series of events or circumstances has occurred or arisen which, in the Borrower's opinion, is likely to have a Material Adverse Effect;

1.6.4 that no investigation, litigation, arbitration or administrative proceedings of or before any court, arbitral body, competent competition authority or other regulatory authority or government agency which, if adversely determined, will have or is reasonably likely to have a Material Adverse Effect have, to the best of its knowledge and belief, been started or threatened against it or any member of the Group.

1.7 If such Original Obligor is a US Guarantor, a certificate as to the existence and good standing (including verification of tax status, if generally available) of such US Guarantor from the appropriate governmental authorities in such US Guarantor's jurisdiction of organisation, in form and substance satisfactory to the Facility Agent and its counsel.

1.8 If such Original Obligor is a US Guarantor, a solvency certificate signed by the chief financial officer of such Obligor in form and substance satisfactory to the Facility Agent and its counsel.

2. Other documents and evidence

2.1 Confirmation by the VCP Investment Manager that the VCP Undertaking remains in full force and effect notwithstanding any amendments to the Finance Documents pursuant to this Agreement.

2.2 A copy of any other authorisation or other document, opinion or assurance which the Facility Agent considers to be necessary (if it has notified the Borrower accordingly) in connection with the entry into and performance of the transactions contemplated by any Finance Document or for the validity and enforceability of any Finance Document.

SCHEDULE 3

AMENDED AND RESTATED SENIOR FACILITY G AGREEMENT

SENIOR FACILITY G AGREEMENT

ORIGINALLY DATED 24 JANUARY, 2022

AS AMENDED AND RESTATED ON 16 MARCH, 2023

AND AS AMENDED AND RESTATED ON 24 NOVEMBER, 2023

SENIOR TERM LOAN AND REVOLVING CREDIT FACILITY

for

LESAKA TECHNOLOGIES PROPRIETARY LIMITED

(FORMERLY KNOWN AS NET1 APPLIED TECHNOLOGIES SOUTH AFRICA

PROPRIETARY LIMITED)

(as borrower)

provided by

FIRSTRAND BANK LIMITED

(ACTING THROUGH ITS RAND MERCHANT BANK DIVISION)

(as lender)

with

FIRSTRAND BANK LIMITED

(ACTING THROUGH ITS RAND MERCHANT BANK DIVISION)

(as facility agent)

This Agreement is entered into subject to the terms of a Common Terms Agreement

originally dated on or about 21 July, 2017

CONTENTS

THIS AGREEMENT is made between:

(1) LESAKA TECHNOLOGIES PROPRIETARY LIMITED (FORMERLY KNOWN AS NET1 APPLIED TECHNOLOGIES SOUTH AFRICA PROPRIETARY LIMITED), registration number 2002/031446/07, as borrower (the Borrower);

(2) FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION) as original lender (in this capacity, the Original Senior Facility G Lender); and

(3) FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION) as agent of the Senior Facility G Lenders (the Facility Agent).

IT IS AGREED as follows:

1. DEFINITIONS AND INTERPRETATION

1.1 Definitions

In this Agreement:

1.1.1 Applicable Margin means, in relation to any Senior Facility G Loan or Unpaid Sum:

(a) from the Fourth Amendment and Restatement Date until the date occurring nine months after the Fourth Amendment and Restatement Date, 3.00 per cent. per annum, provided that no Event of Default has occurred and is continuing;

(b) from the date occurring nine months after the Fourth Amendment and Restatement Date until 31 December, 2022:

(i) while the Senior Facility G Outstandings are less than or equal to R250,000,000, 2.50 per cent. per annum;

(ii) while the Senior Facility G Outstandings are between R250,000,000 and R450,000,000, 3.00 per cent. per annum;

(iii) while the Senior Facility G Outstandings are equal to or greater than R450,000,000, 3.50 per cent. per annum;

(c) with effect from 1 January, 2023 until 30 September, 2023, for so long as the aggregate of the Senior Facility G Outstandings and Senior Facility H Outstandings are greater than R800,000,000, 5.50 per cent. per annum. Thereafter, with effect from the next Interest Payment Date after a change in threshold, for so long as the aggregate of the Senior Facility G Outstandings and Senior Facility H Outstandings:

(i) are greater than R800,000,000, 5.50 per cent. per annum;

(ii) are equal to or less than R800,000,000 but greater than R350,000,000, 4.25 per cent. per annum;

(iii) are equal to or less than R350,000,000, 2.50 per cent. per annum,

provided that no Event of Default has occurred and is continuing;

(d) with effect from 1 October, 2023, for so long as the Look Through Leverage Ratio:

(i) is greater than 3.50, 5.50 per cent. per annum;

(ii) is less than 3.50 and greater than 2.75, 4.75 per cent. per annum;

(iii) is less than 2.75 and greater than 1.75, 3.75 per cent. per annum;

(iv) is less than 1.75, 2.50 per cent. per annum, and

(e) with effect from the date of occurrence of an Event of Default and for so long as it is continuing, the Applicable Margin shall be the percentage per annum set out in paragraph (a), (b), (c) or (d) above, as applicable, plus 2.00 per cent.

1.1.2 Applicable Percentage means:

(a) in respect of the Holdco, 100 per cent.;

(b) in respect of any other member of the Margin Group, the percentage shareholding held by the Holdco in that member of the Margin Group at that time.

1.1.3 Attributable EBITDA means, in respect of any member of the Margin Group:

(a) in respect of the Measurement Dates occurring during the period from 1 October, 2023 until (and including)30 June, 2024, its EBITDA for the period of 3 months ending on that Measurement Date multiplied by 4;

(b) in respect of the Measurement Dates occurring from (and including) 30 September, 2024, in respect of any Measurement Period, its EBITDA for that period,

multiplied by its Applicable Percentage.

1.1.4 Attributable Net Debt, in respect of any member of the Margin Group, shall be determined as follows:

where:

| A = |

the Total Debt of that member of the Margin Group |

| |

|

| B = |

the Applicable Percentage of that member of the Margin Group |

| |

|

| C = |

the aggregate of the Cash and Cash Equivalents of that member of the Margin Group |

1.1.5 Availability Period means:

(a) the period from and including the Fourth Amendment and Restatement Date to and including the date falling one month from the Fourth Amendment and Restatement Date; and

(b) in respect of the Revolving Credit Commitment, the period from and including the Fifth Amendment and Restatement Date until the date occurring three months before the Final Maturity Date.

