Filed Pursuant to Rule 424(b)(5)

Registration No. 333-274161

The information in this preliminary prospectus supplement is not complete and may be changed. A registration statement relating to these securities has been filed with the Securities and Exchange Commission and is effective. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and they are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 27, 2023

PRELIMINARY PROSPECTUS SUPPLEMENT

(To the Prospectus dated August 29, 2023)

Shares of Common Stock

Genasys Inc.

Common Stock

We are offering shares of our common stock.

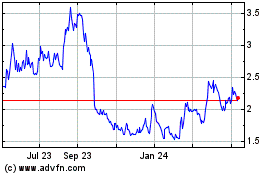

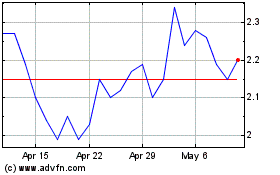

Our common stock is listed on the Nasdaq Capital Market under the symbol “GNSS.” The last reported sale price of our common stock on September 26, 2023 was $2.67 per share.

Investment in our common stock involves significant risks. See “Risk Factors” beginning on page S-4 of this prospectus supplement, as well as the risk factors contained in the documents incorporated by reference into this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

| |

|

Per Share

|

|

|

Total

|

|

|

Public offering price

|

|

$ |

|

|

|

$ |

|

|

|

Underwriting discounts and commissions(1)

|

|

$ |

|

|

|

$ |

|

|

|

Proceeds, before expenses, to us

|

|

$ |

|

|

|

$ |

|

|

(1) See “Underwriting” for a description of all compensation payable to the underwriters.

The underwriters have been granted a 30-day option to purchase up to an additional of shares of common stock from us at the public offering price, less underwriting discounts and commissions.

The underwriters expect to deliver the shares against payment on or about , 2023.

|

Sole Book-Running Manager

Roth Capital Partners

Co-Manager

Joseph Gunnar & Co., LLC

|

The date of this prospectus supplement is , 2023

TABLE OF CONTENTS

Prospectus Supplement

|

PROSPECTUS SUPPLEMENT SUMMARY

|

S-1

|

|

RISK FACTORS

|

S-4

|

|

USE OF PROCEEDS

|

S-9

|

|

DIVIDEND POLICY

|

S-10

|

|

DILUTION

|

S-11

|

|

CERTAIN MATERIAL U.S. FEDERAL INCOME AND ESTATE TAX CONSIDERATIONS FOR NON-U.S. HOLDERS OF OUR COMMON STOCK

|

S-12

|

|

UNDERWRITING

|

S-16

|

|

LEGAL MATTERS

|

S-23

|

|

EXPERTS

|

S-23

|

|

WHERE YOU CAN FIND ADDITIONAL INFORMATION

|

S-23

|

|

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

|

S-23

|

Prospectus

|

ABOUT THIS PROSPECTUS

|

1 |

|

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE

|

2 |

|

ABOUT GENASYS

|

3 |

|

RISK FACTORS

|

4 |

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

|

4 |

|

USE OF PROCEEDS

|

4 |

|

DIVIDEND POLICY

|

5 |

|

DESCRIPTION OF CAPITAL STOCK

|

5 |

|

DESCRIPTION OF DEBT SECURITIES

|

7 |

|

DESCRIPTION OF WARRANTS

|

13 |

|

DESCRIPTION OF UNITS

|

14 |

|

GLOBAL SECURITIES

|

15 |

|

PLAN OF DISTRIBUTION

|

17 |

|

LEGAL MATTERS

|

18 |

|

EXPERTS

|

19 |

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is the prospectus supplement, including the documents incorporated by reference herein, which describes the specific terms of this offering. The second part, the accompanying prospectus, including the documents incorporated by reference, provides more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. Before you invest, you should carefully read this prospectus supplement, the accompanying prospectus, all information incorporated by reference herein and therein, as well as the additional information described under “Where You Can Find Additional Information” on page S-23 of this prospectus supplement. These documents contain information you should consider when making your investment decision. This prospectus supplement may add, update or change information contained in the accompanying prospectus. To the extent that any statement that we make in this prospectus supplement is inconsistent with statements made in the accompanying prospectus or any documents incorporated by reference therein, the statements made in this prospectus supplement will be deemed to modify or supersede those made in the accompanying prospectus and such documents incorporated by reference therein.

You should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and in any free writing prospectuses we may provide to you in connection with this offering. We have not, and the underwriters have not, authorized any other person to provide you with any information that is different than that contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and any related free writing prospectus that we provide you in connection with the offering. If anyone provides you with different or inconsistent information, you should not rely on it. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The distribution of this prospectus supplement and the offering of the common stock in certain jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement must inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus supplement outside the United States. This prospectus supplement does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

When we refer to “Genasys,” “we,” “our,” “us” and the “Company” in this prospectus, we mean Genasys Inc. and its consolidated subsidiaries, unless otherwise specified.

Industry and Market Data

The market data and certain other statistical information used throughout this prospectus supplement and the accompanying prospectus are based on independent industry publications, government publications and other published sources. Some data, such as our estimates of the potential pool of donors and our potential addressable commercial opportunity, are also based on our good faith estimates. Although we believe these third-party sources are reliable as of their respective dates, neither we nor the underwriters have independently verified the accuracy or completeness of this information. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the sections entitled “Risk Factors” in this prospectus supplement and in the documents incorporated by reference to this prospectus supplement. These and other factors could cause results to differ materially from those expressed in these publications.

Trademarks and Tradenames

The Genasys name and logo and other names including LRAD®, LONG RANGE ACOUSTIC DEVICE®, LRAD-X®, LRAD-RX®, SOUNDSABER®, ZONEHAVEN®, SOUND SHIELD® and the names of other products and services offered by Genasys are trademarks, registered trademarks, service marks or registered service marks of Genasys. All other trademarks, trade names and service marks appearing in this prospectus or the documents incorporated by reference herein are the property of their respective owners. Use or display by us of other parties’ trademarks, trade dress or products is not intended to and does not imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owner. Solely for convenience, trademarks and tradenames referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information about us, this offering and information appearing elsewhere in this prospectus supplement, in the accompanying prospectus and in the documents incorporated by reference herein and therein. This summary is not complete and does not contain all the information you should consider before investing in our common stock pursuant to this prospectus supplement and the accompanying prospectus. Before making an investment decision, to fully understand this offering and its consequences to you, you should carefully read this entire prospectus supplement and the accompanying prospectus, including “Risk Factors” beginning on page S-4 of this prospectus supplement, the financial statements, and related notes, and the other information that we incorporated by reference herein, including our Annual Report on Form 10-K for the fiscal year ended September 30, 2022, our Quarterly Reports on Form 10-Q for the quarters ended December 31, 2022, March 31, 2023, and June 30, 2023, and our other filings with the SEC that we file from time to time. Unless otherwise indicated or the context otherwise requires, all references in this prospectus supplement to “Genasys,” the “Company,” “we,” “us,” and “our” mean Genasys, Inc. and its consolidated subsidiaries.

