CardioNet, Inc. (NASDAQ:BEAT), a leading wireless medical

technology company with an initial focus on the diagnosis and

monitoring of cardiac arrhythmias, today reported results for the

quarter ended June 30, 2008. Q2 2008 Highlights Reported revenue of

$29.3 million, up 68.4%, compared to $17.4 million in the same

period last year. Experienced a profitable quarter with an 8.7%

operating margin in Q2 2008 compared to a loss in Q2 2007.

Continued to build on the momentum of payor acceptance generated

from the publication of our clinical trial results in March 2007,

securing 9 new direct payor contracts in the second quarter

representing approximately 1 million additional lives, bringing the

total number of covered lives to approximately 177 million covered

by 181 commercial contracts and Medicare. Expanded our direct sales

force by 11.0% from the end of Q1 2008, broadening our footprint as

the largest arrhythmia monitoring sales force. Appointed Randy

Thurman, former Chairman and CEO of VIASYS Healthcare (acquired by

Cardinal Health for $1.5 billion in June 2007), as Executive

Chairman to replace founder Jim Sweeney. Bolstered our senior

management team with the hiring of additional experienced

executives in key management positions in Operations and Human

Resources. Entered into a settlement agreement with LifeWatch

Corp., in the amicable resolution of a lawsuit with dismissal by

both sides of all claims asserted in the litigation. President and

CEO Commentary Arie Cohen, President and CEO, commented: �We are

excited to report a record second quarter that builds on our market

momentum. The CardioNet System has demonstrated a 3x higher yield

in diagnosing cardiac arrhythmias versus event monitoring for

patients who previously had negative or non-diagnostic Holter

monitoring. We believe that the enhanced ability to diagnose and

manage patients with cardiac arrhythmias results in superior

clinical outcomes and reduced health care costs. Accordingly, the

momentum we are experiencing in payor adoption continues,

demonstrated by CardioNet reaching the milestone of approximately

70% of lives under coverage from commercial payors and Medicare.

During the first six months of 2008, we secured 14 new contracts

representing 19 million covered lives. �Our recent appointment of

Randy Thurman as Executive Chairman further enhances CardioNet�s

leadership team, as we seek to expand our penetration in the $2

billion arrhythmia monitoring opportunity. Annualizing our Q2

revenue suggests that we have achieved less than 6% penetration,

underscoring the significant growth opportunity going forward in

our core business. We believe our wireless medicine platform also

can be leveraged in the future for other new applications and

markets and remain excited about the potential for this innovative

and scalable technology.� Financial Results Revenues for the second

quarter of 2008 increased to $29.3 million compared to $17.4

million in the second quarter of 2007, an increase of $11.9

million, or 68.4%. Revenues for the six months ended June 30, 2008

increased to $54.8 million compared to $28.5 million in the

comparable period in the prior year. After taking into account the

acquisition of PDSHeart, Inc. (�PDSHeart�), which the Company

acquired in March 2007, revenue in the first half of 2008 increased

68.2% to $54.8 million compared to $32.6 million in the same period

last year(1A). Gross profit increased to $19.5 million in the

second quarter of 2008, or 66.5% of revenues, compared to $11.5

million in the second quarter of 2007, or 65.8% of revenues. The

66.5% gross margin in second quarter of 2008 also compares

favorably to the 62.6% gross margin in the first quarter of 2008.

