IF Bancorp, Inc. (NASDAQ: IROQ) (the “Company”) the holding

company for Iroquois Federal Savings and Loan Association (the

“Association”), announced net income of $1.8 million, or $0.57 per

basic share and diluted share for the fiscal year ended June 30,

2024, compared to $4.7 million, or $1.50 per basic share and $1.46

per diluted share for the fiscal year ended June 30, 2023. The

Company also announced net income of $431,000, or $0.13 per basic

share and diluted share for the three months ended June 30, 2024,

compared to $597,000, or $0.19 per basic share and $0.18 per

diluted share for the three months ended June 30, 2023.

“As we mentioned in our last earnings release, the interest rate

environment for the past several years has been challenging for the

banking industry. Our biggest challenge remains managing the cost

of funding our assets, where we are highly sensitive to current

pricing. The Board and management continue to evaluate all

opportunities to enhance shareholder value and improve earnings,"

said Walter H. “Chip” Hasselbring III, President and CEO.

Net income decreased $2.9 million, or 61.6%, to $1.8 million for

the year ended June 30, 2024, from $4.7 million for the year ended

June 30, 2023. For the year ended June 30, 2024, net interest

income was $17.7 million, compared to $22.0 million for the year

ended June 30, 2023. Interest income increased to $41.0 million for

the year ended June 30, 2024, from $32.1 million for the year ended

June 30, 2023. Interest expense increased to $23.3 million for the

year ended June 30, 2024, from $10.1 million for the year ended

June 30, 2023. Noninterest income increased to $4.4 million for the

year ended June 30, 2024, from $4.1 million for the year ended June

30, 2023. Noninterest expense decreased to $19.7 million for the

year ended June 30, 2024, from $20.0 million for the year ended

June 30, 2023. For the year ended June 30, 2024, income tax expense

totaled $565,000 compared to $1.6 million for the year ended June

30, 2023.

Total assets at June 30, 2024 were $887.7 million compared to

$849.0 million at June 30, 2023. Cash and cash equivalents

decreased to $9.6 million at June 30, 2024, from $11.0 million at

June 30, 2023. Investment securities decreased to $190.5 million at

June 30, 2024, from $201.3 million at June 30, 2023. Net loans

receivable increased to $639.3 million at June 30, 2024, from

$587.5 million at June 30, 2023. Deposits decreased to $727.2

million at June 30, 2024, from $735.3 million at June 30, 2023.

Total borrowings, including FHLB advances, borrowings from the

Federal Reserve Bank Term Funding Program (BTFP), and repurchase

agreements, increased to $76.0 million at June 30, 2024 from $30.3

million at June 30, 2023. Stockholders’ equity increased to $73.9

million at June 30, 2024 from $71.8 million at June 30, 2023.

Equity increased primarily due to net income of $1.8 million, an

increase of $1.1 million in accumulated other comprehensive income

(loss), net of tax, and ESOP and stock equity plan activity of

$563,000, partially offset by the accrual of approximately $1.3

million in dividends to our shareholders. The increase in

accumulated other comprehensive income (loss) was primarily due to

unrealized depreciation on available-for-sale securities, net of

tax.

The allowance for credit losses on loans increased $360,000, to

$7.5 million at June 30, 2024, from $7.1 million at June 30, 2023.

The increase in the allowance for credit losses on loans was the

result of a provision for credit losses of $150,000 and net

recoveries of $210,000.

As announced on August 14, 2024, IF Bancorp, Inc. will pay a

cash dividend of $0.20 per common share on or about October 18,

2024, to stockholders of record as of the close of business on

September 27, 2024.

IF Bancorp, Inc. is the savings and loan holding company for

Iroquois Federal Savings and Loan Association (the “Association”).

The Association, originally chartered in 1883 and headquartered in

Watseka, Illinois, conducts its operations from seven full-service

banking offices located in Watseka, Danville, Clifton, Hoopeston,

Savoy, Bourbonnais, and Champaign, Illinois and a loan production

office in Osage Beach, Missouri. The principal activity of the

Association’s wholly-owned subsidiary, L.C.I. Service Corporation,

is the sale of property and casualty insurance.

