CardioNet, Inc. (NASDAQ:BEAT), a leading wireless medical

technology company with a current focus on the diagnosis and

monitoring of cardiac arrhythmias, today reported results for the

first quarter ended March 31, 2010.

First Quarter 2010 Highlights

- Achieved gross margin of 63% on

revenues of $32 million

- Experienced improved results

with a loss of $0.23 per diluted share, a $0.44 improvement over

the fourth quarter 2009; on an adjusted basis the loss per diluted

share was $0.13, a 46% improvement over the fourth quarter

2009

- MCOTTM patient volume increased

23% to over 30,000 patients compared to the first quarter 2009

- Commercial reimbursement rates

in the first quarter 2010 remained stable with the fourth quarter

2009 rates

- Reduced DSO to 113 days, a

reduction of 9 days compared to the fourth quarter 2009

- Secured 14 new payor contracts,

covering over one million lives, for total covered lives of over

200 million

- Ahead of plan to achieve

previously announced $15 million in cost reductions

- Received FDA approval of our

next generation MCOTTM platform

- $45 million in cash and no debt

as of March 31, 2010

President and CEO Commentary

Randy Thurman, Chairman, President and Chief Executive Officer

of CardioNet, commented: “Our strong operating results for the

first quarter 2010 included significant improvements compared to

the fourth quarter 2009 in both operating margin and gross margin.

We reported strong revenues at $31.8 million with stable

reimbursement and MCOTTM volume growth of 23% over the first

quarter 2009. While our operating and gross margins exceeded our

projections, we experienced lower than anticipated volume growth,

which we believe is largely due to increased patient deferrals

resulting from rising insurance deductibles and co-pays. In

addition, with the implementation of our new electronic payor

connectivity system, we were better able to identify patients who

did not have coverage for our service. While this decreased the

number of patients put on service, it improved profitability. In

response to the lower than anticipated volume, we accelerated the

implementation of productivity and cost improvement initiatives

across the organization.

“The market potential for MCOTTM remains strong. We believe we

can drive higher adoption and utilization of MCOTTM with the

addition of a contracted sales organization to complement our

existing sales force, which is the largest and most experienced in

wireless medicine. Throughout 2010, we expect to gain share in the

cardio thoracic surgery and neurology markets, driven by new

specialized physician reporting enhancements. During the first

quarter, we launched a new marketing campaign to increase physician

awareness of the benefits of our product. In addition, numerous

clinical studies are currently underway which will add to the

unparalleled body of clinical support for MCOTTM, which today

stands at 30 published abstracts and peer reviewed papers.

“FDA clearance of our next generation MCOTTM platform is a major

milestone for the Company and we expect to launch this new

technology in the latter part of 2010. This advanced MCOTTM

platform will utilize our patented core technology with expanded

capabilities, an improved patient interface and a smaller and

lighter body sensor. In addition, we expect to be able to deliver

these enhancements at a lower product cost which will contribute

incrementally to our on-going cost reduction strategy. We look

forward to this innovation in our technology and the impact it will

have in the marketplace.

“While the Company is ahead of schedule to achieve $15 million

in cost savings and on track to achieve positive EBITDA during the

second half of the year, we are closely monitoring volume growth.

We are continuing our efforts to obtain a national reimbursement

rate from CMS and secure contracts with the few remaining large

commercial payors. Though we still face the challenge posed by the

unexpected decision by Highmark Medicare Services in July 2009 to

cut the reimbursement rate for mobile cardiac telemetry by

one-third as of September 2009, our key focus remains on delivering

unparalleled service and quality of care to the physicians and

patients that we serve while we work to improve the cost structure

of the company. While we still have much to accomplish, we feel

that we have made significant progress and remain optimistic about

the future of CardioNet.”

