Current Report Filing (8-k)

May 25 2022 - 8:31AM

Edgar (US Regulatory)

0001892322

false

0001892322

2022-05-13

2022-05-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): May 13, 2022

HEARTCORE

ENTERPRISES, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41272 |

|

87-0913420 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

1-2-33,

Higashigotanda, Shinagawa-ku, Tokyo, Japan

(Address

of principal executive offices)

+81-3-6409-6966

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under

any of the following provisions.

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

HTCR |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01. Entry into Material Definitive Agreement.

On

May 13, 2022 (the “Effective Date”), HeartCore Enterprises, Inc. (the “Company”) entered into a Consulting and

Services Agreement (the “Consulting Agreement”) by and between the Company and SYLA Holdings Co. Ltd., a Japanese corporation

(“SYLA”). Pursuant to the terms of the Consulting Agreement, the Company agreed to provide SYLA certain services, including

the following (collectively, the “Services”):

| |

(i) |

Assistance

with the selection and negotiation of terms for a law firm, underwriter and auditing firm for SYLA; |

| |

(ii) |

Assisting

in the preparation of documentation for internal controls required for an initial public offering by SYLA; |

| |

(iii) |

Providing

support services to remove problematic accounting accounts upon listing; |

| |

(iv) |

Translation

of requested documents into English; |

| |

(v) |

Attend

and, if requested by SYLA, lead meetings with SYLA’s management and employees; |

| |

(vi) |

Provide

SYLA with support services related to SYLA’s NASDAQ listing; |

| |

(vii) |

Conversion

of accounting data from Japanese standards to U.S. GAAP; |

| |

(viii) |

Services

to remove problematic accounting accounts upon listing; |

| |

(ix) |

Support

for the SYLA’s negotiations with the audit firm; |

| |

(x) |

Assist

in the preparation of S-1 or F-1 filings; and |

| |

(xi) |

Preparing

an investor presentation/deck and executive summary of SYLA’s business and operations. |

In

providing the Services, the Company will not perform accounting services, and will not act as an investment advisor or broker/dealer.

Pursuant to the terms of the Consulting Agreement, the parties agreed that the Company will not provide the following services, among

others: negotiation of the sale of SYLA’s securities; participation in discussions between SYLA and potential investors; assisting

in structuring any transactions involving the sale of SYLA’s securities; pre-screening of potential investors; due diligence activities;

nor providing advice relating to valuation of or financial advisability of any investments in SYLA.

Pursuant

to the terms of the Consulting Agreement, SYLA agreed to compensate the Company as follows in return for the provision of Services during

the six-month term (the “Term”):

| |

(a) |

$500,000,

to be paid as follows: (i) $200,000 on the Effective Date; (ii) $150,000 on the three-month anniversary of the Effective Date; and

(iii) $150,000 on the six-month anniversary of the Effective Date; and |

| |

|

|

| |

(b) |

Issuance

by SYLA to the Company of a warrant (the “Warrant”), deemed fully earned and vested as of the Effective Date,

to acquire a number of shares of capital stock of SYLA, to initially be equal to 2% of the fully diluted share capital of SYLA as

of the Effective Date, subject to adjustment as set forth in the Warrant. |

For

any services performed by the Company beyond the Term, SYLA will compensate the Company for Services at the rate of $150 per hour,

based on the hours spent by personnel of the Company.

The

Consulting Agreement’s Term of six-months shall expire unless renewed upon mutual written agreement of the parties.

As

provided in the Consulting Agreement, on the Effective Date, SYLA issued the Warrant to the Company. Pursuant to the terms of

the Warrant, the Company may, at any time on or after the date (the “IPO Date”) that SYLA completes its first initial public

offering of stock in the United States resulting in any class of SYLA’s stock being listed for trading on any tier of the Nasdaq

Stock Market, the New York Stock Exchange or the NYSE American (the “IPO”) and on or prior to the close of business on the

tenth anniversary of the IPO Date, exercise the Warrant to purchase 2% of the fully diluted share capital of SYLA as of the Effective

Date for an exercise price per share of $0.01, subject to adjustment as provided in the Warrant. The number of shares for which the Warrant

will be exercisable will be automatically adjusted on the IPO Date to be 2% of the fully diluted number and class of shares of capital

stock of SYLA as of the IPO Date that are listed for trading. The Warrant contains a 9.99% equity blocker.

The

foregoing description of the Consulting Agreement and the Warrant is qualified in its entirety by reference to the Consulting Agreement

and the Warrant, copies of which are filed as Exhibits 10.1 and 10.2 hereto, respectively, and which are incorporated herein by reference.

Item

7.01. Regulation FD.

On

May 25, 2022, the Company issued a press release announcing its engagement of SYLA for Go IPO, the Company’s latest consulting

service offering for Japanese companies interested in listing on the Nasdaq Stock Market (“Nasdaq”). Through the recent engagement

with this private company, the Company expects to generate an aggregate of $500,000 in intial fee sales. In addition, the Company has

received warrants to acquire 2% of SYLA’s common stock, on a fully diluted basis.

The

Company cannot guarantee that a company will successfully close an initial public offering, that it will meet Nasdaq listing standards,

and/or that a Nasdaq listing application, if submitted, will be approved. The Company will not perform accounting services, and will

not act as an investment advisor or broker/dealer. The Company will not provide the following services, among others: negotiation of

the sale of a company’s securities; participation in discussions between a company and potential investors; assisting in structuring

any transactions involving the sale of a company’s securities; pre-screening of potential investors; due diligence activities;

and/or providing advice relating to valuation of or financial advisability of any investments in a company.

The

information included in this Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that

section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or

the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The information set forth under this

Item 7.01 shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is required

to be disclosed solely to satisfy the requirements of Regulation FD.

Item

9.01 Financial Statement and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

HEARTCORE

ENTERPRISES, INC. |

| |

|

| Dated:

May 25, 2022 |

By: |

/s/

Sumitaka Yamamoto |

| |

Name: |

Sumitaka

Yamamoto |

| |

Title: |

Chief

Executive Officer |

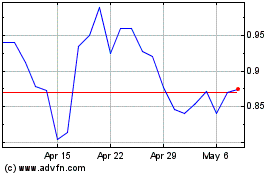

HeartCore Enterprises (NASDAQ:HTCR)

Historical Stock Chart

From Aug 2024 to Sep 2024

HeartCore Enterprises (NASDAQ:HTCR)

Historical Stock Chart

From Sep 2023 to Sep 2024