This press release may contain statements relating to the future

results of the Company (including certain projections and business

trends) that are considered "forward-looking statements" as defined

in the Private Securities Litigation Reform Act of 1995 (the

“PSLRA”). Such forward-looking statements may be identified by the

use of such words as "believe," "expect," "anticipate," "should,"

"planned," "estimated," "intend" and "potential." For these

statements, the Company claims the protection of the safe harbor

for forward-looking statements contained in the PSLRA.

The Company cautions you that a number of important factors

could cause actual results to differ materially from those

currently anticipated in any forward-looking statement. Such

factors include, but are not limited to: prevailing economic and

geopolitical conditions, including as a result of pandemics;

changes in interest rates, loan demand, real estate values and

competition; changes in accounting principles, policies, and

guidelines; changes in any applicable law, rule, regulation or

practice with respect to tax or legal issues; and other economic,

competitive, governmental, regulatory and technological factors

affecting the Company's operations, pricing, products and services

and other factors that may be described in the Company’s annual

report on Form 10-K and quarterly reports on Form 10-Q as filed

with the Securities and Exchange Commission. The forward-looking

statements are made as of the date of this release, and, except as

may be required by applicable law or regulation, the Company

assumes no obligation to update the forward-looking statements or

to update the reasons why actual results could differ from those

projected in the forward-looking statements.

Selected Income Statement Data

(Dollars in thousands, except per share data)

Quarter Ended June 30,

2024

Quarter Ended June 30,

2023

Year Ended June 30,

2024

Year Ended June 30,

2023

(unaudited)

(unaudited)

(unaudited)

Interest income

$

10,661

$

8,690

$

40,984

$

32,072

Interest expense

6,162

4,024

23,255

10,075

Net interest income

4,499

4,666

17,729

21,997

Provision (credit) for

credit losses

(164

)

(481

)

32

(228

)

Net interest income after

provision (credit) for

credit losses

4,663

5,147

17,697

22,225

Noninterest income

1,203

1,041

4,386

4,069

Noninterest expense

5,335

5,419

19,728

20,034

Income before taxes

531

769

2,355

6,260

Income tax expense

100

172

565

1,600

Net income

$

431

$

597

$

1,790

$

4,660

Earnings per share (1):

Basic

$

0.13

$

0.18

$

0.57

$

1.50

Diluted

$

0.13

$

0.19

$

0.57

$

1.46

Weighted average shares

outstanding (1):

Basic

3,215,905

3,198,260

3,132,153

3,113,307

Diluted

3,215,905

3,259,085

3,132,153

3,195,029

Performance Ratios

Year Ended June 30,

2024

Year Ended June 30,

2023

(unaudited)

Return on average assets

0.20%

0.56%

Return on average equity

2.54%

6.56%

Net interest margin on average interest

earning assets

2.10%

2.80%

Selected Balance Sheet Data

(Dollars in thousands, except per share data)

Year Ended June 30,

2024

Year Ended June 30,

2023

(unaudited)

Assets

$

887,745

$

848,976

Cash and cash equivalents

9,571

10,988

Investment securities

190,475

201,299

Net loans receivable

639,297

587,457

Deposits

727,177

735,314

Total borrowings, including repurchase

agreements

76,021

30,287

Total stockholders’ equity

73,916

71,753

Book value per share (2)

22.04

21.39

Average stockholders’ equity to average

total assets

7.99%

8.59%

Asset Quality

(Dollars in thousands)

Year Ended June 30,

2024

Year Ended June

30, 2023

(unaudited)

Non-performing assets (3)

$

173

$

148

Allowance for credit losses

7,499

7,139

Non-performing assets to total assets

0.02

%

0.02

%

Allowance for credit losses to total

loans

1.16

%

1.20

%

(1)

Shares outstanding do not include ESOP shares not committed for

release.

(2)

Total stockholders’ equity divided by shares outstanding of

3,353,026 and 3,354,626 at June 30, 2024 and 2023,

respectively.

(3)

Non-performing assets include non-accrual loans, loans past due

90 days or more and accruing, and foreclosed assets held for

sale.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240829363598/en/

Walter H. Hasselbring, III (815) 432-2476

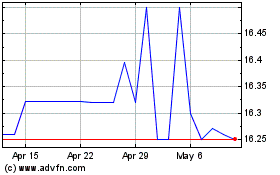

IF Bancorp (NASDAQ:IROQ)

Historical Stock Chart

From Jan 2025 to Feb 2025

IF Bancorp (NASDAQ:IROQ)

Historical Stock Chart

From Feb 2024 to Feb 2025