First Quarter Financial Results

Revenues for the first quarter 2010 were $31.8 million compared

to $35.7 million in the first quarter 2009, a decrease of $3.9

million. Increased MCOTTM patient volume drove additional revenues,

but was offset by the impact of the Medicare rate reduction as well

as lower commercial reimbursement versus the prior year. For the

first quarter 2010, the Company’s payor mix for revenue was 33%

Medicare and 67% commercial. Gross profit declined to $20.1 million

in the first quarter 2010, or 63.1% of revenues, compared to $23.9

million in the first quarter 2009, or 66.9% of revenues.

On a GAAP basis, operating loss was $5.4 million in the first

quarter 2010 compared to operating loss of $1.3 million in the

first quarter 2009. Excluding $2.4 million of expense related to

restructuring and other charges, adjusted operating loss was $3.0

million in the first quarter 2010. This compares to adjusted

operating income of $1.6 million in the first quarter 2009, which

excludes $3.0 million of expense related to restructuring and other

charges in the prior year period.

On a GAAP basis, net loss for the first quarter 2010 was $5.4

million, or a loss of $0.23 per diluted share, compared to a net

loss of $0.7 million, or a loss of $0.03 per diluted share, for the

first quarter 2009. Excluding expenses related to restructuring and

other charges, adjusted net loss for the first quarter 2010 was

$3.0 million, or a loss of $0.13 per diluted share. This compares

to adjusted net income of $1.0 million, or $0.04 per diluted share,

for the first quarter 2009, which excludes the impact of

restructuring and other charges.

Heather Getz, CardioNet’s Chief Financial Officer, commented:

“We made significant progress in our cost reduction initiatives

with more than $3.0 million in savings during the first quarter

2010. The cost reductions contributed to a gross margin improvement

of 220 basis points and a seven percentage point improvement in

adjusted operating margin compared to the fourth quarter 2009.

“Our balance sheet remains strong with $45 million in cash and

no debt. In the first quarter, our DSO was 113 days, an improvement

of 9 days versus the fourth quarter 2009. We expect continued

improvement during the remainder 2010.

“We are pleased with our results to date and remain confident in

our ability to achieve the Company’s financial goals for 2010. We

will continue to look for additional opportunities to streamline

our operations and improve our profitability.”

Conference Call

CardioNet, Inc. will host an earnings conference call on

Wednesday, April 28, 2010, at 5:00 PM Eastern Time. The call will

be simultaneously webcast on the investor information page of our

website, www.cardionet.com. The call will be archived on our

website and will also be available for two weeks via phone at

888-286-8010, access code 25578622.

About CardioNet

CardioNet is the leading provider of ambulatory, continuous,

real-time outpatient management solutions for monitoring relevant

and timely clinical information regarding an individual’s health.

CardioNet’s initial efforts are focused on the diagnosis and

monitoring of cardiac arrhythmias, or heart rhythm disorders, with

a solution that it markets as Mobile Cardiac Outpatient TelemetryTM

(MCOT™). More information can be found at

http://www.cardionet.com.

Forward-Looking Statements

This press release includes certain forward-looking statements

within the meaning of the "Safe Harbor" provisions of the Private

Securities Litigation Reform Act of 1995 regarding, among other

things, our growth prospects, the prospects for our products and

our confidence in the Company’s future. These statements may be

identified by words such as “expect,” “anticipate,” “estimate,”

“intend,” “plan,” “believe,” ”potential,” “promises” and other

words and terms of similar meaning. Such forward-looking statements

are based on current expectations and involve inherent risks and

uncertainties, including important factors that could delay,

divert, or change any of them, and could cause actual outcomes and

results to differ materially from current expectations. These

factors include, among other things, the success of our efforts to

address the operational issues, including cost savings initiatives,

changes to reimbursement levels for our products and the success of

our attempts to achieve a national rate from CMS, the success of

our sales and marketing initiatives, our ability to attract and

retain talented executive management and sales personnel, our

ability to identify acquisition candidates, acquire them on

attractive terms and integrate their operations into our business,

the commercialization of new products, market factors, internal

research and development initiatives, partnered research and

development initiatives, competitive product development, changes

in governmental regulations and legislation, the continued

consolidation of payors, acceptance of our new products and

services and patent protection and litigation. For further details

and a discussion of these and other risks and uncertainties, please

see our public filings with the Securities and Exchange Commission,

including our latest periodic reports on Form 10-K and 10-Q. We

undertake no obligation to publicly update any forward-looking

statement, whether as a result of new information, future events,

or otherwise.

