Gevo, Inc. (NASDAQ: GEVO) (“Gevo”, the “Company”, “we”, “us” or

“our”) today announced financial results for the third quarter 2024

and recent corporate highlights.

Recent Corporate Highlights

- Net-Zero 1 (“NZ1”): Gevo has received a

conditional commitment for a loan guarantee with borrowing capacity

of $1.6 billion (including capitalized interest during

construction) from the U.S. Department of Energy (“DOE”) Loan

Programs Office (“LPO”) for the NZ1 project in South Dakota. We

believe this significant milestone signals the strength of the

project to finance the world’s first large-scale,

net-zero-emissions alcohol-to-jet production facility.

- Red Trail Asset Acquisition: Gevo has entered

into a definitive agreement to acquire the ethanol production and

carbon capture and sequestration (“CCS”) assets of Red Trail

Energy, LLC (“Red Trail Energy”). The Adjusted EBITDA1 from the Red

Trail Energy assets, when combined with Adjusted EBITDA1 from

Gevo’s renewable natural gas (“RNG”), Verity and other businesses,

is expected to make Gevo’s Adjusted EBITDA1 positive in 2025.

- CultivateAI Acquisition: Gevo acquired

Cultivate Agricultural Intelligence, LLC (“CultivateAI”), which

leverages drone and satellite-based imaging and GIS mapping to

generate digital inventories for agriculture and land use, for its

Verity business unit. We believe the integration of CultivateAI

into the Verity platform will provide comprehensive, highest

quality, data-driven solutions for carbon abatement in food, feed,

fuels, and industrial markets, while simultaneously helping farmers

improve their operations, sustainability, and profitability.

- Ethanol to Olefins (“ETO”) Patent: The U.S.

Patent and Trademark Office has granted to Gevo two patents for its

ETO process. This process is designed to improve the cost and

yields of drop-in, bio-based hydrocarbon fuels and chemicals from

ethanol, and adds to Gevo’s global portfolio of more than 300

patents, as well as proprietary processes and know-how concerning

processes to convert carbohydrates to hydrocarbons.

- Sale of Investment Tax Credits: Gevo announced

the sale of Investment Tax Credits, monetizing Inflation Reduction

Act (“IRA”) credits generated from the commercialization of its

renewable natural gas (“RNG”) facility.

______________________1 Adjusted EBITDA is a

non-GAAP measure calculated as earnings before interest, taxes,

depreciation and amortization, inclusive of the value of

monetizable tax credits such as 45-Q and 45-Z and excluding project

development costs.

2024 Third Quarter

Financial Highlights

- Ended the third quarter with cash,

cash equivalents and restricted cash of $292.9 million.

- Combined revenue and interest and

investment income was $5.8 million for the third quarter of 2024.

For the nine months ended September 30, 2024, combined revenue and

interest and investment income was $23.8 million.

- On a standalone basis, our RNG

subsidiary generated revenue of $2.0 million in the third quarter

of 2024, consisting of RNG sales of 101,101 MMBtu for $0.2 million

and $1.8 million of net proceeds from sales of environmental

attributes. This revenue decreased relative to the same period in

2023, primarily due to lower sales of environmental attributes as a

result of a buildup of environmental attribute inventory. The

buildup of inventory is in anticipation of receiving the final

pathway approval under the LCFS Program, which we expect to result

in a lower carbon intensity (“CI”) score and result in a

potentially higher value when the inventory is released and sold.

This CI pathway approval is anticipated during the first quarter of

2025.

- Loss from operations of $24.0 million

for the third quarter.

- Non-GAAP adjusted EBITDA loss2 of

$16.7 million for the third quarter.

- Investment Tax Credit sale proceeds of

$15.3 million are reflected in the Statement of Cash Flows,

Investing Activities, as a capital-related items, net of

adjustments.

- On a standalone basis, our RNG

subsidiary generated standalone GAAP loss from operations of $2.8

million, and non-GAAP adjusted EBITDA loss2 of $1.2 million for the

third quarter.

- Net loss per share of $0.09 for the

third quarter.

