Harbor Custom Development, Inc. (Nasdaq: HCDI, HCDIP, HCDIW, HCDIZ)

(“Harbor,” “Harbor Custom Homes®,” or the “Company”), an innovative

real estate company involved in all aspects of the land development

cycle, today announced its financial results for the first quarter

ended March 31, 2023.

First Quarter

2023 Financial Highlights Compared

to First Quarter

2022

- Sales of $9.2 million compared to

$28.6 million

- Gross loss of $(2.0) million

compared to gross profit of $6.1 million

- Gross margin loss of (22.3)%

compared to gross margin 21.2%

- Net loss of $(4.9) million compared

to net income of $1.6 million

- Basic loss per share of $(9.39)

compared to basic loss per share of $(0.56)

- EBITDA loss of $(4.5) million

compared to EBITDA of $3.5 million

- Adjusted EBITDA loss of $(4.4)

million compared to Adjusted EBITDA of $3.9 million

Harbor Custom Development’s President and CEO,

Sterling Griffin stated, “Compared to last year’s quarter record

performance, our results during this first quarter were unfavorably

impacted by ongoing challenges in the broader housing market,

including higher mortgage interest rates and inflationary

pressures. We have taken and will continue to take cost control

initiatives to help navigate changing market conditions and

maintain the health of our balance sheet.”

Mr. Griffin, continued, “We are encouraged with

the progress of our multi-family projects and, the progress of our

long-term strategy. Our unique portfolio enables us to adapt to

changing demand trends in our key markets. Looking forward, as the

summer selling and rental season approaches, we are confident in

our opportunities to drive future growth and rebuild shareholder

value.”

Results for the First

Quarter 2023Sales for the first quarter

2023 decreased by (67.9)% to $9.2 million, compared to sales of

$28.6 million for the first quarter 2022. This decrease was due to

decreases in developed lots sales of $6.6 million, home sales of

$6.2 million, entitled land sales of $4.5 million, and fee build

revenue of $2.4 million, which were partially offset by $0.4

million of rental revenues earned from multi-family projects in the

first quarter 2023. The decreases in developed lots, home, and

entitled land sales were mainly due to large prior year sales in

California and Washington that did not recur in the first quarter

2023. The fee build revenue continued to decrease as the fee build

projects are nearing completion.

Gross profit (loss) for the first quarter 2023

decreased to $(2.0) million compared to $6.1 million for the first

quarter 2022. Gross margin (loss) for the first quarter 2023

decreased to (22.3)% compared to 21.2% for the first quarter 2022.

The $(8.1) million decrease in gross profit and (43.5)% decrease in

gross margin were primarily due to the non-recurrence of high

margin entitled land sales that occurred in 2022, lower margins on

home and developed lot sales in 2023, $1.6 million of impairment

loss on the Pacific Ridge, Darkhorse, and Bunker Ranch properties,

and a decrease in fee build gross profit and gross margin due to

additional cost overruns to complete Harbor’s legacy fee build

projects that are nearing completion. The entitled land sales in

the first quarter 2022 provided $3.8 million gross profit and a

gross margin of 84.1% that did not recur in the first quarter 2023.

The gross profit for home and developed lot sales, excluding

impairment charges, decreased by $1.5 million and $1.1 million,

respectively, and the related gross margins decreased to 4.2% and

approximately break-even, respectively, for the first quarter

2023.

Operating expenses for the first quarter 2023

were $2.9 million compared to $3.8 million for the first quarter

2022. The $(0.9) million decrease in operating expenses was

primarily due to Harbor’s reduction in general and administrative

costs. The majority of the savings came from reductions of

professional fees, insurance expense, depreciation, and stock

compensation expense. Operating expenses as a percentage of sales

for the first quarter 2023 were 32.0% compared to 13.4% for the

first quarter 2022. The increase in operating expenses as a

percentage of sales was primarily due to significantly lower sales

in the first quarter 2023 as compared to the first quarter 2022,

partially offset by the decrease in operating expenses for the

comparable periods.

