UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary

Proxy Statement |

| ¨ | Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive

Proxy Statement |

| ¨ | Definitive

Additional Materials |

| x | Soliciting

Material Pursuant to §240.14a-12 |

ITERIS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check the appropriate

box):

| ¨ | Fee

paid previously with preliminary materials. |

| ¨ | Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and

0-11. |

Filed by Iteris, Inc.

Pursuant to Rule 14a-12 under the Securities

Exchange Act of 1934

Subject Company: Iteris, Inc.

Commission File No.: 001-08762

This filing relates to the proposed merger (the

“Merger”) of Iteris, Inc., a Delaware corporation (“Iteris”), Almaviva S.p.A, an Italian Societá

per azioni (“Parent”), and Pantheon Merger Sub Inc., a Delaware corporation and an indirect wholly-owned subsidiary

of Parent (“Merger Sub”), pursuant to the terms of that certain Agreement and Plan of Merger, dated as of August 8,

2024 (the “Merger Agreement”), by and among Iteris, Merger Sub, and Parent.

The following emails and communication were

sent by Iteris, on behalf of Joe Bergera, Chief Executive Officer of Iteris, to certain customers and business partners of Iteris on

August 9, 2024.

Customer Note

To: Top Iteris Customers

From: J. Bergera

Subject: Important News about Iteris

Dear Valued Customer,

I am excited to share some important news about Iteris. We have entered

into a definitive agreement to be acquired by Almaviva S.p.A., a global leader in digital innovation and transformation. A copy of the

press release can be found on our company website.

Almaviva is headquartered in Italy and has built an extensive global

network of innovative solutions and services across digital transformation, digital reputation management and people-centered technology.

Almaviva’s transportation and logistics business creates and manages mission-critical enterprise solutions that are trusted by

public and private rail, road and terminal hub operators around the world.

Looking ahead, we are excited about the opportunity to deepen our

relationship with customers like you. Almaviva shares our commitment to excellence in everything we do, from technology and products

to customer support, as well as our vision for the future of digital mobility.

As part of Almaviva’s global network, we will be in a much stronger

position to continue to innovate and expand our ClearMobility platform.

We expect the transaction to close in 2024. Until then, nothing about

the way we work with you will change. We will be sure to keep you updated of any important changes as we move closer to the close of

the transaction.

Thank you for your continued trust and support of Iteris. Please don’t

hesitate to reach out to your Iteris contact if you have any questions.

Sincerely,

Joe Bergera

Business Partner Note

To: Top Iteris Partners

From: J. Bergera

Subject: Important News about Iteris

Dear valued partner,

I wanted to reach out directly to share some important news about

Iteris. Today, we announced that we have entered into a definitive agreement to be acquired by Almaviva S.p.A., a global leader in digital

innovation and transformation headquartered in Italy. A copy of the press release can be found on our company website.

Almaviva has built an extensive global network of innovative solutions

and services across digital transformation, digital reputation management and people-centered technology. As part of Almaviva’s

global network, we will be strongly positioned to continue to innovate and expand the adoption of our AI-powered ClearMobility Platform

at greater scale, including building on our product suite and expanding our offerings to encompass other modes of transportation.

As we work towards a smooth integration of our businesses, we believe

our partners and all of our stakeholders will appreciate and value the commitment to innovation and the best-in-class service that Iteris

and Almaviva share. Above all, we are excited about the opportunities this transaction will create to deepen our partnership with you

in the future.

In terms of what to expect next, you should experience virtually no

changes in the way we serve and partner with you. Until the close of the transaction which we expect to occur in 2024, we will continue

to operate as independent companies. We will keep you updated of any important changes as we move toward the close of the transaction.

If you have any questions about today’s news, please reach out

to your regular Iteris contact.

Thank you for your continued partnership and support.

Sincerely,

Joe Bergera

Iteris President and CEO

* * *

About Iteris

Iteris, Inc. is a provider of smart mobility

infrastructure management solutions. Iteris’ cloud-enabled solutions help public transportation agencies, municipalities, commercial

entities and other transportation infrastructure providers monitor, visualize, and optimize mobility infrastructure to make mobility

safe, efficient, and sustainable. As a pioneer in intelligent transportation systems technology, Iteris’ advanced detection

sensors, mobility and traffic data, software-as-a-service offerings, and consulting services represent a comprehensive range of mobility

infrastructure management solutions that serve customers in the United States and internationally. For more information about Iteris,

please visit www.iteris.com.

Additional Information About the Merger

and Where to Find It

This communication is being made in respect of

the proposed merger involving Iteris, Inc. (“Iteris”), Pantheon Merger Sub Inc. (“Merger Subsidiary”),

and Almaviva S.p.A (“Parent”). Iteris expects to seek, and intends to file with the SEC a proxy statement and other

relevant documents in connection with a special meeting of the Iteris stockholders for purposes of obtaining, stockholder approval of

the proposed transaction. The definitive proxy statement will be sent or given to the stockholders of Iteris and will contain important

information about the proposed transaction and related matters. INVESTORS AND STOCKHOLDERS OF ITERIS ARE URGED TO READ THE DEFINITIVE

PROXY STATEMENT AND OTHER RELEVANT MATERIALS CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT ITERIS AND THE PROPOSED TRANSACTION. Investors may obtain a free copy of these materials (when they are available)

and other documents filed by Iteris with the SEC at the SEC’s website at www.sec.gov or from Iteris at its website at https://iterisinc.gcs-web.com/financial-information/sec-filings.