____________________2 Adjusted EBITDA is a

non-GAAP measure calculated by adding back depreciation and

amortization, allocated intercompany expenses for shared service

functions, and non-cash stock-based compensation to GAAP loss from

operations. A reconciliation of adjusted EBITDA to GAAP loss from

operations is provided in the financial statement tables following

this release. Adjusted EBITDA was referred to as “cash EBITDA” in

previous periods.

Management Comment

Lynn Smull, Gevo’s Chief Financial Officer,

commented, “Securing the DOE's $1.6 billion loan guarantee

conditional commitment is a transformative milestone for Gevo and

our Net-Zero 1 project. Reaching the DOE commitment illustrates

Gevo’s pioneering ability to develop and reduce the risk of a

financially attractive, large-scale, net-zero SAF production

facility. Additionally, given the acquisition of the Red Trail

Energy assets combined with Verity and expected near term RNG

growth, we believe that we are well-positioned to achieve positive

Adjusted EBITDA in 2025. The investments we’re making are

strategically positioning us for long-term growth in new industries

that need low-carbon products, while managing our cash and capital

expenditures to execute from a position of financial strength.”

Dr. Patrick Gruber, Gevo’s Chief Executive Officer,

added, “Everything we do is tied together by the concept of carbon

abatement as a means to create value in the clean energy market

sector, profit for the company, and value for our shareholders. The

progress on Net-Zero business systems, which include NZ1 and the

Red Trail Energy asset acquisition, underscores our commitment to

developing our businesses to abate carbon and serving enormous,

growing markets. Our advancements in areas like Verity, with our

CultivateAI acquisition, reflect our commitment to creating

resilient value chains that support carbon abatement from field to

flight, in the case of SAF, but also for other fuels, chemicals and

food chains. In the Net-Zero business system, it is all about

making products that people value, and doing it profitably, just

like any other business. There is more, though. It’s also about

rural economic development, energy security, creation of jobs, and

rewarding farmers. Overall, it’s all about carbon abatement across

the whole of the supply chain, while everyone in the supply chain

benefits economically.”

2024 Third Quarter

Financial Results

Operating revenue. During the three months

ended September 30, 2024, operating revenue decreased

$2.6 million compared to the three months ended

September 30, 2023, primarily due to lower sales of

environmental attributes from our RNG project. This is due to a

buildup of environmental attribute inventory in anticipation of

receiving the final pathway approval under the LCFS Program, which

we expect to result in a lower CI score. Said approval is

anticipated during the first quarter of 2025. During the three

months ended September 30, 2024, we sold 101,101 MMBtu of

RNG from our RNG project, resulting in RNG sales of $0.2 million

and environmental attribute sales of $1.8 million.

Cost of production. Cost of production

remained flat during the three months ended

September 30, 2024, compared to the three months ended

September 30, 2023.

Depreciation and amortization. Depreciation

and amortization decreased $1.5 million during the three months

ended September 30, 2024, compared to the three months

ended September 30, 2023, due to the timing of sales of

environmental attribute inventory, which includes allocated

depreciation and amortization.

Research and development expense. Research and

development expenses decreased $0.4 million during the three months

ended September 30, 2024, compared to the three months

ended September 30, 2023, primarily due to decreased

consulting expenses and professional fees.

General and administrative expense. General

and administrative expense increased $1.2 million during the three

months ended September 30, 2024, compared to the three

months ended September 30, 2023, primarily due to

increases in personnel costs related to the hiring of highly

qualified and skilled professionals, and professional consulting

fees, partially offset by a decrease in stock-based compensation.

On an annual basis, we assess our corporate cost allocation

estimates across all segments to reflect the use of centralized

administrative functions as well as the allocation of personnel

costs related to our project development efforts.

Project development costs. Project development

costs are primarily related to our Net-Zero Projects and Verity,

which consist primarily of employee expenses, preliminary

engineering costs, and technical consulting costs. Project

development costs increased $1.8 million during the three months

ended September 30, 2024, compared to the three months

ended September 30, 2023, primarily due to increases in

personnel costs, consulting fees, and costs related to our USDA

Grant, which have not yet been reimbursed.

