Lee Enterprises, Incorporated (NASDAQ: LEE), a digital-first

subscription platform providing high quality, trusted, local news,

information and a major platform for advertising in 72 markets,

today reported preliminary first quarter fiscal 2025 financial

results(3) for the period ended December 29, 2024.

"Our first quarter results demonstrate the

continued progression of our digital transformation. We achieved

over $300 million in Total Digital Revenue over the last twelve

months, including over $100 million in Amplified Digital Agency®

revenue," said Kevin Mowbray, Lee's President and Chief Executive

Officer.

"To accelerate our digital transformation, we recently announced

a strategic partnership with Amazon Web Services (AWS). By

leveraging AWS's cutting-edge cloud computing solutions, we aim to

optimize content delivery, improve customer engagement, and drive

innovative digital products across our extensive portfolio of

publications. This partnership highlights our commitment to

embracing advanced technologies to meet the evolving needs of our

audience and advertisers while achieving long-term growth and

scalability. With AWS's proven expertise, Lee Enterprises is

well-positioned to drive sustainable growth, enhance efficiency,

and deliver increased value to our shareholders," said Mowbray.

"As we look forward into the rest of the fiscal year, we expect

digital revenue growth to accelerate achieving full year guidance

of growth between 7% and 10%. In addition, we have identified

approximately $40 million of annualized cost reductions that we

expect to have executed on by the end of the second quarter. We

expect strong digital revenue growth combined with strong cost

management of our print business to keep us on track to achieve our

overall Adjusted EBITDA(1) guidance for the fiscal year," Mowbray

added.

Key First Quarter

Highlights:

- Total operating revenue was $145

million.

- Total Digital Revenue was $73

million, a 5% increase over the prior year(2), and represented 51%

of our total operating revenue.

- Revenue from digital-only

subscribers totaled $22 million, up 14% over the prior

year(2).

- Digital advertising and marketing

services revenue represented 70% of our total advertising revenue

and totaled $47 million.

- Digital services revenue, which is

predominantly from BLOX Digital, totaled $5 million in the

quarter.

- Operating expenses totaled $149

million and Cash Costs totaled $139 million, flat and a 1% decrease

compared to the prior year, respectively.

- Net loss totaled $16 million and

Adjusted EBITDA totaled $8 million.

Debt and Free Cash Flow:

The Company has $446 million of debt outstanding

under our Credit Agreement(5) with BH Finance. The financing has

favorable terms including a 25-year maturity, a fixed annual

interest rate of 9.0%, no fixed principal payments, and no

financial performance covenants.

As of and for the period ended December 29, 2024:

- The principal

amount of debt totaled $446 million.

- Cash on the balance sheet totaled

$6 million. Debt, net of cash on the balance sheet, totaled $440

million.

- Capital expenditures totaled $2

million for the quarter. We expect up to $12 million of capital

expenditures in FY25.

- We expect cash paid for income

taxes to total between $4 million and $10 million in 2025.

- We do not expect any material

pension contributions in the fiscal year as our plans are fully

funded in the aggregate.

Conference Call Information:

As previously announced, we will hold an

earnings conference call and audio webcast today at 9 a.m. Central

Time. The live webcast will be accessible at www.lee.net and will

be available for replay 24 hours later. Analysts have been invited

to ask questions on the call. Questions from other participants may

be submitted by participating in the webcast. To participate in the

live conference call via telephone, please visit www.lee.net. Upon

registering, a dial-in number and unique PIN will be provided to

join the conference call.

About Lee:

Lee Enterprises is a major subscription and

advertising platform and a leading provider of local news and

information, with daily newspapers, rapidly growing digital

products and nearly 350 weekly and specialty publications serving

72 markets in 25 states. Our core commitment is to provide

valuable, intensely local news and information to the communities

we serve. Our markets include St. Louis, MO; Buffalo, NY; Omaha,

NE; Richmond, VA; Lincoln, NE; Madison, WI; Davenport, IA; and

Tucson, AZ. Lee Common Stock is traded on NASDAQ under the symbol

LEE. For more information about Lee, please visit www.lee.net.