Participants in the Solicitation

Iteris and certain of its directors, executive

officers and other members of management and employees may be deemed to be participants in soliciting proxies from its stockholders in

connection with the proposed transaction. Information regarding the persons who may, under the rules of the SEC, be considered to

be participants in the solicitation of Iteris’ stockholders in connection with the proposed transaction will be set forth in Iteris’

definitive proxy statement for its stockholder meeting at which the proposed transaction will be submitted for approval by Iteris’

stockholders. You may also find additional information about Iteris’ directors and executive officers in Iteris’ Annual Report

on Form 10-K for the fiscal year ended March 31, 2024, which was filed with the SEC on June 13, 2024 and amended on July 29,

2024, Iteris’ Definitive Proxy Statement for its 2023 annual meeting of stockholders, which was filed with the SEC on July 28,

2023, as supplemented by its Definitive Additional Materials for its 2023 annual meeting of stockholders, which was filed with the SEC

on August 11, 2023, and in subsequently filed Current Reports on Form 8-K and Quarterly Reports on Form 10-Q.

Forward Looking Statements

This communication contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act

of 1934 and as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the context

of the statement and generally arise when Iteris, Inc. (“Iteris”) or its management is discussing its beliefs, estimates

or expectations. Such statements generally include words such as “believes,” “expects,” “intends,”

“anticipates,” “estimates,” “continues,” “may,” “plan,” “will,”

“goal,” or similar expressions. Forward-looking statements are prospective in nature and are not based on historical facts,

but rather on current expectations and projections of our management about future events and are therefore subject to risks and uncertainties,

many of which are outside Iteris’ control, which could cause actual results to differ materially from what is contained in such

forward-looking statements as a result of various factors, including, without limitation: (1) the inability to consummate the proposed

transaction within the anticipated time period, or at all, due to any reason, including the failure to obtain stockholder approval to

adopt the Agreement and Plan of Merger, the failure to obtain required regulatory approvals for the proposed transaction or the failure

to satisfy the other conditions to the consummation of the proposed transaction; (2) the risk that the Merger Agreement may be terminated

in circumstances requiring Iteris to pay a termination fee; (3) the risk that the proposed transaction disrupts Iteris’ current

plans and operations or diverts management’s attention from its ongoing business; (4) the effect of the announcement of the

proposed transaction on the ability of Iteris to retain and hire key personnel and maintain relationships with its customers, suppliers

and others with whom it does business; (5) the effect of the announcement of the proposed transaction on Iteris’ operating

results and business generally; (6) the significant costs, fees and expenses related to the proposed transaction; (7) the risk

that Iteris’ stock price may decline significantly if the proposed transaction is not consummated; (8) the nature, cost and

outcome of any litigation and other legal proceedings, including any such proceedings related to the proposed transaction and instituted

against Iteris and/or its directors, executive officers or other related persons; (9) other factors that could affect Iteris’

business such as, without limitation, inflationary cost pressure in labor, supply chain, energy, and other expenses, disruptions resulting

from deployment of systems, changing market conditions, competition and demand for services, the market acceptance of our products and

services, competition, the impact of any current or future litigation, the impact of recent accounting pronouncements, the impacts of

ongoing and new supply chain constraints, the status of our facilities and product development, reliance on key personnel, general economic

conditions, including rising interest rates, the impact of any current or future volatility or instability in national or international

political conditions, any shutdown of the United States federal government, future impacts of COVID-19 or other future pandemics, changes

in governmental regulation, personnel or budgetary constraints or policies and political agendas, the availability of project funding

or other project budget issues, and operational risks, including cybersecurity incidents, and (10) other risks to consummation of

the proposed Merger, including the risk that the proposed Merger will not be consummated within the expected time or at all.

If the proposed transaction is consummated, Iteris’

stockholders will cease to have any equity interest in Iteris and will have no right to participate in its earnings and future growth.

These and other factors are identified and described in more detail in Iteris’ Annual Report on Form 10-K for the year ended

March 31, 2024 as well as Iteris’ subsequent filings and is available online at www.sec.gov. Readers are cautioned not to

place undue reliance on Iteris’ projections and other forward-looking statements, which speak only as of the date thereof. Except

as required by applicable law, Iteris undertakes no obligation to update any forward-looking statement, or to make any other forward-looking

statements, whether as a result of new information, future events or otherwise.

* * *

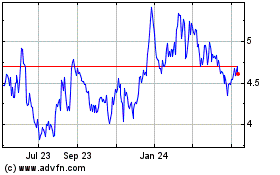

Iteris (NASDAQ:ITI)

Historical Stock Chart

From Nov 2024 to Dec 2024

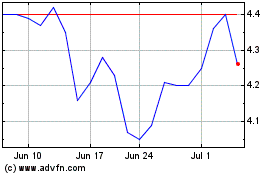

Iteris (NASDAQ:ITI)

Historical Stock Chart

From Dec 2023 to Dec 2024