Genasys, Inc.

We are a global provider of Protective Communications solutions including the Genasys Protect software platform and Genasys Long Range Acoustic Devices (LRAD).

Genasys Protect is the first and only complete portfolio of Protective Communications software and systems serving federal governments and agencies; state and local governments, agencies, and education (SLED); and enterprise organizations in sectors including but not limited to oil and gas, utilities, manufacturing, automotive, and healthcare. Genasys Protect solutions have a diverse range of applications, including emergency warning and mass notification for public safety; critical event management for enterprise companies; de-escalation for defense and law enforcement; as well as automated detection of real-time threats like active shooters and severe weather.

Genasys LRAD provides directed audible voice messages with exceptional, intelligible vocal clarity from close range out to 5,500 meters. We have a history of successfully delivering innovative systems and solutions in mission critical situations, pioneering the acoustic hailing device (“AHD”) market with the introduction of our first LRAD AHD in 2003, creating the first multidirectional public safety mass notification systems. Building on our proven, best in class and reliable solution and systems, we are launching the first and only unified, end to end Protective Communications Platform.

Genasys Protect

The Complete Protective Communications Platform

Genasys Protect combines the most comprehensive combination of solutions enabling preparedness, response, and analytics to keep people, assets, and operations protected against the impacts of natural disasters, terrorism, violent civil unrest, and other dangerous situations, as well as power failures, facility shutdowns, and other non-emergency operational disruptions.

| |

1.

|

Proven Technology: Genasys solutions have been on the front lines for more than 40 years, providing optimal response with precision-targeted communications that ensure the right people get the message - right away.

|

| |

2.

|

Modular Suite: Built on open standards, Genasys software and hardware systems are designed to easily integrate, whether using the full Genasys suite or complementing the notification platforms customers already have in place.

|

| |

3.

|

Predictive Simulation: Genasys Protect is designed to permit customers to test response plans preemptively with advanced simulation of evacuation-level events, like fires and floods, and their impact on infrastructure, including traffic patterns and perimeter establishment.

|

| |

4.

|

Unified Viewpoint: One common safety operating picture provides real-time, visibility into our customers’ people, assets, and environment by combining first-party data from asset / people-management platforms and IoT sensors with vetted third-party data sources, including FEMA, NOAA, DHS, and more.

|

| |

5.

|

Unmatched Precision: Customized zone mapping enables targeting of mass notifications at the street level, making it easier to sequence response areas from most to least critical.

|

| |

6.

|

Multi-channel: Genasys Protect is designed to allow customers to saturate their notification area by simultaneously alerting people across SMS, voice calls, social media, TV, radio, digital signage, and outdoor acoustic devices.

|

| |

7.

|

Network Effect: Implementation in neighboring municipalities as well as public- and private-sector organizations within the same municipality extends coverage and enables greater precision when notifying people of threats.

|

Genasys LRAD

The defacto standard in AHDs, Genasys LRAD is the world’s leading AHD. Projecting alert tones and audible voice messages with exceptional vocal clarity in a 30° beam from close range to 5,500 meters, Genasys LRADs are used throughout the world in multiple applications and circumstances to safely hail, warn, inform, direct, prevent mishaps, establish large safety zones, and save lives. Genasys LRADs have been deployed on military vehicles, at corporate headquarters, on marine vessels, aboard private yachts, and in numerous other situations where clear and intelligible voice communications are essential.

Genasys’ offerings cover over 70 Million people globally and are used in more than 100 countries, including more than 500 cities, counties, and states in the U.S. helping safeguard millions of people in a range of diverse applications that include public safety, emergency warning, mass notification, defense, law enforcement, border and homeland security, critical infrastructure protection, and many more. We continue to develop new critical communications that offers significant competitive advantage in our principal markets.

Recent Developments

Evertel Acquisition

On September 20, 2023, Genasys, Word Systems Operations, LLC, an Indiana limited liability company (“Seller”), and Evertel Technologies, LLC, a Nevada limited liability company (“Evertel”), entered into a Membership Interest Purchase Agreement (the “Purchase Agreement”), pursuant to which the Company agreed, upon the terms and subject to the conditions of the Purchase Agreement, to purchaser all of the Seller’s right, title and interest in, to and under all of the membership interests of Evertel (the “Transaction”). The Company also agreed to offer employment to certain of Evertel’s employees upon consummation of the Transaction. As consideration for the purchase of the membership interests of Evertel, the Company has agreed to pay to the Seller total consideration of approximately $5.8 million, comprised of approximately 75 percent stock and 25 percent cash, subject to customary adjustments. Genasys expects the cash consideration to be financed through cash on hand. The transaction is expected to close the first week of October.

Evertel offers a secure and compliant mission-critical collaboration platform for the public safety market that connects public safety personnel, information, and tools in one space. Evertel’s information and collaboration platform is designed to help public agencies of all sizes – small towns, big cities, and everything in between – to work together more effectively in their efforts to protect their communities and save lives.

The Purchase Agreement contains customary representations and warranties of the Company and of the Seller and Evertel and its business and assets. Additionally, the Purchase Agreement provides for customary covenants of Genasys, the Seller and Evertel, as well as indemnification provisions subject to specified limitations. In addition, for a period of five years after the closing of the Transaction, the Seller has agreed not to compete or engage in any business competing with Evertel’s business.

Financial Update

On September 18, 2023, Genasys issued a press release announcing an update to its fiscal 2023 fourth quarter and fiscal 2023 full year revenue guidance. As reported therein, the Company now expects full year revenues to be 15% below the prior year and the Company reduced its official outlook for fiscal fourth quarter 2023 revenues to be at least $10 million, down from the prior outlook of just a 5% decline from the prior quarter.

Corporate Information

We were incorporated initially in Utah in 1980. We changed our jurisdiction of organization from Utah to Delaware in 1992. Our principal executive offices are located at 16262 West Bernardo Drive, San Diego, California, 92127. Our telephone number is (858) 676-1112. We maintain an Internet website at www.genasys.com. We have not incorporated the information on our website by reference into this prospectus supplement, and you should not consider it to be a part of this prospectus supplement.

