Earnings Scorecard: Hologic - Analyst Blog

May 10 2012 - 10:30AM

Zacks

Following the announcement of

Hologic’s (HOLX) second quarter of fiscal 2012

results and the proposed acquisition of Gen-Probe

(GPRO) on April 30 2012, analysts have lowered their estimates for

the forthcoming quarters.

Previous Quarter

Highlights

Hologic reported a loss per share

of 15 cents in the second quarter of fiscal 2012 compared with

earnings per share (“EPS”) of 31 cents in the year-ago period.

After taking into account certain one-time items in both the

periods, adjusted EPS came in at 33 cents, in line with the Zacks

Consensus Estimate and ahead of the year-ago quarter’s 30 cents.

Among several adjustments, adjusted EPS in the reported quarter

excludes charges of $18.3 million related to the write-off of

certain assets as a result of the company's decision to cease

commercialization of Adiana. The decision to discontinue

Adiana was taken as it was not found to be commercially viable.

Revenues were $471.2 million, an

increase of 7.4% year over year driven by growth across all

segments. However, revenues were short of the Zacks Consensus

Estimate of $474 million and came in on the lower end of the

company’s guidance of $470–$475 million.

Hologic also announced its decision

to acquire all outstanding shares of Gen-Probe, a player in the

field of molecular diagnostics, for $82.75 per share in cash, or a

total enterprise value of approximately $3.7 billion. The deal will

be funded through available cash and additional financing of term

loans.

Hologic provided its guidance for

the third quarter of fiscal 2012. For the said quarter, the company

expects to report $475−$480 million of revenues (representing

annualized growth of 5−6%) resulting in adjusted EPS of 34 cents, a

penny short of the then Zacks Consensus Estimate. The revenue

estimate was behind the consensus estimate of $482 million. For

fiscal 2012, Hologic still expects to report revenues of

$1.9−$1.925 billion (growth of 6−8%) and adjusted EPS of

$1.36−$1.38.

For a full coverage on the

earnings, read: Hologic Incurs Loss, Eyes Gen-Probe

Agreement of

Analysts

The brokerage community seems to be

apprehensive of Hologic’s merger plans with Gen-Probe citing

integration issues that can emerge in big M&A deals. Over the

last 30 days, 9 of the 18 analysts covering the stock have lowered

their estimates for the third quarter of fiscal 2012, with no

positive revisions. For the current fiscal, 6 analysts have lowered

their estimates with only one upward revision. Although Hologic

expects the combined company to yield $75 million in cost synergies

within three years, no further details were provided.

Another area of concern is the high

leverage, which now stands at 5.3. Hologic however expects to

utilize strong cash flow from operations, of the combined company,

to bring down the leverage to the pre-transaction debt level within

three years. However, if sales of the new products fail to meet

estimates, the company’s performance will be adversely

affected.

Magnitude of Estimate

Revisions

Based on negative revision trends,

the consensus estimate for the third quarter has dropped by a penny

to 34 cents in the past 30 days. The consensus estimate for fiscal

2012 also declined by a penny to $1.37 over the last 30 days,

indicative of market pessimism surrounding several issues related

to the Gen-Probe deal.

Neutral on

Hologic

Offering a wide range of products,

Hologic has become an industry giant in the field of women’s

health. Moreover, the proposed acquisition of Gen-Probe will bring

with it a strong molecular diagnostics segment with special focus

on women’s health. Besides, the company will have access to

Gen-Probe's molecular diagnostic platforms of Tigris and Panther

systems along with a wide portfolio of tests. While the deal should

add value over the long term, the company would come up against

several near-term challenges.

Sales of Dimensions continued to

gain traction and are expected to be an important growth driver for

the Breast Health segment. Given the current status (35%

accomplished till date and targeting 60% at the end of the current

fiscal), the company is confident of being able to achieve the

target of placing 500-700 3D systems in the US within the first two

years of approval. While we are concerned with Hologic

discontinuing Adiana, we are encouraged by the reiteration of the

2012 guidance.

Over the long term, we have a

Neutral recommendation on Hologic. The stock remains a Zacks #3

Rank (Hold) in the short term.

About Earnings Estimate

Scorecard

As a PhD from MIT, Len Zacks

proved over 30 years ago that earnings estimate revisions are the

most powerful force impacting stock prices. He turned this ground

breaking discovery into two of the most celebrating stock rating

systems in use today. The Zacks Rank for stock trading in a 1 to 3

month time horizon and the Zacks Recommendation for long-term

investing (6+ months). These “Earnings Estimate Scorecard” articles

help analyze the important aspects of estimate

revisionsfor each stock after their quarterly earnings

announcements. Learn more about earnings estimates and our proven

stock ratings at

http://www.zacks.com/education/

GEN-PROBE INC (GPRO): Free Stock Analysis Report

HOLOGIC INC (HOLX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

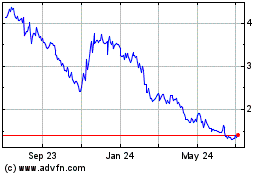

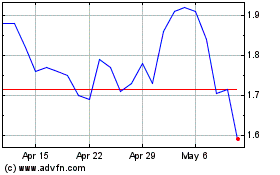

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jun 2024 to Jul 2024

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jul 2023 to Jul 2024