For the first quarter 2023, net loss was $(4.9)

million compared to net income of $1.6 million for the first

quarter 2022. Net loss attributable to common stockholders for the

first quarter 2023 was $(6.8) million or $(9.39) basic loss per

share compared to net loss attributable to common stockholders of

$(0.4) million or $(0.56) basic loss per share for the first

quarter 2022.

EBITDA for the first quarter 2023 decreased from

$3.5 million in the first quarter 2022 to a loss of $(4.5) million

for the first quarter 2023. Adjusted EBITDA, which excludes the

impact of stock compensation and other non-recurring items, for the

first quarter 2023 decreased to a loss of $(4.4) million compared

to Adjusted EBITDA of $3.9 million for the first quarter 2022. For

the first quarter 2023, Adjusted EBITDA loss as a percentage of

sales was (48.3)% compared to 13.6% Adjusted EBITDA as a percentage

of sales for the first quarter 2022.

Financial Results Conference Call

Details

Harbor will host a conference call on Monday,

May 15, 2023, at 9:30 a.m. PT (12:30 p.m. ET) to elaborate on the

first quarter results. The public may access the conference call

through an audio webcast available at

https://investors.harborcustomdev.com/events, or by telephone at

1-877-407-0789 (for international callers, dial 1-201-689-8562),

and refer to “Harbor,” “Harbor Custom Development,” or conference

ID: 13738285. A replay of the conference call will be available for

two weeks at 1-844-512-2921 (for international callers, dial

1-412-317-6671) using the replay PIN: 13738285.

About Harbor Custom Development,

Inc.Harbor Custom Development, Inc. is a real estate

development company involved in all aspects of the land development

cycle including land acquisition, entitlements, construction of

project infrastructure, home and apartment building, marketing, and

sales of various residential projects in Western Washington’s Puget

Sound region; Sacramento, California; Austin, Texas; and Punta

Gorda, Florida. As a land developer and builder of apartment

buildings and single-family luxury homes, Harbor Custom

Development’s business strategy is to acquire and develop land

strategically based on an understanding of population growth

patterns, entitlement restrictions, infrastructure development, and

geo-economic forces. Harbor focuses on acquiring land with scenic

views or convenient access to freeways and public transportation to

develop and sell residential lots, new home communities, and

multi-story apartment properties within a 20- to 60-minute commute

of the nation’s fastest-growing metro employment corridors. For

more information on Harbor Custom Development, Inc., please visit

www.harborcustomdev.com.

Forward-Looking StatementsThis

press release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. These statements relate

to, but are not limited to, expectations of future operating

results and financial performance, including GAAP and non-GAAP

guidance, and the calculation of certain of our key financial and

operating metrics, as well as assumptions relating to the

foregoing. Forward-looking statements are inherently subject to

risks and uncertainties, some of which cannot be predicted or

quantified. In some cases, you can identify forward-looking

statements by terminology such as “may,” “should,” “could,”

“expect,” “plan,” anticipate,” “believe,” “estimate, “predict,”

“target,” “project,” “intend,” “potential,” “would,” “continue,”

“ongoing,” or the negative of these terms or other comparable

terminology that concerns our expectations, strategy, priorities,

plans, or intentions. You should not put undue reliance on any

forward-looking statements. Forward-looking statements should not

be read as guarantees of future performance or results and will not

necessarily be accurate indications of the times at or by which

such performance or results may be achieved, if at all. These

forward-looking statements are subject to various risks and

uncertainties, including without limitation, changes in the real

estate industry such as continued increases in mortgage interest

rates or recessionary pressures in the local or national economies

where we operate which could dampen residential home purchases, as

well as those risks and uncertainties set forth in the Company’s

filings with the Securities and Exchange Commission. Thus, actual

results could be materially different. This document includes

statements of summarized financial projections. There will be

differences between any projected and actual results because events

and circumstances frequently do not occur as expected and those

differences may be material. The Company expressly disclaims any

obligation to update or alter statements whether as a result of new

information, future events, or otherwise, except as required by

law.