FORWARD-LOOKING STATEMENTS — The Private

Securities Litigation Reform Act of 1995 provides a "safe harbor"

for forward-looking statements. This release contains information

that may be deemed forward-looking that is based largely on our

current expectations, and is subject to certain risks, trends and

uncertainties that could cause actual results to differ materially

from those anticipated. Among such risks, trends and other

uncertainties, which in some instances are beyond our control,

are:

- We may be required to indemnify the

previous owners of BH Media or The Buffalo News for unknown legal

and other matters that may arise;

- Our ability to manage declining

print revenue and circulation subscribers;

- The impact and duration of adverse

conditions in certain aspects of the economy affecting our

business;

- Changes in advertising and

subscription demand;

- Changes in technology that impact

our ability to deliver digital advertising;

- Potential changes in newsprint,

other commodities and energy costs;

- Interest rates;

- Labor costs;

- Significant cyber security breaches

or failure of our information technology systems;

- Our ability to achieve planned

expense reductions and realize the expected benefit of our

acquisitions;

- Our ability to maintain employee

and customer relationships;

- Our ability to manage increased

capital costs;

- Our ability to maintain our listing

status on NASDAQ;

- Competition; and

- Other risks detailed from time to

time in our publicly filed documents.

Any statements that are not statements of

historical fact (including statements containing the words "may",

"will", "would", "could", "believes", "expects", "anticipates",

"intends", "plans", "projects", "considers" and similar

expressions) generally should be considered forward-looking

statements. Statements regarding our plans, strategies, prospects

and expectations regarding our business and industry and our

responses thereto may have on our future operations, are

forward-looking statements. They reflect our expectations, are not

guarantees of performance and speak only as of the date the

statement is made. Readers are cautioned not to place undue

reliance on such forward-looking statements, which are made as of

the date of this report. We do not undertake to publicly update or

revise our forward-looking statements, except as required by

law.

Contact:IR@lee.net(563) 383-2100

|

CONSOLIDATED STATEMENTS OF

OPERATIONS(UNAUDITED) |

|

|

Three months ended |

|

(Thousands of Dollars, Except Per Common Share Data) |

December 29, 2024 |

|

December 24, 2023 |

|

Percent Change |

|

|

|

|

|

|

| Operating revenue: |

|

|

|

|

Print advertising revenue |

19,861 |

|

24,435 |

|

(19 |

)% |

|

Digital advertising revenue |

46,729 |

|

46,452 |

|

1 |

% |

|

Advertising and marketing services revenue |

66,590 |

|

70,887 |

|

(6 |

)% |

|

Print subscription revenue |

43,432 |

|

51,872 |

|

(16 |

)% |

|

Digital subscription revenue |

21,565 |

|

19,467 |

|

11 |

% |

|

Subscription revenue |

64,997 |

|

71,339 |

|

(9 |

)% |

|

Print other revenue |

7,888 |

|

8,492 |

|

(7 |

)% |

|

Digital other revenue |

5,087 |

|

4,960 |

|

3 |

% |

|

Other revenue |

12,975 |

|

13,452 |

|

(4 |

)% |

|

Total operating revenue |

144,562 |

|

155,678 |

|

(7 |

)% |

|

Operating expenses: |

|

|

|

|

Compensation |

60,254 |

|

59,676 |

|

1 |

% |

|

Newsprint and ink |

3,616 |

|

4,843 |

|

(25 |

)% |

|

Other operating expenses |

74,680 |

|

74,776 |

|

— |

% |

|

Depreciation and amortization |

6,265 |

|

7,295 |

|

(14 |

)% |

|

Assets (gain) on sales, impairments and other, net |

(929 |

) |

(1,469 |

) |

(37 |

)% |

|

Restructuring costs and other |

5,150 |

|

4,265 |

|

21 |

% |

|

Total operating expenses |

149,036 |

|

149,386 |

|

— |

% |

|

Equity in earnings of associated companies |

1,122 |

|

1,541 |

|

(27 |

)% |

|

Operating (loss) income |

(3,352 |

) |

7,833 |

|

NM |

|

Non-operating (expense) income: |

|

|

|

|

Interest expense |

(10,282 |

) |

(10,131 |

) |

1 |

% |

|

Pension and OPEB related benefit and other, net |

653 |

|

186 |

|

NM |

|

Curtailment/Settlement gains |

— |

|

3,593 |

|

NM |

|

Total non-operating expense, net |

(9,629 |

) |

(6,352 |

) |

52 |

% |

|

(Loss) income before income taxes |

(12,981 |

) |

1,481 |

|

NM |

| Income

tax expense |

3,243 |

|

248 |

|

NM |

|

Net (loss) income |

(16,224 |

) |

1,233 |

|

NM |

| Net

income attributable to non-controlling interests |

(524 |

) |

(545 |

) |

(4 |

)% |

|

(Loss) income attributable to Lee Enterprises, Incorporated |

(16,748 |

) |

688 |

|

NM |

| Other

comprehensive loss, net of income taxes |

(115 |

) |

(2,314 |

) |

(95 |

)% |

|

Comprehensive loss attributable to Lee Enterprises,

Incorporated |

(16,863 |

) |

(1,626 |

) |

NM |

| (Loss)