THE OFFERING

| |

|

|

|

Common stock offered by us

|

|

shares of our common stock

|

| |

|

|

Common stock to be outstanding after this offering

|

|

shares of our common stock (or shares if the underwriters exercise their option to purchase additional shares in full)

|

| |

|

|

Option to purchase additional common stock

|

|

We have granted the underwriters a 30-day option to purchase up to additional shares of common stock from us at the public offering price, less underwriting discounts and commissions.

|

| |

|

|

Use of Proceeds

|

|

We intend to use the net proceeds from this offering for general corporate purposes, including funding organic growth, working capital, capital expenditures, and continued research and development with respect to products and technologies, as well as costs related to the post-closing integration of Evertel with our company and research and development activities related to the integrated business. See “Use of Proceeds” on page S-9.

|

| |

|

|

Risk Factors

|

|

See “Risk Factors” beginning on page S-4 of this prospectus supplement as well as the risk factors contained in the documents incorporated by reference to this prospectus supplement for a discussion of factors that you should read and consider before investing in our securities.

|

| |

|

|

Nasdaq Capital Market symbol

|

|

“GNSS”

|

The number of shares of our common stock to be outstanding following this offering is based on 37,211,071 shares of our common stock outstanding as of September 27, 2023. This number of shares excludes the following:

| |

●

|

3,314,522 shares of common stock issuable upon exercise of options outstanding as of September 27, 2023, at a weighted average exercise price of $3.21 per share;

|

| |

●

|

380,097 shares of common stock issuable upon the vesting of restricted stock units outstanding as of September 27, 2023; and

|

| |

●

|

2,765,077 shares of common stock reserved for future issuance under our 2015 Equity Incentive Plan as of September 27, 2023.

|

Except as otherwise indicated, all information in this prospectus supplement assumes:

| |

●

|

no exercise of the outstanding stock options described above;

|

| |

●

|

no vesting of outstanding restricted stock units described above; and

|

| |

●

|

no exercise by the underwriters of their option to acquire additional shares of our common stock.

|

RISK FACTORS

You should carefully consider the risks and uncertainties described in this prospectus supplement and the accompanying prospectus, including the risk factors set forth below and in the documents and reports filed with the SEC that are incorporated by reference herein, such as the risk factors under the heading “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended September 30, 2022 and in our Quarterly Reports on Form 10-Q for the quarters ended December 31, 2022, March 31, 2023, and June 30, 2023 on file with the SEC, before deciding whether to invest in our common stock. The risks and uncertainties described below and those described in the filings incorporated by reference are not the only ones we face. If any of the following risks actually occurs, our business, financial condition or results of operations could be adversely affected. In such case, the trading price of our common stock could decline and you could lose all or part of your investment. Our actual results could differ materially from those anticipated in the forward-looking statements made throughout this prospectus supplement and in the documents incorporated by reference herein as a result of different factors, including the risks we face described below and those described in the filings incorporated by reference.

Risks Relating to the Transaction

Failure to complete, or delays in completing, the Transaction could materially and adversely affect our business and our stock price.

Consummation of the Transaction is subject to customary closing conditions, a number of which are not within our control and any of which may prevent, delay, or otherwise materially and adversely affect our ability to complete the Transaction. The negotiation of the Purchase Agreement and the other activities related to the Transaction have resulted and will continue to result in significant cost and expense and management distraction, which will occur whether or not the Transaction is successfully consummated. We cannot predict whether or when the required closing conditions under the Purchase Agreement will be satisfied and we therefore cannot be certain that we will be able to successfully consummate the Transaction as currently contemplated under the Purchase Agreement. Failure to consummate the Transaction could have a material adverse effect on our business and our stock price.

We may fail to realize the anticipated benefits of the Transaction.

The success of the Transaction will depend on, among other things, our ability to incorporate the Evertel business into our business in a manner that enhances our value proposition to clients and facilitates other growth opportunities. We must successfully include the Evertel business within our business in a manner that permits these growth opportunities to be realized. In addition, we must achieve the growth opportunities without adversely affecting current revenues and investments in other future growth opportunities. If we are not able to successfully achieve these objectives, the anticipated benefits of the Transaction may not be realized fully, if at all, or may take longer to realize than expected. Additionally, management may face challenges in incorporating certain elements and functions of the Evertel business with our business, and this process may result in additional and unforeseen expenses. The Transaction may also disrupt the Evertel business and our ongoing business or cause inconsistencies in standards, controls, procedures and policies that adversely affect our relationships with third party partners, employees, suppliers, customers and others with whom the Evertel business and we have business or other dealings or limit our ability to achieve the anticipated benefits of the Transaction. If we are not able to successfully add the Evertel business to our existing business in an efficient, effective and timely manner, anticipated benefits, including the opportunities for growth we expect from the Transaction, may not be realized fully, if at all, or may take longer to realize than expected, and our cash flow and financial condition may be negatively affected.

We will incur significant transaction costs in connection with the Transaction.

We have incurred and expect to incur a number of non-recurring costs associated with the Transaction, which could exceed the amounts currently estimated. These costs and expenses include financial advisory, legal, accounting, consulting and other advisory fees and expenses, filing fees and other related charges. There is also a large number of processes, policies, procedures, operations, technologies and systems that must be integrated in connection with the Transaction. While we have assumed that a certain level of expenses would be incurred in connection with the Transaction and the other transactions contemplated by the Purchase Agreement, there are many factors beyond our control that could affect the total amount or the timing of the integration and implementation expenses.

There may also be additional unanticipated significant costs in connection with the Transaction that we may not recoup. These costs and expenses could reduce the benefits and additional income we expect to achieve from the Transaction. Although we expect that these benefits will offset the transaction expenses and implementation costs over time, this net benefit may not be achieved in the near term or at all.

We are not providing pro forma financial statements reflecting the impact of the Transaction on our historical operating results.

We do not expect to file a Current Report on Form 8-K with financial information for the Evertel business and pro forma financial statement information and, as a result, we are not including any pro forma financial statement information in this prospectus supplement. As a result, investors will be required to determine whether to participate in this offering without the benefit of the pro forma financial statement information.

It is possible that our experience in operating the Evertel business will require us to adjust our expectations regarding the impact of the Transaction on our operating results.

Third parties may terminate or alter existing contracts or relationships with us or the Evertel business.

The Evertel business has contracts with customers, licensors and other business partners which may require the consent from these other parties in connection with the Transaction. If these consents cannot be obtained, the Evertel business may suffer a loss of potential future revenue and may lose rights that are material to the Evertel business. In addition, third parties with which we or the Evertel business currently have relationships may terminate or otherwise reduce the scope of their relationships with either or both parties in connection with or as a result of the Transaction. Any such disruptions could limit our ability to achieve the anticipated benefits of the Transaction. The adverse effect of such disruptions could also be exacerbated by a delay in the completion of the Transaction or the termination of the Purchase Agreement.

We may have difficulty attracting, motivating and retaining key personnel and other employees in light of the Transaction.