Use of Non-GAAP Financial

MeasuresThis press release and the financial information

contained herein include EBITDA, Adjusted EBITDA, and Adjusted

EBITDA margin, which are financial measures that have not been

calculated in accordance with accounting principles generally

accepted in the United States, (GAAP), and are therefore referred

to as non-GAAP financial measures. We have provided definitions for

these non-GAAP financial measures and tables in the schedules

hereto to reconcile these non-GAAP financial measures to the

comparable GAAP financial measures.

We believe that these non-GAAP financial

measures provide valuable information regarding our earnings and

business trends by excluding specific items that we believe are not

indicative of the ongoing operating results of our business,

providing a useful way for investors to make a comparison of our

performance over time and against other companies in our

industry.

We have provided these non-GAAP financial

measures as supplemental information to our GAAP financial measures

and believe these non-GAAP measures provide investors with

additional meaningful financial information regarding our operating

performance and cash flows. Our management and board of directors

also use these non-GAAP measures as supplemental measures to

evaluate our business and the performance of management, including

the determination of performance-based compensation, to make

operating and strategic decisions, and to allocate financial

resources. We believe that these non-GAAP measures also provide

meaningful information for investors and securities analysts to

evaluate our historical and prospective financial performance.

These non-GAAP measures should not be considered a substitute for

or superior to GAAP results. Furthermore, the non-GAAP measures

presented by us may not be comparable to similarly titled measures

of other companies.

Investor RelationsHanover

InternationalIR@harborcustomdev.com 866-744-0974

|

|

|

HARBOR CUSTOM DEVELOPMENT, INC. AND

SUBSIDIARIES |

|

D/B/A HARBOR CUSTOM HOMES |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

| |

|

|

|

|

| |

|

March 31, 2023 |

|

December 31, 2022 |

| |

|

(unaudited) |

|

|

| ASSETS |

|

|

|

|

|

Cash |

|

$ |

7,689,500 |

|

|

$ |

9,665,300 |

|

|

Restricted Cash |

|

|

597,600 |

|

|

|

597,600 |

|

|

Accounts Receivable, net |

|

|

1,239,600 |

|

|

|

1,707,000 |

|

|

Notes Receivable, net |

|

|

2,390,300 |

|

|

|

4,525,300 |

|

|

Prepaid Expense and Other Assets |

|

|

2,451,000 |

|

|

|

5,318,100 |

|

|

Real Estate |

|

|

217,835,900 |

|

|

|

205,478,200 |

|

|

Property and Equipment, net |

|

|

1,950,100 |

|

|

|

2,289,500 |

|

|

Right of Use Assets |

|

|

1,878,000 |

|

|

|

1,926,100 |

|

|

Deferred Tax Asset |

|

|

5,936,800 |

|

|

|

4,659,300 |

|

| TOTAL ASSETS |

|

$ |

241,968,800 |

|

|

$ |

236,166,400 |

|

| |

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’

