ImmuCell Corporation (Nasdaq: ICCC)

(“ImmuCell” or the “Company”), a growing animal health company that

develops, manufactures and markets scientifically proven and

practical products that improve the health and productivity of

dairy and beef cattle, today announced its unaudited financial

results for the quarter ended September 30, 2023.

Management’s Discussion:

“Our unaudited, preliminary product sales for the third quarter

of 2023 were first reported on October 5, 2023,” commented Michael

F. Brigham, President and CEO of ImmuCell. “We have no changes to

those figures.”

“The production slowdown that was necessary to remediate several

contamination events materially impacted performance metrics during

the first nine months of the year,” continued Mr. Brigham. “We

believe that the operational improvements and controls that we have

implemented throughout the production process (from farm to

finished goods) will enable us to run more effectively and at a

higher output level going forward.”

Finished goods produced increased steadily from approximately

$3.3 million to $4 million and further to $5.3 million during the

first, second and third quarters of 2023, respectively. The

Company’s goal is to be able to produce product with an estimated

sales value of approximately $6 million per quarter, which would

annualize to about 80% of its estimated full production capacity of

approximately $30 million.

“We are implementing and optimizing recent investments to

increase our production capacity and resume full production,” added

Mr. Brigham. “Third quarter production was approximately 89% of our

quarterly objective.”

“At the same time, we remain poised and excited to revolutionize

the way that subclinical mastitis is treated in today’s dairy

market with Re-Tain®, a novel alternative to

traditional antibiotics that is subject to FDA approval,” concluded

Mr. Brigham.

Certain Financial Results:

- Product sales increased by 13%, or $600,000, to $5.4 million

during the three-month period ended September 30, 2023 compared to

$4.8 million during the three-month period ended September 30,

2022.

- Product sales decreased by 16%, or $2.3 million, to $12.4

million during the nine-month period ended September 30, 2023

compared to $14.7 million during the nine-month period ended

September 30, 2022.

- Product sales decreased by 19%, or $3.8 million, to $16.3

million during the trailing twelve-month period ended September 30,

2023 compared to $20.1 million during the trailing twelve-month

period ended September 30, 2022.

- Gross margin earned was 23% and 38% of product sales during the

three-month periods ended September 30, 2023 and 2022,

respectively, and 21% and 45% of product sales during the

nine-month periods ended September 30, 2023 and 2022, respectively.

The less than normal gross margin during 2023 was largely the

result of product contamination events in the production processes

that resulted in a slowdown in output and write-offs of affected

inventory. Remediation measures have been implemented that are

anticipated to mitigate or significantly reduce the risk of future

contamination events.

- Net loss was $940,000, or $0.12 per basic share, during the

three-month period ended September 30, 2023 in comparison to net

loss of $655,000, or $0.08 per basic share, during the three-month

period ended September 30, 2022.

- Net loss was $4.6 million, or $0.60 per basic share, during the

nine-month period ended September 30, 2023 in comparison to net

loss of $826,000, or $0.11 per basic share, during the nine-month

period ended September 30, 2022.

- EBITDA (a non-GAAP financial measure described on page 5 of

this press release) decreased to approximately ($95,000) during the

three-month period ended September 30, 2023 from $71,000 during the

three-month period ended September 30, 2022 and to approximately

($2.3) million during the nine-month period ended September 30,

2023 from $1.3 million during the nine-month period ended September

30, 2022.

Balance Sheet Data as of September 30,

2023:

- Cash and cash equivalents decreased to just under $2 million as

of September 30, 2023 from $5.8 million as of December 31, 2022,

with no draw outstanding on the available $1 million line of credit

as of these dates.

- Net working capital decreased to approximately $8.6 million as

of September 30, 2023 from $10.9 million as of December 31,

2022.

- Stockholders’ equity decreased to $26 million as of September

30, 2023 from $30.4 million as of December 31, 2022.