Facility idling costs. Facility idling costs

are related to the care and maintenance of our Luverne

Facility. Facility idling costs decreased $0.4 million during

the three months ended September 30, 2024, compared to

the three months ended September 30, 2023.

Loss from operations. The Company’s loss from

operations increased $3.3 million during the three months ended

September 30, 2024, compared to the three months ended

September 30, 2023, primarily due to the increase in

costs for our Net-Zero and Verity projects.

Interest expense. Interest expense increased $0.6

million during the three months ended September 30, 2024,

compared to the three months ended September 30, 2023,

and was primarily comprised of interest on the Remarketed

Bonds.

Interest and investment income. Interest and

investment income decreased $1.4 million during the three months

ended September 30, 2024, compared to the three months

ended September 30, 2023, primarily due to the usage of

cash for our capital projects and operating costs, resulting in a

lower balance of cash equivalent investments during the three

months ended September 30, 2024.

Other income (expense), net. Other income

(expense), net remained flat for the three months ended

September 30, 2024, compared to the three months ended

September 30, 2023.

Webcast and Conference Call

Information

Hosting today’s conference call at 4:30 p.m. ET

will be Dr. Patrick R. Gruber, Chief Executive Officer, L. Lynn

Smull, Chief Financial Officer, and Dr. Eric Frey, Vice President

of Finance. They will review Gevo’s financial results and provide

an update on recent corporate highlights.

To participate in the live call, please register

through the following event weblink:

https://register.vevent.com/register/BId0c13b561f9d442ba7211ad0cbc56dbc.

After registering, participants will be provided with a dial-in

number and pin.

To listen to the conference call (audio only),

please register through the following event weblink:

https://edge.media-server.com/mmc/p/ggx3po5y.

A webcast replay will be available two hours after

the conference call ends on November 7, 2024. The archived webcast

will be available in the Investor Relations section of Gevo’s

website at www.gevo.com.

About Gevo

Gevo's mission is to convert renewable energy and

biogenic carbon into sustainable fuels and chemicals with a

net-zero or better carbon footprint. Gevo’s innovative technology

can be used to make a variety of products, including SAF, motor

fuels, chemicals, and other materials. Gevo’s business model

includes developing, financing, and operating production facilities

for these renewable fuels and other products. It currently runs one

of the largest dairy-based RNG facilities in the United States. It

also owns the world’s first production facility for specialty

alcohol-to-jet (“ATJ”) fuels and chemicals. Gevo emphasizes the

importance of sustainability by tracking and verifying the carbon

footprint of its business systems through its Verity

subsidiary.

Learn more at Gevo’s website: www.gevo.com.

Forward-Looking Statements

Certain statements in this press release may

constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. These

forward-looking statements relate to a variety of matters,

including, without limitation, the financing and the timing of our

NZ1 project, the agreement with LG Chem, the DOE loan guarantee

process, the Red Trail Energy acquisition and timing of its

closing, the successful integration of the CultivateAI acquisition,

the success and revenue of Verity, the success of our ETO business,

our financial condition, our results of operation and liquidity,

our business plans, our business development activities, our

Net-Zero Projects, financial projections related to our business,

our RNG project, our fuel sales agreements, our plans to develop

our business, our ability to successfully develop, construct and

finance our operations and growth projects, our ability to achieve

cash flow from our planned projects, the ability of our products to

contribute to lower greenhouse gas emissions, particulate and

sulfur pollution, and other statements that are not purely

statements of historical fact. These forward-looking statements are

made based on the current beliefs, expectations and assumptions of

the management of Gevo and are subject to significant risks and

uncertainty. Investors are cautioned not to place undue reliance on

any such forward-looking statements. All such forward-looking

statements speak only as of the date they are made, and Gevo

undertakes no obligation to update or revise these statements,

whether as a result of new information, future events or otherwise.