earnings per common share: |

|

|

|

|

Basic: |

(2.80 |

) |

0.12 |

|

NM |

|

Diluted: |

(2.80 |

) |

0.12 |

|

NM |

DIGITAL / PRINT REVENUE

COMPOSITION(UNAUDITED)

|

|

Three months Ended |

|

(Thousands of Dollars) |

December 29, 2024 |

December 24, 2023 |

|

|

|

|

|

Digital Advertising and Marketing Services Revenue |

46,729 |

46,452 |

|

Digital Only Subscription Revenue |

21,565 |

19,467 |

|

Digital Services Revenue |

5,087 |

4,960 |

|

Total Digital Revenue |

73,381 |

70,879 |

|

Print Advertising Revenue |

19,861 |

24,435 |

|

Print Subscription Revenue |

43,432 |

51,872 |

|

Other Print Revenue |

7,888 |

8,492 |

|

Total Print Revenue |

71,181 |

84,799 |

|

Total Operating Revenue |

144,562 |

155,678 |

RECONCILIATION OF NON-GAAP FINANCIAL

MEASURES(UNAUDITED)

The table below reconciles the non-GAAP financial performance

measure of Adjusted EBITDA to Net loss, its most directly

comparable U.S. GAAP measure:

|

|

Three months ended |

|

(Thousands of Dollars) |

December 29, 2024 |

|

December 24, 2023 |

|

|

|

|

|

| Net (loss) income |

(16,224 |

) |

1,233 |

|

| Adjusted to exclude |

|

|

|

Income tax expense |

3,243 |

|

248 |

|

|

Non-operating expenses, net |

9,629 |

|

6,352 |

|

|

Equity in earnings of TNI and MNI |

(1,122 |

) |

(1,541 |

) |

|

Depreciation and amortization |

6,265 |

|

7,295 |

|

|

Restructuring costs and other |

5,150 |

|

4,265 |

|

|

Assets gain on sales, impairments and other, net |

(929 |

) |

(1,469 |

) |

|

Stock compensation |

430 |

|

214 |

|

| Add: |

|

|

|

Ownership share of TNI and MNI EBITDA (50%) |

1,167 |

|

2,052 |

|

|

Adjusted EBITDA |

7,609 |

|

18,649 |

|

The table below reconciles the non-GAAP

financial performance measure of Cash Costs to Operating expenses,

the most directly comparable U.S. GAAP measure:

|

|

Three months ended |

|

(Thousands of Dollars) |

December 29, 2024 |

|

December 24, 2023 |

|

|

|

|

|

| Operating expenses |

149,036 |

|

149,386 |

|

| Adjustments |

|

|

|

Depreciation and amortization |

6,265 |

|

7,295 |

|

|

Assets (gain) loss on sales, impairments and other, net |

(929 |

) |

(1,469 |

) |

|

Restructuring costs and other |

5,150 |

|

4,265 |

|

|

Cash Costs |

138,550 |

|

139,295 |

|

The table below reconciles the non-GAAP

financial performance measure of Same-store Revenues to Operating

Revenues, its most directly comparable U.S. GAAP measure:

|

|

Three months ended |

|

(Thousands of Dollars) |

December 29, 2024 |

December 24, 2023 |

Percent Change |

|

|

|

|

|

|

Print Advertising Revenue |

19,861 |

|

24,435 |

|

(19 |

)% |

|

Exited operations |

(39 |

) |

(923 |

) |

NM |

|

Same-store, Print Advertising Revenue |

19,822 |

|

23,512 |

|

(16 |

)% |

|

Digital Advertising and Marketing Services Revenue |

46,729 |

|

46,452 |

|

1 |

% |

|

Exited operations |

(1 |

) |

(484 |

) |

NM |

|

Same-store, Digital Advertising and Marketing Services Revenue |

46,728 |

|

45,968 |

|

2 |

% |

|

Total Advertising Revenue |

66,590 |

|

70,887 |

|

(6 |

)% |

|

Exited operations |

(40 |

) |

(1,406 |

) |

NM |

|

Same-store, Total Advertising Revenue |

66,550 |

|

69,481 |

|

(4 |

)% |

|

Print Subscription Revenue |

43,432 |

|

51,872 |

|

(16 |

)% |

|

Exited operations |

(2 |

) |

(446 |

) |

NM |

|

Same-store, Print Subscription Revenue |

43,430 |

|

51,426 |

|

(16 |

)% |

|

Digital Subscription Revenue |

21,565 |

|

19,467 |

|

11 |

% |

|

Exited operations |

(1 |

) |

(472 |

) |

NM |

|

Same-store, Digital Subscription Revenue |

21,564 |

|

18,995 |

|

14 |

% |

|

Total Subscription Revenue |

64,997 |

|

71,339 |

|

(9 |

)% |

|

Exited operations |

(3 |

) |

(918 |

) |

NM |

|

Same-store, Total Subscription Revenue |

64,994 |

|

70,421 |

|

(8 |

)% |

|

Print Other Revenue |

7,888 |

|

8,492 |

|

(7 |

)% |

|

Exited operations |

— |

|

(8 |

) |

NM |

|

Same-store, Print Other Revenue |

7,888 |

|

8,484 |

|

(7 |

)% |

|

Digital Other Revenue |

5,087 |

|

4,960 |

|

3 |

% |

|

Exited operations |

— |

|

— |

|

NM |

|

Same-store, Digital Other Revenue |

5,087 |

|

4,960 |

|

3 |

% |

|

Total Other Revenue |

12,975 |

|

13,452 |

|

(4 |

)% |

|

Exited operations |

— |

|

(8 |

) |

NM |

|

Same-store, Total Other Revenue |

12,975 |

|

13,444 |

|

(3 |

)% |

|

Total Operating Revenue |

144,562 |

|

155,678 |

|

(7 |

)% |

|

Exited operations |

(43 |

) |

(2,332 |

) |

NM |

|

Same-store, Total Operating Revenue |

144,519 |

|

153,346 |

|

(6 |

)% |

NOTES

(1) Total Digital

Revenue is defined as digital advertising and marketing services

revenue (including Amplified Digital® Agency), digital-only

subscription revenue and digital services revenue.

(2) Same-store

revenues is a non-GAAP performance measure based on U.S. GAAP

revenues for Lee for the current period, excluding exited

operations. Exited operations include (1) business divestitures and

(2) the elimination of stand-alone print products discontinued

within our markets.

(3) This earnings

release is a preliminary report of results for the periods

included. The reader should refer to the Company's most recent

reports on Form 10-Q and on Form 10-K for definitive

information.

(4) The following

are non-GAAP (Generally Accepted Accounting Principles) financial

measures for which reconciliations to relevant U.S GAAP measures

are included in tables accompanying this release:

- Adjusted EBITDA is

a non-GAAP financial performance measure that enhances financial

statement users overall understanding of the operating performance

of the Company. The measure isolates unusual, infrequent or

non-cash transactions from the operating performance of the

business. This allows users to easily compare operating performance

among various fiscal periods and how management measures the

performance of the business. This measure also provides users with

a benchmark that can be used when forecasting future operating

performance of the Company that excludes unusual, nonrecurring or

one-time transactions. Adjusted EBITDA is a component of the

calculation used by stockholders and analysts to determine the

value of our business when using the market approach, which applies

a market multiple to financial metrics. It is also a measure used

to calculate the leverage ratio of the Company, which is a key

financial ratio monitored and used by the Company and its

investors. Adjusted EBITDA is defined as net income (loss), plus

non-operating expenses, income tax expense, depreciation and

amortization, assets loss (gain) on sales, impairments and other,

restructuring costs and other, stock compensation and our 50% share

of EBITDA from TNI and MNI, minus equity in earnings of TNI and

MNI.

- Cash Costs

represent a non-GAAP financial performance measure of operating

expenses which are measured on an accrual basis and settled in

cash. This measure is useful to investors in understanding the

components of the Company’s cash-settled operating costs.

Periodically, the Company provides forward-looking guidance of Cash

Costs, which can be used by financial statement users to assess the

Company's ability to manage and control its operating cost

structure. Cash Costs are defined as compensation, newsprint and

ink and other operating expenses. Depreciation and amortization,

assets loss (gain) on sales, impairments and other, other non-cash

operating expenses and other expenses are excluded. Cash Costs also

exclude restructuring costs and other, which are typically paid in

cash.

(5) The Company's

debt is the $576 million term loan under a credit agreement with BH

Finance LLC dated January 29, 2020 (the "Credit Agreement"). Excess

Cash Flow is defined under the Credit Agreement as any cash greater

than $20,000,000 on the balance sheet in accordance with U.S. GAAP

at the end of each fiscal quarter, beginning with the quarter

ending June 28, 2020.

(6) TNI refers to

TNI Partners publishing operations in Tucson, AZ. MNI refers to

Madison Newspapers, Inc. publishing operations in Madison, WI.

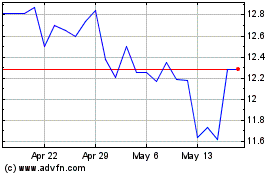

Lee Enterprises (NASDAQ:LEE)

Historical Stock Chart

From Jan 2025 to Feb 2025

Lee Enterprises (NASDAQ:LEE)

Historical Stock Chart

From Feb 2024 to Feb 2025