1.1.6 Available Commitment means the "Available Commitment" (as defined in the Common Terms Agreement) of a Senior Facility G Lender in respect of Senior Facility G.

1.1.7 Available Facility means the aggregate, from time to time, of the Available Commitment of each Senior Facility G Lender.

1.1.8 Break Costs means the amount (if any) determined by a Senior Facility G Lender by which:

(a) the interest (excluding the Applicable Margin) which that Senior Facility G Lender should have received for the period from the date of receipt of an amount repaid or prepaid in respect of any part of its participation in a Senior Facility G Loan or Unpaid Sum to the last day of the current Interest Period for that Senior Facility G Loan or Unpaid Sum, if the principal amount of that Senior Facility G Loan or Unpaid Sum received had been paid on the last day of that Interest Period;

exceeds:

(b) the amount which that Senior Facility G Lender would be able to obtain by placing an amount equal to the principal amount of the Senior Facility G Loan or Unpaid Sum received by it on deposit with a leading bank in the Johannesburg interbank market for a period starting on the Business Day following receipt or recovery and ending on the last day of the current Interest Period,

and Break Gains means the amount (if any) determined by the relevant Senior Facility G Lender by which the amount of interest contemplated in paragraph (b) above exceeds that in paragraph (a) above.

1.1.9 Common Terms Agreement means the written agreement entitled "Common Terms Agreement", dated on or about 21 July, 2017 (as amended and/or reinstated from time to time), between, amongst others, the Borrower (as borrower) and the Facility Agent.

1.1.10 EBITDA, means, in relation to a period, the aggregate of the consolidated operating income of a member of the Margin Group (including dividends received in Cash), in each case, for that period, without taking any account of the following items (without double counting):

(a) any Interest accrued as an obligation of that member of the Margin Group, whether or not paid, deferred or capitalised during that period;

(b) any amount of Tax on profits, gains or income paid or payable by that member of the Margin Group and any amount of any rebate or credit in respect of Tax on profits, gains or income received or receivable by that member of the Margin Group;

(c) any depreciation or amortisation whatsoever, and any charge for impairment or any reversal in that period of any previous impairment charge;

(d) any charges related to stock-based compensation;

(e) treating any lease contract (concluded either prior to or after 1 January, 2019) which would have been classified as an operating lease under IFRS16 prior to 1 January, 2019 and solely as a result of changes to IFRS with effect from 1 January, 2019 is now classified as a balance sheet liability as an operating lease for accounting purposes, notwithstanding any change (or the implementation of any change) to IFRS on or after 1 January, 2019;

(f) any loss against book value incurred by that member of the Margin Group on the disposal of any asset (other than trading stock) during that period;

(g) any gain over book value arising in favour of that member of the Margin Group on the disposal of any asset (other than trading stock) during that period and any gain arising on any revaluation of an asset during that period;

(h) any unrealised gains or losses due to exchange rate movements which are reported through the income statement;

(i) any unrealised gains or losses on any financial instrument (other than any financial instrument which is accounted for on a hedge accounting basis) which are reported through the income statement;

(j) the amount of profit or loss of any associate entity (which is not a member of the Margin Group) in which that member of the Margin Group has an ownership interest, to the extent (in respect of profit only) that the amount of such profit reported through the income statement exceeds the amount (net of any applicable withholding tax) received in cash by that member of the Margin Group through distributions by that entity; and

(k) any extraordinary and exceptional items approved by the Facility Agent in writing before the applicable Measurement Date.

1.1.11 Final Maturity Date means 31 December, 2025.

1.1.12 Interest Payment Date means:

(a) the last day of March, June, September and December in any year; and

(b) the Final Maturity Date.

1.1.13 Interest Period means, in relation to a Senior Facility G Loan, each period determined in accordance with Clause 9 (Interest Periods).

1.1.14 Look Through Leverage Ratio, on any applicable date, means the ratio of the Total Attributable Net Debt on that date to the Total Attributable EBITDA for the Measurement Period ending on that date.

1.1.15 Margin Certificate means a certificate substantially in the form set out in Schedule 2 (Form of Margin Certificate) or otherwise in the agreed form.

1.1.16 Margin Group means each member of the Group from time to time, but excluding (a) members of the Kwande Group, (b) any Subsidiaries of Net1 Applied Technologies Netherlands and (c) SmartSwitch Botswana.

1.1.17 Party means a party to this Agreement.

1.1.18 Revolving Credit Commitment means a portion of the Senior Facility G Commitment equal to ZAR200,000,000 to the extent not cancelled, transferred or reduced under this Agreement.

1.1.19 Revolving Credit Facility Available Commitment means, in relation to the Facility, the Revolving Credit Commitment minus (subject as set out below):

(a) the amount of any outstanding Utilisations under the Facility made after the Fifth Amendment and Restatement Date; and

(b) in relation to any proposed Utilisation made after the Fifth Amendment and Restatement Date, the amount of any Utilisations made after the Fifth Amendment and Restatement Date that are due to be made under the Facility on or before the proposed Utilisation Date.

1.1.20 Senior Facility G or Facility means the term loan facility made available to the Borrower under this Agreement.

1.1.21 Senior Facility G Commitment means the "Senior Facility G Commitment" as defined in the Common Terms Agreement.

1.1.22 Senior Facility G Loan or Loan means a "Senior Facility G Loan" as defined in the Common Terms Agreement.

1.1.23 Senior Facility G Outstandings means "Senior Facility G Outstandings" as defined in the Common Terms Agreement.

1.1.24 Senior Facility H Outstandings means "Senior Facility H Outstandings" as defined in the Common Terms Agreement.

1.1.25 Signature Date means the date stated at the beginning of this Agreement.

1.1.26 Total Attributable EBITDA means the aggregate of the Attributable EBITDA of the members of the Margin Group.

1.1.27 Total Attributable Net Debt means the aggregate of the Attributable Net Debt of the members of the Margin Group.

1.1.28 Total Debt in respect of any member of the Margin Group, at any time, means the aggregate at that time of the Financial Indebtedness of that member of the Margin Group from sources external to the Margin Group calculated at its nominal or principal amount (or, if greater, the maximum amount payable on repayment or redemption of the relevant liabilities) together with capitalised interest thereon at such time less any Financial Indebtedness of that member of the Margin Group incurred pursuant to Facility E and which is not due and payable.