Although Gevo believes that the expectations reflected in these

forward-looking statements are reasonable, these statements involve

many risks and uncertainties that may cause actual results to

differ materially from what may be expressed or implied in these

forward-looking statements. For a further discussion of risks and

uncertainties that could cause actual results to differ from those

expressed in these forward-looking statements, as well as risks

relating to the business of Gevo in general, see the risk

disclosures in our most recent Annual Report on Form 10-K and in

subsequent reports on Forms 10-Q and 8-K and other filings made

with the U.S. Securities and Exchange Commission by Gevo.

Non-GAAP Financial Information

This press release contains a financial measure

that does not comply with U.S. generally accepted accounting

principles (“GAAP”), including non-GAAP adjusted EBITDA. Non-GAAP

adjusted EBITDA excludes depreciation and amortization, allocated

intercompany expenses for shared service functions, and non-cash

stock-based compensation from GAAP loss from operations. Management

believes this measure is useful to supplement its GAAP financial

statements with this non-GAAP information because management uses

such information internally for its operating, budgeting and

financial planning purposes. This non-GAAP financial measure also

facilitates management’s internal comparisons to Gevo’s historical

performance as well as comparisons to the operating results of

other companies. In addition, Gevo believes this non-GAAP financial

measure is useful to investors because it allows for greater

transparency into the indicators used by management as a basis for

its financial and operational decision making. Non-GAAP information

is not prepared under a comprehensive set of accounting rules and

therefore, should only be read in conjunction with financial

information reported under U.S. GAAP when understanding Gevo’s

operating performance. A reconciliation between GAAP and non-GAAP

financial information is provided below.

| |

|

|

|

|

|

| Gevo,

Inc.Condensed Consolidated Balance

Sheets(Unaudited, in thousands, except share and

per share amounts) |

| |

|

|

|

|

|

| |

September 30,2024 |

|

December 31,2023 |

| Assets |

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

223,227 |

|

|

$ |

298,349 |

|

|

Restricted cash |

|

1,489 |

|

|

|

77,248 |

|

|

Trade accounts receivable, net |

|

1,411 |

|

|

|

2,623 |

|

|

Inventories |

|

5,846 |

|

|

|

3,809 |

|

|

Prepaid expenses and other current assets |

|

4,659 |

|

|

|

4,353 |

|

|

Total current assets |

|

236,632 |

|

|

|

386,382 |

|

| Property, plant and equipment,

net |

|

219,804 |

|

|

|

211,563 |

|

| Restricted cash |

|

68,155 |

|

|

|

— |

|

| Operating right-of-use

assets |

|

1,149 |

|

|

|

1,324 |

|

| Finance right-of-use

assets |

|

2,236 |

|

|

|

210 |

|

| Intangible assets, net |

|

8,548 |

|

|

|

6,524 |

|

| Goodwill |

|

3,742 |

|

|

|

— |

|

| Deposits and other assets |

|

63,524 |

|

|

|

44,319 |

|

|

Total assets |

$ |

603,790 |

|

|

$ |

650,322 |

|

|

Liabilities |

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

Accounts payable and accrued liabilities |

$ |

26,396 |

|

|

$ |

22,752 |

|

|

Operating lease liabilities |

|

351 |

|

|

|

532 |

|

|

Finance lease liabilities |

|

1,873 |

|

|

|

45 |

|

|

Loans payable |

|

53 |

|

|

|

130 |

|

|

2021 Bonds payable, net |

|

— |

|

|

|

67,967 |

|

|

Total current liabilities |

|

28,673 |

|

|

|

91,426 |

|

| Remarketed Bonds payable,

net |

|

66,902 |

|

|

|

— |

|

| Loans payable |

|

— |

|

|

|

21 |

|

| Operating lease

liabilities |

|

1,051 |

|

|

|

1,299 |

|

| Finance lease liabilities |

|

613 |

|

|

|

187 |

|

| Other long-term

liabilities |

|

1,830 |

|

|

|

— |

|

|

Total liabilities |

|

99,069 |

|

|

|

92,933 |

|

| Stockholders'