For the first half of 2008, gross profit increased to $35.5

million, or 64.7% of revenues, compared to $18.8 million, or 65.8%

of revenues, in the comparable period in the prior year. After

taking into account the acquisition of PDSHeart, the 64.7% gross

profit in the year to date period compares to 65.0% gross profit in

the same period last year, a decrease of 30 basis points due to

first quarter performance(1A). Marty Galvan, CardioNet�s Chief

Financial Officer commented: �Our second quarter gross profit

reflects cost reductions and productivity improvements that

successfully offset the negative factors experienced in the first

quarter of 2008, primarily a fuel surcharge. In addition, our

revenue mix continues to shift towards our proprietary CardioNet

System, away from legacy event and Holter monitoring products based

on the strength of its superior diagnostic yield. It is important

to emphasize that the gross margin for the CardioNet System is

higher than the gross margin for the legacy event and Holter

monitoring products, thereby contributing to the gross margin

improvement.� On a GAAP basis, operating income increased to $2.5

million in the second quarter of 2008 compared to an operating loss

of $1.0 million in the second quarter of 2007. Excluding $0.6

million of expense related to the integration of PDSHeart and other

restructuring efforts(1B), adjusted operating income increased to

$3.1 million in the second quarter of 2008, or 10.7% of revenue,

compared to an operating loss of $1.0 million in the second quarter

of 2007. On a GAAP basis, operating income for the year to date

period increased to $1.9 million compared to an operating loss of

$3.2 million in the comparable period in the prior year. Excluding

the impact of $1.9 million of integration, restructuring and other

nonrecurring charges(1B), adjusted operating income increased to

$3.8 million in the first half of 2008, or 6.9% of revenue,

compared to an operating loss of $3.2 million in the first half of

2007. Marty Galvan remarked: �As previously discussed, we expect to

record approximately $1.3 million in PDSHeart integration charges

in 2008. In the first half of the year, we have reported

approximately $1.0 million in charges, with the balance expected

primarily in the third quarter of 2008. The litigation settlement

charges with LifeWatch announced in May 2008 were included in Q1

2008 results and did not impact the second quarter results.� On a

GAAP basis, net income for the second quarter of 2008 increased to

$1.6 million, or $0.07 per diluted share, compared to a net loss of

$1.1 million, or a loss of $0.36 per diluted share, for the same

period last year. Adjusted net income for the second quarter of

2008 increased to $2.0 million, or $0.08 per diluted share,

excluding the impact of integration, restructuring and other

nonrecurring charges(1B), compared to a net loss of $1.1 million,

or a loss of $0.36 per diluted share, for the same period last

year. On a GAAP basis, net income for the first half of 2008

increased to $1.3 million, or $0.06 per diluted share, compared to

a net loss of $4.3 million, or a loss of $1.41 per diluted share,

for the first half of 2007. Adjusted net income for the first half

of 2008 increased to $2.4 million, or $0.11 per diluted share,

excluding the impact of integration, restructuring and other

nonrecurring charges(1B), compared to a net loss of $4.3 million,

or a loss of $1.41 per diluted share, for the same period last

year. Net income available to common shareholders, which is derived

by reducing net income by the accrued dividends and accretion on

mandatorily redeemable convertible preferred stock, was $1.6

million, or $0.07 per diluted share, for the second quarter of 2008

compared to a net loss of $3.5 million, or a loss of $1.13 per

diluted share, for the second quarter of 2007. Net loss available

to common shareholders for the six month period ending June 30,

2008 was $1.3 million, or a loss of $0.10 per diluted share,

compared to a loss of $7.1 million, or a loss of $2.35 per diluted

share, for the same period last year. The mandatorily redeemable

convertible preferred stock, which was issued in part to finance

the March 2007 PDSHeart acquisition, was converted to common stock

in connection with CardioNet�s March 2008 initial public offering.

Marty Galvan noted: �During our first quarter 2008 earnings

release, CardioNet announced 2008 revenue guidance of $117 to $120

million. The strength of our second quarter increases our level of

comfort toward the high-end of that range. We believe that the

third quarter will be impacted by seasonality related to physician

and patient schedules over the summer months, which will moderate

our sequential growth. In regard to expenses, today we also

announced a secondary offering and we expect to incur charges

related to the offering in the third quarter of 2008. We also

expect to make continued investments in sales and marketing

resources, infrastructure to support our growth and R&D

projects to enhance our product portfolio over the second half of

2008, positioning the Company for growth in 2009 and beyond. Going

forward, we firmly believe that we remain well-positioned to

deliver sustained revenue and earnings growth and will continue to

maintain a very strong balance sheet.� Conference Call CardioNet,

Inc. will host an earnings conference call on Tuesday, July 22,

2008, at 8:00 AM Eastern Time. The call will be simultaneously

webcast on the investor information page of our website,

www.cardionet.com. The call will be archived on our website and

will also be available for two weeks via phone at 888-286-8010,

access code 61950613. CardioNet, Inc. is a leading provider of

ambulatory, continuous, real-time outpatient management solutions

for monitoring relevant and timely clinical information regarding

an individual�s health. CardioNet�s initial efforts are focused on

the diagnosis and monitoring of cardiac arrhythmias with a solution

that it markets as the CardioNet System. More information can be

found at http://www.CardioNet.com. Forward Looking Statements This

press release includes certain forward-looking statements within

the meaning of the �Safe Harbor� provisions of the Private

Securities Litigation Reform Act of 1995 regarding, among other

things, our ability to deliver sustained revenue and earnings

growth, to maintain a strong balance sheet, the momentum in payor

acceptance, the ability of our products and services to deliver

superior clinical outcomes and reduced heath care costs, our

ability to increase our market penetration, the size of our

potential markets and growth opportunities, our ability to leverage

our platform for other applications and markets, our expectations

with respect to our revenue mix or the continued shift from legacy

products to the CardioNet System, the amount of our integration

charges related to the PDSHeart acquisition, our expectations with

respect to future financial performance and seasonality in our

business, expectations with respect to charges relating to the

planned secondary offering, expectations with respect to future

investments, our outlook for our businesses, our 2008 revenue

target, our prospects for continued growth and our confidence in

the Company�s future. These statements may be identified by words

such as �expect,� �anticipate,� �estimate,� �project,� �intend,�

�plan,� �believe,� and other words and terms of similar meaning.