1.1.29 Total Senior Facility G Commitments means "Total Senior Facility G Commitments" as defined in the Common Terms Agreement.

1.1.30 Unpaid Sum means an "Unpaid Sum" as defined in the Common Terms Agreement in respect of Senior Facility G.

1.1.31 Utilisation Request means the notice substantially in the form set out in Schedule 1 (Form of Utilisation Request).

1.2 Construction

1.2.1 Terms and expressions defined in the Common Terms Agreement, unless expressly defined in this Agreement, have the same meaning in this Agreement.

1.2.2 The provisions of clauses 1.3 (Construction) and 1.4 (Third party rights) of the Common Terms Agreement apply to this Agreement as though they were set out in full in this Agreement, except that a reference in those clauses to the Common Terms Agreement are to be construed as references to this Agreement.

1.2.3 This Agreement and the rights and obligations of the Parties hereunder shall in all respects be subject to the terms and conditions of the Common Terms Agreement, which shall apply mutatis mutandis to this Agreement and be incorporated herein by reference. If there is any conflict between this Agreement and the Common Terms Agreement, this Agreement shall prevail.

2. THE FACILITY

2.1 Senior Facility G

Subject to the terms of this Agreement and the Common Terms Agreement, the Senior Facility G Lenders make available to the Borrower a Rand-denominated term loan and revolving credit facility in an aggregate amount equal to the Total Senior Facility G Commitments.

2.2 Designation

This Agreement is a Senior Facility Agreement and the Senior Facility G Agreement, each as defined in the Common Terms Agreement.

3. PURPOSE

3.1 The Borrower shall apply all amounts borrowed by it under Senior Facility G only in or towards the purpose set out in clause 3.1.2 (Purpose) of the Common Terms Agreement, and for no other purpose whatsoever.

3.2 No Finance Party is bound to monitor or verify the utilisation of Senior Facility G or will be responsible for, or for the consequences of, such a utilisation.

4. CONDITIONS OF UTILISATION

4.1 Conditions precedent

The Borrower may not deliver a Utilisation Request to the Facility Agent under Senior Facility G (and no Senior Facility G Lender shall have any obligation to advance any Senior Facility G Loan or to provide any other form of credit or financial accommodation under this Agreement to any person) unless the Facility Agent has issued the notice contemplated by clause 4.1 (Initial conditions precedent) of the Common Terms Agreement.

4.2 Further conditions precedent

Subject to the Common Terms Agreement and this Agreement, a Senior Facility G Lender will only be obliged to participate in a Senior Facility G Loan if the requirements of clause 4.2 (Further conditions precedent) of the Common Terms Agreement have been met.

4.3 Maximum number of Loans

The Borrower may not deliver a Utilisation Request under Senior Facility G if as a result of the proposed Utilisation more than four Senior Facility G Loans would be outstanding.

5. UTILISATION AND DISBURSEMENT

5.1 Delivery of a Utilisation Request

5.1.1 The Borrower may utilise Senior Facility G during the Availability Period by delivery to the Facility Agent of a duly completed Utilisation Request.

5.1.2 Unless the Facility Agent otherwise agrees, the latest time for receipt by the Facility Agent of a Utilisation Request is 17h00 two Business Days before the proposed Utilisation Date or such shorter period as the Facility Agent agrees in writing.

5.1.3 A Utilisation Request is irrevocable.

5.1.4 Only one Utilisation Request may be delivered in any calendar month.

5.2 Completion of a Utilisation Request

5.2.1 A Utilisation Request will not be regarded as having been duly completed unless:

(a) the proposed Utilisation Date is a Business Day within the Availability Period;

(b) the currency and amount of the Utilisation comply with Clause 5.3 below; and

(c) it specifies a bank account in South Africa to which the Borrower requires the proceeds of the Senior Facility G Loan to be credited.

5.2.2 Only one Senior Facility G Loan may be requested in a Utilisation Request.

5.3 Currency and amount

5.3.1 The currency specified in a Utilisation Request must be Rand.

5.3.2 Until the Fifth Amendment and Restatement Date, the amount of the proposed Senior Facility G Loan is for the full amount of the Senior Facility G Available Commitments of the relevant Senior Facility G Lender or such lesser amount as the Facility Agent may agree.

5.3.3 From the Fifth Amendment and Restatement Date, the amount of the proposed Senior Facility G Loan is not more than the Revolving Credit Facility Available Commitment and which is a minimum of ZAR5,000,000 or, if less, the Available Facility and in integrals of ZAR1,000,000.

5.4 Disbursement

5.4.1 If the conditions set out in this Agreement and the Common Terms Agreement have been met, each Senior Facility G Lender must advance and lend to the Borrower, who shall borrow from each such Lender, that Lender's participation in the Senior Facility G Loan on the Utilisation Date. A Senior Facility G Lender must make its participation in the Senior Facility G Loan available to the Facility Agent by no later than 11h00 on the applicable Utilisation Date for disbursement to the Borrower.

5.4.2 The amount of each Senior Facility G Lender's participation in the Senior Facility G Loan will be equal to the proportion borne by its Available Commitment (if any) to the Available Facility immediately prior to making the Loan.

5.4.3 No Senior Facility G Lender is obliged to participate in a Senior Facility G Loan if, as a result:

(a) its share in the outstanding Senior Facility G Loan would exceed its Available Commitment; or

(b) the outstanding Senior Facility G Loan would exceed the Available Facility.

5.5 Automatic cancellation of Commitments

The Senior Facility G Commitments which, at that time, are unutilised, and in respect of which no Utilisation Request has been delivered, shall be immediately cancelled at 10h00 on the last day of the Availability Period.

5.6 Deemed Utilisation in respect of the Revolving Credit Commitment

On the Fifth Amendment and Restatement Date, the Borrower shall be deemed to have utilised the Revolving Credit Commitment in full.

6. REPAYMENT

6.1 The Borrower shall repay the Senior Facility G Loan in full on the Final Maturity Date (subject to Clauses 7 (Prepayment and Cancellation) and 10 (Default)).

6.2 Any amount which remains outstanding under Senior Facility G on the Final Maturity Date shall be repaid in full on that date.

7. PREPAYMENT AND CANCELLATION

7.1 Voluntary cancellation

7.1.1 The Borrower may cancel the unutilised and undrawn amount of the Senior Facility G Commitments in accordance with the requirements (and subject to the terms) of clause 7 (Prepayment and Cancellation) of the Common Terms Agreement.

