Current Report Filing (8-k)

March 26 2021 - 4:39PM

Edgar (US Regulatory)

falseHUNTINGTON BANCSHARES INC /MD/001-34073000004919600000491962021-03-252021-03-250000049196hban:DepositarySharesEachRepresentingA140thInterestInAShareOf5875SeriesCNonCumulativePerpetualPreferredStockMember2021-03-252021-03-250000049196us-gaap:CommonStockMember2021-03-252021-03-250000049196hban:DepositarySharesEachRepresentingA140thInterestInAShareOf4500SeriesHNonCumulativePerpetualPreferredStockMember2021-03-252021-03-250000049196hban:DepositarySharesEachRepresentingA140thInterestInAShareOf6250SeriesDNonCumulativePerpetualPreferredStockMember2021-03-252021-03-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): March 25, 2021

Huntington Bancshares Incorporated

(Exact Name of Registrant as Specified in Charter)

|

Maryland

|

|

1-34073

|

|

31-0724920

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

41 South High Street, Columbus, Ohio 43287

(Address of Principal Executive Offices, and Zip Code)

(614) 480-2265

Registrant’s Telephone Number, Including Area Code

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Depositary Shares (each representing a 1/40th interest in a share of 5.875% Series C Non-Cumulative, perpetual preferred stock)

|

|

HBANN

|

|

NASDAQ

|

Depositary Shares (each representing a 1/40th interest in a share of 6.250% Series D Non-Cumulative, perpetual preferred stock)

|

|

HBANO

|

|

NASDAQ

|

Depositary Shares (each representing a 1/40th interest in a share of 4.500% Series H Non-Cumulative, perpetual preferred stock)

|

|

HBANP

|

|

NASDAQ

|

Common Stock-Par Value $0.01 per Share

|

|

HBAN

|

|

NASDAQ

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the

Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 5.07.

|

Submission of Matters to a Vote of Security Holders.

|

On March 25, 2021, Huntington Bancshares Incorporated (“Huntington”) held a special meeting of shareholders (the “Huntington

special meeting”) to consider certain proposals related to the Agreement and Plan of Merger, dated as of December 13, 2020, by and between Huntington and TCF Financial Corporation (“TCF”), which provides, among other things and subject to the

terms and conditions set forth therein, that TCF will merge with and into Huntington (the “merger”), with Huntington as the surviving corporation.

As of the close of business on February 11, 2021, the record date for the Huntington special meeting, there were 1,017,245,480

shares of common stock, par value $0.01, of Huntington (“Huntington common stock”) outstanding, each of which was entitled to one vote for each proposal at the Huntington special meeting. At the Huntington special meeting, a total of 795,857,328

shares of Huntington common stock, representing approximately 78% of the shares of Huntington common stock outstanding and entitled to vote, were present virtually via the Huntington special meeting website or by proxy, constituting a quorum to

conduct business.

At the Huntington special meeting, the following proposals were considered:

|

1.

|

a proposal to approve the merger (the “Huntington merger proposal”);

|

|

2.

|

a proposal to approve an amendment to Huntington’s charter to increase the number of authorized shares of Huntington common stock from one billion five hundred million shares to two billion two hundred fifty million shares (the

“Huntington charter amendment” and such proposal, the “Huntington authorized share count proposal”); and

|

|

3.

|

a proposal to adjourn the Huntington special meeting, if necessary or appropriate, to solicit additional proxies if, immediately prior to such adjournment, there are not sufficient votes to

approve the Huntington merger proposal or the Huntington authorized share count proposal or to ensure that any supplement or amendment to the joint proxy statement/prospectus is timely provided to holders of Huntington common stock (the

“Huntington adjournment proposal”).

|

Each of the three proposals was approved by the requisite vote of Huntington’s shareholders. The final voting results for each

proposal are described below. For more information on each of these proposals, see the definitive joint proxy statement/prospectus filed by Huntington with the U.S. Securities and Exchange Commission on February 17, 2021.

|

1.

|

The Huntington merger proposal:

|

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

783,031,682

|

10,767,942

|

2,057,703

|

N/A

|

The Huntington merger proposal received the affirmative vote of more than two-thirds of all the votes entitled to be cast on the

merger by the holders of outstanding Huntington common stock. The votes cast in favor of the Huntington merger proposal represented approximately 99% of all votes cast on the Huntington merger proposal.

|

2.

|

The Huntington authorized share count proposal:

|

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

776,913,269

|

16,149,979

|

2,794,080

|

N/A

|

The Huntington authorized share count proposal received the affirmative vote of more than two-thirds of all the votes entitled to

be cast on the Huntington charter amendment by the holders of outstanding Huntington common stock. The votes cast in favor of the Huntington authorized share count proposal represented approximately 98% of all votes cast on the Huntington

authorized share count proposal.

|

3.

|

The Huntington adjournment proposal:

|

|

For

|

Against

|

Abstain

|

Broker Non-Votes

|

|

663,820,293

|

128,660,878

|

3,376,156

|

N/A

|

The Huntington adjournment proposal received the vote of more than a majority of the votes cast on the Huntington adjournment

proposal by the holders of Huntington common stock entitled to vote. The votes cast in favor of the Huntington adjournment proposal represented approximately 84% of all votes cast on the Huntington adjournment proposal.

On March 25, 2021, Huntington and TCF issued a joint press release announcing the results of the Huntington special meeting and the

results of the special meeting of TCF shareholders held on March 25, 2021. A copy of the joint press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

Exhibit

No.

|

Description

|

|

|

|

|

|

Joint Press Release dated March 25, 2021

|

|

104

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

HUNTINGTON BANCSHARES INCORPORATED

|

|

|

|

|

|

|

By:

|

/s/ Jana J. Litsey

|

|

|

Name:

|

Jana J. Litsey

|

|

|

Title:

|

General Counsel

|

|

|

|

|

|

Date: March 26, 2021

|

|

|

3

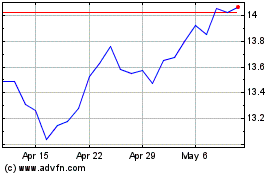

Huntington Bancshares (NASDAQ:HBAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

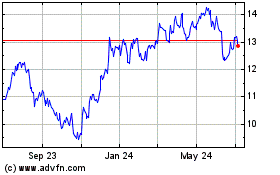

Huntington Bancshares (NASDAQ:HBAN)

Historical Stock Chart

From Apr 2023 to Apr 2024