Such forward-looking statements are based on current expectations

and involve inherent risks and uncertainties, including important

factors that could delay, divert, or change any of them, and could

cause actual outcomes and results to differ materially from current

expectations. These factors include, among other things, the

integration of our recent acquisition of PDSHeart, the continued

implementation of our restructuring plans, sales and marketing

initiatives, our ability to attract and retain talented sales

personnel, the commercialization of new products, market factors,

internal research and development initiatives, partnered research

and development initiatives, competitive product development,

changes in governmental regulations and legislation, changes to

reimbursement levels for our products, the continued consolidation

of payors, acceptance of our new products and services and patent

protection and litigation. For further details and a discussion of

these and other risks and uncertainties, please see our public

filings with the Securities and Exchange Commission, including our

latest periodic report on Form 10-K or 10-Q. We undertake no

obligation to publicly update any forward-looking statement,

whether as a result of new information, future events, or

otherwise. � � Three Months Ended � Consolidated Statements of

Operations (unaudited) (In Thousands, Except Per Share Amounts) �

June 30, June 30, 2008 2007 � Revenues $ 29,340 $ 17,419 Cost of

revenues � 9,834 � � 5,953 � Gross Profit 19,506 11,466 Gross

Profit % 66.5 % 65.8 % � Operating Expenses: Research and

development expense 931 1,019 General and administrative expense

9,768 6,834 Sales and marketing expense 5,412 4,377 Amortization of

intangibles 246 246 Integration, restructuring and other

nonrecurring charges � 610 � � - � Total Operating Expenses 16,967

12,476 � � � � � � Operating Income (Loss) � 2,537 � � (1,010 )

Interest Income (Expense), net 267 (94 ) � Income (Loss) before

Income Taxes 2,804 (1,104 ) Provision for Income Taxes � (1,172 ) �

- � Net Income (Loss) $ 1,632 $ (1,104 ) Dividends on and accretion

of mandatorily redeemable convertible preferred stock � - � �

(2,362 ) Net Income (Loss) available to common shareholders $ 1,632

� $ (3,466 ) � Earnings (Loss) per Share: Basic $ 0.07 $ (1.13 )

Diluted $ 0.07 $ (1.13 ) � � Weighted Average Shares Outstanding:

Basic 23,098 3,054 Diluted 24,191 3,054 � � � � � Six Months Ended

� Consolidated Statements of Operations (unaudited) (In Thousands,

Except Per Share Amounts) June 30, June 30, 2008 2007 � Revenues $

54,803 $ 28,519 Cost of revenues � 19,353 � � 9,743 � Gross Profit

35,450 18,776 Gross Profit % 64.7 % 65.8 % � Operating Expenses:

Research and development expense 2,073 2,010 General and

administrative expense 18,589 11,974 Sales and marketing expense

10,527 7,696 Amortization of intangibles 492 307 Integration,

restructuring and other nonrecurring charges � 1,916 � � - � Total

Operating Expenses 33,597 21,987 � � � � � � Operating Income

(Loss) � 1,853 � � (3,211 ) Interest Income (Expense), net 379

(1,047 ) � Income (Loss) before Income Taxes 2,232 (4,258 )

Provision for Income Taxes � (940 ) � - � Net Income (Loss) $ 1,292

$ (4,258 ) Dividends on and accretion of mandatorily redeemable

convertible preferred stock � (2,597 ) � (2,845 ) Net Income (Loss)

available to common shareholders $ (1,305 ) $ (7,103 ) � Earnings

(Loss) per Share: Basic and Diluted $ (0.10 ) $ (2.35 ) � Weighted

Average Shares Outstanding: Basic and Diluted 13,368 3,024 � The

following table presents detail of the stock-based compensation

expense that is included in each functional line item in the

Condensed Statement of Operations above (000�s): � Three Months

Ended � Stock based compensation expense (unaudited) (In Thousands)

