Current Report Filing (8-k)

October 07 2020 - 4:41PM

Edgar (US Regulatory)

false000004608000000460802020-10-052020-10-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 5, 2020

Hasbro, Inc.

(Exact name of registrant as specified in its charter)

Registrant’s telephone number, including area code: (401) 431-8697

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

☐ Written communications pursuant to Rule 425

under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to

Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to

Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act.

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the

Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period provided pursuant to Section

13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

On October 5th, 2020, Hasbro, Inc. (the “Company”) and John A. Frascotti entered into a Transitional Advisory Services Agreement (the

“Transition Agreement”). The Transition Agreement provides that Mr. Frascotti will retire from his position as President and Chief Operating Officer of the Company when the term of his August 1, 2018 Employment Agreement (the “Prior Agreement”)

expires on March 31, 2021. Pursuant to the Transition Agreement, Mr. Frascotti will serve as a special advisor to the Company for a one-year term running from April 1, 2021 through April 1, 2022. Mr. Frascotti will serve out the remainder of his

current one-year term as a member of the Board of Directors of the Company, but will not stand for re-election at the Company’s 2021 annual meeting of shareholders expected to be held in May 2021.

The terms of the Prior Agreement will continue in effect until March 31, 2021 (the “Prior Agreement End Date”), including any terms

relating to compensation, bonuses (including for fiscal year 2020, which bonus will be determined and settled in accordance with the Company’s 2014 senior management annual incentive plan) and benefits thereunder. If Mr. Frascotti’s employment

terminates before the Prior Agreement End Date, any rights and obligations upon such termination will be governed by the Prior Agreement, as described in the Company’s Annual Proxy Statement, filed with the SEC on April 1, 2020, and the provisions

of the Transition Agreement relating to employment during the Term (defined below) will not become effective.

Service under the Transition Agreement

Under the Transition Agreement, commencing April 1, 2021 and running through the April 1, 2022 expiration date, or any earlier date of

termination (the “Term”), Mr. Frascotti will assist in providing an orderly transition of his responsibilities and duties through continuation of his employment as a special advisor reporting to the Chief Executive Officer of the Company. During

the Term, Mr. Frascotti will generally continue to receive the same compensation and benefits he received as President and Chief Operating Officer, including his base salary and annual long-term incentive awards, except his annual cash bonus award

for fiscal year 2021, if earned, will be equal to 50% of the average of the bonuses he received under the Company’s bonus plan for fiscal years 2017, 2018 and 2019. During the Term, Mr. Frascotti’s long-term incentive awards, including the 2021

annual equity award, will continue to vest in accordance with their terms, and any awards that remain unvested as of the end of the Term, including after taking into account any “retirement vesting”, will be forfeited.

Except as otherwise provided in the Transition Agreement, if Mr. Frascotti’s employment is terminated on or prior to April 1, 2022 for

any reason, other than for “cause”, then, for a period of twelve (12) months commencing on Mr. Frascotti’s date of termination, the Company will pay: (i) Mr. Frascotti his base salary, payable in accordance with the Company’s customary payroll

practices; and (ii) if applicable, the Company’s portion of the premium necessary to provide Mr. Frascotti group medical and/or dental insurance under COBRA. In the event Mr. Frascotti takes or performs certain other full-time employment prior to

or during the last six months of this 12-month salary continuation period, his salary during this last six months will be subject to partial mitigation, as set forth in the Transition Agreement. In the event Mr. Frascotti’s employment as a special

advisor is terminated due to death or disability prior to the planned retirement date of April 1, 2022, Mr. Frascotti or his estate, beneficiary or legal beneficiary will continue to be paid his base salary through the planned retirement date of

April 1, 2022 and for the twelve (12) month period following such planned retirement date.

If Mr. Frascotti remains employed through April 1, 2022, then, for a period of twelve (12) months commencing on such date, the Company

will pay, without duplication, the payments described in clauses (i) and (ii) in the preceding paragraph.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

|

|

HASBRO, INC.

|

|

|

|

|

|

|

|

By:

|

/s/ Deborah Thomas

|

|

|

|

|

Name:

|

Deborah Thomas

|

|

|

|

|

Title:

|

Executive Vice President and Chief Financial Officer (Duly Authorized Officer and Principal Financial Officer)

|

|

|

|

|

|

|

Date: October 7, 2020

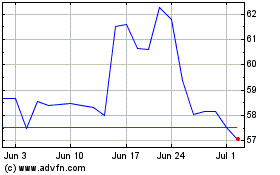

Hasbro (NASDAQ:HAS)

Historical Stock Chart

From Mar 2024 to Apr 2024

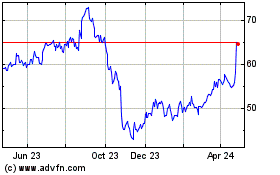

Hasbro (NASDAQ:HAS)

Historical Stock Chart

From Apr 2023 to Apr 2024