Amended Statement of Beneficial Ownership (sc 13d/a)

December 16 2020 - 10:10AM

Edgar (US Regulatory)

|

|

UNITED STATES

|

|

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

|

Washington, D.C. 20549

|

|

|

|

|

|

|

|

SCHEDULE 13D

|

|

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

INSPIRED ENTERTAINMENT, INC.

(Name of Issuer)

Common Stock, Par Value $0.0001 Per Share

(Title of Class of Securities)

(CUSIP Number)

Luke L. Alvarez

c/o Spindle Limited

23 Portland House

Glacis Road

GX11 1AA

Gibraltar

+350 2000 1763

with a copy to:

David Rivera

CMS (Nominees) Limited

Cannon Place

78 Cannon Street

London EC4N 6AF

United Kingdom

+44 20 7524 6685

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. o

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. 45782N108

|

|

|

|

|

1.

|

Names of Reporting Persons

Luke L. Alvarez

|

|

|

|

|

2.

|

Check the Appropriate Box if a Member of a Group (See Instructions)

|

|

|

|

(a)

|

o

|

|

|

|

(b)

|

o

|

|

|

|

|

3.

|

SEC Use Only

|

|

|

|

|

4.

|

Source of Funds (See Instructions)

OO

|

|

|

|

|

5.

|

Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) o

|

|

|

|

|

6.

|

Citizenship or Place of Organization

United Kingdom

|

|

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With

|

7.

|

Sole Voting Power

928,363

|

|

|

|

8.

|

Shared Voting Power

0

|

|

|

|

9.

|

Sole Dispositive Power

928,363

|

|

|

|

10.

|

Shared Dispositive Power

0

|

|

|

|

|

11.

|

Aggregate Amount Beneficially Owned by Each Reporting Person

928,363

|

|

|

|

|

12.

|

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See Instructions) o

|

|

|

|

|

13.

|

Percent of Class Represented by Amount in Row (11)

4.0%

|

|

|

|

|

14.

|

Type of Reporting Person (See Instructions)

IN

|

|

|

|

|

|

|

|

2

|

Item 1.

|

Security and Issuer

|

|

|

|

|

|

This Amendment No. 1 (“Amendment”) amends the statement on Schedule 13D filed on December 21, 2017 (the “Original Schedule 13D” and as amended hereby, the “Schedule 13D”) with respect to the shares of common stock, par value $0.0001 per share (the “Common Stock”), of Inspired Entertainment, Inc., a corporation formed under the laws of Delaware (the “Issuer”), whose principal executive offices are located at 250 West 57th Street, Suite 415, New York, New York 10107. Except as set forth herein, this Amendment does not supplement, restate or amend any of the other information disclosed in the Original Schedule 13D. Items not supplemented or amended are omitted from this Amendment. Capitalized terms used and not defined in this Amendment have the meanings set forth in the Original Schedule 13D.

On March 25, 2019, the Reporting Person ceased to be the beneficial owner of five percent (5%) or more of the Common Stock as a result of the Issuer issuing shares of Common Stock to a third party. The filing of this Amendment represents the final amendment to the Original Schedule 13D and constitutes an “exit filing” for the Reporting Person.

|

|

|

|

|

Item 2.

|

Identity and Background

|

|

|

|

|

|

The description contained herein amends and restates in its entirety Item 2 in the Original Schedule 13D.

This statement is being filed by Luke L. Alvarez (the “Reporting Person”). The Reporting Person is a citizen of the United Kingdom and a resident of Gibraltar. The Reporting Person is the former chief executive officer and president, and a former director, of the Issuer who departed from the Issuer in May 2018.

The Reporting Person is currently employed as a consultant with an investment advisor, Spindle Limited. The principal office and business address of the Reporting Person is c/o Spindle Limited, 23 Portland House, Glacis Road, GX11 1AA, Gibraltar.

During the last five years, the Reporting Person: (i) has not been convicted in any criminal proceeding (excluding traffic violations or similar misdemeanors) and (ii) was not a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

|

|

|

|

|

Item 3.

|

Source and Amount of Funds or Other Consideration

|

|

|

|

|

|

The description contained herein amends and restates in its entirety Item 3 in the Original Schedule 13D.

The Reporting Person holds (i) 461,795 restricted shares of Common Stock which were granted to the Reporting Person pursuant to the Inspired Entertainment, Inc. 2016 Long-Term Incentive Plan, (ii) 315,848 vested shares which were granted to the Reporting Person pursuant to the Inspired Entertainment, Inc. 2016 Long-Term Incentive Plan; and (iii) 150,720 shares of Common Stock, which the Reporting Person subscribed for at a price of $10.00 per share.

|

|

|

|

|

Item 5.

|

Interest in Securities of the Issuer

|

|

|

|

|

|

The description contained herein amends and restates in its entirety Item 5 in the Original Schedule 13D.

|

|

|

|

|

|

The percentages used in this Item and in the rest of the Schedule 13D are calculated based upon an aggregate of 23,029,492 shares of Common Stock outstanding as of November 10, 2020, as reported in the Issuer’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2020, filed on November 12, 2020.

|

|

|

|

|

|

(a) As of the date of this Amendment, the Reporting Person beneficially owns 928,363 shares of Common Stock representing 4.0% of the Company’s issued and outstanding Common Stock.

|

|

|

|

|

|

(b) The number of shares of Common Stock as to which the Reporting Person has:

|

|

|

|

|

|

Sole power to vote or direct the vote

|

928,363

|

|

|

|

|

|

|

Shared power to vote or direct the vote

|

0

|

|

|

|

|

|

|

Sole power to dispose or direct the disposition

|

928,363

|

|

|

|

|

|

|

Shared power to dispose or direct the disposition

|

0

|

|

|

|

|

|

(c) There have been no transactions in the class of securities reported on that were effected within the past sixty days.

|

|

|

|

|

|

(d) Not applicable.

|

|

|

|

|

|

(e) On March 25, 2019, the Reporting Person ceased to be the beneficial owner of five percent (5%) or more of the Common Stock as a result of the Issuer issuing shares of Common Stock to a third party. The filing of this Amendment represents the final amendment to the Original Schedule 13D and constitutes an “exit filing” for the Reporting Person.

|

3

Signature

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

December 16, 2020

|

|

|

Date

|

|

|

|

|

|

/s/ Luke L. Alvarez

|

|

|

Signature

|

|

|

|

|

|

Luke L. Alvarez

|

|

|

Name/Title

|

|

|

ATTENTION

|

|

|

Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001).

|

4

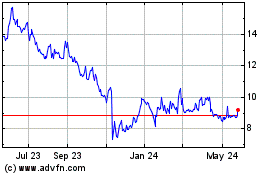

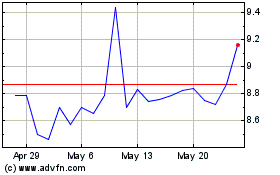

Inspired Entertainment (NASDAQ:INSE)

Historical Stock Chart

From Aug 2024 to Sep 2024

Inspired Entertainment (NASDAQ:INSE)

Historical Stock Chart

From Sep 2023 to Sep 2024