7.1.2 No amount of the Senior Facility G Commitments cancelled pursuant to this Clause may be reinstated.

7.2 Voluntary prepayment

The Borrower may make voluntary prepayments in respect of the Senior Facility G Loan made to it, in whole or in part, in accordance with the requirements (and subject to the terms) of clause 7 (Prepayment and Cancellation) of the Common Terms Agreement.

7.3 Re-borrowing and reinstatement

7.3.1 Any voluntary prepayment of a Senior Facility G Loan under Clause 7.2 may be re-borrowed on the terms of this Agreement up to the Revolving Credit Facility Available Commitment. Any other repayment or prepayment of a Senior Facility G Loan may not be re-borrowed.

7.3.2 No amount of a Commitment cancelled under this Agreement may be subsequently reinstated.

7.4 Mandatory prepayment and prepayment offers

The Borrower shall be obliged to make mandatory prepayments and/or offers to make prepayments (as applicable) in respect of the Senior Facility G Loan made to it to the Senior Facility G Lenders in accordance with the requirements (and subject to the terms) of clauses 7 (Prepayment and Cancellation) and 8 (Prepayment Offers and Priorities) of the Common Terms Agreement.

8. INTEREST

8.1 Calculation of interest

The rate of interest on each Senior Facility G Loan (and any Unpaid Sum) for each Interest Period is the percentage rate per annum which is the aggregate of:

8.1.1 the Applicable Margin; and

8.1.2 the Base Rate.

8.2 Payment of interest

8.2.1 The Borrower shall pay all accrued interest on the Senior Facility H Loan made to it on each Interest Payment Date, in accordance with the requirements of clause 31 (Payment Mechanics) of the Common Terms Agreement.

8.2.2 Notwithstanding Clause 8.2.1, the Borrower may, by notice to the Facility Agent delivered not less than 10 Business Days' prior to an Interest Payment Date, elect that any accrued interest on a Senior Facility G Loan for the relevant Interest Period which ends on that Interest Payment Date, be capitalised to the Senior Facility G Outstandings on that Interest Payment Date, provided that the Senior Facility G Outstandings plus any capitalised interest in respect of Senior Facility G shall not exceed 120 per cent. of the Senior Facility G Commitment on that Interest Payment Date. If the Senior Facility G Outstandings would exceed the Senior Facility G Commitment on that Interest Payment Date that portion of the accrued interest which would cause the Senior Facility G Outstandings to exceed 120 per cent. of the Senior Facility G Commitment shall be paid on that Interest Payment Date.

8.3 Interest on overdue amounts

8.3.1 Any interest accruing on an Unpaid Sum shall be immediately payable by the Borrower on demand by the Facility Agent.

8.3.2 Default interest (if unpaid) arising on any Unpaid Sum will be compounded with that Unpaid Sum on the last day of each calendar month, but will remain immediately due and payable.

8.4 Notification of rates of interest

Without prejudice to the obligation of the Borrower to pay interest calculated at any applicable rate under this Clause 8, the Facility Agent shall notify the Senior Facility G Lenders and the Borrower, as soon as reasonably practicable:

8.4.1 of the determination of a rate of interest under this Agreement;

8.4.2 when interest commences to accrue at the rate calculated by reference to the Applicable Margin specified in Clause 1.1.1(e) (Definitions).

9. INTEREST PERIODS

9.1 Duration

Each Senior Facility G Loan has successive Interest Periods:

9.1.1 commencing on (and including) the Utilisation Date (in respect of the first Interest Period for that Senior Facility G Loan) or commencing on (and including) an Interest Payment Date; and

9.1.2 ending on (but excluding) the next Interest Payment Date.

9.2 Interest Periods for Unpaid Sums

Interest accruing on an Unpaid Sum shall be calculated as if that Unpaid Sum, during the period of non-payment, constituted a Loan under Senior Facility G for successive Interest Periods, each of a duration selected by the Facility Agent (acting reasonably). For this purpose, the Facility Agent (acting reasonably) may:

9.2.1 select successive Interest Periods of any duration of up to three months; and

9.2.2 determine the appropriate Quotation Day for that Interest Period.

If any Unpaid Sum consists of all or part of the Senior Facility G Loan which became due on a day which was not the last day of an Interest Period relating to that Senior Facility G Loan, the first Interest Period for that Unpaid Sum shall have a duration equal to the unexpired portion of the current Interest Period relating to the Senior Facility G Loan.

9.3 No overrunning the Final Maturity Date

If an Interest Period for a Senior Facility G Loan would otherwise extend beyond the Final Maturity Date, it will be shortened so that it ends on the Final Maturity Date. This Clause does not apply to Interest Periods selected under Clause 9.2 above in respect of Unpaid Sums which remain outstanding on the Final Maturity Date.

9.4 Non-Business Days

If an Interest Payment Date would otherwise occur on a day which is not a Business Day, that Interest Payment Date will instead be the next Business Day in the same calendar month (if there is one) or the preceding Business Day (if there is not).

9.5 Consolidation of Loans

If, on an Interest Payment Date, there is more than one Loan outstanding, then on such Interest Payment Date such Loans shall be consolidated and treated as a single Loan.

10. FEES

10.1 Non-refundable Deal Origination Fee

The Borrower shall pay to the Senior Facility G Lender a non-refundable deal origination fee in the amount and at the times agreed in a Fee Letter.

10.2 Commitment Fee

10.2.1 The Borrower must pay to the Senior Facility G Lender a commitment fee computed at the rate of 35 per cent. per annum of the Applicable Margin on the Revolving Credit Facility Available Commitment for the Availability Period (the Commitment Fee).

10.2.2 The Commitment Fee is payable on the last Business Day of each quarter during the Availability Period, the last day of the Availability Period, and, if cancelled in full, on the cancelled amount of the Commitment at the time the cancellation is effective (each a Commitment Fee Payment Date).

10.2.3 The Commitment Fee will be capitalised to the Senior Facility G Outstandings on each Commitment Fee Payment Date.

11. DEFAULT

If an Event of Default occurs, and for so long as it is continuing, the Facility Agent may enforce any of the rights and remedies provided for in clause 23.15 (Acceleration) of the Common Terms Agreement.

12. MARGIN CERTIFICATE

12.1 The Borrower shall supply to the Facility Agent, with each set of financial statements and management accounts delivered pursuant to Clause 20.1.1 and 20.1.2 of the Common Terms Agreement in relation to a Measurement Date, a Margin Certificate setting out (in reasonable detail) computations as to the calculation of the Look Through Leverage Ratio as at the date as at which those financial statements or management accounts (as applicable) were drawn up.