EQUITY |

|

|

|

|

| |

|

|

|

|

| LIABILITIES |

|

|

|

|

|

Accounts Payable and Accrued Expenses |

|

$ |

13,781,400 |

|

|

$ |

14,090,700 |

|

|

Dividends Payable |

|

|

1,903,700 |

|

|

|

634,700 |

|

|

Contract Liabilities |

|

|

672,200 |

|

|

|

497,400 |

|

|

Deferred Revenue |

|

|

150,300 |

|

|

|

52,000 |

|

|

Note Payable - Insurance |

|

|

237,700 |

|

|

|

378,500 |

|

|

Revolving Line of Credit Loan, net of Unamortized Debt Discount of

$0 and $0.6 million respectively |

|

|

22,893,500 |

|

|

|

24,359,700 |

|

|

Equipment Loans |

|

|

1,300 |

|

|

|

2,057,100 |

|

|

Finance Leases |

|

|

— |

|

|

|

154,500 |

|

|

Construction Loans, net of Unamortized Debt Discount of $1.4

million and $1.9 million, respectively |

|

|

122,608,300 |

|

|

|

107,483,700 |

|

|

Construction Loans - Related Party, net of Unamortized Debt

Discount of $0.1 million and $0.1 million, respectively |

|

|

8,127,300 |

|

|

|

8,122,800 |

|

|

Right of Use Liabilities |

|

|

2,719,300 |

|

|

|

2,779,400 |

|

| TOTAL LIABILITIES |

|

|

173,095,000 |

|

|

|

160,610,500 |

|

| |

|

|

|

|

| STOCKHOLDERS’ EQUITY |

|

|

|

|

|

Preferred Stock, no par value per share, 10,000,000 shares

authorized and 3,799,799 issued and outstanding at March 31, 2023

and December 31, 2022 |

|

|

62,912,100 |

|

|

|

62,912,100 |

|

|

Common Stock, no par value per share, 50,000,000 shares authorized

and 732,245 issued and outstanding at March 31, 2023 and 718,835

issued and outstanding at December 31, 2022 |

|

|

35,704,700 |

|

|

|

35,704,700 |

|

|

Additional Paid In Capital |

|

|

1,349,700 |

|

|

|

1,266,300 |

|

|

Retained Earnings (Accumulated Deficit) |

|

|

(31,092,700 |

) |

|

|

(24,327,200 |

) |

| TOTAL STOCKHOLDERS’

EQUITY |

|

|

68,873,800 |

|

|

|

75,555,900 |

|

| |

|

|

|

|

| TOTAL LIABILITIES AND

STOCKHOLDERS’ EQUITY |

|

$ |

241,968,800 |

|

|

$ |

236,166,400 |

|

|

|

|

HARBOR CUSTOM DEVELOPMENT, INC. AND

SUBSIDIARIES |

|

D/B/A HARBOR CUSTOM HOMES |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited) |

