Iridex Corporation (Nasdaq: IRIX), a provider of innovative

ophthalmic laser-based medical products for the treatment of

glaucoma and retinal diseases, today reported financial results for

the fourth quarter and year ended December 31, 2022 and issued 2023

financial guidance.

Fourth Quarter 2022 & Recent Highlights

- Generated total revenue of $15.2 million, essentially unchanged

from the prior year period

- Cyclo G6® product family revenue of $4.2 million, an increase

of 9% year-over-year

- 16,400 Cyclo G6 probes sold, a quarterly record and 8% increase

year-over-year

- 79 Cyclo G6 Glaucoma Laser Systems sold, compared to 90 in the

prior year period

- Retina product revenue decreased 11% year-over-year to $8.1

million

- Received FDA Clearance for the next-generation Iridex Pascal®

scanning laser platform in November 2022 and announces FDA

clearance of its new single-spot laser platform for the Iridex 532

and the Iridex 577 systems in February 2023

- Cash and cash equivalents totaled approximately $13.9 million

as of December 31, 2022

Full Year 2022 Highlights

- Generated total revenue of $57.0 million, an increase of 6%

compared to 2021

- Cyclo G6 product family revenue of $14.7 million, an increase

of 5% year-over-year

- Sold 59,800 Cyclo G6 probes, compared to 58,200 in the prior

year

- Expanded Cyclo G6 Glaucoma Laser Systems installed base by 237

compared to 243 in the prior year, bringing the total global

installed base to over 2,300 systems

- Retina product revenue increased 2% year-over-year to $31.7

million

“The highlight of our fourth quarter results were record Cyclo

G6 probe sales. We are pleased with our commercial and operational

execution in the second half of the year resulting in improvements

in gross margins and declining operating loss,” said David Bruce,

President and CEO of Iridex. “In 2022 we continued to reestablish

the foundation for customer adoption and market penetration with

our Cyclo G6 glaucoma treatment platform. The broadening use of

sweep management software combined with the establishment of the

updated dosing recommendations published by our clinical consensus

panel, have led users to report improved clinical outcomes and

consistency with MPTLT. When coupled with the launch of our new

Iridex Pascal platform in the U.S. to be followed by our new

single-spot platform just cleared by FDA, we are well-positioned to

build momentum in 2023.”

Fourth Quarter 2022 Financial ResultsRevenue

for the three months ended December 31, 2022 was $15.2 million

compared to $15.3 million during the same period of the prior year.

Total product revenue from the Cyclo G6 glaucoma product group was

$4.2 million, 9% higher than the fourth quarter of 2021 driven by

higher Cyclo G6 probe sales. Retina product revenue in the fourth

quarter was $8.1 million compared to $9.1 million in the prior

year, a decrease of 11%, primarily driven by weaker international

capital equipment sales due to strength in the U.S. dollar. Other

revenue, which includes royalties, services, and other legacy

products, increased 26% to $2.9 million in the fourth quarter of

2022 compared to the prior year, primarily driven by strength in

each category.

Gross profit for the fourth quarter of 2022 increased to $6.7

million, or a 43.9% gross margin, compared to $6.0 million, or a

39.3% gross margin, in the same period of the prior year. The

higher gross margin was the result of higher Cyclo G6 probe sales

and higher product mix of U.S. laser systems sales.

Operating expenses for the fourth quarter of 2022 decreased 4%

to $8.1 million compared to $8.4 million in the same period of the

prior year.

Net loss for the fourth quarter of 2022 was $1.1 million, or

$0.07 per share, compared to a net loss of $2.4 million, or $0.15

per share, in the same period of the prior year.

Full Year 2022 Financial ResultsRevenue for the

year ended December 31, 2022 increased 6% to $57.0 million from

$53.9 million in 2021. Total product revenue from the Cyclo G6

glaucoma product family was $14.7 million, 5% higher than fiscal

year 2021 driven by higher Cyclo G6 system and probe sales in the

US. Retina product revenue was $31.7 million compared to $31.1

million in the prior year, an increase of 2%, driven by strong

capital equipment sales in the U.S., that was partially offset by

lower international sales due to the strong U.S. dollar. Other

revenue increased 20% to $10.6 million in 2022 compared to the

prior year primarily driven by full year revenue recognition from

the sale of distribution rights and higher legacy probe sales.

Gross profit for the full year 2022 was $25.4 million on higher

revenue and favorable product mix, representing 44.5% gross margin,

compared to $22.8 million, or 42.4% gross margin, during the prior

year.