12.2 Each Margin Certificate shall be signed by two directors of Borrower (including the financial director of the Lesaka Group).

13. GENERAL

13.1 Notices and domicilium

All documents in legal proceedings and notices in connection with this Agreement shall be served in accordance with clause 34 (Notices) of the Common Terms Agreement, which clause is incorporated by reference in this Agreement as if repeated in this Agreement in full (except that references in that clause to the Common Terms Agreement are to be construed as references to this Agreement).

13.2 Incorporation of by reference

The provisions clauses 18 (Costs and Expenses), 35 (Amendments and Waivers), 37 (General Provisions) and 41 (Waiver of Immunity) of the Common Terms Agreement apply to this Agreement as though they were set out in full in this Agreement (except that references in those clauses to the Common Terms Agreement are to be construed as references to this Agreement).

13.3 Governing Law

This Agreement and any non-contractual obligations arising out of or in connection with it are governed by South African law.

13.4 Jurisdiction

13.4.1 The Parties hereby irrevocably and unconditionally consent to the non-exclusive jurisdiction of the High Court of South Africa (Gauteng Local Division, Johannesburg) (or any successor to that division) in regard to all matters arising from this Agreement (including a dispute relating to the existence, validity or termination of this Agreement or any non-contractual obligation arising out of or in connection with this Agreement) (a dispute).

13.4.2 The Parties agree that the High Court of South Africa is the most appropriate and convenient court to settle disputes. The Parties agree not to argue to the contrary and waive objection to this court on the grounds of inconvenient forum or otherwise in relation to proceedings in connection with this Agreement.

13.4.3 This Clause 13.4 is for the benefit of the Finance Parties only. As a result, no Finance Party shall be prevented from taking proceedings relating to a dispute in any other court with jurisdiction. To the extent allowed by law, a Finance Party may take concurrent proceedings in any number of jurisdictions.

13.5 Counterparts

This Agreement may be executed in any number of counterparts, and this has the same effect as if the signatures on the counterparts were on a single copy of this Agreement.

THIS AGREEMENT has been entered into on the date stated at the beginning of this Agreement.

SCHEDULE 1

FORM OF UTILISATION REQUEST

To: [●] (as Facility Agent)

From: LESAKA TECHNOLOGIES PROPRIETARY LIMITED (FORMERLY KNOWN AS NET1 APPLIED TECHNOLOGIES SOUTH AFRICA PROPRIETARY LIMITED)

[⬤], [⬤]

Dear Sirs,

LESAKA TECHNOLOGIES PROPRIETARY LIMITED

(FORMERLY KNOWN AS NET1 APPLIED TECHNOLOGIES SOUTH AFRICA

PROPRIETARY LIMITED)

Senior Facility G Agreement, dated [●], 2022

(the Agreement)

1. We refer to the Agreement. This is a Utilisation Request. Terms defined in the Agreement have the same meaning in this Utilisation Request unless given a different meaning in this Utilisation Request.

2. We wish to borrow a Senior Facility G Loan on the following terms:

| Proposed Utilisation Date: |

[●] (or, if that is not a Business Day, the next Business Day) |

| |

|

| Amount: |

R[●] or, if less, the Available Facility |

3. The proceeds of this Loan must be credited to [account].

4. We confirm that each condition specified in Clause 4.2 (Further conditions precedent) of the Agreement is satisfied on the date of this Utilisation Request.

5. This Utilisation Request is irrevocable.

Yours faithfully,

…………………………………

authorised signatory for

LESAKA TECHNOLOGIES PROPRIETARY LIMITED (FORMERLY KNOWN AS NET1 APPLIED TECHNOLOGIES SOUTH AFRICA PROPRIETARY LIMITED)

SCHEDULE 2

FORM OF MARGIN CERTIFICATE

To: [Facility Agent], as Facility Agent

[⬤]

[⬤]

From: LESAKA TECHNOLOGIES PROPRIETARY LIMITED

[⬤], 202[⬤]

Dear Sirs,

LESAKA TECHNOLOGIES PROPRIETARY LIMITED

Senior Facility G Agreement, dated [⬤], 2022

(the Agreement)

1. We refer to the Agreement. This is a Margin Certificate. Terms defined in the Agreement have the same meaning when used in this Margin Certificate unless given a different meaning in this Margin Certificate.

2. We confirm that as at [relevant testing date] the Look Through Leverage Ratio was:

| |

Ratio |

As Calculated |

| 1. |

Look Through Leverage Ratio |

[⬤] |

3. We set out below calculations establishing the figures in paragraph 2 above:

[⬤]

4. We confirm that the [financial statements]/[management accounts] which this compliance certificate accompanies fairly represents the financial condition of the Margin Group as at the date as to which those [financial statements]/[management accounts] were drawn up.

5. [We confirm that no Default is continuing as at [relevant testing date].]1

Yours faithfully,

| Signed: |

….......................................... |

….......................................... |

| |

|

|

| |

Director |

Director |

| |

|

|

| |

Lesaka Technologies Proprietary

Limited |

Lesaka Technologies Proprietary

Limited |

1 If this statement cannot be made, the certificate should identify any Default that is continuing and the steps, if any, being taken to remedy it.

SCHEDULE 4

AMENDED AND RESTATED SENIOR FACILITY H AGREEMENT

EXECUTION

SENIOR FACILITY H AGREEMENT

ORIGINALLY DATED 24 JANUARY, 2022

AS AMENDED AND RESTATED ON 16 MARCH, 2023

AND AS AMENDED AND RESTATED ON 24 NOVEMBER, 2023

SENIOR TERM LOAN FACILITY

for

LESAKA TECHNOLOGIES PROPRIETARY LIMITED

(FORMERLY KNOWN AS NET1 APPLIED TECHNOLOGIES SOUTH AFRICA

PROPRIETARY LIMITED)

(as borrower)

provided by

FIRSTRAND BANK LIMITED

(ACTING THROUGH ITS RAND MERCHANT BANK DIVISION)

(as lender)

with

FIRSTRAND BANK LIMITED

(ACTING THROUGH ITS RAND MERCHANT BANK DIVISION)

(as facility agent)

This Agreement is entered into subject to the terms of a Common Terms Agreement

originally dated on or about 21 July, 2017

CONTENTS

THIS AGREEMENT is made between:

(1) LESAKA TECHNOLOGIES PROPRIETARY LIMITED (FORMERLY KNOWN AS NET1 APPLIED TECHNOLOGIES SOUTH AFRICA PROPRIETARY LIMITED), registration number 2002/031446/07, as borrower (the Borrower);

(2) FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION) as original lender (in this capacity, the Original Senior Facility H Lender); and

(3) FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION) as agent of the Senior Facility H Lenders (the Facility Agent).