The success of our business after the Transaction will depend in part on our ability to attract and retain key personnel and other employees. In connection with or as a result of the Transaction, we may lose key personnel or may be unable to attract, retain and motivate qualified individuals, or the associated costs may increase. If we cannot retain employees of the Evertel business because of uncertainty relating to the Transaction or the difficulty of integration or for any other reason, our ability to realize the anticipated benefits of the Transaction could be reduced, and it may have a material adverse impact on our business and operations.

Litigation and other legal proceedings could require the expenditure of substantial resources and distract our personnel from being able to integrate the Evertel business into our business in a manner that enhances its value proposition to clients and facilitates other growth opportunities.

We are and may become involved in various legal proceedings arising from our business activities. While management is not aware of any litigation matter that in and of itself would have a material adverse impact on our consolidated results of operations, cash flows or financial position, litigation is inherently unpredictable, and depending on the nature and timing of a proceeding, an unfavorable resolution could materially affect our future consolidated results of operations, cash flows or financial position in a particular period, as well as our ability to successfully integrate the Evertel business into our business. For example, we are subject, from time to time, to product liability claims, intellectual property claims and claims brought by our competitors, including with respect to the hiring of employees. Such litigation or other legal proceedings, with or without merit, is unpredictable, generally expensive and time consuming and likely to divert significant resources from our business and from our efforts to integrate the Evertel business. Furthermore, because of the discovery that is required in connection with certain litigation, there is a risk that some of our confidential information could be compromised by disclosure. In addition, there could be public announcements of the results of trials, hearings, motions or other interim proceedings or developments and, if securities analysts or investors perceive these results to be negative, it could have a substantial adverse effect on the price of our common stock.

Risks Relating to our Business

Failure to meet revenue expectations could have an adverse effect on our business, operating results, cash flows, liquidity and stock price.

On September 18, 2023, we issued a press release announcing updated fiscal 2023 fourth quarter and fiscal 2023 full year revenue guidance. Providing revenue guidance requires management to make estimates and assumptions based on historical experience, the current economic and geopolitical environment and on various other assumptions believed to be reasonable. Failure to meet our revised estimates could have an adverse effect on our business, operating results, cash flows and liquidity. Additionally, if we change, update or fail to meet any element of our updated guidance, our stock price could decline.

Risks Relating to this Offering

We have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

We have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. We intend to use the net proceeds from this offering for general corporate purposes, including funding organic growth, working capital, capital expenditures, and continued research and development with respect to products and technologies. A portion of the net proceeds of this offering may be used to fund possible investments in or acquisitions of complementary businesses, products, or technologies in the future. As of the date of this prospectus supplement, we have no agreements or commitments to complete any such transaction. We have not allocated these net proceeds for any specific purposes. We might not be able to yield a significant return, if any, on any investment of these net proceeds. Stockholders will not have the opportunity to influence our management’s decisions on how to use the net proceeds, and our failure to apply the funds effectively could have a material adverse effect on our business, delay the development of our product candidates and cause the price of our common stock to decline.

You will experience immediate and substantial dilution in the net tangible book value per share of the common stock you purchase.

The public offering price of the common stock offered pursuant to this prospectus supplement is substantially higher than the net tangible book value per share of our common stock. Therefore, if you purchase shares of common stock in this offering, you will incur immediate and substantial dilution in the pro forma net tangible book value per share of common stock from the price per share that you pay for the common stock.

You may experience future dilution as a result of future equity offerings.

To raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. We may sell shares or other securities in any other offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions may be higher or lower than the price per share paid by investors in this offering. We also expect to continue to utilize equity-based compensation. To the extent the options are exercised or we issue common stock, preferred stock, or securities such as warrants that are convertible into, exercisable or exchangeable for, our common stock or preferred stock in the future, you may experience further dilution.

We last declared and paid cash dividends on our capital stock in 2016, and we do not anticipate paying any cash dividends in the foreseeable future.

We last declared and paid cash dividends on our capital stock in 2016. We currently intend to retain all available funds and any future earnings for use in the operation and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the SEC filings that are incorporated by reference into this prospectus supplement and the accompanying prospectus contain or incorporate by reference forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or Exchange Act, that are based on our management’s beliefs and assumptions and on information currently available to our management. Forward-looking statements include information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, industry environment, potential growth opportunities and the effects of competition. Forward-looking statements include statements that are not historical facts and can be identified by terms such as “anticipates, “believes,” “could,” “seeks, “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “should,” “will,” “would” or similar expressions and the negatives of those terms.

Forward looking statements include statements regarding:

| |

●

|

our estimates regarding anticipated operating losses, future revenue, expenses, capital requirements, uses and sources of cash and liquidity, including our anticipated revenue growth and cost savings;

|

| |

●

|

our ability to ensure that we have effective disclosure controls and procedures;

|

| |

●

|

our ability to market, improve, grow, commercialize and achieve market acceptance of any of our products or any new products that we are developing or may develop in the future;

|

| |

●

|

our beliefs about the features, strengths and benefits of our products;

|

| |

●

|

our ability to continue to enhance our product offerings and expand the commercialization of our products;

|

| |

●

|

our ability to successfully integrate, and realize benefits from licenses and acquisitions, including the Evertel business;

|

| |

●

|

the effect of any existing or future federal, state or international regulations on our ability to effectively conduct our business;

|

| |

●

|

our estimates of market sizes and anticipated uses of our products;

|

| |

●

|

our business strategy and our underlying assumptions about market data, demographic trends, reimbursement trends and pricing trends;

|

| |

●

|

our ability to maintain profitability, and the potential need to raise additional funding;

|

| |

●

|

our ability to maintain an adequate sales network for our products, including to attract and retain independent distributors;

|

| |

●

|

our ability to increase the use and promotion of our products by training and educating our sales network;

|

| |

●

|

our ability to attract and retain a qualified management team, as well as other qualified personnel and advisors , including in connection with the ongoing operation of the Evertel business;

|

| |

●

|

our ability to effectively manage the anticipated and any unanticipated costs related to the acquisition of the Evertel business;

|

| |

●

|

our management team’s ability to accommodate growth and manage a larger organization;

|

| |

●

|

our ability to protect our intellectual property, and to not infringe upon the intellectual property of third parties;

|

| |

●

|

our ability to meet or exceed the industry standard in compliance and corporate governance programs;

|

| |

●

|

our beliefs about our competitors and the principal competitive factors in our market;

|

| |

●

|

potential liability resulting from litigation;

|

| |

●

|

our beliefs about our employee relations;

|

| |

●

|

our beliefs with respect to our critical accounting policies and the reasonableness of our estimates and assumptions; and

|

| |

●

|

other factors discussed elsewhere in this prospectus supplement and accompanying prospectus or any document incorporated by reference herein or therein.

|

Although we believe that we have a reasonable basis for each forward-looking statement contained in this prospectus supplement, the accompanying prospectus and the SEC filings that are incorporated by reference into this prospectus supplement and the accompanying prospectus, we caution you that these statements are based on our projections of the future that are subject to known and unknown risks and uncertainties and other factors that may cause our actual results, level of activity, performance or achievements expressed or implied by these forward-looking statements, to differ. The sections in this prospectus supplement captioned “Risk Factors” and in the sections of our Annual Report on Form 10-K captioned “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business,” and in the sections of our Quarterly Reports on Form 10-Q captioned “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as other sections in such documents, discuss some of the factors that could contribute to these differences.