Operating expenses for 2022 increased 8% to $32.9 million

compared to $30.4 million in the prior year. This increase in

operating expenses is primarily a result of broader sales and

marketing investments plus additional R&D investments in the

PASCAL product line and other new product development

initiatives.

Net loss for 2022 increased to $7.5 million, or $0.47 per share,

compared to a net loss of $5.2 million, or $0.34 per share in the

prior year, which included PPP loan forgiveness of $2.5 million in

2021.

Cash and cash equivalents as of December 31, 2022 totaled $13.9

million. Cash reduction during the year was $10.0 million, which

includes approximately $3.5 million increase in inventories and

related pre-orders to mitigate potential supply-chain issues, which

are expected to substantially unwind throughout 2023.

Guidance for Full Year 2023Iridex projects

Cyclo G6 probe sales of 65,000 to 67,000 representing approximately

9% to 12% growth over 2022 and to expand the Cyclo G6 systems

installed base by 225 to 250 systems. Total revenue for the full

year is expected to be $57 million to $59 million. 2023

total revenue guidance represents growth of approximately 3% to 6%

after adjusting for an approximate $1.5 million reduction of Other

Revenue royalty income resulting from the expiration of licensed

patents.

Webcast and Conference Call InformationIridex’s

management team will host a conference call today beginning at 2:00

p.m. PT / 5:00 p.m. ET. Investors interested in listening to the

conference call may do so by accessing the live and recorded

webcast on the “Event Calendar” page of the “Investors” section of

the Company’s website at www.iridex.com.

About IridexIridex Corporation is a

worldwide leader in developing, manufacturing, and marketing

innovative and versatile laser-based medical systems, delivery

devices and consumable instrumentation for the ophthalmology

market. The Company’s proprietary MicroPulse® technology

delivers a differentiated treatment that provides safe, effective,

and proven treatment for targeted sight-threatening eye conditions.

Iridex’s current product line is used for the treatment of glaucoma

and diabetic macular edema (DME) and other retinal

diseases. Iridex products are sold in the United

States through a direct sales force and internationally

primarily through a network of independent distributors into more

than 100 countries. For further information, visit

the Iridex website at www.iridex.com.

Safe Harbor StatementThis announcement contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Act of 1934, as amended, including those statements

concerning clinical and commercial momentum, market adoption and

expansion, demand for and utilization of the Company's products,

financial guidance and results and expected sales volumes. These

statements are not guarantees of future performance and actual

results may differ materially from those described in these

forward-looking statements as a result of a number of factors.

Please see a detailed description of these and other risks

contained in our Quarterly Report on Form 10-Q filed with the

Securities and Exchange Commission on November 10, 2022 and our

Annual Report on Form 10-K to be filed with the Securities and

Exchange Commission for the fiscal year ended December 31, 2022.

Forward-looking statements contained in this announcement are made

as of this date and will not be updated.

Investor Relations ContactPhilip

TaylorGilmartin Groupinvestors@iridex.com

IRIDEX

CorporationCondensed Consolidated Statements of

Operations(In thousands, except per share

data)(unaudited)

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

|

|

|

December 31, |

|

|

January 1, |

|

|

December 31, |

|

|

January 1, |

|

| |

|

2022 |

|

|

2022 |

|

|

2022 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

15,195 |

|

|

$ |

15,254 |

|

|

$ |

56,972 |

|

|

$ |

53,903 |

|

| Cost of revenues |

|

|

8,531 |

|

|

|

9,252 |

|

|

|

31,604 |

|

|

|

31,072 |

|

|

Gross profit |

|

|

6,664 |

|

|

|

6,002 |

|

|

|

25,368 |

|

|

|

22,831 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

1,450 |

|

|

|

2,243 |

|

|

|

7,175 |

|

|

|

6,868 |

|

|

Sales and marketing |

|

|

4,826 |

|

|

|

4,095 |

|

|

|

18,178 |

|

|

|

14,637 |

|

|

General and administrative |

|

|

1,798 |

|

|

|

2,061 |

|

|

|

7,557 |

|

|

|

8,859 |

|

|

Total operating expenses |

|

|

8,074 |

|

|

|

8,399 |

|

|

|

32,910 |

|

|

|

30,364 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(1,410 |

) |

|

|

(2,397 |

) |

|

|

(7,542 |

) |

|

|

(7,533 |

) |

| Other income (expense),

net |

|

|

276 |

|

|

|

(30 |

) |

|

|

60 |

|

|

|

2,348 |

|

| Loss from operations before

provision for income taxes |

|

|

(1,134 |

) |

|

|

(2,427 |

) |

|

|

(7,482 |

) |

|

|

(5,185 |

) |

| Provision for income

taxes |

|

|

14 |

|

|

|

16 |

|

|

|

65 |

|

|

|

40 |

|

| Net loss |

|

$ |

(1,148 |

) |

|

$ |

(2,443 |

) |

|

$ |

(7,547 |

) |

|

$ |

(5,225 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.07 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.47 |