� June 30, June 30, 2008 2007 � Stock based compensation expense

included in: Cost of revenues $ 8 $ - Research and development

expense 17 - General and administrative expense 227 132 Sales and

marketing expense � 139 � � - � � Total stock based compensation

expense $ 391 $ 132 � � � � Six Months Ended � Stock based

compensation expense (unaudited) (In Thousands) June 30, June 30,

2008 2007 � Stock based compensation expense included in: Cost of

revenues $ 15 $ - Research and development expense 32 - General and

administrative expense 466 201 Sales and marketing expense � 238 �

� - � � Total stock based compensation expense $ 751 $ 201 � � � �

Summary Consolidated Balance Sheet Data (In Thousands) June 30,

December 31, 2008 2007 (unaudited) � Cash and cash equivalents $

54,572 $ 18,091 Accounts receivable, net 29,301 22,854 Working

capital 71,031 29,375 Total assets 152,842 103,040 Total debt 346

2,744 Mandatorily redeemable convertible preferred stock - 115,302

Total shareholders� equity (deficit) 137,255 (26,865 ) � �

Reconciliation of Non-GAAP Financial Measures (In Thousands, Except

Per Share Amounts) � In accordance with Regulation G of the

Securities and Exchange Commission, the tables set forth below

reconcile certain financial measures used in this press release

that were not calculated in accordance with generally accepted

accounting principles, or GAAP, with the most directly comparable

financial measure calculated in accordance with GAAP. � (1A) The

following table provides a reconciliation of year to date 2007

results as if the PDSHeart acquisition had been completed as of

January 1, 2007. � � Six Months Ended � (unaudited) � June 30, 2007

� Total Revenue � GAAP $ 28,519 PDSHeart Revenue prior to

acquisition � January 1 to March 7, 2007 � 4,069 � Adjusted Revenue

$ 32,588 � Total Gross Profit � GAAP $ 18,776 PDSHeart Gross Profit

prior to acquisition � January 1 to March 7, 2007 � 2,423 �

Adjusted Gross Profit $ 21,199 � Adjusted Gross Profit % 65.0 % � �

(1B) The following tables reconcile certain financial measures used

in this press release that were not calculated in accordance with

GAAP. � � Three Months Ended � (unaudited) � June 30, 2008 � June

30, 2007 Operating Income (Loss) � GAAP $ 2,537 $ (1,010 )

Integration, Restructuring and Other Nonrecurring Charges(a) � 610

� � - � Adjusted Operating Income (Loss) $ 3,147 � $ (1,010 ) � Net

Income (Loss) available to common shareholders � GAAP $ 1,632 $

(3,466 ) Dividends on and accretion of mandatorily redeemable

convertible preferred stock which converted to common stock in the

first quarter of 2008 � - � � 2,362 � Net Income (Loss) � GAAP $

1,632 $ (1,104 ) Integration, Restructuring and Other Nonrecurring

Charges (net of income taxes of $255) (a) � 355 � � - � Adjusted

Net Income (Loss) $ 1,987 � $ (1,104 ) � Diluted Earnings (Loss)

per Share � GAAP $ 0.07 $ (1.13 ) � Dividends on and accretion of

mandatorily redeemable convertible preferred stock which converted

to common stock in the first quarter of 2008 and Integration,

Restructuring and Other Nonrecurring Charges per Share (a) � 0.01 �

� 0.77 � Adjusted Diluted Earnings (Loss) per Share $ 0.08 � $

(0.36 ) � � (a) In the second quarter of 2008, we incurred $0.6

million of integration and restructuring charges. � � Six Months

Ended � (unaudited) � June 30, 2008 � June 30, 2007 Operating

Income (Loss) � GAAP $ 1,853 $ (3,211 ) Integration, Restructuring

and Other Nonrecurring Charges(a) � 1,916 � � - � Adjusted

Operating Income (Loss) $ 3,769 � $ (3,211 ) � Net Income (Loss)

available to common shareholders � GAAP $ (1,305 ) $ (7,103 )

Dividends on and accretion of mandatorily redeemable convertible

preferred stock which converted to common stock in the first

quarter of 2008 � 2,597 � � 2,844 � Net Income (Loss) � GAAP $

1,292 $ (4,258 ) Integration, Restructuring and Other Nonrecurring

Charges (net of income taxes of $807) (a) � 1,109 � � - � Adjusted

Net Income (Loss) $ 2,401 � $ (4,258 ) � Diluted Earnings (Loss)

per Share � GAAP $ (0.10 ) $ (2.35 ) � Dividends on and accretion

of mandatorily redeemable convertible preferred stock which

converted to common stock in the first quarter of 2008 and

Integration, Restructuring and Other Nonrecurring Charges per Share

(a) � 0.21 � � 0.94 � Adjusted Diluted Earnings (Loss) per Share $

0.11 � $ (1.41 ) � � (a)�For the six month period ending June 30,

2008, we incurred $0.9 million of integration and restructuring

expense and $1.0 million of expense related to the resolution of

litigation. �

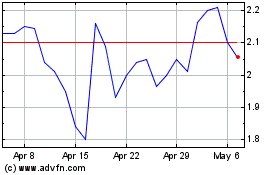

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jun 2024 to Jul 2024

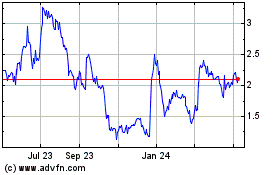

HeartBeam (NASDAQ:BEAT)

Historical Stock Chart

From Jul 2023 to Jul 2024