0001846235false00018462352024-01-312024-01-31iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

January 31, 2024

Date of Report (Date of earliest event reported)

International Media Acquisition Corp. |

(Exact Name of Registrant as Specified in its Charter) |

Delaware | | 001-40687 | | 86-1627460 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

1604 US Highway 130 North Brunswick, NJ | | 08902 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 960-3677

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock | | IMAQ | | The Nasdaq Stock Market LLC |

Warrants | | IMAQW | | The Nasdaq Stock Market LLC |

Rights | | IMAQR | | The Nasdaq Stock Market LLC |

Units | | IMAQU | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

First Amendment to the Securities Purchase Agreement

As previously disclosed in the Current Report on Form 8-K filed on November 16, 2023 by International Media Acquisition Corp., a Delaware corporation and a special purpose acquisition company (the “Company”), the Company entered into a Securities Purchase Agreement dated November 10, 2023 (the “Securities Purchase Agreement”) with JC Unify Capital (Holdings) Limited, a BVI company (the “Buyer”), Content Creation Media LLC, a Delaware limited liability company (“Sponsor”), and Shibasish Sarkar, (“Seller”, together with the Sponsor the “Sellers”), pursuant to which (i) the Sponsor agreed to sell, and the Buyer agreed to purchase, 4,125,000 shares of common stock and 597,675 private placement units of the Company, which represents 75% of the total company securities owned by the Sponsor for an aggregate purchase price of $1.00 (the “Closing Cash Purchase Price”), (ii) the closing of the transactions contemplated by the Securities Purchase Agreement (the “Closing”) shall take place as soon as practicable after signing of the Securities Purchase Agreement, on such time and date as may be mutually agreed by the Buyer and the Sellers, subject to satisfaction of the conditions set forth in the Securities Purchase Agreement.

On January 31, 2024, the Company entered into the First Amendment to the Securities Purchase Agreement (the “First Amendment”) with the Sponsor, Buyer and Sellers, that amended and modified the Securities Purchase Agreement pursuant to which, among other things, (i) the Sponsor agreed to sell, and the Buyer agreed to purchase, 4,125,000 shares of common stock and 657,675 private placement units of the Company, which represents 76% of the total company securities owned by the Sponsor (“Transferred Sponsor SPAC Securities”), (ii) the Sellers shall deliver the termination of indemnity agreements of Shibasish Sarkar and Vishwas Joshi, and resignations of all of the officer and directors of the SPAC, other than the officer and director(s) as mutually agreed, whose resignations shall be effective on the 10th day following the mailing to stockholders of a Schedule 14F or proxy statement pursuant to the rules of the SEC advising stockholders of a Change in Control of the Board of Directors (the “Schedule 14F Change in Control Date”) (iii) in connection with the issuance of a $1,300,000 promissory note by the Buyer to the Company, the SPAC shall issue (i) 100,000 new units and 847,675 shares of common stock from the Company at the closing of a business combination, (iv) out of the $300,000 fee due to Chardan Capital Markets LLC (the “Chardan”), $50,000 shall be rebated via wire transfer from the Chardan to the Sponsor at the Closing, (v) the Sellers and the Buyer agree and acknowledge that the Company shall purchase directors and officers’ insurance for the officers or directors of the Company that is serving or has served as an officer or director of the SPAC prior to the signing of the SPA (“Initial Officers and Directors”) with coverage of $1 million for an one (1) year, covering the period from July 26, 2023 to July 26, 2024, and (vi) the Company will use best efforts to include a provision in the definitive business combination agreement, stipulating that the potential target will refrain from initiating any legal action against Initial Officers and Directors of the Company, except in the event of fraud, negligence or bad faith prior to their resignations.

Issuance of Promissory Note

On January 31, 2024, the Company issued an unsecured promissory note in the aggregate principal amount of up to $1,300,000 (the “Note”) to the Buyer. Pursuant to the Note, the Buyer agreed to loan to the Company an aggregate amount of up to $1,300,000. The Note shall be payable promptly on demand and in any event, no later than the date on which the Company terminates or consummates an initial business combination. Such Note is convertible into units having the same terms and conditions as the private placement units as described in the prospectus dated April 7, 2021 (Registration NO. 333-255106) (the “Prospectus”), at the price of $10.00 per unit, at the option of the Buyer. The Note does not bear interest.

As additional consideration for the Buyer making the Note available to the Company, the Company shall issue to the Buyer (a) 100,000 new units at the closing of the Business Combination, which shall be identical in all respects to the private placement units issued at the Company’s initial public offering (the “New Units”), and (b) 847,675 shares of Common Stock of the Company (the “Additional Securities”) of which (i) 250,000 of the Additional Securities shall be subject to no transfer restrictions or any other lock-up provisions, earn outs or other contingencies, and shall be registered for resale pursuant to the first registration statement filed by the Company or the surviving entity in connection with the closing of the Business Combination, or if no such registration statement is filed in connection with the closing of the Business Combination, the first registration statement filed subsequent to the closing of the Business Combination, which will be filed no later than 30 days after the closing of the Business Combination and declared effective no later than 60 days after the closing of the Business Combination; and (ii) 657,675 of the Additional Securities shall be subject to the same terms and conditions applied to the insider shares described in the Prospectus. The Additional Securities and New Units shall be issued to the Buyer in conjunction with the closing of a Business Combination.

The proceeds of the Note will be used by the Company to pay various expenses of the Company, including any payment to extend the period of time the Company has to consummate an initial business combination, and for working capital purposes. The foregoing description of the Note is qualified in its entirety by reference to the full text of the Note, a copy of which is filed with this Current Report on Form 8-K as Exhibit 2.2 and is incorporated herein by reference.

The foregoing description of the First Amendment and the Note is not complete and is subject to and qualified in its entirety by reference to the full text of the First Amendment and the Note which are filed as Exhibit 2.1 and 2.2 hereto, and the terms of which are incorporated herein by reference.

Item 8.01. Other Events

On February 1, 2024, the Company made a deposit of $20,000 (the “Extension Payment”) to the trust account to extend the period of time the Company has to consummate an initial business combination from February 2, 2024 to March 2, 2024.

Item 9.01. Financial Statements and Exhibits

(c) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: February 6, 2024

INTERNATIONAL MEDIA ACQUISITION CORP. | |

| | | |

| By: | /s/ Shibasish Sarkar | |

Name: | Shibasish Sarkar | |

| Title: | Chief Executive Officer | |

nullnull

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

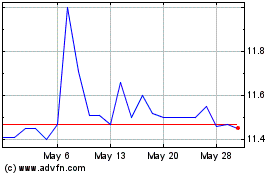

International Media Acqu... (NASDAQ:IMAQ)

Historical Stock Chart

From Oct 2024 to Nov 2024

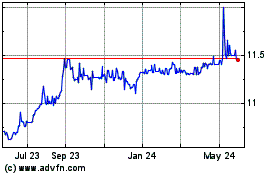

International Media Acqu... (NASDAQ:IMAQ)

Historical Stock Chart

From Nov 2023 to Nov 2024