) |

|

$ |

(0.34 |

) |

|

Diluted |

|

$ |

(0.07 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.47 |

) |

|

$ |

(0.34 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares used

in computing net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

15,990 |

|

|

|

15,867 |

|

|

|

15,938 |

|

|

|

15,421 |

|

|

Diluted |

|

|

15,990 |

|

|

|

15,867 |

|

|

|

15,938 |

|

|

|

15,421 |

|

IRIDEX

CorporationCondensed Consolidated Balance

Sheets(In thousands and unaudited)

| |

|

December 31, |

|

|

January 1, |

|

| |

|

2022 |

|

|

2022 |

|

|

Assets |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

13,922 |

|

|

$ |

23,852 |

|

|

Accounts receivable, net |

|

|

9,768 |

|

|

|

9,716 |

|

|

Inventories |

|

|

10,608 |

|

|

|

7,614 |

|

|

Prepaid expenses and other current assets |

|

|

1,468 |

|

|

|

1,071 |

|

| Total current assets |

|

|

35,766 |

|

|

|

42,253 |

|

| Property and equipment,

net |

|

|

462 |

|

|

|

428 |

|

| Intangible assets, net |

|

|

1,977 |

|

|

|

2,205 |

|

| Goodwill |

|

|

965 |

|

|

|

965 |

|

| Operating lease right-of-use

assets, net |

|

|

1,665 |

|

|

|

2,565 |

|

| Other long-term assets |

|

|

1,455 |

|

|

|

271 |

|

| Total assets |

|

$ |

42,290 |

|

|

$ |

48,687 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

3,873 |

|

|

$ |

3,399 |

|

|

Accrued compensation |

|

|

2,448 |

|

|

|

3,192 |

|

|

Accrued expenses |

|

|

1,548 |

|

|

|

1,575 |

|

|

Other current liabilities |

|

|

968 |

|

|

|

1,098 |

|

|

Accrued warranty |

|

|

168 |

|

|

|

100 |

|

|

Deferred revenue |

|

|

2,411 |

|

|

|

2,355 |

|

|

Operating lease liabilities |

|

|

1,037 |

|

|

|

927 |

|

| Total current liabilities |

|

|

12,453 |

|

|

|

12,646 |

|

| |

|

|

|

|

|

|

|

|

| Long-term liabilities: |

|

|

|

|

|

|

|

|

|

Accrued warranty |

|

|

106 |

|

|

|

58 |

|

|

Deferred revenue |

|

|

11,742 |

|

|

|

10,930 |

|

|

Operating lease liabilities |

|

|

732 |

|

|

|

1,729 |

|

|

Other long-term liabilities |

|

|

26 |

|

|

|

25 |

|

| Total liabilities |

|

|

25,059 |

|

|

|

25,388 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

|

|

|

|

Common stock |

|

|

169 |

|

|

|

168 |

|

|

Additional paid-in capital |

|

|

86,802 |

|

|

|

85,255 |

|

|

Accumulated other comprehensive (loss) income |

|

|

(24 |

) |

|

|

45 |

|

|

Accumulated deficit |

|

|

(69,716 |

) |

|

|

(62,169 |

) |

|

Total stockholders' equity |

|

|

17,231 |

|

|

|

23,299 |

|

|

Total liabilities and stockholders' equity |

|

$ |

42,290 |

|

|

$ |

48,687 |

|

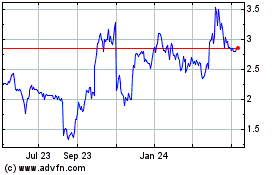

IRIDEX (NASDAQ:IRIX)

Historical Stock Chart

From Oct 2024 to Nov 2024

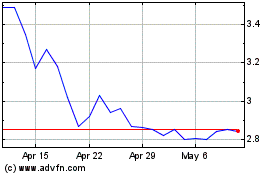

IRIDEX (NASDAQ:IRIX)

Historical Stock Chart

From Nov 2023 to Nov 2024