IT IS AGREED as follows:

1. DEFINITIONS AND INTERPRETATION

1.1 Definitions

In this Agreement:

1.1.1 Applicable Margin means, in relation to any Senior Facility H Loan or Unpaid Sum:

(a) from the Fourth Amendment and Restatement Date until 31 December, 2022, 2.00 per cent. per annum;

(b) with effect from 1 January, 2023 until 30 September, 2023, for so long as the aggregate of the Senior Facility G Outstandings and Senior Facility H Outstandings are greater than R800,000,000, 5.50 per cent. per annum. Thereafter, with effect from the next Interest Payment Date after a change in threshold, for so long as the aggregate of the Senior Facility G Outstandings and Senior Facility H Outstandings:

(i) are greater than R800,000,000, 5.50 per cent. per annum;

(ii) are equal to or less than R800,000,000 but greater than R350,000,000, 4.25 per cent. per annum;

(iii) are equal to or less than R350,000,000, 2.50 per cent. per annum,

provided that no Event of Default has occurred and is continuing;

(c) with effect from 1 October, 2023, for so long as the Look Through Leverage Ratio:

(i) is greater than 3.50, 5.50 per cent. per annum;

(ii) is less than 3.50 and greater than 2.75, 4.75 per cent. per annum;

(iii) is less than 2.75 and greater than 1.75, 3.75 per cent. per annum;

(iv) is less than 1.75, 2.50 per cent. per annum, and

(d) with effect from the date of occurrence of an Event of Default and for so long as it is continuing, the Applicable Margin shall be the percentage per annum set out in paragraph (a), (b), or (c) above, as applicable, plus 2.00 per cent.

1.1.2 Applicable Percentage means:

(a) in respect of the Holdco, 100 per cent.;

(b) in respect of any other member of the Margin Group, the percentage shareholding held by the Holdco in that member of the Margin Group at that time.

1.1.3 Attributable EBITDA means, in respect of any member of the Margin Group:

(a) in respect of the Measurement Dates occurring during the period from 1 October, 2023 until (and including)30 June, 2024, its EBITDA for the period of 3 months ending on that Measurement Date multiplied by 4;

(b) in respect of the Measurement Dates occurring from (and including) 30 September, 2024, in respect of any Measurement Period, its EBITDA for that period,

multiplied by its Applicable Percentage.

1.1.4 Attributable Net Debt, in respect of any member of the Margin Group, shall be determined as follows:

where:

|

A =

|

the Total Debt of that member of the Margin Group

|

|

B =

|

the Applicable Percentage of that member of the Margin Group

|

|

C =

|

the aggregate of the Cash and Cash Equivalents of that member of the Margin Group

|

1.1.5 Availability Period means the period from and including the Fourth Amendment and Restatement Date to and including the date falling one month from the Fourth Amendment and Restatement Date.

1.1.6 Available Commitment means the "Available Commitment" (as defined in the Common Terms Agreement) of a Senior Facility H Lender in respect of Senior Facility H.

1.1.7 Available Facility means the aggregate, from time to time, of the Available Commitment of each Senior Facility H Lender.

1.1.8 Break Costs means the amount (if any) determined by a Senior Facility H Lender by which:

(a) the interest (excluding the Applicable Margin) which that Senior Facility H Lender should have received for the period from the date of receipt of an amount repaid or prepaid in respect of any part of its participation in a Senior Facility H Loan or Unpaid Sum to the last day of the current Interest Period for that Senior Facility H Loan or Unpaid Sum, if the principal amount of that Senior Facility H Loan or Unpaid Sum received had been paid on the last day of that Interest Period;

exceeds:

(b) the amount which that Senior Facility H Lender would be able to obtain by placing an amount equal to the principal amount of the Senior Facility H Loan or Unpaid Sum received by it on deposit with a leading bank in the Johannesburg interbank market for a period starting on the Business Day following receipt or recovery and ending on the last day of the current Interest Period,

and Break Gains means the amount (if any) determined by the relevant Senior Facility H Lender by which the amount of interest contemplated in paragraph (b) above exceeds that in paragraph (a) above.

1.1.9 Common Terms Agreement means the written agreement entitled "Common Terms Agreement", dated on or about 21 July, 2017 (as amended and/or reinstated from time to time), between, amongst others, the Borrower (as borrower) and the Facility Agent.

1.1.10 EBITDA, means, in relation to a period, the aggregate of the consolidated operating income of a member of the Margin Group (including dividends received in Cash), in each case, for that period, without taking any account of the following items (without double counting):

(a) any Interest accrued as an obligation of that member of the Margin Group, whether or not paid, deferred or capitalised during that period;

(b) any amount of Tax on profits, gains or income paid or payable by that member of the Margin Group and any amount of any rebate or credit in respect of Tax on profits, gains or income received or receivable by that member of the Margin Group;

(c) any depreciation or amortisation whatsoever, and any charge for impairment or any reversal in that period of any previous impairment charge;

(d) any charges related to stock-based compensation;

(e) treating any lease contract (concluded either prior to or after 1 January, 2019) which would have been classified as an operating lease under IFRS16 prior to 1 January, 2019 and solely as a result of changes to IFRS with effect from 1 January, 2019 is now classified as a balance sheet liability as an operating lease for accounting purposes, notwithstanding any change (or the implementation of any change) to IFRS on or after 1 January, 2019;

(f) any loss against book value incurred by that member of the Margin Group on the disposal of any asset (other than trading stock) during that period;

(g) any gain over book value arising in favour of that member of the Margin Group on the disposal of any asset (other than trading stock) during that period and any gain arising on any revaluation of an asset during that period;

(h) any unrealised gains or losses due to exchange rate movements which are reported through the income statement;

(i) any unrealised gains or losses on any financial instrument (other than any financial instrument which is accounted for on a hedge accounting basis) which are reported through the income statement;

(j) the amount of profit or loss of any associate entity (which is not a member of the Margin Group) in which that member of the Margin Group has an ownership interest, to the extent (in respect of profit only) that the amount of such profit reported through the income statement exceeds the amount (net of any applicable withholding tax) received in cash by that member of the Margin Group through distributions by that entity; and

(k) any extraordinary and exceptional items approved by the Facility Agent in writing before the applicable Measurement Date.