Equity |

|

|

|

|

|

|

Common stock, $0.01 par value per share; 500,000,000 shares

authorized; 239,407,448 and 240,499,833 shares issued and

outstanding at September 30, 2024, and

December 31, 2023, respectively. |

|

2,394 |

|

|

|

2,405 |

|

|

Additional paid-in capital |

|

1,284,957 |

|

|

|

1,276,581 |

|

|

Accumulated deficit |

|

(782,630 |

) |

|

|

(721,597 |

) |

|

Total stockholders' equity |

|

504,721 |

|

|

|

557,389 |

|

|

Total liabilities and stockholders' equity |

$ |

603,790 |

|

|

$ |

650,322 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Gevo,

Inc.Condensed Consolidated Statements of

Operations(Unaudited, in thousands, except share

and per share amounts) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Total operating revenues |

$ |

1,965 |

|

|

$ |

4,528 |

|

|

$ |

11,215 |

|

|

$ |

12,826 |

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of production |

|

2,544 |

|

|

|

2,480 |

|

|

|

8,554 |

|

|

|

8,836 |

|

|

Depreciation and amortization |

|

3,494 |

|

|

|

4,994 |

|

|

|

12,222 |

|

|

|

14,323 |

|

|

Research and development expense |

|

1,113 |

|

|

|

1,558 |

|

|

|

4,302 |

|

|

|

4,716 |

|

|

General and administrative expense |

|

11,679 |

|

|

|

10,522 |

|

|

|

35,342 |

|

|

|

31,891 |

|

|

Project development costs |

|

6,593 |

|

|

|

4,789 |

|

|

|

19,648 |

|

|

|

10,635 |

|

|

Facility idling costs |

|

550 |

|

|

|

911 |

|

|

|

2,325 |

|

|

|

2,923 |

|

|

Total operating expenses |

|

25,973 |

|

|

|

25,254 |

|

|

|

82,393 |

|

|

|

73,324 |

|

| Loss from operations |

|

(24,008 |

) |

|

|

(20,726 |

) |

|

|

(71,178 |

) |

|

|

(60,498 |

) |

| Other income

(expense) |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(1,107 |

) |

|

|

(540 |

) |

|

|

(2,762 |

) |

|

|

(1,615 |

) |

|

Interest and investment income |

|

3,843 |

|

|

|

5,261 |

|

|

|

12,579 |

|

|

|

14,083 |

|

|

Other income, net |

|

116 |

|

|

|

305 |

|

|

|

328 |

|

|

|

292 |

|

|

Total other income, net |

|

2,852 |

|

|

|

5,026 |

|

|

|

10,145 |

|

|

|

12,760 |

|

| Net loss |

$ |

(21,156 |

) |

|

$ |

(15,700 |

) |

|

$ |

(61,033 |

) |

|

$ |

(47,738 |

) |

| Net loss per share - basic and

diluted |

$ |

(0.09 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.20 |

) |

| Weighted-average number of

common shares outstanding - basic and diluted |

|

239,445,900 |

|

|

|

239,537,811 |

|

|

|

239,767,047 |

|

|

|

238,100,986 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Gevo,

Inc.Condensed Consolidated Statements of

Comprehensive Loss(Unaudited, in

thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net loss |

$ |

(21,156 |

) |

|

$ |

(15,700 |

) |

|

$ |

(61,033 |

) |

|

$ |

(47,738 |

) |

| Other comprehensive income

(loss): |

|

|

|

|

|

|

|

|

|

|

|

| Unrealized gain (loss) on

available-for-sale securities |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,040 |

|

| Comprehensive

loss |

$ |

(21,156 |

) |

|

$ |

(15,700 |

) |

|

$ |

(61,033 |

) |

|

$ |

(46,698 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gevo,

Inc.Condensed Consolidated Statements of

Stockholders’ Equity(Unaudited,

in thousands, except share amounts) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