| |

|

|

|

|

|

For the Three Months EndedMarch

31, |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

| Sales |

$ |

9,181,000 |

|

|

$ |

28,581,000 |

|

| |

|

|

|

| Cost of Sales |

|

11,225,400 |

|

|

|

22,526,300 |

|

| |

|

|

|

| Gross Profit (Loss) |

|

(2,044,400 |

) |

|

|

6,054,700 |

|

| |

|

|

|

| Operating Expenses |

|

2,935,400 |

|

|

|

3,839,300 |

|

| |

|

|

|

| Operating Income (Loss) |

|

(4,979,800 |

) |

|

|

2,215,400 |

|

| |

|

|

|

| Other Income (Expense) |

|

|

|

|

Interest Expense |

|

(1,207,100 |

) |

|

|

(124,500 |

) |

|

Interest Income |

|

72,900 |

|

|

|

55,000 |

|

|

Loss on Sale of Equipment |

|

(36,200 |

) |

|

|

— |

|

|

Other Income |

|

10,900 |

|

|

|

7,900 |

|

| Total Other Expense |

|

(1,159,500 |

) |

|

|

(61,600 |

) |

| |

|

|

|

| Income (Loss) Before Income

Tax |

|

(6,139,300 |

) |

|

|

2,153,800 |

|

| |

|

|

|

| Income Tax Expense

(Benefit) |

|

(1,277,500 |

) |

|

|

508,500 |

|

| |

|

|

|

| Net Income (Loss) |

$ |

(4,861,800 |

) |

|

$ |

1,645,300 |

|

| |

|

|

|

| Net Loss Attributable to

Non-controlling interests |

|

— |

|

|

|

(500 |

) |

| Preferred Dividends |

|

(1,903,700 |

) |

|

|

(2,012,500 |

) |

| |

|

|

|

| Net Loss Attributable to

Common Stockholders |

$ |

(6,765,500 |

) |

|

$ |

(366,700 |

) |

| |

|

|

|

| Loss Per Share - Basic |

$ |

(9.39 |

) |

|

$ |

(0.56 |

) |

| Loss Per Share - Diluted |

$ |

(9.39 |

) |

|

$ |

(0.56 |

) |

| |

|

|

|

| Weighted Average Common Shares

Outstanding - Basic |

|

720,618 |

|

|

|

660,038 |

|

| Weighted Average Common Shares

Outstanding - Diluted |

|

720,618 |

|

|

|

660,038 |

|

|

|

|

HARBOR CUSTOM DEVELOPMENT, INC. AND

SUBSIDIARIES |

|

D/B/A HARBOR CUSTOM HOMES |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited) |

|

|

| |

For the Three Months Ended March 31, |

|

|

|

2023 |

|

|

|

2022 |

|

| CASH FLOWS FROM OPERATING

ACTIVITIES |

|

|

|

|

Net Income (Loss) |

$ |

(4,861,800 |

) |

|

$ |

1,645,300 |

|

|

Adjustments to reconcile net income (loss) to net cash from

operating activities: |

|

|

|

|

Depreciation |

|

95,000 |

|

|

|

303,800 |

|

|

Amortization of right of use assets |

|

48,100 |

|

|

|

195,500 |

|

|

Lease incentives |

|

— |

|

|

|

260,100 |

|

|

Loss on sale of equipment |

|

36,200 |

|

|

|

— |

|

|

Provision for loss on contract |

|

23,800 |

|

|

|

— |

|

|

Impairment loss on real estate |

|

1,555,800 |

|

|

|

— |

|

|

Stock compensation |

|

83,400 |

|

|

|

242,400 |

|

|

Amortization of revolver issuance costs |

|

640,300 |

|

|

|

45,700 |

|

|

Net change in assets and liabilities: |

|

|

|

|

Accounts receivable |

|

467,300 |

|

|

|

(63,700 |

) |

|

Contract assets |

|

— |

|

|

|

(471,900 |

) |

|

Notes receivable |

|

2,135,000 |

|

|

|

(10,746,800 |

) |

|

Prepaid expenses and other assets |

|

2,689,800 |

|

|

|

691,500 |

|

|

Real estate |

|

(13,149,200 |

) |

|

|

(6,347,500 |

) |

|

Deferred tax asset |

|

(1,277,500 |

) |

|

|

(365,100 |

) |

|

Accounts payable and accrued expenses |

|

(309,500 |

) |

|

|

5,254,600 |

|

|

Contract liabilities |

|

151,000 |

|

|

|

— |

|

|

Deferred revenue |

|

98,300 |

|

|

|

78,200 |

|

|

Payments on right of use liability, net of incentives |

|

(60,100 |

) |

|

|

(123,200 |

) |

| NET CASH USED IN OPERATING

ACTIVITIES |

$ |

(11,634,100 |

) |

|

$ |

(9,401,100 |

) |

| |

|

|

|

| CASH FLOWS FROM INVESTING

ACTIVITIES |

|

|

|

|

Purchase of property and equipment |

$ |

— |

|

|

$ |

(1,042,600 |

) |

|

Proceeds on the sale of equipment |

|

128,500 |

|

|

|

— |

|

| NET CASH PROVIDED BY (USED IN)

