Kaiser Aluminum Corporation (NASDAQ: KALU) (the "Company" or

"Kaiser"), a leading producer of semi-fabricated specialty aluminum

products serving customers worldwide with highly-engineered

solutions for aerospace and high-strength, packaging, general

engineering, automotive extrusions, and other industrial

applications, today announced third quarter 2024 results.

Management Commentary

"We continued to make strong progress on our strategic

initiatives in the third quarter and delivered stable financial

performance despite mixed market conditions," said Keith A. Harvey,

President and Chief Executive Officer. "Specifically, we continue

to execute on our margin expansion plan, which we expect will lead

to improved financial performance. Importantly, the

performance enhancements at our Warrick packaging facility,

including the associated capital expenditures, will be complete by

the end of this year, providing a clear path to sustained margin

improvement. Across the rest of our business, we are

well-positioned with industry-leading products, serving a strong

base of customers across diversified end markets. We are optimistic

about the coming year and our ability to continue to advance our

strategic plan by making further operational and efficiency

improvements, maintaining our disciplined approach to investing

capital to meet the needs of our customers, and ultimately

delivering profitable growth to our shareholders.”

|

Third Quarter 2024 Consolidated Results |

|

(Unaudited)* |

(In millions of dollars, except shipments,

realized price and per share amounts)

|

|

|

Quarter EndedSeptember 30, |

|

|

Nine Months EndedSeptember

30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Shipments (millions of lbs.) |

|

|

292 |

|

|

|

299 |

|

|

|

880 |

|

|

|

913 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

748 |

|

|

$ |

744 |

|

|

$ |

2,259 |

|

|

$ |

2,365 |

|

| Less: Hedged cost of alloyed

metal1 |

|

|

(386 |

) |

|

|

(387 |

) |

|

|

(1,161 |

) |

|

|

(1,260 |

) |

| Conversion revenue |

|

$ |

362 |

|

|

$ |

357 |

|

|

$ |

1,098 |

|

|

$ |

1,105 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Realized price per pound

($/lb.) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

2.56 |

|

|

$ |

2.48 |

|

|

$ |

2.57 |

|

|

$ |

2.59 |

|

| Less: Hedged cost of alloyed

metal |

|

|

(1.32 |

) |

|

|

(1.29 |

) |

|

|

(1.32 |

) |

|

|

(1.38 |

) |

| Conversion revenue |

|

$ |

1.24 |

|

|

$ |

1.19 |

|

|

$ |

1.25 |

|

|

$ |

1.21 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| As reported |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

$ |

17 |

|

|

$ |

19 |

|

|

$ |

66 |

|

|

$ |

74 |

|

| Net income |

|

$ |

12 |

|

|

$ |

5 |

|

|

$ |

40 |

|

|

$ |

40 |

|

|

Net income per share, diluted2 |

|

$ |

0.74 |

|

|

$ |

0.34 |

|

|

$ |

2.44 |

|

|

$ |

2.46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted3 |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

$ |

21 |

|

|

$ |

20 |

|

|

$ |

80 |

|

|

$ |

78 |

|

|

EBITDA4 |

|

$ |

50 |

|

|

$ |

48 |

|

|

$ |

166 |

|

|

$ |

158 |

|

|

EBITDA margin5 |

|

|

13.9 |

% |

|

|

13.3 |

% |

|

|

15.1 |

% |

|

|

14.3 |

% |

| Net income |

|

$ |

8 |

|

|

$ |

7 |

|

|

$ |

36 |

|

|

$ |

35 |

|

|

EPS, diluted2 |

|

$ |

0.51 |

|

|

$ |

0.46 |

|

|

$ |

2.18 |

|

|

$ |

2.14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Hedged cost of alloyed metal for the quarters ended