Other unknown or unpredictable factors also could harm our results. Consequently, actual results or developments anticipated by us may not be realized or, even if substantially realized, may not have the expected consequences to, or effects on, us. Given these uncertainties, prospective investors are cautioned not to place undue reliance on such forward-looking statements. Except as required by law, we undertake no obligation to update or revise publicly any of the forward-looking statements after the date of this prospectus supplement.

This prospectus supplement, the accompanying prospectus, and the documents incorporated by reference in this prospectus supplement may contain market data that we obtained from industry sources, including independent industry publications. In presenting this information, we have also made assumptions based on such data and other similar sources and on our knowledge of, and our experience to date in, the markets for our products. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While we believe any market data included in this prospectus supplement is generally reliable, such information is inherently imprecise. In addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described under the heading “Risk Factors” in this prospectus supplement and “Item 1A—Risk Factors” of our most recent report on Form 10-K or 10-Q which is incorporated by reference in this prospectus supplement. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

All forward-looking statements are based on information available to us on the date of this prospectus supplement and we will not update any of the forward-looking statements after the date of this prospectus supplement, except as required by law. Our actual results could differ materially from those discussed in this prospectus supplement. The forward-looking statements contained in this prospectus supplement, and other written and oral forward-looking statements made by us from time to time, are subject to certain risks and uncertainties that could cause actual results to differ materially from those anticipated in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in the following discussion and within the section of this prospectus supplement captioned “Risk Factors” beginning on page S-4, as well as the risk factors contained in the documents incorporated by reference to this prospectus supplement.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus, and although we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted a thorough inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

USE OF PROCEEDS

We estimate that the net proceeds to us from this offering, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, will be approximately $ million (or approximately $ million if the underwriters’ option to acquire additional shares of our common stock is exercised in full).

We intend to use the net proceeds from this offering for general corporate purposes, including funding organic growth, working capital, capital expenditures, and continued research and development with respect to products and technologies, as well as costs related to post-closing integration with Genasys of the Evertel business and research and development activities related to the integrated business.

Pending their full use, we intend to invest our net proceeds from this offering primarily in investment-grade, interest-bearing instruments. We might not be able to yield a significant return, if any, on any investment of these net proceeds. Stockholders will not have the opportunity to influence our management’s decisions on how to use the net proceeds, and our failure to apply the funds effectively could have a material adverse effect on our business, delay the development of our product candidates and cause the price of our common stock to decline.

As of the date of this prospectus supplement, we cannot specify with certainty all of the particular uses for the net proceeds to be received upon the completion of this offering. The amount and timing of our expenditures will depend on several factors, including cash flows from our operations and the anticipated growth of our business. Accordingly, our management will have broad discretion in the application of the net proceeds and investors will be relying on the judgment of our management regarding the application of the proceeds from this offering. We reserve the right to change the use of these proceeds as a result of certain contingencies such as the results of our commercialization efforts, competitive developments, opportunities to acquire products, technologies or businesses and other factors.

DIVIDEND POLICY

We last declared and paid cash dividends on our capital stock in 2016. We currently intend to retain all available funds and any future earnings for use in the operation and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future.

DILUTION

If you invest in our common stock, your interest will be diluted immediately to the extent of any difference between the offering price per share you pay for shares of our common stock in this offering and the as adjusted net tangible book value per share of our common stock after this offering. Net tangible book value per share represents our total tangible assets less total liabilities, divided by the number of shares of our common stock outstanding, as of June 30, 2023.

As of June 30, 2023, our net tangible book value was approximately $24.3 million, or $0.65 per share of common stock. After giving effect to the sale of shares of common stock at the offering price of $ per share and after deducting estimated underwriting discounts and commissions and estimated expenses payable by us, our net tangible book value as of June 30, 2023 would have been approximately $ million, or $ per share of common stock. This represents an immediate increase in as adjusted net tangible book value to existing stockholders of $ per share and an immediate dilution to new investors purchasing common stock in this offering of $ per share.

The following table illustrates this per share dilution to the new investors purchasing shares of common stock in this offering:

|

Offering price per share

|

|

|

|

|

|

$ |

|

|

|

Net tangible book value per share at June 30, 2023

|

|

$ |

0.65 |

|

|

|

|

|

|

Increase in net tangible book value per share attributable to new investors purchasing shares in this offering

|

|

$ |

|

|

|

|

|

|

|

As adjusted net tangible book value per share as of June 30, 2023 after giving effect to this offering

|

|

|

|

|

|

$ |

|

|

|

Dilution per share to new investors in this offering

|

|

|

|

|

|

$ |

|

|

If the underwriters exercise their option to purchase additional shares in full, at the offering price of $ per share, the as adjusted net tangible book value will increase to $ per share, representing an immediate increase in net tangible book value to existing stockholders of $ per share and immediate dilution in net tangible book value of $ per share to new investors.

The foregoing table and calculations are based on 37,181,071 shares of our common stock outstanding as of June 30, 2023 and excludes:

| |

●

|

3,287,772 shares of common stock issuable upon exercise of options outstanding as of June 30, 2023, at a weighted average exercise price of $3.21 per share;

|

| |

●

|

385,429 shares of common stock issuable upon the vesting of restricted stock units outstanding as of June 30, 2023; and

|

| |

●

|

2,821,827 shares of common stock reserved for future issuance under our 2015 Equity Incentive Plan as of June 30, 2023.

|

To the extent that outstanding options are exercised, outstanding restricted stock units are settled, new options are issued under our equity incentive plans, or we otherwise issue additional shares of common stock in the future, you may experience further dilution. We may choose to raise additional capital due to market conditions or strategic considerations even if at that time we believe we have sufficient funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

CERTAIN MATERIAL U.S. FEDERAL INCOME AND ESTATE TAX

CONSIDERATIONS FOR NON-U.S. HOLDERS OF OUR COMMON STOCK

The following is a general discussion of the material U.S. federal income tax considerations and certain U.S. estate tax considerations applicable to Non-U.S. Holders (as defined below) relating to the purchase, ownership and disposition of our common stock issued pursuant to this offering, but does not purport to be a complete analysis of all potential tax effects, including any U.S. federal income tax considerations to the Company.

