false

0001446847

0001446847

2025-01-17

2025-01-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report Pursuant to

Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported):

January 17, 2025

IRONWOOD PHARMACEUTICALS, INC.

(Exact name of registrant as specified

in its charter)

| Delaware |

|

001-34620 |

|

04-3404176 |

| (State

or other jurisdiction |

|

(Commission

File Number) |

|

(I.R.S.

Employer |

| of incorporation) |

|

|

|

Identification Number) |

| 100 Summer Street, Suite 2300 |

|

|

|

|

| Boston, Massachusetts |

|

|

|

02110 |

| (Address of principal |

|

|

|

(Zip code) |

| executive offices) |

|

|

|

|

(617)

621-7722

(Registrant’s telephone number,

including area code)

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which

registered |

| Class A common stock, $0.001 par value |

IRWD |

Nasdaq Global Select Market |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

Item 2.05 Costs Associated

with Exit or Disposal Activities.

Following

an analysis of Ironwood Pharmaceuticals, Inc.’s (the “Company”) strategy and core business needs, and in an effort to

streamline focus and support the continued development of the Company’s pipeline, on January 17, 2025, the Board of Directors of

the Company approved a reduction in the Company’s workforce of approximately 50%, primarily consisting of field-based sales employees.

Affected employees were notified on January 29, 2025. This reduction in workforce is expected to be substantially completed by the end

of the first half of 2025, following which the Company expects to have approximately 120 full-time employees.

The

Company estimates that, in connection with this reduction in its workforce, it will incur aggregate charges of approximately $20.0 million

to approximately $25.0 million, primarily comprised of one-time employee severance and benefit costs. The charges related to the reduction

in workforce are expected to be substantially incurred in the first half of 2025. Of these charges, substantially all are expected to

result in cash expenditures. The Company may incur additional costs not currently contemplated due to events associated with or resulting

from the workforce reduction. The estimated charges that the Company expects to incur are subject to a number of assumptions, and actual

results may differ materially from these estimates.

Item 5.02 Departure of Directors

or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Also

on January 29, 2025, the Company announced the promotion of Gregory Martini, 36, to Senior Vice President, Chief Financial Officer. Mr.

Martini’s promotion was effective as of January 27, 2025. Mr. Martini will assume the responsibilities of the Company’s principal

financial officer from Thomas McCourt, who will remain the Company’s principal executive officer.

Mr.

Martini has been the Company’s Vice President, Strategic Finance & Investor Relations since March 2022. Mr. Martini joined the

Company in 2017 and previously served as Senior Director, Financial Planning & Analysis from 2020 to 2022 and as Director, Financial

Planning & Analysis from 2019 to 2020. Prior thereto, he served in various financial planning & analysis roles of increasing responsibility

enterprise-wide, supporting the commercial, research and development, and general and administrative functions. Before joining the Company,

Mr. Martini served in various financial and corporate development roles at Thermo Fisher Scientific, Ernst & Young and Raytheon. Mr.

Martini holds a B.S. in finance from Bentley University.

As

the Company’s Senior Vice President, Chief Financial Officer, Mr. Martini will receive a base salary of $485,000 a year and will

have an individual bonus target of 45% of his base salary, subject to achievement of individual and corporate goals. In addition, on January

27, 2025, Mr. Martini received a grant of 111,111 restricted stock units (“RSUs”) representing the right to receive shares

of the Company’s Class A common stock upon vesting of such awards granted under the Company’s 2019 Amended and Restated Equity

Incentive Plan. The RSUs will vest over four years as to 25% of the RSUs on each approximate anniversary of the date of grant.

In

addition, the Company will enter into an indemnification agreement and an executive severance agreement with Mr. Martini, the terms of

each are consistent with the forms of indemnification agreement and executive severance agreement described in the Company’s proxy

statement (the “Proxy Statement”) filed with the Securities and Exchange Commission (the “SEC”) on April 25, 2024

in connection with the Company’s 2024 annual meeting of stockholders, such descriptions being incorporated herein by reference and

qualified in their entirety by (i) with respect to the indemnification agreement, the full text of the form of indemnification agreement,

which was filed as Exhibit 10.12 to the Company’s Registration Statement on Form S-1 (as amended) filed with the SEC on December

23, 2009, and (ii) with respect to the executive severance agreement, the full text of the form of executive severance agreement, which

was filed as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on December 1, 2021.

There

is no arrangement or understanding between Mr. Martini and any other person pursuant to which Mr. Martini was appointed as the Company’s

Senior Vice President, Chief Financial Officer. There is no family relationship between Mr. Martini and any director, executive officer,

or person nominated or chosen by the Company to become a director or executive officer of the Company. Mr. Martini is not, and has not

been since January 1, 2024, a participant in any transaction involving the Company, and is not a participant in any proposed transaction

with the Company, required to be disclosed pursuant to Item 404(a) of Regulation S-K under the Securities Exchange Act of 1934, as amended.

This Current Report on Form 8-K contains forward-looking

statements. Investors are cautioned not to place undue reliance on these forward-looking statements, including statements about the Company’s

expectations regarding the timing and financial impact to be incurred in connection with the workforce reduction, as well as the timing

of completion of all impacts of the workforce reduction. Each forward-looking statement is subject to risks and uncertainties that could

cause actual results to differ materially from those expressed or implied in such statement. Applicable risks and uncertainties include

those related to the difficulty of predicting the financial impact or timing of the reduction, including the risk that the actual financial

could vary materially from the outcomes anticipated; and the risks listed under the heading “Risk Factors” and elsewhere in

the Company’s Annual Report on Form 10-K for the year ended December 31, 2024, and in subsequent SEC filings. These forward-looking

statements speak only as of the date of this Current Report on Form 8-K, and the Company undertakes no obligation to update these forward-looking

statements.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

Ironwood Pharmaceuticals, Inc. |

| Dated: January 29, 2025 |

By: |

/s/ Thomas McCourt |

| |

|

Name: Thomas McCourt |

| |

|

Title: Chief Executive Officer |

v3.24.4

Cover

|

Jan. 17, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 17, 2025

|

| Entity File Number |

001-34620

|

| Entity Registrant Name |

IRONWOOD PHARMACEUTICALS, INC.

|

| Entity Central Index Key |

0001446847

|

| Entity Tax Identification Number |

04-3404176

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

100 Summer Street

|

| Entity Address, Address Line Two |

Suite 2300

|

| Entity Address, City or Town |

Boston

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02110

|

| City Area Code |

617

|

| Local Phone Number |

621-7722

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, $0.001 par value

|

| Trading Symbol |

IRWD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

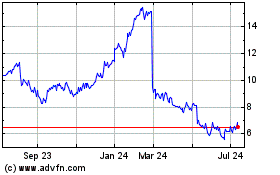

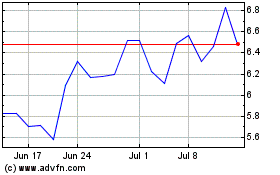

Ironwood Pharmaceuticals (NASDAQ:IRWD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Ironwood Pharmaceuticals (NASDAQ:IRWD)

Historical Stock Chart

From Mar 2024 to Mar 2025