For the Nine Months Ended September 30, 2024 and

2023 |

| |

Common Stock |

|

|

|

|

Accumulated Other |

|

Accumulated |

|

Stockholders’ |

| |

Shares |

|

Amount |

|

Paid-In Capital |

|

Comprehensive Loss |

|

Deficit |

|

Equity |

|

Balance, December 31, 2023 |

240,499,833 |

|

|

$ |

2,405 |

|

|

$ |

1,276,581 |

|

|

$ |

— |

|

|

$ |

(721,597 |

) |

|

$ |

557,389 |

|

|

Non-cash stock-based compensation |

— |

|

|

|

— |

|

|

|

12,485 |

|

|

|

— |

|

|

|

— |

|

|

|

12,485 |

|

|

Stock-based awards and related share issuances, net |

6,015,823 |

|

|

|

60 |

|

|

|

481 |

|

|

|

— |

|

|

|

— |

|

|

|

541 |

|

|

Repurchase of common stock |

(7,190,006 |

) |

|

|

(72 |

) |

|

|

(4,638 |

) |

|

|

— |

|

|

|

— |

|

|

|

(4,710 |

) |

|

Issuance of common stock upon exercise of warrants |

81,798 |

|

|

|

1 |

|

|

|

48 |

|

|

|

— |

|

|

|

— |

|

|

|

49 |

|

|

Net loss |

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(61,033 |

) |

|

|

(61,033 |

) |

| Balance,

September 30, 2024 |

239,407,448 |

|

|

$ |

2,394 |

|

|

$ |

1,284,957 |

|

|

$ |

— |

|

|

$ |

(782,630 |

) |

|

$ |

504,721 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance,

December 31, 2022 |

237,166,625 |

|

|

$ |

2,372 |

|

|

$ |

1,259,527 |

|

|

$ |

(1,040 |

) |

|

$ |

(655,382 |

) |

|

$ |

605,477 |

|

|

Non-cash stock-based compensation |

— |

|

|

|

— |

|

|

|

12,752 |

|

|

|

— |

|

|

|

— |

|

|

|

12,752 |

|

|

Stock-based awards and related share issuances, net |

3,086,082 |

|

|

|

31 |

|

|

|

(31 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Other comprehensive income |

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,040 |

|

|

|

— |

|

|

|

1,040 |

|

|

Net loss |

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(47,738 |

) |

|

|

(47,738 |

) |

| Balance,

September 30, 2023 |

240,252,707 |

|

|

$ |

2,403 |

|

|

$ |

1,272,248 |

|

|

$ |

— |

|

|

$ |

(703,120 |

) |

|

$ |

571,531 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

| Gevo,

Inc.Condensed Consolidated Statements of Cash

Flows(Unaudited, in thousands) |

| |

|

|

|

|

|

| |

Nine Months EndedSeptember 30, |

| |

2024 |

|

|

2023 |

|

| Operating

Activities |

|

|

|

|

|

|

Net loss |

$ |

(61,033 |

) |

|

$ |

(47,738 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

Stock-based compensation |

|

12,485 |

|

|

|

12,752 |

|

|

Depreciation and amortization |

|

12,222 |

|

|

|

14,323 |

|

|

Amortization of marketable securities discount |

|

— |

|

|

|

(102 |

) |

|

Other noncash expense |

|

1,847 |

|

|

|

655 |

|

|

Changes in operating assets and liabilities, net of effects of

acquisition: |

|

|

|

|

|

|

Accounts receivable |

|

1,417 |

|

|

|

(1,766 |

) |

|

Inventories |

|

(1,542 |

) |

|

|

1,137 |

|

|

Prepaid expenses and other current assets, deposits and other

assets |

|

(10,750 |

) |

|

|

(816 |

) |

|

Accounts payable, accrued expenses and non-current liabilities |

|

6,814 |

|

|

|

427 |

|

|

Net cash used in operating activities |

|

(38,540 |

) |

|

|

(21,128 |

) |

| Investing

Activities |

|

|

|

|

|

|

Acquisitions of property, plant and equipment |

|

(36,459 |

) |

|

|

(61,413 |

) |

|

Proceeds from sale of investment tax credit |

|

15,336 |

|

|

|

— |

|

|

Payment of earnest money deposit |

|

(10,000 |

) |

|

|

— |

|

|

Acquisition of CultivateAI, net |

|

(6,070 |

) |

|

|

— |

|

|

Proceeds from maturity of marketable securities |

|

— |

|

|

|

168,550 |

|

|

Proceeds from sale of property, plant and equipment |

|

— |

|

|

|

34 |

|

|

Net cash (used in) provided by investing

activities |

|

(37,193 |

) |

|

|

107,171 |

|

| Financing

Activities |

|

|

|

|

|

|

Proceeds from issuance of Remarketed Bonds, net |

|

68,155 |

|

|

|

— |

|

|

Extinguishment of 2021 Bonds, net |

|

(68,155 |

) |

|

|

— |

|

|

Payment of debt offering costs |

|

(1,665 |

) |

|

|

— |

|

|

Proceeds from the exercise of warrants |

|

49 |

|

|

|

— |

|

|

Payment of loans payable |

|

(89 |

) |

|

|

(128 |

) |

|

Payment of finance lease liabilities |

|

(578 |

) |

|

|

(22 |

) |

|

Repurchases of common stock |

|

(4,710 |

) |

|

|

— |

|

|

Net cash used in financing activities |

|

(6,993 |

) |

|

|

(150 |

) |

| Net (decrease) increase in

cash and cash equivalents |

|

(82,726 |

) |

|

|

85,893 |

|

| Cash, cash equivalents and

restricted cash at beginning of period |

|

375,597 |

|

|

|

315,376 |

|

| Cash, cash equivalents

and restricted cash at end of period |

$ |

292,871 |

|

|

$ |

401,269 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Gevo,

Inc.Reconciliation of GAAP to Non-GAAP Financial

Information(Unaudited, in thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Non-GAAP Adjusted

EBITDA (Consolidated): |

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

$ |

(24,008 |

) |

|

$ |

(20,726 |

) |

|

$ |

(71,178 |

) |

|

$ |

(60,498 |

) |

| Depreciation and

amortization |

|

3,494 |

|

|

|

4,994 |

|

|

|

12,222 |

|

|

|

14,323 |

|

| Stock-based compensation |

|

3,786 |

|

|

|

4,132 |

|

|

|

12,485 |

|

|

|

12,752 |

|

| Non-GAAP adjusted EBITDA

(loss) (Consolidated) |

$ |

(16,728 |

) |

|

$ |

(11,600 |

) |

|

$ |

(46,471 |

) |

|

$ |

(33,423 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months

EndedSeptember 30, |

|

Nine Months EndedSeptember 30, |

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Non-GAAP Adjusted

EBITDA (Gevo NW Iowa RNG): |

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

$ |

(2,832 |

) |

|

$ |

(1,120 |

) |

|

$ |

(5,263 |

) |

|

$ |

(6,382 |

) |

| Depreciation and

amortization |

|

672 |

|

|

|

1,914 |

|

|

|

3,347 |

|

|

|

5,099 |

|

| Allocated intercompany

expenses for shared service functions |

|

890 |

|

|

|

890 |

|

|

|

2,671 |

|

|

|

2,671 |

|

| Stock-based compensation |

|

48 |

|

|

|

18 |

|

|

|

125 |

|

|

|

59 |

|

| Non-GAAP adjusted EBITDA

(loss) (Gevo NW Iowa RNG) |

$ |

(1,222 |

) |

|

$ |

1,702 |

|

|

$ |

880 |

|

|

$ |

1,447 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Media ContactHeather ManuelVP of Stakeholder

Engagement & PartnershipsPR@gevo.com

Investor ContactEric Frey, PhDVice President of

Finance & StrategyIR@Gevo.com

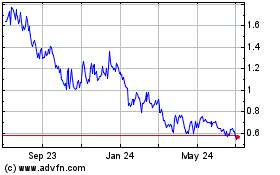

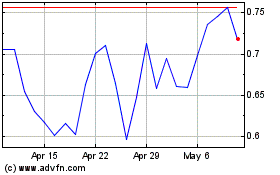

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Gevo (NASDAQ:GEVO)

Historical Stock Chart

From Jan 2024 to Jan 2025