Cautionary Note Regarding Forward-Looking Statements

(Safe Harbor

Statement):

This Press Release and the statements to be made in the related

earnings conference call referenced herein contain “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, as amended. Forward-looking statements can be

identified by the fact that they do not relate strictly to

historical or current facts and will often include words such as

“expects”, “may”, “anticipates”, “aims”, “intends”, “would”,

“could”, “should”, “will”, “plans”, “believes”, “estimates”,

“targets”, “projects”, “forecasts”, “seeks” and similar words and

expressions. Such statements include, but are not limited to, any

forward-looking statements relating to: our plans and strategies

for our business; projections of future financial or operational

performance; the timing and outcome of pending or anticipated

applications for regulatory approvals; future demand for our

products; the scope and timing of ongoing and future product

development work and commercialization of our products; dairy

producers’ level of interest in treating subclinical mastitis given

the current economic and market conditions; the expected efficacy

of new products; our ability to increase production output and

reduce costs of goods sold per unit; the adequacy of our own

manufacturing facilities or those of third parties with which we

have contractual relationships to meet demand for our products on a

timely basis; the effectiveness of our contamination remediation

efforts; the likelihood, severity or impact of future contamination

events; the robustness of our manufacturing processes and related

technical issues; estimates about our production capacity,

efficiency and yield; future regulatory requirements relating to

our products; future expense ratios and margins; the efficacy of

our investments in our business; anticipated changes in our

manufacturing capabilities and efficiencies; and any other

statements that are not historical facts. These statements are

intended to provide management's current expectation of future

events as of the date of this earnings release, are based on

management's estimates, projections, beliefs and assumptions as of

the date hereof; and are not guarantees of future performance. Such

statements involve known and unknown risks and uncertainties that

may cause the Company's actual results, financial or operational

performance or achievements to be materially different from those

expressed or implied by these forward-looking statements,

including, but not limited to, those risks and uncertainties

relating to: difficulties or delays in development, testing,

regulatory approval, production and marketing of our products

(including the First Defense®

product line and Re-Tain®),

competition within our anticipated product markets, customer

acceptance of our new and existing products, product performance,

alignment between our manufacturing resources and product demand

(including the consequences of backlogs), uncertainty associated

with the timing and volume of customer orders as we come out of a

prolonged backlog, adverse impacts of supply chain disruptions on

our operations and customer and supplier relationships, commercial

and operational risks relating to our current and planned expansion

of production capacity, and other risks and uncertainties detailed

from time to time in filings we make with the Securities and

Exchange Commission (SEC), including our Quarterly Reports on Form

10-Q, our Annual Reports on Form 10-K and our Current Reports on

Form 8-K. Such statements involve risks and uncertainties and are

based on our current expectations, but actual results may differ

materially due to various factors. In addition, there can be no

assurance that future risks, uncertainties or developments

affecting us will be those that we anticipate. We undertake no

obligation to update any forward-looking statement, whether written

or oral, that may be made from time to time, whether as a result of

new information, future developments or otherwise.

Condensed Statements of

Operations (Unaudited)

| |

During the Three-MonthPeriods Ended

September 30, |

|

During the Nine-MonthPeriods Ended

September 30, |

|

(In thousands, except per share amounts) |

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

|

|

Product sales |

$5,397 |

|

$4,796 |

|

$12,376 |

|

$14,657 |

| Costs of goods sold |

4,130 |

|

2,950 |

|

9,764 |

|

8,000 |

|

Gross margin |

1,267 |

|

1,846 |

|

2,612 |

|

6,657 |

| |

|

|

|

|

|

|

|

| Product development expenses |

1,118 |

|

1,270 |

|

3,328 |

|

3,444 |

| Sales, marketing and

administrative expenses |

1,333 |

|

1,193 |

|

4,028 |

|

3,878 |

|

Operating expenses |

2,451 |

|

2,463 |

|

7,356 |

|

7,322 |

| |

|

|

|

|

|

|

|

| NET OPERATING

LOSS |

(1,184) |

|

(617) |

|

(4,744) |

|

(665) |

| |

|

|

|

|

|

|

|

| Other (income) expenses, net |

(244) |

|

34 |

|

(113) |

|

155 |

| |

|

|

|

|

|

|

|

| LOSS BEFORE INCOME

TAXES |

(940) |

|

(651) |

|

(4,631) |

|

(820) |

| |

|

|

|

|

|

|

|

| Income tax expense |

- |

|

4 |

|

4 |

|

6 |

| |

|

|

|

|

|

|

|

| NET LOSS |

($940) |

|

($655) |

|

($4,635) |

|

($826) |

| |

|

|

|

|

|

|

|

|

Basic weighted average common shares outstanding |

7,747 |

|

7,747 |

|

7,747 |

|

7,745 |

|

Basic net loss per share |

($0.12) |

|

($0.08) |

|

($0.60) |

|

($0.11) |

|

|

|

|

|

|

|

|

|

|

Diluted weighted average common shares outstanding |

7,747 |

|

7,747 |

|

7,747 |

|

7,745 |

|

Diluted net loss per share |

($0.12) |

|

($0.08) |

|

($0.60) |

|

($0.11) |

| |

Selected Balance Sheet Data (In

thousands) (Unaudited)