This discussion is based on current provisions of the Internal Revenue Code of 1986, as amended (“Code”), final, temporary and proposed Treasury regulations promulgated thereunder (“Treasury Regulations”), judicial decisions, published rulings and administrative pronouncements of the U.S. Internal Revenue Service (“IRS”), all in effect as of the date of this prospectus supplement and all of which are subject to change or to differing interpretation, possibly with retroactive effect. Any change could alter the tax consequences to Non-U.S. Holders described herein. There can be no assurance that the IRS will not challenge one or more of the tax consequences described herein.

This discussion is limited to Non-U.S. Holders that hold our common stock as a “capital asset” within the meaning of Section 1221 of the Code (generally, property held for investment). This discussion does not address all aspects of U.S. federal income and estate taxation that may be relevant to a particular Non-U.S. Holder in light of that Non-U.S. Holder’s individual circumstances nor does it address any aspects of U.S. state, local or non-U.S. taxes, the alternative minimum tax, or the unearned income Medicare contribution tax on net investment income. This discussion also does not consider any specific facts or circumstances that may apply to a Non-U.S. Holder and does not address the special tax rules applicable to particular Non-U.S. Holders, including, without limitation:

| |

●

|

U.S. expatriates and former citizens or long-term residents of the United States;

|

| |

●

|

banks, insurance companies and other financial institutions;

|

| |

●

|

brokers or dealers or traders in securities;

|

| |

●

|

partnerships or other entities or arrangements treated as partnerships for U.S. federal income tax purposes (and investors therein);

|

| |

●

|

tax-exempt organizations or governmental organizations;

|

| |

●

|

persons deemed to sell our common stock under constructive sale provisions of the Code;

|

| |

●

|

tax-qualified retirement plans;

|

| |

●

|

persons holding our common stock as part of a straddle, hedge or other risk reduction strategy or as part of a conversion transaction or other integrated investment;

|

| |

●

|

“controlled foreign corporations,” “passive foreign investment companies,” and corporations that accumulate earnings to avoid U.S. federal income tax;

|

| |

●

|

persons who hold or receive our common stock pursuant to the exercise of any employee stock option or otherwise as compensation;

|

| |

●

|

persons subject to special tax accounting rules as a result of any item of gross income with respect to our common stock being taken into account in an applicable financial statement; and

|

| |

●

|

“qualified foreign pension funds” as defined in Section 897(l)(2) of the Code and entities all of the interests of which are held by qualified foreign pension funds.

|

If a partnership (or other entity or arrangement treated as a partnership for U.S. federal income tax purposes) holds our common stock, the tax treatment of a partner therein will generally depend on the status of the partner and the activities of the partnership. Partners of a partnership holding our common stock should consult their tax advisors as to the particular U.S. federal income tax consequences applicable to them.

THIS SUMMARY IS NOT INTENDED TO CONSTITUTE A COMPLETE DESCRIPTION OF ALL TAX CONSEQUENCES FOR NON-U.S. HOLDERS RELATING TO THE PURCHASE, OWNERSHIP AND DISPOSITION OF OUR COMMON STOCK. PROSPECTIVE HOLDERS OF OUR COMMON STOCK SHOULD CONSULT WITH THEIR TAX ADVISORS REGARDING THE TAX CONSEQUENCES TO THEM (INCLUDING THE APPLICATION AND EFFECT OF ANY STATE, LOCAL, NON-U.S. INCOME AND OTHER TAX LAWS) OF THE PURCHASE, OWNERSHIP AND DISPOSITION OF OUR COMMON STOCK.

For purposes of this discussion, a “Non-U.S. Holder” means a beneficial owner of our common stock (other than an entity or arrangement that is treated as a partnership for U.S. federal income tax purposes) that is not, for U.S. federal income tax purposes, any of the following:

| |

●

|

an individual who is a citizen or resident of the United States;

|

| |

●

|

a corporation (or other entity treated as a corporation for U.S. federal income tax purposes) created or organized in the United States or under the laws of the United States, any state thereof or the District of Columbia;

|

| |

●

|

an estate, the income of which is includable in gross income for U.S. federal income tax purposes regardless of its source; or

|

| |

●

|

a trust if (i) a court within the United States is able to exercise primary supervision over the administration of the trust and one or more “U.S. persons,” as defined under the Code, have the authority to control all substantial decisions of the trust or (ii) such trust has made a valid election to be treated as a U.S. person for U.S. federal income tax purposes.

|

Distributions

As discussed under “Dividend Policy” above, we do not expect to make distributions on our common stock in the foreseeable future. However, if we do make distributions of cash or property on our common stock, such distributions will constitute dividends for U.S. federal income tax purposes to the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. Amounts of distributions not treated as dividends for U.S. federal income tax purposes will first constitute a tax-free return of capital of the Non-U.S. Holder's investment and be applied against and reduce a Non-U.S. Holder's adjusted tax basis in its common stock, but not below zero. Any remaining excess will be treated as capital gain and will be treated as described below under “Gain on Sale or Other Disposition of Common Stock.” Any such distributions will also be subject to the discussions below under the headings “Foreign Account Tax Compliance Act” and “Backup Withholding, Information Reporting and Other Reporting Requirements.”

Subject to the discussion in the next paragraph regarding effectively connected income, dividends paid to a Non-U.S. Holder generally will be subject to withholding of U.S. federal income tax at a 30% rate or such lower rate as may be specified by an applicable income tax treaty between the United States and such holder's country of residence.

Dividends we pay to a Non-U.S. Holder that are effectively connected with its conduct of a trade or business within the United States (and, if required by an applicable tax treaty, are attributable to a U.S. permanent establishment or a fixed base maintained by such Non-U.S. Holder) will generally be exempt from the U.S. federal withholding tax, as described above, if the Non-U.S. Holder complies with applicable certification and disclosure requirements (generally including provision of a valid IRS Form W-8ECI (or applicable successor form) certifying that the dividends are effectively connected with the Non-U.S. Holder's conduct of a trade or business within the United States). Instead, such dividends generally will be subject to U.S. federal income tax on a net income basis, at regular U.S. federal income tax rates as would apply if such holder were a U.S. person (as defined in the Code). Any U.S. effectively connected income received by a Non-U.S. Holder that is classified as a corporation for U.S. federal income tax purposes, may also be subject to an additional “branch profits tax” at a rate of 30% (or such lower rate as may be specified by an applicable income tax treaty).

A Non-U.S. Holder of our common stock who claims the benefit of an applicable income tax treaty between the United States and such holder’s country of residence generally will be required to provide a properly executed IRS Form W-8BEN or W-8BEN-E (or successor form) and satisfy applicable certification and other requirements. Non-U.S. Holders are urged to consult their tax advisors regarding their entitlement to benefits under a relevant income tax treaty and the specific methods available to them to satisfy these requirements.