Three Months

Ended Consolidated Statements of Operations

(unaudited) (In Thousands, Except Per Share Amounts)

March 31,

2010

March 31,

2009

Revenues $ 31,816 $ 35,720 Cost of revenues 11,749

11,838 Gross profit 20,067 23,882 Gross profit

% 63.1 % 66.9 % Operating expenses: General and

administrative expense 14,136 14,087 Sales and marketing expense

7,997 7,547 Research and development expense 1,243 1,216

Amortization of intangibles 181 238 Integration, restructuring and

other charges 1,945 2,139 Total

operating expenses 25,502 25,227 (Loss) income from

operations (5,435 ) (1,345 ) Interest income, net 4

118 (Loss) income before income taxes (5,431 ) (1,227 )

Benefit (provision) from income taxes - 505

Net (loss) income $ (5,431 ) $ (722 )

Earnings per Share:

Basic $ (0.23 ) $ (0.03 ) Diluted $ (0.23 ) $ ( 0.03 )

Weighted Average Shares Outstanding: Basic 23,893 23,600 Diluted

23,893 23,600

Summary Financial Data

(In Thousands)

March 31, 2010

December 31,

2009

(unaudited) Cash and cash equivalents $ 45,255 $

49,152 Accounts receivable, net 39,313 40,885 Days sales

outstanding 113 122 Total debt - -

Three Months Ended March 31, 2010

March 31, 2009 Cash used in operations $ (2,952 ) $

(4,629 ) Capital expenditures (1,478 ) (5,594 ) Free

cash flow (4,430 ) (10,223 ) Stock compensation expense 918

1,660 Depreciation and amortization expense 3,197 2,520

Reconciliation of Non-GAAP Financial

Measures(In Thousands, Except Per Share Amounts)

In accordance with Regulation G of the Securities and Exchange

Commission, the table set forth below reconciles certain financial

measures used in this press release that were not calculated in

accordance with generally accepted accounting principles, or GAAP,

with the most directly comparable financial measure calculated in

accordance with GAAP.

Three Months Ended

(unaudited)

March 31, 2010 March 31, 2009 Operating loss –

GAAP $ (5,435 ) $ (1,345 ) Other charges (a) 2,421

2,987

Adjusted operating (loss)

income

$ (3,014 ) $ 1,642

Net loss – GAAP $ (5,431 ) $ (722 ) Other charges (net of

income tax of $0 and a benefit of $1,228) (a) 2,421

1,759

Adjusted net (loss) income $

(3,010 ) $ 1,037

Loss per diluted share – GAAP $ (0.23 ) $ (0.03 ) Other

charges per share (a) 0.10 0.07

Adjusted (loss) earnings per diluted share $

(0.13 ) $ 0.04 (a)

In the first quarter of 2010, we incurred $1.7 million of severance

and other exit cost related to the restructuring of our sales and

service organizations and management changes, as well as $0.7

million of other charges largely related to our class action and

Biotel law suits. In the first quarter of 2009 we incurred $0.4

million of costs in connection with the since terminated definitive

merger agreement to acquire Biotel, Inc., $0.5 million for special

bonus paid to the then incoming CEO and $2.1 million of

integration, restructuring and other charges.

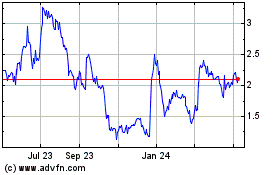

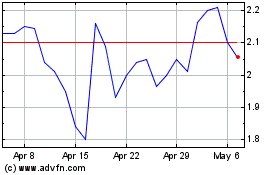

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jul 2023 to Jul 2024