Hologic Incurs Loss, Eyes Gen-Probe - Analyst Blog

May 01 2012 - 8:00AM

Zacks

Hologic (HOLX)

reported a loss per share of 15 cents in the second quarter of

fiscal 2012 compared with earnings per share (“EPS”) of 31 cents in

the year-ago period. After taking into account certain one-time

items in both the periods, adjusted EPS came in at 33 cents, in

line with the Zacks Consensus Estimate and ahead of the year-ago

quarter’s 30 cents. Among several adjustments, adjusted EPS in the

reported quarter excludes charges of $18.3 million related to the

write-off of certain assets as a result of the company's decision

to cease commercialization of Adiana.

Revenues were $471.2 million, an

increase of 7.4% year over year driven by growth across all

segments. However, revenues were short of the Zacks Consensus

Estimate of $474 million and came in on the lower end of the

company’s guidance of $470–$475 million.

The company decided on

discontinuing Adiana because it found the product commercially not

viable. Instead Hologic preferred to focus on its core products.

The company also resolved the patent infringement litigation with

Conceptus (CPTS) by discontinuing Adiana in return

for the latter forgoing the $18.8 million jury award. In addition

to Hologic granting Conceptus a license to intellectual property

related to Adiana, the two companies have also agreed to dismiss

the false patent marking case between them.

Gen-Probe

Acquisition

In a separate statement, Hologic

announced that it has decided to acquire all outstanding shares of

Gen-Probe (GPRO), a player in the field of

molecular diagnostics, for $82.75 per share in cash, or a total

enterprise value of approximately $3.7 billion. The offer price

represents a 20% premium over Gen-Probe’s closing price on Friday.

The deal will be funded through available cash and additional

financing of term loans. The company exited the second quarter with

$855 million of cash and cash equivalents.

The transaction, to be completed in

the second half of calendar 2012, is expected to be accretive to

Hologic’s adjusted EPS by 20 cents in the first year after closure.

Apart from boosting both the top and the bottom line, the deal

would yield $75 million in cost synergies within three years. The

combined company will use its strong free cash flow to repay

outstanding debt.

Segments

Hologic operates through four

segments − Breast Health, Diagnostics, GYN (Gynecology) Surgical

and Skeletal Health − each contributing a corresponding 46.4%,

32.2%, 16.4% and 5% to total revenue during the quarter. These

segments recorded robust growth of 6.2% year over year (to $218.6

million), 9.8% ($151.8 million), 8% ($77.2 million) and 2% ($23.5

million), respectively.

The upside at the Breast Health

segment was driven by a shift in sales from Selenia to Dimensions,

sales of breast biopsy products led by Eviva and to a lesser extent

an increase in the total number of digital mammography systems

sold. In addition, a 7.1% rise in service revenue related to

Hologic’s increased installed base of digital mammography systems

also contributed to growth.

Growth at the Diagnostic segment

was driven by higher ThinPrep revenues and growth in sales of

molecular diagnostics products. Besides, incremental ThinPrep

revenue from the TCT acquisition is on an uptrend with $8.2 million

in the reported quarter, up from $7.3 million during the last

quarter.

The increase in GYN Surgical

revenues was primarily due to higher sales from MyoSure, partially

offset by lower sales of the NovaSure system and to a lesser

extent, Adiana. The increase in Skeletal Health revenues emanated

from higher sales of bone densitometry units, partially offset by a

decline in Mini C-Arm product sales.

In the recent past, Hologic has

received some significant product approvals. These include 510k

clearance for Aquilex fluid control system, which reduces procedure

and anesthesia time while providing high quality visualization to

the surgeon during hysteroscopy procedures. The company’s GYN

surgical sales force is working on its penetration in the US

market.

Besides, Hologic has begun

commercializing its C-View synthesized 2D image reconstruction

algorithm for 3D mammography exams in Europe following the receipt

of CE Mark approval in November 2011. The company is gradually

strengthening its presence in China with the commercialization of

Serenity digital mammography system and Cervista HPV HR tests in

the second quarter.

Guidance

Hologic provided its guidance for

the third quarter of fiscal 2012. For the said quarter, the company

expects to report $475−$480 million of revenues (representing

annualized growth of 5−6%) resulting in adjusted EPS of 34 cents, a

penny short of the current Zacks Consensus EPS Estimate. The

current Zacks Consensus revenue estimate stands at $482 million.

For fiscal 2012, Hologic still expects to report revenues of

$1.9−$1.925 billion (growth of 6−8%) while the adjusted EPS

guidance was raised by a penny at both ends to $1.36−$1.38.

Recommendation

Though the company reported an

uninspiring second quarter, the announcement of the Gen-Probe

acquisition was significant. If the deal goes through, the combined

company will become a prominent player in the HPV business, which

has players like Qiagen (QGEN). However, an

increasing debt burden along with higher interest expense will

adversely affect the bottom line. We are also disappointed with the

company’s decision to discontinue the Adiana system. The stock

retains a Zacks #4 Rank (“Sell”) in the short term.

Offering a wide range of products,

Hologic has become an industry giant in the field of women’s health

products. The proposed acquisition will further strengthen its

position in this field. We are also encouraged by the recent

product approvals, which should help the company in recording

higher sales going forward. Over the long term, we are Neutral on

Hologic.

CONCEPTUS INC (CPTS): Free Stock Analysis Report

GEN-PROBE INC (GPRO): Free Stock Analysis Report

HOLOGIC INC (HOLX): Free Stock Analysis Report

QIAGEN NV (QGEN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

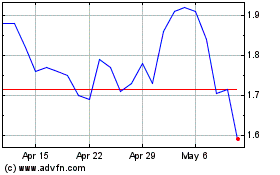

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jun 2024 to Jul 2024

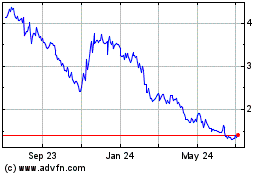

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jul 2023 to Jul 2024