1.1.11 Final Maturity Date means 31 December, 2025.

1.1.12 Interest Payment Date means:

(a) the last day of March, June, September and December in any year; and

(b) the Final Maturity Date.

1.1.13 Interest Period means, in relation to a Senior Facility H Loan, each period determined in accordance with Clause 9 (Interest Periods).

1.1.14 Lesaka Market Price Discussion Trigger Event means the market capitalisation of Holdco on the NASDAQ Stock Market (based on the closing price on the NASDAQ Stock Market) on any day falls below the USD equivalent of ZAR3,250,000,000 (or such other amount agreed by the Parties).

1.1.15 Lesaka Market Price Trigger Event means the market capitalisation of Holdco on the NASDAQ Stock Market (based on the closing price on the NASDAQ Stock Market) falls and remains below the USD equivalent of ZAR2,600,000,000 (or such other amount agreed by the Parties) on more than one day between the first Utilisation Date and the Final Discharge Date.

1.1.16 Look Through Leverage Ratio, on any applicable date, means the ratio of the Total Attributable Net Debt on that date to the Total Attributable EBITDA for the Measurement Period ending on that date.

1.1.17 Margin Certificate means a certificate substantially in the form set out in Schedule 2 (Form of Margin Certificate) or otherwise in the agreed form.

1.1.18 Margin Group means each member of the Group from time to time, but excluding (a) members of the Kwande Group, (b) any Subsidiaries of Net1 Applied Technologies Netherlands and (c) SmartSwitch Botswana.

1.1.19 Party means a party to this Agreement.

1.1.20 Senior Facility G Outstandings means "Senior Facility G Outstandings" as defined in the Common Terms Agreement.

1.1.21 Senior Facility H or Facility means the term loan facility made available to the Borrower under this Agreement.

1.1.22 Senior Facility H Commitment means the "Senior Facility H Commitment" as defined in the Common Terms Agreement.

1.1.23 Senior Facility H Loan or Loan means a "Senior Facility H Loan" as defined in the Common Terms Agreement.

1.1.24 Senior Facility H Outstandings means "Senior Facility H Outstandings" as defined in the Common Terms Agreement.

1.1.25 Signature Date means the date stated at the beginning of this Agreement.

1.1.26 Total Attributable EBITDA means the aggregate of the Attributable EBITDA of the members of the Margin Group.

1.1.27 Total Attributable Net Debt means the aggregate of the Attributable Net Debt of the members of the Margin Group.

1.1.28 Total Debt in respect of any member of the Margin Group, at any time, means the aggregate at that time of the Financial Indebtedness of that member of the Margin Group from sources external to the Margin Group calculated at its nominal or principal amount (or, if greater, the maximum amount payable on repayment or redemption of the relevant liabilities) together with capitalised interest thereon at such time less any Financial Indebtedness of that member of the Margin Group incurred pursuant to Facility E and which is not due and payable.

1.1.29 Total Senior Facility H Commitments means "Total Senior Facility H Commitments" as defined in the Common Terms Agreement.

1.1.30 Unpaid Sum means an "Unpaid Sum" as defined in the Common Terms Agreement in respect of Senior Facility H.

1.1.31 Utilisation Request means the notice substantially in the form set out in Schedule 1 (Form of Utilisation Request).

1.1.32 VCP Investment Fund means the Value Capital Partners H4 QI Hedge Fund Portfolio.

1.1.33 VCP Investment Manager means Value Capital Partners Proprietary Limited (registration number 2016/242305/07), a company registered under the laws of South Africa.

1.1.34 VCP Manco means H4 Collective Investments (RF) Proprietary Limited (registration number 2002/009140/07), a company registered under the laws of South Africa.

1.2 Construction

1.2.1 Terms and expressions defined in the Common Terms Agreement, unless expressly defined in this Agreement, have the same meaning in this Agreement.

1.2.2 The provisions of clauses 1.3 (Construction) and 1.4 (Third party rights) of the Common Terms Agreement apply to this Agreement as though they were set out in full in this Agreement, except that a reference in those clauses to the Common Terms Agreement are to be construed as references to this Agreement.

1.2.3 This Agreement and the rights and obligations of the Parties hereunder shall in all respects be subject to the terms and conditions of the Common Terms Agreement, which shall apply mutatis mutandis to this Agreement and be incorporated herein by reference. If there is any conflict between this Agreement and the Common Terms Agreement, this Agreement shall prevail.

2. THE FACILITY

2.1 Senior Facility H

Subject to the terms of this Agreement and the Common Terms Agreement, the Senior Facility H Lenders make available to the Borrower a Rand-denominated term loan facility in an aggregate amount equal to the Total Senior Facility H Commitments.

2.2 Designation

This Agreement is a Senior Facility Agreement and the Senior Facility H Agreement, each as defined in the Common Terms Agreement.

3. PURPOSE

3.1 The Borrower shall apply all amounts borrowed by it under Senior Facility H only in or towards the purpose set out in clause 3.1.3 (Purpose) of the Common Terms Agreement, and for no other purpose whatsoever.

3.2 No Finance Party is bound to monitor or verify the utilisation of Senior Facility H or will be responsible for, or for the consequences of, such a utilisation.

4. CONDITIONS OF UTILISATION

4.1 Conditions precedent

The Borrower may not deliver a Utilisation Request to the Facility Agent under Senior Facility H (and no Senior Facility H Lender shall have any obligation to advance any Senior Facility H Loan or to provide any other form of credit or financial accommodation under this Agreement to any person) unless the Facility Agent has issued the notice contemplated by clause 4.1 (Initial conditions precedent) of the Common Terms Agreement.

4.2 Further conditions precedent

Subject to the Common Terms Agreement and this Agreement, a Senior Facility H Lender will only be obliged to participate in a Senior Facility H Loan if the requirements of clause 4.2 (Further conditions precedent) of the Common Terms Agreement have been met.

4.3 Maximum number of Loans

The Borrower may not deliver a Utilisation Request under Senior Facility H if as a result of the proposed Utilisation more than one Senior Facility H Loan would be outstanding.