Gain on Sale or Other Disposition of Common Stock

Subject to the discussion below under the headings “Foreign Account Tax Compliance Act” and “Backup Withholding, Information Reporting and Other Reporting Requirements,” a Non-U.S. Holder generally will not be subject to U.S. federal income tax on any gain realized upon the sale or other taxable disposition of the Non-U.S. Holder’s shares of our common stock unless:

| |

●

|

the gain is effectively connected with a trade or business carried on by the Non-U.S. Holder within the United States (and, if required by an applicable income tax treaty, is attributable to a U.S. permanent establishment or fixed base maintained by such Non-U.S. Holder);

|

| |

●

|

the Non-U.S. Holder is an individual and is present in the United States for 183 days or more in the taxable year of disposition and certain other conditions are met; or

|

| |

●

|

we are or have been a “U.S. real property holding corporation” for U.S. federal income tax purposes at any time within the shorter of the five-year period preceding such disposition or such Non-U.S. Holder’s holding period of our common stock, and, provided that our common stock is “regularly” traded in an established securities market within the meaning of applicable Treasury Regulations, the Non-U.S. Holder has held, directly or constructively, at any time during said period, more than 5% of our common stock.

|

Gain described in the first bullet point above generally will be subject to U.S. federal income tax on a net income tax basis, at regular U.S. federal income tax rates. If the Non-U.S. Holder is a non-U.S. corporation, the branch profits tax described above also may apply to such effectively connected gain. Gain described in the second bullet point above will be subject to a flat 30% tax (or such lower rate as may be specified by an applicable income tax treaty); provided that the such gain is derived from U.S. sources (which may be offset by certain U.S.-source capital losses, if any, even though the individual is not considered a resident of the United States, provided that the Non-U.S. Holder has timely filed U.S. federal income tax returns with respect to such losses). With respect to the third bullet point above, we believe that we are not, and we do not anticipate becoming a U.S. real property holding corporation for U.S. federal income tax purposes.

Foreign Account Tax Compliance Act

Withholding taxes may be imposed under Sections 1471 to 1474 of the Code and related Treasury Regulations and guidance (“FATCA”), on certain types of payments made to non-U.S. financial institutions and certain other non-U.S. entities. Specifically, a 30% withholding tax may be imposed on dividends on our common stock paid to a “foreign financial institution” or a “non-financial foreign entity” (each as defined in the Code), unless (1) the foreign financial institution undertakes certain diligence and reporting obligations, (2) the non-financial foreign entity either certifies it does not have any “substantial United States owners” (as defined in the Code) or furnishes identifying information regarding each substantial United States owner, or (3) the foreign financial institution or non-financial foreign entity otherwise qualifies for an exemption from these rules. If the payee is a foreign financial institution and is subject to the diligence and reporting requirements in (1) above, it must enter into an agreement with the U.S. Department of the Treasury requiring, among other things, that it undertake to identify accounts held by certain “specified United States persons” or “United States-owned foreign entities” (each as defined in the Code), annually report certain information about such accounts, and withhold 30% on certain payments to non-compliant foreign financial institutions and certain other account holders. Foreign financial institutions located in jurisdictions that have an intergovernmental agreement with the United States governing FATCA may be subject to different rules.

Under the applicable Treasury Regulations and administrative guidance, withholding under FATCA generally applies to payments of dividends on our common stock. While withholding under FATCA would have also applied to payments of gross proceeds from the sale or other disposition of stock on or after January 1, 2019, recently proposed Treasury Regulations eliminate FATCA withholding on payments of gross proceeds entirely. Taxpayers generally may rely on these proposed Treasury Regulations until final Treasury Regulations are issued.

Prospective investors should consult their tax advisors regarding the potential application of withholding under FATCA to their investment in our common stock.

Backup Withholding, Information Reporting and Other Reporting Requirements

We must report annually to the IRS and to each Non-U.S. Holder the amount of any distributions paid to, and the tax withheld with respect to, each Non-U.S. Holder. These reporting requirements apply regardless of whether withholding was reduced or eliminated by an applicable income tax treaty. Copies of this information reporting may also be made available under the provisions of a specific income tax treaty or agreement with the tax authorities in the country in which the Non-U.S. Holder resides or is established.

A Non-U.S. Holder will generally be subject to backup withholding for dividends on our common stock paid to such holder unless such holder certifies under penalties of perjury that, among other things, it is a Non-U.S. Holder (provided that the payor does not have actual knowledge or reason to know that such holder is a U.S. person) or otherwise establishes an exemption.

Information reporting and backup withholding generally will apply to the proceeds of a disposition of our common stock by a Non-U.S. Holder effected by or through the U.S. office of any broker, U.S. or non-U.S., unless the holder certifies its status as a Non-U.S. Holder and satisfies certain other requirements, or otherwise establishes an exemption. Generally, information reporting and backup withholding will not apply to a payment of disposition proceeds to a Non-U.S. Holder where the transaction is effected outside the United States through a non-U.S. office of a broker. However, for information reporting purposes, dispositions effected through a non-U.S. office of a broker with substantial U.S. ownership or operations generally will be treated in a manner similar to dispositions effected through a U.S. office of a broker. Non-U.S. Holder should consult their tax advisors regarding the application of the information reporting and backup withholding rules to them.

Backup withholding is not an additional income tax. Any amounts withheld under the backup withholding rules from a payment to a Non-U.S. Holder generally can be credited against the Non-U.S. Holder’s U.S. federal income tax liability, if any, or refunded, provided that the required information is furnished to the IRS in a timely manner. Non-U.S. Holder should consult their tax advisors regarding the application of the information reporting and backup withholding rules to them.

U.S. Federal Estate Tax

Shares of our common stock that are owned or treated as owned by an individual who is not a citizen or resident of the United States (as specially defined for U.S. federal estate tax purposes) at the time of death are considered U.S. situs assets and will be included in the individual’s gross estate for U.S. federal estate tax purposes. Such shares, therefore, may be subject to U.S. federal estate tax, unless an applicable estate tax or other treaty provides otherwise.

The preceding discussion of material U.S. federal income tax considerations and certain U.S. estate tax considerations is for information only. It is not legal or tax advice. Prospective investors should consult their tax advisors regarding the particular U.S. federal, state, local and non-U.S. tax consequences of purchasing, owning and disposing of our common stock, including the consequences of any proposed changes in applicable laws.

UNDERWRITING

We have entered into an underwriting agreement with Roth Capital Partners, LLC, as representative to the underwriters (the “Representative ”) with respect to the shares of Common Stock subject to this offering. Subject to the terms and conditions of the underwriting agreement, we have agreed to sell to the underwriters, and the underwriters have agreed to purchase from us, shares of our Common Stock.

|

Underwriter

|

|

Number of Shares

|

|

Roth Capital Partners, LLC

|

|

|

|

Joseph Gunnar & Co., LLC

|

|

|

|

Total

|

|

|

The underwriters are offering the shares of Common Stock subject to its acceptance of the shares of Common Stock from us and subject to prior sale. The underwriting agreement provides that the obligation of the underwriters to purchase the shares of Common Stock offered by this prospectus supplement is subject to certain conditions. The underwriters are obligated to purchase all of the shares of Common Stock offered hereby if any of the shares are purchased. However, the underwriters are not required to take or pay for the shares of Common Stock covered by the underwriters’ over-allotment option described below.

We have granted the underwriters an option to buy up to an additional shares of Common Stock from us at the public offering price, less the underwriting discounts. The underwriters may exercise this option at any time, in whole or in part, during the 30-day period after the date of this prospectus supplement.

Discounts, Commissions and Expenses

The underwriters propose to offer the shares of Common Stock purchased pursuant to the underwriting agreement to the public at the public offering price set forth on the cover page of this prospectus supplement and to certain dealers at that price less a concession not in excess of $ per share. After this offering, the public offering price, concession and reallowance to dealers may be changed by the underwriters. No such change shall change the amount of proceeds to be received by us as set forth on the cover page of this prospectus supplement.

The following table shows the underwriting discounts and commissions payable to the underwriters by us in connection with this offering (assuming both the exercise and non-exercise of the over-allotment option to purchase additional shares of common stock we have granted to the underwriters):

| |

|

Per Share (1)

|

|

|

Total

|

|

| |

|

Without Over-

Allotment

|

|

|

With Over-

Allotment

|

|

|

Without Over-

Allotment

|

|

|

With Over-

Allotment

|

|

|

Public offering price

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Underwriting discounts and commissions paid by us

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

Proceeds, before expenses, to Company

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

$ |

|

|

|

(1)

|

The underwriters shall receive an underwriting discount of 6.0% of the aggregate gross proceeds hereunder.

|

We have also agreed to reimburse the Representative for certain out-of-pocket expenses, including the fees and disbursements of its counsel, up to an aggregate of $115,000. We estimate that the total expenses payable by us in connection with this offering, other than the underwriting discount and commissions referred to above, will be approximately $ .

Indemnification

Pursuant to the underwriting agreement, we have agreed to indemnify the underwriters and certain of its controlling persons against certain liabilities, including liabilities under the Securities Act, or to contribute to payments that the underwriter or such other indemnified parties may be required to make in respect of those liabilities.

Lock-Up Agreements

We have agreed not to, during the period ending ninety (90) days after the date of the underwriting agreement (the “Lock-Up Period”) (i) offer, pledge, issue, sell, contract to sell, purchase, contract to purchase, lend or otherwise transfer or dispose of, directly or indirectly, any shares of our Common Stock or any securities convertible into or exercisable or exchangeable for shares of our Common Stock; (ii) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of shares of our Common Stock, whether any such transaction described in clause (i) or (ii) above is to be settled by delivery of our Common Stock or such other securities, in cash or otherwise; or (iii) request effectiveness of any filed registration statement (other than registration statements on Form S-8 relating to the issuance of stock options or other equity awards to employees) with the SEC relating to the offering of any shares of our Common Stock or any securities convertible into or exercisable or exchangeable for shares of our common stock. These restrictions do not apply to: (i) the issuance of shares of our Common Stock sold in this offering, (ii) the issuance of shares of our Common Stock upon the exercise of outstanding options or warrants or other outstanding convertible securities disclosed in this prospectus supplement, (iii) the issuance of employee stock options not exercisable during the Lock-Up Period and the grant of restricted stock awards or restricted stock units or shares of Common Stock pursuant to equity incentive plans disclosed herein, or (iv) the issuance of shares as full or partial consideration for, or to fund all or a portion of any cash consideration for, any acquisition consummated by us during the Lock-Up Period.

In addition, each of our directors and executive officers, and certain of our stockholders, have agreed not to, during the Lock-Up Period: (i) offer, pledge, announce the intention to sell, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, make any short sale or otherwise transfer or dispose of, directly or indirectly, any shares of our Common Stock or any securities convertible into, exercisable or exchangeable for or that represent the right to receive Common Stock (including, without limitation, common stock which may be deemed to be beneficially owned by the undersigned in accordance with the rules and regulations of the SEC and securities which may be issued upon exercise of a stock option or warrant) whether now owned or hereafter acquired; (ii) enter into any swap or other agreement that transfers, in whole or in part, any of the economic consequences of ownership of such securities; or (iii) make any demand for or exercise any right with respect to the registration of any shares of our Common Stock or any security convertible into or exercisable or exchangeable for shares of our Common Stock. These restrictions do not apply to (i) transfers of such securities (A) as a bona fide gift or gifts, (B) to any trust for the direct or indirect benefit of the holder or the immediate family of the holder or (C) by will or intestacy; (ii) the exercise of stock options granted pursuant to our equity incentive plans and the withholding of shares of Common Stock by us for the payment of taxes due upon such exercise; (iii) cashless “net” exercises of options and warrants; (iv) the receipt of any of our securities including, but not limited to, Common Stock and stock options granted pursuant to our equity incentive plans, and warrants exercisable for our Common Stock, provided that the restrictions shall apply to any of the holder’s securities issued upon such exercise; and, for certain of our directors, executive officers, and certain stockholders as set forth in their applicable lock-up agreement, (v) the pledge, hypothecation or other granting of a security interest in shares of Common Stock or securities convertible into or exchangeable for shares of Common Stock to one more lending institutions as collateral or security for any loan, advance or extension of credit.

Electronic Distribution

This prospectus supplement may be made available in electronic format on websites or through other online services maintained by the underwriters or their affiliates. Other than this prospectus supplement in electronic format, the information on the underwriters websites and any information contained in any other websites maintained by the underwriters are not part of this prospectus supplement or the registration statement of which this prospectus supplement forms a part, have not been approved and/or endorsed by us or the underwriters, and should not be relied upon by investors.

Price Stabilization, Short Positions and Penalty Bids

In connection with the offering, the underwriters may engage in stabilizing transactions, over-allotment transactions, syndicate covering transactions and penalty bids in accordance with Regulation M under the Exchange Act:

| |

●

|

Stabilizing transactions permit bids to purchase the underlying security so long as the stabilizing bids do not exceed a specified maximum.

|

| |

●

|

Over-allotment involves sales by the underwriters of shares in excess of the number of shares the underwriters are obligated to purchase, which creates a syndicate short position. The short position may be either a covered short position or a naked short position. In a covered short position, the number of shares over-allotted by the underwriters are not greater than the number of shares that it may purchase in the over-allotment option. In a naked short position, the number of shares involved is greater than the number of shares in the over-allotment option. The underwriters may close out any covered short position by either exercising its over-allotment option and/or purchasing shares in the open market.

|

| |

●

|