INVESTING ACTIVITIES |

$ |

128,500 |

|

|

$ |

(1,042,600 |

) |

| |

|

|

|

| CASH FLOWS FROM FINANCING

ACTIVITIES |

|

|

|

|

Construction loans |

$ |

17,866,800 |

|

|

$ |

6,640,800 |

|

|

Payments on construction loans |

|

(3,002,300 |

) |

|

|

(6,930,800 |

) |

|

Financing fees construction loans |

|

(224,800 |

) |

|

|

(577,500 |

) |

|

Related party construction loans |

|

— |

|

|

|

3,757,300 |

|

|

Payments on related party construction loans |

|

— |

|

|

|

(3,838,700 |

) |

|

Financing fees related party construction loans |

|

(75,000 |

) |

|

|

— |

|

|

Revolving line of credit loan |

|

— |

|

|

|

12,038,900 |

|

|

Payments on revolving line of credit loan |

|

(2,106,500 |

) |

|

|

— |

|

|

Financing fees revolving line of credit loan |

|

— |

|

|

|

(1,097,700 |

) |

|

Payments on note payable - insurance |

|

(163,000 |

) |

|

|

(384,500 |

) |

|

Payments on equipment loans |

|

(2,055,900 |

) |

|

|

(471,000 |

) |

|

Payments on financing leases |

|

(74,800 |

) |

|

|

(43,500 |

) |

|

Preferred dividends |

|

(634,700 |

) |

|

|

(2,012,500 |

) |

|

Proceeds from exercise of stock options |

|

— |

|

|

|

8,600 |

|

| NET CASH PROVIDED BY FINANCING

ACTIVITIES |

$ |

9,529,800 |

|

|

$ |

7,089,400 |

|

| |

|

|

|

| NET DECREASE IN CASH AND

RESTRICTED CASH |

|

(1,975,800 |

) |

|

|

(3,354,300 |

) |

| |

|

|

|

| CASH AND RESTRICTED CASH AT

BEGINNING OF PERIOD |

|

10,262,900 |

|

|

|

26,226,800 |

|

| |

|

|

|

| CASH AND RESTRICTED CASH AT

END OF PERIOD |

$ |

8,287,100 |

|

|

$ |

22,872,500 |

|

|

|

|

HARBOR CUSTOM DEVELOPMENT, INC. AND

SUBSIDIARIES |

|

D/B/A HARBOR CUSTOM HOMES |

|

RECONCILIATION OF NET INCOME TO EBITDA AND ADJUSTED EBITDA

(Unaudited) |

| |

|

|

|

| |

For the Three Months EndedMarch

31, |

|

|

|

2023 |

|

|

|

2022 |

|

| |

|

|

|

| Net Income (Loss) |

$ |

(4,861,800 |

) |

|

$ |

1,645,300 |

|

| |

|

|

|

| Interest Expense - Cost of

Sales |

|

310,700 |

|

|

|

922,700 |

|

| Interest Expense - Other |

|

1,207,100 |

|

|

|

124,500 |

|

| Depreciation |

|

95,000 |

|

|

|

303,800 |

|

| Amortization |

|

2,400 |

|

|

|

800 |

|

| Tax Expense (Benefit) |

|

(1,277,500 |

) |

|

|

508,500 |

|

| EBITDA |

$ |

(4,524,100 |

) |

|

$ |

3,505,600 |

|

| |

|

|

|

| Stock compensation |

|

83,400 |

|

|

|

242,400 |

|

| Other non-recurring costs |

|

5,000 |

|

|

|

150,200 |

|

| Total Add backs |

|

88,400 |

|

|

|

392,600 |

|

| Adjusted EBITDA |

$ |

(4,435,700 |

) |

|

$ |

3,898,200 |

|

EBITDA is defined as consolidated net income

(loss) before interest, taxes, depreciation, and amortization.

Adjusted EBITDA is defined as consolidated net

income (loss) before interest, taxes, depreciation, and

amortization, equity-based compensation expense and other

non-recurring costs, which are primarily related to restructuring

costs, that are deemed to be transitional in nature or not related

to the Company’s core operations.

Adjusted EBITDA margin is Adjusted EBITDA as a

percentage of sales.

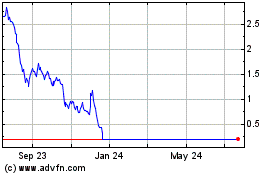

Harbor Custom Development (NASDAQ:HCDI)

Historical Stock Chart

From Dec 2024 to Jan 2025

Harbor Custom Development (NASDAQ:HCDI)

Historical Stock Chart

From Jan 2024 to Jan 2025