5. UTILISATION AND DISBURSEMENT

5.1 Delivery of a Utilisation Request

5.1.1 The Borrower may utilise Senior Facility H during the Availability Period by delivery to the Facility Agent of a duly completed Utilisation Request.

5.1.2 Unless the Facility Agent otherwise agrees, the latest time for receipt by the Facility Agent of a Utilisation Request is 17h00 two Business Days before the proposed Utilisation Date or such shorter period as the Facility Agent agrees in writing.

5.1.3 A Utilisation Request is irrevocable.

5.1.4 A maximum of one Utilisation Request may be delivered by the Borrower on or following the Fourth Amendment and Restatement Date.

5.2 Completion of a Utilisation Request

5.2.1 A Utilisation Request will not be regarded as having been duly completed unless:

(a) the proposed Utilisation Date is a Business Day within the Availability Period;

(b) the currency and amount of the Utilisation comply with Clause 5.3 below; and

(c) it specifies a bank account in South Africa to which the Borrower requires the proceeds of the Senior Facility H Loan to be credited.

5.2.2 Only one Senior Facility H Loan may be requested in a Utilisation Request.

5.3 Currency and amount

5.3.1 The currency specified in a Utilisation Request must be Rand.

5.3.2 The amount of the proposed Senior Facility H Loan is for the full amount of the Senior Facility H Available Commitments of the relevant Senior Facility H Lender or such lesser amount as the Facility Agent may agree.

5.4 Disbursement

5.4.1 If the conditions set out in this Agreement and the Common Terms Agreement have been met, each Senior Facility H Lender must advance and lend to the Borrower, who shall borrow from each such Lender, that Lender's participation in the Senior Facility H Loan on the Utilisation Date. A Senior Facility H Lender must make its participation in the Senior Facility H Loan available to the Facility Agent by no later than 11h00 on the applicable Utilisation Date for disbursement to the Borrower.

5.4.2 The amount of each Senior Facility H Lender's participation in the Senior Facility H Loan will be equal to the proportion borne by its Available Commitment (if any) to the Available Facility immediately prior to making the Loan.

5.4.3 No Senior Facility H Lender is obliged to participate in a Senior Facility H Loan if, as a result:

(a) its share in the outstanding Senior Facility H Loan would exceed its Available Commitment; or

(b) the outstanding Senior Facility H Loan would exceed the Available Facility.

5.5 Automatic cancellation of Commitments

The Senior Facility H Commitments which, at that time, are unutilised, and in respect of which no Utilisation Request has been delivered, shall be immediately cancelled at 10h00 on the last day of the Availability Period.

6. REPAYMENT

6.1 The Borrower shall repay the Senior Facility H Loan in full on the Final Maturity Date (subject to Clauses 7 (Prepayment and Cancellation) and 12 (Default)).

6.2 Any amount which remains outstanding under Senior Facility H on the Final Maturity Date shall be repaid in full on that date.

6.3 No amount of a Senior Facility H Loan repaid under this Clause 6 may be re-borrowed.

7. PREPAYMENT AND CANCELLATION

7.1 Voluntary cancellation

7.1.1 The Borrower may cancel the unutilised and undrawn amount of the Senior Facility H Commitments in accordance with the requirements (and subject to the terms) of clause 7 (Prepayment and Cancellation) of the Common Terms Agreement.

7.1.2 No amount of the Senior Facility H Commitments cancelled pursuant to this Clause may be reinstated.

7.2 Voluntary prepayment

7.2.1 The Borrower may make voluntary prepayments in respect of the Senior Facility H Loan made to it, in whole or in part, in accordance with the requirements (and subject to the terms) of clause 7 (Prepayment and Cancellation) of the Common Terms Agreement.

7.2.2 No amount of a Senior Facility H Loan prepaid pursuant to this Clause may be re-borrowed.

7.3 Mandatory prepayment and prepayment offers

The Borrower shall be obliged to make mandatory prepayments and/or offers to make prepayments (as applicable) in respect of the Senior Facility H Loan made to it to the Senior Facility H Lenders in accordance with the requirements (and subject to the terms) of clauses 7 (Prepayment and Cancellation) and 8 (Prepayment Offers and Priorities) of the Common Terms Agreement.

8. INTEREST

8.1 Calculation of interest

The rate of interest on each Senior Facility H Loan (and any Unpaid Sum) for each Interest Period is the percentage rate per annum which is the aggregate of:

8.1.1 the Applicable Margin; and

8.1.2 the Base Rate.

8.2 Payment of interest

8.2.1 The Borrower shall pay all accrued interest on the Senior Facility H Loan made to it on each Interest Payment Date, in accordance with the requirements of clause 31 (Payment Mechanics) of the Common Terms Agreement.

8.2.2 Notwithstanding Clause 8.2.1, the Borrower may, by notice to the Facility Agent delivered not less than 10 Business Days' prior to an Interest Payment Date, elect that any accrued interest on a Senior Facility H Loan for the relevant Interest Period which ends on that Interest Payment Date, be capitalised to the Senior Facility H Outstandings on that Interest Payment Date, provided that the Senior Facility H Outstandings plus any capitalised interest in respect of Senior Facility H shall not exceed 120 per cent. of the Senior Facility H Commitment on that Interest Payment Date. If the Senior Facility H Outstandings would exceed the Senior Facility H Commitment on that Interest Payment Date that portion of the accrued interest which would cause the Senior Facility H Outstandings to exceed 120 per cent. of the Senior Facility H Commitment shall be paid on that Interest Payment Date.

8.3 Interest on overdue amounts

8.3.1 Any interest accruing on an Unpaid Sum shall be immediately payable by the Borrower on demand by the Facility Agent.

8.3.2 Default interest (if unpaid) arising on any Unpaid Sum will be compounded with that Unpaid Sum on the last day of each calendar month, but will remain immediately due and payable.

8.4 Notification of rates of interest

Without prejudice to the obligation of the Borrower to pay interest calculated at any applicable rate under this Clause 8, the Facility Agent shall notify the Senior Facility H Lenders and the Borrower, as soon as reasonably practicable:

8.4.1 of the determination of a rate of interest under this Agreement;

8.4.2 when interest commences to accrue at the rate calculated by reference to the Applicable Margin specified in Clause 1.1.1(d)(Definitions).

9. INTEREST PERIODS

9.1 Duration

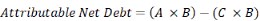

Each Senior Facility H Loan has successive Interest Periods: