EUROPE MARKETS: European Indexes Positive Amid Renewed Trade Deal Hopes; WPP Gains 8%

March 01 2019 - 5:31AM

Dow Jones News

By Emily Horton

Europe's markets were in positive territory on Friday, following

renewed hopes of a trade deal between the U.S. and China and the

latest manufacturing figures from the latter.

The German jobs markets also remained strong in February.

How are markets performing?

The Stoxx Europe 600 gained 0.6% to 375.17 on Friday after

finishing February up 4% for the month.

Meanwhile, the FTSE 100 added a similar amount on the first day

of March, rising by 0.6% to 7,119.90 after finishing the previous

month up 1.5%.

Germany's DAX (DAX) was the region's top gainer, rising by 1.1%

to 11,644.57, with France's CAC 40 and Italy's FTSE MIB index

following close behind, both adding 0.7% to 5,29.96 and 20,799.66,

respectively.

Spain's IBEX 35 rose by just under 0.7% to 9,339.10.

The British pound retracted slightly, after a week of highs, to

$1.3236 from $1.3261 late in New York on Thursday. The euro dipped

to $1.1362 from $1.1372.

What's driving the markets?

Bloomberg has reported

(http://www.marketwatch.com/story/us-china-preparing-final-trade-deal-that-could-be-signed-within-weeks-report-2019-02-28)

that U.S. officials are planning a final trade deal with China

ahead of the summit between President Donald Trump and Chinese

leader Xi Jinping in the coming weeks.

The latest Caixin manufacturing purchasing managers index -- a

private gauge of factory activity in China -- meanwhile, has come

in well ahead of forecasts

(http://www.marketwatch.com/story/china-factory-activity-rises-says-private-gauge-2019-02-28),

adding to investor optimism.

Naeem Aslam, chief market analyst at ThinkMarkets, said in a

note to clients: "A lot of this is due to the continuing optimism

about the trade war negotiations between the U.S. and China. The

deal could be around the corner, both parties are in the final

steps of completing them; in fact, they are exploring the dates for

the joint summit. This really shows that some tremendous progress

has been made."

In Germany, new data shows the labor market retained its

strength

(http://www.marketwatch.com/story/german-jobless-claims-fall-faster-than-expected-2019-03-01)in

February; the number of jobless claims declined at a faster pace

than in January and by more than analysts expected.

In the U.K. Britain's pro-Brexit politicians will reportedly

back Theresa May's EU withdrawal deal in return for her quick

departure as Prime Minister

(http://www.marketwatch.com/story/brexit-brief-theresa-may-could-secure-deal-in-return-for-early-exit-as-pm-2019-03-01),

according to The Sun.

What stocks are active?

Advertising giant WPP PLC (WPP.LN) rallied 8% on Friday, with

the group's results and outlook "broadly in line" with

expectations, according to Barclays analysts Julien Roch and Emily

Johnson. But WPP has predicted a challenging year ahead after a

tough 2018

(http://www.marketwatch.com/story/wpp-forecasts-challenging-2019-after-tough-year-2019-03-01).

Meanwhile, French luxury goods titan LVMH Moët Hennessy Louis

Vuitton SE (LVMUY) added 2%.

Among the Stoxx 600 biggest losers was Rightmove PLC(RMV.LN),

which dropped by 6% after the property website reported is slowest

profit growth in nine years, Reuters reported

(https://uk.reuters.com/article/uk-rightmove-results/rightmove-shares-fall-on-slowing-full-year-profit-growth-idUKKCN1QI419).

Man Group PLC (EMG.LN) lost 4% after the hedge-fund manger said

that

(http://www.marketwatch.com/story/man-group-says-lower-performance-fees-hits-profit-2019-03-01)lower

performance fees knocked its profit in 201

(http://www.marketwatch.com/story/man-group-says-lower-performance-fees-hits-profit-2019-03-01)8

(http://www.marketwatch.com/story/man-group-says-lower-performance-fees-hits-profit-2019-03-01).

(END) Dow Jones Newswires

March 01, 2019 05:16 ET (10:16 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

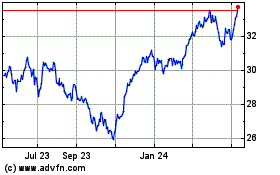

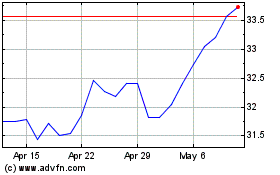

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Global X Funds Global X ... (NASDAQ:DAX)

Historical Stock Chart

From Dec 2023 to Dec 2024