|

|

As ofSeptember 30, 2023 |

As ofDecember 31, 2022 |

| Cash and cash equivalents |

$1,989 |

$5,792 |

| Net working capital |

8,634 |

10,923 |

| Total assets |

44,545 |

44,861 |

| Stockholders’ equity |

$26,013 |

$30,380 |

| |

|

|

Non-GAAP Financial Measures:Generally, a

non-GAAP financial measure is a numerical measure of a company’s

performance, financial position or cash flow that either excludes

or includes amounts that are not normally excluded or included in

the most directly comparable measure calculated and presented in

accordance with GAAP. The non-GAAP measures included in this press

release should be considered in addition to, and not as a

substitute for or superior to, the comparable measure prepared in

accordance with GAAP. We believe that considering the non-GAAP

measure of Earnings Before Interest, Taxes, Depreciation and

Amortization (EBITDA) assists management and investors by looking

at our performance across reporting periods on a consistent basis

excluding these certain charges that are not uses of cash from our

reported loss before income taxes. We calculate EBITDA as described

in the following table:

| |

During the Three-Month Periods Ended September

30, |

|

During the Nine-Month Periods Ended

September 30, |

|

(In thousands) |

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

|

|

|

|

|

|

|

| Loss before income taxes |

($940) |

|

($651) |

|

($4,631) |

|

($820) |

| Interest expense (excluding

debt issuance and debt discount costs) |

136 |

|

88 |

|

311 |

|

249 |

| Depreciation |

696 |

|

627 |

|

2,027 |

|

1,869 |

| Amortization |

13 |

|

7 |

|

27 |

|

20 |

| EBITDA |

($95) |

|

$71 |

|

($2,266) |

|

$1,318 |

| |

EBITDA included stock-based compensation expense of

approximately $96,000 and $85,000 during the three-month periods

ended September 30, 2023 and 2022, respectively, and $268,000 and

$201,000 during the nine-month periods ended September 30, 2023 and

2022, respectively, which is a non-cash expense that we add back to

EBITDA when assessing our cash flows.

Conference Call:The Company will host a

conference call on Tuesday, November 14, 2023 at 9:00 AM ET to

discuss the full unaudited financial results for the quarter ended

September 30, 2023. Interested parties can access the conference

call by dialing (844) 855-9502 (toll free) or (412) 317-5499

(international). A teleconference replay of the call will be

available until November 21, 2023 at (877) 344-7529 (toll free) or

(412) 317-0088 (international), utilizing replay access code

#5077962. Investors are encouraged to review the Company’s updated

Corporate Presentation slide deck that provides an overview of the

Company’s business and is available under the “Investors” tab of

the Company’s website at www.immucell.com, or by request to the

Company.

About ImmuCell:ImmuCell Corporation's

(Nasdaq: ICCC) purpose is to create scientifically

proven and practical products that improve the health and

productivity of dairy and beef cattle. ImmuCell manufactures

and markets First Defense®, providing

Immediate Immunity™ to newborn dairy and beef

calves, and is in the late stages of developing

Re-Tain®, a novel treatment for subclinical

mastitis in dairy cows with a no milk discard claim that provides

an alternative to traditional antibiotics. Press releases and other

information about the Company are available at:

http://www.immucell.com.

|

Contacts: |

Michael F. Brigham, President and CEO |

|

|

ImmuCell Corporation |

|

|

(207) 878-2770 |

|

|

|

|

|

Joe Diaz, Robert Blum and Joe Dorame |

|

|

Lytham Partners, LLC |

|

|

(602) 889-9700 |

|

|

iccc@lythampartners.com |

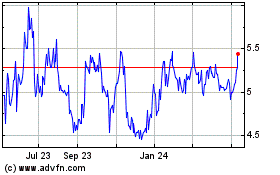

ImmuCell (NASDAQ:ICCC)

Historical Stock Chart

From Oct 2024 to Nov 2024

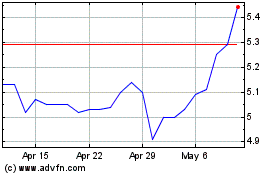

ImmuCell (NASDAQ:ICCC)

Historical Stock Chart

From Nov 2023 to Nov 2024