-- Company Posts Non-GAAP EPS of $0.51(1), Excluding $0.02 of

Expenses Related to Tepnel Acquisition -- SAN DIEGO, April 30

/PRNewswire-FirstCall/ -- Gen-Probe Incorporated (NASDAQ:GPRO)

today reported financial results for the first quarter of 2009,

including non-GAAP earnings per share (EPS) of $0.51. "Gen-Probe

posted good financial results in the first quarter of 2009,

highlighted by a new record in clinical diagnostics product sales,

despite significant foreign exchange headwinds," said Henry L.

Nordhoff, the Company's chairman and chief executive officer. "In

recent weeks, we also completed our Tepnel acquisition and decided

to begin a U.S. clinical trial of our PCA3 prostate cancer test,

both of which we expect to drive future growth." As expected, total

revenues and net income declined in the first quarter of 2009

compared to the prior year period because the Company recorded

$16.4 million of revenue from Bayer in the first quarter of 2008.

This non-recurring revenue, which added $0.20 to EPS in the prior

year period, represented the third and final payment due to

Gen-Probe in connection with the 2006 settlement of the companies'

patent infringement litigation. In the first quarter of 2009,

product sales were $112.5 million, compared to $101.5 million in

the prior year period, an increase of 11%. Compared to the first

quarter of 2008, the stronger U.S. dollar reduced product sales

growth by an estimated 4%. Total revenues for the first quarter of

2009 were $116.2 million, compared to $122.6 million in the prior

year period, a decrease of 5%. Net income was $27.0 million ($0.51

per share) on a non-GAAP basis in the first quarter of 2009,

compared to $31.9 million ($0.58 per share) on a GAAP basis in the

prior year period, a decrease of 15% (12% per share). Gen-Probe's

non-GAAP results for the first quarter of 2009 exclude $1.6 million

($0.02 per share) of expenses related to the Company's acquisition

of Tepnel. Including these expenses, and on a GAAP basis, net

income in the first quarter of 2009 was $25.7 million ($0.48 per

share). Detailed Results Gen-Probe's clinical diagnostics sales in

the first quarter of 2009 benefited from continued growth of the

APTIMA Combo 2(R) assay, an amplified nucleic acid test (NAT) for

simultaneously detecting Chlamydia trachomatis (CT) and Neisseria

gonorrhoeae (GC). Sales of this assay increased based on market

share gains on both the Company's semi-automated instrument

platform and on the high-throughput, fully automated TIGRIS(R)

system. Revenue from the PACE(R) product line, the Company's

non-amplified tests for the same microorganisms, declined in the

first quarter compared to the prior year period, in line with

Gen-Probe's expectations. Clinical diagnostics sales also were

negatively affected by the stronger U.S. dollar, which reduced

growth by an estimated 2% compared to the prior year period. In

blood screening, product sales in the first quarter of 2009

benefited from $8.2 million of one-time revenue associated with the

previously announced renegotiation of the Company's collaboration

agreement with Novartis Vaccines and Diagnostics. Novartis markets

the collaboration's blood screening products worldwide. This

benefit was largely offset, however, by the stronger U.S. dollar,

which reduced growth by an estimated $2.9 million, or 6%; by $3.9

million of reduced instrument sales to Novartis due to the timing

of orders; and by $1.3 million of lower West Nile virus assay

shipments due to ordering patterns. Product sales were, in

millions: Three Months Ended March 31, Change 2009 2008 Reported

Constant Currency Clinical diagnostics $59.6 $52.5 14% 16% Blood

screening $52.9 $49.0 8% 14% Total product sales $112.5 $101.5 11%

15% Collaborative research revenues for the first quarter of 2009

were $1.7 million, compared to $2.5 million in the prior year

period, a decrease of 32% that resulted primarily from two factors:

lower reimbursement from Novartis of shared development expenses in

the companies' blood screening collaboration; and the absence of

reimbursement from 3M resulting from the termination of the

companies' collaboration regarding healthcare-associated

infections. Royalty and license revenues for the first quarter of

2009 were $2.0 million, compared to $18.6 million in the prior year

period. As discussed, this significant decrease resulted primarily

from $16.4 million of revenue from Bayer that was recorded in the

prior year period. This revenue represented the third and final

payment due in connection with the 2006 settlement of the

companies' patent infringement litigation. Gross margin on product

sales in the first quarter of 2009 was 70.4%, compared to 67.8% in

the prior year period. This improvement resulted primarily from the

renegotiated blood screening agreement with Novartis, increased

sales of APTIMA(R) assays, and lower instrument sales. These

benefits were offset in part by the stronger U.S. dollar and by

unfavorable manufacturing variances. Research and development

(R&D) expenses in the first quarter of 2009 were $25.0 million,

compared to $23.1 million in the prior year period, an increase of

8%. This increase resulted primarily from costs associated with

U.S. clinical trials of the investigational APTIMA(R) human

papillomavirus (HPV) assay and the development of a fully automated

instrument system for low- and mid-volume labs, known as PANTHER.

Marketing and sales expenses in the first quarter of 2009 were

$11.1 million, compared to $11.9 million in the prior year period,

a decrease of 7% that resulted primarily from the timing of

specific studies associated with the Company's ongoing European

market development efforts for the APTIMA Combo 2, APTIMA HPV and

PROGENSA(TM) PCA3 assays. General and administrative (G&A)

expenses in the first quarter of 2009 were $13.8 million, compared

to $11.9 million in the prior year period, an increase of 16% that

resulted primarily from $1.6 million of expenses associated with

the acquisition of Tepnel. As described above, these

transaction-related costs have been excluded from the Company's

non-GAAP results for the first quarter. Gen-Probe expects to record

additional Tepnel-related charges in the second quarter, which also

will be excluded from the Company's non-GAAP results. Total other

income in the first quarter of 2009 was $4.6 million, compared to

$5.7 million in the prior year period, a decrease of 19% that

resulted primarily from the $1.6 million gain recorded in the first

quarter of 2008 related to the Company's sale of its equity

investment in Molecular Profiling Institute. Gen-Probe continues to

have a strong balance sheet. As of March 31, 2009, the Company had

$652.6 million of cash, cash equivalents and marketable securities,

and $170.0 million outstanding under a revolving credit facility.

The Company currently pays interest on funds borrowed under the

credit facility at a floating rate 0.6 percent above the one-month

London Interbank Offered Rate (LIBOR), which was recently 0.5

percent. In the first quarter of 2009, Gen-Probe generated net cash

of $52.0 million from its operating activities, more than double

the Company's net income. The Company also repurchased

approximately 0.9 million shares of its common stock for $35.6

million during the quarter. Updated 2009 Financial Guidance "We are

updating our guidance based on our solid first-quarter performance

and our Tepnel acquisition," said Herm Rosenman, the Company's

senior vice president of finance and chief financial officer. "We

continue to expect solid growth from our STD franchise, new

products and recently acquired business, although we anticipate

that blood screening growth will be pressured by the strong dollar

and increasing competitive pressures." In the table below,

Gen-Probe's non-GAAP guidance excludes certain expenses related to

the Tepnel acquisition, namely transaction costs and the increase

in non-cash depreciation and amortization expense required under

the rules of purchase accounting. These expenses are forecast to

total between $8 million and $10 million in 2009, equating to

between ($0.10) and ($0.13) of EPS on a GAAP basis. Current Current

Guidance Previous Guidance (GAAP) Guidance (non-GAAP) (GAAP)* Total

revenues $490 to $510 $490 to $510 $460 to $490 million million

million Product gross margins 68% to 70% 68% to 70% 69% to 72%

R&D expenses 21% to 23% 21% to 23% 20% to 22% Marketing and

sales expenses 10% to 11% 11% to 12% 10% to 11% G&A expenses

10% to 11% 11% to 12% 10% to 11% Tax rate 33% to 34% 33% to 34% 34%

Diluted shares outstanding 52 million 52 million 52 to 54 million

EPS $1.85 to $2.00 $1.72 to $1.90 $1.80 to $2.05 * Did not include

revenues or expenses associated with the acquisition of Tepnel.

Recent Events -- Carl Hull Elected CEO. On March 23, Gen-Probe

announced that its board of directors had elected Carl W. Hull the

Company's new chief executive officer (CEO), effective May 18,

2009. Mr. Hull, currently the Company's president and chief

operating officer, will become CEO following the retirement of

current CEO Henry L. Nordhoff. Mr. Hull also is expected to join

the Company's board of directors at that time. -- Tepnel

Acquisition Completed. On April 8, Gen-Probe announced that the

Company had completed its acquisition of Tepnel Life Sciences plc,

a rapidly growing molecular diagnostics and pharmaceutical services

company based in the United Kingdom. The acquisition brings

Gen-Probe new growth opportunities in transplant diagnostics,

genetic testing and pharmaceutical services, and accelerates the

Company's European expansion strategy. -- New Credit Facility. On

March 2, Gen-Probe announced it was borrowing $170.0 million under

a newly issued credit facility to finance its pending acquisition

of Tepnel and for other general corporate purposes, including its

existing share repurchase program. The maximum amount that may be

borrowed under the facility was increased in April to $250.0

million, under which the Company has borrowed $240.0 million. --

U.S. Clinical Trial for PCA3. On April 29, Gen-Probe announced that

it intends to initiate a U.S. clinical trial for its

investigational PCA3 assay. The trial is expected to begin in the

third quarter of 2009 and take approximately a year to complete.

The Company also announced that it had amended its PCA3 license

agreement with DiagnoCure, and will acquire $5 million of newly

issued DiagnoCure convertible preferred stock. -- Victory in HPV

Arbitration. On April 1, Gen-Probe announced that the Company,

along with its co-respondents F. Hoffmann-La Roche Ltd. and Roche

Molecular Systems, Inc., had prevailed in its arbitration with

Digene (now Qiagen) concerning the Company's supply and purchase

agreement with Roche for HPV products. Webcast Conference Call A

live webcast of Gen-Probe's first quarter 2009 conference call for

investors can be accessed at http://www.gen-probe.com/ beginning at

4:30 p.m. Eastern Time today. The webcast will be archived for at

least 90 days. A telephone replay of the call also will be

available for approximately 24 hours. The replay number is

866-454-1437 for domestic callers and 203-369-1239 for

international callers. About Gen-Probe Gen-Probe Incorporated is a

global leader in the development, manufacture and marketing of

rapid, accurate and cost-effective nucleic acid tests (NATs) that

are used primarily to diagnose human diseases and screen donated

human blood. Gen-Probe has more than 25 years of NAT expertise, and

received the 2004 National Medal of Technology, America's highest

honor for technological innovation, for developing NAT assays for

blood screening. Gen-Probe is headquartered in San Diego and

employs approximately 1,200 people. For more information, go to

http://www.gen-probe.com/. Trademarks APTIMA, APTIMA COMBO 2, PACE,

PROGENSA and TIGRIS are trademarks of Gen-Probe Incorporated.

ULTRIO and PROCLEIX are trademarks of Chiron, a business unit of

Novartis Vaccines and Diagnostics. All other trademarks are the

property of their owners. About Non-GAAP Financial Measures To

supplement Gen-Probe's financial results for the first quarter of

2009 and its updated 2009 financial guidance, in each case

presented in accordance with GAAP, Gen-Probe uses the following

financial measures defined as non-GAAP by the SEC: non-GAAP net

income, non-GAAP G&A expenses, non-GAAP effective income tax

rate, and non-GAAP EPS. Gen-Probe's management does not itself, nor

does it suggest that investors should, consider such non-GAAP

financial measures in isolation from, or as a substitute for,

financial information prepared and presented in accordance with

GAAP. Gen-Probe's management believes that these non-GAAP financial

measures provide meaningful supplemental information regarding the

Company's performance by excluding certain expenses that may not be

indicative of core business results. Gen-Probe believes that both

management and investors benefit from referring to these non-GAAP

financial measures in assessing Gen-Probe's performance and when

planning, forecasting and analyzing future periods. These non-GAAP

financial measures also facilitate management's internal

comparisons to Gen-Probe's historical performance and our

competitors' operating results. Gen-Probe believes these non-GAAP

financial measures are useful to investors in allowing for greater

transparency with respect to supplemental information used by

management in its financial and operational decision making.

Caution Regarding Forward-Looking Statements Any statements in this

press release about our expectations, beliefs, plans, objectives,

assumptions or future events or performance, including those under

"Updated 2009 Financial Guidance," are not historical facts and are

forward-looking statements. These statements are often, but not

always, made through the use of words or phrases such as believe,

will, expect, anticipate, estimate, intend, plan and would. For

example, statements concerning Gen-Probe's financial condition,

possible or expected results of operations, regulatory approvals,

future milestone payments, growth opportunities, and plans and

objectives of management are all forward-looking statements.

Forward-looking statements are not guarantees of performance. They

involve known and unknown risks, uncertainties and assumptions that

may cause actual results, levels of activity, performance or

achievements to differ materially from those expressed or implied.

Some of these risks, uncertainties and assumptions include but are

not limited to: (i) the risk that we may not achieve our expected

2009 financial targets, (ii) the risk that we may not integrate

acquisitions such as Tepnel successfully, (iii) the possibility

that the market for the sale of our new products, such as our

TIGRIS system, PROCLEIX ULTRIO assay and PROGENSA PCA3 assay, may

not develop as expected, (iv) the enhancement of existing products

and the development of new products, including products, if any, to

be developed under our industrial collaborations, may not proceed

as planned, (v) the risk that products, including the

investigational PROGENSA PCA3 assay for which we expect to begin

clinical trials shortly, may not be approved by regulatory

authorities or commercially available in the time frame we

anticipate, or at all, (vi) the risk that we may not be able to

compete effectively, (vii) the risk that we may not be able to

maintain our current corporate collaborations and enter into new

corporate collaborations or customer contracts, (viii) our

dependence on Novartis, Siemens (as assignee of Bayer) and other

third parties for the distribution of some of our products, (ix)

our dependence on a small number of customers, contract

manufacturers and single source suppliers of raw materials, (x)

changes in third-party reimbursement policies regarding our

products could adversely affect sales of our products, (xi) changes

in government regulation affecting our diagnostic products could

harm our sales and increase our development costs, (xii) the risk

that our intellectual property may be infringed by third parties or

invalidated, and (xiii) our involvement in patent and other

intellectual property and commercial litigation could be expensive

and could divert management's attention. This list includes some,

but not all, of the factors that could affect our ability to

achieve results described in any forward-looking statements. For

additional information about risks and uncertainties we face and a

discussion of our financial statements and footnotes, see documents

we file with the SEC, including our most recent annual report on

Form 10-K and all subsequent periodic reports. We assume no

obligation and expressly disclaim any duty to update

forward-looking statements to reflect events or circumstances after

the date of this news release or to reflect the occurrence of

subsequent events. Gen-Probe Incorporated Consolidated Balance

Sheets (In thousands, except share and per share data) March 31,

December 31, 2009 2008 (unaudited) Assets Current assets: Cash and

cash equivalents $286,195 $60,122 Marketable securities 366,395

445,056 Trade accounts receivable, net of allowance for doubtful

accounts of $600 and $700 at March 31, 2009 and December 31, 2008,

respectively 35,206 33,397 Accounts receivable - other 1,886 2,900

Inventories 52,175 54,406 Deferred income tax - short term 5,965

7,269 Prepaid income tax - 2,306 Prepaid expenses 14,144 15,094

Other current assets 5,699 6,135 Total current assets 767,665

626,685 Marketable securities 32,677 - Property, plant and

equipment, net 142,799 141,922 Capitalized software, net 12,780

13,409 Goodwill 18,621 18,621 Deferred income tax - long term

12,286 12,286 Licenses, manufacturing access fees and other assets,

net 56,483 56,608 Total assets $1,043,311 $869,531 Liabilities and

stockholders' equity Current liabilities: Accounts payable $15,788

$16,050 Accrued salaries and employee benefits 19,434 25,093 Other

accrued expenses 6,239 4,027 Income tax payable 8,491 - Short-term

borrowings 170,000 - Deferred revenue - short term 1,592 1,278

Total current liabilities 221,544 46,448 Non-current income tax

payable 4,671 4,773 Deferred income tax - long term 54 55 Deferred

revenue - long term 2,167 2,333 Deferred compensation plan

liabilities 2,244 2,162 Commitments and contingencies Stockholders'

equity: Preferred stock, $0.0001 par value per share, 20,000,000

shares authorized, none issued and outstanding - - Common stock,

$0.0001 par value per share; 200,000,000 shares authorized,

52,068,633 and 52,920,971 shares issued and outstanding at March

31, 2009 and December 31, 2008, respectively 5 5 Additional paid-in

capital 353,304 382,544 Accumulated other comprehensive income

5,419 3,055 Retained earnings 453,903 428,156 Total stockholders'

equity 812,631 813,760 Total liabilities and stockholders' equity

$1,043,311 $869,531 Gen-Probe Incorporated Consolidated Statements

of Income - GAAP (In thousands, except per share data) (Unaudited)

Three Months Ended March 31, 2009 2008 Revenues: Product sales

$112,522 $101,507 Collaborative research revenue 1,675 2,459

Royalty and license revenue 1,986 18,597 Total revenues 116,183

122,563 Operating expenses: Cost of product sales 33,314 32,636

Research and development 24,998 23,066 Marketing and sales 11,055

11,908 General and administrative 13,846 11,937 Total operating

expenses 83,213 79,547 Income from operations: 32,970 43,016 Other

income/(expense) Interest income 4,882 4,207 Interest expense (151)

- Other income/(expense) (142) 1,473 Total other income, net 4,589

5,680 Income before income tax 37,559 48,696 Income tax expense

11,812 16,751 Net income $25,747 $31,945 Net income per share:

Basic $0.49 $0.59 Diluted $0.48 $0.58 Weighted average shares

outstanding: Basic 52,407 53,796 Diluted 53,126 55,023 Gen-Probe

Incorporated Consolidated Statements of Income (In thousands,

except per share data) (Unaudited) Three Months Ended Three Months

Ended March 31, 2009 March 31, 2008 Non- Adjustments GAAP Non-

Adjustments GAAP GAAP GAAP Revenues: Product sales $112,522 $ -

$112,522 $101,507 $- $101,507 Collaborative research revenue 1,675

- 1,675 2,459 - 2,459 Royalty and license revenue 1,986 - 1,986

18,597 - 18,597 Total revenues 116,183 - 116,183 122,563 - 122,563

Operating expenses: Cost of product sales 33,314 - 33,314 32,636 -

32,636 Research and development 24,998 - 24,998 23,066 - 23,066

Marketing and sales 11,055 - 11,055 11,908 - 11,908 General and

administrative 12,244 1,602 13,846 11,937 - 11,937 Total operating

expenses 81,611 1,602 83,213 79,547 - 79,547 Income from operations

34,572 (1,602) 32,970 43,016 - 43,016 Other income/ (expense)

Interest income 4,882 - 4,882 4,207 - 4,207 Interest expense (151)

- (151) - - - Other income/ (expense) (142) - (142) 1,473 - 1,473

Total other income, net 4,589 - 4,589 5,680 - 5,680 Income before

income tax 39,161 (1,602) 37,559 48,696 - 48,696 Income tax expense

12,187 (375) 11,812 16,751 - 16,751 Net income $ 26,974 $ (1,227) $

25,747 $31,945 $- $ 31,945 Net income per share: Basic $ 0.51 $

(0.02) $ 0.49 $ 0.59 $- $ 0.59 Diluted $ 0.51 $ (0.02) $ 0.48 $

0.58 $- $ 0.58 Weighted average shares outstanding: Basic 52,407

52,407 52,407 53,796 - 53,796 Diluted 53,126 53,126 53,126 55,023 -

55,023 Gen-Probe Incorporated Consolidated Statements of Income -

Non-GAAP (In thousands, except per share data) (Unaudited) Three

Months Ended March 31, 2009 2008 Revenues: Product sales $112,522

$101,507 Collaborative research revenue 1,675 2,459 Royalty and

license revenue 1,986 18,597 Total revenues 116,183 122,563

Operating expenses: Cost of product sales 33,314 32,636 Research

and development 24,998 23,066 Marketing and sales 11,055 11,908

General and administrative 12,244 11,937 Total operating expenses

81,611 79,547 Income from operations 34,572 43,016 Other

income/(expense) Interest income 4,882 4,207 Interest expense (151)

- Other income/(expense) (142) 1,473 Total other income, net 4,589

5,680 Income before income tax 39,161 48,696 Income tax expense

12,187 16,751 Net income $ 26,974 $ 31,945 Net income per share:

Basic $ 0.51 $0.59 Diluted $ 0.51 $0.58 Weighted average shares

outstanding: Basic 52,407 53,796 Diluted 53,126 55,023 Gen-Probe

Incorporated Consolidated Statements of Cash Flows (In thousands)

(Unaudited) Three Months Ended March 31, 2009 2008 Operating

activities: Net income $25,747 $31,945 Adjustments to reconcile net

income to net cash provided by operating activities: Depreciation

and amortization 8,748 8,608 Amortization of premiums on

investments, net of accretion of discounts 1,523 1,735 Stock-based

compensation charges 5,758 5,192 Stock-based compensation income

tax benefits 126 369 Excess tax benefit from stock-based

compensation (127) (145) Gain on sale of investment in Molecular

Profiling Institute, Inc. - (1,600) Changes in assets and

liabilities: Trade and other accounts receivable (784) 3,842

Inventories 2,223 (1,796) Prepaid expenses 945 3,447 Other current

assets 436 (1,161) Other long term assets (1,161) (743) Accounts

payable (219) 3,181 Accrued salaries and employee benefits (5,657)

(3,069) Other accrued expenses 2,217 965 Income tax payable 10,709

15,663 Deferred revenue 147 (45) Deferred income tax 1,305 688

Deferred rent - (10) Deferred compensation plan liabilities 82 454

Net cash provided by operating activities 52,018 67,520 Investing

activities: Proceeds from sales and maturities of marketable

securities 84,008 97,290 Purchases of marketable securities

(37,124) (181,546) Purchases of property, plant and equipment

(7,525) (20,033) Purchases of intangible assets, including licenses

and manufacturing access fees (205) (194) Proceeds from sale of

investment in Molecular Profiling Institute, Inc. - 4,100 Other

assets (13) 75 Net cash provided by (used in) investing activities

39,141 (100,308) Financing activities: Excess tax benefit from

stock-based compensation 127 145 Repurchase and retirement of

restricted stock for payment of taxes (34) (41) Repurchases of

common stock (35,627) - Proceeds from issuance of common stock 534

3,027 Borrowings under credit facility 170,000 - Net cash provided

by financing activities 135,000 3,131 Effect of exchange rate

changes on cash and cash equivalents (86) (7) Net increase

(decrease) in cash and cash equivalents 226,073 (29,664) Cash and

cash equivalents at the beginning of period 60,122 75,963 Cash and

cash equivalents at the end of period $286,195 $46,299 Michael

Watts Vice president, investor relations and corporate

communications 858-410-8673 (1) In this press release, all per

share amounts are calculated on a fully diluted basis. Non-GAAP EPS

excludes $1.6 million ($0.02) of expenses related to the Company's

acquisition of Tepnel. Some totals may not foot due to rounding.

(2) In this press release, "constant currency" revenue growth rates

assume that average foreign exchange rates in the first quarter of

2009 were equal to those in the first quarter of 2008. DATASOURCE:

Gen-Probe Incorporated CONTACT: Michael Watts, Vice president,

investor relations and corporate communications, Gen-Probe

Incorporated, +1-858-410-8673 Web Site: http://www.gen-probe.com/

Copyright

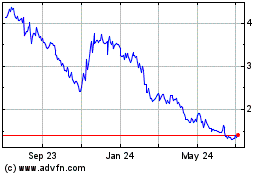

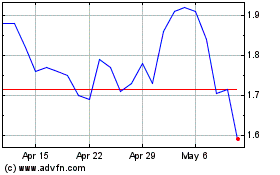

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jun 2024 to Jul 2024

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Jul 2023 to Jul 2024