HOLX Provides Gen-Probe Deal Update - Analyst Blog

July 12 2012 - 1:51PM

Zacks

Hologic (HOLX), a prominent player in the field

of women’s health, provided an update on the pending acquisition of

Gen-Probe (GPRO), which is expected to close in

August. The company announced that Carl Hull, Chairman and CEO of

Gen-Probe, will continue as the Senior Vice President and General

Manager of the combined company's Diagnostics business for a

minimum time frame of 15 months.

Also, the integration process is currently making progress as

per the companies. Hologic has also issued $750 million of senior

notes due 2020, which will be used to finance the Gen-Probe

acquisition. The company currently has $3.05 billion of credit

facility in place, including $2.75 billion term loan facility and a

$300 million revolving credit facility.

It is expected that the proposed acquisition of Gen-Probe will

prove to be valuable for Hologic over the long-term. With 61% of

revenues from molecular diagnostics and 35% from blood testing,

Gen-Probe is a prominent player in molecular diagnostics products

and services that are used primarily to diagnose human diseases,

screen donated human blood, and helps ensure transplant

compatibility.

Hologic will also have access to Gen-Probe's molecular

diagnostic platforms of Tigris and Panther. Gen-Probe has a wide

portfolio of tests, including the Aptima franchise used to detect

common sexually transmitted diseases, certain high-risk strains of

the HPV, and trichomonas products.

We believe the combined company will be well placed to augment

in the molecular diagnostics space with special focus on the

women’s health segment based on an attractive portfolio, wide

marketing and distribution network, and continued investment in

R&D.

Preliminary Third Quarter Fiscal 2012

Results

Along with the update on the Gen-Probe deal, the company also

announced its preliminary results for the third quarter of fiscal

2012.

Hologic will report revenues of approximately $470 million in

the third quarter, up 4.2% year over year but lower than the

current Zacks Consensus Estimate of $477 million. Adjusted net

income should be in the range of $90−$93 million ($85.7 million in

the prior-year quarter) resulting in adjusted EPS of 34−35 cents

(32 cents in the year-ago quarter), almost in line with the Zacks

Consensus Estimate.

Hologic also reaffirmed the low-end of its 2012 revenue guidance

of $1.9 billion and adjusted EPS range of $1.36−$1.38.

The company recorded robust growth in shift of orders from 2D

digital mammography systems to its new Dimensions 3D breast

tomosynthesis systems. In addition, Hologic has reached over 45% of

its goal of placing 500−700 3D systems in US within two years of

launch and is on track to achieve the 60% level by the end of the

current fiscal.

We have a Neutral recommendation on Hologic. The stock retains a

Zacks #3 Rank (Hold) in the short-term.

GEN-PROBE INC (GPRO): Free Stock Analysis Report

HOLOGIC INC (HOLX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

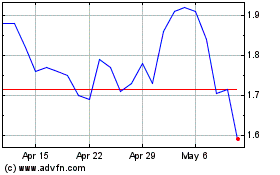

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jun 2024 to Jul 2024

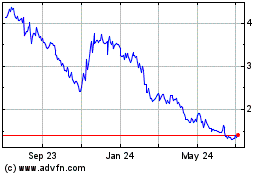

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jul 2023 to Jul 2024