September 30, 2024 and September 30, 2023 included $383.6

million and $380.0 million, respectively, reflecting the cost of

aluminum at the average Midwest Transaction Price and the cost of

alloys used in the production process, as well as metal price

exposure on shipments that the Company hedged with realized losses

upon settlement of $2.1 million and $6.5 million in the quarters

ended September 30, 2024 and September 30, 2023,

respectively, all of which were included within both Net sales and

Cost of products sold, excluding depreciation and amortization in

the Company’s Statements of Consolidated Income. Hedged cost of

alloyed metal for the nine months ended September 30, 2024 and

September 30, 2023 included $1,158.6 million and $1,245.6

million, respectively, reflecting the cost of aluminum at the

average Midwest Transaction Price and the cost of alloys used in

the production process, as well as metal price exposure on

shipments that the Company hedged with realized losses upon

settlement of $2.2 million and $14.8 million in the nine months

ended September 30, 2024 and September 30, 2023,

respectively, all of which were included within both Net sales and

Cost of products sold, excluding depreciation and amortization in

the Company’s Statements of Consolidated Income.

- Diluted shares for EPS are calculated

using the two-class method for the quarter and nine months ended

September 30, 2024 and the treasury stock method for the

quarter and nine months ended September 30, 2023.

- Adjusted numbers exclude non-run-rate

items. For all Adjusted numbers and EBITDA refer to Reconciliation

of Non-GAAP Measures.

- Adjusted EBITDA = Consolidated

operating income, excluding operating non-run-rate items, plus

Depreciation and amortization.

- Adjusted EBITDA margin = Adjusted

EBITDA as a percent of Conversion Revenue.

* Please refer to GAAP financial statements.

Totals may not sum due to

rounding.

Third Quarter 2024 Financial Highlights

Net sales for the third quarter 2024 increased to $748 million

compared to $744 million in the prior year period, driven primarily

by improved pricing.

Conversion revenue for the third quarter 2024 was $362 million,

reflecting a 1% increase compared to the prior year period.

- Net sales for aerospace/high strength applications were $213

million, and conversion revenue was $128 million, a 5% decrease

driven primarily by a 7% decrease in shipments over the prior year

quarter, reflecting the broader supply chain challenges in the

market.

- Net sales for packaging applications were $320 million, and

conversion revenue was $128 million, reflecting a 9% increase over

the prior year quarter due mainly to improved product mix and

pricing, partially offset by a 2% decrease in shipments as the

Company continued to stabilize production levels following the

second quarter outage and destocking period earlier in the year.

Underlying demand continued to strengthen during the quarter.

- Net sales for general engineering applications were $151

million, and conversion revenue was $76 million, reflecting a

modest year-over-year increase on a 5% increase in shipments as

pricing remained relatively stable despite uneven demand and import

pressures.

- Net sales for automotive extrusions were $62 million, and

conversion revenue was $29 million, reflecting a 3% increase driven

by improved pricing and product mix.

Reported net income for the third quarter 2024 was $12 million,

or $0.74 income per diluted share, compared to net income and

income per diluted share of $5 million and $0.34, respectively, in

the prior year period. Excluding the impact of a pre-tax,

non-run-rate charge of $4 million and a non-operating, non-run-rate

gain of $9 million, adjusted net income was $8 million for the

third quarter 2024, compared to adjusted net income of $7 million

in the prior year period. Adjusted net income per diluted share was

$0.51 for the third quarter 2024, compared to adjusted net income

per diluted share of $0.46 for the third quarter 2023.

Adjusted EBITDA of $50 million in the third quarter 2024

increased $2 million compared to the prior year period. Adjusted

EBITDA as a percentage of conversion revenue was 13.9% in the third

quarter 2024 compared to 13.3% in the prior year period. The

increase in adjusted EBITDA and margin for the third quarter 2024

was driven primarily by an increase in conversion revenue,

partially offset by an increase in energy costs and a higher GAAP

LIFO charge.

Cash Flow and Liquidity

Adjusted EBITDA of $166 million reported in the first nine

months of 2024 and cash on hand funded $47 million of working

capital, $125 million of capital investments, $31 million of

interest payments and $38 million of cash returned to stockholders

through quarterly dividends.

As of September 30, 2024, the Company had cash and cash

equivalents of $46 million and borrowing availability under the

Company's revolving credit facility of $549 million, providing

total liquidity of $595 million. There were no outstanding

borrowings under the revolving credit facility as of September 30,

2024.

On October 15, 2024, the Company announced the declaration of a

quarterly cash dividend of $0.77 per share, which will be paid on

November 15, 2024 to stockholders of record as of the close of

business on October 25, 2024.

2024 Outlook

The Company expects demand to be consistent with its previous

expectations for the balance of 2024. In aerospace/high strength

applications, the Company remains cautious on its near-term outlook

due to the timing of certain customer commercial and labor

negotiations which may have a short-term impact on demand and

shipments. In the packaging end market, industry momentum and

performance improvements at the Company’s Warrick facility are

expected to continue as it nears the completion of its fourth

coating line investment, which will drive margin improvement

starting in 2025. In general engineering, destocking within the

Company’s long products has concluded with shipment levels now in

better alignment with end market demand. In automotive extrusions,

the Company is maintaining a positive outlook as production for

light and heavy truck and sport utility vehicle platforms has

outpaced broader automotive production rates.

Accordingly, for the full year 2024, the Company continues to

expect overall conversion revenue to remain stable with growth up

to 1% compared to 2023. Adjusted EBITDA margin, less the full year

impact from GAAP LIFO charges, is expected to improve 50 to 100

basis points compared to 2023, as it continues to implement cost

reduction measures in its operations, increase manufacturing

efficiencies and execute its strategic growth initiatives.

Conference Call

Kaiser Aluminum Corporation will host a conference call on

Thursday, October 24, 2024, at 10:00 am (Eastern Time); 9:00 am

(Central Time); 7:00 am (Pacific Time), to discuss its third

quarter 2024 results. To participate, the conference call can be

directly accessed from the U.S. and Canada at (877) 423-9813 and

accessed internationally at (201) 689-8573. The conference call ID

number is 13747332. A link to the simultaneous webcast can be

accessed on the Company’s website at

https://investors.kaiseraluminum.com. A copy of a presentation will

be available for download prior to the call and an audio archive

will be available on the Company’s website following the call.

Company Description

Kaiser Aluminum Corporation, headquartered in Franklin, Tenn.,

is a leading producer of semi-fabricated specialty aluminum

products, serving customers worldwide with highly-engineered

solutions for aerospace and high-strength, packaging, general

engineering, automotive extrusions, and other industrial

applications. The Company’s North American facilities produce

value-added plate, sheet, coil, extrusions, rod, bar, tube, and

wire products, adhering to traditions of quality, innovation, and

service that have been key components of the culture since the

Company was founded in 1946. The Company’s stock is included in the

Russell 2000® index and the S&P Small Cap 600® index.

Available Information

For more information, please visit the Company’s website at

www.kaiseraluminum.com. The website includes a section for investor

relations under which the Company provides notifications of news or

announcements regarding its financial performance, including

Securities and Exchange Commission (SEC) filings, investor events,

and earnings and other press releases. In addition, all Company

filings submitted to the SEC are available through a link to the

section of the SEC’s website at www.sec.gov, which includes: Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current

Reports on Form 8-K and Proxy Statements for the Company’s annual

stockholders’ meetings, and other information statements as filed

with the SEC. In addition, the Company provides a webcast of its

quarterly earnings calls and certain events in which management

participates or hosts with members of the investment community.

Non-GAAP Financial Measures

This earnings release contains certain non-GAAP financial

measures. A “non-GAAP financial measure” is defined as a numerical

measure of a company’s financial performance that excludes or

includes amounts so as to be different than the most directly

comparable measure calculated and presented in accordance with GAAP

in the statements of income, balance sheets, or statements of cash

flow of the Company. Pursuant to the requirements of Regulation G,

the Company has provided a reconciliation of non-GAAP financial

measures to the most directly comparable financial measure in the

accompanying tables.

The non-GAAP financial measures used within this earnings

release are conversion revenue, adjusted operating income, adjusted

EBITDA, adjusted net income, and adjusted earnings per diluted

share which exclude non-run-rate items and ratios related thereto.

As more fully described in these reports, “non-run-rate” items are

items that, while they may occur from period to period, are

particularly material to results, impact costs primarily as a

result of external market factors and may not occur in future

periods if the same level of underlying performance were to occur.

These measures are presented because management uses this

information to monitor and evaluate financial results and trends

and believes this information to also be useful for investors.

Reconciliations of certain forward looking non-GAAP financial

measures to comparable GAAP measures are not provided because

certain items required for such reconciliations are outside of the

Company's control and/or cannot be reasonably predicted or provided

without unreasonable effort.

Forward-Looking Statements

This press release contains statements based on management’s

current expectations, estimates and projections that constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995 involving known and

unknown risks and uncertainties that may cause actual results,

performance or achievements of the Company to be materially

different from those expressed or implied. These factors include:

(a) the effectiveness of management's strategies and decisions,

including strategic investments, capital spending strategies, cost

reduction initiatives, sourcing strategies, process and

countermeasures implemented to address operational and supply chain

challenges, and the execution of those strategies; (b) the

execution and timing of strategic investments; (c) general economic

and business conditions, including the impact of geopolitical

factors and governmental and other actions taken in response,

cyclicality, reshoring, labor challenges, supply interruptions,

customer operation disruptions, customer inventory imbalances and

supply chain issues and other conditions that impact demand drivers

in the aerospace/high strength, packaging, general engineering,

automotive extrusions and other end markets we serve; (d) the

Company’s ability to participate in mature and anticipated new

automotive programs expected to launch in the future and

successfully launch new automotive programs; (e) changes or shifts

in defense spending due to competing national priorities; (f)

pricing, market conditions and the Company’s ability to effectively

execute its commercial and labor strategies, pass through cost

increases, including the institution of surcharges, and flex costs

in response to inflation, volatile commodity costs and changing

economic conditions; (g) developments in technology; (h) the impact

of the Company's future earnings, cash flows, financial condition,

capital requirements and other factors on its financial strength

and flexibility; (i) new or modified statutory or regulatory

requirements; (j) the successful integration of the acquired

operations and technologies; (k) stakeholder, including regulator

and customer, views regarding the Company's sustainability goals

and initiatives and the impact of factors outside of the Company's

control on such goals and initiatives; and (l) other risk factors

summarized in the Company's reports filed with the Securities and

Exchange Commission including the Company's Form 10-K for the year

ended December 31, 2023. All information in this release is as of

the date of the release. The Company undertakes no duty to update

any forward-looking statement to conform the statement to actual

results or changes in the Company’s expectations.

| Investor Relations and

Public Relations Contact: |

|

| Addo Investor Relations |

|

|

Investors@KaiserAluminum.com |

|

| (949) 614-1769 |

|

|

|

|

Kaiser Aluminum Corporation and Subsidiary

Companies |

|

Statements of Consolidated Income

(Unaudited)1 |

|

(In millions of dollars, except share and per share amounts) |

|

|

|

|

|

Quarter EndedSeptember 30, |

|

|

Nine Months EndedSeptember

30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net sales |

|

$ |

747.7 |

|

|

$ |

743.6 |

|

|

$ |

2,258.6 |

|

|

$ |

2,365.3 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of products sold, excluding depreciation and amortization |

|

|

671.8 |

|

|

|

665.2 |

|

|

|

2,005.2 |

|

|

|

2,114.7 |

|

|

Depreciation and amortization |

|

|

29.0 |

|

|

|

27.2 |

|

|

|

86.8 |

|

|

|

79.9 |

|

|

Selling, general, administrative, research and development |

|

|

28.8 |

|

|

|

30.5 |

|

|

|

93.0 |

|

|

|

92.4 |

|

|

Restructuring costs |

|

|

0.7 |

|

|

|

1.6 |

|

|

|

7.6 |

|

|

|

4.2 |

|

|

Other operating charges, net |

|

|

— |

|

|

|

— |

|

|

|

0.4 |

|

|

|

— |

|

|

Total costs and expenses |

|

|

730.3 |

|

|

|

724.5 |

|

|

|

2,193.0 |

|

|

|

2,291.2 |

|

| Operating income |

|

|

17.4 |

|

|

|

19.1 |

|

|

|

65.6 |

|

|

|

74.1 |

|

| Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(10.7 |

) |

|

|

(11.4 |

) |

|

|

(33.3 |

) |

|

|

(35.4 |

) |

|

Other income (expense), net |

|

|

8.7 |

|

|

|

(2.2 |

) |

|

|

19.1 |

|

|

|

8.9 |

|

| Income before income

taxes |

|

|

15.4 |

|

|

|

5.5 |

|

|

|

51.4 |

|

|

|

47.6 |

|

| Income tax provision |

|

|

(3.4 |

) |

|

|

(0.1 |

) |

|

|

(11.7 |

) |

|

|

(8.0 |

) |

| Net income |

|

$ |

12.0 |

|

|

$ |

5.4 |

|

|

$ |

39.7 |

|

|

$ |

39.6 |

|

| Net income per common

share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.75 |

|

|

$ |

0.34 |

|

|

$ |

2.47 |

|

|

$ |

2.48 |

|

|

Diluted2 |

|

$ |

0.74 |

|

|

$ |

0.34 |

|

|

$ |

2.44 |

|

|

$ |

2.46 |

|

| Weighted-average number of

common shares outstanding (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

16,087 |

|

|

|

15,995 |

|

|

|

16,062 |

|

|

|

15,970 |

|

|

Diluted2 |

|

|

16,335 |

|

|

|

16,154 |

|

|

|

16,291 |

|

|

|

16,110 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Please refer to the Company's Form 10-Q for the quarter ended

September 30, 2024 for detail regarding the items in the

table.

- Diluted shares for EPS are calculated using the two-class

method for the quarter and nine months ended September 30, 2024 and

the treasury stock method for the quarter and nine months ended

September 30, 2023.

|

|

|

Summary of Cash Flows - Consolidated |

|

(Unaudited)1 |

|

(In millions of dollars) |

|

|

|

|

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

| Total cash provided by (used

in): |

|

|

|

|

|

|

|

Operating activities |

|

$ |

123.7 |

|

|

$ |

137.6 |

|

|

Investing activities |

|

$ |

(118.6 |

) |

|

$ |

(105.0 |

) |

|

Financing activities |

|

$ |

(41.8 |

) |

|

$ |

(41.2 |

) |

|

|

|

|

|

|

|

|

|

|

- Please refer to the Company's Form 10-Q for the quarter ended

September 30, 2024 for detail regarding the items in the

table.

|

|

|

Kaiser Aluminum Corporation and Subsidiary

Companies |

|

Consolidated Balance Sheets

(Unaudited)1 |

|

(In millions of dollars, except share and per share amounts) |

|

|

|

|

|

As of September 30, 2024 |

|

|

As of December 31, 2023 |

|

|

ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

45.7 |

|

|

$ |

82.4 |

|

|

Receivables: |

|

|

|

|

|

|

|

Trade receivables, net |

|

|

370.2 |

|

|

|

325.2 |

|

|

Other |

|

|

0.9 |

|

|

|

12.4 |

|

|

Contract assets |

|

|

62.0 |

|

|

|

58.5 |

|

|

Inventories |

|

|

473.9 |

|

|

|

477.2 |

|

|

Prepaid expenses and other current assets |

|

|

42.2 |

|

|

|

34.5 |

|

|

Total current assets |

|

|

994.9 |

|

|

|

990.2 |

|

| Property, plant and equipment,

net |

|

|

1,100.4 |

|

|

|

1,052.1 |

|

| Operating lease assets |

|

|

27.6 |

|

|

|

32.6 |

|

| Deferred tax assets, net |

|

|

6.3 |

|

|

|

6.0 |

|

| Intangible assets, net |

|

|

46.6 |

|

|

|

50.0 |

|

| Goodwill |

|

|

18.8 |

|

|

|

18.8 |

|

| Other assets |

|

|

116.8 |

|

|

|

117.7 |

|

|

Total assets |

|

$ |

2,311.4 |

|

|

$ |

2,267.4 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

275.4 |

|

|

$ |

252.7 |

|

|

Accrued salaries, wages and related expenses |

|

|

51.9 |

|

|

|

53.0 |

|

|

Other accrued liabilities |

|

|

54.9 |

|

|

|

64.3 |

|

| Total current liabilities |

|

|

382.2 |

|

|

|

370.0 |

|

| Long-term portion of operating

lease liabilities |

|

|

25.2 |

|

|

|

29.2 |

|

| Pension and other

postretirement benefits |

|

|

77.6 |

|

|

|

76.8 |

|

| Net liabilities of Salaried

VEBA |

|

|

3.7 |

|

|

|

3.8 |

|

| Deferred tax liabilities |

|

|

23.7 |

|

|

|

13.9 |

|

| Long-term liabilities |

|

|

90.8 |

|

|

|

81.7 |

|

| Long-term debt, net |

|

|

1,041.2 |

|

|

|

1,039.8 |

|

| Total liabilities |

|

|

1,644.4 |

|

|

|

1,615.2 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

|

Preferred stock, 5,000,000 shares authorized at both September 30,

2024 and December 31, 2023; no shares were issued and

outstanding at September 30, 2024 and December 31, 2023 |

|

|

— |

|

|

|

— |

|

|

Common stock, par value $0.01, 90,000,000 shares authorized at both

September 30, 2024 and December 31, 2023; 22,923,041 shares

issued and 16,087,755 shares outstanding at September

30, 2024; 22,851,077 shares issued and 16,015,791 shares

outstanding at December 31, 2023 |

|

|

0.2 |

|

|

|

0.2 |

|

|

Additional paid in capital |

|

|

1,114.6 |

|

|

|

1,104.7 |

|

|

Retained earnings |

|

|

11.8 |

|

|

|

10.1 |

|

|

Treasury stock, at cost, 6,835,286 shares at both September 30,

2024 and December 31, 2023 |

|

|

(475.9 |

) |

|

|

(475.9 |

) |

|

Accumulated other comprehensive income |

|

|

16.3 |

|

|

|

13.1 |

|

| Total stockholders'

equity |

|

|

667.0 |

|

|

|

652.2 |

|

|

Total liabilities and stockholders' equity |

|

$ |

2,311.4 |

|

|

$ |

2,267.4 |

|

| |

|

|

|

|

|

|

|

|

- Please refer to the Company's Form 10-Q for the quarter ended

September 30, 2024 for detail regarding the items in the

table.

|

|

|

Reconciliation of Non-GAAP Measures -

Consolidated |

|

(Unaudited) |

|

(In millions of dollars, except per share amounts) |

|

|

| |

Quarter EndedSeptember 30, |

|

|

Nine Months EndedSeptember

30, |

|

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

GAAP net income |

$ |

12.0 |

|

|

$ |

5.4 |

|

|

$ |

39.7 |

|

|

$ |

39.6 |

|

|

Interest expense |

|

10.7 |

|

|

|

11.4 |

|

|

$ |

33.3 |

|

|

|

35.4 |

|

|

Other (income) expense, net |

|

(8.7 |

) |

|

|

2.2 |

|

|

$ |

(19.1 |

) |

|

|

(8.9 |

) |

|

Income tax provision |

|

3.4 |

|

|

|

0.1 |

|

|

$ |

11.7 |

|

|

|

8.0 |

|

| GAAP operating income |

|

17.4 |

|

|

|

19.1 |

|

|

|

65.6 |

|

|

|

74.1 |

|

|

Mark-to-market (gain) loss1 |

|

— |

|

|

|

(0.3 |

) |

|

|

2.2 |

|

|

|

(0.2 |

) |

|

Restructuring costs |

|

0.7 |

|

|

|

1.6 |

|

|

|

7.6 |

|

|

|

4.2 |

|

|

Non-cash asset impairment charge |

|

— |

|

|

|

— |

|

|

|

0.4 |

|

|

|

— |

|

|

Other operating NRR loss2,3 |

|

3.3 |

|

|

|

— |

|

|

|

3.7 |

|

|

|

— |

|

| Operating income, excluding

operating NRR items |

|

21.4 |

|

|

|

20.4 |

|

|

|

79.5 |

|

|

|

78.1 |

|

|

Depreciation and amortization |

|

29.0 |

|

|

|

27.2 |

|

|

|

86.8 |

|

|

|

79.9 |

|

| Adjusted EBITDA4 |

$ |

50.4 |

|

|

$ |

47.6 |

|

|

$ |

166.3 |

|

|

$ |

158.0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| GAAP net income |

$ |

12.0 |

|

|

$ |

5.4 |

|

|

$ |

39.7 |

|

|

$ |

39.6 |

|

|

Operating NRR items |

|

4.0 |

|

|

|

1.3 |

|

|

$ |

13.9 |

|

|

|

4.0 |

|

|

Non-operating NRR items5 |

|

(8.6 |

) |

|

|

1.4 |

|

|

$ |

(19.1 |

) |

|

|

(10.3 |

) |

|

Tax impact of above NRR items |

|

1.0 |

|

|

|

(0.7 |

) |

|

$ |

1.1 |

|

|

|

1.2 |

|

| Adjusted net income |

$ |

8.4 |

|

|

$ |

7.4 |

|

|

$ |

35.6 |

|

|

$ |

34.5 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Net income per share,

diluted6 |

$ |

0.74 |

|

|

$ |

0.34 |

|

|

$ |

2.44 |

|

|

$ |

2.46 |

|

| Adjusted earnings per diluted

share6 |

$ |

0.51 |

|

|

$ |

0.46 |

|

|

$ |

2.18 |

|

|

$ |

2.14 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Mark-to-market (gain) loss on derivative instruments includes

the (gain) loss on non-designated commodity hedges. Adjusted EBITDA

reflects the impact realized upon settlement.

- NRR is an abbreviation for

non-run-rate; NRR items are pre-tax.

- Other operating NRR items primarily

represent the impact of adjustments to legacy environmental

accruals.

- Adjusted EBITDA = Consolidated

operating income, excluding operating NRR items, plus Depreciation

and amortization.

- Non-operating NRR items represent the

impact of non-cash net periodic benefit cost related to the

Salaried VEBA excluding service cost, gains recorded from the sale

of land, and gains recorded from business interruption insurance

recoveries.

- Diluted shares for EPS are calculated

using the two-class method for the quarter and nine months ended

September 30, 2024 and the treasury stock method for the quarter

and nine months ended September 30, 2023.

Totals may not sum due to rounding.

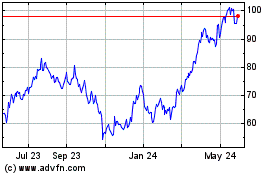

Kaiser Aluminum (NASDAQ:KALU)

Historical Stock Chart

From Nov 2024 to Dec 2024

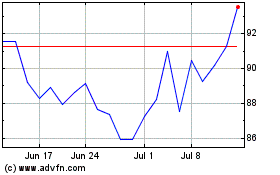

Kaiser Aluminum (NASDAQ:KALU)

Historical Stock Chart

From Dec 2023 to Dec 2024